Professional Documents

Culture Documents

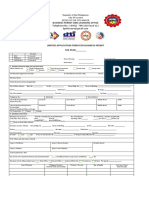

OPS Registration Form 1

OPS Registration Form 1

Uploaded by

Rheneir MoraCopyright:

Available Formats

You might also like

- Final Ems Gr. 7 Lesson Plans Term 2 Week 1 102Document20 pagesFinal Ems Gr. 7 Lesson Plans Term 2 Week 1 102Anonymous gPhRqg391% (11)

- Session 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsDocument55 pagesSession 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsRheneir Mora100% (1)

- The Ultimate Guide To P2P Lending PDFDocument112 pagesThe Ultimate Guide To P2P Lending PDFArthur Liew100% (1)

- Notes From - Trade Like A Stock Market Wizard - How To Achieve Super Performance in Stocks in Any MarketDocument4 pagesNotes From - Trade Like A Stock Market Wizard - How To Achieve Super Performance in Stocks in Any Marketvinayak p hNo ratings yet

- Application Form For Foreign Exchange Services: Specify)Document7 pagesApplication Form For Foreign Exchange Services: Specify)Reena Rizza Ocampo0% (1)

- Problem 1.6Document1 pageProblem 1.6SamerNo ratings yet

- Membership Application (On The Letterhead of The Applicant Member)Document29 pagesMembership Application (On The Letterhead of The Applicant Member)ShardaNo ratings yet

- 118 - Sfi 17 A 2017 PDFDocument137 pages118 - Sfi 17 A 2017 PDFFery Ann C. BravoNo ratings yet

- RFM SEC 17-Q 3rd Quarter 2022Document54 pagesRFM SEC 17-Q 3rd Quarter 2022Carissa May Maloloy-onNo ratings yet

- Global-Estate Resorts, Inc. SEC Form 17-A 2021Document191 pagesGlobal-Estate Resorts, Inc. SEC Form 17-A 2021Mard Argueza GaliciaNo ratings yet

- Certificate of Incorporation: Hotels and Restaurants Association in Pampanga (Harp) IncDocument17 pagesCertificate of Incorporation: Hotels and Restaurants Association in Pampanga (Harp) IncLablee CatzNo ratings yet

- 17-A Annual Report As of December 31 2020 5.7.21Document380 pages17-A Annual Report As of December 31 2020 5.7.21Jonabel Lenares BorresNo ratings yet

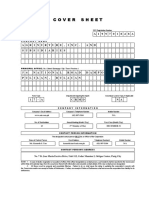

- Cover Sheet: For Audited Financial StatementsDocument2 pagesCover Sheet: For Audited Financial StatementsKris Anne Delos SantosNo ratings yet

- ENTITY - User ManualDocument31 pagesENTITY - User ManualSameer KhanNo ratings yet

- Supplier Accreditation Form - CorporationDocument2 pagesSupplier Accreditation Form - CorporationTerence Jhon TabonNo ratings yet

- Application New Bus. Permit NewDocument3 pagesApplication New Bus. Permit NewDadz CoraldeNo ratings yet

- 2020 DITO CME SEC FS REISSUED - Separate - FinalDocument56 pages2020 DITO CME SEC FS REISSUED - Separate - FinalPaulNo ratings yet

- Emperador Inc. Annual Report 2016Document167 pagesEmperador Inc. Annual Report 2016grail.donaelNo ratings yet

- Disclosure No. 996 2019 Annual Report For Fiscal Year Ended December 31 2018 SEC Form 17 ADocument320 pagesDisclosure No. 996 2019 Annual Report For Fiscal Year Ended December 31 2018 SEC Form 17 ASamael LightbringerNo ratings yet

- Word - ISS Application For Authorized Persons - BSE - 01-JULY-2015Document35 pagesWord - ISS Application For Authorized Persons - BSE - 01-JULY-2015meera nNo ratings yet

- BEL MT 2023 Results 29feb24 For Website-2Document106 pagesBEL MT 2023 Results 29feb24 For Website-2PrinceNo ratings yet

