Professional Documents

Culture Documents

Procedure For Gpi Full Automatic Cash Transfer Under Indonesia Banking Practice

Procedure For Gpi Full Automatic Cash Transfer Under Indonesia Banking Practice

Uploaded by

maharanibieeng46Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Procedure For Gpi Full Automatic Cash Transfer Under Indonesia Banking Practice

Procedure For Gpi Full Automatic Cash Transfer Under Indonesia Banking Practice

Uploaded by

maharanibieeng46Copyright:

Available Formats

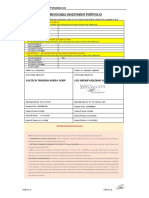

THE PROCEDURE FOR MT103 GPI FULL AUTOMATIC

TRANSFER

Due to the transaction being done by DB Germany Bank which has been credited from

our company, we would to inform your banker that the transaction is valid and have to

process with the bank for the following procedure states:

TRANSACTION PROCEDURE FOR SWIFT (SWIFT BRUSSEL) MT103 GPI

FULL AUTOMATIC CASH TRANSFER

About the transfer we advise to Deutsche Bank - Global Transaction Banking - Cash

Management Transaction Banking - General Terms and Conditions for Institutional

Customers, The following procedure for the across the border fund transfer :

1. Applicant apply for outgoing transfer with Swift MT103 GPI Automatic cash transfer.

2. Bank Officer of sending bank process it by debiting applicant account and credited to

common account or nostro account of the receiving bank. In case, the applicant has

credited to DB, BO will credit to nostro account of receiving bank.

3. Bank Officer of sending bank review compliance with

outgoing transfer procedure and prepare inputing message

as application into Swift System comply with outgoing

transaction procedure such as fulfilling applicant name,

applicant account number, receiving bank along wit swift

code , beneficiary name, beneficiary account number,

amount money to be transferred, instruction verbiage, etc.

4. Bank Officer of sending bank issues proof of transfer or

copy of swift MT103 to the applicant.

5. Receiving bank get swift mt103 incoming transfer and

check its nostro account which has been credited by sending

bank.

6. Bank officer of receiving bank check compliance with

incoming transfer procedure such KYC, anti money laundry,

anti terrorist, underlying business transaction, etc and

notifies beneficiary accordingly.

7. Having passed the incoming transfer compliance test, the BO of receiving bank debit

its nostro account and credit to beneficiary account.

You might also like

- SwiftDocument1 pageSwiftSudeepDPoojaryNo ratings yet

- UntitledDocument3 pagesUntitledTiga Nusa Artha SekawabNo ratings yet

- mt199 Bank of AmericaDocument1 pagemt199 Bank of Americaxhxbxbxbbx79100% (1)

- Dwtransfer 2024Document8 pagesDwtransfer 2024hromax76No ratings yet

- Doa - Gpi Semi - Auto - Uetr - Aqts-Oceanic - 500BDocument13 pagesDoa - Gpi Semi - Auto - Uetr - Aqts-Oceanic - 500BNANJING JINGMENG INDUSTRY CO.,LTD.No ratings yet

- Client Information Sheet-Invest Estate LTDDocument4 pagesClient Information Sheet-Invest Estate LTDalitechbelgiumNo ratings yet

- Wilo White Direct 501-2Document1 pageWilo White Direct 501-2cspinks641No ratings yet

- FNB Transfer PDFDocument1 pageFNB Transfer PDFGreat MonnyNo ratings yet

- SBLC Purchase BPU 799 Pre Advice Prepayment Procedures ALFDocument3 pagesSBLC Purchase BPU 799 Pre Advice Prepayment Procedures ALFismail saltanNo ratings yet

- Mandate Letter BID - FDO - Ocr PDFDocument6 pagesMandate Letter BID - FDO - Ocr PDFMiguel AngelNo ratings yet

- Transfer ProcedureDocument2 pagesTransfer ProcedureMarco palaciosNo ratings yet

- Contract S2S - 23-02-2024Document10 pagesContract S2S - 23-02-20245h9fcn8jfjNo ratings yet

- MT 103Document9 pagesMT 103HukleberipenNo ratings yet

- 2 - Terminal - Tech Procedure For Extraction and Downloading of Funds - ELGSB - 20july2022Document2 pages2 - Terminal - Tech Procedure For Extraction and Downloading of Funds - ELGSB - 20july2022uink wowNo ratings yet

- MT 103202Document5 pagesMT 103202uink wow100% (1)

- Sports Capital Partners LTD 5bDocument3 pagesSports Capital Partners LTD 5bEllerNo ratings yet

- Mt103 Icicbank 500m EuroDocument2 pagesMt103 Icicbank 500m Eurorasool mehrjooNo ratings yet

- HSBC Schweiz CisDocument4 pagesHSBC Schweiz CischachouNo ratings yet

- 50M Annex - LeoDocument1 page50M Annex - LeoEllerNo ratings yet

- O F F E R 2 B MT 103 2way Swift 10+4 Etf 1302 KulDocument2 pagesO F F E R 2 B MT 103 2way Swift 10+4 Etf 1302 KulPool AtalayaNo ratings yet

- Db-799pof+999-77m-Ecoucd Usa-Raiff-Albania-171117Document2 pagesDb-799pof+999-77m-Ecoucd Usa-Raiff-Albania-171117almawest.llpNo ratings yet

- Doa Echo Arys DB de Rhe 500M MT103 Via Swift - Com 06march24 - 20240407142104Document11 pagesDoa Echo Arys DB de Rhe 500M MT103 Via Swift - Com 06march24 - 20240407142104christinageorges417No ratings yet

