Professional Documents

Culture Documents

BML 304 CAT MAY-AUG 2024

BML 304 CAT MAY-AUG 2024

Uploaded by

mercymunyori290 ratings0% found this document useful (0 votes)

3 views4 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views4 pagesBML 304 CAT MAY-AUG 2024

BML 304 CAT MAY-AUG 2024

Uploaded by

mercymunyori29Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

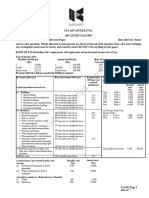

BML 304- TAXATION CAT

MAY-AUGUST 2024

INSTRUCTIONS:

1. Use Times New Roman font type.

2. Font size 12

3. MINIMUM number of pages for CAT should be between 5 & 10 pages and for

WBA should be between 5 & 10 pages.

4. Clearly show the beginning of every new concept by using paragraphs.

5. Have a cover page that shows Name of University, students full name, student

Admission number, Unit title, Unit code, nature of assignment (CAT or WBA),

Lecturers name, Semester and Year

6. Use APA style –Reference & Citation

7. Use clear examples.

8. Use Ideas from the Notes presented & enhance your assignment by undertaking

a comprehensive research using material in the University Library, off campus

library material or any other reference material relevant to this course. Copy

pasting will lead to an automatic zero for the students involved.

9. All Students must hand in a soft copy through Moodle online system

10. No assignment will be accepted after the due date. Deadline for submission is

14th June 2024.

QUESTION ONE

Read the Case Study below carefully and answer the questions that follow.

COMMISSIONER’S PRESCRIBED BENEFIT RATES (EXTRACT FROM PAYE

GUIDE)

A SERVICES

Monthly Rates Annual Rates

(Ksh) (Ksh)

Electricity (communal or from a generator) 1,500 18,000

Water (communal or from a borehole) 500 6,000

Provision of furniture (1% of cost to employer). If

hired, the cost of hire should be brought to charge

Telephone (Landline and Mobile Phones) 30% of bills

B AGRICULTURAL EMPLOYEES REDUCED RATES OF BENEFITS

Monthly Rates Annual Rates

(Ksh) (Ksh)

Water 200 2,400

Electricity 900 10,800

RESIDENTS INDIVIDUAL INCOME TAX RATES AND RELIEF – EFFECTIVE 1ST

JANUARY 2017 (KRA PUBLIC NOTICE BASED ON FINANCE ACT 2016)

TAX BANDS ON ANNUAL INCOME TAX RATES

On the first shs 134,164 10 %

On the next shs 126,403 15 %

On the next shs 126,403 20 %

On the next shs 126,403 25 %

On all income over shs 513,373 30 %

Personal Relief shs 15,360 Per Annum

Use the above sets of information together with the knowledge of Taxation you have

acquired to answer the following questions:

Mr. ABC is an employee, businessman and investor. His emoluments, benefits and

other incomes and expenses from various sources were as follows during the years of

income shown below:

i) Employment income and expenses per annum

Year 2017 Year 2018 Year 2019

Ksh. Ksh. Ksh.

Basic salary 400,000 460,000 500,000

Electricity bill (paid by employer) 14,000 17,000 20,000

Bus fare expenses (to and from work) 18,000 20,000 23,000

Pension contributions by Self 40,000 46,000 50,000

Pension contributions by Employer 40,000 46,000 50,000

Contributions to Home Ownership

Savings Plan (HOSP) in registered

Insurance company 40,000 50,000 60,000

ii) Business income and expenses (Sole proprietorship)

Year 2017 Year 2018 Year 2019

Ksh. Ksh. Ksh.

Gross profit 180,000 360,000 420,000

Expenses:

Salaries and wages 100,000 120,000 160,000

Rent and rates 30,000 50,000 70,000

Tax penalties by KRA 10,000 - 20,000

Selling and distribution expenses 60,000 80,000 100,000

Bad debts written off 10,000 30,000 20,000

Provision for doubtful debts (2.5% of

Trade debtors) 20,000 30,000 50,000

iii) Other incomes

Year 2017 Year 2018 Year 2019

Ksh. Ksh. Ksh.

Interest income (net):

From XYZ bank fixed deposit 25,000 35,000 30,000

From Kenya Postbank 8,000 10,000 15,000

Dividend income (net) 12,000 18,000 20,000

Required:

a) Evaluate Mr. ABC's total taxable income for each of the years 2017, 2018 and 2019.

