Professional Documents

Culture Documents

Homework Chapter 4 - Student

Homework Chapter 4 - Student

Uploaded by

giunxd2108Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homework Chapter 4 - Student

Homework Chapter 4 - Student

Uploaded by

giunxd2108Copyright:

Available Formats

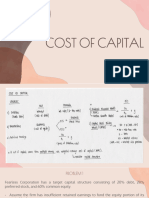

Homework Chapter 4

Concept review

1. On the most basic level, if a firm’s WACC is 12 percent, what does this mean?

2. In calculating the WACC, if you had to use book values for either debt or equity, which would you

choose? Why?

3. If you can borrow all the money you need for a project at 6 percent, doesn’t it follow that 6 percent is

your cost of capital for the project?

4. Why do we use an after-tax figure for cost of debt but not for cost of equity?

Exercise

1. The Rollag Co. just issued a dividend of $2.75 per share on its common stock. The company is

expected to maintain a constant 5.8 percent growth rate in its dividends indefinitely. If the stock sells for

$59 a share, what is the company’s cost of equity?

2. Coaldale Bank has an issue of preferred stock with a $4.25 stated dividend that just sold for $92 per

share. What is the bank’s cost of preferred stock?

3. Nobleford Inc. is trying to determine its cost of debt. The firm has a debt issue outstanding with 18

years to maturity that is quoted at 107 percent of face value. The issue makes semiannual payments and

has an embedded cost of 6 percent annually. Assume the par value of the bond is $1,000. What is the

company’s pre-tax cost of debt? If the tax rate is 35 percent, what is the after-tax cost of debt?

4. Peacock Corporation has a target capital structure of 60 percent common stock, 5 percent preferred

stock, and 35 percent debt. Its cost of equity is 12 percent, the cost of preferred stock is 5 percent, and

the cost of debt is 7 percent. The relevant tax rate is 35 percent.What is Peacock’s WACC?

5.v Turin Corp. has a weighted average cost of capital of 9.6 percent. The company’s cost of equity is 12

percent and its pre-tax cost of debt is 7.9 percent. The tax rate is 35 percent. What is the company’s

target debt-equity ratio?

6. Raymond Mining Corporation has 8.5 million shares of common stock outstanding, 250,000 shares of

5 percent preferred stock outstanding, and 135,000 7.5 percent semiannual bonds outstanding, par

value $1,000 each. The common stock currently sells for $34 per share and has a beta of 1.25, the

preferred stock currently sells for $91 per share, and the bonds have 15 years to maturity and sell for

114 percent of par. The market risk premium is 7.5 percent, T-bills are yielding 4 percent, and Adex

Mining’s tax rate is 35 percent.

a. What is the firm’s market value capital structure?

b. If Raymond Mining is evaluating a new investment project that has the same risk as the firm’s typical

project, what rate should the firm use to discount the project’s cash flows?

You might also like

- Chapter1 - Tài chính doanh nghiệp 2Document6 pagesChapter1 - Tài chính doanh nghiệp 2Thị Kim TrầnNo ratings yet

- Case of Cost of CapitalDocument1 pageCase of Cost of CapitalochtanisaNo ratings yet

- Actividad 8 en ClaseDocument2 pagesActividad 8 en Claseluz_ma_6No ratings yet

- Cost of Capital QDocument2 pagesCost of Capital QPrinkeshNo ratings yet

- FINA 4383 Quiz 2Document9 pagesFINA 4383 Quiz 2Samantha LunaNo ratings yet

- Safavid Ceramics and Chinese InspirationDocument4 pagesSafavid Ceramics and Chinese InspirationGermanikNo ratings yet

- BS 57 (1951)Document23 pagesBS 57 (1951)dapsiduNo ratings yet

- FIN222 Autumn2016 Tutorials Tutorial 8Document8 pagesFIN222 Autumn2016 Tutorials Tutorial 8HELENANo ratings yet

- MAS02Document8 pagesMAS02andzie09876No ratings yet

- Tutorial 3 Cost of CapitalDocument1 pageTutorial 3 Cost of Capitaltai kianhongNo ratings yet

- Cost of CapitalDocument4 pagesCost of CapitalNusratJahanHeabaNo ratings yet

- Cost of Capital Practice QuestionsDocument2 pagesCost of Capital Practice QuestionskhubaibNo ratings yet

- Practice Questions Corporate FinanceDocument2 pagesPractice Questions Corporate FinanceRajeshNo ratings yet

- A Company Is 40Document2 pagesA Company Is 40muhammad farhanNo ratings yet

- Chap 8 Cost of capital HWDocument1 pageChap 8 Cost of capital HWhoangthiluong0104No ratings yet

- FinMan Unit 7 Tutorial Cost of Capital Revised Sep2021Document3 pagesFinMan Unit 7 Tutorial Cost of Capital Revised Sep2021Ajani McPhersonNo ratings yet

- Chapter1 ExercisesDocument4 pagesChapter1 ExercisesMinh Tâm Nguyễn0% (1)

