Professional Documents

Culture Documents

2 Impact

2 Impact

Uploaded by

Prottoy DasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Impact

2 Impact

Uploaded by

Prottoy DasCopyright:

Available Formats

Corporate Governance and

Firm Valuation

Impact of Corporate Governance on Firms' Valuation –

A Study on the Commercial Banks of Bangladesh

Anamul Haque Rubayet Hasan

Assistant Professor Lecturer

Department of Banking & Insurance Department of Banking & Insurance

University of Chittagong University of Chittagong

anam.haq@cu.ac.bd

Abstract

Traditional corporate finance theory pronounces the implementation of corporate governance practices as an

instrumental issue for the firms’ value. In this regard, this paper aims at investigating the impact of internal corporate

governance practices on the firms’ value in a developing market setting where the regulatory arrangements

are week and fragile. It considers five commercial banks working in Bangladesh and their governance related

variables and other control variables collected as secondary data from 2013-2017. Different financial ratios and

statistical tools (descriptive statistics, Pearson’s correlation & regression analysis) have been utilized for verifying

the hypotheses. The findings reflect that CEO duality, board size, institutional directorship, age of the firm and

managerial shareholding have significant impacts on sampled banks’ net asset value (NAV). Finally, another

multivariate regression model has been reentered considering the only accepted variables.

Keywords: Corporate Governance, Net Asset Value, Commercial Banks.

Introduction

Understanding the influence of corporate governance on firm’s value has attracted the much interest of the

researchers in the field of finance and economics. This study has developed an interaction of corporate governance

in impacting firm’s value in the context of developing countries like Bangladesh where the regulatory arrangements

are week and fragile. In this regard, existing research like Berle and Means (1932) articulated the relevance of

corporate governance as an essential determinant between controlling insiders and exterior speculators, which

has vibrant suggestions for the valuation of the firm. The findings have consistency with the results of Jensen and

Meckling, 1976; Lemmon and Lins, 2003. Other studies (e.g., Morck, Shleifer, and Vishny, 1988; McConnell and

Servaes, 1990 and Holderness, Kroszner, and Sheehan; 1999 also provided similar empirical evidences in respect

of this hypothesis regarding the firm’s value. Besides, corporate governance has got much consideration due

to tall profile scandals such as Adelphia, Enron and WorldCom, serving as the impulse to the Sarbanes–Oxley Act

17 THE COST AND MANAGEMENT

ISSN 1817-5090, VOLUME-48, NUMBER-01, JANUARY-FEBRUARY 2020

of 2002, the foremost clearing corporate governance many facets of corporate decisions. Further, Kumar

regulation in the US within the final 70 a long (2004) and Barbosa and Louri (2002) observed that a

time (Byrnes et al., 2003). Consistent with this focus firms’ productivity consumed by its agents is significantly

on corporate governance, prior studies (e.g; Gompers influenced by ownership structure. In specific, corporate

et al., 2003; Bebchuk and Cohen, 2005; Bebchuk et governance is a motivation contraption for

al., 2005; Cremers and Nair, 2005) have originated diminishing the agency costs related with the

that better governance is connected to higher firm separation of ownership and firm’s value. This

valuation as proxied by Tobin’s Q. An interaction research has in particular on the impact of corporate

between the ownership and governance literature has governance within this scope on firm valuation and the

been merged by Xu and Wang (1999) and suggested related literature.

the causation of large institutional investors in Previously, Jensen and Meckling (1976) expressed that

influencing firm level corporate governance practices corporate governance and its impact on firm’s value

and firm’s value adversely. Therefore, this research is widely influenced by the firm specific ownership

aims at establishing a developing economy relevance structure in the sense of generally accepted corporate

of corporate governance in impacting firm’s value. finance literatures. There are six theoretical literatures

This research has considered the interaction related to on corporate governance channels that could be

corporate governance practices in the Banking industry attributed to controlling agency costs (Kumar, 2004).

of Bangladesh for several reasons. The previous i.e. Ownership structure: Jensen and Meckling (1976)

literatures (e.g. Cho, 1998; Demsetz and Villalonga, and Shleifer and Vishny (1986), Capital Structure and

2001; Bøhren and Ødegaard, 2001; Barbosa and Board: Jensen (1986), Compensation: Jensnen and

Louri, 2002) directed for the purpose of examining Mourphy (1990), Competitive Risk: Hart (1983),

the effects of ownership structure is largely available Takeover Market: Fama and Jensen (1983). Empirical

with greater attention to U.S. and European market. evidences suggest that firm value is an outcome of

While we have explored banking firms of Bangladesh these above counteracting mechanisms. Shleifer and

in order to afford new evidence. Based on theoretical Vishny (1986) argued that institutional investors

arguments our empirical model is specific to derive enjoy the competitive advantage and incentive to

the relationship between corporate governance and collect information and monitor management reduces

firm’s value. Therefore, this study in origin contributed agency costs. These are evidences are quite available

to examine the impact of corporate governance on in relation with developed countries but relatively

firm’s value of banking industry which has immense scare in developing countries like Bangladesh.

policy consideration. There have been found two conflicting body of

The remainder of the study is organized as follows. literatures regarding the impact of corporate

