Professional Documents

Culture Documents

Corporate Gifting Policy

Corporate Gifting Policy

Uploaded by

Manager HR Shalya XcellanceCopyright:

Available Formats

You might also like

- DPDHL Anti-Corruption & Business Ethics PolicyDocument12 pagesDPDHL Anti-Corruption & Business Ethics PolicyMISAEL SINCLAIRNo ratings yet

- Sample Subcontractor AgreementDocument2 pagesSample Subcontractor Agreementisabellearnold100% (2)

- System Wiring Diagrams Defogger Circuit: 1989 Isuzu Trooper II For XDocument18 pagesSystem Wiring Diagrams Defogger Circuit: 1989 Isuzu Trooper II For XMac PirxNo ratings yet

- Anti-Bribery and Corruption PolicyDocument7 pagesAnti-Bribery and Corruption Policyrikii80100% (1)

- Conflict of Interest PolicyDocument6 pagesConflict of Interest PolicyGautam RanganNo ratings yet

- Business Gifts & Courtesies GuidelineDocument3 pagesBusiness Gifts & Courtesies GuidelinemustafaNo ratings yet

- Marine Superintendent - 2012Document2 pagesMarine Superintendent - 2012Muhammad IsalNo ratings yet

- Corporate-Gifting-Policy - 171221Document5 pagesCorporate-Gifting-Policy - 171221Ankit SheoranNo ratings yet

- Gift and Entertainment PolicyDocument8 pagesGift and Entertainment Policysandeepreddys091537No ratings yet

- GE Policy SynopsisDocument3 pagesGE Policy SynopsisDigital MettNo ratings yet

- Gifts Hospitality PolicyDocument5 pagesGifts Hospitality PolicyJohn NcubeNo ratings yet

- K Hospitality PolicyDocument8 pagesK Hospitality PolicyLinda AliNo ratings yet

- Gift PolicyDocument2 pagesGift PolicySandeepNo ratings yet

- Anti-Corruption and Anti-Bribery Policy PDFDocument6 pagesAnti-Corruption and Anti-Bribery Policy PDFKarthik ChandrasekaranNo ratings yet

- Receipt of Employment Related Gifts Policy: ScopeDocument2 pagesReceipt of Employment Related Gifts Policy: Scopeoair2000No ratings yet

- Anti-Bribery and Anti-Corruption PolicyDocument8 pagesAnti-Bribery and Anti-Corruption Policyrajiv71No ratings yet

- Factors in Determining The Morality of Gift-GivingDocument11 pagesFactors in Determining The Morality of Gift-GivingDarling Mae Cabrera67% (3)

- Anti Bribery and Anti - Corruption Policy.Document9 pagesAnti Bribery and Anti - Corruption Policy.rajiv71No ratings yet

- Giving and Receiving Gifts and Entertainment PolicyDocument3 pagesGiving and Receiving Gifts and Entertainment PolicyHilyn FloresNo ratings yet

- Anti Corruption PolicyDocument6 pagesAnti Corruption PolicyFadhel FebryansyahNo ratings yet

- ABC PolicyDocument6 pagesABC PolicySunil JaglanNo ratings yet

- Gifts Hospitality Tata Industries PolicyDocument5 pagesGifts Hospitality Tata Industries PolicyVikas PratikNo ratings yet

- Gift Giving and BriberyDocument2 pagesGift Giving and BriberyJay Mark Marcial JosolNo ratings yet

- Gift Policy and Procedure 12012018Document10 pagesGift Policy and Procedure 12012018billyplacencia06No ratings yet

- 1 Anti Bribery and Corruption Policy 1.0Document7 pages1 Anti Bribery and Corruption Policy 1.0Sundaramoorthy ArumugamNo ratings yet

- Gifting Policy 2022Document4 pagesGifting Policy 2022charitha sravaniNo ratings yet

- Anti Bribery and Corruption PolicyDocument11 pagesAnti Bribery and Corruption PolicyghtyNo ratings yet

- Gift BanDocument4 pagesGift BanPennCapitalStarNo ratings yet

- Gift and HospitalityDocument6 pagesGift and Hospitalitynikita.a.chavan21No ratings yet

- Anti-Bribery & Corruption Policy TemplateDocument3 pagesAnti-Bribery & Corruption Policy Templatehabiba raisNo ratings yet

- Anti Bribery Corruption PolicyDocument8 pagesAnti Bribery Corruption Policyagyein26No ratings yet

- 1 Anti Bribery and Corruption Policy 1.0Document7 pages1 Anti Bribery and Corruption Policy 1.0RiqoNo ratings yet

- Anti-Bribery & Anti-Corruption PolicyDocument15 pagesAnti-Bribery & Anti-Corruption PolicyPuja Popuri100% (1)

- PLA Anti Bribery and Corruption Policy (17 Dec 13)Document8 pagesPLA Anti Bribery and Corruption Policy (17 Dec 13)CinCan Poenya PiePieNo ratings yet

