Professional Documents

Culture Documents

1.44 Whitehall: Monitoring The Markets Vol. 1 Iss. 44 (November 29, 2011)

1.44 Whitehall: Monitoring The Markets Vol. 1 Iss. 44 (November 29, 2011)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

You might also like

- Global Macro Trading: Profiting in a New World EconomyFrom EverandGlobal Macro Trading: Profiting in a New World EconomyRating: 4 out of 5 stars4/5 (5)

- Cocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsFrom EverandCocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsNo ratings yet

- Outline For Informative SpeechDocument3 pagesOutline For Informative Speechrobazantout100% (1)

- 1.41 Whitehall: Monitoring The Markets Vol. 1 Iss. 41 (November 8, 2011)Document2 pages1.41 Whitehall: Monitoring The Markets Vol. 1 Iss. 41 (November 8, 2011)Whitehall & CompanyNo ratings yet

- 1.31 Whitehall: Monitoring The Markets Vol. 1 Iss. 31 (August 30, 2011)Document2 pages1.31 Whitehall: Monitoring The Markets Vol. 1 Iss. 31 (August 30, 2011)Whitehall & CompanyNo ratings yet

- 1.48 Whitehall: Monitoring The Markets Vol. 1 Iss. 48 (December 28, 2011)Document2 pages1.48 Whitehall: Monitoring The Markets Vol. 1 Iss. 48 (December 28, 2011)Whitehall & CompanyNo ratings yet

- 1.35 Whitehall: Monitoring The Markets Vol. 1 Iss. 35 (September 27, 2011)Document2 pages1.35 Whitehall: Monitoring The Markets Vol. 1 Iss. 35 (September 27, 2011)Whitehall & CompanyNo ratings yet

- 1.28 Whitehall: Monitoring The Markets Vol. 1 Iss. 28 (August 09, 2011)Document2 pages1.28 Whitehall: Monitoring The Markets Vol. 1 Iss. 28 (August 09, 2011)Whitehall & CompanyNo ratings yet

- 1.37 Whitehall: Monitoring The Markets Vol. 1 Iss. 37 (October 12, 2011)Document2 pages1.37 Whitehall: Monitoring The Markets Vol. 1 Iss. 37 (October 12, 2011)Whitehall & CompanyNo ratings yet

- 1.29 Whitehall: Monitoring The Markets Vol. 1 Iss. 29 (August 16, 2011)Document2 pages1.29 Whitehall: Monitoring The Markets Vol. 1 Iss. 29 (August 16, 2011)Whitehall & CompanyNo ratings yet

- 1.22 Whitehall: Monitoring The Markets Vol. 1 Iss. 22 (June 28, 2011)Document2 pages1.22 Whitehall: Monitoring The Markets Vol. 1 Iss. 22 (June 28, 2011)Whitehall & CompanyNo ratings yet

- 1.30 Whitehall: Monitoring The Markets Vol. 1 Iss. 30 (August 23, 2011)Document2 pages1.30 Whitehall: Monitoring The Markets Vol. 1 Iss. 30 (August 23, 2011)Whitehall & CompanyNo ratings yet

- 1.26 Whitehall: Monitoring The Markets Vol. 1 Iss. 26 (July 26, 2011)Document2 pages1.26 Whitehall: Monitoring The Markets Vol. 1 Iss. 26 (July 26, 2011)Whitehall & CompanyNo ratings yet

- 1.46 Whitehall: Monitoring The Markets Vol. 1 Iss. 46 (December 13, 2011)Document2 pages1.46 Whitehall: Monitoring The Markets Vol. 1 Iss. 46 (December 13, 2011)Whitehall & CompanyNo ratings yet

- 1.25 Whitehall: Monitoring The Markets Vol. 1 Iss. 25 (July 19, 2011)Document2 pages1.25 Whitehall: Monitoring The Markets Vol. 1 Iss. 25 (July 19, 2011)Whitehall & CompanyNo ratings yet

- 1.34 Whitehall: Monitoring The Markets Vol. 1 Iss. 34 (September 20, 2011)Document2 pages1.34 Whitehall: Monitoring The Markets Vol. 1 Iss. 34 (September 20, 2011)Whitehall & CompanyNo ratings yet

