Professional Documents

Culture Documents

csnt56 2023

csnt56 2023

Uploaded by

jade1993redCopyright:

Available Formats

You might also like

- CBIC Non Tariff Notification No. 072023-Customs (N.T) Dated 31.01.2023Document2 pagesCBIC Non Tariff Notification No. 072023-Customs (N.T) Dated 31.01.2023AltafNo ratings yet

- csnt66 2013Document1 pagecsnt66 2013stephin k jNo ratings yet

- csnt69 2013Document2 pagescsnt69 2013stephin k jNo ratings yet

- csnt71 2013Document1 pagecsnt71 2013stephin k jNo ratings yet

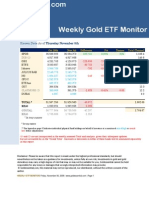

- Weekly Gold ETF MonitorDocument6 pagesWeekly Gold ETF MonitorRakesh VNo ratings yet

- Selectmarket and Thrust Product: Iii Internal AssignmentDocument4 pagesSelectmarket and Thrust Product: Iii Internal AssignmentDrx Mehazabeen KachchawalaNo ratings yet

- Cap Prices Wef 7th February 2024 - EnglishDocument7 pagesCap Prices Wef 7th February 2024 - EnglishboffuhusseinNo ratings yet

- Presentation PPN EmasDocument10 pagesPresentation PPN EmasIndra YuNo ratings yet

- #12 Batch - Delivery Note - 13.02.2020 PDFDocument1 page#12 Batch - Delivery Note - 13.02.2020 PDFShiva RajNo ratings yet

- Commercial Invoice-DM 32-23Document1 pageCommercial Invoice-DM 32-23AbouNo ratings yet

- 287 BoqDocument3 pages287 BoqbejayNo ratings yet

- Https Chennaicustoms - Gov.in Wp-Content Uploads 2021 08 1434517275.htmDocument4 pagesHttps Chennaicustoms - Gov.in Wp-Content Uploads 2021 08 1434517275.htmBhuvanNo ratings yet

- Cap Prices For Petroleum Products Wef 1st March 2023 EnglishDocument7 pagesCap Prices For Petroleum Products Wef 1st March 2023 EnglishEdgar SimfukweNo ratings yet

- 66-G.O.ms - No.48-Cashew and Coconut GardensDocument6 pages66-G.O.ms - No.48-Cashew and Coconut GardenskvjraghunathNo ratings yet

- 【PL】MEGAINDO Packinglist 323Document2 pages【PL】MEGAINDO Packinglist 323Wenny KamaruddinNo ratings yet

- 060-2010 Nsel ScamDocument3 pages060-2010 Nsel ScamNtvnews TeluguNo ratings yet

- Public Notice On Cap Prices For Petroleum Products Effective Wednesday, 6 APRIL 2022Document10 pagesPublic Notice On Cap Prices For Petroleum Products Effective Wednesday, 6 APRIL 2022Fredy MasandikaNo ratings yet

- #15 Batch - Delivery Note - 16.02.2020 PDFDocument1 page#15 Batch - Delivery Note - 16.02.2020 PDFShiva RajNo ratings yet

- Vx1100A-H Vx1100B-H Mj-Vx1100 '09: Waverunner VX Cruiser/DeluxeDocument61 pagesVx1100A-H Vx1100B-H Mj-Vx1100 '09: Waverunner VX Cruiser/DeluxeMariano GimenezNo ratings yet

- csnt84 2023Document2 pagescsnt84 2023ketulraval2013No ratings yet

- Budomari Sheet (11) New Second LotDocument12 pagesBudomari Sheet (11) New Second LotRT NafsanNo ratings yet

- Newcrest Dec 19 Quarterly ReportDocument16 pagesNewcrest Dec 19 Quarterly Reportzyy877rzzgNo ratings yet

- Post Office (Monthly Income Account) (Second Amendment) Rules, 1993.Document6 pagesPost Office (Monthly Income Account) (Second Amendment) Rules, 1993.Latest Laws TeamNo ratings yet

- Post Office Time Deposit (Amendment) Rules, 1995.Document4 pagesPost Office Time Deposit (Amendment) Rules, 1995.Latest Laws TeamNo ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- Daily Material Report Jan 19Document2 pagesDaily Material Report Jan 19safety apcoNo ratings yet