Section two reflects the existing literature, section governance on firm valuation. Firstly, Farooque, et al

three aims and objectives, section four about (2007) explained that ownership structure as a basis

methodology, section five reflects analysis and findings for exercising power and control over corporate

and section six provides the conclusion. entities can address problem of agency costs and

ensure efficient financial performance. They further

Literature Review suggested to examine the ownership effect as one of

The nature of connection between the corporate the core governance mechanisms along with others

governance and firm performance and valuation have such as, debt structure, board structure, incentive-

been the center issue in the areas of corporate finance based compensation structure, dividend structure,

literature. Al-Ahdal et al. (2020) defines corporate and external auditing on firm performance. However,

governance in a mechanism that offers the conducting a “reverse-way” causality relationship

organizational structures through which firms between ownership and firm level performance on

are directed and maintain a balance distribution the listed firms of Bangladesh, they documented

of resources among the competing parties like that ownership does not have a significant impact

shareholders, managers, investors, customers and on performance (Tobin’s Q or ROA) but theory

regulators. Researchers have therefore been exploring does appear to have a significant negative impact on

the complex effect of corporate governance on the ownership. Findings also imply the significant relevance

18 THE COST AND MANAGEMENT

ISSN 1817-5090, VOLUME-48, NUMBER-01, JANUARY-FEBRUARY 2020

of “internal governance mechanisms” on firm’s value. shareholding has a linear significant impact on

To some extent earlier literatures (e.g. Loderer and Japanese firm performance, even after controlling for

Martin, 1997; Cho, 1998; Demsetz and Villalonga, firm fixed effects. However, they find that the fixed

2001) address endogeneity concerns about the effect is significant. Majumdar (1998) using industry

performance-ownership relationship in their analysis. level survey data for 1973-89, compared performance

Loderer and Martin (1997) and Demsetz and Villalonga of state-owned enterprises, mixed-enterprises,

(2001) found find no evidence that larger managerial and private corporations and found that ownership

ownership boosts performance. In contrast, structure matters in firm valuation. Sarkar and Sarkar

performance appears to have a negative effect on (2000), Khanna and Palepu (2000), Patibandla (2002)

executive stockholdings. Cho (1998) confirms that and Douma, George, and Kabir (2003) found that

investment positively affects corporate value, which governance practices through the channels of several

in turn affects insider ownership. In addition, Bohren structures of ownership have positive effect on firm

and Odegaard (2001) based on Norwegian data, performance. With respect to recent literature,

Fernandez and Gomez (2002) based on Spanish firms, Brown and Caylor (2006) also found that governance

Agrawal and Knoeber (1996), Firth et al. (2002) based score is positively related with firm’s value measured

on U.S. firms and Himmelberg et al. (1999) found no in Tobin’s Q in the U.S. economy. Aggarwal et al.

evidence of ownership structure influencing firm’s (2010) have considered the comparative impact

value through the channel of corporate governance. of governance between 22 foreign countries and

In recent literature, Ciftci et al. (2019) examined the the U.S. with 1527 institutional observations and

impact of corporate governance on firm performance supported that the governance gap is strongly related

based on Turkey as an example of family capitalism to firm value. The flow of recent literature still shows

and concluded that more concentrated ownership a competing view of corporate governance impact

mainly family ownership directed to better firms’ on firm performance. Different researchers (e.g. Al-

performance. Varshney et al. (2012), Saini and Najjar, 2014; Arora & Bodhanwala, 2018) also posed

Singhania (2018) also found the similar conclusion mixed evidences consistent with Brown and Caylor

based on Indian firms. Iqbal et al. (2019) studied that (2006) regarding the corporate governance impact.

relationship for micro finance institutions working in The above contrasting views of literatures around

Asia based on seven measures about board size and the impact of corporate governance on firm

composition, CEO characteristics, and ownership valuation prove the relevance the fact as a matter of

type and emphasized the endogenous nature of worthiness to be investigated. This research would

corporate governance and financial performance. like to utilize the panel data of listed banking firms of

Similar research done by Pillai and Al-malkawi (2017) Bangladesh to examine the empirical specifications

settled that government shareholdings, audit type, of the relationship between corporate governance

size of the board, corporate social responsibility and and firms’ performance. In Bangladesh domestically

leverage significantly affect the firm performances in owned commercial banks have state, private and

the majority of the countries of the Gulf Cooperation mixed ownership. For the research simplicity we have

Council (GCC). Based on Chinese economy Shao considered them just commercial banks.

(2018) explored the relationship between corporate

governance structure and firm performance from

2001 to 2015 and found no relationship between

Objectives

This research aims at exploring the impact of

board size (including independent directors) and firm

corporate governance on firm valuation. Studies show

performance and positive effects of concentrated

(Heugens, Van Essen and van Oosterhout, 2009)

and state ownership. Surprisingly, Gupta and Sharma

that ownership concentration represents the optimal

(2014) found the limited impact of corporate

corporate governance arrangement in contexts

governance on financial performance based top 10

such where institutions are relatively weak. Further,

Indian & South Korean listed companies based on

cross ownership allows minority shareholders to

turnover for the period from 2005–6 to 2012–13.

maintain control, whilst only holding a relatively

Secondly, Lubatkin and Chatterjee (1994) and Chen, small proportion of equity (Bebchuk, Kraakman and

Guo, and Mande (2003) document that managerial Triantis, 2000). Therefore, the below mentioned key

19 THE COST AND MANAGEMENT

ISSN 1817-5090, VOLUME-48, NUMBER-01, JANUARY-FEBRUARY 2020

research question identifies the broad area of my research aim and supplementary questions outline the specific

intended research findings.