- 1.27 Whitehall: Monitoring The Markets Vol. 1 Iss. 27 (August 02, 2011)Document2 pages1.27 Whitehall: Monitoring The Markets Vol. 1 Iss. 27 (August 02, 2011)Whitehall & CompanyNo ratings yet

- 1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Document2 pages1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Whitehall & CompanyNo ratings yet

- 1.24 Whitehall: Monitoring The Markets Vol. 1 Iss. 24 (July 13, 2011)Document2 pages1.24 Whitehall: Monitoring The Markets Vol. 1 Iss. 24 (July 13, 2011)Whitehall & CompanyNo ratings yet

- 2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Document2 pages2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Whitehall & CompanyNo ratings yet

- 2.17 Whitehall: Monitoring The Markets Vol. 2 Iss. 17 (April 24, 2012)Document2 pages2.17 Whitehall: Monitoring The Markets Vol. 2 Iss. 17 (April 24, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 45 (December 1, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 45 (December 1, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 42 (November 10, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 42 (November 10, 2015)Whitehall & CompanyNo ratings yet

- 2.15 Whitehall: Monitoring The Markets Vol. 2 Iss. 15 (April 10, 2012)Document2 pages2.15 Whitehall: Monitoring The Markets Vol. 2 Iss. 15 (April 10, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: United States Debt MarketDocument2 pagesWhitehall: United States Debt MarketWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Whitehall & CompanyNo ratings yet

- United States Debt Market: Us Libor Us Treasury Yield CurveDocument2 pagesUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNo ratings yet

- 2.49 Whitehall: Monitoring The Markets Vol. 2 Iss. 49 (December 4, 2012)Document2 pages2.49 Whitehall: Monitoring The Markets Vol. 2 Iss. 49 (December 4, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 44 (December 16, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 44 (December 16, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 46 (December 8, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 46 (December 8, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 15 (April 12, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 15 (April 12, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 36 (September 29, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 36 (September 29, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets 2011 Year in ReviewDocument1 pageWhitehall: Monitoring The Markets 2011 Year in ReviewWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 44 (November 1, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 44 (November 1, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 14 (April 21, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 14 (April 21, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 20 (May 17, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 20 (May 17, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 43 (November 19, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 43 (November 19, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 33 (August 17, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 33 (August 17, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 41 (October 11, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 41 (October 11, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 44 (November 24, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 44 (November 24, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 42 (November 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 42 (November 18, 2014)Whitehall & CompanyNo ratings yet

- US Financial Data Weekly Via STL Federal Reserve BankDocument24 pagesUS Financial Data Weekly Via STL Federal Reserve Bankrryan123123No ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 37 (September 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 37 (September 14, 2016)Whitehall & CompanyNo ratings yet

- 2.35 Whitehall: Monitoring The Markets Vol. 2 Iss. 35 (August 28, 2012)Document2 pages2.35 Whitehall: Monitoring The Markets Vol. 2 Iss. 35 (August 28, 2012)Whitehall & CompanyNo ratings yet

- US Financial Data Weekly - St. Louis FedDocument24 pagesUS Financial Data Weekly - St. Louis Fedrryan123123No ratings yet

- 2.23 Whitehall: Monitoring The Markets Vol. 2 Iss. 23 (June 5, 2012)Document2 pages2.23 Whitehall: Monitoring The Markets Vol. 2 Iss. 23 (June 5, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Whitehall & CompanyNo ratings yet

- 2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Document2 pages2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 31 (August 19, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 31 (August 19, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 33 (September 10, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 33 (September 10, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 38 (October 16, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 38 (October 16, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 31 (August 25, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 31 (August 25, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 18 (May 20, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 18 (May 20, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNo ratings yet

- 2024 13 1 22 05 16 Statement - 1705163716154Document2 pages2024 13 1 22 05 16 Statement - 1705163716154eniyaconstructionsNo ratings yet

- Liabilities Amount Assets AmountDocument5 pagesLiabilities Amount Assets AmountVinushree J PawarNo ratings yet

- Axis New Gpa FormatDocument2 pagesAxis New Gpa FormatSravyareddy SamaNo ratings yet

- CFA L1 GlossaryDocument35 pagesCFA L1 Glossaryanindita.nag68No ratings yet

- Mba 8622 - Corporation Finance: Course Syllabus Fall Semester 2003Document9 pagesMba 8622 - Corporation Finance: Course Syllabus Fall Semester 2003lilbouyinNo ratings yet