(16 Marks)

b) Compute the tax payable by Mr. ABC on his total taxable income for each of the

years 2017, 2018 and 2019. (6 Marks)

c) Comment on any three (3) items not used in (a) above giving the reason thereof for

each. (3 Marks)

You might also like

- 9.2 Assignment - Allowable DeductionsDocument5 pages9.2 Assignment - Allowable Deductionssam imperialNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Tax 2Document128 pagesTax 2valentine mutunga0% (3)

- AP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document10 pagesAP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Bernadette Panican100% (1)

- Economics: Market ScenariosDocument3 pagesEconomics: Market ScenariosOsiris HernandezNo ratings yet

- Instructions: Choose The BEST Answer For Each of The Following ItemsDocument18 pagesInstructions: Choose The BEST Answer For Each of The Following ItemsVaughn TheoNo ratings yet

- PGP I 2021 Fra Quiz 1Document3 pagesPGP I 2021 Fra Quiz 1Pulkit SethiaNo ratings yet

- Midterm Departmental ExaminationDocument6 pagesMidterm Departmental ExaminationCrizzalyn Cruz100% (1)

- TaxationDocument3 pagesTaxationIshika PansariNo ratings yet

- Bsa Quiz 2.0 - Pure ProbsDocument4 pagesBsa Quiz 2.0 - Pure ProbsCyrss BaldemosNo ratings yet

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- PST AT 2015 2023Document110 pagesPST AT 2015 2023nataliecheung324No ratings yet

- AFA End Examination 2021-2022Document6 pagesAFA End Examination 2021-2022sebastian mlingwaNo ratings yet

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

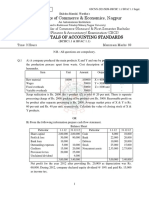

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- TaxationDocument6 pagesTaxationAlexa ParkNo ratings yet

- M.B.A (2016 Pattern)Document39 pagesM.B.A (2016 Pattern)Radha ChoudhariNo ratings yet

- Tutorial - BudgetingDocument7 pagesTutorial - BudgetingKimberly AsanteNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- 01.PGDTM 303 (B) - Tax Practices (Direct and Indirect Taxation) - Class No. 01Document3 pages01.PGDTM 303 (B) - Tax Practices (Direct and Indirect Taxation) - Class No. 01Md. Abu NaserNo ratings yet

- Mam2e 72221Document8 pagesMam2e 72221priyanehasahaNo ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- Sunil Panda Commerce Classes: Before Exam Practice Questions For Term 2 Boards Accounts-Not For Profit OrganisationDocument3 pagesSunil Panda Commerce Classes: Before Exam Practice Questions For Term 2 Boards Accounts-Not For Profit OrganisationHigi SNo ratings yet

- ACCOUNTANCY - II MID - Quastion PaperDocument6 pagesACCOUNTANCY - II MID - Quastion PaperveenaNo ratings yet

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- AFM-CFS ProblemsDocument10 pagesAFM-CFS ProblemskanikaNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Document24 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Madhuram SharmaNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- Financial Accounting 3.1Document6 pagesFinancial Accounting 3.1Tawanda HerbertNo ratings yet

- Business TaxationDocument4 pagesBusiness Taxationshejal naikNo ratings yet

- Exercise Problems SECTION-A (6 Marks) : Page - 1Document14 pagesExercise Problems SECTION-A (6 Marks) : Page - 1Saa RaaNo ratings yet

- Financial Accounting 3.2Document7 pagesFinancial Accounting 3.2Tawanda HerbertNo ratings yet

- Govt Acctg 1234Document5 pagesGovt Acctg 1234taylor swiftyyyNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Paper 16Document5 pagesPaper 16VijayaNo ratings yet

- Management Accounting PAPERDocument7 pagesManagement Accounting PAPERtemailggNo ratings yet

- 92 08 DeductionsDocument18 pages92 08 DeductionsNikkoNo ratings yet

- Miscellaneous TopicsDocument93 pagesMiscellaneous Topicsgean eszekeilNo ratings yet

- Css Accountancy2 2018 PDFDocument2 pagesCss Accountancy2 2018 PDFMaria NazNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Financial Plan: and Economic ChallengesDocument5 pagesFinancial Plan: and Economic ChallengesEmmanuel AkoloNo ratings yet

- RA - M16UCM12 - B.Com. - 24.03.2021 - FNDocument4 pagesRA - M16UCM12 - B.Com. - 24.03.2021 - FNkavinilavan14072004No ratings yet

- AMF 2202 Test 2 2022-2023 - 221111 - 085401Document3 pagesAMF 2202 Test 2 2022-2023 - 221111 - 085401mugenyi DixonNo ratings yet

- Assignment QuestionsDocument3 pagesAssignment QuestionsKARTIK CHADHANo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Sri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - V (UNIT-V)Document9 pagesSri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - V (UNIT-V)Jaya BharneNo ratings yet

- 2020 Acc 410 Test 1Document8 pages2020 Acc 410 Test 1Kesa Metsi100% (1)

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- DEATH OF A PARTNER Intro and Sum-6Document6 pagesDEATH OF A PARTNER Intro and Sum-6gankNo ratings yet

