Professional Documents

Culture Documents

26QB Seller Details

26QB Seller Details

Uploaded by

suniloffcOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

26QB Seller Details

26QB Seller Details

Uploaded by

suniloffcCopyright:

Available Formats

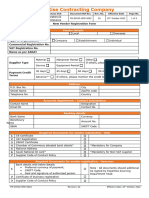

Dashboard e-Pay Tax e-Pay Tax

2 3 4

Add Buyer Add Seller Add Property Add

DetailsAdd Details Transferred Payment

Seller Details Details Details

New Payment

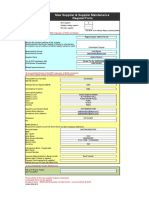

PAN: AXAPS5459A

Please note that if the seller’s PAN is inoperative, then a higher rate of TDS will be deductible in accordance with section 206AA of the Income-tax Act, 1961

read with CBDT Notification No. 15 of 2023 dated 28th March 2023 and Circular No.3 of 2023 dated 28th March 2023.

Please verify the status of PAN by accessing “Verify PAN Status” Pre-login service available under ‘Quick Links’ on e-Filing portal. Please make sure to

mention the correct amount of TDS.

* Indicates mandatory fields

Residential Status of the Seller

Resident Non Resident

1 4 : 5 0 Skip to main content

PAN of Seller * menu Confirm PAN * call language

Call expand_more English

menu

Us expand_more

Aadhaar Number of Seller

Name of Seller Category of PAN

Address details

Country *

India

Flat / Door / Building * Road / Street / Block / Sector

PIN Code *

Post Office Area/Locality

District State

Mobile Number * Email ID *

Whether more than one Seller *

Yes No

Please fill another Form 26QB for co-seller share

Back Save as Draft Continue

Feedback Website Policies Site Map Browser Support Accessibility Statement CoBrowse Help

india.gov.in Last reviewed and updated on : 6-Jun-2024

national portal of india

This site is best viewed in 1024 * 768 resolution with latest version of Chrome, Firefox, Safari and Internet Explorer.

Copyright Ⓒ Income Tax Department, Ministry of Finance, Government of India. All Rights Reserved

You might also like

- New Property TDSDocument2 pagesNew Property TDSHariKrishnaNo ratings yet

- Log Book For Finance Summer InternshipDocument2 pagesLog Book For Finance Summer Internshiptanisha kumar0% (1)

- The General Ledger of Zips Storage at January 1 2018Document2 pagesThe General Ledger of Zips Storage at January 1 2018Amit PandeyNo ratings yet

- 26qb Property DetailsDocument2 pages26qb Property DetailssuniloffcNo ratings yet

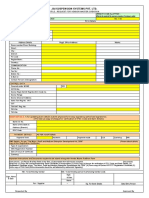

- Vendor Registration Form V.8.0-2021Document6 pagesVendor Registration Form V.8.0-2021vyanshijainNo ratings yet

- 1 - ENet Application FormDocument6 pages1 - ENet Application FormSahil RajputNo ratings yet

- Manju PDFDocument2 pagesManju PDFharshit gargNo ratings yet

- Vendor Creation Request Form Terbaru - 21 April 2017Document2 pagesVendor Creation Request Form Terbaru - 21 April 2017Rafika LubisNo ratings yet

- Vendor Declaration FormDocument2 pagesVendor Declaration FormMuazzamAliNo ratings yet

- Uribapplicationform 39694878 PDFDocument3 pagesUribapplicationform 39694878 PDFsheelkumar belekarNo ratings yet

- Please DocuSign CAF v100 PhoenixDocument4 pagesPlease DocuSign CAF v100 PhoenixJf LarongNo ratings yet

- Folio Details of 36228725Document4 pagesFolio Details of 36228725sahusushila096No ratings yet

- Ghisulalji JainDocument2 pagesGhisulalji JainManish HedaNo ratings yet

- Vendor Master Registration Form: Creditor Name Payee NameDocument1 pageVendor Master Registration Form: Creditor Name Payee NameArun EthirajNo ratings yet

- Registration Form - Market Place: Shop Details Contact PersonDocument2 pagesRegistration Form - Market Place: Shop Details Contact PersonKumar K MudaliarNo ratings yet

- Application Form For BCsDocument2 pagesApplication Form For BCsAbhijit SingNo ratings yet

- FM-DIV03-MPD-0002-New Vendor Registration Form-KSA and OverseasDocument3 pagesFM-DIV03-MPD-0002-New Vendor Registration Form-KSA and OverseasShakeer PttrNo ratings yet

- 3-5 Dec, 2022Document34 pages3-5 Dec, 2022Faiq MurtazaNo ratings yet

- Vendor Master Request Form Ctrireapinya: Beverages Myanmar LTDDocument1 pageVendor Master Request Form Ctrireapinya: Beverages Myanmar LTDRichard ZawNo ratings yet

- Infocom Network LTD Onl Inv 2023-2024 274666Document4 pagesInfocom Network LTD Onl Inv 2023-2024 274666dbind1999No ratings yet

- Customer Application FormDocument4 pagesCustomer Application Formoeruel bautistaNo ratings yet

