Professional Documents

Culture Documents

Lyceum 2004 - 03

Lyceum 2004 - 03

Uploaded by

Lennon TurnerCopyright:

Available Formats

You might also like

- Pojman - Philosophy The Quest For Truth 6eDocument670 pagesPojman - Philosophy The Quest For Truth 6eLennon TurnerNo ratings yet

- Random Processes For Engineers 1st Hajek Solution ManualDocument18 pagesRandom Processes For Engineers 1st Hajek Solution ManualJustine Lotthammer100% (42)

- The Gateway ExperienceDocument25 pagesThe Gateway ExperienceLennon Turner100% (3)

- Building A Good Vol SurfaceDocument49 pagesBuilding A Good Vol SurfaceFabio ZenNo ratings yet

- Midterm Review Notes - MATA32 FDocument21 pagesMidterm Review Notes - MATA32 FShivam KapilaNo ratings yet

- Lyceum 2004 - 01Document1 pageLyceum 2004 - 01Lennon TurnerNo ratings yet

- Lyceum 2003 - 11Document2 pagesLyceum 2003 - 11Lennon TurnerNo ratings yet

- Pattern Recognition & Learning II: © UW CSE Vision FacultyDocument47 pagesPattern Recognition & Learning II: © UW CSE Vision FacultyDuong TheNo ratings yet

- Lecture 4Document31 pagesLecture 4AMIRNo ratings yet

- Eco 423 Exam 2018 SolDocument6 pagesEco 423 Exam 2018 SolNguyễn Quang HuyNo ratings yet

- Assignment No. - Problem Statement:-: InputDocument6 pagesAssignment No. - Problem Statement:-: InputSouradeep GhoshNo ratings yet

- Winsem2023-24 Bsts302p Ss Ch2023240500208 Reference Material I 26-02-2024 Bellman-Ford AlgorithmDocument21 pagesWinsem2023-24 Bsts302p Ss Ch2023240500208 Reference Material I 26-02-2024 Bellman-Ford AlgorithmSrinivasan 21BME1128No ratings yet

- The Robertson Problem - DymosDocument2 pagesThe Robertson Problem - Dymosmichael.sielemannNo ratings yet

- Some Things I Have Learned About Volatility Over The Years NotesDocument48 pagesSome Things I Have Learned About Volatility Over The Years NotesJNo ratings yet

- 28 - L-9 (DK) (Pe) ( (Ee) Nptel)Document1 page28 - L-9 (DK) (Pe) ( (Ee) Nptel)GagneNo ratings yet

- Dynamic Programming: Odds & Ends: T 1 T I I 1Document5 pagesDynamic Programming: Odds & Ends: T 1 T I I 1HIRAN KUMAR SINHANo ratings yet

- CH4. Greedy Approach: - Grab Data Items in Sequence, Each TimeDocument17 pagesCH4. Greedy Approach: - Grab Data Items in Sequence, Each TimeJungWoo ChoNo ratings yet

- 09 PyTorchDocument44 pages09 PyTorchSalvation TivaNo ratings yet

- Chapter Four and FiveDocument56 pagesChapter Four and Fivehagosabate9No ratings yet

- ECS550NFB Introduction To Numerical Methods Using Matlab Day 5Document45 pagesECS550NFB Introduction To Numerical Methods Using Matlab Day 5Pham Hai YenNo ratings yet

- Floyd Warshall Algorithm - GeeksforGeeksDocument1 pageFloyd Warshall Algorithm - GeeksforGeeksDivya SinghNo ratings yet

- 6-Flux-Limiting FOU MINMOD 2019Document14 pages6-Flux-Limiting FOU MINMOD 2019babakNo ratings yet

- CS341 Lec14 Annotated Mar14Document67 pagesCS341 Lec14 Annotated Mar14artemNo ratings yet

- Prim's Algorithm: On Minimum Spanning TreeDocument22 pagesPrim's Algorithm: On Minimum Spanning TreeJeasmine SultanaNo ratings yet

- Tree ExDocument36 pagesTree ExFrancis ZhouNo ratings yet

- MIT18 303F14 MidtermDocument2 pagesMIT18 303F14 MidtermParshwa ConsultancyNo ratings yet