- Savings Account - 25480100018370 Dharm Singh So Shiv RamDocument8 pagesSavings Account - 25480100018370 Dharm Singh So Shiv RamParveen SainiNo ratings yet

- 2021 Muni Tax Foreclosure BookDocument110 pages2021 Muni Tax Foreclosure BookBrandonNo ratings yet

- Greece: Preliminary Draft Debt Sustainability AnalysisDocument24 pagesGreece: Preliminary Draft Debt Sustainability AnalysisCostas EfimerosNo ratings yet

- Chapter 18 - AnswerDocument9 pagesChapter 18 - Answerwynellamae0% (2)

- Quant Data SufficiencyDocument31 pagesQuant Data SufficiencyShoaib AhmedNo ratings yet

- Statement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Document2 pagesStatement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Sayan SarkarNo ratings yet

- Lecture 2 MCQDocument7 pagesLecture 2 MCQQi ZhuNo ratings yet

- ChallanFormDocument1 pageChallanFormGaurav SardanaNo ratings yet

- UAS Muhammad Misbahul HudaDocument6 pagesUAS Muhammad Misbahul Hudawhite shadowNo ratings yet

- Who Is HSBC?: Business Principles and ValuesDocument5 pagesWho Is HSBC?: Business Principles and Valuesrohitshetty84No ratings yet

- Simpkins School Agra: Economics Project On DemonetisationDocument17 pagesSimpkins School Agra: Economics Project On DemonetisationJayesh gaurNo ratings yet

- Measuring Risk-Adjusted Performance: Michel Crouhy and Stuart M. TurnbullDocument31 pagesMeasuring Risk-Adjusted Performance: Michel Crouhy and Stuart M. Turnbullabhishek210585No ratings yet

- Alternative Means of Government FinanceDocument20 pagesAlternative Means of Government FinanceFatihMANo ratings yet

- Don't Put All Your Eggs in One BasketDocument25 pagesDon't Put All Your Eggs in One BasketChristine Leal - EstenderNo ratings yet

- Statement of Account: Product: Ca-Gen-Pub-Metro/Urban-Inr Currency: INRDocument1 pageStatement of Account: Product: Ca-Gen-Pub-Metro/Urban-Inr Currency: INRAottry MukherjeeNo ratings yet

- Basle Ii and Economic CapitalDocument44 pagesBasle Ii and Economic Capitalaboloe5451100% (2)

- Lev 2Document4 pagesLev 2biniamNo ratings yet

- Summer Internship Project: (A Project With NNEELL'S INVEST)Document45 pagesSummer Internship Project: (A Project With NNEELL'S INVEST)Aditi BagadeNo ratings yet

- Syc Ausmat Sept Fee Structure 2019Document1 pageSyc Ausmat Sept Fee Structure 2019SeanNo ratings yet

- HihiDocument20 pagesHihiCath OquialdaNo ratings yet

- Taxpnl FY2023 2024Document31 pagesTaxpnl FY2023 2024sumitthakur17No ratings yet

- Financial Statement AnalysisDocument78 pagesFinancial Statement AnalysisdhruvNo ratings yet

- Economic ReformsDocument77 pagesEconomic Reformssayooj tvNo ratings yet

- Chap2 - The One Lesson of BusinessDocument6 pagesChap2 - The One Lesson of BusinessAnthony DyNo ratings yet

1.44 Whitehall: Monitoring The Markets Vol. 1 Iss. 44 (November 29, 2011)

1.44 Whitehall: Monitoring The Markets Vol. 1 Iss. 44 (November 29, 2011)

Uploaded by

Whitehall & CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.44 Whitehall: Monitoring The Markets Vol. 1 Iss. 44 (November 29, 2011)

1.44 Whitehall: Monitoring The Markets Vol. 1 Iss. 44 (November 29, 2011)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

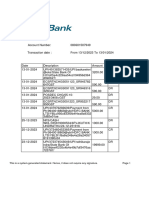

Volume 1, Issue 44 November 29, 2011

.

