Professional Documents

Culture Documents

Financial Management Assignment Trim 1-2023

Financial Management Assignment Trim 1-2023

Uploaded by

Kafonyi JohnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management Assignment Trim 1-2023

Financial Management Assignment Trim 1-2023

Uploaded by

Kafonyi JohnCopyright:

Available Formats

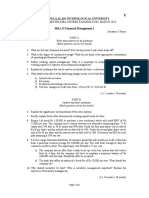

KENYA METHODIST UNIV ERSITY

DEPARTMENT OF BUSINE SS ADMINISTRATION

COURSE CODE: FINA 213/BUSS 321/FINA 201

COURSE TITLE: FINANCIAL MANAGEMENT

INSTRUCTO R: SAM MULI

Instructions

1. Assignment – Due date: Friday 10th March 2023 by 11:59pm

2. Assignment must submitted in hardcopy (Class or Office) or softcopy to Samuel.muli@kemu.ac.ke

3. Copy/paste will earn no points.

Question 1

a) Describe the agency problem between shareholders of a company and each of the following

groups, and for each, identify two ways the problem can be mitigated. (2 marks each)

i) Debtholders

ii) Employees

iii) Society

b) You have been approached for professional advice on what sources of finance are available

for a Startup small business. Briefly describe at least THREE sources you would advise. For

each give at least TWO advantages and TWO disadvantages of the sources mentioned. (14

marks)

Question 2

KK limited has the following capital structure.

Ordinary shares @ sh. 10 each 100,000

10% preference shares of sh. 20 each 50,000

12% debentures of Ksh. 1000 each 50,000

Additional Information:

1) Last year the company had paid a dividend of Ksh. 3.5 per share. Earnings

and dividends are expected to grow at 8% P.a into the future.

Shares are currently trading at Ksh. 25 each.

2) Preference shares are trading at par value.

3) Debentures have a market value of Ksh. 1250 each.

4) Corporation tax rate is 30%

Required:

Calculate:

a) Cost of equity. (5marks)

b) Cost of preference shares. (5marks)

c) Cost of debt. (5marks)

d) Weighted Average Cost of Capital. (5marks)

Question 3

In order to automate its operations, Bima Ltd is proposing to purchasing a packing machine for

Ksh. 950,000/=. Installation costs for the machine will amount to Ksh. 50,000/=. The machine is

expected to have a life of 8 years after which it will have a scrap value of Ksh. 100,000/=. The 8

years are expected to have the following cash flows:

Year Net Cash flows

1 50,000

2 160,000

3 300,000

4 400,000

5 400,000

6 250,000

7 200,000

8 150,000

The cost of capital for Bima is 15% p.a.

Required:

Use the NPV method to advice the company on whether it should proceed to implement the

proposal. (20 marks)

You might also like

- Accounting For E-CommerceDocument44 pagesAccounting For E-CommerceKafonyi John75% (4)

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Document71 pagesQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- An Overview of PFM Act 2015 RegulationDocument28 pagesAn Overview of PFM Act 2015 RegulationKafonyi JohnNo ratings yet

- Pathao: An Emerging Motorcycle-Ride Service in Bangladesh: Southern AsiaDocument12 pagesPathao: An Emerging Motorcycle-Ride Service in Bangladesh: Southern AsiaMuhammad Towfiqul IslamNo ratings yet

- Bfi 300Document3 pagesBfi 300mahmoudfatahabukarNo ratings yet

- 440 Mid 1 - Fall 2020Document21 pages440 Mid 1 - Fall 2020tanvir.ahammad01688No ratings yet

- MAF603-QUESTION TEST 2 - Dec 2018Document4 pagesMAF603-QUESTION TEST 2 - Dec 2018fareen faridNo ratings yet

- Amity International Business School: Industrial Relations Project WorkDocument12 pagesAmity International Business School: Industrial Relations Project WorkTirthangkar TalukdarNo ratings yet

- AL Financial Management May Jun 2014Document2 pagesAL Financial Management May Jun 2014hyp siinNo ratings yet

- AL Financial Management Nov Dec 2013Document4 pagesAL Financial Management Nov Dec 2013hyp siinNo ratings yet

- What Is The Efficient Markets Hypothesis? Explain This Concept in Your Own Words.300 WordsDocument3 pagesWhat Is The Efficient Markets Hypothesis? Explain This Concept in Your Own Words.300 WordsAnil RatnaniNo ratings yet