Key Research Question:

w How does corporate governance influence firm valuation?

Supplementary Research Questions:

w How does corporate governance influence firm level performance?

w How do firm-specific control variables influence firm valuation?

Methodology

This study will consider five listed commercial banks1 of Bangladesh accumulating financial data from their

respective annual reports 2013 to 2017. To estimate the impact of corporate governance on firm valuation, this

research has used the model suggested Morck, Shleifer, and Vishny (1988) and McConnell and Servaes (1990).

We have also checked the robustness of the following model through controlling size, leverage and intangible

fixed assets and revealed the findings as consistent.

NAVit=α0+α1 CEODit+α2 BDSit+α3 TAit+α4 ISDit-1+α5WNDit+α7 AGEF

+α8 MSHt+α9 ASGt+εit

FVit=NAVit=α0+α1CEODit+α2BDSit++α3 TAit+α4 ISDit-1+α5WNDit

+α7 AGEF+α8 MSHt+α9 ASGt+εit

Here, FV refers the market value of shares and NAV for net asset value. We have measured the impact of

corporate governance through CEO duality (CEOD) a binary variable with 1 (when CEO duality) and 0 as

otherwise, board size (BDS), institutional director (ISD), women director (WND) and management shareholding

(MSH) variables and added other firm specific control variables like Firm Size as measured the log of total assets

(TA), age of the firm (AGE), asset growth (ASG) etc. Though the methodological components are dependable

and concrete in testing the hypothesis, the concern of endogeneity can be even managed though adopting an

instrumental variable approach.

Analysis and Findings

It is surprising that the analysis is STATA did not show any significant impact of corporate governance on market

value of share. It is somehow related with the efficient market hypothesis (Fama, 1991). Therefore, we have

moved with the dependent variable, Net Asset Value (NAV). Table-1 shows descriptive statistics of all dependent

and explanatory variables that have been considered in this study. The sample has mean NAV of Tk. 92.99 with

Tk. 93.74 standard deviation. The minimum level of NAV is Tk. 16.86 and the maximum is Tk. 444.52. The all

other explanatory variables also present their means, standard deviations, maximum and minimum values.

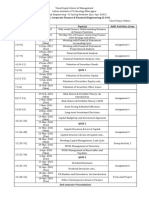

Table-1: Descriptive Statistics

Variables N Minimum Maximum Mean Std. Deviation

NAV 50 16.86 444.52 92.99 93.74

CEOD 50 0 1 .16 .37

BDS 50 0 1 .5 .505

TA 50 23.8 226.52 30.40 28.32

ISD 50 0 1 .82 .388

WND 50 0 1 .64 .4848

AGE 50 18 58 39.7 9.88

MSH 50 0 1 .5 .505

ASG 50 .33 .25 .123 .045

Source: STATA Output

1 The name of those five listed commercial banks of Bangladesh has not been revealed here for ethical concern.

20 THE COST AND MANAGEMENT

ISSN 1817-5090, VOLUME-48, NUMBER-01, JANUARY-FEBRUARY 2020

Table-2: Correlation Matrix

NAV CEOD BDS TA ISD WND AGE MSH ASG

NAV 1.0000

CEOD -0.0570 1.0000

BDS -0.6630 -0.2182 1.0000

TA -0.0876 -0.0695 0.1253 1.0000

ISD -0.3171 -0.5055 0.4685 0.0595 1.0000

WND -0.0536 -0.2409 0.1667 0.1158 0.6247 1.0000

AGE 0.2024 -0.4214 0.1982 -0.0994 0.4643 0.2792 1.0000

MSH -0.5745 0.1091 0.2000 0.1394 -0.0521 -0.1667 -0.2758 1.0000

ASG -0.1377 -0.0335 0.1561 -0.0153 -0.0603 -0.1926 -0.0579 0.0436 1.0000

Source: STATA Output

Table-2 shows the pattern how the dependent and explanatory variables are interrelated with one another.

Dependent variable, NAV has positive relationships with AGE (.2024) and negative relationship with CEOD, BDS,

TA, ISD, WBD, MSH and ASG. There is a mix of contrasting and consistent correlations among the variables.

Table-3: Regression Analysis

NAV Coef. Robust z P> |z| [95% Conf.

Std. Err. Interval]

CEOD -43.2949 16.05547 -2.70 0.007 -74.76305 -11.82676

BDS -97.69393 31.86815 -3.07 0.002 -160.1544 -35.2335

TA .2065371 .1349349 1.53 0.126 -.0579305 .4710048

ISD -82.82909 30.13666 -2.75 0.006 -141.8959 -23.76233

WND 9.736174 24.42181 0.40 0.690 -38.1297 57.60205

AGE 2.616544 1.221708 2.14 0.032 .2220396 5.011048

MSH -72.55752 20.91685 -3.47 0.001 -113.5538 -31.56126

ASG -78.60999 95.63027 -0.82 0.411 -266.0419 108.8219

_cons 146.2654 57.70203 2.53 0.011 33.17153 259.3593

Dependent Variable: Net Asset Value Per Share

Source: STATA Output

Regression model in the table-3 specifies that total assets, women directorship and firm age have positive

impacts on sample banks’ net asset value (NAV) and besides, CEO duality, board size, institutional directors,

managerial shareholding, asset growth have negative impacts. Findings show contradictory conclusion with the

traditional hypothesis in case of institutional directorship and asset growth variables. The model finally accepted

alternative hypotheses that CEO duality, board size, institutional directorship, age of the firm and managerial

shareholding has significant negative impacts on sample banks’ NAV. These all signify that corporate governance

is an instrumental matter in firm valuation.