- Anti Bribery and Corruption PolicyDocument7 pagesAnti Bribery and Corruption PolicyAqua RedNo ratings yet

- Gift Giving and BriberyDocument6 pagesGift Giving and BriberyJulius AlcantaraNo ratings yet

- Case Study 8 Gifts GaloreDocument3 pagesCase Study 8 Gifts Galoreanuni1995No ratings yet

- EES Anti-Bribery & Corruption PolicyDocument3 pagesEES Anti-Bribery & Corruption Policysales infoNo ratings yet

- Anti-Bribery Policy Including Gift & EntertainmentDocument8 pagesAnti-Bribery Policy Including Gift & EntertainmentElmey Bin JulkeplyNo ratings yet

- Sample Code of Conduct & Corporate EthicssDocument10 pagesSample Code of Conduct & Corporate Ethicssjsconrad12No ratings yet

- Anti Bribery Corruption PolicyDocument8 pagesAnti Bribery Corruption PolicySatya TripathiNo ratings yet

- Anti Bribery Corruption PolicyDocument8 pagesAnti Bribery Corruption PolicyBALAJINo ratings yet

- Worldwide Gift and Entertainment Policy - ENGLISH - 06!03!2013Document13 pagesWorldwide Gift and Entertainment Policy - ENGLISH - 06!03!2013Sarvesh AhluwaliaNo ratings yet

- WSP Gifts Entertainment Hospitality Policy enDocument8 pagesWSP Gifts Entertainment Hospitality Policy enTiến Phát TrầnNo ratings yet

- Pronano Technical Services - Anti-Corruption PolicyDocument5 pagesPronano Technical Services - Anti-Corruption PolicyBrendon SavageNo ratings yet

- Code of ConductDocument6 pagesCode of ConductAnonymous Ybtp2iSNo ratings yet

- 1IBF HR Policy - Copy - PPT LastDocument28 pages1IBF HR Policy - Copy - PPT LastAbdul KaderNo ratings yet

- Code of Conduct Do Not'sDocument2 pagesCode of Conduct Do Not'sclmnNo ratings yet

- Gift Policy: ETHICS Handbook 23Document3 pagesGift Policy: ETHICS Handbook 23Way jayNo ratings yet

- Guidelines For The Prevention of Conflicts of Interest and CorruptionDocument6 pagesGuidelines For The Prevention of Conflicts of Interest and CorruptionMahesh PatilNo ratings yet

- The Code of Conduct IS FAIR May 5 DRAFTDocument9 pagesThe Code of Conduct IS FAIR May 5 DRAFTJason FranklinNo ratings yet

- (New) 12 BIL Code of Ethics - 13 04 14Document13 pages(New) 12 BIL Code of Ethics - 13 04 14Dolly ThoguruNo ratings yet

- Fastjet's Anti Bribery and Corruption Policy 1 Policy StatementDocument6 pagesFastjet's Anti Bribery and Corruption Policy 1 Policy StatementSigSigNo ratings yet

- Anti-Bribery Policy: 1. PurposeDocument4 pagesAnti-Bribery Policy: 1. PurposefayazNo ratings yet

- Briefing 3 PDFDocument2 pagesBriefing 3 PDFElle RiveraNo ratings yet

- Anti-Bribery & Anti-Corruption PolicyDocument8 pagesAnti-Bribery & Anti-Corruption PolicyVaishali SinhaNo ratings yet

- Museums Victoria Policy Statement Gifts Benefits Hospitality and Attendance Policy 28 September 2022Document14 pagesMuseums Victoria Policy Statement Gifts Benefits Hospitality and Attendance Policy 28 September 2022dawnNo ratings yet

- Code of Ethics For Purchasing: - Adopted by The Irving City Council, July 9, 2009Document3 pagesCode of Ethics For Purchasing: - Adopted by The Irving City Council, July 9, 2009onc30187No ratings yet

- Corporate Policy Manual On Ethical Conduct Avoidance of Conflict of Interest and Protection of Confidential and ProprietaryDocument20 pagesCorporate Policy Manual On Ethical Conduct Avoidance of Conflict of Interest and Protection of Confidential and ProprietaryLakshmivindo rayalaNo ratings yet

- Lecture 2.2Document4 pagesLecture 2.2barshaadhikari83No ratings yet

- Business Risk Factors: Evaluation and Guidelines for EntrepreneursFrom EverandBusiness Risk Factors: Evaluation and Guidelines for EntrepreneursNo ratings yet

- Gift Vouchers: Everything You Need to Know but Never Thought to Ask: Nitty Gritty MarketingFrom EverandGift Vouchers: Everything You Need to Know but Never Thought to Ask: Nitty Gritty MarketingNo ratings yet

- Success In Franchising: Learn the Secrets of Successful FranchisesFrom EverandSuccess In Franchising: Learn the Secrets of Successful FranchisesRating: 5 out of 5 stars5/5 (1)

