Professional Documents

Culture Documents

Insurance Claim

Insurance Claim

Uploaded by

Sarun ChhetriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Claim

Insurance Claim

Uploaded by

Sarun ChhetriCopyright:

Available Formats

Ins Claim pdf Page 1

Ins Claim pdf Page 2

Question

A fire engulfed the premises of a business of M/s X Ltd. in the morning, of 1st October, 2020. The entire stock was destroyed

except, stock salvaged of Rs. 50,000. Insurance Policy was for Rs. 3,00,000 with average clause. The following information w as

obtained from the records saved for the period from 1st April to 30th September, 2020:

Sales 27,75,000

Purchases (including Purchase of Machinery 1,00,000) 20,30,000

Carriage inward 35,000

Sales value of drawings 20,000

Cost of goods distributed as free sample 10,000

Wages (including installation of Machinery 10,000) 50,000

Cost of goods sent to Consignee on 20th September 2020, lying unsold with them 30,000

Stock in hand on 31st March, 2020 (lower than 10% cost) 3,15,000

Additional Information:

(1) Sales upto 30th September, 2020, includes Rs. 75,000 for which goods had not been dispatched.

(2) On 1st June, 2020, goods worth Rs. 1,98,000 sold to Hari on approval basis which was included in sales but no approval has

been received in respect of 2/3rd of the goods sold to him till 30th September, 2020.

(3) Purchases upto 30th September, 2020 did not include Rs. 1,00,000 for which purchase invoices had not been received from

suppliers, though goods have been received in godown.

(4) Past records show the gross profit rate of 25% on sales.

You are required to prepare the statement of claim for loss of stock for submission to the Insurance Company

Solution

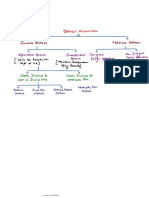

Memorandum Trading A/c

(1.4.20 to 30.9.20)

Particulars (Rs.) Particulars (Rs.)

To Opening stock 3,50,000 By Sales 25,68,000

(3,15,000*100/90)

To Purchases 20,05,000 By Goods with customers 99,000

(W.N. 1) (for approval) (W.N.2)

To Wages 40,000 By Goods with consignee 30,000

(50,000 – 10,000)

To Carriage inward 35,000 By Closing stock (bal. fig.) 3,75,000

To Gross profit 6,42,000

(Rs. 25,68,000 x 25%)

30,72,000 30,72,000

Computation of claim for loss of stock

Ins Claim pdf Page 3

Computation of claim for loss of stock

Rs.

Stock on the date of fire (i.e. on 1.10.2020) 3,75,000

Less: Stock salvaged (50,000)

Stock destroyed by fire (Loss of stock) 3,25,000

Insurance claim

Average clause is applicable as insurance policy amount (Rs. 3,00,000) is less than the value of closing stock ie. Rs. 3,75,000

Claim = Loss of Stock x Policy Amount

Stock on date of fire

= 3,25,000 x 3,00,000

3,75,000

= 2,60,000

Working Notes:

1. Computation of Purchases

Rs.

Purchases (Given) 20,30,000

Less: Purchase of Machinery (1,00,000)

Less: Cost of Drawings (20,000-25%) (15,000)

Less: Cost of Goods distributed as samples (10,000)

Add: Goods physically received in godown 1,00,000

20,05,000

2. Calculation of goods with customers

Since no approval for sale has been received for the goods of Rs. 1,32,000 (i.e. 2/3 of 1,98,000) hence, these should be valued at cost

i.e. Rs. 1,32,000 – 25% of Rs. 1,32,000 =Rs. 99,000.

3. Calculation of actual sales

Total sales – Goods not dispatched - Sale of goods on approval (2/3rd) =

Sales (Rs. 27,75,000 – 75,000 – Rs.1,32,000) = Rs. 25,68,000

Ins Claim pdf Page 4

Trading Account [Last Year]

Particulars Amount Particulars Amount

To Opening Stock By Sales

To Purchases By Closing Stock

Actual Value shown in books

Add: Amount written off

To Gross Profit

(Bal. Figure)

Memorandum Trading A/c

Particulars Normal Abnormal Total Particulars Normal Abnormal Total

To Opening Stock By Sales

To Purchases By Loss on sale

To Direct Expenses By Loss on revaluation

To Gross Profit By Closing Stock

(% of Normal sales) (Bal. figure)

Treatment of Abnormal Items of Stock

1) If any abnormal items of stock is given in question, then amount which has been written off from this stock shall be 1 st of all

added in closing stock while preparing last year Trading A/c.