- Prims Algorithm On MSTDocument22 pagesPrims Algorithm On MSTpremsk_09No ratings yet

- BellmanDocument28 pagesBellmanmanju287No ratings yet

- VB NET Quick ReferenceDocument1 pageVB NET Quick Referencecrutili100% (3)

- Analysis of Diode CircuitsDocument8 pagesAnalysis of Diode CircuitsApril Joy Gelilang PulgaNo ratings yet

- Infinite-Horizon Dynamic Programming: Tianxiao Zheng SaifDocument10 pagesInfinite-Horizon Dynamic Programming: Tianxiao Zheng SaifmateoNo ratings yet

- Java Code For Video GameDocument25 pagesJava Code For Video Gametul SanwalNo ratings yet

- The Mountain Car Problem - DymosDocument4 pagesThe Mountain Car Problem - Dymosmichael.sielemannNo ratings yet

- Source Code Example For "A Practical Introduction To Data Structures and // Algorithm Analysis" by Clifford A. Shaffer, Prentice Hall, 1998Document14 pagesSource Code Example For "A Practical Introduction To Data Structures and // Algorithm Analysis" by Clifford A. Shaffer, Prentice Hall, 1998Riska ApriliyantiNo ratings yet

- Lab Report #1: Transient Stability Analysis For Single Machine Infinite Bus Bar Using MATLABDocument5 pagesLab Report #1: Transient Stability Analysis For Single Machine Infinite Bus Bar Using MATLABIjaz Ahmad0% (1)

- Mit Fall 2010 Bellman FordDocument5 pagesMit Fall 2010 Bellman Fordjuliejoe122jjNo ratings yet

- Shortest Path AlgorithmsDocument5 pagesShortest Path AlgorithmsRonak PanchalNo ratings yet

- Black's ModelDocument4 pagesBlack's ModelAdityaPandhareNo ratings yet

- Module 3 Greedy Algorithms Lect-1 and 2Document28 pagesModule 3 Greedy Algorithms Lect-1 and 2Clash Of ClanesNo ratings yet

- Online AppendixDocument18 pagesOnline Appendixjk2cr7byd7No ratings yet

- High Level Synthesis - 05 - SchedulingDocument32 pagesHigh Level Synthesis - 05 - Schedulinga bNo ratings yet

- Exercise Solutions To Complex Analysis: Thanks To The William's Work!Document20 pagesExercise Solutions To Complex Analysis: Thanks To The William's Work!Franco Golfieri MadriagaNo ratings yet

- Arrier Ynchronization: by Samir NajarDocument70 pagesArrier Ynchronization: by Samir NajarSamir NajarNo ratings yet

- Verilog 2Document9 pagesVerilog 2lohithallu2005No ratings yet

- Gradient Descent Deep Learning: by T.K. Damodharan Vice President, RBS Reg - No: PC2013003013008Document37 pagesGradient Descent Deep Learning: by T.K. Damodharan Vice President, RBS Reg - No: PC2013003013008Shanmuganathan V (RC2113003011029)No ratings yet

- Implementation Using Logic Gates andDocument29 pagesImplementation Using Logic Gates andGautamNo ratings yet

- Summary Description For GlobjectDocument3 pagesSummary Description For GlobjectlyndaNo ratings yet

- The GreeksDocument16 pagesThe GreeksTinasheNo ratings yet

- Motions and Coordinates: Kinematics of ParticlesDocument23 pagesMotions and Coordinates: Kinematics of ParticlesFaiselNo ratings yet

- BinomialDocument60 pagesBinomialFrancis ZhouNo ratings yet

- Neural Networks MATH ExplainedDocument14 pagesNeural Networks MATH ExplainedGautam KumarNo ratings yet

- Moody KMV Explained UT Berlin Tetereva - 05042012 PDFDocument32 pagesMoody KMV Explained UT Berlin Tetereva - 05042012 PDFKapil AgrawalNo ratings yet

- Implied VolatilityDocument2 pagesImplied VolatilityMeherJazibAliNo ratings yet

- Problem Statement:-: Prim's Algorithm For Minimum Spanning TreeDocument6 pagesProblem Statement:-: Prim's Algorithm For Minimum Spanning TreeSouradeep GhoshNo ratings yet