- Social Media PolicyDocument3 pagesSocial Media PolicyManager HR Shalya XcellanceNo ratings yet

- Salary Advance PolicyDocument2 pagesSalary Advance PolicyManager HR Shalya XcellanceNo ratings yet

- Promotion Recommendation FormDocument1 pagePromotion Recommendation FormManager HR Shalya XcellanceNo ratings yet

- Long Service Award PolicyDocument2 pagesLong Service Award PolicyManager HR Shalya XcellanceNo ratings yet

- First Aid PolicyDocument8 pagesFirst Aid PolicyManager HR Shalya XcellanceNo ratings yet

- Code of ConductDocument8 pagesCode of ConductManager HR Shalya XcellanceNo ratings yet

- Employee Promotion PolicyDocument4 pagesEmployee Promotion PolicyManager HR Shalya XcellanceNo ratings yet

- Dress Code PolicyDocument4 pagesDress Code PolicyManager HR Shalya XcellanceNo ratings yet

- Birthday Celebration PolicyDocument2 pagesBirthday Celebration PolicyManager HR Shalya XcellanceNo ratings yet

- Business Card PolicyDocument2 pagesBusiness Card PolicyManager HR Shalya XcellanceNo ratings yet

- Exit Interview TemplateDocument3 pagesExit Interview TemplateManager HR Shalya XcellanceNo ratings yet

- Company Vehicle PolicyDocument2 pagesCompany Vehicle PolicyManager HR Shalya XcellanceNo ratings yet

- Handover Document For SalesDocument2 pagesHandover Document For SalesManager HR Shalya XcellanceNo ratings yet

- Shalya Employee Satisfaction Questionnaire 2023Document5 pagesShalya Employee Satisfaction Questionnaire 2023Manager HR Shalya XcellanceNo ratings yet

- Dokumen - Tips - Latihan Soal Sap Finance Lengkap Ada JawabanDocument6 pagesDokumen - Tips - Latihan Soal Sap Finance Lengkap Ada Jawabanurbae chaNo ratings yet

- Car Parts - Picture DictionaryDocument18 pagesCar Parts - Picture Dictionaryabcbaccomhk0% (1)

- 3 - Noynay Vs Citihomes Builder (MACEDA)Document7 pages3 - Noynay Vs Citihomes Builder (MACEDA)Sansa StarkNo ratings yet

- Financial Modelling AssignmentDocument6 pagesFinancial Modelling AssignmentMomin AbrarNo ratings yet

- Coursework Assignment Answer Template: Coursework Assessment Guidelines and Instructions Available On RevisionmateDocument5 pagesCoursework Assignment Answer Template: Coursework Assessment Guidelines and Instructions Available On Revisionmateshams khushtarNo ratings yet

- Petition To LSBC For A Special General Meeting Concerning TWUDocument3 pagesPetition To LSBC For A Special General Meeting Concerning TWUDouglas W. JudsonNo ratings yet

- Mlaw Past Papers Since 2019-1Document107 pagesMlaw Past Papers Since 2019-1JawadNo ratings yet

- Scopic ClauseDocument20 pagesScopic ClausePuneet MishraNo ratings yet

- Chap 2 Cases Full TextDocument28 pagesChap 2 Cases Full TextJica GulaNo ratings yet

- Petitioners Vs Vs Respondents Arturo S. Santos For Petitioners. Conrado R. Mangahas & Associates For RespondentsDocument5 pagesPetitioners Vs Vs Respondents Arturo S. Santos For Petitioners. Conrado R. Mangahas & Associates For RespondentsAudrey DeguzmanNo ratings yet

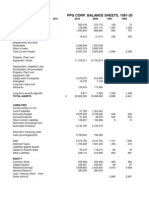

- EmkayDocument15 pagesEmkayCek IfaNo ratings yet

- Act Company Profile 2016 1Document5 pagesAct Company Profile 2016 1AnkurDagaNo ratings yet

- HP Elitebook Revolve Data SheetDocument4 pagesHP Elitebook Revolve Data SheetAditya BistNo ratings yet

- Performance of Schools Agricultural and Biosystems Engineer Board ExamDocument3 pagesPerformance of Schools Agricultural and Biosystems Engineer Board ExamTheSummitExpress100% (2)

- ESSAY OUTLINE Can Violence Be A Solution To TerrorismDocument3 pagesESSAY OUTLINE Can Violence Be A Solution To Terrorismh1generalpaperNo ratings yet

- STS Lesson 6Document34 pagesSTS Lesson 6Sharina Mhyca SamonteNo ratings yet

- Failure To Detect and Report The Scams That Took Place Involving IL&FS and Its 21 Entities When They Were The Auditors of The IL&FSDocument4 pagesFailure To Detect and Report The Scams That Took Place Involving IL&FS and Its 21 Entities When They Were The Auditors of The IL&FSJay NirupamNo ratings yet

- IrvingCC Packet 2010-02-04Document342 pagesIrvingCC Packet 2010-02-04Irving BlogNo ratings yet