Table-4: Regression Analysis

NAV Coef. Robust z P > |z| [95% Conf.

Std. Err. Interval]

CEOD -29.19222 10.07612 -2.90 0.004 -48.94104 -9.44339

BDS -57.88199 32.64969 -1.77 0.076 -121.8742 6.110223

ISD -79.65502 19.17995 -4.15 0.000 -117.247 -42.06302

AGE 2.104678 1.50158 1.40 0.161 -.8383654 5.047721

MSH -84.53836 29.76777 -2.84 0.005 -142.8821 -26.1946

_cons 150.6373 57.79635 2.61 0.009 37.35856 263.9161

Dependent Variable: Net Asset Value Per Share

Source: STATA Output

21 THE COST AND MANAGEMENT

ISSN 1817-5090, VOLUME-48, NUMBER-01, JANUARY-FEBRUARY 2020

With the findings of coefficients shown in table-3, the model has been further modified only considering the

significant independent variables with a view to making the model more intensive. In that regression, the impact of

all considered independent variables is found as significant except the age of the firm. Finally, following regression

model has been developed for measuring the impact of corporate governance on sample banks’ value including

only the accepted variables.

NAV = 150.63 14.84 -29.19*CEOD – 57.88*BDS – 79.66*ISD – 84.54*MSH + e

Conclusion

Motivated by the conflicting views of earlier researches, this study has examined the impacts of corporate

governance variables on the banking institutions of Bangladesh. The study found that CEO duality, large board

size and managerial shareholding have negative impact on firms’ value as expected according to literature.

Theoretically, CEO dominance, dispersed board size, joint ownership and managerial participation have

significance relevance in spreading agency problem that hinders firms’ performance and value. This study further

revealed that control variables like, firm size and age of the firm have positive impact on firm valuation. Though

these impacts are not significant, they largely contributed to examine the impact of the governance variables

much extensively. After all, the research has much contribution to the literature that studies the importance

of corporate governance on firm valuation in a developing country context. In particular, it proves that there

is a growing concern for governance practices in corporate decisions for better firm level performances in a

fragile institutional and regulatory framework like in Bangladesh. However, the impact of institutional directorship

discloses a negative impact on firm value which is against the traditional literature in corporate finance. Also, most

interestingly the study could not establish any significant causal relationship between the corporate governance

variables and firm’s value (measured in market value per share) reported in the annual reports of those sampled

banks. The lack of that relationship can somehow be related with the weak form of market efficiency. As stock

markets in Bangladesh cannot truly reflect all the inside and public information in their asset pricing. Also, the

study is limited in sample size and period, extended sample size could pose more reliable and robust result which

could be an important topic for further research. Finally, the study recommends the careful concern in board

formation and diversity, active separation between ownership and management with a view to ensuring better

financial performance and value.

References

Aggarwal, R., Erel, I., Stulz, R., Williamson, R., 2010. Differences in governance practices between US and foreign firms: measurement, causes, and

consequences. Review of Financial Studies, 22 (8), 3131–3169.

Agrawal, A. and Knoeber, C.R., 1996. Firm performance and mechanisms to control agency problems between managers and shareholders. Journal

of financial and quantitative analysis, 31(3), pp.377-397.

Al Farooque, O., Van Zijl, T., Dunstan, K. and Karim, A.W., 2007. Corporate governance in Bangladesh: Link between ownership and financial

performance. Corporate governance: An international review, 15(6), pp.1453-1468.

Al-ahdal, W.M., Alsamhi, M.H., Tabash, M.I. and Farhan, N.H., 2020. The impact of corporate governance on financial performance of Indian and

GCC listed firms: An empirical investigation. Research in International Business and Finance, 51, p.101083.

Al-Malkawi, H.A.N., Pillai, R., Bhatti, M.I., 2014. Corporate governance practices in emerging markets: the case of GCC countries. Economic

Modelling, 38, 133–141.

Al‐Najjar, B., 2015. The Effect of Governance Mechanisms on Small and Medium‐Sized Enterprise Cash Holdings: Evidence from the United

Kingdom. Journal of Small Business Management, 53(2), pp.303-320.

Arora, A. and Bodhanwala, S., 2018. Relationship between corporate governance index and firm performance: Indian evidence. Global Business

Review, 19(3), pp.675-689.

Barbosa, N. and Louri, H., 2002. On the determinants of multinationals’ ownership preferences: evidence from Greece and Portugal. International

Journal of Industrial Organization, 20(4), pp.493-515.

Bebchuk, L.A. and Cohen, A., 2005. The costs of entrenched boards. Journal of financial economics, 78(2), pp.409-433.

Bebchuk, L.A., Kraakman, R. and Triantis, G., 2000. Stock pyramids, cross-ownership, and dual class equity: the mechanisms and agency costs of

separating control from cash-flow rights. In Concentrated corporate ownership (pp. 295-318). University of Chicago Press.