- AP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document5 pagesAP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Fella GultianoNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- 8th Homework FAR 1Document3 pages8th Homework FAR 1Ahmed RazaNo ratings yet

- Industrialization Reading Comprehension Primary Source Readings With Questions Ron WoolleyDocument10 pagesIndustrialization Reading Comprehension Primary Source Readings With Questions Ron WoolleyTeodoro RanqueNo ratings yet

- Aceh Investment Opportunities-2018 PDFDocument122 pagesAceh Investment Opportunities-2018 PDFRizwanda RizwandaNo ratings yet

- Levy and Charges of GSTDocument16 pagesLevy and Charges of GSTMoosa ZaidiNo ratings yet

- Resources and Trade: The Heckscher-Ohlin ModelDocument43 pagesResources and Trade: The Heckscher-Ohlin ModelDharmajaya SoetotoNo ratings yet

- Asif Aziz Challan PrintChallanDocument1 pageAsif Aziz Challan PrintChallanAdeelBaigNo ratings yet

- 16 Candlestick PatternsDocument18 pages16 Candlestick Patternsarjun crastoNo ratings yet

- Assignment 1 WorkingDocument9 pagesAssignment 1 WorkingUroosa VayaniNo ratings yet

- Pricelist DynastyDocument3 pagesPricelist DynastyRohit ChhabraNo ratings yet

- YHZS60 Concrete Mixing Plant (Mechanical Part)Document60 pagesYHZS60 Concrete Mixing Plant (Mechanical Part)aia.ingenierosNo ratings yet

- Business Studies Form 1 Schemes of WorkDocument11 pagesBusiness Studies Form 1 Schemes of WorkDavi Kapchanga KenyaNo ratings yet

- The Basic Economic Problem: Section IDocument10 pagesThe Basic Economic Problem: Section IhbuzdarNo ratings yet

- The Lobster Fiefs Economic and Ecological EffectsDocument25 pagesThe Lobster Fiefs Economic and Ecological EffectsPerdi AdjiNo ratings yet

- Goods & Services Tax Invoice Insurance Invoice (Labour)Document1 pageGoods & Services Tax Invoice Insurance Invoice (Labour)Deepak SharmaNo ratings yet

- Part VI Civil ProcedureDocument3 pagesPart VI Civil Procedurexeileen08No ratings yet

- Prefinal Exams Actg 6100Document7 pagesPrefinal Exams Actg 6100Kim BrionesNo ratings yet

- 56 ETA 10 0425 FM X5 3+editionDocument28 pages56 ETA 10 0425 FM X5 3+editionFletcher VazNo ratings yet

- Photograph EssayDocument8 pagesPhotograph EssayHarjas MalhiNo ratings yet

- TD 513796-EnDocument13 pagesTD 513796-EnIT TLiNo ratings yet

- L1 - L2 - Lifts and Escalators - 2023 PDFDocument55 pagesL1 - L2 - Lifts and Escalators - 2023 PDFKapele Bruce TshepisoNo ratings yet

- Profit Sharing ASSIGNMENTDocument4 pagesProfit Sharing ASSIGNMENTRoldan AzueloNo ratings yet

- The WTO Agreement On Agriculture: RightsDocument20 pagesThe WTO Agreement On Agriculture: Rightsfasil tarekegnNo ratings yet

- Problem 11-1 Given: (Refer To Book) Required:: Date Payment 9% Interest Principal Present ValueDocument2 pagesProblem 11-1 Given: (Refer To Book) Required:: Date Payment 9% Interest Principal Present ValueDominic RomeroNo ratings yet

- (POL) Paper Set - 1 (E)Document4 pages(POL) Paper Set - 1 (E)New Prestige WelfareNo ratings yet

- Files - Downloads - 06072015 - List of Registered Homoeopathy Doctors With Concerned Remark Updated Till 01-07-2015-RegNo-55001-60000Document1,540 pagesFiles - Downloads - 06072015 - List of Registered Homoeopathy Doctors With Concerned Remark Updated Till 01-07-2015-RegNo-55001-60000Siddhesh AdamNo ratings yet

- Imperfectly Competitive Markets: Imperfect Heterogenous Not All Price TakersDocument19 pagesImperfectly Competitive Markets: Imperfect Heterogenous Not All Price TakersRomit BanerjeeNo ratings yet

- DuoyuanGlobalWaterInc AR2009Document130 pagesDuoyuanGlobalWaterInc AR2009Timothy ChklovskiNo ratings yet

- Additional CasesDocument2 pagesAdditional CasesJeraldine Mae RaotraotNo ratings yet

- UPOREDNI PREGLED Reci Za Bilans StanjaDocument78 pagesUPOREDNI PREGLED Reci Za Bilans StanjaDragan BearaNo ratings yet

- SUMMARY PROJECT FixDocument4 pagesSUMMARY PROJECT FixMas DaniNo ratings yet