- Perlas Lim Tay vs. Court of AppealsDocument1 pagePerlas Lim Tay vs. Court of AppealsAllenNo ratings yet

- Test Bank Pfrs 15 - CompressDocument44 pagesTest Bank Pfrs 15 - CompressKarren Claire C. VillaNo ratings yet

- Project Integration Management With FIDICDocument8 pagesProject Integration Management With FIDICkmmanoj1968No ratings yet

- Annual Report IndInfravit Trust 1Document183 pagesAnnual Report IndInfravit Trust 1Vikas VidhurNo ratings yet

- First Division (G.R. No. 149261: December 15, 2010) Azucena B. Corpuz, Petitioner, vs. Roman G. Del Rosario, Respondent. Decision Del Castillo, J.Document2 pagesFirst Division (G.R. No. 149261: December 15, 2010) Azucena B. Corpuz, Petitioner, vs. Roman G. Del Rosario, Respondent. Decision Del Castillo, J.Boom ManuelNo ratings yet

- National Form Ucc-1Document4 pagesNational Form Ucc-1AaSima HajjaNo ratings yet

- Article 48A.: Protection and Improvement of Environment and Safeguarding of Forests and Wild LifeDocument7 pagesArticle 48A.: Protection and Improvement of Environment and Safeguarding of Forests and Wild LifeanuNo ratings yet

- Supreme Court of The United States: 1 Cite As: 601 U. S. - (2024) Per CuriamDocument20 pagesSupreme Court of The United States: 1 Cite As: 601 U. S. - (2024) Per CuriamABC News PoliticsNo ratings yet

- Osmeña v. Commission On Elections, 351 Phil. 692 (1998)Document4 pagesOsmeña v. Commission On Elections, 351 Phil. 692 (1998)Samuel John CahimatNo ratings yet

Corporate Gifting Policy

Corporate Gifting Policy

Uploaded by

Manager HR Shalya XcellanceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Gifting Policy

Corporate Gifting Policy

Uploaded by

Manager HR Shalya XcellanceCopyright:

Available Formats

CORPORATE GIFTING POLICY

OBJECTIVE

Gifting is a widespread aspect as a customary practice in the country, and that refusal of gift can be

considered offensive. However, Gifts can be seen as bribes and they may be intended to influence

decisions of an organization or create reciprocal obligations. While it is discouraged to accept or offer

(directly or indirectly) gifts or entertainment from customers, suppliers, distributors, dealers, or any other

business associates of the company, however in some situations it is considered customary to accept or

offer gifts.

The Corporate Gifting Policy defines guidelines and acceptable norms for accepting and offering of gifts.

EFFECTIVE

Corporate Gifting Policy will be effective from 01st April 2024

APPLICABILITY

This policy shall apply to all regular employees of Xcellance Medical Technologies Pvt. Ltd.

Receipt of Gifts:

A gift is an item of cash or goods or any service of commercial value that is given to an individual for

personal use/benefit without any return of payment. Following are the guidelines with regards to receipt of

gifts:

1.1 Guidelines on Acceptable Gifts:

The following kind of gifts are acceptable:

a. Gifts in the form of flowers/fruits/sweets/food items/company souvenirs if they are of nominal value

are acceptable.

b. In any event, the above acceptable gifts should be addressed to the Company rather than the particular

individual handling the business transaction and receipt of such gifts at residence or any other place

other than work related places is strictly prohibited.

Corporate Gifting Policy Page 1

1

1.2 Guidelines on Unacceptable Gifts:

The following kinds of gifts are strictly unacceptable:

a. Gifts in the form of cash or cash equivalent (gift vouchers) or anything that is illegal, unsavory or

offensive or that brings in an agreement of reciprocal obligation whether immediate or at a later period

should not be accepted on any occasions viz. marriage invitation, dealer meet, inauguration or launch

of an event, achievement of milestone etc.

b. Services provided by a business associate at nil or reduced cost. E.g. free boarding, transportation,

lodging, free telephone facilities, free or subsidized tour packages etc. or other service when provided

by any other person other than a near relative or a personal friend having no official dealings with the

Company.

c. Acceptance of any other expensive gifts in the form of goods like any kind of electronic items like

mobile phones, watches, cameras; jewelry, precious stones or metals; etc. is strictly prohibited and to

be returned politely with a refusal letter (template attached).

d. Any sponsorship by a business associate for the employee and/or their family members.

e. Remuneration in cash for lectures/professional talks at public forum should be politely refused,

however gifts in line with Company Guidelines on Acceptable Gifts can be accepted.

f. No employee should accept or permit any member of his family or any other person acting on his

behalf to accept any gift directly from Vendors, Dealers, Contractors, Suppliers, and anyone having

business dealings with the Company or from their employees/relatives.