US

Libor

"6

mth"

"3

mth"

"1

mth"

Whitehall &

C o m p a n y,

L L C

US

Treasury

Yield

Curve

Presented by:

US

DEBT

MARKET*

80

bps

70

bps

60

bps

50

bps

40

bps

30

bps

20

bps

10

bps

7.00%

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

I I 2 3 I 5 I 7

Jun

Aug

Feb

May

Dec

Mar

Sep

Jan

Apr

Nov

Oct

Libor 11/29/11

1mth 26 bps

3mth 52 bps

6mth 74 bps

Nov

I 10

Jul

30yr Avg 15yr Avg Today (11/29/11) I 30

UST 11/29/11

2yr 0.26%

3yr 0.48%

5yr 0.92%

7yr 1.34%

10yr 1.97%

10 Year US Swap Rates

11/29/11 2.16% 3.80% 3.30% 2.80% 2.30%

10

Year

US

Treasury

11/29/11

1.97%

3.60%

3.10%

2.60%

2.10%

11/29/11 2.16% 11/29/11 1.97%

Jul

Aug

Feb

Sep

Nov

Oct Oct Oct

May

Mar

Aug

Nov

May

Mar

Average 10 Year US Industrial Yield

5.00% 4.50%

Nov

Dec

Apr

Average 10 Year US Industrial Spreads

11/29/11 A: 138 bps A BBB: 218 bps BBB 235 bps 220 bps 205 bps 190 bps 175 bps 160 bps 145 bps 130 bps 115 bps 100 bps 85 bps

11/29/11

A:

3.39%

BBB:

4.19% 4.00%

11/29/11

11/29/11

3

.39%

A

:

138

bps

BBB:

218

bps

A:

BBB:

4.19%

A BBB

3.50%

Jul

Aug

Feb

Nov

Sep

May

Mar

Aug

Nov

Oct

Mar

S&P/LSTA Leveraged Loan Index

11/29/11 91.51 11/29/11 8.45 %

11/29/11 91.51 97.00 96.00 95.00 94.00 93.00 92.00 91.00 90.00 89.00 88.00

May

Nov

Dec

Feb

Sep

Apr

Average Junk-Bond Yield

9.50% 11/29/11 8.45 % 9.00% 8.50% 8.00% 7.50%

Jun

Aug

Nov

Oct

Mar

Nov

Dec

Jan

Feb

Sep

Jul

Aug

Feb

Nov

Sep

May

Mar

This market letter is not to be construed as a recommendation to buy, hold or sell any particular security. *Source: Bloomberg Copyright 2011 Whitehall & Company, LLC www.whitehallandcompany.com

May

Nov

Dec

Jan

Apr

Apr

Jun

Jul

Nov

Dec

Jan

Jun

Jan

Apr

Jun

Jul

3.00%

Nov

Dec

Jan

Feb

Sep

Oct

Apr

Jan

Jun

Jun

Jul

1.80%

1.60%

7.00%

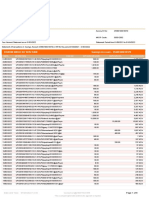

Volume 1, Issue 44 November 29, 2011

.

Select

US

Private

Placements

Type

FMB Snr Notes

Whitehall &

C o m p a n y,

L L C

Sector

Energy Utility

Presented by:

Date Issuer

11/25 ITC Midwest LLC 11/25 UK Power Networks

$mm Tenor (y)

$100 $200 15 10

Spread Coupon

N/A 300bps 5.00% 3.50%

Rating

1 2

Country

USA UK

Public and private market information is from sources that are deemed reliable, but information has not been confirmed.

Select US Public Market New Issues

Investment Grade Issuance

Date

Source: Bloomberg

Issuer

Type

$mm

Tenor (y)

Spread Coupon

Yield

Rating

Sector

Country

No Investment Grade Issuance last week

Below Investment Grade Issuance

Date

Source: Bloomberg

Issuer

Type

Snr Notes

$mm

$800

11/22 Sesi LLC

Tenor (y)

Spread Coupon

517bps 7.13%

Yield

Rating

Sector

Energy

Country

USA

10

6.941% Ba3/BB+

Select Closed Syndicated Loans

Date Issuer Type

Gtd Unsec Snr Sec Snr Sec Snr Unsec 11/25 Parkson Retail Group Ltd 11/22 Cogeco Cable Inc 11/22 Host Hotels & Resorts LP 11/21 Arbitron Inc

Source: Bloomberg

$mm

$400

Tenor (m) (mth) Spread

24 60 48 60

Class

Term Revolver Revolver Revolver

L+215bps N/A N/A L+105bps

Iss.

