Professional Documents

Culture Documents

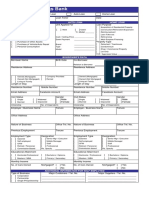

Kins Hospital - SL

Kins Hospital - SL

Uploaded by

Arunprasath SOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kins Hospital - SL

Kins Hospital - SL

Uploaded by

Arunprasath SCopyright:

Available Formats

Date: 28th March 2023 SL/HFS-CH-02/SCHHFS0000283664

To,

M/s. Kins Hospital,

18/65-A5, B3, Kuzhithurai town,

Court Road, Marthandam,

Kanniyakumari - 629163

Kind Attention - Dr. Edwin Kins Raj

Subject: Equipment Loan of up-to INR 31,88,771/- (Rupees Thirty One Lakh Eighty Eight Thousand Seven hundred

and Seventy One Only)

Clix Capital Services Pvt Ltd and/or one or more of its affiliates (“Lender”) is pleased to Dr. Edwin Kins Raj

(“Borrower”) a credit facility of upto INR 31,88,771/- (Rupees Thirty One Lakh Eighty Eight Thousand Seven

hundred and Seventy One Only) (“Facility”) subject to the following terms and conditions

: M/s. Kins Hospital,

Borrower 18/65-A5, B3, Kuzhithurai town,

Court Road, Marthandam,

Kanniyakumari - 629163

Name: Clix Capital Services Pvt Ltd.(CCS) and/or one of more of its affiliates

Lender : Address: Plot No. 23, 5th Floor, Aggarwal corporate Tower, Govind Lal Sikka Marg,

Rajendra Place, New Delhi- 110008

: Maximum; - INR 31,88,771/- (Rupees Thirty One Lakh Eighty Eight Thousand Seven

Facility hundred and Seventy One Only)

Asset Loan Amount: - INR 30,76,360/- (Rupees Thirty Lakh Seventy Six Thousand Three

Hundred and Sixty Only)

Asset Insurance: - INR 9,075/- (INR Nine Thousand and Seventy Five Only)

Loan cover Insurance: INR 99,936/- (INR Ninety Nine Thousand Nine hundred and Thirty

Six Only)

Care Insurance: - INR 3,400/- (INR Three Thousand Four hundred Only)

Purpose : Purchase of equipment as mentioned in Annexure B (“Equipment”).

Equipment Cost : INR 30,76,360/- (Rupees Thirty Lakh Seventy Six Thousand Three Hundred and Sixty Only)

Security 1. First and exclusive charge on the equipment financed by the Lender.

2. Security over collateral given by the Borrower under or pursuant to any other facility

: granted by the Lender And/or its affiliates.

3. Unconditional and Irrevocable Personal/Corporate Guarantee Dr. Edwin Kins Raj and

Dr. Sowmi SK

4. Security Deposit of Rs. 6,41,421/- to be collected upfront

Margin Money : NIL

Drawdown : On or before 60 Days from date of Sanction letter

Tenure/Term : Up-to maximum of 5 years (60 Months)

Clix Internal Circulation Only

Interest Rate : ROI @ 13.50% p.a.(Equipment Loan)

(CRBR - Margin)

(Floating)

Interest Spread -550 basis point per annum

: (In case of any change in benchmark before the date of first drawdown, the same will get

offset in interest spread and overall rate will remain as 13.50%)

Clix Reference Clix Capital Services Pvt Ltd. Prime Lending Rate (PLR) which is 19.00% as on 31st Jan

Benchmark Rate : 2023

The Interest Rate shall be the difference between Reference Benchmark Rate (as

Pricing/ Interest : announced from time to time) and Interest Spread. The current Interest Rate on the Facility

Rate is 13.50% p.a. linked to current Clix Capital Services Pvt Ltd PLR of 19.00%.

For the avoidance of doubt, the Clix PLR will be the rate published by Clix on its website

from time to time, whether or not Lender has provided intimation of change.

The rate shall be reset at quarterly intervals from the date of first drawdown and every

quarter thereafter (“Rate Reset Date”).

The Lender shall have the option, in its sole discretion, to revise/reset Interest Spread

and/or Reference Benchmark Rate (currently Clix Capital Services Pvt Ltd Prime Lending

Rate) at any point of time during currency of the loan. Lender shall provide a notice prior

to change in the Interest spread or benchmark rate.