- Annual Budget For The Operating Costs: Page 1 of 4Document4 pagesAnnual Budget For The Operating Costs: Page 1 of 4swarna dasNo ratings yet

- MTP 17 53 Questions 1710507531Document9 pagesMTP 17 53 Questions 1710507531janasenalogNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- Combined Test 1 QDocument6 pagesCombined Test 1 QSyabil SyahmiNo ratings yet

- PST CL 2015 2023Document88 pagesPST CL 2015 2023Benny MwaloziNo ratings yet

- Financial Management SuggestionsDocument7 pagesFinancial Management SuggestionsSundarNo ratings yet

- CA Inter FM SM RTP May 2024 Castudynotes ComDocument44 pagesCA Inter FM SM RTP May 2024 Castudynotes ComGeo P BNo ratings yet

- Instructions To CandidatesDocument19 pagesInstructions To CandidatesCLIVENo ratings yet

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- ADL 13 Ver2+Document9 pagesADL 13 Ver2+DistPub eLearning Solution100% (1)

- December 2010 Examination: FM12 Financial Management Time: Three Hours Maximum Marks: 100Document5 pagesDecember 2010 Examination: FM12 Financial Management Time: Three Hours Maximum Marks: 100Eashan YadavNo ratings yet

- 2023 JA - FM - QuestionDocument4 pages2023 JA - FM - Questionmiradvance studyNo ratings yet

- UntitledDocument5 pagesUntitledbetty KemNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument8 pagesThis Paper Is Not To Be Removed From The Examination HallsPaul DavisNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- BComDocument3 pagesBComChristy jamesNo ratings yet

- 7ACCN018W - May 2022 AUTHENTIC Assessment - (FINAL VERSION) UPDATED 7 May 2022Document5 pages7ACCN018W - May 2022 AUTHENTIC Assessment - (FINAL VERSION) UPDATED 7 May 2022ZubairLiaqatNo ratings yet

- Cost of CapitalDocument2 pagesCost of CapitalSundarNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument8 pagesInstitute of Actuaries of India: ExaminationsVijaya AgrawalNo ratings yet

- Tutorial Sheet 2Document2 pagesTutorial Sheet 2siamesamuel229No ratings yet

- Acc 501 Midterm Preparation FileDocument22 pagesAcc 501 Midterm Preparation FilesephienoorNo ratings yet

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- Pen & Paper Final Group I SFM April 10 Test 1Document4 pagesPen & Paper Final Group I SFM April 10 Test 1rbhadauria_1No ratings yet

- Workbased Assignment - Financial ManagementDocument2 pagesWorkbased Assignment - Financial Managementsuemwinza0% (1)

- Financial Management-1Document6 pagesFinancial Management-1chelseaNo ratings yet

- Financial Management-P III - Nov 08Document4 pagesFinancial Management-P III - Nov 08gundapolaNo ratings yet

- Ca-Final SFM Question Paper Nov 13Document11 pagesCa-Final SFM Question Paper Nov 13Pravinn_MahajanNo ratings yet

- 65 339549 5886Document1 page65 339549 5886Abdullah AkhtarNo ratings yet

- Project AppraisalDocument2 pagesProject AppraisaltimothyNo ratings yet

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNo ratings yet

- 0126financial and Corporate ReportingDocument6 pages0126financial and Corporate ReportingSmag SmagNo ratings yet

- Tutorial Question 1 (December 2018) : "Electrical Speed Rail Project" With The Government of BruneiDocument5 pagesTutorial Question 1 (December 2018) : "Electrical Speed Rail Project" With The Government of Bruneihannacute0% (1)

- Exercise 9 (15 Jan 2023)Document3 pagesExercise 9 (15 Jan 2023)Teo ShengNo ratings yet

- CF1 Homework 4Document2 pagesCF1 Homework 4Rudine Pak MulNo ratings yet

- 5_6172219306907012723Document6 pages5_6172219306907012723ap.quatrroNo ratings yet

- MAF603-QUESTION TEST 2 - Nov 2019Document3 pagesMAF603-QUESTION TEST 2 - Nov 2019fareen faridNo ratings yet

- FM MITSoB Capital - Budgeting Exercises)Document3 pagesFM MITSoB Capital - Budgeting Exercises)Saket SumanNo ratings yet