- DX800 Rock DrillDocument35 pagesDX800 Rock Drilljakarohmat88No ratings yet

- E 2 0 1 0 XXXX X SL0: AS 9100 ISO 9001Document1 pageE 2 0 1 0 XXXX X SL0: AS 9100 ISO 9001Sağlam RasimNo ratings yet

- Anti Dump ch-84Document36 pagesAnti Dump ch-84Tanwar KeshavNo ratings yet

- #16 Batch - Delivery Note - 17.02.2020Document1 page#16 Batch - Delivery Note - 17.02.2020Shiva RajNo ratings yet

- Bitre Fatalities Oct2023Document9 pagesBitre Fatalities Oct2023Darren mullanNo ratings yet

- Ms. Sunita Sunita (Adult, Female)Document2 pagesMs. Sunita Sunita (Adult, Female)Shivam SainiNo ratings yet

- Pii 2006599 SF Cal SilDocument1 pagePii 2006599 SF Cal SilSayyid AzzamNo ratings yet

- #14 Batch - Delivery Note - 15.02.2020 PDFDocument1 page#14 Batch - Delivery Note - 15.02.2020 PDFShiva RajNo ratings yet

- RAP PT. Surya Mas MentariDocument1 pageRAP PT. Surya Mas MentariofiNo ratings yet

- Qasd 838Document47 pagesQasd 838psicologoantonelliNo ratings yet

- VXSDocument60 pagesVXSJorjNo ratings yet

- 6ae48b3b c5bDocument22 pages6ae48b3b c5bBhima SuhardiyansyahNo ratings yet

- csnt54 2013Document2 pagescsnt54 2013stephin k jNo ratings yet

- Pat List-Timas-Desalter PDFDocument14 pagesPat List-Timas-Desalter PDFrizky efrinaldoNo ratings yet

- With Rock PRINT 19.3.2007 Final East Command FinalDocument171 pagesWith Rock PRINT 19.3.2007 Final East Command Finalwudineh debebeNo ratings yet

- Honda VarioDocument11 pagesHonda VariopsmpNo ratings yet

- 7392 Tr15CMSP Tr5MMDR 2nd Attempt Upfront Amount Bid Security and Fixed Amount 16.11.2022Document3 pages7392 Tr15CMSP Tr5MMDR 2nd Attempt Upfront Amount Bid Security and Fixed Amount 16.11.2022Aayush DubeyNo ratings yet

- Gas Form C Main Particulars: 2.1 PreambleDocument8 pagesGas Form C Main Particulars: 2.1 PreambleKeyur B ShrimaliNo ratings yet

- 394 Mecd ValveDocument11 pages394 Mecd ValveAnonymous jvaG8m7No ratings yet

- Overnment Otices Oewermentskennisgewings: Department of Transport Departement Van VervoerDocument28 pagesOvernment Otices Oewermentskennisgewings: Department of Transport Departement Van VervoerAlmeroNo ratings yet

- Schedules Under Tamil Nadu Value Added Tax Act, 2006actDocument42 pagesSchedules Under Tamil Nadu Value Added Tax Act, 2006actvickyani1986yahoo.co.inNo ratings yet

- Ambition Sep 2002Document111 pagesAmbition Sep 2002La Castle Automobile ChannelNo ratings yet

- WR250FF WR250F WR250FF WR250F: (2GB2) (2GB3) (2GB4) (2GB4)Document70 pagesWR250FF WR250F WR250FF WR250F: (2GB2) (2GB3) (2GB4) (2GB4)Gabriel ZamoraNo ratings yet

- Customs 2013Document1 pageCustoms 2013api-246792629No ratings yet

- Part II IndexDocument20 pagesPart II IndexJuan Daniel Rojas PalmaNo ratings yet

- Open Cell - 5% - 9 ConditionDocument1 pageOpen Cell - 5% - 9 Conditionbe21513dNo ratings yet

- National Clutch Catalogue 2019Document156 pagesNational Clutch Catalogue 2019mm6088873No ratings yet

- 9 Central Excise Notifications 2009Document17 pages9 Central Excise Notifications 2009aveeramani@yahoo.comNo ratings yet

- E035 Rev. 01Document9 pagesE035 Rev. 01Ayoub ChebaaneNo ratings yet

- 2009 Sro 211Document40 pages2009 Sro 211buttforoneNo ratings yet

- License Fee 2nd Round 20102Document6 pagesLicense Fee 2nd Round 20102SATRIONo ratings yet