Repayment/EMI : Repayable in 60 ( Sixty Month) Monthly Installments from the date of drawdown

payable per

month EMI Amount with Insurance 1-60 Months: - INR 73,373/- (Seventy Three Thousand Three

Hundred and Seventy Three Only/-).

EMI Amount without Insurance 1-60 Months: - INR 70,787 /- (Seventy Thousand Seven

hundred and Seven Only/-)

Note: The above EMI amount is a Tentative Indication of the EMI and is subject to

change depending on the date of Availing of this facility, and final EMI would be

communicated to you via Repayment Schedule.

Processing fee : Processing Fee of 2%

Availability : The Facility shall be available for Drawdown within 6 months from the date of sanction

Period (“Availability Period”). However, during the Availability Period, the Lender may, in its sole

discretion, cancel the Facility, if any Events of Default or potential Event of Default has

occurred or if it becomes unlawful for the Lender to disburse or continue the Facility to the

Borrower.

Voluntary / : Voluntary Prepayment:

Mandatory The Borrower shall at any time during the Facility Term have the option to prepay the

Prepayment Facility, in full, together with all interest, prepayment premium and other charges and

monies due and payable to the Lender up to the date of such prepayment by giving a prior

written notice of fifteen (15) days. Such Voluntary Prepayment will attract a prepayment

charges of the outstanding amount under the Facility as given below:

*Prepayment Charges:

< 12 Month – Prepayment not allowed

Clix Internal Circulation Only

=>12 Month & <24 months – 5% of Principal outstanding for loan amount + GST**

=>24 Months – up to 4% of Principal outstanding for loan amount + GST**

*Part-prepayment is not permitted. Borrower shall prepay the Loan in full.

**Above rate is applicable, if foreclosure done by own fund. In case other source of fund,

it will be 6% of Principal O/s + GST

Call/Put Option: Borrower shall have the option to ‘Put’ the Facility without any

prepayment penalty and Lender shall have the option to ‘Call’ the Facility at the end of

twelve (12) months from the date of the Drawdown and at the end of every twelve (12)

months thereafter during tenure of the Facility. Borrower and Lender shall give each other

prior written notice of fifteen (15) days of their intent to exercise the Put/Call Option.

Mandatory Prepayment means and includes:

When it becomes unlawful for the Lender to make, fund or allow continuance of the

Facility; then (a) the Lender shall be entitled to cancel the Facility; and (b) if the Lender so

requires, the Borrower shall on such date as the Lender shall specify repay all amounts

outstanding under the Facility (together with accrued interest) and/or pay to the Lender

such amounts equal to the contingent or future liabilities under the Facility. Mandatory

Prepayment and prepayment upon exercise of Call/Put Option shall not attract any

prepayment fees

Interest on : Default interest will accrue on overdue sums @ 3.0% (Three percent) per month,

delayed compounded monthly.

payments

Covenants : Customary to transaction of this nature.

Documentation : On acceptance of the terms of this Sanction Letter by the Borrower, the Borrower will be

required to execute all documentation in respect of the Facility to the satisfaction of the

Lender. Such documents will contain such conditions, representations and warranties,

affirmative and negative covenants, reporting covenants, indemnification provisions,

events of default and remedies as are customary for facilities of the type described in this

Sanction Letter (“Transaction Documents”).

Other conditions : • Lender shall retain the unconditional right to sell down a part or whole of the Facility,

at any time, during the Term of the Facility.

• The Borrower shall not assign its rights or obligations under the Facility.

• Disbursement of the Facility will be conditional upon:

• All documentation in form & substance, satisfactory to the Lender (the “Condition

Precedent Documents”) set out in Annexure ‘A’ hereto having been delivered to

the Lender

• The Borrower being in compliance with all the terms under the Transaction

Documents.

Provided however, that the Lender may, by sending a notice in writing, in its sole

discretion and upon the written request of the Borrower, defer the submission of any

of the Condition Precedent Documents.

Clix Internal Circulation Only

• Any default under this Facility shall be a default under any other existing / future

facility extended by the Lender to the Borrower. Any default under any other loan

availed of or to be availed of by the Borrower shall be a default under any existing /

future facility extended by the Lender to the Borrower.