Berle, A.A. and Means, G.C., 1932. The modern corporation and private property. New Brunswick. NJ: Transaction.

22 THE COST AND MANAGEMENT

ISSN 1817-5090, VOLUME-48, NUMBER-01, JANUARY-FEBRUARY 2020

Bøhren, Ø. and Ødegaard, B.A., 2001. Corporate governance and managerial behavior, agency costs and ownership structure En:

economic performance in Norwegian listed firms. Research Journal of Finance Economics, 3.

Reports, 11. Khanna, T. and Palepu, K., 2000. The future of business groups in

Brown, L.D. and Caylor, M.L., 2004. Corporate governance and firm emerging markets: Long-run evidence from Chile. Academy of

performance. Available at SSRN 586423. Management journal, 43(3), pp.268-285.

Brown, L.D., Caylor, M.L., 2006. Corporate governance and firm Kumar, J., 2004. Does ownership structure influence firm value?

valuation. Journal of Accounting and Public Policy, 25 (4), 409–434. Evidence from India. Journal of Entrepreneurial Finance and

Chen, C.R., Guo, W. and Mande, V., 2003. Managerial ownership and Business Ventures, 9(2), pp.61-93.

firm valuation: Evidence from Japanese firms. Pacific-Basin Finance Lemmon, M.L. and Lins, K.V., 2003. Ownership structure, corporate

Journal, 11(3), pp.267-283. governance, and firm value: Evidence from the East Asian financial

Cho, M.H., 1998. Ownership structure, investment, and the corporate crisis. Journal of Finance, 58(4), pp.1445-1468.

value: an empirical analysis. Journal of financial economics, 47(1), Loderer, C. and Martin, K., 1997. Executive stock ownership

pp.103-121. and performance tracking faint traces. Journal of Financial

Chung, R., Firth, M. and Kim, J.B., 2002. Institutional monitoring Economics, 45(2), pp.223-255.

and opportunistic earnings management. Journal of corporate Lubatkin, M. and Chatterjee, S., 1994. Extending modern portfolio

finance, 8(1), pp.29-48. theory into the domain of corporate diversification: does it

Ciftci, I., Tatoglu, E., Demirbag, M., Zaim, S., 2019. Corporate apply? Academy of Management Journal, 37(1), pp.109-136.

governance and firm performance in emerging markets: evidence Majumdar, S.K., 1998. Assessing comparative efficiency of the state-

from Turkey. International Business Review, 28,90–103. owned mixed and private sectors in Indian industry. Public

Cremers, K.M. and Nair, V.B., 2005. Governance mechanisms and choice, 96(1-2), pp.1-24.

equity prices. the Journal of Finance, 60(6), pp.2859-2894. McConnell, J.J. and Servaes, H., 1990. Additional evidence on

Demsetz, H. and Villalonga, B., 2001. Ownership structure and equity ownership and corporate value. Journal of Financial

corporate performance. Journal of corporate finance, 7(3), Economics, 27(2), pp.595-612.

pp.209-233. Morck, R., Shleifer, A. and Vishny, R.W., 1988. Management ownership

Douma, S., George, R. and Kabir, R., 2006. Foreign and domestic and market valuation: An empirical analysis. Journal of Financial

ownership, business groups, and firm performance: Evidence from Economics, 20, pp.293-315.Patibandla, M., 2006.

a large emerging market. Strategic Management Journal, 27(7), Equity pattern, corporate governance and performance: A study

pp.637-657. of India’s corporate sector. Journal of Economic Behavior &

Fama, E.F. and Jensen, M.C., 1983. Separation of ownership and Organization, 59(1), pp.29-44.

control. Journal of law and Economics, 26(2), pp.301-325. Saini, N., Singhania, M., 2018. Corporate governance, globalization

Fama, E.F., 1991. Efficient market hypothesis. Journal of Finance, 46, and firm performance in emerging economies: evidence from

pp.383-417. India. International Journal of Productivity and Performance

Management, 67 (8), 1310–1333.

Fernandez, C. and Gomez, S., 2002. Does ownership structure affect

firm performance? Evidence from a continental-type governance Sarkar, J. and Sarkar, S., 2000. Large shareholder activism in

system. Journal of Finance, pp.1835-1874. corporate governance in developing countries: Evidence from

India. International Review of Finance, 1(3), pp.161-194.

Gompers, P., Ishii, J. and Metrick, A., 2003. Corporate governance and

equity prices. Quarterly Journal of Economics, 118(1), pp.107- Shao, Lin, 2018. Dynamic Study of Corporate Governance Structure

156. and Firm Performance in China: Evidence From 2001-2015.

Chinese Management Studies, https://doi.org/10.1108/CMS-08-

Gupta, P., Sharma, A.M., 2014. A study of the impact of corporate 2017-0217.

governance practices on firm performance in Indian and South

Korean Companies. Procedia Social and Behavioral Sciences, 133, Shleifer, A. and Vishny, R.W., 1986. Large shareholders and corporate

4–11. control. Journal of Political Economy, 94(3, Part 1), pp.461-488.