Corporate Gifting Policy Page 2

2

2. Meals and Entertainment:

2.1 Attendance to lunches, dinner and other ceremonies (seminars/lectures) are acceptable if these are

part of normal business discussions or negotiations. Attendance at such events should not form

part of a regular pattern of activity.

2.2 Invitations to attend recreational events should be agreed beforehand by the employee’s reporting

officer. Non business related recreation provided free of charge by business associates is treated as

gift and should only be accepted within the limits of this policy.

2.3 All expenses made towards entertainment or of recreation should be reasonable and

commensurate with the purpose and should be duly supported by bills and vouchers and

reimbursement thereof claimed through expenses statement clearly stating the purpose and details

of people involved and duly authorized by the approving authority as per Entertainment Expense

Policy.

3. Giving Gifts:

3.1 Outside the Organization:

a. Since giving away gifts during festive season is part of our national culture, distribution of company

souvenirs/gifts to individual with whom Company has business relationships, public officials, and

other business associates is required. Different categories of souvenirs/gifts are defined based on

stature/position of the recipients and maximum upper limit fixed from time to time at the discretion

of the Company.

b. However, such gift should be infrequent and should not be seen as a favor extended to a section or

group of people as a matter of gratification.

c. In case of gifts required to be given on special occasions such as festivals & wedding etc. to business

associates, the same matrix should be followed and should be claimed through an expense

statement, clearly setting out the purpose for which the gift was made with the details of the

recipient and duly authorized by the approving authority as applicable for Entertainment Expenses.

Corporate Gifting Policy Page 3

3

d. In the case of public officials such gifts will be given only where customary and reasonable under

generally accepted practice, provided it will not be seen as favoritism or gratification.

e. In any event, the gift should be from Maruti Suzuki and not from an individual employee or

department.

4. Disciplinary Action:

4.1 Any deviation of this policy will be seen as violation of MSIL’s Code of Conduct.

4.2 Any employee who accepts money, gifts, favour or benefits for an inappropriate purpose or of an

inappropriate monetary value will be liable to disciplinary action, to be investigated by Disciplinary

Committee.

4.3 Disciplinary actions may include immediate termination of employment or business relationship or

any other necessary action based on the severity of the breach at Company’s sole discretion.

5 SNAPSHOT:

Category Description

Receipt of Gifts:

a. Festive gifts in the form of

Acceptable Gifts: flowers/fruits/sweets/food items of nominal

value.

a. Cash or cash equivalent (gift vouchers) or anything that is

illegal, unsavory or offensive or that brings in an

agreement of reciprocal obligation on any occasions viz.

marriage invitation, dealer meet, inauguration or launch of

an event, achievement of milestone etc.

b. Services provided by a business associate at nil or reduced

cost.

c. Individual sponsorship by a business associate for the

Unacceptable Gifts: employee and/or their family members.

d. Remuneration in cash for lectures/professional talks at

public forum.

e. Expensive gift items like Electronic Goods (mobile

phones, watches, cameras etc.), Jewelry, Precious Stones or

Metals etc.

Giving Gifts (Outside Organization):

Corporate Gifting Policy Page 4

4

Categories of souvenirs/gifts a. Where company souvenirs/gifts are required to be given to

defined based on individuals with whom Company has business

stature/position of the relationships, public officials, and other business

recipients and max. Upper associates.

Limit decided at the discretion b. Where gifts are required to be given on special

of the Company from time to occasions such as festivals & wedding etc. to business

time. associates.

Corporate Gifting Policy Page 5

5

You might also like

- DPDHL Anti-Corruption & Business Ethics PolicyDocument12 pagesDPDHL Anti-Corruption & Business Ethics PolicyMISAEL SINCLAIRNo ratings yet

- Sample Subcontractor AgreementDocument2 pagesSample Subcontractor Agreementisabellearnold100% (2)

- System Wiring Diagrams Defogger Circuit: 1989 Isuzu Trooper II For XDocument18 pagesSystem Wiring Diagrams Defogger Circuit: 1989 Isuzu Trooper II For XMac PirxNo ratings yet

- Anti-Bribery and Corruption PolicyDocument7 pagesAnti-Bribery and Corruption Policyrikii80100% (1)

- Conflict of Interest PolicyDocument6 pagesConflict of Interest PolicyGautam RanganNo ratings yet

- Business Gifts & Courtesies GuidelineDocument3 pagesBusiness Gifts & Courtesies GuidelinemustafaNo ratings yet

- Marine Superintendent - 2012Document2 pagesMarine Superintendent - 2012Muhammad IsalNo ratings yet

- Corporate-Gifting-Policy - 171221Document5 pagesCorporate-Gifting-Policy - 171221Ankit SheoranNo ratings yet

- Gift and Entertainment PolicyDocument8 pagesGift and Entertainment Policysandeepreddys091537No ratings yet

- GE Policy SynopsisDocument3 pagesGE Policy SynopsisDigital MettNo ratings yet

- Gifts Hospitality PolicyDocument5 pagesGifts Hospitality PolicyJohn NcubeNo ratings yet