- Post Office Time Deposit (Amendment) Rules, 1982.Document4 pagesPost Office Time Deposit (Amendment) Rules, 1982.Latest Laws TeamNo ratings yet

- ABS-CBN Supervisors Employees Union Members v. ABS-CBN Broadcasting Corp.Document11 pagesABS-CBN Supervisors Employees Union Members v. ABS-CBN Broadcasting Corp.Samuel ValladoresNo ratings yet

- Paul Lee Tan V Paul Sycip G.R. NO. 153468, August 17, 2006Document12 pagesPaul Lee Tan V Paul Sycip G.R. NO. 153468, August 17, 2006ChatNo ratings yet

- Aws WHB2 CH25 PDFDocument30 pagesAws WHB2 CH25 PDFAlex SalasNo ratings yet

- OpTransactionHistory09 02 2023Document11 pagesOpTransactionHistory09 02 2023Ishita KadamNo ratings yet

- 64.waiver, Release and QuitclaimDocument1 page64.waiver, Release and QuitclaimDeness Caoili-MarceloNo ratings yet

- RELAY InterlockingDocument14 pagesRELAY InterlockingYadwendra YadavNo ratings yet

- Advertisement Police ConstableDocument1 pageAdvertisement Police ConstableHussain AhmadNo ratings yet

- ONGC Recruitment of Graduate Trainees - 2011: Registration SlipDocument1 pageONGC Recruitment of Graduate Trainees - 2011: Registration SlipAshish JainNo ratings yet

- Sopariwala India LLP MaharashtraDocument3 pagesSopariwala India LLP MaharashtraBackend1 UniversalNo ratings yet

- KTM DetailsDocument2 pagesKTM DetailsBushra RehmanNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoiceMansi JaiswalNo ratings yet

- Contractor Performance Assessment & Reporting System (CPARS) InformationDocument4 pagesContractor Performance Assessment & Reporting System (CPARS) InformationCloud cesco2No ratings yet

- Alice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeDocument2 pagesAlice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeKulasekara PandianNo ratings yet

- General Information General InformationDocument8 pagesGeneral Information General Informationanthonny lionelNo ratings yet

- Analisis Keekonomian Proyek MigasDocument4 pagesAnalisis Keekonomian Proyek MigasAly RasyidNo ratings yet

- Leave Request Form (1-12)Document5 pagesLeave Request Form (1-12)Gretta FernandesNo ratings yet

- Family Plays: Excerpt Terms & ConditionsDocument14 pagesFamily Plays: Excerpt Terms & ConditionsyesNo ratings yet

- Tiger Airways Booking Confirmation - N435BLDocument2 pagesTiger Airways Booking Confirmation - N435BLTommy PhanNo ratings yet

- By Chris Kutschera: TweetDocument7 pagesBy Chris Kutschera: TweetOmar SimeNo ratings yet

- EMI Tenure Processing Fee % Rate of Interest Processing FeeDocument2 pagesEMI Tenure Processing Fee % Rate of Interest Processing FeeLakshay SainiNo ratings yet

- You Have Two Cows ..Document3 pagesYou Have Two Cows ..johnNo ratings yet

- Indian Tyres SreDocument1 pageIndian Tyres SreABHISHEK SHARMANo ratings yet

- Order Letters - Business Letter SamplesDocument5 pagesOrder Letters - Business Letter SamplesSandy Singh100% (3)

- Punjab Police: Senior Station Assistant (Ssa)Document3 pagesPunjab Police: Senior Station Assistant (Ssa)Muhammad JunaidNo ratings yet

- Pensioner's Update Form PDFDocument1 pagePensioner's Update Form PDFKaren Virrey100% (1)

- Liquid Hand Wash Rs. 5.06 Million Mar-2020 SMEDADocument19 pagesLiquid Hand Wash Rs. 5.06 Million Mar-2020 SMEDAgladiator_usNo ratings yet

- Cadre and Recruitment RulesDocument170 pagesCadre and Recruitment Rulessatheesh_srvNo ratings yet

- CHAMBER of Commerce PDFDocument20 pagesCHAMBER of Commerce PDFSamina Ashrabi UpomaNo ratings yet

- Nur Farzana Mohd Zaini United Malayan Land BHD Accounts AssistantDocument5 pagesNur Farzana Mohd Zaini United Malayan Land BHD Accounts AssistantFarzana ZainiNo ratings yet

- HBL Management SystemDocument6 pagesHBL Management Systemali chahilNo ratings yet

csnt56 2023

csnt56 2023

Uploaded by

jade1993redOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

csnt56 2023

csnt56 2023

Uploaded by

jade1993redCopyright:

Available Formats

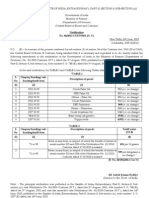

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART-II,

SECTION-3, SUB-SECTION (ii)]

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

Notification No. 56/2023-CUSTOMS (N.T.)