Hart, O.D., 1983. The market mechanism as an incentive scheme. Bell Varshney, P., Kaul, V.K., Vasal, V.K., 2012. Corporate governance

Journal of Economics, pp.366-382. index and firm performance: empirical evidence from India. SSRN

Electronic Journal, (April), 1–3

Heugens, P.P., Van Essen, M. and van Oosterhout, J.H., 2009. Meta-

analyzing ownership concentration and firm performance in Asia: Xu, X. and Wang, Y., 1999. Ownership structure and corporate

Towards a more fine-grained understanding. Asia Pacific Journal of governance in Chinese stock companies. China Economic

Management, 26(3), pp.481-512. Review, 10(1), pp.75-98.

Himmelberg, C.P., Hubbard, R.G. and Palia, D., 1999. Understanding

the determinants of managerial ownership and the link between

ownership and performance. Journal of financial economics, 53(3),

pp.353-384.

Holderness, C.G., Kroszner, R.S. and Sheehan, D.P., 1999. Were the

good old days that good? Changes in managerial stock ownership

since the great depression. Journal of Finance, 54(2), pp.435-469.

Iqbal, S., Nawaz, A., Ehsan, S., 2019. Financial performance and

corporate governance in microfinance: evidence from Asia. Journal

of Asian Economy, 60, 1–13.

Jensen, M.C. and Meckling, W., 1976. H. (1976). Theory of the firm:

23 THE COST AND MANAGEMENT

ISSN 1817-5090, VOLUME-48, NUMBER-01, JANUARY-FEBRUARY 2020

You might also like

- TR 25-1-2022 PreviewDocument9 pagesTR 25-1-2022 Previewkanarendran50% (2)

- L&T Construction: Practice Aptitude Questions With Answer KeyDocument6 pagesL&T Construction: Practice Aptitude Questions With Answer KeyRamaDinakaranNo ratings yet

- Corporate Governance Mechanisms and Firm Performance A Survey of LiteratureDocument16 pagesCorporate Governance Mechanisms and Firm Performance A Survey of Literaturekamal khanNo ratings yet

- Borescope TrainingDocument40 pagesBorescope Traininggantuya battulga100% (2)

- NCD 18 05 2024Document22 pagesNCD 18 05 2024Dr. Nitai Chandra DebnathNo ratings yet

- Literature Review: Impact of Corporate Governance and Ownership Structure On Cost of Capital in PakistanDocument25 pagesLiterature Review: Impact of Corporate Governance and Ownership Structure On Cost of Capital in PakistanAisha JavedNo ratings yet

- School of Management YAPIM Maros, IndonesiaDocument10 pagesSchool of Management YAPIM Maros, IndonesiaAnonymous ed8Y8fCxkSNo ratings yet

- Impact of Independent Directors and Remuneration Committee On Firm Performance? Evidence From Malaysian Capital MarketDocument4 pagesImpact of Independent Directors and Remuneration Committee On Firm Performance? Evidence From Malaysian Capital MarketCorolla SedanNo ratings yet

- Impact of Quality Corporate Governance On Firm Performance: A Ten Year PerspectiveDocument15 pagesImpact of Quality Corporate Governance On Firm Performance: A Ten Year PerspectiveFaisal JavaidNo ratings yet

- Corporate Governance and Firm PerformancDocument18 pagesCorporate Governance and Firm PerformancAfzalNo ratings yet

- The Moderating Effect of Large Shareholders On Board Structure-Firm Performance Relationship: An Agency PerspectiveDocument10 pagesThe Moderating Effect of Large Shareholders On Board Structure-Firm Performance Relationship: An Agency PerspectivebaruthiomNo ratings yet

- JFIA/Vol 7 - 1 - 3Document21 pagesJFIA/Vol 7 - 1 - 3naseem ashrafNo ratings yet

- Accounting: An Empirical Analysis of Corporate Governance and Firm Value: Evidence From KSE-100 IndexDocument12 pagesAccounting: An Empirical Analysis of Corporate Governance and Firm Value: Evidence From KSE-100 IndexAdnan HussainNo ratings yet

- Literature ReviewDocument7 pagesLiterature ReviewAkanni Lateef ONo ratings yet

- Equity Ownership and Fin PerformanceDocument7 pagesEquity Ownership and Fin PerformancePinal ShahNo ratings yet

- 1 SMDocument11 pages1 SMIndah Roikhatul JannahNo ratings yet

- Rafi Uddin Ahmed & Md. Imran HossainDocument20 pagesRafi Uddin Ahmed & Md. Imran HossainRabeya AktarNo ratings yet

- Does Good Governance Lead To Better Financial Performance?: Supriti MishraDocument19 pagesDoes Good Governance Lead To Better Financial Performance?: Supriti MishraHira RasheedNo ratings yet

- Ownership Structure, Corporate Governance and Firm Performance (#352663) - 363593Document10 pagesOwnership Structure, Corporate Governance and Firm Performance (#352663) - 363593mrzia996No ratings yet

- Post-Restructuring Governance: An Examination of Interlocking DirectoratesDocument16 pagesPost-Restructuring Governance: An Examination of Interlocking DirectoratesEhssan SamaraNo ratings yet

- Corporate Governance and The Relationship Between EVA and Created Shareholder ValueDocument13 pagesCorporate Governance and The Relationship Between EVA and Created Shareholder ValueClayton HansenNo ratings yet

- For Plag CheckDocument259 pagesFor Plag CheckAftab TabasamNo ratings yet

- Paper 5Document23 pagesPaper 5kasmshahabNo ratings yet

- CG, SD-FP India (2016)Document16 pagesCG, SD-FP India (2016)Renaldi PutraNo ratings yet

