Professional Documents

Culture Documents

MCQ June 2023

MCQ June 2023

Uploaded by

g6kztsgjmmOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MCQ June 2023

MCQ June 2023

Uploaded by

g6kztsgjmmCopyright:

Available Formats

MCQ Year June 2023

1. A

2. B

3. D

4. B Sales ledger control a/c

Balance b/d 700 Cash received 1 250

Credit sales 1 000 Balance c/d 450

1 700 1 700

5. D

6. A

7. D

8. D – Basic salary 40 hours x $50 = $2 000

+ Overtime 9 hours (49 – 40) x {1.5 x $50} = 675

Total salary $2 675

9. C

10. D

11. D

12. C

13. D

14. A

15. Trading Account

Sales

less Cost of Goods Sold

Opening inventory 2 000 ( 6500 – 4500)

add purchases 5 000

add carriage inwards 500

less purchases return (1 000)

Net Purchases 4 500

Cost of goods available for sale 6 500

less closing inventory (1 000)

Cost of Goods Sold 5 500

16. C

17. A Invoice - cost price $4 000

less trade discount (25/100 x $4 000) (1 000)

$3 000

Return outwards 1/8 x $3 000 = $375

18. A Sales Account

Mr. Abel $50

Mrs. Blue 75

Cash sales 550

less drawings (500)

Balance in the sales account $125

19. A

20. C

21. A

22. A

23. B

24. C Bank $10 000

Vehicle 6 000

Building 15 000

customer 4 000

Total Assets 35 000

less drawings ( 1 500)

creditors (2 000)

Capital 31 500

25. D

26. A - Working capital = Current assets – current liabilities

$15 500 = $16 500 – x

$16 500 – 15 500 = $1 000 ( current liabilities)

27. B List price $600

less trade discount (20/100 x $600) = ($120)

Sales Price $480

28. C Receipts and Payments a/c

subs. Recd 300 Rent 60

proceeds 250 Purchase of games 150

postage 20

Balance c/d 320

550 550

27. C Raw materials $1 900

+ factory wages 2 500

+rent and rates 2 000

Production cost 6 400

Production cost per unit = 6 400 /640 = $10

28.

29.

30. A

31. D Balance as per updated cashbook $560

add unpresented cheques 120

less lodgements (150)

Balance as per bank statement $530

32. C

33. D Trial Balance

Debit Credit

Machinery $4 000

Inventory 3 000

Purchases 1 000

Sales $5 000

Capital 3 000

$8 000 $8 000

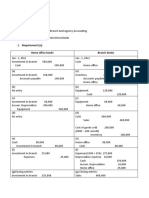

34. C Manufacturing a/c

Cost of materials used $ 3 000

add factory wages 5 000

Prime Cost $8 000

add indirect expenses 3 200

Total Current Manufacturing Cost $11 200

add Opening working-in-process 1 600

less Closing working-ini-process ( 1 700)

Cost of goods produced $11 100

35. D

36. D

37. B

38. D

39. Rent Expense a/c

Balance b/d 2 000 Transfer to Profit and loss 9

500

Bank 6 000

owing c/d 1 500

40. B

41. D Trading A/c

Sales $45 000

less cost of goods sold

opening inventory

add purchases 10 000

Cost of goods available for sale 10 000

less closing inventory (FIFO) (5 000)

( 5 000)

Gross profit / Gross Income $40 000

42. C Trading A/c

Sales $45 000

less cost of goods sold

opening inventory

add purchases 10 000

Cost of goods available for sale 10 000

less closing inventory (AVCO) (3 000)

( 7 000)

Gross profit / Gross Income $38 000

43. B

44. A

45. D

46. B

47. C

48. A

49. D

50. B

51. A

52. B Receipts and Payments a/c

Balance b/d $700 Purchase of refreshments 500

Proceeds from raffle 1 500 Purchase of furniture 500

Sale of equipment 600 Donations to charity 200

Balance c/d

1 600

2 800

2 800

53. C - Value of Assets

Motor vehicles 2 000

Receivables 2 000

Building 10 000

Total value of assets $14 000

54. C

55. C

56. B - 10/100 x 5 000 x $5 = $ 2 500

57. A - national insurance $ 250

+ income tax 1 500

total statutory deductions $1 750

58. A - Gross Pay $10 000

+ sales commission 300

total gross income $10 300

- statutory deductions ( 1 750)

- credit union ( 2 500)

Net Pay $ 6 050

59. B

60. A - factor y rent $ 2 000

+ depreciation on factory machinery 7 000

+ factory insurance 6 000

+ lubricants 500

Total indirect costs $15 500

You might also like

- Week 3 SolutionDocument5 pagesWeek 3 SolutionI190006 Taimoor JanNo ratings yet

- Toy Factory Worksheet For The Year Ended Dec. 31, 20X4 Account Titles Trial Balance Adjustments Debit Credit DebitDocument12 pagesToy Factory Worksheet For The Year Ended Dec. 31, 20X4 Account Titles Trial Balance Adjustments Debit Credit DebitShiela EscobarNo ratings yet