2) Total value of this closing stock shall be written in total column in Memo Trading A/c, the original cost of abnormal items

shall be written in abnormal column & the balance stock shall be written in normal column.

3) For loss of stock on date of fire, closing stock includes both normal & abnormal stocks.

4) Unless otherwise stated, estimated value of stock on date of fire consists of book value of normal items & book value of

abnormal items. Sometimes specific valuation of abnormal items is given for purpose of claim, then instead of book value

such valuation should be taken.

Question

A fire occurred in the premises of M/s. Z & Co. on 30-06-2020. From the salvaged accounting records, the following

particulars were ascertained

Stock at cost as on 01-04-2019 1,20,000

Stock valued as on 31-03-2020 1,30,000

Purchases less return during 2019-20 5,25,000

Sales less return during 2019-20 6,00,000

Purchases from 01-04-2020 to 30-06-2020 1,32,000

Sales from 1.4.2020 to 30.6.2020 1,66,000

In valuing the stock for the Balance Sheet at 31st March, 2020, Rs. 5,000 had been written off on certain stock which was a

poor selling line having the cost of Rs. 8,000. A portion of these goods were sold in May, 2020 at a loss of Rs. 1,000 on

original cost of Rs. 7,000. The remainder of the stock was now estimated to be worth its original cost. Subject to that

exception, gross profit had remained at a uniform rate throughout the year.

The value of the salvaged stock was Rs. 10,000. M/s. Z & Co. had insured their stock for Rs. 1,00,000 subject to average

clause. Compute the amount of claim to be lodged to the insurance company.

Solution

Trading A/c

Ins Claim pdf Page 5

Trading A/c

(1.4.19 to 31.03.20)

Particulars Amount Particulars Amount

To Opening Stock 1,20,000 By Sales 6,00,000

To Purchases 5,25,000 By Closing Stock 1,35,000

(1,30,000 + 5,000)

To G.P (Bal. figure) 90,000

7,35,000 7,35,000

GP Ratio for 19-20 = 90,000 x 100 = 15%

6,00,000

Memorandum Trading A/c

(1.4.20 to 30.6.20)

Particulars Normal Abnormal Total Particulars Normal Abnormal Total

To Opening Stock 1,27,000 8,000 1,35,000 By Sales 1,60,000 6,000 1,66,000

To Purchases 1,32,000 1,32,000 By Loss 1,000 1,000

To Gross Profit 24,000 24,000 By Closing Stock 1,23,000 1,000 1,24,000

(15% of 1,60,000) (Bal. figure)

2,83,000 8,000 2,91,000 2,83,000 8,000 2,91,000

Computation of Insurance Claim

Stock on the date of fire 1,24,000

Less: Stock salvaged (10,000)

Loss of stock 1,14,000

Claim subject to average clause:

Insurance Claim = 1,14,000 x 1,00,000 = 91,935

1,24,000

Ins Claim pdf Page 6

Step 1: Calculate GP Ratio of Last/Previous Year:

It is calculated as per Insurance Rules & has nothing to do with GP ratios in accounts.

GP (%) = NP + Insured standing charges X 100

Sales

Effective GP(%)= GP (%) ± Increase/(Decrease) in trend

Note: Insured standing charges means fixed charges which has been insured.

Step 2: Calculate Short Sales

Turnover in corresponding period of Previous Year/ Standard Turnover [After adjusting trend, if any] xxx

Less: Actual Turnover in dislocated/effected period (xxx)

Short Sales xxx

Note:

Trend will be given or calculated as below:

Sales in Current Year ( Non Affected Period) xxx

Trend= Increase/Decrease in Turnover X 100

Sales in Previous Year ( Non Affected Period) xxx Turnover in Previous Year

Increase/Decrease in Turnover xxx

Step 3: Loss of Profit = Short Sales X GP ( %) (i.e. Step 2 X Step 1)

Step 4:

a) Adjusted Annual turnover= Turnover during 12 months immediately the preceding date of fire

[After adjusting trend, if any]

b) Insurable Amount = Adjusted Annual Turnover X GP (%)

Step 5: Additional Expenses (Lower of the following to be considered)

1. Actual Additional expenses

2. Actual Additional Expenses X Insurable Amount .

Insurable Amount +Uninsured standing charges

3. Turnover achieved due to additional expenses X GP Ratio

(If not given then take Turnover in dislocated period)