New Delhi, 31st July, 2023

09 SHRAAVANA, 1945 (SAKA)

S.O. … (E).– In exercise of the powers conferred by sub-section (2) of section 14 of the

Customs Act, 1962 (52 of 1962), the Central Board of Indirect Taxes & Customs, being

satisfied that it is necessary and expedient to do so, hereby makes the following

amendments in the notification of the Government of India in the Ministry of Finance

(Department of Revenue), No. 36/2001-Customs (N.T.), dated the 3 rd August, 2001,

published in the Gazette of India, Extraordinary, Part-II, Section-3, Sub-section (ii), vide

number S. O. 748 (E), dated the 3rd August, 2001, namely:-

In the said notification, for TABLE-1, TABLE-2, and TABLE-3 the following

Tables shall be substituted, namely: -

“TABLE-1

Chapter/ heading/ Tariff value

Sl. No. sub-heading/tariff Description of goods (US $Per Metric

item Tonne)

(1) (2) (3) (4)

1 1511 10 00 Crude Palm Oil 896

2 1511 90 10 RBD Palm Oil 925

3 1511 90 90 Others – Palm Oil 911

4 1511 10 00 Crude Palmolein 936

5 1511 90 20 RBD Palmolein 939

6 1511 90 90 Others – Palmolein 938

7 1507 10 00 Crude Soya bean Oil 1014

8 7404 00 22 Brass Scrap (all grades) 4886

TABLE-2

Sl. Chapter/ heading/ Description of goods

No. sub-heading/tariff Tariff value

item (US $)

(1) (2) (3) (4)

Gold, in any form, in respect of which

the benefit of entries at serial number 356 629 per 10

1. 71 or 98

of the Notification No. 50/2017-Customs grams

dated 30.06.2017 is availed

Silver, in any form, in respect of which 791 per

the benefit of entries at serial number 357 kilogram

2. 71 or 98

of the Notification No. 50/2017-Customs

dated 30.06.2017 is availed

(i) Silver, in any form, other than

medallions and silver coins having silver

content not below 99.9% or semi-

manufactured forms of silver falling

under sub-heading 7106 92;

(ii) Medallions and silver coins having

silver content not below 99.9% or semi-

791 per

manufactured forms of silver falling

3. 71 kilogram

under sub-heading 7106 92, other than

imports of such goods through post,

courier or baggage.

Explanation. - For the purposes of this

entry, silver in any form shall not include

foreign currency coins, jewellery made of

silver or articles made of silver.

(i) Gold bars, other than tola bars,

bearing manufacturer’s or refiner’s

engraved serial number and weight

expressed in metric units;

(ii) Gold coins having gold content not

below 99.5% and gold findings, other

than imports of such goods through post, 629 per 10

4. 71

courier or baggage. grams

Explanation. - For the purposes of this

entry, “gold findings” means a small

component such as hook, clasp, clamp,

pin, catch, screw back used to hold the

whole or a part of a piece of Jewellery in

place.

TABLE-3

Sl. Chapter/ heading/ Description of goods

No. sub-heading/tariff Tariff value

item (US $ Per Metric Ton)

(1) (2) (3) (4)

1 080280 Areca nuts 10379 (i.e., no change)”

2. This notification shall come into force with effect from the 01st day of August, 2023.

[F. No. 467/01/2023-Cus.V]

(Komila Punia)

Deputy Secretary

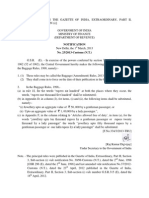

Note: - The principal notification was published in the Gazette of India, Extraordinary,

Part-II, Section-3, Sub-section (ii), vide Notification No. 36/2001–Customs (N.T.), dated

the 3rd August, 2001, vide number S. O. 748 (E), dated the 3rd August, 2001 and was last

amended vide Notification No. 53/2023-Customs (N.T.), dated the 14th July, 2023, e-

published in the Gazette of India, Extraordinary, Part-II, Section-3, Sub-section (ii), vide

number S.O.3148 (E), dated 14th July, 2023.