- The Cost of Capital (WACC)Document3 pagesThe Cost of Capital (WACC)hira shaikhNo ratings yet

- Btap KTDNDocument16 pagesBtap KTDNleducNo ratings yet

- Cost of Capital Questions 2Document3 pagesCost of Capital Questions 2Andrya VioNo ratings yet

- Chapter 8. Cost of Capital - StudentDocument1 pageChapter 8. Cost of Capital - Studentnamle999101No ratings yet

- Cost of Cap More QuestionsDocument4 pagesCost of Cap More QuestionsAnipa HubertNo ratings yet

- Finman - Q2 Cost Os CaptDocument2 pagesFinman - Q2 Cost Os CaptJennifer RasonabeNo ratings yet

- Corporate Finance 3rd AssignmentDocument5 pagesCorporate Finance 3rd AssignmentMuhammad zahoorNo ratings yet

- Cost of Capital (Practice Questions)Document2 pagesCost of Capital (Practice Questions)Wais Deen NazariNo ratings yet

- FNCE 101: DR Chiraphol New Chiyachantana Problem Set # 6 (Chapter 14)Document2 pagesFNCE 101: DR Chiraphol New Chiyachantana Problem Set # 6 (Chapter 14)Vicky HongNo ratings yet

- Wacc QuestionsDocument5 pagesWacc Questionsmuhammad farhanNo ratings yet

- Cost of CapitalDocument2 pagesCost of Capitalkomal100% (1)

- Cost of capital questions- tutorialsDocument3 pagesCost of capital questions- tutorialscliffton malcolm tshumaNo ratings yet

- Tutorial 6 - Cost of EquitiesDocument1 pageTutorial 6 - Cost of EquitiesAmy LimnaNo ratings yet

- Quiz: Assignment 3 (Individual) FINANCE PRACTICEDocument5 pagesQuiz: Assignment 3 (Individual) FINANCE PRACTICEabir.mahmud.232No ratings yet

- Cost of Capital ProblemsDocument5 pagesCost of Capital ProblemsYusairah Benito DomatoNo ratings yet

- Cost of CapitalDocument110 pagesCost of CapitalafsarulalviNo ratings yet

- CH 14Document7 pagesCH 14AnsleyNo ratings yet

- Quiz 1 - Special Transactions: TheoriesDocument9 pagesQuiz 1 - Special Transactions: TheoriesRhejean LozanoNo ratings yet

- 4a. Question - Chapter 4Document4 pages4a. Question - Chapter 4plinhcoco02No ratings yet

- Exam 3 FinanceDocument8 pagesExam 3 FinanceJayNo ratings yet

- Case 31 Wonder BarsDocument11 pagesCase 31 Wonder Barsasri nurfathiNo ratings yet

- Bad-312 Fin. MGT Post TestDocument4 pagesBad-312 Fin. MGT Post TestJohn JanuaryNo ratings yet

- Tutorial 11 QuestionsDocument1 pageTutorial 11 QuestionsAmber Yi Woon NgNo ratings yet

- Unit 5 Financing DecisionDocument49 pagesUnit 5 Financing DecisionGaganGabrielNo ratings yet

- CF Week9 Seminar3Document4 pagesCF Week9 Seminar3KesyadwikaNo ratings yet

- Chapter 14 Cost of CapitalDocument1 pageChapter 14 Cost of CapitalGhina SalsabilaNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalAfsana Mim JotyNo ratings yet

- Wacc Practice 1Document11 pagesWacc Practice 1saroosh ul islamNo ratings yet

- Capital Structure and Cost of CapitalVal Exercises StudentsDocument2 pagesCapital Structure and Cost of CapitalVal Exercises StudentsApa-ap, CrisdelleNo ratings yet

- COST OF CAPITAL Exercises 1Document6 pagesCOST OF CAPITAL Exercises 1fatin syahiraNo ratings yet

- Cost of CapitalDocument1 pageCost of CapitalPradip KhatriNo ratings yet

- Practice Questions-Week 8 Chapter Name: Cost of CapitalDocument2 pagesPractice Questions-Week 8 Chapter Name: Cost of CapitalTanveer AhmedNo ratings yet

- Assignment 1 Online-3Document2 pagesAssignment 1 Online-3Ushanthini NithanthanNo ratings yet

- WACCDocument1 pageWACCsauravNo ratings yet

- Capital Budgeting: Questions and ExercisesDocument4 pagesCapital Budgeting: Questions and ExercisesLinh HoangNo ratings yet

- Cost of CapitalDocument2 pagesCost of CapitalShota ChenebresNo ratings yet

- Chapter 6Document19 pagesChapter 6FISH JELLYNo ratings yet

- 2009-03-11 142055 TholmesDocument14 pages2009-03-11 142055 TholmesSirVicNYNo ratings yet

- Wacc Practice 1Document3 pagesWacc Practice 1Ash LayNo ratings yet

- TUTORIAL 6 The Cost of Capital PDFDocument1 pageTUTORIAL 6 The Cost of Capital PDFBrenda BernardNo ratings yet