Step 6: Calculate Total Loss

Loss of Profit (Step 3) xx

Add: Additional Expenses (Step 5) xx

Less: Saving in insured standing charges (xx)

Total Loss xx

Step 7: Applicability of Average Clause: It is applied if Insurable Amount > Insured Amount

Claim to be Lodged= Total Loss (Step 6) X Insured Amount

Insurable Amount

Ins Claim pdf Page 7

Question

The premises of a company were partly destroyed by the fire which took place on 31st July, 2021 and as a result of which

the business was disorganized from 31st July to 30th November, 2021. Accounts are closed on 31st March, every year. The

company is insured under a loss of profit policy for Rs.7,50,000. The period of indemnity specified in the policy is 6

months. From the following information you are required to compute the amount of claim under the Loss of Profits policy:

Particulars Rs.

Turnover for the year 2020-21 40,00,000

Net profit for the year 2020-21 2,40,000

Insured standing charges 4,80,000

Uninsured standing charges 80,000

Turnover during the period of dislocation, i.e., from 1.8.2021 to 30.11.2021 8,00,000

Standard turnover for the corresponding period in the preceding year, i.e., from 1.8.2020 to 30.11.2020 20,00,000

Annual turnover for the year immediately preceding the fire i.e., from 1.8.2020 to 31.7.2021 44,00,000

Increased cost of working 1,50,000

Savings in insured standing charges 10,000

Reduction in turnover avoided through increase in working cost 3,00,000

Owing to reasons acceptable to the insurer, the “special circumstances clause” stipulates for:

1. Increase of turnover (Standard and annual) by 10% and

2. Increase of rate of gross profit by 2%.

Solution

1) GP (%) = Net Profit + Insured standing charges X 100

Sales

= 2,40,000+4,80,000 X 100 = 18%

40,00,000

Effective GP Ratio

GP (%) 18%

+ Increase in Trend 2%

Effective GP(%) 20%

2) Short Sales =

Turnover in corresponding period of Previous Year i.e. from 01.08.20 to 30.11.20 20,00,000

Add: Trend in Turnover i.e. 10% 2,00,000

Expected Turnover 22,00,000

Less: Actual Turnover in dislocated period i.e. from 01.08.21 to 30.11.21 (8,00,000)

Short Sales 14,00,000

3) Loss of Profit = Short Sales X GP ( %)

= 14,00,000 X 20% = 2,80,000

4)

a) Adjusted Annual turnover=

Turnover during 12 months immediately the preceding date of fire 44,00,000

i.e. from 01.08.20 to 31.07.21

Add: Trend in Turnover i.e. 10% 4,40,000

Adjusted Annual turnover 48,40,000

b) Insurable Amount = Adjusted Annual Turnover X GP (%)

= 48,40,000 X 20% = 9,68,000

5) Additional Expenses

Ins Claim pdf Page 8

5) Additional Expenses

a) 1,50,000

b) 1,50,000 X . 9,68,000 . = 1,38,550

9,68,000+80,000

c) 3,00,000 X 20% = 60,000

(Turnover achieved due to additional expenditure)

Lower out of above is Rs. 60,000

6) Total Loss

Loss of Profit (Step 3) 2,80,000

Add: Additional Expenses (Step 5) 60,000

Less: Saving in insured standing charges (10,000)

Total Loss 3,30,000

7) Average clause applicable since Insurable Amount > Policy Amount

Claim to be Lodged= 3,30,000 X 7,50,000 = 2,55,682

9,68,000

Ins Claim pdf Page 9

Ins Claim pdf Page 10

You might also like

- Final Accounts of Sole Proprietorship QuestionsDocument6 pagesFinal Accounts of Sole Proprietorship QuestionsMuskan Rathi 5100No ratings yet

- Chapter - 8 Management of ReceivablesDocument6 pagesChapter - 8 Management of ReceivablesadhishcaNo ratings yet

- Medical Check Up BillDocument2 pagesMedical Check Up BillAniketh Pradhan100% (1)

- Fire Insurance ClaimsDocument43 pagesFire Insurance ClaimsArshad Mohd100% (1)

- Department AccountingDocument12 pagesDepartment AccountingRajesh NangaliaNo ratings yet

- 123 - AS Question Bank by Rahul MalkanDocument182 pages123 - AS Question Bank by Rahul MalkanPooja GuptaNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- Hire Purchase PeqDocument21 pagesHire Purchase PeqRishikaNo ratings yet