You might also like

- CBIC Non Tariff Notification No. 072023-Customs (N.T) Dated 31.01.2023Document2 pagesCBIC Non Tariff Notification No. 072023-Customs (N.T) Dated 31.01.2023AltafNo ratings yet

- csnt66 2013Document1 pagecsnt66 2013stephin k jNo ratings yet

- csnt69 2013Document2 pagescsnt69 2013stephin k jNo ratings yet

- csnt71 2013Document1 pagecsnt71 2013stephin k jNo ratings yet

- Weekly Gold ETF MonitorDocument6 pagesWeekly Gold ETF MonitorRakesh VNo ratings yet

- Selectmarket and Thrust Product: Iii Internal AssignmentDocument4 pagesSelectmarket and Thrust Product: Iii Internal AssignmentDrx Mehazabeen KachchawalaNo ratings yet

- Cap Prices Wef 7th February 2024 - EnglishDocument7 pagesCap Prices Wef 7th February 2024 - EnglishboffuhusseinNo ratings yet

- Presentation PPN EmasDocument10 pagesPresentation PPN EmasIndra YuNo ratings yet

- #12 Batch - Delivery Note - 13.02.2020 PDFDocument1 page#12 Batch - Delivery Note - 13.02.2020 PDFShiva RajNo ratings yet

- Commercial Invoice-DM 32-23Document1 pageCommercial Invoice-DM 32-23AbouNo ratings yet

- 287 BoqDocument3 pages287 BoqbejayNo ratings yet

- Https Chennaicustoms - Gov.in Wp-Content Uploads 2021 08 1434517275.htmDocument4 pagesHttps Chennaicustoms - Gov.in Wp-Content Uploads 2021 08 1434517275.htmBhuvanNo ratings yet

- Cap Prices For Petroleum Products Wef 1st March 2023 EnglishDocument7 pagesCap Prices For Petroleum Products Wef 1st March 2023 EnglishEdgar SimfukweNo ratings yet

- 66-G.O.ms - No.48-Cashew and Coconut GardensDocument6 pages66-G.O.ms - No.48-Cashew and Coconut GardenskvjraghunathNo ratings yet

- 【PL】MEGAINDO Packinglist 323Document2 pages【PL】MEGAINDO Packinglist 323Wenny KamaruddinNo ratings yet

- 060-2010 Nsel ScamDocument3 pages060-2010 Nsel ScamNtvnews TeluguNo ratings yet

- Public Notice On Cap Prices For Petroleum Products Effective Wednesday, 6 APRIL 2022Document10 pagesPublic Notice On Cap Prices For Petroleum Products Effective Wednesday, 6 APRIL 2022Fredy MasandikaNo ratings yet

- #15 Batch - Delivery Note - 16.02.2020 PDFDocument1 page#15 Batch - Delivery Note - 16.02.2020 PDFShiva RajNo ratings yet

- Vx1100A-H Vx1100B-H Mj-Vx1100 '09: Waverunner VX Cruiser/DeluxeDocument61 pagesVx1100A-H Vx1100B-H Mj-Vx1100 '09: Waverunner VX Cruiser/DeluxeMariano GimenezNo ratings yet

- csnt84 2023Document2 pagescsnt84 2023ketulraval2013No ratings yet

- Budomari Sheet (11) New Second LotDocument12 pagesBudomari Sheet (11) New Second LotRT NafsanNo ratings yet

- Newcrest Dec 19 Quarterly ReportDocument16 pagesNewcrest Dec 19 Quarterly Reportzyy877rzzgNo ratings yet

- Post Office (Monthly Income Account) (Second Amendment) Rules, 1993.Document6 pagesPost Office (Monthly Income Account) (Second Amendment) Rules, 1993.Latest Laws TeamNo ratings yet

- Post Office Time Deposit (Amendment) Rules, 1995.Document4 pagesPost Office Time Deposit (Amendment) Rules, 1995.Latest Laws TeamNo ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- Daily Material Report Jan 19Document2 pagesDaily Material Report Jan 19safety apcoNo ratings yet

- DX800 Rock DrillDocument35 pagesDX800 Rock Drilljakarohmat88No ratings yet

- E 2 0 1 0 XXXX X SL0: AS 9100 ISO 9001Document1 pageE 2 0 1 0 XXXX X SL0: AS 9100 ISO 9001Sağlam RasimNo ratings yet