- K Hospitality PolicyDocument8 pagesK Hospitality PolicyLinda AliNo ratings yet

- Gift PolicyDocument2 pagesGift PolicySandeepNo ratings yet

- Anti-Corruption and Anti-Bribery Policy PDFDocument6 pagesAnti-Corruption and Anti-Bribery Policy PDFKarthik ChandrasekaranNo ratings yet

- Receipt of Employment Related Gifts Policy: ScopeDocument2 pagesReceipt of Employment Related Gifts Policy: Scopeoair2000No ratings yet

- Anti-Bribery and Anti-Corruption PolicyDocument8 pagesAnti-Bribery and Anti-Corruption Policyrajiv71No ratings yet

- Factors in Determining The Morality of Gift-GivingDocument11 pagesFactors in Determining The Morality of Gift-GivingDarling Mae Cabrera67% (3)

- Anti Bribery and Anti - Corruption Policy.Document9 pagesAnti Bribery and Anti - Corruption Policy.rajiv71No ratings yet

- Giving and Receiving Gifts and Entertainment PolicyDocument3 pagesGiving and Receiving Gifts and Entertainment PolicyHilyn FloresNo ratings yet

- Anti Corruption PolicyDocument6 pagesAnti Corruption PolicyFadhel FebryansyahNo ratings yet

- ABC PolicyDocument6 pagesABC PolicySunil JaglanNo ratings yet

- Gifts Hospitality Tata Industries PolicyDocument5 pagesGifts Hospitality Tata Industries PolicyVikas PratikNo ratings yet

- Gift Giving and BriberyDocument2 pagesGift Giving and BriberyJay Mark Marcial JosolNo ratings yet

- Gift Policy and Procedure 12012018Document10 pagesGift Policy and Procedure 12012018billyplacencia06No ratings yet

- 1 Anti Bribery and Corruption Policy 1.0Document7 pages1 Anti Bribery and Corruption Policy 1.0Sundaramoorthy ArumugamNo ratings yet

- Gifting Policy 2022Document4 pagesGifting Policy 2022charitha sravaniNo ratings yet

- Anti Bribery and Corruption PolicyDocument11 pagesAnti Bribery and Corruption PolicyghtyNo ratings yet

- Gift BanDocument4 pagesGift BanPennCapitalStarNo ratings yet

- Gift and HospitalityDocument6 pagesGift and Hospitalitynikita.a.chavan21No ratings yet

- Anti-Bribery & Corruption Policy TemplateDocument3 pagesAnti-Bribery & Corruption Policy Templatehabiba raisNo ratings yet

- Anti Bribery Corruption PolicyDocument8 pagesAnti Bribery Corruption Policyagyein26No ratings yet

- 1 Anti Bribery and Corruption Policy 1.0Document7 pages1 Anti Bribery and Corruption Policy 1.0RiqoNo ratings yet

- Anti-Bribery & Anti-Corruption PolicyDocument15 pagesAnti-Bribery & Anti-Corruption PolicyPuja Popuri100% (1)

- PLA Anti Bribery and Corruption Policy (17 Dec 13)Document8 pagesPLA Anti Bribery and Corruption Policy (17 Dec 13)CinCan Poenya PiePieNo ratings yet

- Anti Bribery and Corruption PolicyDocument7 pagesAnti Bribery and Corruption PolicyAqua RedNo ratings yet

- Gift Giving and BriberyDocument6 pagesGift Giving and BriberyJulius AlcantaraNo ratings yet

- Case Study 8 Gifts GaloreDocument3 pagesCase Study 8 Gifts Galoreanuni1995No ratings yet

- EES Anti-Bribery & Corruption PolicyDocument3 pagesEES Anti-Bribery & Corruption Policysales infoNo ratings yet

- Anti-Bribery Policy Including Gift & EntertainmentDocument8 pagesAnti-Bribery Policy Including Gift & EntertainmentElmey Bin JulkeplyNo ratings yet

- Sample Code of Conduct & Corporate EthicssDocument10 pagesSample Code of Conduct & Corporate Ethicssjsconrad12No ratings yet

- Anti Bribery Corruption PolicyDocument8 pagesAnti Bribery Corruption PolicySatya TripathiNo ratings yet

- Anti Bribery Corruption PolicyDocument8 pagesAnti Bribery Corruption PolicyBALAJINo ratings yet

- Worldwide Gift and Entertainment Policy - ENGLISH - 06!03!2013Document13 pagesWorldwide Gift and Entertainment Policy - ENGLISH - 06!03!2013Sarvesh AhluwaliaNo ratings yet

- WSP Gifts Entertainment Hospitality Policy enDocument8 pagesWSP Gifts Entertainment Hospitality Policy enTiến Phát TrầnNo ratings yet

- Pronano Technical Services - Anti-Corruption PolicyDocument5 pagesPronano Technical Services - Anti-Corruption PolicyBrendon SavageNo ratings yet