Rating

BB+ BB+ BBN/A

Sector

Consumer, Cyclical Communications Financial Communications

$750 $1,000 $150

Contact

Whitehall

Jonathan

Cody

Managing

Director

(646)

450-9750

jp.cody@

whitehallandcompany.com

Timothy

Page

Managing

Director

(646)

450-9751

Mmothy.page@

whitehallandcompany.com

Giord

Nowland

Analyst

(646)

543-4443

giord.nowland@

whitehallandcompany.com

Gabrielle Sullivan Analyst (646) 543-4404 gabrielle.sullivan@ whitehallandcompany.com

This market letter is not to be construed as a recommendation to buy, hold or sell any particular security.

Copyright 2011 Whitehall & Company, LLC www.whitehallandcompany.com

You might also like

- Global Macro Trading: Profiting in a New World EconomyFrom EverandGlobal Macro Trading: Profiting in a New World EconomyRating: 4 out of 5 stars4/5 (5)

- Cocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsFrom EverandCocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsNo ratings yet

- Outline For Informative SpeechDocument3 pagesOutline For Informative Speechrobazantout100% (1)

- 1.41 Whitehall: Monitoring The Markets Vol. 1 Iss. 41 (November 8, 2011)Document2 pages1.41 Whitehall: Monitoring The Markets Vol. 1 Iss. 41 (November 8, 2011)Whitehall & CompanyNo ratings yet

- 1.31 Whitehall: Monitoring The Markets Vol. 1 Iss. 31 (August 30, 2011)Document2 pages1.31 Whitehall: Monitoring The Markets Vol. 1 Iss. 31 (August 30, 2011)Whitehall & CompanyNo ratings yet

- 1.48 Whitehall: Monitoring The Markets Vol. 1 Iss. 48 (December 28, 2011)Document2 pages1.48 Whitehall: Monitoring The Markets Vol. 1 Iss. 48 (December 28, 2011)Whitehall & CompanyNo ratings yet

- 1.35 Whitehall: Monitoring The Markets Vol. 1 Iss. 35 (September 27, 2011)Document2 pages1.35 Whitehall: Monitoring The Markets Vol. 1 Iss. 35 (September 27, 2011)Whitehall & CompanyNo ratings yet

- 1.28 Whitehall: Monitoring The Markets Vol. 1 Iss. 28 (August 09, 2011)Document2 pages1.28 Whitehall: Monitoring The Markets Vol. 1 Iss. 28 (August 09, 2011)Whitehall & CompanyNo ratings yet

- 1.37 Whitehall: Monitoring The Markets Vol. 1 Iss. 37 (October 12, 2011)Document2 pages1.37 Whitehall: Monitoring The Markets Vol. 1 Iss. 37 (October 12, 2011)Whitehall & CompanyNo ratings yet

- 1.29 Whitehall: Monitoring The Markets Vol. 1 Iss. 29 (August 16, 2011)Document2 pages1.29 Whitehall: Monitoring The Markets Vol. 1 Iss. 29 (August 16, 2011)Whitehall & CompanyNo ratings yet

- 1.22 Whitehall: Monitoring The Markets Vol. 1 Iss. 22 (June 28, 2011)Document2 pages1.22 Whitehall: Monitoring The Markets Vol. 1 Iss. 22 (June 28, 2011)Whitehall & CompanyNo ratings yet

- 1.30 Whitehall: Monitoring The Markets Vol. 1 Iss. 30 (August 23, 2011)Document2 pages1.30 Whitehall: Monitoring The Markets Vol. 1 Iss. 30 (August 23, 2011)Whitehall & CompanyNo ratings yet

- 1.26 Whitehall: Monitoring The Markets Vol. 1 Iss. 26 (July 26, 2011)Document2 pages1.26 Whitehall: Monitoring The Markets Vol. 1 Iss. 26 (July 26, 2011)Whitehall & CompanyNo ratings yet