- CAP III - Suggested Answer Papers - All Subjects - June 2019 PDFDocument133 pagesCAP III - Suggested Answer Papers - All Subjects - June 2019 PDFsantosh thapa chhetriNo ratings yet

- Investment Accounts: Basic ConceptsDocument13 pagesInvestment Accounts: Basic ConceptsDebasis KarNo ratings yet

- 6-Cost Sheet (Unsolved) (25-02-2024)Document17 pages6-Cost Sheet (Unsolved) (25-02-2024)Kajal BindalNo ratings yet

- Suggested - Answer - CAP - II - June - 2011 4Document64 pagesSuggested - Answer - CAP - II - June - 2011 4Dipen Adhikari100% (1)

- Not For Profit Organisation: Basic ConceptsDocument48 pagesNot For Profit Organisation: Basic Conceptsmonudeep aggarwalNo ratings yet

- Practice Questions-Accounts For Mon Profit Making-1Document4 pagesPractice Questions-Accounts For Mon Profit Making-1Letsah Bright100% (1)

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaPraveen KumarNo ratings yet

- Accounting For Investment in Variable Income Bearing Securities Lesson 27Document10 pagesAccounting For Investment in Variable Income Bearing Securities Lesson 27Sumantha SahaNo ratings yet

- Investment AccountDocument2 pagesInvestment AccountQuestionscastle Friend67% (3)

- Advanced Accounting Ca Ipcc OldDocument36 pagesAdvanced Accounting Ca Ipcc OldKrishna Rama Theertha KoritalaNo ratings yet

- CA Inter (QB) - Chapter 9Document77 pagesCA Inter (QB) - Chapter 9Aishu SivadasanNo ratings yet

- Introduction To Final AccountsDocument38 pagesIntroduction To Final AccountsCA Deepak Ehn88% (8)

- Investment Accounts: Attempt Wise AnalysisDocument54 pagesInvestment Accounts: Attempt Wise AnalysisJaveedNo ratings yet

- 3 Pre - PostDocument7 pages3 Pre - PostParul Bhardwaj VaidyaNo ratings yet

- Share Based Payments by Ca PS BeniwalDocument16 pagesShare Based Payments by Ca PS Beniwalhrudaya boys100% (1)

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument25 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falsegargee thakareNo ratings yet

- Chap 3Document56 pagesChap 3Basant OjhaNo ratings yet

- Seminar Questions Royality and ContainerDocument10 pagesSeminar Questions Royality and ContainerEligius NyikaNo ratings yet

- RTP June 19 AnsDocument27 pagesRTP June 19 AnsbinuNo ratings yet

- Advanced Issues in Partnership: AccountsDocument72 pagesAdvanced Issues in Partnership: AccountsAnilNo ratings yet

- Department AccountsDocument14 pagesDepartment Accountsjashveer rekhiNo ratings yet

- Branch Accounts Gr-II 2Document12 pagesBranch Accounts Gr-II 2Dipen AdhikariNo ratings yet

- CAF 1 IA Autumn 2020Document5 pagesCAF 1 IA Autumn 2020Qasim Hafeez KhokharNo ratings yet

- Accounts Previous Year PapersDocument37 pagesAccounts Previous Year PapersAlankritaNo ratings yet

- Principles of Accounting PDFDocument2 pagesPrinciples of Accounting PDFfrank mutale0% (1)

- Advanced Accounts 1 PDFDocument304 pagesAdvanced Accounts 1 PDFJohn Louie NunezNo ratings yet

- Ilovepdf Merged PDFDocument666 pagesIlovepdf Merged PDFchandraNo ratings yet

- CA IPCC Branch AccountsDocument19 pagesCA IPCC Branch AccountsAkash Gupta75% (4)

- 7 Finalnew Sugg June09Document17 pages7 Finalnew Sugg June09mknatoo1963No ratings yet

- Midlands State UniversityDocument11 pagesMidlands State UniversityIsheanesu MutusvaNo ratings yet

- CA Inter Adv Accounts (New) Suggested Answer Dec21Document30 pagesCA Inter Adv Accounts (New) Suggested Answer Dec21omaisNo ratings yet

- M/s Alag Pre Post SolutionDocument2 pagesM/s Alag Pre Post SolutionAyush VermaNo ratings yet

- Capital Structure.Document22 pagesCapital Structure.Puneet ShirahattiNo ratings yet

- Banking CompaniesDocument34 pagesBanking CompaniesLodaNo ratings yet

- Paper4 Taxation PYP All Attempts Nov22Document206 pagesPaper4 Taxation PYP All Attempts Nov22devaaNo ratings yet

