Professional Documents

Culture Documents

Dit 001

Dit 001

Uploaded by

princetrojanCopyright:

Available Formats

You might also like

- Account Reconciliation Policy (Sample 2)Document5 pagesAccount Reconciliation Policy (Sample 2)kjheiinNo ratings yet

- IFRS Proposal From Heed Advisory Services To ArconDocument39 pagesIFRS Proposal From Heed Advisory Services To ArconOlufemi Moyegun83% (6)

- Inventories and The Cost of Goods Sold: Mcgraw-Hill/IrwinDocument76 pagesInventories and The Cost of Goods Sold: Mcgraw-Hill/Irwinazee inmix0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- Accounting Supplementary ExamDocument4 pagesAccounting Supplementary Examlajwang27No ratings yet

- Acc XiDocument6 pagesAcc XiRekha DeviNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- CBM 514-3 Question 3Document3 pagesCBM 514-3 Question 3hafsamohmd793No ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- 3.CA Foundation Test 3Document5 pages3.CA Foundation Test 3Nived Narayan PNo ratings yet

- Date Description AmountDocument5 pagesDate Description AmountClaire BarbaNo ratings yet

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- PA2 Assignment 2022 EdDocument9 pagesPA2 Assignment 2022 EdShaggYNo ratings yet

- Accounts Prelim Paper 28-11-23Document4 pagesAccounts Prelim Paper 28-11-23roshanchoudhary4350No ratings yet

- Contentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFDocument4 pagesContentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFJoseph OndariNo ratings yet

- ACCOUNTSDocument5 pagesACCOUNTSM-mila Chepterit KenyNo ratings yet

- ICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andDocument6 pagesICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andArpit GuptaNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- Q 1 3Document9 pagesQ 1 3Ahasanul AlamNo ratings yet

- Accountancy 17Document12 pagesAccountancy 17Manav GargNo ratings yet

- 84 164046 5994Document3 pages84 164046 5994Afaq ZaimNo ratings yet

- Ca - Foundation: Principles and Practice AccountingDocument7 pagesCa - Foundation: Principles and Practice Accountingritikkumarsharmash9499No ratings yet

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- Sample Paper-2016 Subject: Class 11: Part - A (Financial Accounting - I)Document4 pagesSample Paper-2016 Subject: Class 11: Part - A (Financial Accounting - I)Šhûbh Šhôûřyâ KâšhyâpNo ratings yet

- 2017-12 ICMAB FL 001 PAC Year Question December 2017Document3 pages2017-12 ICMAB FL 001 PAC Year Question December 2017Mohammad ShahidNo ratings yet

- Baf1201 Financial Accounting I CatDocument5 pagesBaf1201 Financial Accounting I CatcyrusNo ratings yet

- Test 4Document6 pagesTest 4Jayant MittalNo ratings yet

- S4 Aceiteka 2017 AccountsDocument7 pagesS4 Aceiteka 2017 AccountsEremu ThomasNo ratings yet

- 2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Document4 pages2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Best ThingsNo ratings yet

- Midterm Exam KeyDocument5 pagesMidterm Exam KeyRiña Lizte AlteradoNo ratings yet

- Amrita QP - Accountancy Class XI - First Term 2018-2019Document3 pagesAmrita QP - Accountancy Class XI - First Term 2018-2019Prakash KumarNo ratings yet

- Afa 1 Icmab QuestionsDocument65 pagesAfa 1 Icmab QuestionsKamrul HassanNo ratings yet

- Reg. No.: Q.P. Code: (19 SC 01/ 19 SS 01/ 19 CA 01)Document12 pagesReg. No.: Q.P. Code: (19 SC 01/ 19 SS 01/ 19 CA 01)K0140 Jeevanantham.SNo ratings yet

- CA - Zam Dec-2017Document102 pagesCA - Zam Dec-2017Dixie CheeloNo ratings yet

- S.6 Ent 2Document5 pagesS.6 Ent 2danielzashleybobNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- 5664accountancy XIDocument9 pages5664accountancy XIAryan VishwakarmaNo ratings yet