- Supplier Information: Supplier Registration & Authorization FormDocument2 pagesSupplier Information: Supplier Registration & Authorization FormVeer RajputeNo ratings yet

- Income Tax Portal, Government of India Link Aadhar PageDocument1 pageIncome Tax Portal, Government of India Link Aadhar PageofficialshahidulislamNo ratings yet

- Account Details Addition / Modification Request Form (KRA / Trading / DP A/c)Document1 pageAccount Details Addition / Modification Request Form (KRA / Trading / DP A/c)Pankaj AgarwalNo ratings yet

- Credit Note and Debit Note Under GST - Masters IndiaDocument5 pagesCredit Note and Debit Note Under GST - Masters Indiaarun alwaysNo ratings yet

- UntitledDocument2 pagesUntitledsharukNo ratings yet

- Aastha Realtors Vendor FormDocument2 pagesAastha Realtors Vendor Formshibani thomasNo ratings yet

- IO'22Document2 pagesIO'22Saksham SinhaNo ratings yet

- New Vendor Code Creation / Change Form For ServiceDocument2 pagesNew Vendor Code Creation / Change Form For ServiceJyotsana VyasNo ratings yet

- Distributor Transfer Request Form: Locus Telecommunications, LLCDocument1 pageDistributor Transfer Request Form: Locus Telecommunications, LLCGlendaNo ratings yet

- Form 26QB: Your E-Tax Acknowledgement Number Is AI1640575Document2 pagesForm 26QB: Your E-Tax Acknowledgement Number Is AI1640575PATAN ELAKATHNo ratings yet

- Direct Customer FormDocument1 pageDirect Customer FormGurudas KadamNo ratings yet

- Vendor ManualDocument10 pagesVendor ManualSandeep SinghNo ratings yet

- Easypay Form: Company ParticularsDocument3 pagesEasypay Form: Company Particularsanirban royNo ratings yet

- Vendor Maintenance Form Proalco: All Requests Affecting Payment Info Need BACKUP From Vendor!!Document6 pagesVendor Maintenance Form Proalco: All Requests Affecting Payment Info Need BACKUP From Vendor!!Elena Escorcia AlmanzaNo ratings yet

- LPG SUBSIDYCustomer SupportDocument1 pageLPG SUBSIDYCustomer SupportDeenesh DoleyNo ratings yet

- Date Merchant Name: Reason For AdjustmentDocument1 pageDate Merchant Name: Reason For AdjustmentDada Baraniano PandaanNo ratings yet

- Client Registration Form: IndividualDocument23 pagesClient Registration Form: IndividualAshutosh IndNo ratings yet

- Eb 5887Document1 pageEb 5887Kevin Ray BajadoNo ratings yet

- BPCF KCR Placement - Signed ASzDocument5 pagesBPCF KCR Placement - Signed ASzAJay MJNo ratings yet

- Flow For Online On-Boarding - For CP Clients - v1.0Document22 pagesFlow For Online On-Boarding - For CP Clients - v1.0sidhesh randhaveNo ratings yet

- 723156E6C36ADocument1 page723156E6C36AWilliam MirandaNo ratings yet

- Account Details Addition / Modification Request Form (Trading & DP A/c)Document1 pageAccount Details Addition / Modification Request Form (Trading & DP A/c)vickyNo ratings yet

- Resident Individual Account Opening Form For Trading and Demat AccountDocument16 pagesResident Individual Account Opening Form For Trading and Demat AccountCHITA RANJAN GHADAINo ratings yet

- APEC - Vendor Form v2.6Document2 pagesAPEC - Vendor Form v2.6Sanjeev AroraNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Avinash Kumar ChoudharyNo ratings yet

- Sa1236372149266831 - 23om27in00003755 - Aditya Raj - 21-05-2023Document2 pagesSa1236372149266831 - 23om27in00003755 - Aditya Raj - 21-05-2023adityaNo ratings yet

- Checkout QuickPayESuccessDocument1 pageCheckout QuickPayESuccessmonsterballtradingNo ratings yet

- CUAD Request For Certification Required by Utility Company - CCD 2 13 15Document1 pageCUAD Request For Certification Required by Utility Company - CCD 2 13 15Caren UnidoNo ratings yet

- Corporate Account FormDocument6 pagesCorporate Account FormHari HseNo ratings yet

- Supplier Record Update Request FormDocument1 pageSupplier Record Update Request FormBlessings MusukwaNo ratings yet

- Quicklink Networks Janitor Imbs 2.0Document1 pageQuicklink Networks Janitor Imbs 2.0Vrujesh BhattNo ratings yet

- ApplicationformDocument2 pagesApplicationformdk100% (2)

- Account Opening Form: Client Code Client Name CDSL IdDocument21 pagesAccount Opening Form: Client Code Client Name CDSL IdUtkarsh Kumar LahareNo ratings yet

- Vendor - Form CopDocument1 pageVendor - Form CopMaaz KhanNo ratings yet

- 1Document2 pages1Sahil HasanNo ratings yet

- Sample Vendor FormDocument2 pagesSample Vendor Formarjunav41No ratings yet

- Vendor Info Sheet-NONFOODDocument1 pageVendor Info Sheet-NONFOODwinbanagaNo ratings yet