• Notwithstanding the issuance of this Sanction Letter and the acceptance thereof, the

Lender in its sole discretion may decide to not disburse the Facility, repudiate and

rescind this Sanction Letter unilaterally without assigning any reasons, including in

case of any adverse change in the financial, banking or capital markets.

• Lender shall have an unconditional right but not an obligation to set off against all

moneys due and payable by the Borrower to the Lender under any document against

any obligations owed by the Lender to the Borrower including those arising out of

excess cash received by the Lender from enforcement of any security offered in

relation to any facility availed by the Borrower from the Lender.

• Regardless of whether Borrower accepts the Sanction Letter, Lender retains the right

to withdraw this offer upon the occurrence of: (i) any material adverse change, or any

development reasonably likely to result in a material adverse change, in or affecting

Borrower’s general affairs, management, financial position, business plans or results

of operations; or (ii) prior to the date of disbursal, any disruption, adverse change or

condition in the financial, banking or capital markets generally, or in the market for

loan syndications or high yield debt in particular, which, in Lender’s reasonable

judgment, has materially impaired, or could materially impair Lender’s ability to

perform under any of the transaction documents; or materially adversely affect the

international or any relevant domestic loan, debt, bank, capital or equity market.

• The Borrower shall keep the Equipment under appropriate insurance coverage and

Comprehensive Maintenance Contract till the end of the Term of the Facility.

• NACH/Electronic Clearing Service mandate any other mode as mandated by RBI from

time to time, and as acceptable to the Lender, to be activated by the Borrower for the

benefit of the Lender for complete tenor of the Facility.

• Unless specifically agreed otherwise, all Drawdown under the Facility shall be directly

in favor of the manufacturer of the Equipment. In case of payment to dealer, necessary

due diligence to be completed prior to funding by the Lender. Equipment and

manufacturer and location to be acceptable to the Lender

All unsecured loans/promoter loans/NCDs will be subordinated to the Facility with no

repayments allowed on such loans till the full repayment of the Facility.

:

Validity The terms of this Sanction Letter are valid for acceptance on or 60 days unless extended

by the Lender in its absolute discretion.

Events of : Upon occurrence of an Event of Default, the Lender shall have the right to (a) recall the

Default entire outstanding Loan along with any interest (including default interest), fees, costs,

charges and all other sums whatsoever payable by the Borrower to the Lender

(“Outstanding Amount”) whereby the Outstanding Amount shall become immediately due

and payable by the Borrower.

Expenses Any expenses incurred in closing this transaction shall be borne by the Borrower, including

but not limited to the following:

Clix Internal Circulation Only

a. All legal charges and fees of the legal counsel deemed necessary by Lender. All

legal fees shall be reimbursed to the Lender prior to the first Drawdown. In the

event that the Facility is not drawn down, for any reason whatsoever, the

Borrower shall immediately arrange to reimburse such fees to the Lender.

b. All other costs, stamp duties, and general costs associated with the preparation,

registration and settlement of documentation.

Taxes All applicable taxes on Fee, Interest and other charges due/payable per this Sanction Letter

shall be borne by the Borrower

Governing Law Indian

** The terms of this Sanction Letter supersedes and over-rides any and all of the terms and conditions of any sanction

letter previously issued by the Lender and has to be treated as the final sanction letter with final sanction terms.

** Insurance is a subject matter of solicitation. The Borrower agrees that the insurance is a third party product and

the Borrower shall be subject to insurance terms of the Insurance Company. Insurance premium as agreed by on

the Insurance enrollment form will be deducted upfront from disbursed loan amount/ Facility Amount.

**The lender shall be entitled to a percentage of facility amounts as Subvention from the Manufacturer/Supplier.

The terms in this Sanction Letter are intended to summarize certain basic terms of the proposed Transaction. It is not

intended to be a definitive list of all requirements of the Lender in connection with the Transaction.

This Sanction Letter is confidential and the property of the Lender and neither this document nor the contents hereof

shall be reproduced, communicated to in any form or used for the purpose of approaching other parties without

Lender’s prior written consent to persons other than those individuals or entities who are directors, officers,

employees or advisors of the proposed Borrower on a confidential and need-to-know basis and for the purposes of

their evaluation of the proposed financing or as may be compelled in a judicial or administrative proceeding or as

otherwise required by applicable law.