- Chapter 03 PDFDocument23 pagesChapter 03 PDFMihir PatelNo ratings yet

- Assignment 5 2106173Document9 pagesAssignment 5 2106173Ramima MumtarinNo ratings yet

- MATLAB ODE SolverDocument11 pagesMATLAB ODE SolverhdlchipNo ratings yet

- Multi-Asset Options: 4.1 Pricing ModelDocument10 pagesMulti-Asset Options: 4.1 Pricing ModeldownloadfromscribdNo ratings yet

- Chapter 03Document12 pagesChapter 03seanwu95No ratings yet

- 5 Reasons Leftists Hate Project 2025 Ebook THFDocument13 pages5 Reasons Leftists Hate Project 2025 Ebook THFLennon TurnerNo ratings yet

- Brother Mark's Spiritual ServicesDocument1 pageBrother Mark's Spiritual ServicesLennon TurnerNo ratings yet

- CMI Student Information Sheet UpdatedDocument1 pageCMI Student Information Sheet UpdatedLennon TurnerNo ratings yet

- Threats To InvestmentsDocument8 pagesThreats To InvestmentsLennon TurnerNo ratings yet

- SopDocument33 pagesSopcrocoreaderNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- CQF January 2023 M1L1 BlankDocument52 pagesCQF January 2023 M1L1 BlankAntonio Cifuentes GarcíaNo ratings yet

- Risk-Adjusted PerformanceDocument30 pagesRisk-Adjusted PerformanceVaidyanathan RavichandranNo ratings yet

- Chapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSMariem JabberiNo ratings yet

- Acc 103 - Module 5aDocument14 pagesAcc 103 - Module 5aPrincess Darlyn AlimagnoNo ratings yet

- Syllabus of T.Y.B.A/B.Sc. (Mathematics)Document28 pagesSyllabus of T.Y.B.A/B.Sc. (Mathematics)Rahul PalNo ratings yet

- Practice Multiple Choice Test 7: (E) (D) (B) (A)Document9 pagesPractice Multiple Choice Test 7: (E) (D) (B) (A)api-3834751No ratings yet

- Formulae SheetDocument4 pagesFormulae SheetSameer SharmaNo ratings yet

- 2 Sharpe1Document4 pages2 Sharpe1Krunal PatelNo ratings yet

- CNRS RankingDocument2 pagesCNRS Rankingsonia969696No ratings yet

- Finance Applications and Theory 3rd Edition Cornett Test Bank 1Document120 pagesFinance Applications and Theory 3rd Edition Cornett Test Bank 1kyle100% (49)

- Chapter 10 Option PropertiesDocument20 pagesChapter 10 Option PropertiesJeevan TejaNo ratings yet

- Chap 3 M4B TT 1Document10 pagesChap 3 M4B TT 1Mai Phương AnhNo ratings yet

- Tybms Sem5 RM Nov19Document2 pagesTybms Sem5 RM Nov19Kritika SinghNo ratings yet

- Intra-Horizon VaR and Expected Shortfall Spreadsheet With VBADocument7 pagesIntra-Horizon VaR and Expected Shortfall Spreadsheet With VBAPeter Urbani0% (1)

- Chapter 5: Option Pricing Models: The Black-Scholes-Merton ModelDocument7 pagesChapter 5: Option Pricing Models: The Black-Scholes-Merton ModelDUY LE NHAT TRUONGNo ratings yet

- Aep-Ansep-4 Report ArDocument38 pagesAep-Ansep-4 Report ArAnonymous GWvK4fDNo ratings yet

- Individual Assignment FM (273821)Document4 pagesIndividual Assignment FM (273821)Rafiq AimanNo ratings yet

- BCG Matrix TemplateDocument6 pagesBCG Matrix Templategaurshivam935769No ratings yet

- Undergraduate and Honours Student Guide 2019: Centre For Actuarial Studies Department of EconomicsDocument28 pagesUndergraduate and Honours Student Guide 2019: Centre For Actuarial Studies Department of EconomicsRishi KumarNo ratings yet

- Eng Sci OptionsDocument3 pagesEng Sci OptionsPaulseNo ratings yet

- 01 NPV vs. IRRDocument10 pages01 NPV vs. IRRAbbu JNo ratings yet

- 8 - TVM - ClassWork - Example of ScenariosDocument14 pages8 - TVM - ClassWork - Example of ScenariosRaj KumarNo ratings yet