- Corporate Governance: A Review of Theoretical and Practical ImplicationsDocument7 pagesCorporate Governance: A Review of Theoretical and Practical ImplicationsThe IjbmtNo ratings yet

- Corporate Governance in IndiaDocument9 pagesCorporate Governance in IndiaRamkrishna LanjewarNo ratings yet

- CorporateDocument7 pagesCorporateAshu TyagiNo ratings yet

- Board Structure Ceo Tenure Firm Characte PDFDocument25 pagesBoard Structure Ceo Tenure Firm Characte PDFTeshaleNo ratings yet

- FYP Proposal FinalDocument11 pagesFYP Proposal FinalDaniyal MirzaNo ratings yet

- Chap4 PDFDocument45 pagesChap4 PDFFathurNo ratings yet

- 9910-33101-1-SMDocument8 pages9910-33101-1-SMPhương LinhNo ratings yet

- Managerial Ownership, Corporate Governance, and Voluntary DisclosureDocument19 pagesManagerial Ownership, Corporate Governance, and Voluntary Disclosure701450No ratings yet

- 1 PB PDFDocument8 pages1 PB PDFsome_one372No ratings yet

- Ownership Structure & Corporate Performance: An Investigation On The Textile Sector of BangladeshDocument14 pagesOwnership Structure & Corporate Performance: An Investigation On The Textile Sector of BangladeshkhanmukterNo ratings yet

- Corporate Governance and Firms PerformanceDocument12 pagesCorporate Governance and Firms PerformanceDrSekhar Muni AmbaNo ratings yet

- Relationship of Institutional Ownership With Firm Value and Earnings Quality: Evidence From Tehran Stock ExchangeDocument8 pagesRelationship of Institutional Ownership With Firm Value and Earnings Quality: Evidence From Tehran Stock ExchangeTI Journals PublishingNo ratings yet

- The Relationship Between Ownership Structure Dimensions and CorpoDocument19 pagesThe Relationship Between Ownership Structure Dimensions and Corpokiokojuma4No ratings yet

- Corporate Governance and Shareholder Value in Listed Firms: An Empirical Analysis in Five Countries (France, Italy, Japan, UK, USA)Document35 pagesCorporate Governance and Shareholder Value in Listed Firms: An Empirical Analysis in Five Countries (France, Italy, Japan, UK, USA)vaibhavNo ratings yet

- Ijcms 955 02Document10 pagesIjcms 955 02Shobhan MallaNo ratings yet

- 1 Iceme2011 A10015Document5 pages1 Iceme2011 A10015kaluasma100% (1)

- The Relationship Between Ownership Structures and Financial Performance Evidence From JordanDocument10 pagesThe Relationship Between Ownership Structures and Financial Performance Evidence From JordanKhaled BarakatNo ratings yet

- Corporate Governance and Firm Performance: A Case Study of Karachi Stock MarketDocument5 pagesCorporate Governance and Firm Performance: A Case Study of Karachi Stock MarketreynaldianwarNo ratings yet

- Government Ownership and Performance: An Analysis of Listed Companies in MalaysiaDocument9 pagesGovernment Ownership and Performance: An Analysis of Listed Companies in MalaysiaMuhammad FadelNo ratings yet

- Journal of Corporate Finance: Sanjai Bhagat, Brian BoltonDocument17 pagesJournal of Corporate Finance: Sanjai Bhagat, Brian BoltonDavid ScottNo ratings yet

- Corporate Governance and Firms' Financial Performance: Cite This PaperDocument12 pagesCorporate Governance and Firms' Financial Performance: Cite This PaperRahmat KaswarNo ratings yet

- Literature Review On The Relationship Between Board Structure and Firm PerformanceDocument11 pagesLiterature Review On The Relationship Between Board Structure and Firm PerformanceDr Shubhi AgarwalNo ratings yet

- Corporate Governance and Institutional OwnershipDocument53 pagesCorporate Governance and Institutional OwnershipFouad KaakiNo ratings yet

- Board Characteristics Relating To FirmsDocument11 pagesBoard Characteristics Relating To FirmsSri VarshiniNo ratings yet

- 3480 13918 1 PBDocument14 pages3480 13918 1 PBIndah Roikhatul JannahNo ratings yet

- Price Book Value & Tobin's Q: Which One Is Better For Measure Corporate Governance?Document6 pagesPrice Book Value & Tobin's Q: Which One Is Better For Measure Corporate Governance?MaxieNo ratings yet

- Vol - 19 3 1Document15 pagesVol - 19 3 1Shafick GabungaNo ratings yet

- Does Good Governance Matter To Institutional Investors - Evidence From The Enactment of Corporate Governance Guidelines - Picou - 2006Document13 pagesDoes Good Governance Matter To Institutional Investors - Evidence From The Enactment of Corporate Governance Guidelines - Picou - 2006Jashim UddinNo ratings yet

- 245-Article Text (Without Authors' Details) - 461-2-10-20220523Document18 pages245-Article Text (Without Authors' Details) - 461-2-10-20220523Lobna QassemNo ratings yet

- Lamport M J, Latona M N, Seetanah B, Sannassee R VDocument31 pagesLamport M J, Latona M N, Seetanah B, Sannassee R VManjula AshokNo ratings yet

- JPSP - 2022 - 479 PDFDocument11 pagesJPSP - 2022 - 479 PDFMohamed EL-MihyNo ratings yet