- Investment Agreement Via L2LDocument15 pagesInvestment Agreement Via L2LGremlini HieronimoNo ratings yet

- AGR 103 - DraftDocument11 pagesAGR 103 - DraftSeymour AhmedbeyliNo ratings yet

- Ubs Cis SummitDocument3 pagesUbs Cis SummitVictor HernandezNo ratings yet

- MT 199 de 0902202412180404548Document2 pagesMT 199 de 0902202412180404548james.vonmoltkeNo ratings yet

- Revisedon11 4th2015CIIGL&KRYLONJointVentureDocument22 pagesRevisedon11 4th2015CIIGL&KRYLONJointVenturenakarodrNo ratings yet

- MT760 Blocked Funds Confirmation Draft WordingDocument1 pageMT760 Blocked Funds Confirmation Draft WordingWasis WidjajadiNo ratings yet

- Forty-Eight Million One Hundred and Fifty Thousand Euro)Document2 pagesForty-Eight Million One Hundred and Fifty Thousand Euro)Gremlini HieronimoNo ratings yet

- Doa MR - IpulDocument29 pagesDoa MR - IpulShindu NagaraNo ratings yet

- Monikoth - 20B SlipDocument2 pagesMonikoth - 20B SlipEllerNo ratings yet

- CTR GPI Draft 20221116Document9 pagesCTR GPI Draft 20221116Sr. Nico.No ratings yet

- LC ApplicationDocument2 pagesLC ApplicationShruti BudhirajaNo ratings yet

- Mt103 Manual Download - DoaDocument11 pagesMt103 Manual Download - DoaboncodeNo ratings yet

- Isep Grand S2S ContractDocument17 pagesIsep Grand S2S Contractalexrina71No ratings yet

- CIS UnionPay Wahyudiono Akhmad-1-1 - 230810 - 091232Document3 pagesCIS UnionPay Wahyudiono Akhmad-1-1 - 230810 - 091232YUHDHC LUNo ratings yet

- MT 707 MR - Seong Hwan YiDocument1 pageMT 707 MR - Seong Hwan YiAmaliri GeoffreyNo ratings yet

- AMENDED SWIFT GPI 3 PARTNERSHIP AGREEMENT-Ver2ADocument23 pagesAMENDED SWIFT GPI 3 PARTNERSHIP AGREEMENT-Ver2AJamaluddin SaidNo ratings yet

- TT Amount For ISGF SpainDocument2 pagesTT Amount For ISGF SpainAmar ParajuliNo ratings yet

- DOA For $150 Million - HSBCDocument19 pagesDOA For $150 Million - HSBCsampaio2710No ratings yet

- Screen Noir 48M Boa 13.12.2021Document1 pageScreen Noir 48M Boa 13.12.2021EllerNo ratings yet

- 950 M MT103 Contract-2Document21 pages950 M MT103 Contract-2michaelgracias700No ratings yet

- Cryptohost Procedure and Detail, 28 April 24 Via Updated Api OnlyDocument1 pageCryptohost Procedure and Detail, 28 April 24 Via Updated Api Onlynamina9631No ratings yet

- Gpi ModelDocument1 pageGpi ModelEllerNo ratings yet

- Camt 054 001 08Document1 pageCamt 054 001 08Abdulwahab AhmedNo ratings yet

- Deutsche BankDocument28 pagesDeutsche BankMmahsima98No ratings yet

- Payment Details: Telegraphic Transfer Instruction 电汇指示Document2 pagesPayment Details: Telegraphic Transfer Instruction 电汇指示Benedict Wong Cheng WaiNo ratings yet

- 18,500 New Update Mp2112 Turkey Gpi 103 Cash TTDocument6 pages18,500 New Update Mp2112 Turkey Gpi 103 Cash TTMmahsima98No ratings yet

- Mt103 Manual Download - PGLDocument10 pagesMt103 Manual Download - PGLboncodeNo ratings yet

- Formaatbeschrijving MT202 SWIFT FINDocument7 pagesFormaatbeschrijving MT202 SWIFT FINAnonymous qLzEgXOsNo ratings yet

- 2-Cis ZoliDocument4 pages2-Cis Zolirasool mehrjooNo ratings yet

- 52b Uploading Procedures and Conversion ProceduresDocument13 pages52b Uploading Procedures and Conversion ProceduresAndrew RivelinNo ratings yet

- Report Header: Message 1Document2 pagesReport Header: Message 1Yash EmrithNo ratings yet

- MT103 202 STP Toliketherm Vertriebs GMBH 44,66M 06.03.2024Document2 pagesMT103 202 STP Toliketherm Vertriebs GMBH 44,66M 06.03.2024Giuseppe Sahachiel100% (1)

- MT103Document24 pagesMT103Satria Fidka GroupNo ratings yet

- UAEFTS AdviceDocument1 pageUAEFTS AdvicefasihNo ratings yet

- KTT TELEX CODE PAYMENT (Signed)Document4 pagesKTT TELEX CODE PAYMENT (Signed)ChristianMNo ratings yet

- 2 - Bank Contract - Hongda Chem Vzla CADocument12 pages2 - Bank Contract - Hongda Chem Vzla CAjose cordovezNo ratings yet

- PGL DraftDocument5 pagesPGL DraftDH-99No ratings yet

- ПРОЦЕДУРА РАСШИРЕННАЯ SPP 103Document5 pagesПРОЦЕДУРА РАСШИРЕННАЯ SPP 103Jase KuNo ratings yet