- 2017-06 ICMAB FL 001 PAC Year Question JUNE 2017Document3 pages2017-06 ICMAB FL 001 PAC Year Question JUNE 2017Mohammad ShahidNo ratings yet

- Acc Xi Class Test-I 2022Document4 pagesAcc Xi Class Test-I 2022shaurya kapoorNo ratings yet

- 2019-04 ICMAB FL 001 PAC Year Question April 2019Document3 pages2019-04 ICMAB FL 001 PAC Year Question April 2019Mohammad ShahidNo ratings yet

- 2021-06 Icmab FL 001 Pac Year Question June 2021Document3 pages2021-06 Icmab FL 001 Pac Year Question June 2021Mohammad ShahidNo ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- RAC 102 - Principles of Financial Accounting 11 - Draft ExamDocument5 pagesRAC 102 - Principles of Financial Accounting 11 - Draft Examemmanuel mwitaNo ratings yet

- Accounting: Required: Prepare Journal Entries To Record The Above TransactionsDocument3 pagesAccounting: Required: Prepare Journal Entries To Record The Above TransactionsMahediNo ratings yet

- Acs 303Document4 pagesAcs 303Amos kundaNo ratings yet

- 11 Accountancy SP 2Document17 pages11 Accountancy SP 2Vikas Chandra BalodhiNo ratings yet

- Accounts EnglishDocument12 pagesAccounts EnglishPradeepa SadhviNo ratings yet

- Paper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDocument25 pagesPaper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsorySaurabh JainNo ratings yet

- Accounts Suggested Ans CAF Nov 20Document25 pagesAccounts Suggested Ans CAF Nov 20Anshu DasNo ratings yet

- Book-Keeping Form Three PDFDocument4 pagesBook-Keeping Form Three PDFdesa ntosNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- UntitledDocument269 pagesUntitledvijaypeketiNo ratings yet

- Ae 11 Mar 19 AccDocument3 pagesAe 11 Mar 19 AccRitu GuptaNo ratings yet

- Transfer PricingDocument235 pagesTransfer PricingRamesh KrishnanNo ratings yet

- Group Assignment FAR Semester 2 2020Document4 pagesGroup Assignment FAR Semester 2 2020Shamimi ShahNo ratings yet

- The Cpa Licensure Examination Syllabus Complete)Document8 pagesThe Cpa Licensure Examination Syllabus Complete)Ssan DunqueNo ratings yet

- Guide On Risk Based Internal Audit Plan04!06!15Document15 pagesGuide On Risk Based Internal Audit Plan04!06!15Christen CastilloNo ratings yet

- PRTC MAS 2015 May Preboards 140Document17 pagesPRTC MAS 2015 May Preboards 140NillChrisTurbanadaDoroquez100% (3)

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Multilingual GlossaryDocument53 pagesMultilingual GlossaryMaurA AruaMNo ratings yet

- MBA516 Assignment 1Document2 pagesMBA516 Assignment 1ShamittaaNo ratings yet

- F A, B & M 2: Undamentals of Ccountancy Usiness AnagementDocument14 pagesF A, B & M 2: Undamentals of Ccountancy Usiness AnagementDories AndalNo ratings yet

- Luca Bartolomeo de PacioliDocument2 pagesLuca Bartolomeo de PacioliLuna LedezmaNo ratings yet

- The Review of Management Accounting: Niu Shuo, Du JianDocument3 pagesThe Review of Management Accounting: Niu Shuo, Du JianJannat JavedNo ratings yet

- Accounting Activity 6Document2 pagesAccounting Activity 6Kae Abegail GarciaNo ratings yet

- Tally ERPDocument18 pagesTally ERPimtiazNo ratings yet

- Financial Accounting ChabDocument2 pagesFinancial Accounting ChabDiana FuNo ratings yet

- Class Note 3Document13 pagesClass Note 3Abdallah HassanNo ratings yet

- Soal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficeDocument6 pagesSoal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficePUTRI YANINo ratings yet