- AccountancyDocument4 pagesAccountancyAbhijan Carter BiswasNo ratings yet

- Important Points of Our Notes/Books:: TH THDocument42 pagesImportant Points of Our Notes/Books:: TH THpuru sharmaNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- CAP II Scanner Corporate LawDocument121 pagesCAP II Scanner Corporate LawEdtech NepalNo ratings yet

- 12 (A) - Contract Costing: Model Wise Analysis of Past Exam Papers of IpccDocument19 pages12 (A) - Contract Costing: Model Wise Analysis of Past Exam Papers of Ipccgopi kansalNo ratings yet

- Question-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamDocument4 pagesQuestion-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamMuhammad ArslanNo ratings yet

- PGBPDocument32 pagesPGBPKartikNo ratings yet

- Part F - Additional QuestionsDocument9 pagesPart F - Additional QuestionsDesmond Grasie ZumankyereNo ratings yet

- Accounts RTP May 23Document34 pagesAccounts RTP May 23ShailjaNo ratings yet

- Suggested - Answer - CAP - II - June - 2016 6Document75 pagesSuggested - Answer - CAP - II - June - 2016 6Dipen AdhikariNo ratings yet

- UntitledDocument482 pagesUntitlednanu miglaniNo ratings yet

- Capital Gain and IFOS - SolutionDocument6 pagesCapital Gain and IFOS - SolutionVenkataRajuNo ratings yet

- Insurance ClaimsDocument17 pagesInsurance Claimshk7012004No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaHarsh KumarNo ratings yet

- Study Note - 4: Preparation of Final AccountsDocument48 pagesStudy Note - 4: Preparation of Final Accountsshivam kumarNo ratings yet

- ICAI CA Found. Accounts Solution 13.12.2020Document11 pagesICAI CA Found. Accounts Solution 13.12.2020Tanisha GuptaNo ratings yet

- Final AccountsDocument11 pagesFinal AccountsAnushka DharangaonkarNo ratings yet

- DownloadDocument4 pagesDownloadBAZINGANo ratings yet

- Nas 18Document1 pageNas 18BAZINGANo ratings yet

- DownloadDocument9 pagesDownloadBAZINGANo ratings yet

- ReconstructionDocument4 pagesReconstructionBAZINGANo ratings yet

- 1 AccountDocument5 pages1 AccountBAZINGANo ratings yet

- Attachment 761Document108 pagesAttachment 761BAZINGANo ratings yet

- DownloadDocument11 pagesDownloadBAZINGANo ratings yet

- Saugat Paudel Et Al. Be Project Report Civil May2023Document240 pagesSaugat Paudel Et Al. Be Project Report Civil May2023BAZINGANo ratings yet

- 8 Cash Flow StatementDocument10 pages8 Cash Flow StatementBAZINGANo ratings yet

- 4 Branch AccountsDocument18 pages4 Branch AccountsBAZINGA100% (1)

- 5 Investment AccountsDocument11 pages5 Investment AccountsBAZINGANo ratings yet

- Q. 2aDocument9 pagesQ. 2aBAZINGANo ratings yet

- Intermediate Advance Accounting RTP May 20Document48 pagesIntermediate Advance Accounting RTP May 20BAZINGANo ratings yet

- Insurance Company Accounts: Solutions To Assignment ProblemsDocument13 pagesInsurance Company Accounts: Solutions To Assignment ProblemsBAZINGANo ratings yet

- Final Advaccount Dec12Document13 pagesFinal Advaccount Dec12BAZINGANo ratings yet

- NSA 500.doc, 313-332Document10 pagesNSA 500.doc, 313-332BAZINGANo ratings yet

- Life Insurance:: ST STDocument18 pagesLife Insurance:: ST STBAZINGA100% (1)

- Suggested Answer CAP II June 2017rDocument104 pagesSuggested Answer CAP II June 2017rBAZINGANo ratings yet

- This Study Resource Was: Withholding Tax DefinitionsDocument9 pagesThis Study Resource Was: Withholding Tax DefinitionsBAZINGANo ratings yet

- Compositions All in OneDocument1 pageCompositions All in OneBAZINGA100% (1)

- CAP II Result June 2019Document11 pagesCAP II Result June 2019BAZINGANo ratings yet

- Comparison of Buy Back of Share (BAFIA, 2073 & Companies Act, 2063)Document23 pagesComparison of Buy Back of Share (BAFIA, 2073 & Companies Act, 2063)BAZINGANo ratings yet