- MLI Brochure Cohort 2Document12 pagesMLI Brochure Cohort 2Talha SuhailNo ratings yet

- Data - Q1 (Version 1)Document15 pagesData - Q1 (Version 1)baselzayied23No ratings yet

- COM 6 (B) of 96th AIBBDocument2 pagesCOM 6 (B) of 96th AIBBShamima AkterNo ratings yet

- Cdroussiots ch4 ExcerptDocument17 pagesCdroussiots ch4 ExcerptArief MaulanaNo ratings yet

Lyceum 2004 - 03

Lyceum 2004 - 03

Uploaded by

Lennon TurnerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lyceum 2004 - 03

Lyceum 2004 - 03

Uploaded by

Lennon TurnerCopyright:

Available Formats

Lyceum

Aristotle's Lyceum is the institution considered to be the forerunner of the modern university.

Opened in 335 BC, the Lyceum was a center of study and research in both science and philosophy.

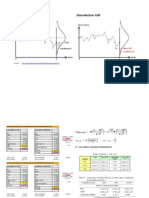

Out Barrier Options and the

Finite-difference Method

And now the pricing of our first exotic option, an Function OutBarrierOptionValue(Asset As Double, Strike As Double, _

up-and-out call. Knockout options have the same Expiry As Double, Volatility As Double, Divvie As Double, _

Intrate As Double, Barrier As Double, NoAssetSteps As Integer) ‘(a)

pay-off as vanilla options unless the underlying

asset has reached some prescribed level, the barri- Dim VOld(0 To 100) As Double

er or trigger, prior to expiry. If the barrier is trig- Dim VNew(0 To 100) As Double

gered then typically the option expires worthless. Dim S(0 To 100) As Double

Financially and mathematically this means that

dS = Barrier / NoAssetSteps ‘(b)

the option value must be zero when the asset NearestGridPt = Int(Asset / dS)

value is the barrier level. dummy = (Asset - NearestGridPt * dS) / dS

In the code below we have had to include Timestep = dS * dS / Volatility / Volatility / (Barrier * Barrier) ‘(c)

Barrier, the position of the barrier (above the NoTimesteps = Int(Expiry / Timestep) + 1

Strike). We’ve also made the top of the asset-price Timestep = Expiry / NoTimesteps

array coincide with the position of the barrier. For i = 0 To NoAssetSteps

S(i) = i * dS

VOld(i) = Application.Max(S(i) - Strike, 0)

Next i

For j = 1 To NoTimesteps

For i = 1 To NoAssetSteps - 1

Delta = (VOld(i + 1) - VOld(i - 1)) / (2 * dS)

Gamma = (VOld(i + 1) - 2 * VOld(i) + VOld(i - 1)) / (dS * dS)

VNew(i) = VOld(i) + Timestep * (0.5 * Volatility * Volatility * _

S(i) * S(i) * Gamma + (Intrate – Divvie) * S(i) * Delta - Intrate * VOld(i))

Notes:

Next i

(a) The function call now asks for barrier information

(b) The asset array only needs to go as far as the barrier VNew(0) = 0

(c) The timestep has been chosen to ensure stability of VNew(NoAssetSteps) = 0 ‘(d)

the explicit method

For i = 0 To NoAssetSteps

(d) This is the barrier boundary condition

VOld(i) = VNew(i)

Next i

Exercise:

Change the above code to value Next j

1. an up-and-out call option if there is a rebate at the

OutBarrierOptionValue = (1 - dummy) * VOld(NearestGridPt) + _

time of knockout

dummy * VOld(NearestGridPt + 1)

2. a down-and-out call option End Function

W

Wilmott magazine 29

You might also like

- Pojman - Philosophy The Quest For Truth 6eDocument670 pagesPojman - Philosophy The Quest For Truth 6eLennon TurnerNo ratings yet

- Random Processes For Engineers 1st Hajek Solution ManualDocument18 pagesRandom Processes For Engineers 1st Hajek Solution ManualJustine Lotthammer100% (42)

- The Gateway ExperienceDocument25 pagesThe Gateway ExperienceLennon Turner100% (3)