- Strategic Management: A Multiple-Perspective Approach, Edited by Mark Jenkins and V. Ambrosini, PalgraveDocument20 pagesStrategic Management: A Multiple-Perspective Approach, Edited by Mark Jenkins and V. Ambrosini, PalgraveHarshad Vinay SavantNo ratings yet

- Attachment AccountingDocument6 pagesAttachment Accountingtaylor swiftyyyNo ratings yet

- Asuprin Activity Worksheet: Compiled By: A. S. MALQUISTODocument5 pagesAsuprin Activity Worksheet: Compiled By: A. S. MALQUISTOLynNo ratings yet

- Auditing Multiple ChoiceDocument11 pagesAuditing Multiple Choiceunique_vn100% (1)

- RKDPLK - 3353 - 2021Document42 pagesRKDPLK - 3353 - 2021Benjamin Eliezer Pascareno SimanjuntakNo ratings yet

- Componentization and Cost SegregationDocument1 pageComponentization and Cost SegregationRamanujam RaghavanNo ratings yet

- 15 BRSDocument18 pages15 BRSDayaan ANo ratings yet

- Antipolo City Executive Summary 2023Document10 pagesAntipolo City Executive Summary 2023Jim TuparanNo ratings yet

- Essentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Test Bank 1Document36 pagesEssentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Test Bank 1leahjohnsonfncrigpmxj100% (35)

- Special JournalsDocument25 pagesSpecial JournalsDaisy Mae Orbita100% (1)

- Cash Flow Statements Exercises and AnswersDocument39 pagesCash Flow Statements Exercises and Answersszn189% (9)

Dit 001

Dit 001

Uploaded by

princetrojanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dit 001

Dit 001

Uploaded by

princetrojanCopyright:

Available Formats

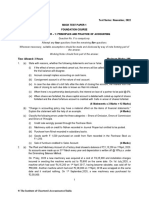

THE CATHOLIC UNIVERSITY OF EASTERN AFRICA

A. M. E. C. E. A P.O. Box 62157

00200 Nairobi - KENYA

MAIN EXAMINATION Telephone: 891601-6

Fax: 254-20-891084

JANUARY – APRIL 2020 TRIMESTER

FACULTY OF SCIENCE

DEPARTMENT OF COMPUTER AND LIBRARY SCIENCE

REGULAR PROGRAMME

DIT 001: BASIC ACCOUNTING

Date: APRIL 2020 Duration: 2 Hours

INSTRUCTIONS: Answer Question ONE and any other TWO Questions

Q1. a) i Briefly explain the importance of accounting information to a young

entrepreneur (3marks)

ii) Discuss the qualities of accounting information (3marks)

iii) Briefly discuss the purpose and content of the balance sheet

(2marks)

iv) Classify the following items into liabilities, assets and capital

(3marks)

Unpaid electricity Unpaid dividend

Machinery Owner’s Equity

Bank Loan Cash in hand

b) i) Define the term source document. Discuss the details and purpose

of two source documents. (3marks)

ii) Joseph made the following purchases during the month of July

2018.

July 1: From Isaac, credit purchases , 4 radios @Shs3000 each, 3

washing machines @Shs16000 each,less 25% trade discounts

through Invoice no. 4083.

July 5: From Bell, credit purchases, 5 iron boxes @Shs2000 each,

6 radios @shs7200 each, less 30% trade discount through Invoice

no. 1003

July 18: Cash purchases: 4 radios @shs5000 each ,less 5% trade

discounts receipt.3089

July 30: From Lewis, credit purchases 4 fridges @ Shs7,000 less

15% trade discount through invoice.38

Cuea/ACD/EXM/JANUARY – APRIL 2020 / COMPUTER / LIBRARY SCIENCE Page 1

ISO 9001:2015 Certified by the Kenya Bureau of Standards

Required:

i)Prepare the purchases journal for the month

(3marks)

ii)Post the items to the creditors personal accounts

(3marks)

iii) Post the totals of the journal to the purchases A/C in the general ledger

(2marks)

c) Differentiate between the following terms

i)Bad debts and provision for bad doubtful debts

ii) Accrued expenses and prepaid expenses

iii) Carriage inwards and carriage outwards

(6marks)

d) Clearly explain the imprest system

(2marks)