- 1.46 Whitehall: Monitoring The Markets Vol. 1 Iss. 46 (December 13, 2011)Document2 pages1.46 Whitehall: Monitoring The Markets Vol. 1 Iss. 46 (December 13, 2011)Whitehall & CompanyNo ratings yet

- 1.25 Whitehall: Monitoring The Markets Vol. 1 Iss. 25 (July 19, 2011)Document2 pages1.25 Whitehall: Monitoring The Markets Vol. 1 Iss. 25 (July 19, 2011)Whitehall & CompanyNo ratings yet

- 1.34 Whitehall: Monitoring The Markets Vol. 1 Iss. 34 (September 20, 2011)Document2 pages1.34 Whitehall: Monitoring The Markets Vol. 1 Iss. 34 (September 20, 2011)Whitehall & CompanyNo ratings yet

- 1.27 Whitehall: Monitoring The Markets Vol. 1 Iss. 27 (August 02, 2011)Document2 pages1.27 Whitehall: Monitoring The Markets Vol. 1 Iss. 27 (August 02, 2011)Whitehall & CompanyNo ratings yet

- 1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Document2 pages1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Whitehall & CompanyNo ratings yet

- 1.24 Whitehall: Monitoring The Markets Vol. 1 Iss. 24 (July 13, 2011)Document2 pages1.24 Whitehall: Monitoring The Markets Vol. 1 Iss. 24 (July 13, 2011)Whitehall & CompanyNo ratings yet

- 2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Document2 pages2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Whitehall & CompanyNo ratings yet

- 2.17 Whitehall: Monitoring The Markets Vol. 2 Iss. 17 (April 24, 2012)Document2 pages2.17 Whitehall: Monitoring The Markets Vol. 2 Iss. 17 (April 24, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 45 (December 1, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 45 (December 1, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 42 (November 10, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 42 (November 10, 2015)Whitehall & CompanyNo ratings yet

- 2.15 Whitehall: Monitoring The Markets Vol. 2 Iss. 15 (April 10, 2012)Document2 pages2.15 Whitehall: Monitoring The Markets Vol. 2 Iss. 15 (April 10, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: United States Debt MarketDocument2 pagesWhitehall: United States Debt MarketWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Whitehall & CompanyNo ratings yet

- United States Debt Market: Us Libor Us Treasury Yield CurveDocument2 pagesUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNo ratings yet

- 2.49 Whitehall: Monitoring The Markets Vol. 2 Iss. 49 (December 4, 2012)Document2 pages2.49 Whitehall: Monitoring The Markets Vol. 2 Iss. 49 (December 4, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 44 (December 16, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 44 (December 16, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 46 (December 8, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 46 (December 8, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 15 (April 12, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 15 (April 12, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 36 (September 29, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 36 (September 29, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets 2011 Year in ReviewDocument1 pageWhitehall: Monitoring The Markets 2011 Year in ReviewWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 44 (November 1, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 44 (November 1, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 14 (April 21, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 14 (April 21, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 20 (May 17, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 20 (May 17, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 43 (November 19, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 43 (November 19, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 33 (August 17, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 33 (August 17, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 41 (October 11, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 41 (October 11, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 44 (November 24, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 44 (November 24, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 42 (November 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 42 (November 18, 2014)Whitehall & CompanyNo ratings yet

- US Financial Data Weekly Via STL Federal Reserve BankDocument24 pagesUS Financial Data Weekly Via STL Federal Reserve Bankrryan123123No ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 37 (September 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 37 (September 14, 2016)Whitehall & CompanyNo ratings yet

- 2.35 Whitehall: Monitoring The Markets Vol. 2 Iss. 35 (August 28, 2012)Document2 pages2.35 Whitehall: Monitoring The Markets Vol. 2 Iss. 35 (August 28, 2012)Whitehall & CompanyNo ratings yet

- US Financial Data Weekly - St. Louis FedDocument24 pagesUS Financial Data Weekly - St. Louis Fedrryan123123No ratings yet

- 2.23 Whitehall: Monitoring The Markets Vol. 2 Iss. 23 (June 5, 2012)Document2 pages2.23 Whitehall: Monitoring The Markets Vol. 2 Iss. 23 (June 5, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Whitehall & CompanyNo ratings yet