- Building A Good Vol SurfaceDocument49 pagesBuilding A Good Vol SurfaceFabio ZenNo ratings yet

- Midterm Review Notes - MATA32 FDocument21 pagesMidterm Review Notes - MATA32 FShivam KapilaNo ratings yet

- Lyceum 2004 - 01Document1 pageLyceum 2004 - 01Lennon TurnerNo ratings yet

- Lyceum 2003 - 11Document2 pagesLyceum 2003 - 11Lennon TurnerNo ratings yet

- Pattern Recognition & Learning II: © UW CSE Vision FacultyDocument47 pagesPattern Recognition & Learning II: © UW CSE Vision FacultyDuong TheNo ratings yet

- Lecture 4Document31 pagesLecture 4AMIRNo ratings yet

- Eco 423 Exam 2018 SolDocument6 pagesEco 423 Exam 2018 SolNguyễn Quang HuyNo ratings yet

- Assignment No. - Problem Statement:-: InputDocument6 pagesAssignment No. - Problem Statement:-: InputSouradeep GhoshNo ratings yet

- Winsem2023-24 Bsts302p Ss Ch2023240500208 Reference Material I 26-02-2024 Bellman-Ford AlgorithmDocument21 pagesWinsem2023-24 Bsts302p Ss Ch2023240500208 Reference Material I 26-02-2024 Bellman-Ford AlgorithmSrinivasan 21BME1128No ratings yet

- The Robertson Problem - DymosDocument2 pagesThe Robertson Problem - Dymosmichael.sielemannNo ratings yet

- Some Things I Have Learned About Volatility Over The Years NotesDocument48 pagesSome Things I Have Learned About Volatility Over The Years NotesJNo ratings yet

- 28 - L-9 (DK) (Pe) ( (Ee) Nptel)Document1 page28 - L-9 (DK) (Pe) ( (Ee) Nptel)GagneNo ratings yet

- Dynamic Programming: Odds & Ends: T 1 T I I 1Document5 pagesDynamic Programming: Odds & Ends: T 1 T I I 1HIRAN KUMAR SINHANo ratings yet

- CH4. Greedy Approach: - Grab Data Items in Sequence, Each TimeDocument17 pagesCH4. Greedy Approach: - Grab Data Items in Sequence, Each TimeJungWoo ChoNo ratings yet

- 09 PyTorchDocument44 pages09 PyTorchSalvation TivaNo ratings yet

- Chapter Four and FiveDocument56 pagesChapter Four and Fivehagosabate9No ratings yet

- ECS550NFB Introduction To Numerical Methods Using Matlab Day 5Document45 pagesECS550NFB Introduction To Numerical Methods Using Matlab Day 5Pham Hai YenNo ratings yet

- Floyd Warshall Algorithm - GeeksforGeeksDocument1 pageFloyd Warshall Algorithm - GeeksforGeeksDivya SinghNo ratings yet

- 6-Flux-Limiting FOU MINMOD 2019Document14 pages6-Flux-Limiting FOU MINMOD 2019babakNo ratings yet

- CS341 Lec14 Annotated Mar14Document67 pagesCS341 Lec14 Annotated Mar14artemNo ratings yet

- Prim's Algorithm: On Minimum Spanning TreeDocument22 pagesPrim's Algorithm: On Minimum Spanning TreeJeasmine SultanaNo ratings yet

- Tree ExDocument36 pagesTree ExFrancis ZhouNo ratings yet

- MIT18 303F14 MidtermDocument2 pagesMIT18 303F14 MidtermParshwa ConsultancyNo ratings yet

- Prims Algorithm On MSTDocument22 pagesPrims Algorithm On MSTpremsk_09No ratings yet

- BellmanDocument28 pagesBellmanmanju287No ratings yet

- VB NET Quick ReferenceDocument1 pageVB NET Quick Referencecrutili100% (3)

- Analysis of Diode CircuitsDocument8 pagesAnalysis of Diode CircuitsApril Joy Gelilang PulgaNo ratings yet

- Infinite-Horizon Dynamic Programming: Tianxiao Zheng SaifDocument10 pagesInfinite-Horizon Dynamic Programming: Tianxiao Zheng SaifmateoNo ratings yet