Q2. a) The following trial balance was extracted from the books of Omondi’s

Business as at 31/12/2018

Item Debit Credit

Kshs Kshs

Sales 120,000

Return inwards 5,000

Opening stock 1/1/2018 46,000

Return outwards 7,000

Purchases 34,000

Carriage inwards 3,000

Rent expenses 4,000

Furniture at cost 25,000

Debtors 18,000

Creditors 17,000

Provision for doubtful 1,200

debts 1/1/18

Salary expense 8,000

Capital 37,800

183,000 183,000

Additional information:

Cuea/ACD/EXM/JANUARY – APRIL 2020 / COMPUTER / LIBRARY SCIENCE Page 2

ISO 9001:2015 Certified by the Kenya Bureau of Standards

i.Closing stock value shs5,000

ii. Bad debts to be written off shs1,500

iii.Provision for doubtful debts 10% of the remaining debtors

iv.Furniture to be depreciated at the rate of 5%p.a on cost

v.Motor vehicle to be depreciated at the rate of 8% p.a on cost

vi.Prepaid rent expenses shs1,000

vii.Unpaid salary bills shs2,000

Required:

Using the vertical format prepare:

i)Trading and Profit and Loss acoount for the year ended 31/12/2018.

(10marks)

ii)Balance Sheet as at 31/12/18 (8marks)

b) List two uses of the Trial Balance

(2marks)

Q3. a) The following transcations took place in Rebeca’s business during the

month of December 2016.

The opening balances on 1/12/2016 in the cashbook were cash-

shs40,000 (DR) bank – shs2,000 (CR)

2/12/2016 Bought business premises worth shs8,000 and paid by cash

3/12/2016 Deposited shs15,000 cash into the business bank a/c

5/12/2016 Bought goods worth shs5,000 on credit from Beatrice

9/12/2016 Returned goods shs800 to Beatrice as they were faulty

14/12/2016 Received shs10,000 cash as aloan from Isaac

15/12/2016 Made credit sales to Daniel worth shs9,000

16/12/2016 Paid the amount due to Beatrice less 15% cash discount using a cheque

17/12/2016 Made cash sales amounting to shs7,000

18/12/2016 Purchased goods worth shs7,000 from Joseph on credit

19/12/2016 Paid electricity bill shs2,000 using a cheque

20/12/2016 Made credit sales to Robert worth shs6,000

21/12/2016 Returned goods worth shs500 to Robert complaining that they had expired

26/12/2016 Received cash from Daniel, a debtor in respect to the amount due from

him less 8%cash discount

27/12/2016 Paid the amount due to Joseph less 3% cash discount using cash

28/12/2016 Received the amount due from Robert less 5% cash discount in form of

cheque

31/12/2016 Received a cheque of Shs10,000 in respect to rent income earning

Required:

i)Write a three-column cashbook for the month (10marks)

ii)Clearly show the posting of discounts to the respective ledger accounts.

(2marks)

Cuea/ACD/EXM/JANUARY – APRIL 2020 / COMPUTER / LIBRARY SCIENCE Page 3

ISO 9001:2015 Certified by the Kenya Bureau of Standards

b) Explain the following accounting error giving an example in each case:

i)Error of principle

ii)Compensating error

iii)Error of original entry

iv)Error of complete reversal of entries

(8marks)