- Capital Structure: Questions and ExercisesDocument4 pagesCapital Structure: Questions and ExercisesLinh HoangNo ratings yet

- Exam 2 PracticeDocument4 pagesExam 2 PracticeRaunak KoiralaNo ratings yet

- Preferred Shares vs. Common Stocks: Welcome to Dividend Royalty: Financial Freedom, #86From EverandPreferred Shares vs. Common Stocks: Welcome to Dividend Royalty: Financial Freedom, #86No ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- BREAKDOWN TIMELINE - Rev1Document12 pagesBREAKDOWN TIMELINE - Rev1Dimas AndiNo ratings yet

- Pinoy Development of Groups and TeamsDocument19 pagesPinoy Development of Groups and TeamsSarah Jane SeñaNo ratings yet

- 11 Physical Education Keynotes Ch08 Fundamental of AnatomyDocument3 pages11 Physical Education Keynotes Ch08 Fundamental of AnatomyAkashNo ratings yet

- Is 3594 Fire Safety of Industrial Buildings General-Storage Ware HouseDocument11 pagesIs 3594 Fire Safety of Industrial Buildings General-Storage Ware HouseRamakrishna AgumbeNo ratings yet

- Haunted: MuseumDocument36 pagesHaunted: MuseumNgoc PhanNo ratings yet

- EN EU Declaration of Conformity VEGAPULS Serie 60Document8 pagesEN EU Declaration of Conformity VEGAPULS Serie 60Jhon SuarezNo ratings yet

- Midtown Ratepayers Association's Letter To Ontario OmbudsmenDocument3 pagesMidtown Ratepayers Association's Letter To Ontario OmbudsmenAndrew GrahamNo ratings yet

- Manual FSP150 GE114PRO FAM PDFDocument80 pagesManual FSP150 GE114PRO FAM PDFJanet Sabado CelzoNo ratings yet

- A Generalization of Wilson's Theorem: R. Andrew Ohana June 3, 2009Document13 pagesA Generalization of Wilson's Theorem: R. Andrew Ohana June 3, 2009Ramón Darío CarrasqueroNo ratings yet

- Biostat IntroductionDocument31 pagesBiostat IntroductionteklayNo ratings yet

- Advisor Webcast - Customizing The Workflows in Oracle EBS ProcurementDocument53 pagesAdvisor Webcast - Customizing The Workflows in Oracle EBS ProcurementhgopalanNo ratings yet

- Electronic Parts Catalog - Option DetailDocument2 pagesElectronic Parts Catalog - Option DetailmunhNo ratings yet

- Persuasive Writing Assessment RubricDocument2 pagesPersuasive Writing Assessment Rubricapi-523656984No ratings yet

- Project Based LearningDocument217 pagesProject Based LearningMohamed Ali96% (23)

- SDocument8 pagesSdebate ddNo ratings yet

- Contribution of Medieval MuslimDocument16 pagesContribution of Medieval Muslimannur osmanNo ratings yet

- Icest2030 AzureDocument4 pagesIcest2030 AzureJorge RoblesNo ratings yet

- Berg Danielle ResumeDocument2 pagesBerg Danielle Resumeapi-481770567No ratings yet

- Superficial Fungal Infections (2019)Document6 pagesSuperficial Fungal Infections (2019)mustika rachmaNo ratings yet

- E W Hildick - (McGurk Mystery 05) - The Case of The Invisible Dog (siPDF) PDFDocument132 pagesE W Hildick - (McGurk Mystery 05) - The Case of The Invisible Dog (siPDF) PDFTheAsh2No ratings yet

- WH2009 WaterHorseCatalogDocument132 pagesWH2009 WaterHorseCatalogAiko FeroNo ratings yet

- Characteristics Finite Element Methods in Computational Fluid Dynamics - J. Iannelli (Springer, 2006) WW PDFDocument744 pagesCharacteristics Finite Element Methods in Computational Fluid Dynamics - J. Iannelli (Springer, 2006) WW PDFsanaNo ratings yet

- PFW - Vol. 23, Issue 08 (August 18, 2008) Escape To New YorkDocument0 pagesPFW - Vol. 23, Issue 08 (August 18, 2008) Escape To New YorkskanzeniNo ratings yet

- CE230207 Copia WC Presentation FINALDocument47 pagesCE230207 Copia WC Presentation FINALIdir MahroucheNo ratings yet

- Classification of Common Musical InstrumentsDocument3 pagesClassification of Common Musical InstrumentsFabian FebianoNo ratings yet

- Static MAC Address Table EntryDocument2 pagesStatic MAC Address Table EntryphamvanhaNo ratings yet

- Manual de Instalación - Tableros Centro de Carga - Marca GEDocument4 pagesManual de Instalación - Tableros Centro de Carga - Marca GEmariana0% (1)

- Defense Support of Civil Authorities (Dsca) : This Briefing IsDocument15 pagesDefense Support of Civil Authorities (Dsca) : This Briefing IsChris WhiteheadNo ratings yet