- Board Characteristics and Firm PerformanDocument17 pagesBoard Characteristics and Firm PerformanMd Shofiqul IslamNo ratings yet

- Strategic Literature Review On Contingency Factors and Bank Performance in ChinaDocument10 pagesStrategic Literature Review On Contingency Factors and Bank Performance in ChinaThe IjbmtNo ratings yet

- Corporate Governance and Firm Performance - A Study of Bse 100 CompaniesDocument11 pagesCorporate Governance and Firm Performance - A Study of Bse 100 CompaniesAbhishek GagnejaNo ratings yet

- Final Draft Mini ResearchDocument26 pagesFinal Draft Mini ResearchvitahazeNo ratings yet

- Influence of Corporate Governance On Strategy Implementation in Kenya Agricultural and Livestock Research OrganizationDocument15 pagesInfluence of Corporate Governance On Strategy Implementation in Kenya Agricultural and Livestock Research Organizationmariam yanalsNo ratings yet

- Carine FYP From GoogleDocument42 pagesCarine FYP From GoogleCarine TeeNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Admixtures 2Document34 pagesAdmixtures 2MudduKrishna shettyNo ratings yet

- 480-Article Text-1471-1-10-20211112Document6 pages480-Article Text-1471-1-10-20211112Chemtech-tupt EF ClassNo ratings yet

- Chapter 6 CompleteDocument30 pagesChapter 6 Completeduniya t vNo ratings yet

- 01 Operational Procedure Jay R BidolDocument3 pages01 Operational Procedure Jay R BidolRonie MoniNo ratings yet

- Osiloskop Analog PDFDocument4 pagesOsiloskop Analog PDFSauqia MufidamuyassarNo ratings yet

- Sand Moulded Castings Defects, Causes, Remedies - Review PaperDocument5 pagesSand Moulded Castings Defects, Causes, Remedies - Review PapersaranyaNo ratings yet

- Operation ManualDocument15 pagesOperation ManualWagdy BonaaNo ratings yet

- 5BSW (Syllabus) Revised and Approved by The Board of Studies of Social WorkDocument18 pages5BSW (Syllabus) Revised and Approved by The Board of Studies of Social WorkRohit SinghNo ratings yet

- Kashmir Moeed PirzadaDocument13 pagesKashmir Moeed Pirzadamanojkp33No ratings yet

- More PIC Programming: Serial and Parallel Data Transfer External Busses Analog To Digital ConversionDocument28 pagesMore PIC Programming: Serial and Parallel Data Transfer External Busses Analog To Digital ConversionLuckyBlueNo ratings yet

- Detailed Lesson Plan Electropneumatics - No HeaderDocument5 pagesDetailed Lesson Plan Electropneumatics - No HeaderMarnie AstrologoNo ratings yet

- Ewsd Centrales Telefonicas Siemens PDFDocument116 pagesEwsd Centrales Telefonicas Siemens PDFIvan Wilson AlanocaNo ratings yet

- 2 - Breakeven Analysis & Decision Trees PDFDocument35 pages2 - Breakeven Analysis & Decision Trees PDFRajat AgrawalNo ratings yet

- CS540 Assig NmentDocument12 pagesCS540 Assig NmentSajid AbbasNo ratings yet

- United States Court of Appeals For The Third CircuitDocument4 pagesUnited States Court of Appeals For The Third CircuitScribd Government DocsNo ratings yet

- Teledermatology: Concepts and Applications in MedicineDocument6 pagesTeledermatology: Concepts and Applications in MedicineJesse AguirreNo ratings yet

- Application Form For VITEEE - 2016: Full Name Yashaswi Pathak Application. No.: 2016146445Document1 pageApplication Form For VITEEE - 2016: Full Name Yashaswi Pathak Application. No.: 2016146445YashaswiPathakNo ratings yet

- Manual de Parte Bulldozer d8t Volumne 3Document28 pagesManual de Parte Bulldozer d8t Volumne 3henotharenasNo ratings yet

- Trainers - Methodology - 1 - Portfolio - Doc UnfinishedDocument123 pagesTrainers - Methodology - 1 - Portfolio - Doc UnfinishedHarris MalakiNo ratings yet

- Chery Manual v2.0-03.08Document172 pagesChery Manual v2.0-03.08DENISSE LANDAVERDE RAMIREZNo ratings yet

- Conduit Fill CalculationDocument3 pagesConduit Fill CalculationCarl James GranadaNo ratings yet

- 5-4-3 Wire Apartment Intercom Amp: Wiring InstructionsDocument8 pages5-4-3 Wire Apartment Intercom Amp: Wiring InstructionsVlasta Polic ZileNo ratings yet

- BM60112 - CFFA - FP 2021 - v1.0Document2 pagesBM60112 - CFFA - FP 2021 - v1.0MousumiNo ratings yet

- Habit Tracker + CalendarDocument2 pagesHabit Tracker + Calendarmaha.ashraf5145No ratings yet

- 21st Century Artifact Reflection 7th GRD 1Document2 pages21st Century Artifact Reflection 7th GRD 1api-237162684No ratings yet

- Avc A1d enDocument2 pagesAvc A1d enenergiculNo ratings yet

- 5862 55630 1 PBDocument12 pages5862 55630 1 PBkomiiakihimeNo ratings yet