- Use of Statistical Tables PermittedDocument2 pagesUse of Statistical Tables PermittedPAVAN KUMARNo ratings yet

- FM PP 1 PDFDocument3 pagesFM PP 1 PDFRavichandraNo ratings yet

- BWFF 2023Document21 pagesBWFF 2023Skuan TanNo ratings yet

- MB0029 Financial ManagementDocument2 pagesMB0029 Financial ManagementGP GILLNo ratings yet

- MAF603 COC - StudentsDocument12 pagesMAF603 COC - StudentsZoe McKenzieNo ratings yet

- CBCS 3.3.1 Indian Financial System 2020Document2 pagesCBCS 3.3.1 Indian Financial System 2020Bharath MNo ratings yet

- Trimester 2 Financial Management I March 2016Document2 pagesTrimester 2 Financial Management I March 2016sam vargheseNo ratings yet

- Corporate Financing Decisions, Fall 2016Document4 pagesCorporate Financing Decisions, Fall 2016Ashok BistaNo ratings yet

- BFC 3226 Introduction To Financial Management - 5Document3 pagesBFC 3226 Introduction To Financial Management - 5karashinokov siwoNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Harmonizing Power Systems in the Greater Mekong Subregion: Regulatory and Pricing Measures to Facilitate TradeFrom EverandHarmonizing Power Systems in the Greater Mekong Subregion: Regulatory and Pricing Measures to Facilitate TradeNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- Small Money Big Impact: Fighting Poverty with MicrofinanceFrom EverandSmall Money Big Impact: Fighting Poverty with MicrofinanceNo ratings yet

- The Comprehensive Guide for Minority Tech Startups Securing Lucrative Government Contracts, Harnessing Business Opportunities, and Achieving Long-Term SuccessFrom EverandThe Comprehensive Guide for Minority Tech Startups Securing Lucrative Government Contracts, Harnessing Business Opportunities, and Achieving Long-Term SuccessNo ratings yet

- Product Mix EssayDocument4 pagesProduct Mix EssayKafonyi JohnNo ratings yet

- Auditors Report On Financial StatementsDocument6 pagesAuditors Report On Financial StatementsKafonyi JohnNo ratings yet

- Bba 400 Module Revised 2017 April To DsvolDocument68 pagesBba 400 Module Revised 2017 April To DsvolKafonyi JohnNo ratings yet

- Auditors Report On Financial StatementsDocument6 pagesAuditors Report On Financial StatementsKafonyi JohnNo ratings yet

- Auditors Report On Financial StatementDocument4 pagesAuditors Report On Financial StatementKafonyi JohnNo ratings yet

- Worksheet For Means With SolutionsDocument13 pagesWorksheet For Means With SolutionsKafonyi John100% (1)

- Application of Ethical Principles To A Fraud InvestigationDocument2 pagesApplication of Ethical Principles To A Fraud InvestigationKafonyi John100% (1)

- Atd TaxDocument4 pagesAtd TaxKafonyi JohnNo ratings yet

- Principles of BankingDocument3 pagesPrinciples of BankingKafonyi JohnNo ratings yet

- TUK Joining InstructionDocument19 pagesTUK Joining InstructionKafonyi JohnNo ratings yet

- Writing A Research Paper WYNN Lesson Plan: Read HighlightDocument3 pagesWriting A Research Paper WYNN Lesson Plan: Read HighlightKafonyi JohnNo ratings yet

- Student'S Attachment Log-Book: P.O BOX 56808,-00200, NAIROBI TEL (254) 020 8566177,8561803 FAX (020) 8561077 EmailDocument26 pagesStudent'S Attachment Log-Book: P.O BOX 56808,-00200, NAIROBI TEL (254) 020 8566177,8561803 FAX (020) 8561077 EmailKafonyi JohnNo ratings yet

- BAF 4101 Financial Statement AnalysisDocument5 pagesBAF 4101 Financial Statement AnalysisKafonyi JohnNo ratings yet

- Modelling and ForecastingDocument4 pagesModelling and ForecastingKafonyi JohnNo ratings yet

- DemandDocument32 pagesDemandKafonyi JohnNo ratings yet

- Theory of ProductionDocument24 pagesTheory of ProductionKafonyi John100% (1)