- Master Data ManagementDocument3 pagesMaster Data ManagementdefinitisolutionsNo ratings yet

- INV-066786 Proforma InvoiceDocument1 pageINV-066786 Proforma Invoicek.s5520No ratings yet

- Form 68Document1 pageForm 68ombirdahiaNo ratings yet

- InvoiceDocument3 pagesInvoicemukeshNo ratings yet

- Mccann 2004 - Best Places': Interurban Competition, Quality of Life and Popular Media DiscourseDocument22 pagesMccann 2004 - Best Places': Interurban Competition, Quality of Life and Popular Media DiscourseRicardo Hernández MonteroNo ratings yet

- Inv 005641212Document2 pagesInv 005641212m.muhaimenul.islam98No ratings yet

- Suggestions On Economics-2 PDFDocument37 pagesSuggestions On Economics-2 PDFritam chakrabortyNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument17 pagesU.S. Individual Income Tax Return: Filing StatusCristian BurnNo ratings yet

- Documento de Propiedad en Texas, Estados UnidosDocument1 pageDocumento de Propiedad en Texas, Estados UnidosArmandoInfoNo ratings yet

- Bçì Êçç QK Dçåò Äéò Åç Oçë Êáç Dêéöçêáç J Å Ë ÅDocument60 pagesBçì Êçç QK Dçåò Äéò Åç Oçë Êáç Dêéöçêáç J Å Ë ÅmarielNo ratings yet

- Final ThesisDocument50 pagesFinal ThesisSital MaharaNo ratings yet

- Yash Material BillDocument2 pagesYash Material Billbenson9No ratings yet

- Financial Market and Portfolio Management Assignment 2Document6 pagesFinancial Market and Portfolio Management Assignment 2leeroy mekiNo ratings yet

- IFAP Newsletter April 2011Document54 pagesIFAP Newsletter April 2011Shakir Mahboob KhanNo ratings yet

- E-Accounting-and-E-Taxation-E-GST-Tally+ (Free) SAP FICO Course PDFDocument12 pagesE-Accounting-and-E-Taxation-E-GST-Tally+ (Free) SAP FICO Course PDFVIKAS GUPTANo ratings yet

- DRAFT AG InvestigationDocument44 pagesDRAFT AG InvestigationRobert GehrkeNo ratings yet

- Thesis Statement On Government SpendingDocument4 pagesThesis Statement On Government Spendingkcfxiniig100% (1)

- Innovations in Telecom IndustryDocument6 pagesInnovations in Telecom IndustryGopesh VirmaniNo ratings yet

- Questions and Guide For EntrepreneurshipDocument45 pagesQuestions and Guide For EntrepreneurshipNsemi NsemiNo ratings yet

- Take Home Quiz Income TaxationDocument5 pagesTake Home Quiz Income TaxationMae Astoveza100% (3)

- Mukesh Electric & Hardware Stores: Tax InvoiceDocument1 pageMukesh Electric & Hardware Stores: Tax Invoiceshafi shaikh100% (2)

- The Effect of Tax Officer Services, Tax Knowledge and Tax Sanctions On Taxpayer Perceptions of Land Tax Payment Compliance For Rural and Urban Bildings of Musi Banyuasin RegencyDocument6 pagesThe Effect of Tax Officer Services, Tax Knowledge and Tax Sanctions On Taxpayer Perceptions of Land Tax Payment Compliance For Rural and Urban Bildings of Musi Banyuasin RegencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- V6 After Budget 2023 New Tax Regime Vs Old Tax RegimeDocument20 pagesV6 After Budget 2023 New Tax Regime Vs Old Tax RegimegunagaliNo ratings yet

- Chapter 17 With NotesDocument42 pagesChapter 17 With NotesJack100% (1)

- 7th Pylon Cup Final Round SGVDocument11 pages7th Pylon Cup Final Round SGVrcaa04No ratings yet

- MGM China BloombergDocument148 pagesMGM China BloombergDaniel HernàndezNo ratings yet

- Grade 12 2nd Sem Source All in by RamoncabansaganDocument512 pagesGrade 12 2nd Sem Source All in by RamoncabansaganJofanie MeridaNo ratings yet

- Capital Structure (2) : 06F:117 Corporate FinanceDocument86 pagesCapital Structure (2) : 06F:117 Corporate FinanceJason KornbluthNo ratings yet

- Kumpulan 2 - Kancil Group ProjectDocument58 pagesKumpulan 2 - Kancil Group ProjectYamunasri Mari100% (2)

- Olam International Reports 28.5% PATMI Growth For Q2 2017: News ReleaseDocument5 pagesOlam International Reports 28.5% PATMI Growth For Q2 2017: News Releaseashokdb2kNo ratings yet

- H.24 Misamis Oriental Vs Dept of Finance GR No. 108524 11101994Document3 pagesH.24 Misamis Oriental Vs Dept of Finance GR No. 108524 11101994Euodia Hodesh100% (1)