Professional Documents

Culture Documents

Forf Prob

Forf Prob

Uploaded by

Shariq0 ratings0% found this document useful (0 votes)

4 views2 pagesOriginal Title

forf prob

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesForf Prob

Forf Prob

Uploaded by

ShariqCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

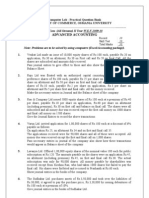

CORPORATE ACCOUNTING

Forfeiture of shares-Issued at par

1. Mr. Senthil is a shareholder in Kiran ltd. holding

2,000 shares of Rs.10 each. He has paid Rs.2 and

Rs.3 per share on application allotment

respectively, but failed to pay Rs. 3 and Rs. 2 per

share for first and second calls respectively. The

Directors forfeited his shares. Give journal entry.

Forfeiture of shares issued at a premium – Premium

fully collected

2. Ambassadors Ltd. issued 2,000 shares of Rs.100

each at a premium of 10% payable as follows:

Rs.25 on application, Rs. 35 on allotment (including

premium), Rs. 20 on first call, Rs.30 on final call. 1,800

shares were applied for and allotted. All the money was

received with the exception of first and final calls on 200

shares held by Raghu. These shares were forfeited.

Give journal entries and prepare balance sheet.

Forfeiture of shares issued at a premium – Premium

not fully collected

3. A company issued 10,000 equity shares of Rs.10

each at a premium of Rs.3 per share payable Rs. 5

on application, Rs.5 (including premium) on

allotment and the balance on call. All the shares

offered were applied for and allotted. All the moneys

due on allotment were received except on 200

shares. Call was made. All the amount due thereon

was received except on 300 shares. Directors

forfeited 200 shares on which both allotment and

call money was not received. Pass the necessary

journal entries to record the above and also show

how this will appear in the Balance Sheet of the

company.

Forfeiture of shares issued at discount

4. Mohan Ltd. invited applications for 2,000 shares of

Rs.100 each at a discount of 10% payable as

follows:

On application Rs. 25

On allotment Rs. 30

On first and final call Rs. 35

Whole of the issue was subscribed and paid for the

except the final call on 300 shares which were forfeited

by the company after giving due notice. Pass the

forfeiture entry.

You might also like

- Accounting For Shares - Notes 2Document9 pagesAccounting For Shares - Notes 2AviNo ratings yet

- COA Unit 2 Issue of Shares - ProblemsDocument3 pagesCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraNo ratings yet

- Accounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsDocument9 pagesAccounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsbinuNo ratings yet

- Corporate Accounting Unit 1 to 5Document43 pagesCorporate Accounting Unit 1 to 5Srinithi PNo ratings yet

- Revision 2 Share CapitalDocument3 pagesRevision 2 Share CapitalGopika BaburajNo ratings yet

- SHARESDocument5 pagesSHARESMohammad Tariq AnsariNo ratings yet

- Numerical QuestionsDocument3 pagesNumerical QuestionsArchi JainNo ratings yet

- Share Capital Assignment PDFDocument6 pagesShare Capital Assignment PDFBHUMIKA JAINNo ratings yet

- Worksheet-Issue of SharesDocument4 pagesWorksheet-Issue of SharesBhavika LargotraNo ratings yet

- Corporate AccountingDocument32 pagesCorporate AccountingSaran Ranny100% (1)

- Class 12 Accountancy - Holiday AssignmentDocument4 pagesClass 12 Accountancy - Holiday AssignmentKritarth AgarwalNo ratings yet

- Accounting For Share Capital Extra Questions Part 2Document2 pagesAccounting For Share Capital Extra Questions Part 2NICOLANo ratings yet

- Shivaraj Corrporeting Acconting 3rd SemDocument9 pagesShivaraj Corrporeting Acconting 3rd Semshivaraj gowdaNo ratings yet

- Practice Sheet Issue of SharesDocument5 pagesPractice Sheet Issue of SharesAryan VermaNo ratings yet

- Issue of SharesDocument3 pagesIssue of SharesPratiksha PatelNo ratings yet

- CompanyDocument11 pagesCompanyBijendra DasNo ratings yet

- 5th Account Gobind Kumar Jha 9874411552Document69 pages5th Account Gobind Kumar Jha 9874411552binay chaudharyNo ratings yet

- SharesDocument2 pagesSharesHannah Ann JacobNo ratings yet

- Company Accounts RevisionDocument4 pagesCompany Accounts RevisionAnu SoniNo ratings yet

- Worksheet - Accounting For Share CapitalDocument6 pagesWorksheet - Accounting For Share CapitalPrisha SharmaNo ratings yet