- Partnership Act 1961 1Document17 pagesPartnership Act 1961 1Pragasam GanaNo ratings yet

- 15 Job and Contract CostingDocument6 pages15 Job and Contract CostingLakshay SharmaNo ratings yet

- Chapter 4 - MCQDocument2 pagesChapter 4 - MCQgihan.fernan87No ratings yet

- The Impact of Advertisement On Consumer Buying Behavior in Electronic IndustryDocument9 pagesThe Impact of Advertisement On Consumer Buying Behavior in Electronic Industryshaiqua TashbihNo ratings yet

- BCG - Senior Knowledge Analyst - TMT - The Boston Consulting GroupDocument4 pagesBCG - Senior Knowledge Analyst - TMT - The Boston Consulting GroupRishiNo ratings yet

- Week-05 - 06 Opportunity Spotting and Opportunity EvaluationDocument12 pagesWeek-05 - 06 Opportunity Spotting and Opportunity EvaluationiqraNo ratings yet

- Practice For Accounting TestDocument5 pagesPractice For Accounting TestNikki MathysNo ratings yet

- A CASE STUDY OF EVEREST BANK LIMITED Mbs ThesisDocument74 pagesA CASE STUDY OF EVEREST BANK LIMITED Mbs Thesisशिवम कर्ण100% (1)

- 01.stabilization Index 20110502 Rev 3Document547 pages01.stabilization Index 20110502 Rev 3Vinoth SivaperumalNo ratings yet

- 930pm - 124.EPRA JOURNALS 7964Document3 pages930pm - 124.EPRA JOURNALS 7964GUNALSIVA VNo ratings yet

- Auditing Dan AtestasiDocument7 pagesAuditing Dan AtestasiYudiantoNo ratings yet

- Master Budget: Sales ForecastDocument61 pagesMaster Budget: Sales ForecastLay TekchhayNo ratings yet

- Plumpton Leisure CenterDocument2 pagesPlumpton Leisure CenterDaine Thomas Jr.50% (2)

- Business PlanDocument15 pagesBusiness PlanangelNo ratings yet

- Module Outline SEM 1 2023-2024 FIN (1) (1) Updated Aug 28 2023 (4) FiinnnDocument5 pagesModule Outline SEM 1 2023-2024 FIN (1) (1) Updated Aug 28 2023 (4) FiinnnKristianNo ratings yet

- Quizlet - SOM 122 Chapter 5 - ManagementDocument3 pagesQuizlet - SOM 122 Chapter 5 - ManagementBob KaneNo ratings yet

- 1 Chapter 1 Linear Equeation EditedDocument9 pages1 Chapter 1 Linear Equeation EditeduuuNo ratings yet

- Women EntrepreneurDocument11 pagesWomen Entrepreneursankum7578No ratings yet

- Accounting: Accounting or Accountancy Is TheDocument7 pagesAccounting: Accounting or Accountancy Is TheMarius AlexandruNo ratings yet

- Ramdeobaba Nagpur CAP 1 MBA CET 2020 Cutoffs MarksDocument12 pagesRamdeobaba Nagpur CAP 1 MBA CET 2020 Cutoffs MarksakuamarinemidNo ratings yet

- Book Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596Document2 pagesBook Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596FirdaNo ratings yet

- FIN 330 Final Project IIDocument7 pagesFIN 330 Final Project IISarai SternzisNo ratings yet

- San Miguel CorporationDocument360 pagesSan Miguel CorporationCharmaine Magdangal50% (2)

- Proverbs About MoneyDocument1 pageProverbs About MoneyZhe Yuan NgeNo ratings yet

- PagesDocument52 pagesPagesnitty shiggersNo ratings yet

- Engagement Opportunities Guide: February 2020Document15 pagesEngagement Opportunities Guide: February 2020branislava1301No ratings yet

- A Guide To Risk Assessment in Ship OperationsDocument6 pagesA Guide To Risk Assessment in Ship OperationsDmytro OparivskyNo ratings yet

- Live Seminar RichesDocument50 pagesLive Seminar RichesFelipe EnsNo ratings yet

- Bicicletas de Carga Como Vehículos de Transporte para El Tráfico Urbano de CargaDocument23 pagesBicicletas de Carga Como Vehículos de Transporte para El Tráfico Urbano de CargaDaniela CelyNo ratings yet