- Java Code For Video GameDocument25 pagesJava Code For Video Gametul SanwalNo ratings yet

- The Mountain Car Problem - DymosDocument4 pagesThe Mountain Car Problem - Dymosmichael.sielemannNo ratings yet

- Source Code Example For "A Practical Introduction To Data Structures and // Algorithm Analysis" by Clifford A. Shaffer, Prentice Hall, 1998Document14 pagesSource Code Example For "A Practical Introduction To Data Structures and // Algorithm Analysis" by Clifford A. Shaffer, Prentice Hall, 1998Riska ApriliyantiNo ratings yet

- Lab Report #1: Transient Stability Analysis For Single Machine Infinite Bus Bar Using MATLABDocument5 pagesLab Report #1: Transient Stability Analysis For Single Machine Infinite Bus Bar Using MATLABIjaz Ahmad0% (1)

- Mit Fall 2010 Bellman FordDocument5 pagesMit Fall 2010 Bellman Fordjuliejoe122jjNo ratings yet

- Shortest Path AlgorithmsDocument5 pagesShortest Path AlgorithmsRonak PanchalNo ratings yet

- Black's ModelDocument4 pagesBlack's ModelAdityaPandhareNo ratings yet

- Module 3 Greedy Algorithms Lect-1 and 2Document28 pagesModule 3 Greedy Algorithms Lect-1 and 2Clash Of ClanesNo ratings yet

- Online AppendixDocument18 pagesOnline Appendixjk2cr7byd7No ratings yet

- High Level Synthesis - 05 - SchedulingDocument32 pagesHigh Level Synthesis - 05 - Schedulinga bNo ratings yet

- Exercise Solutions To Complex Analysis: Thanks To The William's Work!Document20 pagesExercise Solutions To Complex Analysis: Thanks To The William's Work!Franco Golfieri MadriagaNo ratings yet

- Arrier Ynchronization: by Samir NajarDocument70 pagesArrier Ynchronization: by Samir NajarSamir NajarNo ratings yet

- Verilog 2Document9 pagesVerilog 2lohithallu2005No ratings yet

- Gradient Descent Deep Learning: by T.K. Damodharan Vice President, RBS Reg - No: PC2013003013008Document37 pagesGradient Descent Deep Learning: by T.K. Damodharan Vice President, RBS Reg - No: PC2013003013008Shanmuganathan V (RC2113003011029)No ratings yet

- Implementation Using Logic Gates andDocument29 pagesImplementation Using Logic Gates andGautamNo ratings yet

- Summary Description For GlobjectDocument3 pagesSummary Description For GlobjectlyndaNo ratings yet

- The GreeksDocument16 pagesThe GreeksTinasheNo ratings yet

- Motions and Coordinates: Kinematics of ParticlesDocument23 pagesMotions and Coordinates: Kinematics of ParticlesFaiselNo ratings yet

- BinomialDocument60 pagesBinomialFrancis ZhouNo ratings yet

- Neural Networks MATH ExplainedDocument14 pagesNeural Networks MATH ExplainedGautam KumarNo ratings yet

- Moody KMV Explained UT Berlin Tetereva - 05042012 PDFDocument32 pagesMoody KMV Explained UT Berlin Tetereva - 05042012 PDFKapil AgrawalNo ratings yet

- Implied VolatilityDocument2 pagesImplied VolatilityMeherJazibAliNo ratings yet

- Problem Statement:-: Prim's Algorithm For Minimum Spanning TreeDocument6 pagesProblem Statement:-: Prim's Algorithm For Minimum Spanning TreeSouradeep GhoshNo ratings yet

- Chapter 03 PDFDocument23 pagesChapter 03 PDFMihir PatelNo ratings yet

- Assignment 5 2106173Document9 pagesAssignment 5 2106173Ramima MumtarinNo ratings yet

- MATLAB ODE SolverDocument11 pagesMATLAB ODE SolverhdlchipNo ratings yet

- Multi-Asset Options: 4.1 Pricing ModelDocument10 pagesMulti-Asset Options: 4.1 Pricing ModeldownloadfromscribdNo ratings yet

- Chapter 03Document12 pagesChapter 03seanwu95No ratings yet

- 5 Reasons Leftists Hate Project 2025 Ebook THFDocument13 pages5 Reasons Leftists Hate Project 2025 Ebook THFLennon TurnerNo ratings yet