- Accounting of Issue of SharesDocument17 pagesAccounting of Issue of SharesAnkit Tiwari0% (1)

- Chapter 1 - Company Account - Accounting For Share CapitalDocument143 pagesChapter 1 - Company Account - Accounting For Share CapitalAvi yadavNo ratings yet

- Share CapitalDocument10 pagesShare CapitalShreyas PremiumNo ratings yet

- Shares - HTPDocument2 pagesShares - HTPPavithra AnupNo ratings yet

- PT I Acc Xii - 2023Document3 pagesPT I Acc Xii - 2023sindhuNo ratings yet

- Assignment -3 (1)Document1 pageAssignment -3 (1)sc1453869No ratings yet

- Issue of SharesDocument8 pagesIssue of Sharesmdatif00777No ratings yet

- CBSE Class 12 Accountancy - Issue of SharesDocument3 pagesCBSE Class 12 Accountancy - Issue of SharesSahyogNo ratings yet

- Corporate AccountingDocument12 pagesCorporate Accountingkabinaya9150No ratings yet

- Accounting For Share Capital (2019-20)Document20 pagesAccounting For Share Capital (2019-20)niyatiagarwal25No ratings yet

- Hots CompanyDocument5 pagesHots CompanySaloni JainNo ratings yet

- Case Study CaDocument1 pageCase Study Caroshnibangtan2005No ratings yet

- Issue of Shares Comprehensive Sums Part IIDocument5 pagesIssue of Shares Comprehensive Sums Part IIHamza MudassirNo ratings yet

- Practice SheetsDocument7 pagesPractice Sheetskrishnapatidar1907No ratings yet

- ACCOUNTING FOR SHARE CAPITAL PART-1 (Extra Questions)Document2 pagesACCOUNTING FOR SHARE CAPITAL PART-1 (Extra Questions)NICOLANo ratings yet

- Issue of Shares Cbse Question BankDocument7 pagesIssue of Shares Cbse Question Bankabhayku1689No ratings yet

- Questions For My GirlDocument11 pagesQuestions For My Girladhishreesinghal24No ratings yet

- Issue of Share - Q.1Document1 pageIssue of Share - Q.1divyafoundation040711No ratings yet

- DPP 05 Shares Sunil PandaDocument2 pagesDPP 05 Shares Sunil Pandaxrixn11No ratings yet

- Financial Account-II - Assignment-IIDocument1 pageFinancial Account-II - Assignment-IINikhilNo ratings yet

- Company Accounts-Issue of Shares - (Module 8)Document2 pagesCompany Accounts-Issue of Shares - (Module 8)Manshi GolchhaNo ratings yet

- Business Studies Handwritten Notes SPCCDocument94 pagesBusiness Studies Handwritten Notes SPCCkurdiyapiyush9No ratings yet

- Corporate Accounts SuggestionsDocument36 pagesCorporate Accounts Suggestionsshawpiyush328No ratings yet

- Sri Sankara'S Degree College: Liabilities Rs. Assets RsDocument2 pagesSri Sankara'S Degree College: Liabilities Rs. Assets RssowjanyaNo ratings yet

- Issue of ShareDocument2 pagesIssue of ShareavtaranNo ratings yet

- Class Assessment 3 - Class XII Accountancy (Sep 12)Document2 pagesClass Assessment 3 - Class XII Accountancy (Sep 12)Naresh RainaNo ratings yet

- 1-Over subscriptionDocument3 pages1-Over subscriptionsc1453869No ratings yet

- Accounts TestDocument1 pageAccounts TestAvirup ChakrabortyNo ratings yet

- Problems To StudentsDocument1 pageProblems To StudentsAJAIS BABUNo ratings yet

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDocument3 pagesSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNo ratings yet

- Accounting Treatment of Forfeiture of SharesDocument18 pagesAccounting Treatment of Forfeiture of SharesMandy SinghNo ratings yet

- SharesDocument56 pagesSharesakshayashree5306No ratings yet

- Advanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityDocument13 pagesAdvanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitySaif Uddin33% (3)

- 21 March Live Most Imp Questions Shares To Debent 240321 230837Document3 pages21 March Live Most Imp Questions Shares To Debent 240321 230837seemaanil029No ratings yet

- Share Comprehensive QuestionsDocument1 pageShare Comprehensive QuestionsLaxmi Kant Sahani0% (2)

- Issue of Shares Day 2Document3 pagesIssue of Shares Day 2CSCharlie GahlotNo ratings yet

- CM11 3C CacDocument2 pagesCM11 3C CacHaRiPrIyA JaYaKuMaRNo ratings yet