- Anti Dump ch-84Document36 pagesAnti Dump ch-84Tanwar KeshavNo ratings yet

- #16 Batch - Delivery Note - 17.02.2020Document1 page#16 Batch - Delivery Note - 17.02.2020Shiva RajNo ratings yet

- Bitre Fatalities Oct2023Document9 pagesBitre Fatalities Oct2023Darren mullanNo ratings yet

- Ms. Sunita Sunita (Adult, Female)Document2 pagesMs. Sunita Sunita (Adult, Female)Shivam SainiNo ratings yet

- Pii 2006599 SF Cal SilDocument1 pagePii 2006599 SF Cal SilSayyid AzzamNo ratings yet

- #14 Batch - Delivery Note - 15.02.2020 PDFDocument1 page#14 Batch - Delivery Note - 15.02.2020 PDFShiva RajNo ratings yet

- RAP PT. Surya Mas MentariDocument1 pageRAP PT. Surya Mas MentariofiNo ratings yet

- Qasd 838Document47 pagesQasd 838psicologoantonelliNo ratings yet

- VXSDocument60 pagesVXSJorjNo ratings yet

- 6ae48b3b c5bDocument22 pages6ae48b3b c5bBhima SuhardiyansyahNo ratings yet

- csnt54 2013Document2 pagescsnt54 2013stephin k jNo ratings yet

- Pat List-Timas-Desalter PDFDocument14 pagesPat List-Timas-Desalter PDFrizky efrinaldoNo ratings yet

- With Rock PRINT 19.3.2007 Final East Command FinalDocument171 pagesWith Rock PRINT 19.3.2007 Final East Command Finalwudineh debebeNo ratings yet

- Honda VarioDocument11 pagesHonda VariopsmpNo ratings yet

- 7392 Tr15CMSP Tr5MMDR 2nd Attempt Upfront Amount Bid Security and Fixed Amount 16.11.2022Document3 pages7392 Tr15CMSP Tr5MMDR 2nd Attempt Upfront Amount Bid Security and Fixed Amount 16.11.2022Aayush DubeyNo ratings yet

- Gas Form C Main Particulars: 2.1 PreambleDocument8 pagesGas Form C Main Particulars: 2.1 PreambleKeyur B ShrimaliNo ratings yet

- 394 Mecd ValveDocument11 pages394 Mecd ValveAnonymous jvaG8m7No ratings yet

- Overnment Otices Oewermentskennisgewings: Department of Transport Departement Van VervoerDocument28 pagesOvernment Otices Oewermentskennisgewings: Department of Transport Departement Van VervoerAlmeroNo ratings yet

- Schedules Under Tamil Nadu Value Added Tax Act, 2006actDocument42 pagesSchedules Under Tamil Nadu Value Added Tax Act, 2006actvickyani1986yahoo.co.inNo ratings yet

- Ambition Sep 2002Document111 pagesAmbition Sep 2002La Castle Automobile ChannelNo ratings yet

- WR250FF WR250F WR250FF WR250F: (2GB2) (2GB3) (2GB4) (2GB4)Document70 pagesWR250FF WR250F WR250FF WR250F: (2GB2) (2GB3) (2GB4) (2GB4)Gabriel ZamoraNo ratings yet

- Customs 2013Document1 pageCustoms 2013api-246792629No ratings yet

- Part II IndexDocument20 pagesPart II IndexJuan Daniel Rojas PalmaNo ratings yet

- Open Cell - 5% - 9 ConditionDocument1 pageOpen Cell - 5% - 9 Conditionbe21513dNo ratings yet

- National Clutch Catalogue 2019Document156 pagesNational Clutch Catalogue 2019mm6088873No ratings yet

- 9 Central Excise Notifications 2009Document17 pages9 Central Excise Notifications 2009aveeramani@yahoo.comNo ratings yet

- E035 Rev. 01Document9 pagesE035 Rev. 01Ayoub ChebaaneNo ratings yet

- 2009 Sro 211Document40 pages2009 Sro 211buttforoneNo ratings yet

- License Fee 2nd Round 20102Document6 pagesLicense Fee 2nd Round 20102SATRIONo ratings yet