- Audit CAP IIDocument2 pagesAudit CAP IIBAZINGANo ratings yet

- Status Watchlist For Complaince - Dec 2011Document10 pagesStatus Watchlist For Complaince - Dec 2011ProshareNo ratings yet

- Guidelines For RemisiersDocument15 pagesGuidelines For Remisierssantosh.pw4230No ratings yet

- CIB Derivative WhitePaper 293301Document4 pagesCIB Derivative WhitePaper 293301shih_kaichihNo ratings yet

- Estate TaxationDocument25 pagesEstate TaxationNicolas Alonso100% (1)

- Name:-Bathija Jharna SonuDocument36 pagesName:-Bathija Jharna SonuJharnaNo ratings yet

- Cary Conger Debunks Adam Ledford's Sac City Street Improvement Project Explanation Letter in The January 8, 2013 Sac SunDocument3 pagesCary Conger Debunks Adam Ledford's Sac City Street Improvement Project Explanation Letter in The January 8, 2013 Sac SunthesacnewsNo ratings yet

- AIAC 2018 Standard FormDocument97 pagesAIAC 2018 Standard FormFawwaz ShuibNo ratings yet

- BCom (H) Indian Financial System Second Year Sem 3Document24 pagesBCom (H) Indian Financial System Second Year Sem 3Santosh ThakurNo ratings yet

- Govt Test IDocument2 pagesGovt Test ICreate Ed100% (1)

- Deductions On Gross IncomeDocument6 pagesDeductions On Gross IncomeJamaica DavidNo ratings yet

- Case Analysis 1-EditedDocument5 pagesCase Analysis 1-EditedChris WongNo ratings yet

- 033&117-Sergio F. Naguiat vs. NLRC 269 Scra 564 (1997)Document11 pages033&117-Sergio F. Naguiat vs. NLRC 269 Scra 564 (1997)wewNo ratings yet

- General Knowledge & Current Affairs E-BookDocument1,263 pagesGeneral Knowledge & Current Affairs E-BookQuestionbangNo ratings yet

- RamcoDocument6 pagesRamcosurajpopatNo ratings yet

- Group B Assignment Week 13Document6 pagesGroup B Assignment Week 13fghhjjjnjjnNo ratings yet

- 201996185131dmi Im 06092019Document92 pages201996185131dmi Im 06092019Aravind KrishNo ratings yet

- Resume 2Document1 pageResume 2Quek HJNo ratings yet

- Applying The Restatement Approach Under IAS 29 Financial Reporting in Hyperinflationary EconomiesDocument6 pagesApplying The Restatement Approach Under IAS 29 Financial Reporting in Hyperinflationary EconomiesIssa BoyNo ratings yet

- Vivas v. Monetary Board, G.R. No. 191424, August 7, 2013Document11 pagesVivas v. Monetary Board, G.R. No. 191424, August 7, 2013Nikko AzordepNo ratings yet

- Learning From The Lessons of Recent EventsDocument10 pagesLearning From The Lessons of Recent EventsThavam RatnaNo ratings yet

- Before The Ld. Sole Arbitraor Dr. Abhishek Atrey Advocate Supreme Court of IndiaDocument7 pagesBefore The Ld. Sole Arbitraor Dr. Abhishek Atrey Advocate Supreme Court of IndiaSulabh Gupta100% (1)

- Hand Book On AccountingDocument135 pagesHand Book On Accountingmalik_ateeqNo ratings yet

- Financial ManagementDocument8 pagesFinancial Managementoptimistic070% (1)

- Electrical Machinery - Make in IndiaDocument3 pagesElectrical Machinery - Make in IndiaBitan GhoshNo ratings yet

- Standalone Balance Sheet: As at March 31, 2019Document40 pagesStandalone Balance Sheet: As at March 31, 2019Ashutosh BiswalNo ratings yet

- Tugas Bahasa Inggris Ke-2Document5 pagesTugas Bahasa Inggris Ke-2Muhammad izzul hikam1CNo ratings yet

- LESSON-19 Central Excise Laws: StructureDocument21 pagesLESSON-19 Central Excise Laws: Structuresudhir.kochhar3530No ratings yet

- Illustration Problem & SolutionDocument4 pagesIllustration Problem & SolutionClauie BarsNo ratings yet

- Mkonyi Complete Research ProposalDocument48 pagesMkonyi Complete Research ProposalG100% (2)