- Universal Robina Corporation and Subsidiaries 17 A FY2014Document174 pagesUniversal Robina Corporation and Subsidiaries 17 A FY2014StellaNo ratings yet

- Chapter 13 Property Plant and Equi PDFDocument234 pagesChapter 13 Property Plant and Equi PDFMary MariaNo ratings yet

- Cover Sheet: Company NameDocument54 pagesCover Sheet: Company Namekenneth pugalNo ratings yet

- MSRD - Manila Electric Company - 2023 - 17-A Report and Sustainability ReportDocument553 pagesMSRD - Manila Electric Company - 2023 - 17-A Report and Sustainability ReportMard Argueza GaliciaNo ratings yet

- Taxpayer Registration Form OrganisationDocument4 pagesTaxpayer Registration Form OrganisationMagdalene AmewodzoNo ratings yet

- BRCS 2019 SEC Form 17A PDFDocument201 pagesBRCS 2019 SEC Form 17A PDFJiordan Gabriel SimonNo ratings yet

- Taxpayer Registration Form TRF 01 For STRNNTNDocument8 pagesTaxpayer Registration Form TRF 01 For STRNNTNHammad Nazir MalikNo ratings yet

- F 13551Document2 pagesF 13551IRSNo ratings yet

- Form 1594777111Document1 pageForm 1594777111Evcillove Mangubat100% (1)

- Sec 20-Is 2018 (RFM-SSM) - DefinitiveDocument444 pagesSec 20-Is 2018 (RFM-SSM) - DefinitiveDominic RomeroNo ratings yet

- Application Form 220319Document6 pagesApplication Form 220319suppaman1984No ratings yet

- 2020 Eei Corporation Sec 17aDocument258 pages2020 Eei Corporation Sec 17aGabriel SebastianNo ratings yet

- Aceph-Sec17-Q-Q2 2020 PDFDocument92 pagesAceph-Sec17-Q-Q2 2020 PDFPeter Paul RecaboNo ratings yet

- CNVRG - 9M22 - 17Q VFDocument42 pagesCNVRG - 9M22 - 17Q VFJose BorjaNo ratings yet

- Schedule 1Document1 pageSchedule 1Gourav KalaNo ratings yet

- VAT Application FormDocument2 pagesVAT Application Formyudamwambafula30No ratings yet

- IWH M.FO 1.1 Membership ApplicationDocument5 pagesIWH M.FO 1.1 Membership Applicationtiisetsomatlali12No ratings yet

- PDF New Profile FormDocument5 pagesPDF New Profile FormAyesha AsadNo ratings yet

- Business Permit App FormDocument1 pageBusiness Permit App FormcheansiaNo ratings yet

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- SIP Form DebtDocument6 pagesSIP Form DebtNilesh MahajanNo ratings yet

- Merchant Onboarding Form - Revised v1.4Document4 pagesMerchant Onboarding Form - Revised v1.4odboworldNo ratings yet

- Payment Options: (Include Tax, TDS, TCS, Corporate Tax Etc.) (Central Excise & Service Tax)Document4 pagesPayment Options: (Include Tax, TDS, TCS, Corporate Tax Etc.) (Central Excise & Service Tax)Raju Ram PrajapatNo ratings yet

- PAL Holdings, Inc.: CertificationDocument53 pagesPAL Holdings, Inc.: CertificationJerryJoshuaDiaz100% (1)

- Cover Sheet: Unaudited Financial StatementsDocument70 pagesCover Sheet: Unaudited Financial StatementsDan GammadNo ratings yet

- Business Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Document2 pagesBusiness Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Ren Michelle Villaverde PaleracioNo ratings yet

- HDFC Sip FormDocument3 pagesHDFC Sip FormspeedenquiryNo ratings yet

- Annual Report 2012 ATI - 17A - Dec2012Document103 pagesAnnual Report 2012 ATI - 17A - Dec2012cuonghienNo ratings yet

- Thrift Savings Plan Tsp-65: Request To Combine Civilian and Uniformed Services TSP AccountsDocument2 pagesThrift Savings Plan Tsp-65: Request To Combine Civilian and Uniformed Services TSP AccountsjustinfuNo ratings yet