This Sanction Letter shall be governed by and construed in accordance with the laws of India and supersedes any

and all discussions, negotiations, understandings or agreements, written or oral, express or implied, between or

amount the parties hereto or any other person as to the subject matter hereof.

Please return a copy of this Sanction Letter duly signed by the authorized signatories of the Borrower

as acceptance of the above terms and conditions.

We look forward to working with you on this potential transaction.

Yours sincerely,

For Clix Capital Services Pvt Ltd

Acknowledged and Consented:

We accept the Facility on the terms and conditions set out above. We further confirm that we understand the terms

and conditions of the loan / lease sanction letter as laid out in English/the stated terms and conditions of the

sanction(s) have been explained to us in a language of our understanding/in vernacular language. We also confirm

that we are aware of the Pricing Policy of the Lender, as detailed on its website.

Clix Internal Circulation Only

We also authorize you to collect information about us, our Directors, the Promoters, our affiliates and any person

associated with us, as may be required for verification/evaluating the proposed Facility, including, gathering

information from credit information companies. We also authorize you to share information furnished by us with

credit bureaus or any statutory agency as you may deem fit. We further authorize the lender to use the information

furnished by us for offering other financial products offered by the Lender or its affiliates.

Authorized Signatory (/ies) of

M/s. Kins Hospital,

18/65-A5, B3, Kuzhithurai town,

Court Road, Marthandam,

Kanniyakumari - 629163

Annexure A

Condition Precedents and Condition Subsequent

Part A

The following documents shall be duly executed and/or submitted to the Lender in a form and substance satisfactory

to Lender before “ok to ship” or the first drawdown being given by the Lender under the Facility:

1. Duplicate copy of this Sanction Letter duly accepted by the Borrower.

2. Duly executed Transaction Documents including the equipment Loan and Hypothecation Agreement with

applicable schedules, and duly signed and accepted repayment schedule for the Facility.

3. Pay Proceed Letter giving details of disbursement.

4. Satisfactory compliance with Lender’s “Know Your Customer” and “Anti Money Laundering” requirements.

5. Original Final Tax Paid Invoice with CLIX Endorsement to be obtained pre-disbursal.

6. Margin Money receipt/ OCR, Bank statement clearance of Amount paid by customer for purchase of this

Machine.

7. Insurance on assets lien marked to CLIX capital services Pvt Ltd as 1st loss Payee

8. Unconditional and Irrevocable guarantee of Dr. EDWIN KINS RAJ and Mrs. SOWMI S K to the loan structure

9. Performa Invoice to be documented/ Tax Invoice if any to be documented with Hypothecation

10. Asset verification to be done and asset installation report to be documented as per policy

11. Ownership Proof to be documented

12. NACH to be obtained from borrowers State Bank of India - A/c no: 00000011231859242 for the entire tenor of

loan Documented.

13. Additional SPDCs from a/c of Dr. Sowmi SK

Part B

Clix Internal Circulation Only

In addition to the documents mentioned under Part A above, the following documents duly executed and/or

submitted to the Lender in a form and substance satisfactory to Lender before each Drawdown:

14. Such other documents that Lender may reasonably request.

The following documents, executed by its authorised signatories (“Conditions Subsequent Documents”), shall be

submitted by the Borrower to the Lender in form and substance satisfactory in all respects to the Lender, within the

timelines indicated below:

1. Such other documents that Lender may reasonably request.

Annexure B

Details of Equipment

S.

Equipment Name Make Model Dealer Unit Unit Price GST Total GST

No.

ARS

ALLIED MEDITEC 1700 MEDITEC

1 Allied MEDICAL 1 11,04,000 1,32,480 12,36,480

VENTILATOR WITH STAND 1700

SYSTEMS

ARS

ALLIED CARDIASAFE-II

2 Allied CARDIASAFE-II MEDICAL 1 2,99,000 35,880 3,34,880

DEFIBRILLATOR

SYSTEMS

ARS

Allied Jupiter 200

3 Allied Jupiter 200 MEDICAL 1 1,43,750 17,250 1,61,000

Anesthesia Machine

SYSTEMS

Moriah

VERSATOR MOTOR

4 NA NA Health 1 3,50,000 42,000 3,92,000

DRIVE UNIT (VDU)