- Exercise5 With SolutionDocument5 pagesExercise5 With SolutionRexmar Christian Bernardo71% (7)

- Answers To Extra QuestionsDocument8 pagesAnswers To Extra QuestionsHashani KumarasingheNo ratings yet

- Penyesuaian PD Tati EngDocument8 pagesPenyesuaian PD Tati EngnurullafajiraNo ratings yet

- CH 10 Incomplete RecordsDocument27 pagesCH 10 Incomplete RecordsPawan Poynauth0% (1)

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- Account For Home Office and Branch Transactions. ProblemDocument2 pagesAccount For Home Office and Branch Transactions. ProblemDevine Grace A. MaghinayNo ratings yet

- Solutions To ProblemsDocument4 pagesSolutions To ProblemslorraineNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- Kimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadDocument4 pagesKimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadKimberly VeguillaNo ratings yet

- P 5 - Assigned Tasks Afar302aDocument7 pagesP 5 - Assigned Tasks Afar302aLyn CosNo ratings yet

- Tugas Chapter 6 - Sandra Hanania - 120110180024Document4 pagesTugas Chapter 6 - Sandra Hanania - 120110180024Sandra Hanania PasaribuNo ratings yet

- Income StatementDocument13 pagesIncome StatementShakir IsmailNo ratings yet

- Batch 95 FAR First Preboard SolutionDocument7 pagesBatch 95 FAR First Preboard Solutionssslll2No ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Tutorial Test 8 Solution Requirement 1Document3 pagesTutorial Test 8 Solution Requirement 1Minh HiềnNo ratings yet

- Tutorial #3 - Group 5 - PA1 - MarkedDocument8 pagesTutorial #3 - Group 5 - PA1 - MarkedThanh NguyenNo ratings yet

- 6 DesemberDocument8 pages6 DesemberKezia N. ApriliaNo ratings yet

- Accn 101 Assignment Group WorkDocument8 pagesAccn 101 Assignment Group WorkkumbiraidavidNo ratings yet

- Ans m2 PaperDocument6 pagesAns m2 Paperbigab31327No ratings yet

- Chữa đề NLKT thầy Cường và đề EBBADocument12 pagesChữa đề NLKT thầy Cường và đề EBBATiêu Vân GiangNo ratings yet

- Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Document3 pagesDr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Ishrat Jahan PapiyaNo ratings yet

- Accounting 20Document5 pagesAccounting 20Kenshin HayashiNo ratings yet

- Tugas Bab 6 Jawaban P 6-3Document2 pagesTugas Bab 6 Jawaban P 6-3Syahirul AlimNo ratings yet

- Accounting For Special TransactionsDocument6 pagesAccounting For Special TransactionsJanella Umieh De UngriaNo ratings yet

- Costing CaseDocument6 pagesCosting CasenguyenthingocmaimkNo ratings yet

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalNo ratings yet

- Abdirahman Assign 1Document8 pagesAbdirahman Assign 1Mazlax YareNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Jawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Document5 pagesJawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Mega RefiyaniNo ratings yet

- FAR First Preboard Batch 89 SolutionDocument6 pagesFAR First Preboard Batch 89 SolutionZiee00No ratings yet

- POA Online Final Revion - Paper 2Document13 pagesPOA Online Final Revion - Paper 2ricardogibbs9o9No ratings yet

- Departmental Accounts: Particulars Debit (RS.) Credit (RS.)Document8 pagesDepartmental Accounts: Particulars Debit (RS.) Credit (RS.)chaitanya lokeNo ratings yet

- Problem 23 2Document5 pagesProblem 23 2Muhammad SyahbinNo ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Q No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditDocument4 pagesQ No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditNAFEES NASRUDDIN PATEL0% (1)

- Alfiani - QUIZ 1 IASDocument23 pagesAlfiani - QUIZ 1 IASWilda Sania MtNo ratings yet

- Raine SDocument6 pagesRaine Sapi-664248097No ratings yet

- Tugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Document6 pagesTugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Iche IcheNo ratings yet

- CPA 1 - Financial Accounting Dec 2021Document9 pagesCPA 1 - Financial Accounting Dec 2021Asaba GloriaNo ratings yet

- Answer Key Chapter 10 Home OFFICE PART1Document8 pagesAnswer Key Chapter 10 Home OFFICE PART1karen perrerasNo ratings yet

- Managerial Accounting-Solutions To Ch07Document7 pagesManagerial Accounting-Solutions To Ch07Mohammed HassanNo ratings yet

- ACC101 Chapter2newDocument19 pagesACC101 Chapter2newDEREJENo ratings yet

- Accounting For Transactions: Key Terms and Concepts To KnowDocument19 pagesAccounting For Transactions: Key Terms and Concepts To KnowMaria Nicole OroNo ratings yet

- Accounting For Transactions: Key Terms and Concepts To KnowDocument19 pagesAccounting For Transactions: Key Terms and Concepts To KnowAileenNo ratings yet

- Final Account - Sole Trader - Practice QuestionDocument3 pagesFinal Account - Sole Trader - Practice QuestionMUSTHARI KHANNo ratings yet

- Fernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Document3 pagesFernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Kailash KumarNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Document5 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Renee WongNo ratings yet

- Topic 5: Short Term Decision Making Answer To Exercise 1: BKAM3023 Management Accounting IIDocument3 pagesTopic 5: Short Term Decision Making Answer To Exercise 1: BKAM3023 Management Accounting IIdini sofiaNo ratings yet

- Ass 2Document14 pagesAss 2Beza AbrNo ratings yet

- As At: Trial Balance ofDocument7 pagesAs At: Trial Balance ofDev KhatriNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Assingnment 7 SolutionDocument4 pagesAssingnment 7 Solutionshaza jocarlosNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Exercise Topic 5-AnswerDocument3 pagesExercise Topic 5-AnswerPatricia TangNo ratings yet

- Past ExamDocument9 pagesPast ExamHaziNo ratings yet

- M.B.A. QPDocument184 pagesM.B.A. QPyogeshNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Cash Flow Statement Assignment No. 1Document2 pagesCash Flow Statement Assignment No. 1Mahmoud IbrahimNo ratings yet

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-11 PDFDocument11 pagesAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-11 PDFaemanNo ratings yet

- BMBE SeminarDocument60 pagesBMBE SeminarBabyGiant LucasNo ratings yet

- "How Well Am I Doing?" Financial Statement AnalysisDocument61 pages"How Well Am I Doing?" Financial Statement AnalysisSederiku KabaruzaNo ratings yet

- JASF Template English Jan2022Document12 pagesJASF Template English Jan2022Rizky Rizky NurdiansyahNo ratings yet

- Session 1 - Basic Concepts of Corporate Taxation Tax TreatiesDocument35 pagesSession 1 - Basic Concepts of Corporate Taxation Tax TreatiesYash SharmaNo ratings yet

- Cambodian Taxation Reviewers 5Document25 pagesCambodian Taxation Reviewers 5Ken JomelNo ratings yet

- Budgeting Family ResourcesDocument10 pagesBudgeting Family ResourcesKing Justin ManansalaNo ratings yet

- Chapter 6 Accounting For PartnershipDocument19 pagesChapter 6 Accounting For PartnershipBiru EsheteNo ratings yet

- ICAEW Principles of Taxation CH 1-4Document34 pagesICAEW Principles of Taxation CH 1-4ITALIANO hohNo ratings yet

- Browning Ch03 P15 Build A ModelDocument3 pagesBrowning Ch03 P15 Build A ModelAdam0% (1)

- Havelsan Solo (ENG)Document6 pagesHavelsan Solo (ENG)SunShine EverydayNo ratings yet

- Key Words in Scanner PDFDocument25 pagesKey Words in Scanner PDFmikasha977No ratings yet

- Property Plant and EquipmentDocument2 pagesProperty Plant and EquipmentMA. ANGELICA DARL DOMINGO CHAVEZNo ratings yet

- FM Cia 3Document29 pagesFM Cia 3Tanmay JainNo ratings yet

- PGINVIT Tax Exemption Category1-Appendix4Document2 pagesPGINVIT Tax Exemption Category1-Appendix4thirurajaNo ratings yet

- Indian Union Budget 2011-2012 HighlightsDocument11 pagesIndian Union Budget 2011-2012 HighlightsAfroz MalikNo ratings yet

- BASIC CONCEPTS ON COST ACCOUNTING - ContinuationDocument6 pagesBASIC CONCEPTS ON COST ACCOUNTING - ContinuationElyssa Mae C. BigcasNo ratings yet

- Cost Sheet ProblemsDocument11 pagesCost Sheet ProblemsPrem RajNo ratings yet

- CH - 2 For TeacherDocument11 pagesCH - 2 For TeacherEbsa AdemeNo ratings yet

- Team PRTC-10.21 FPB SOLUTION-TAXDocument8 pagesTeam PRTC-10.21 FPB SOLUTION-TAXViolet BaudelaireNo ratings yet

- Advanced Taxation (Malaysia) : March/June 2017 - Sample QuestionsDocument12 pagesAdvanced Taxation (Malaysia) : March/June 2017 - Sample QuestionsKiyong TanNo ratings yet

- Important Questions in Accounting and FMDocument5 pagesImportant Questions in Accounting and FMmajeednishad2No ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- B) Sources of Evidences in Verifying The Ownership and Cost of The Following AssetsDocument4 pagesB) Sources of Evidences in Verifying The Ownership and Cost of The Following AssetsERICK MLINGWANo ratings yet

- Chapter 7 The Analysis of Investment ProjectsDocument41 pagesChapter 7 The Analysis of Investment ProjectsHùng PhanNo ratings yet

- Public Finance: Public Finance Is The Branch of Economics That Studies TheDocument11 pagesPublic Finance: Public Finance Is The Branch of Economics That Studies TheFAIZAN HASSANNo ratings yet

- Profitability: 2008 2010 Operating Profit Margin (%)Document4 pagesProfitability: 2008 2010 Operating Profit Margin (%)prarak7283No ratings yet

- Hotel Chart of AccountsDocument2 pagesHotel Chart of AccountsVivek BhadviyaNo ratings yet