- Code of ConductDocument6 pagesCode of ConductAnonymous Ybtp2iSNo ratings yet

- 1IBF HR Policy - Copy - PPT LastDocument28 pages1IBF HR Policy - Copy - PPT LastAbdul KaderNo ratings yet

- Code of Conduct Do Not'sDocument2 pagesCode of Conduct Do Not'sclmnNo ratings yet

- Gift Policy: ETHICS Handbook 23Document3 pagesGift Policy: ETHICS Handbook 23Way jayNo ratings yet

- Guidelines For The Prevention of Conflicts of Interest and CorruptionDocument6 pagesGuidelines For The Prevention of Conflicts of Interest and CorruptionMahesh PatilNo ratings yet

- The Code of Conduct IS FAIR May 5 DRAFTDocument9 pagesThe Code of Conduct IS FAIR May 5 DRAFTJason FranklinNo ratings yet

- (New) 12 BIL Code of Ethics - 13 04 14Document13 pages(New) 12 BIL Code of Ethics - 13 04 14Dolly ThoguruNo ratings yet

- Fastjet's Anti Bribery and Corruption Policy 1 Policy StatementDocument6 pagesFastjet's Anti Bribery and Corruption Policy 1 Policy StatementSigSigNo ratings yet

- Anti-Bribery Policy: 1. PurposeDocument4 pagesAnti-Bribery Policy: 1. PurposefayazNo ratings yet

- Briefing 3 PDFDocument2 pagesBriefing 3 PDFElle RiveraNo ratings yet

- Anti-Bribery & Anti-Corruption PolicyDocument8 pagesAnti-Bribery & Anti-Corruption PolicyVaishali SinhaNo ratings yet

- Museums Victoria Policy Statement Gifts Benefits Hospitality and Attendance Policy 28 September 2022Document14 pagesMuseums Victoria Policy Statement Gifts Benefits Hospitality and Attendance Policy 28 September 2022dawnNo ratings yet

- Code of Ethics For Purchasing: - Adopted by The Irving City Council, July 9, 2009Document3 pagesCode of Ethics For Purchasing: - Adopted by The Irving City Council, July 9, 2009onc30187No ratings yet

- Corporate Policy Manual On Ethical Conduct Avoidance of Conflict of Interest and Protection of Confidential and ProprietaryDocument20 pagesCorporate Policy Manual On Ethical Conduct Avoidance of Conflict of Interest and Protection of Confidential and ProprietaryLakshmivindo rayalaNo ratings yet

- Lecture 2.2Document4 pagesLecture 2.2barshaadhikari83No ratings yet

- Business Risk Factors: Evaluation and Guidelines for EntrepreneursFrom EverandBusiness Risk Factors: Evaluation and Guidelines for EntrepreneursNo ratings yet

- Gift Vouchers: Everything You Need to Know but Never Thought to Ask: Nitty Gritty MarketingFrom EverandGift Vouchers: Everything You Need to Know but Never Thought to Ask: Nitty Gritty MarketingNo ratings yet

- Success In Franchising: Learn the Secrets of Successful FranchisesFrom EverandSuccess In Franchising: Learn the Secrets of Successful FranchisesRating: 5 out of 5 stars5/5 (1)

- Social Media PolicyDocument3 pagesSocial Media PolicyManager HR Shalya XcellanceNo ratings yet

- Salary Advance PolicyDocument2 pagesSalary Advance PolicyManager HR Shalya XcellanceNo ratings yet

- Promotion Recommendation FormDocument1 pagePromotion Recommendation FormManager HR Shalya XcellanceNo ratings yet

- Long Service Award PolicyDocument2 pagesLong Service Award PolicyManager HR Shalya XcellanceNo ratings yet

- First Aid PolicyDocument8 pagesFirst Aid PolicyManager HR Shalya XcellanceNo ratings yet

- Code of ConductDocument8 pagesCode of ConductManager HR Shalya XcellanceNo ratings yet

- Employee Promotion PolicyDocument4 pagesEmployee Promotion PolicyManager HR Shalya XcellanceNo ratings yet

- Dress Code PolicyDocument4 pagesDress Code PolicyManager HR Shalya XcellanceNo ratings yet

- Birthday Celebration PolicyDocument2 pagesBirthday Celebration PolicyManager HR Shalya XcellanceNo ratings yet

- Business Card PolicyDocument2 pagesBusiness Card PolicyManager HR Shalya XcellanceNo ratings yet

- Exit Interview TemplateDocument3 pagesExit Interview TemplateManager HR Shalya XcellanceNo ratings yet

- Company Vehicle PolicyDocument2 pagesCompany Vehicle PolicyManager HR Shalya XcellanceNo ratings yet

- Handover Document For SalesDocument2 pagesHandover Document For SalesManager HR Shalya XcellanceNo ratings yet

- Shalya Employee Satisfaction Questionnaire 2023Document5 pagesShalya Employee Satisfaction Questionnaire 2023Manager HR Shalya XcellanceNo ratings yet