Services

ALAN ADVANCE MODEL

JBS

5 DIATHERMY WITH VESSEL Alan Max MBXP 1 8,50,000 1,02,000 9,52,000

Meditech

SEALING & BI TURP

30,76,360

Asset will be installed at the below premises and will remain at:

M/s. Kins Hospital,

18/65-A5, B3, Kuzhithurai town,

Court Road, Marthandam,

Kanniyakumari - 629163

Clix Internal Circulation Only

Clix Internal Circulation Only

You might also like

- BIBM Question BankDocument99 pagesBIBM Question BankSalman Ahmed100% (1)

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- Ecb-Loan Agreement-1 Draft TemplateDocument11 pagesEcb-Loan Agreement-1 Draft TemplateNarinder Kaul100% (1)

- Memorandum of Agreement For Livelihood Loan FacilityDocument9 pagesMemorandum of Agreement For Livelihood Loan Facilityglenn padernal100% (1)

- Sanction 4Document4 pagesSanction 4ParinithNo ratings yet

- True Credits Private Limited: Loan Sanction LetterDocument17 pagesTrue Credits Private Limited: Loan Sanction LetterSrinivasu Chintala100% (1)

- EFA Agreement Early TerminationDocument2 pagesEFA Agreement Early TerminationKhoa PhanNo ratings yet

- Your Zestmoney AgreementDocument12 pagesYour Zestmoney AgreementPrasanth ParimiNo ratings yet

- Muthoot FinanceRBI Licence RegnDocument30 pagesMuthoot FinanceRBI Licence RegnTHE PHILOSOPHER MADDYNo ratings yet

- CreditCard Sanction Letter 918217097145Document4 pagesCreditCard Sanction Letter 918217097145Maha RajaNo ratings yet

- General Terms and Conditions Consumer LoanDocument5 pagesGeneral Terms and Conditions Consumer Loanvasupahwa79No ratings yet

- Action RequireDocument10 pagesAction RequireAsma SaeedNo ratings yet

- Resi Proejct Term Sheet - Priyami CommentsDocument9 pagesResi Proejct Term Sheet - Priyami Commentslaxmikanth.goturNo ratings yet

- Loan Offer LetterDocument3 pagesLoan Offer LettermbakurujohnNo ratings yet

- Credit Facility Sanction LetterDocument19 pagesCredit Facility Sanction LetterJyoti SukhdeveNo ratings yet

- Lampiran Loan AgreementDocument15 pagesLampiran Loan AgreementYusuf WahidNo ratings yet

- Sanction LetterDocument2 pagesSanction LetterKundan KumarNo ratings yet

- Loan Offer LetterDocument3 pagesLoan Offer LetterEmerit MusicNo ratings yet

- DMI DMI0022846733 Agreement 1715403302588Document17 pagesDMI DMI0022846733 Agreement 1715403302588reghuvelanNo ratings yet

- LDSDocument17 pagesLDSVenkataramana SarellaNo ratings yet

- LdsDocument16 pagesLdsRavi Rudr MishraNo ratings yet

- 2018091800024Document3 pages2018091800024Gunjan ShahNo ratings yet

- DmiDocument16 pagesDmiprecisioncalibration2023No ratings yet

- Sanction LetterDocument2 pagesSanction LetterSathyan JrNo ratings yet

- UntitledDocument5 pagesUntitledKhatuJi HandicraftsNo ratings yet

- Lgscas-Operational Guidelines - 17 08 2022Document5 pagesLgscas-Operational Guidelines - 17 08 2022Akhtar HussainNo ratings yet

- Loanagreement 64C728P21111Document20 pagesLoanagreement 64C728P21111ST4R L0RDNo ratings yet

- Bank Loan AgreementDocument8 pagesBank Loan AgreementSiddhi LikhmaniNo ratings yet

- Loan - Contract - LIQUILOANS - AGREEMENT - 6821750 5Document17 pagesLoan - Contract - LIQUILOANS - AGREEMENT - 6821750 5zy6btrz6qkNo ratings yet

- Financial Closure AgreementDocument85 pagesFinancial Closure AgreementAMITHNo ratings yet

