Professional Documents

Culture Documents

2018 Assignment

2018 Assignment

Uploaded by

buenop3730 ratings0% found this document useful (0 votes)

0 views1 pageOriginal Title

2018_assignment

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

0 views1 page2018 Assignment

2018 Assignment

Uploaded by

buenop373Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

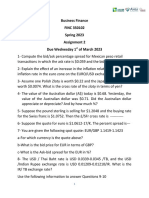

Class Assignment: International Finance ………………………………… ………………………

Name CUE identifier

1. The table below presents exchange rates in the beginning and at the end of 2018. Assess which

appreciation and depreciation for each of the possible currency pairs (including cross-rates, i.e.

PLN/RUB currency pair). [6 points]

Currency pair Beginning (Jan 2 nd 2018) End (Dec. 31 st 2018)

EUR/PLN 4.1633 4.3014

EUR/RUB 69.1176 79.7153

PLN/RUB

Euro appreciated/depreciated* against Polish zloty by …....%

Polish zloty appreciated/depreciated * against the euro by …….%

Euro appreciated/depreciated* against the Russian rouble by …….%

Russian rouble appreciated/depreciated* against the euro by …….%

Polish zloty appreciated/depreciated against Russian rouble by …….%

Russian rouble appreciated/depreciated* against Polish zloty by …….%

*

cross out the inappropriate word

2. Table below presents the quotations of the March futures of the Russian rouble (RUB/USD,

notional amount= 2,500,000 Russian rubles). Supposing that the final spot rate (in March 2019)

will be 0.02 (RUB/USD=0.02), what is the profit/loss of the trader, who: [4 points]

a. Buys 5 contracts today

b. Sells 10 contracts today

3. The quotations of the options related to the same currency pair are as in the table below. What would be

the gain/loss of a trader who buys a call option with the strike price of 0.0155 (denoted below as 15500.0) and

what would be the gain/loss for a trader buying a put option with the strike price of 0.015 (denoted below as

15000.0), supposing again that the ending spot price is 0.02 and the notional amount is 2 500 000 RUB. Illustrate

at least one of these options with a chart (use the prior settle price for the premium). [10 points]

You might also like

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketFrom EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketRating: 4.5 out of 5 stars4.5/5 (4)

- Assignment 2 FINC 3501 02 Spring 2023Document2 pagesAssignment 2 FINC 3501 02 Spring 2023Kareem Khaled SaidNo ratings yet

- Ifm Project 2019Document24 pagesIfm Project 2019Lashand Bennett100% (1)

- Foreign Exchange ArithmeticDocument9 pagesForeign Exchange Arithmeticmeghaparekh11No ratings yet

- 2011 HSBC EM Asia GuideEmergingMarketCurrencies2011Document132 pages2011 HSBC EM Asia GuideEmergingMarketCurrencies2011David SongNo ratings yet

- Daily Currency Briefing: Teflon Currency Part IIDocument4 pagesDaily Currency Briefing: Teflon Currency Part IItimurrsNo ratings yet

- HSBC - Currency Outlook DecemberDocument46 pagesHSBC - Currency Outlook Decembermgroble3No ratings yet

- Broker Shopping Around Spot Arbitrage Retail WholesaleDocument4 pagesBroker Shopping Around Spot Arbitrage Retail WholesaleTrinh Phan Thị NgọcNo ratings yet

- IFM - Lecture NotesDocument249 pagesIFM - Lecture NotesSharath S100% (1)

- Exchange Rate Quotations, Balance of Payments, Prices, Parities and Interest RatesDocument22 pagesExchange Rate Quotations, Balance of Payments, Prices, Parities and Interest RatesSourav PaulNo ratings yet

- FX 102 - FX Rates and ArbitrageDocument32 pagesFX 102 - FX Rates and Arbitragetesting1997No ratings yet

- The Foreign Exchange MarketDocument145 pagesThe Foreign Exchange Marketrobinkapoor100% (16)

- IFM - Lecture NotesDocument256 pagesIFM - Lecture NotesGAJALNo ratings yet

- Deutsche Bank - 2011 12 08Document8 pagesDeutsche Bank - 2011 12 08Mircea VoinescuNo ratings yet

- Ifm - Lecture NotesDocument272 pagesIfm - Lecture NotesJeremy MaihuaNo ratings yet

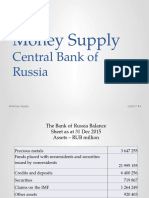

- Money Supply: Central Bank of RussiaDocument18 pagesMoney Supply: Central Bank of RussiaMihaiIliescuNo ratings yet

- Business Model ClassDocument12 pagesBusiness Model ClassKarolina MaibakhNo ratings yet

- Borrowing On International Capital Markets - Nmims.2022Document108 pagesBorrowing On International Capital Markets - Nmims.2022Sachin KandloorNo ratings yet

- Session 2 Week 14: Open Economy Macroeconomics: Basic Concepts (Ch. 18)Document10 pagesSession 2 Week 14: Open Economy Macroeconomics: Basic Concepts (Ch. 18)陈皮乌鸡No ratings yet

- The Foreign Exchange MarketDocument145 pagesThe Foreign Exchange MarketNikita JoshiNo ratings yet

- Homework Topic 3 - To SendDocument4 pagesHomework Topic 3 - To SendThùy NguyễnNo ratings yet

- Foreign Exchange Rate Quotations FM11 19-4Document8 pagesForeign Exchange Rate Quotations FM11 19-4Bey In CorbasiNo ratings yet