- Dokumen - Tips - Latihan Soal Sap Finance Lengkap Ada JawabanDocument6 pagesDokumen - Tips - Latihan Soal Sap Finance Lengkap Ada Jawabanurbae chaNo ratings yet

- Car Parts - Picture DictionaryDocument18 pagesCar Parts - Picture Dictionaryabcbaccomhk0% (1)

- 3 - Noynay Vs Citihomes Builder (MACEDA)Document7 pages3 - Noynay Vs Citihomes Builder (MACEDA)Sansa StarkNo ratings yet

- Financial Modelling AssignmentDocument6 pagesFinancial Modelling AssignmentMomin AbrarNo ratings yet

- Coursework Assignment Answer Template: Coursework Assessment Guidelines and Instructions Available On RevisionmateDocument5 pagesCoursework Assignment Answer Template: Coursework Assessment Guidelines and Instructions Available On Revisionmateshams khushtarNo ratings yet

- Petition To LSBC For A Special General Meeting Concerning TWUDocument3 pagesPetition To LSBC For A Special General Meeting Concerning TWUDouglas W. JudsonNo ratings yet

- Mlaw Past Papers Since 2019-1Document107 pagesMlaw Past Papers Since 2019-1JawadNo ratings yet

- Scopic ClauseDocument20 pagesScopic ClausePuneet MishraNo ratings yet

- Chap 2 Cases Full TextDocument28 pagesChap 2 Cases Full TextJica GulaNo ratings yet

- Petitioners Vs Vs Respondents Arturo S. Santos For Petitioners. Conrado R. Mangahas & Associates For RespondentsDocument5 pagesPetitioners Vs Vs Respondents Arturo S. Santos For Petitioners. Conrado R. Mangahas & Associates For RespondentsAudrey DeguzmanNo ratings yet

- EmkayDocument15 pagesEmkayCek IfaNo ratings yet

- Act Company Profile 2016 1Document5 pagesAct Company Profile 2016 1AnkurDagaNo ratings yet

- HP Elitebook Revolve Data SheetDocument4 pagesHP Elitebook Revolve Data SheetAditya BistNo ratings yet

- Performance of Schools Agricultural and Biosystems Engineer Board ExamDocument3 pagesPerformance of Schools Agricultural and Biosystems Engineer Board ExamTheSummitExpress100% (2)

- ESSAY OUTLINE Can Violence Be A Solution To TerrorismDocument3 pagesESSAY OUTLINE Can Violence Be A Solution To Terrorismh1generalpaperNo ratings yet

- STS Lesson 6Document34 pagesSTS Lesson 6Sharina Mhyca SamonteNo ratings yet

- Failure To Detect and Report The Scams That Took Place Involving IL&FS and Its 21 Entities When They Were The Auditors of The IL&FSDocument4 pagesFailure To Detect and Report The Scams That Took Place Involving IL&FS and Its 21 Entities When They Were The Auditors of The IL&FSJay NirupamNo ratings yet

- IrvingCC Packet 2010-02-04Document342 pagesIrvingCC Packet 2010-02-04Irving BlogNo ratings yet

- Perlas Lim Tay vs. Court of AppealsDocument1 pagePerlas Lim Tay vs. Court of AppealsAllenNo ratings yet

- Test Bank Pfrs 15 - CompressDocument44 pagesTest Bank Pfrs 15 - CompressKarren Claire C. VillaNo ratings yet

- Project Integration Management With FIDICDocument8 pagesProject Integration Management With FIDICkmmanoj1968No ratings yet

- Annual Report IndInfravit Trust 1Document183 pagesAnnual Report IndInfravit Trust 1Vikas VidhurNo ratings yet

- First Division (G.R. No. 149261: December 15, 2010) Azucena B. Corpuz, Petitioner, vs. Roman G. Del Rosario, Respondent. Decision Del Castillo, J.Document2 pagesFirst Division (G.R. No. 149261: December 15, 2010) Azucena B. Corpuz, Petitioner, vs. Roman G. Del Rosario, Respondent. Decision Del Castillo, J.Boom ManuelNo ratings yet

- National Form Ucc-1Document4 pagesNational Form Ucc-1AaSima HajjaNo ratings yet

- Article 48A.: Protection and Improvement of Environment and Safeguarding of Forests and Wild LifeDocument7 pagesArticle 48A.: Protection and Improvement of Environment and Safeguarding of Forests and Wild LifeanuNo ratings yet

- Supreme Court of The United States: 1 Cite As: 601 U. S. - (2024) Per CuriamDocument20 pagesSupreme Court of The United States: 1 Cite As: 601 U. S. - (2024) Per CuriamABC News PoliticsNo ratings yet

- Osmeña v. Commission On Elections, 351 Phil. 692 (1998)Document4 pagesOsmeña v. Commission On Elections, 351 Phil. 692 (1998)Samuel John CahimatNo ratings yet