- 2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Document2 pages2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 31 (August 19, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 31 (August 19, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 33 (September 10, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 33 (September 10, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 38 (October 16, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 38 (October 16, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 31 (August 25, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 31 (August 25, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 18 (May 20, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 18 (May 20, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNo ratings yet

- 2024 13 1 22 05 16 Statement - 1705163716154Document2 pages2024 13 1 22 05 16 Statement - 1705163716154eniyaconstructionsNo ratings yet

- Liabilities Amount Assets AmountDocument5 pagesLiabilities Amount Assets AmountVinushree J PawarNo ratings yet

- Axis New Gpa FormatDocument2 pagesAxis New Gpa FormatSravyareddy SamaNo ratings yet

- CFA L1 GlossaryDocument35 pagesCFA L1 Glossaryanindita.nag68No ratings yet

- Mba 8622 - Corporation Finance: Course Syllabus Fall Semester 2003Document9 pagesMba 8622 - Corporation Finance: Course Syllabus Fall Semester 2003lilbouyinNo ratings yet

- Savings Account - 25480100018370 Dharm Singh So Shiv RamDocument8 pagesSavings Account - 25480100018370 Dharm Singh So Shiv RamParveen SainiNo ratings yet

- 2021 Muni Tax Foreclosure BookDocument110 pages2021 Muni Tax Foreclosure BookBrandonNo ratings yet

- Greece: Preliminary Draft Debt Sustainability AnalysisDocument24 pagesGreece: Preliminary Draft Debt Sustainability AnalysisCostas EfimerosNo ratings yet

- Chapter 18 - AnswerDocument9 pagesChapter 18 - Answerwynellamae0% (2)

- Quant Data SufficiencyDocument31 pagesQuant Data SufficiencyShoaib AhmedNo ratings yet

- Statement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Document2 pagesStatement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Sayan SarkarNo ratings yet

- Lecture 2 MCQDocument7 pagesLecture 2 MCQQi ZhuNo ratings yet

- ChallanFormDocument1 pageChallanFormGaurav SardanaNo ratings yet

- UAS Muhammad Misbahul HudaDocument6 pagesUAS Muhammad Misbahul Hudawhite shadowNo ratings yet

- Who Is HSBC?: Business Principles and ValuesDocument5 pagesWho Is HSBC?: Business Principles and Valuesrohitshetty84No ratings yet

- Simpkins School Agra: Economics Project On DemonetisationDocument17 pagesSimpkins School Agra: Economics Project On DemonetisationJayesh gaurNo ratings yet

- Measuring Risk-Adjusted Performance: Michel Crouhy and Stuart M. TurnbullDocument31 pagesMeasuring Risk-Adjusted Performance: Michel Crouhy and Stuart M. Turnbullabhishek210585No ratings yet

- Alternative Means of Government FinanceDocument20 pagesAlternative Means of Government FinanceFatihMANo ratings yet

- Don't Put All Your Eggs in One BasketDocument25 pagesDon't Put All Your Eggs in One BasketChristine Leal - EstenderNo ratings yet

- Statement of Account: Product: Ca-Gen-Pub-Metro/Urban-Inr Currency: INRDocument1 pageStatement of Account: Product: Ca-Gen-Pub-Metro/Urban-Inr Currency: INRAottry MukherjeeNo ratings yet

- Basle Ii and Economic CapitalDocument44 pagesBasle Ii and Economic Capitalaboloe5451100% (2)

- Lev 2Document4 pagesLev 2biniamNo ratings yet

- Summer Internship Project: (A Project With NNEELL'S INVEST)Document45 pagesSummer Internship Project: (A Project With NNEELL'S INVEST)Aditi BagadeNo ratings yet

- Syc Ausmat Sept Fee Structure 2019Document1 pageSyc Ausmat Sept Fee Structure 2019SeanNo ratings yet

- HihiDocument20 pagesHihiCath OquialdaNo ratings yet

- Taxpnl FY2023 2024Document31 pagesTaxpnl FY2023 2024sumitthakur17No ratings yet

- Financial Statement AnalysisDocument78 pagesFinancial Statement AnalysisdhruvNo ratings yet

- Economic ReformsDocument77 pagesEconomic Reformssayooj tvNo ratings yet

- Chap2 - The One Lesson of BusinessDocument6 pagesChap2 - The One Lesson of BusinessAnthony DyNo ratings yet