Q4. a)The following transaction took place in the month of November 2016 in

Baraka’s business

1/11/2016 Baraka invested shs.50,000 cash in the business

3/11/2016 Bought stock worth shs15,000 and paid by cash

5/11/2016 Returned some broken stock items worth shs.500 and was refunded cash

6/11/2016 Bought more stock worth shs4,000 from Isaac on credit

7/11/2016 Deposited shs.5,000 cash into the business bank account

11/11/2016 Made cash sales amounting to Shs20,000

15/11/2016 Bought furniture worth shs3,000 and paid by cash

20/11/2016 Made credit sales to Kamau worth Shs6,000

22/11/2016 Kamau returned goods worth shs500 because they had expired

25/11/2016 Paid Isaac shs2,000 using cash

28/11/2016 Received a cheque of shs3,000 from Kamau

28/11/2016 Baraka withdrew shs1,000 cash from the business for personal use

Required;

i)Open the relevant ledger accounts and post the above transactions

(8marks)

ii)Balance off the accounts as at 30/11/2016 (6marks)

iii)Prepare a trial balance as at 30/11/2016 (3marks)

b) State and explain the contents of the three ledger books. (3marks)

Q5. a) Explain the following terms as used in accounting

i)Business entity concept

ii)Historical cost concept

iii) Prudence concept

iv)Materiality concept

v)Matching concept

(10marks)

Cuea/ACD/EXM/JANUARY – APRIL 2020 / COMPUTER / LIBRARY SCIENCE Page 4

ISO 9001:2015 Certified by the Kenya Bureau of Standards

b) Karibu Enterprise operates a petty cash book on the imprest system, with

a cash float of Shs.10,000 per week. Reimbursement to the petty cashier

is made at the beginning of each new week.

On 14th October 2019, the petty cashier had a balance of Shs1,790

reimbursment was made on the same date.

During the week ended 11th November 2016, the petty cashier made the

following payments.

7/10/2019 Bus fare shs350,Postage shs.270

8/10/2019 Petrol shs 500, washing detergents shs.80

9/10/2019 Office repairs shs900, registered mail shs370

9/10/2019 Receipt books shs 840,petrol shs370

10/10/2019 Vehicle repairs shs1800, paid creditor(PK) shs2000

11/10/2019 Cleaners wages shs500, biro pens shs230

Required:

Using analysis columns for postage, stationery, motor expenses, cleaning,

miscellaneous and creditors, prepare a petty cash book and show the reimbursement

on 14/10/2019. (10marks)

Cuea/ACD/EXM/JANUARY – APRIL 2020 / COMPUTER / LIBRARY SCIENCE Page 5

ISO 9001:2015 Certified by the Kenya Bureau of Standards

*END*

Cuea/ACD/EXM/JANUARY – APRIL 2020 / COMPUTER / LIBRARY SCIENCE Page 6

ISO 9001:2015 Certified by the Kenya Bureau of Standards

You might also like

- Account Reconciliation Policy (Sample 2)Document5 pagesAccount Reconciliation Policy (Sample 2)kjheiinNo ratings yet

- IFRS Proposal From Heed Advisory Services To ArconDocument39 pagesIFRS Proposal From Heed Advisory Services To ArconOlufemi Moyegun83% (6)

- Inventories and The Cost of Goods Sold: Mcgraw-Hill/IrwinDocument76 pagesInventories and The Cost of Goods Sold: Mcgraw-Hill/Irwinazee inmix0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- Accounting Supplementary ExamDocument4 pagesAccounting Supplementary Examlajwang27No ratings yet

- Acc XiDocument6 pagesAcc XiRekha DeviNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- CBM 514-3 Question 3Document3 pagesCBM 514-3 Question 3hafsamohmd793No ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- 3.CA Foundation Test 3Document5 pages3.CA Foundation Test 3Nived Narayan PNo ratings yet

- Date Description AmountDocument5 pagesDate Description AmountClaire BarbaNo ratings yet

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- PA2 Assignment 2022 EdDocument9 pagesPA2 Assignment 2022 EdShaggYNo ratings yet

- Accounts Prelim Paper 28-11-23Document4 pagesAccounts Prelim Paper 28-11-23roshanchoudhary4350No ratings yet

- Contentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFDocument4 pagesContentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFJoseph OndariNo ratings yet