- Post Office Time Deposit (Amendment) Rules, 1982.Document4 pagesPost Office Time Deposit (Amendment) Rules, 1982.Latest Laws TeamNo ratings yet

- ABS-CBN Supervisors Employees Union Members v. ABS-CBN Broadcasting Corp.Document11 pagesABS-CBN Supervisors Employees Union Members v. ABS-CBN Broadcasting Corp.Samuel ValladoresNo ratings yet

- Paul Lee Tan V Paul Sycip G.R. NO. 153468, August 17, 2006Document12 pagesPaul Lee Tan V Paul Sycip G.R. NO. 153468, August 17, 2006ChatNo ratings yet

- Aws WHB2 CH25 PDFDocument30 pagesAws WHB2 CH25 PDFAlex SalasNo ratings yet

- OpTransactionHistory09 02 2023Document11 pagesOpTransactionHistory09 02 2023Ishita KadamNo ratings yet

- 64.waiver, Release and QuitclaimDocument1 page64.waiver, Release and QuitclaimDeness Caoili-MarceloNo ratings yet

- RELAY InterlockingDocument14 pagesRELAY InterlockingYadwendra YadavNo ratings yet

- Advertisement Police ConstableDocument1 pageAdvertisement Police ConstableHussain AhmadNo ratings yet

- ONGC Recruitment of Graduate Trainees - 2011: Registration SlipDocument1 pageONGC Recruitment of Graduate Trainees - 2011: Registration SlipAshish JainNo ratings yet

- Sopariwala India LLP MaharashtraDocument3 pagesSopariwala India LLP MaharashtraBackend1 UniversalNo ratings yet

- KTM DetailsDocument2 pagesKTM DetailsBushra RehmanNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoiceMansi JaiswalNo ratings yet

- Contractor Performance Assessment & Reporting System (CPARS) InformationDocument4 pagesContractor Performance Assessment & Reporting System (CPARS) InformationCloud cesco2No ratings yet

- Alice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeDocument2 pagesAlice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeKulasekara PandianNo ratings yet

- General Information General InformationDocument8 pagesGeneral Information General Informationanthonny lionelNo ratings yet

- Analisis Keekonomian Proyek MigasDocument4 pagesAnalisis Keekonomian Proyek MigasAly RasyidNo ratings yet

- Leave Request Form (1-12)Document5 pagesLeave Request Form (1-12)Gretta FernandesNo ratings yet

- Family Plays: Excerpt Terms & ConditionsDocument14 pagesFamily Plays: Excerpt Terms & ConditionsyesNo ratings yet

- Tiger Airways Booking Confirmation - N435BLDocument2 pagesTiger Airways Booking Confirmation - N435BLTommy PhanNo ratings yet

- By Chris Kutschera: TweetDocument7 pagesBy Chris Kutschera: TweetOmar SimeNo ratings yet

- EMI Tenure Processing Fee % Rate of Interest Processing FeeDocument2 pagesEMI Tenure Processing Fee % Rate of Interest Processing FeeLakshay SainiNo ratings yet

- You Have Two Cows ..Document3 pagesYou Have Two Cows ..johnNo ratings yet

- Indian Tyres SreDocument1 pageIndian Tyres SreABHISHEK SHARMANo ratings yet

- Order Letters - Business Letter SamplesDocument5 pagesOrder Letters - Business Letter SamplesSandy Singh100% (3)

- Punjab Police: Senior Station Assistant (Ssa)Document3 pagesPunjab Police: Senior Station Assistant (Ssa)Muhammad JunaidNo ratings yet

- Pensioner's Update Form PDFDocument1 pagePensioner's Update Form PDFKaren Virrey100% (1)

- Liquid Hand Wash Rs. 5.06 Million Mar-2020 SMEDADocument19 pagesLiquid Hand Wash Rs. 5.06 Million Mar-2020 SMEDAgladiator_usNo ratings yet

- Cadre and Recruitment RulesDocument170 pagesCadre and Recruitment Rulessatheesh_srvNo ratings yet

- CHAMBER of Commerce PDFDocument20 pagesCHAMBER of Commerce PDFSamina Ashrabi UpomaNo ratings yet

- Nur Farzana Mohd Zaini United Malayan Land BHD Accounts AssistantDocument5 pagesNur Farzana Mohd Zaini United Malayan Land BHD Accounts AssistantFarzana ZainiNo ratings yet

- HBL Management SystemDocument6 pagesHBL Management Systemali chahilNo ratings yet