- FM-GSIS-OPS-PPL-02 - Optional Life Insurance Policy Loan Application - Rev2 - 10may2024Document2 pagesFM-GSIS-OPS-PPL-02 - Optional Life Insurance Policy Loan Application - Rev2 - 10may2024jenjen.sombiseNo ratings yet

- FORMS Emergency - Loan PDFDocument3 pagesFORMS Emergency - Loan PDFUsep ObreroNo ratings yet

- General Terms and Conditions Personal LoanDocument5 pagesGeneral Terms and Conditions Personal LoanRaju BairwaNo ratings yet

- LOAN AGREEMENT ("Loan Agreement") : IsclaimerDocument12 pagesLOAN AGREEMENT ("Loan Agreement") : IsclaimerSurendhar SurendharNo ratings yet

- FN1683347094 Loan AgreementDocument7 pagesFN1683347094 Loan AgreementAbhranil BiswasNo ratings yet

- Ins Consent 4005606872 2021-03-29Document2 pagesIns Consent 4005606872 2021-03-29Saroj GautamNo ratings yet

- Sanction LetterDocument2 pagesSanction Letter313 65 Cheithanya Kumar MNo ratings yet

- Loan Agreement Bank 2.dotDocument20 pagesLoan Agreement Bank 2.dotlily kamwanaNo ratings yet

- Welcome Letter IDEP169831873135LAWO 692816391183734Document14 pagesWelcome Letter IDEP169831873135LAWO 692816391183734tucker078605No ratings yet

- PayDay Loan Terms N C 2Document8 pagesPayDay Loan Terms N C 2igwe christianNo ratings yet

- Ubl Sanction LetterDocument4 pagesUbl Sanction LetterMayukh GhoshNo ratings yet

- Terms and ConditionsDocument4 pagesTerms and ConditionsThatukuru LakshmanNo ratings yet

- Sanction Letter FAST4631717476565817 576774193678181Document10 pagesSanction Letter FAST4631717476565817 576774193678181parasbhalla97No ratings yet

- Loan AgreementDocument5 pagesLoan AgreementPriyanshu SinghNo ratings yet

- Most Important Document: CustomerDocument8 pagesMost Important Document: CustomermasumsojibNo ratings yet

- Life Stay Smart Plan BrochureDocument2 pagesLife Stay Smart Plan BrochureBadi SudhakaranNo ratings yet

- 64f4394643184802a1db4ab8 SignedDocument11 pages64f4394643184802a1db4ab8 Signedrex alwinNo ratings yet

- Welcome Letter IDEP6519177878724Y5C 411695826587198Document12 pagesWelcome Letter IDEP6519177878724Y5C 411695826587198BhoomikaNo ratings yet

- Dear Applicant,: Tata Capital Financial Services LimitedDocument9 pagesDear Applicant,: Tata Capital Financial Services LimitedeamumeshNo ratings yet

- Loan AgreementDocument10 pagesLoan AgreementMukesh VNo ratings yet

- Welcome Letter IDEP1817543492886BDW 573179184512158Document14 pagesWelcome Letter IDEP1817543492886BDW 573179184512158srivastavashivay0No ratings yet

- Complete Loan PSD-454Document8 pagesComplete Loan PSD-454bamnemanish4787No ratings yet

- DownloadDocument40 pagesDownloadabilash singhNo ratings yet

- DMI DMI0032140135 Agreement 1709123645690Document17 pagesDMI DMI0032140135 Agreement 1709123645690razarahil369No ratings yet

- DMI DMI0031838999 Agreement 1709179676414Document18 pagesDMI DMI0031838999 Agreement 1709179676414hinglajsteel2No ratings yet

- DMI DMI0035392313 Agreement 1704702866776Document18 pagesDMI DMI0035392313 Agreement 1704702866776farhaan0091No ratings yet

- DMI DMI0030179395 Agreement 1704150274296Document17 pagesDMI DMI0030179395 Agreement 1704150274296debnathdebabrata123No ratings yet

- Ins Consent 3909252858 2020-04-17Document2 pagesIns Consent 3909252858 2020-04-17Om PkNo ratings yet

- TermsKFS 9582497548Document10 pagesTermsKFS 9582497548dheerajpa009No ratings yet