- Bank of Japan Review: Recent Developments in U.S. Dollar Funding Costs Through FX SwapsDocument7 pagesBank of Japan Review: Recent Developments in U.S. Dollar Funding Costs Through FX SwapshuanghuangouNo ratings yet

- Forex TradingDocument13 pagesForex TradingGia KhánhNo ratings yet

- Financial Markets - Group Assignment - Team 2Document23 pagesFinancial Markets - Group Assignment - Team 2mi.annienguyenNo ratings yet

- Exchange Rate BasicsDocument33 pagesExchange Rate BasicsYNo ratings yet

- 2/24/15 Macro Trading SimulationDocument12 pages2/24/15 Macro Trading SimulationPaul KimNo ratings yet

- 1/15/15 Macro Trading SimulationDocument21 pages1/15/15 Macro Trading SimulationPaul KimNo ratings yet

- Book - IFM - Lecture NotesDocument261 pagesBook - IFM - Lecture NotesasadNo ratings yet

- Finance The 2nd AsmDocument12 pagesFinance The 2nd Asms3878775No ratings yet

- How To Trade Eurusd PDFDocument14 pagesHow To Trade Eurusd PDFNil DorcaNo ratings yet

- CHAPTER 3 - SVDocument42 pagesCHAPTER 3 - SVThuy Ngan NguyenNo ratings yet

- Role of RBI in FOREX MarketDocument14 pagesRole of RBI in FOREX Marketlagfdf88No ratings yet

- Foreign Exchange Rates, Introduction ToDocument202 pagesForeign Exchange Rates, Introduction ToKulbir Singh100% (1)

- 1) Introduction To Forex - Major Currencies 1Document7 pages1) Introduction To Forex - Major Currencies 1shubh_braNo ratings yet

- Balance of Payment 20Document79 pagesBalance of Payment 20Anshul SinhaNo ratings yet

- Foreign Exchange OutlookDocument17 pagesForeign Exchange Outlookdey.parijat209No ratings yet

- Module - 13 Foreign Exchange Quotations: Cross, Rates, TT Buy/Sell Rates, TC Buy/SellratesDocument12 pagesModule - 13 Foreign Exchange Quotations: Cross, Rates, TT Buy/Sell Rates, TC Buy/SellratesGulshan KumarNo ratings yet

- 1/14/15 Macro Trading SimulationDocument21 pages1/14/15 Macro Trading SimulationPaul KimNo ratings yet

- Huong Dan Doc IfsDocument22 pagesHuong Dan Doc IfsCường Nguyễn Trần ArsenalNo ratings yet

- Unit h460 2 Macroeconomics Sample Assessment MaterialDocument44 pagesUnit h460 2 Macroeconomics Sample Assessment MaterialRania KuraaNo ratings yet

- Зависимость цен на недв от макроDocument13 pagesЗависимость цен на недв от макроTaras ChumachenkoNo ratings yet

- Introduction of Indian Rupee 1) Introduction of Indian RupeeDocument33 pagesIntroduction of Indian Rupee 1) Introduction of Indian RupeeRajesh GuptaNo ratings yet

- 3772 International Finance 2011 Weehuyjjujk # 2Document23 pages3772 International Finance 2011 Weehuyjjujk # 2Kamima Aubrian Ng'uniNo ratings yet

- Rupee Depreciation - Probable Causes and OutlookDocument10 pagesRupee Depreciation - Probable Causes and OutlookAshok ChakravarthyNo ratings yet

- 1/23/15 Macro Trading SimulationDocument18 pages1/23/15 Macro Trading SimulationPaul KimNo ratings yet

- FX Forecast Update 190623Document20 pagesFX Forecast Update 190623Ahmed AbedNo ratings yet

- Lighthouse Investment Management - China and The IMF - 2015-11Document28 pagesLighthouse Investment Management - China and The IMF - 2015-11Alexander GloyNo ratings yet

- For Ex ToolkitDocument11 pagesFor Ex ToolkitEdison Queiroz VillelaNo ratings yet

- Chapter 1 - Exchange Rate and Forex TransactionsDocument46 pagesChapter 1 - Exchange Rate and Forex Transactionsnguyenngoctueman2610No ratings yet

- Weak Euro: 2. Study The Extracts Below and Answer All The Parts of The Question That FollowDocument3 pagesWeak Euro: 2. Study The Extracts Below and Answer All The Parts of The Question That FollowchristinaNo ratings yet

- LBS Data StructureDocument22 pagesLBS Data StructurePrabhakar SharmaNo ratings yet

- Balance of Payment 20 PDFDocument79 pagesBalance of Payment 20 PDFRiyaNo ratings yet

- Forex For CAIIBDocument6 pagesForex For CAIIBkushalnadekarNo ratings yet

- Daily Currency Briefing: Europe's Fingers Crossed ApproachDocument4 pagesDaily Currency Briefing: Europe's Fingers Crossed ApproachtimurrsNo ratings yet

- 2/11/15 Macro Trading SimulationDocument14 pages2/11/15 Macro Trading SimulationPaul KimNo ratings yet

- Week 2 Tutorial QuestionsDocument4 pagesWeek 2 Tutorial QuestionsWOP INVESTNo ratings yet

- 11/4/14 Global-Macro Trading SimulationDocument20 pages11/4/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market MovesFrom EverandDay Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market MovesRating: 3.5 out of 5 stars3.5/5 (4)