- Brother Mark's Spiritual ServicesDocument1 pageBrother Mark's Spiritual ServicesLennon TurnerNo ratings yet

- CMI Student Information Sheet UpdatedDocument1 pageCMI Student Information Sheet UpdatedLennon TurnerNo ratings yet

- Threats To InvestmentsDocument8 pagesThreats To InvestmentsLennon TurnerNo ratings yet

- SopDocument33 pagesSopcrocoreaderNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- CQF January 2023 M1L1 BlankDocument52 pagesCQF January 2023 M1L1 BlankAntonio Cifuentes GarcíaNo ratings yet

- Risk-Adjusted PerformanceDocument30 pagesRisk-Adjusted PerformanceVaidyanathan RavichandranNo ratings yet

- Chapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSMariem JabberiNo ratings yet

- Acc 103 - Module 5aDocument14 pagesAcc 103 - Module 5aPrincess Darlyn AlimagnoNo ratings yet

- Syllabus of T.Y.B.A/B.Sc. (Mathematics)Document28 pagesSyllabus of T.Y.B.A/B.Sc. (Mathematics)Rahul PalNo ratings yet

- Practice Multiple Choice Test 7: (E) (D) (B) (A)Document9 pagesPractice Multiple Choice Test 7: (E) (D) (B) (A)api-3834751No ratings yet

- Formulae SheetDocument4 pagesFormulae SheetSameer SharmaNo ratings yet

- 2 Sharpe1Document4 pages2 Sharpe1Krunal PatelNo ratings yet

- CNRS RankingDocument2 pagesCNRS Rankingsonia969696No ratings yet

- Finance Applications and Theory 3rd Edition Cornett Test Bank 1Document120 pagesFinance Applications and Theory 3rd Edition Cornett Test Bank 1kyle100% (49)

- Chapter 10 Option PropertiesDocument20 pagesChapter 10 Option PropertiesJeevan TejaNo ratings yet

- Chap 3 M4B TT 1Document10 pagesChap 3 M4B TT 1Mai Phương AnhNo ratings yet

- Tybms Sem5 RM Nov19Document2 pagesTybms Sem5 RM Nov19Kritika SinghNo ratings yet

- Intra-Horizon VaR and Expected Shortfall Spreadsheet With VBADocument7 pagesIntra-Horizon VaR and Expected Shortfall Spreadsheet With VBAPeter Urbani0% (1)

- Chapter 5: Option Pricing Models: The Black-Scholes-Merton ModelDocument7 pagesChapter 5: Option Pricing Models: The Black-Scholes-Merton ModelDUY LE NHAT TRUONGNo ratings yet

- Aep-Ansep-4 Report ArDocument38 pagesAep-Ansep-4 Report ArAnonymous GWvK4fDNo ratings yet

- Individual Assignment FM (273821)Document4 pagesIndividual Assignment FM (273821)Rafiq AimanNo ratings yet

- BCG Matrix TemplateDocument6 pagesBCG Matrix Templategaurshivam935769No ratings yet

- Undergraduate and Honours Student Guide 2019: Centre For Actuarial Studies Department of EconomicsDocument28 pagesUndergraduate and Honours Student Guide 2019: Centre For Actuarial Studies Department of EconomicsRishi KumarNo ratings yet

- Eng Sci OptionsDocument3 pagesEng Sci OptionsPaulseNo ratings yet

- 01 NPV vs. IRRDocument10 pages01 NPV vs. IRRAbbu JNo ratings yet

- 8 - TVM - ClassWork - Example of ScenariosDocument14 pages8 - TVM - ClassWork - Example of ScenariosRaj KumarNo ratings yet

- MLI Brochure Cohort 2Document12 pagesMLI Brochure Cohort 2Talha SuhailNo ratings yet

- Data - Q1 (Version 1)Document15 pagesData - Q1 (Version 1)baselzayied23No ratings yet

- COM 6 (B) of 96th AIBBDocument2 pagesCOM 6 (B) of 96th AIBBShamima AkterNo ratings yet

- Cdroussiots ch4 ExcerptDocument17 pagesCdroussiots ch4 ExcerptArief MaulanaNo ratings yet