- ACCOUNTSDocument5 pagesACCOUNTSM-mila Chepterit KenyNo ratings yet

- ICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andDocument6 pagesICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andArpit GuptaNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- Q 1 3Document9 pagesQ 1 3Ahasanul AlamNo ratings yet

- Accountancy 17Document12 pagesAccountancy 17Manav GargNo ratings yet

- 84 164046 5994Document3 pages84 164046 5994Afaq ZaimNo ratings yet

- Ca - Foundation: Principles and Practice AccountingDocument7 pagesCa - Foundation: Principles and Practice Accountingritikkumarsharmash9499No ratings yet

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- Sample Paper-2016 Subject: Class 11: Part - A (Financial Accounting - I)Document4 pagesSample Paper-2016 Subject: Class 11: Part - A (Financial Accounting - I)Šhûbh Šhôûřyâ KâšhyâpNo ratings yet

- 2017-12 ICMAB FL 001 PAC Year Question December 2017Document3 pages2017-12 ICMAB FL 001 PAC Year Question December 2017Mohammad ShahidNo ratings yet

- Baf1201 Financial Accounting I CatDocument5 pagesBaf1201 Financial Accounting I CatcyrusNo ratings yet

- Test 4Document6 pagesTest 4Jayant MittalNo ratings yet

- S4 Aceiteka 2017 AccountsDocument7 pagesS4 Aceiteka 2017 AccountsEremu ThomasNo ratings yet

- 2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Document4 pages2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Best ThingsNo ratings yet

- Midterm Exam KeyDocument5 pagesMidterm Exam KeyRiña Lizte AlteradoNo ratings yet

- Amrita QP - Accountancy Class XI - First Term 2018-2019Document3 pagesAmrita QP - Accountancy Class XI - First Term 2018-2019Prakash KumarNo ratings yet

- Afa 1 Icmab QuestionsDocument65 pagesAfa 1 Icmab QuestionsKamrul HassanNo ratings yet

- Reg. No.: Q.P. Code: (19 SC 01/ 19 SS 01/ 19 CA 01)Document12 pagesReg. No.: Q.P. Code: (19 SC 01/ 19 SS 01/ 19 CA 01)K0140 Jeevanantham.SNo ratings yet

- CA - Zam Dec-2017Document102 pagesCA - Zam Dec-2017Dixie CheeloNo ratings yet

- S.6 Ent 2Document5 pagesS.6 Ent 2danielzashleybobNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- 5664accountancy XIDocument9 pages5664accountancy XIAryan VishwakarmaNo ratings yet

- 2017-06 ICMAB FL 001 PAC Year Question JUNE 2017Document3 pages2017-06 ICMAB FL 001 PAC Year Question JUNE 2017Mohammad ShahidNo ratings yet

- Acc Xi Class Test-I 2022Document4 pagesAcc Xi Class Test-I 2022shaurya kapoorNo ratings yet

- 2019-04 ICMAB FL 001 PAC Year Question April 2019Document3 pages2019-04 ICMAB FL 001 PAC Year Question April 2019Mohammad ShahidNo ratings yet

- 2021-06 Icmab FL 001 Pac Year Question June 2021Document3 pages2021-06 Icmab FL 001 Pac Year Question June 2021Mohammad ShahidNo ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- RAC 102 - Principles of Financial Accounting 11 - Draft ExamDocument5 pagesRAC 102 - Principles of Financial Accounting 11 - Draft Examemmanuel mwitaNo ratings yet

- Accounting: Required: Prepare Journal Entries To Record The Above TransactionsDocument3 pagesAccounting: Required: Prepare Journal Entries To Record The Above TransactionsMahediNo ratings yet

- Acs 303Document4 pagesAcs 303Amos kundaNo ratings yet

- 11 Accountancy SP 2Document17 pages11 Accountancy SP 2Vikas Chandra BalodhiNo ratings yet

- Accounts EnglishDocument12 pagesAccounts EnglishPradeepa SadhviNo ratings yet

- Paper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDocument25 pagesPaper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsorySaurabh JainNo ratings yet