- Ins Consent 3909252858 2020-04-17 PDFDocument2 pagesIns Consent 3909252858 2020-04-17 PDFOm PkNo ratings yet

- Key BtapDocument11 pagesKey BtapViệt Phương NguyễnNo ratings yet

- Larchwood Sales Brochure 25B Revision 050123Document106 pagesLarchwood Sales Brochure 25B Revision 050123pbqs27rvphNo ratings yet

- Sycamore Ventures Corporation vs. Metropolitan Bank and Trust Company FactsDocument3 pagesSycamore Ventures Corporation vs. Metropolitan Bank and Trust Company FactsJude ChicanoNo ratings yet

- Chap 3Document26 pagesChap 3Yeshiwork GirmaNo ratings yet

- Presentation On Indian Stamp Act 1899Document26 pagesPresentation On Indian Stamp Act 1899Annuj SrivastavaNo ratings yet

- Five Cs of Credit: CreditworthinessDocument3 pagesFive Cs of Credit: CreditworthinessSakshi Singh YaduvanshiNo ratings yet

- Chapter 1 Research 11Document4 pagesChapter 1 Research 11Tilahun GirmaNo ratings yet

- Prudential Bank vs. MartinezDocument3 pagesPrudential Bank vs. MartinezRomy Ian LimNo ratings yet

- Still Electric Tractor r07 25 r08 20 Spare Parts Lists deDocument22 pagesStill Electric Tractor r07 25 r08 20 Spare Parts Lists demaryfisher141290dkz100% (137)

- Dap Term SheetDocument3 pagesDap Term SheetAnton CastilloNo ratings yet

- Resa Credit TransDocument7 pagesResa Credit TransArielle D.No ratings yet

- Credit Transactions - FinalsDocument27 pagesCredit Transactions - FinalsMon Señorito EdmundoNo ratings yet

- Wa0006.Document47 pagesWa0006.Ashutosh AwasthiNo ratings yet

- Fixed Interest Rate Mortgage LoansDocument29 pagesFixed Interest Rate Mortgage LoansJoseph J. AssafNo ratings yet

- Bod MemoDocument1 pageBod MemoNonilon RoblesNo ratings yet

- Montoya v. Ignacio, G.R. No. L-5868, December 29, 1953Document5 pagesMontoya v. Ignacio, G.R. No. L-5868, December 29, 1953Bob LawNo ratings yet

- Florida Attorney General "Unfair, Deceptive and Unconscionable Acts in Foreclosure Cases"Document98 pagesFlorida Attorney General "Unfair, Deceptive and Unconscionable Acts in Foreclosure Cases"DinSFLANo ratings yet

- RSB Application Form - New 04242013 1st PageDocument1 pageRSB Application Form - New 04242013 1st PageBoyTibsNo ratings yet

- What Is Network Marketing?: MLM TrainingDocument31 pagesWhat Is Network Marketing?: MLM TrainingDonnie KJSSNo ratings yet

- E-Booklet On RBI & BR Act-1Document17 pagesE-Booklet On RBI & BR Act-1Akella LokeshNo ratings yet

- Shivani Project Micro CreditDocument94 pagesShivani Project Micro Creditsonu kumarNo ratings yet

- Jorion 2000Document24 pagesJorion 2000ahmadNo ratings yet

- 09-Affin Skim Rumah Pertamaku-I Tawarruq ENG v07 2020Document10 pages09-Affin Skim Rumah Pertamaku-I Tawarruq ENG v07 2020afiq aqmalNo ratings yet

- Financial Report Analysis of Global IMEDocument26 pagesFinancial Report Analysis of Global IMEशिवम कर्णNo ratings yet

- Venture Capital in IndiaDocument14 pagesVenture Capital in IndiaRemy HerbieNo ratings yet

- Insolvency - Indonesia 2022Document29 pagesInsolvency - Indonesia 2022Andhika Hananta RNo ratings yet

- Engineering Economics (CENG 5011) : Time Value of Money Lecture # 4Document68 pagesEngineering Economics (CENG 5011) : Time Value of Money Lecture # 4anduamlak wondimagegnNo ratings yet

- Depository Financial InstitutionsDocument3 pagesDepository Financial Institutionssamuel kebedeNo ratings yet

- ThesisDocument5 pagesThesisProdip RoyNo ratings yet