- Accounts Suggested Ans CAF Nov 20Document25 pagesAccounts Suggested Ans CAF Nov 20Anshu DasNo ratings yet

- Book-Keeping Form Three PDFDocument4 pagesBook-Keeping Form Three PDFdesa ntosNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- UntitledDocument269 pagesUntitledvijaypeketiNo ratings yet

- Ae 11 Mar 19 AccDocument3 pagesAe 11 Mar 19 AccRitu GuptaNo ratings yet

- Transfer PricingDocument235 pagesTransfer PricingRamesh KrishnanNo ratings yet

- Group Assignment FAR Semester 2 2020Document4 pagesGroup Assignment FAR Semester 2 2020Shamimi ShahNo ratings yet

- The Cpa Licensure Examination Syllabus Complete)Document8 pagesThe Cpa Licensure Examination Syllabus Complete)Ssan DunqueNo ratings yet

- Guide On Risk Based Internal Audit Plan04!06!15Document15 pagesGuide On Risk Based Internal Audit Plan04!06!15Christen CastilloNo ratings yet

- PRTC MAS 2015 May Preboards 140Document17 pagesPRTC MAS 2015 May Preboards 140NillChrisTurbanadaDoroquez100% (3)

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Multilingual GlossaryDocument53 pagesMultilingual GlossaryMaurA AruaMNo ratings yet

- MBA516 Assignment 1Document2 pagesMBA516 Assignment 1ShamittaaNo ratings yet

- F A, B & M 2: Undamentals of Ccountancy Usiness AnagementDocument14 pagesF A, B & M 2: Undamentals of Ccountancy Usiness AnagementDories AndalNo ratings yet

- Luca Bartolomeo de PacioliDocument2 pagesLuca Bartolomeo de PacioliLuna LedezmaNo ratings yet

- The Review of Management Accounting: Niu Shuo, Du JianDocument3 pagesThe Review of Management Accounting: Niu Shuo, Du JianJannat JavedNo ratings yet

- Accounting Activity 6Document2 pagesAccounting Activity 6Kae Abegail GarciaNo ratings yet

- Tally ERPDocument18 pagesTally ERPimtiazNo ratings yet

- Financial Accounting ChabDocument2 pagesFinancial Accounting ChabDiana FuNo ratings yet

- Class Note 3Document13 pagesClass Note 3Abdallah HassanNo ratings yet

- Soal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficeDocument6 pagesSoal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficePUTRI YANINo ratings yet

- Strategic Management: A Multiple-Perspective Approach, Edited by Mark Jenkins and V. Ambrosini, PalgraveDocument20 pagesStrategic Management: A Multiple-Perspective Approach, Edited by Mark Jenkins and V. Ambrosini, PalgraveHarshad Vinay SavantNo ratings yet

- Attachment AccountingDocument6 pagesAttachment Accountingtaylor swiftyyyNo ratings yet

- Asuprin Activity Worksheet: Compiled By: A. S. MALQUISTODocument5 pagesAsuprin Activity Worksheet: Compiled By: A. S. MALQUISTOLynNo ratings yet

- Auditing Multiple ChoiceDocument11 pagesAuditing Multiple Choiceunique_vn100% (1)

- RKDPLK - 3353 - 2021Document42 pagesRKDPLK - 3353 - 2021Benjamin Eliezer Pascareno SimanjuntakNo ratings yet

- Componentization and Cost SegregationDocument1 pageComponentization and Cost SegregationRamanujam RaghavanNo ratings yet

- 15 BRSDocument18 pages15 BRSDayaan ANo ratings yet

- Antipolo City Executive Summary 2023Document10 pagesAntipolo City Executive Summary 2023Jim TuparanNo ratings yet

- Essentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Test Bank 1Document36 pagesEssentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Test Bank 1leahjohnsonfncrigpmxj100% (35)

- Special JournalsDocument25 pagesSpecial JournalsDaisy Mae Orbita100% (1)

- Cash Flow Statements Exercises and AnswersDocument39 pagesCash Flow Statements Exercises and Answersszn189% (9)