- SEC 17-C - Formation of A Subsidiary March 2023Document3 pagesSEC 17-C - Formation of A Subsidiary March 2023anne anneNo ratings yet

- Far Eastern University, Inc. Annual Report FY 2019-2020Document370 pagesFar Eastern University, Inc. Annual Report FY 2019-2020Llanzana EVersonNo ratings yet

- Cover Sheet: For Audited Financial StatementsDocument1 pageCover Sheet: For Audited Financial StatementsKir KirNo ratings yet

- Unified Business Application FormDocument2 pagesUnified Business Application FormKahlila-Keon Morabor-Estorninos100% (1)

- Cover Sheet: Audited Financial StatementsDocument1 pageCover Sheet: Audited Financial StatementsWennie ValdezNo ratings yet

- Cover Sheet For AFS 2015Document1 pageCover Sheet For AFS 2015ELSA BENDAÑANo ratings yet

- Sample FORM A2Document11 pagesSample FORM A2Trinidad InspectionNo ratings yet

- COL Financial Group - SECForm 17-A - 2019 - Consolidated Copy For FilingDocument153 pagesCOL Financial Group - SECForm 17-A - 2019 - Consolidated Copy For FilingGab RielNo ratings yet

- KYC Onboarding Form (The Latest)Document5 pagesKYC Onboarding Form (The Latest)admiraldin putraNo ratings yet

- Report Tax Fraud: Court OfficialsDocument5 pagesReport Tax Fraud: Court Officialslane.moreau29No ratings yet

- Pal Holdings Inc (Phi) 17a-Dec 2019Document235 pagesPal Holdings Inc (Phi) 17a-Dec 2019Joshua CadenaNo ratings yet

- Ani Annual ReportDocument172 pagesAni Annual ReportTreasury ApamiNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- 04 Property PicturesDocument1 page04 Property PicturesRheneir MoraNo ratings yet

- GMM ProgramDocument1 pageGMM ProgramRheneir MoraNo ratings yet

- CVR-16 InviteDocument3 pagesCVR-16 InviteRheneir MoraNo ratings yet

- Peach Confirmation EU88X5Document3 pagesPeach Confirmation EU88X5Rheneir MoraNo ratings yet

- Fun Golf SolicitationDocument2 pagesFun Golf SolicitationRheneir MoraNo ratings yet

- Peach Confirmation QQ5775Document3 pagesPeach Confirmation QQ5775Rheneir MoraNo ratings yet

- Differences PFRSDocument11 pagesDifferences PFRSRheneir MoraNo ratings yet

- 49 Insights July 2022Document41 pages49 Insights July 2022Rheneir MoraNo ratings yet

- Electronic Ticket Receipt 26MAR For RHENEIR PARAN MORADocument3 pagesElectronic Ticket Receipt 26MAR For RHENEIR PARAN MORARheneir MoraNo ratings yet

- MS Call CardsDocument3 pagesMS Call CardsRheneir MoraNo ratings yet

- GMM ProgramDocument1 pageGMM ProgramRheneir MoraNo ratings yet

- Cebu Pacific Air MoraDocument4 pagesCebu Pacific Air MoraRheneir MoraNo ratings yet

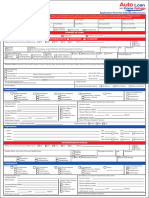

- New Auto-Loan-Application-Form - IndividualDocument2 pagesNew Auto-Loan-Application-Form - IndividualRheneir MoraNo ratings yet

- PAREB AMLC Online Registration System GuideDocument72 pagesPAREB AMLC Online Registration System GuideRheneir MoraNo ratings yet

- SourceTech Consultancy LLCDocument11 pagesSourceTech Consultancy LLCRheneir MoraNo ratings yet

- 1MSADocument1 page1MSARheneir MoraNo ratings yet

- Certificate SphinxDocument1 pageCertificate SphinxRheneir MoraNo ratings yet

- CVR16 PresentationDocument8 pagesCVR16 PresentationRheneir MoraNo ratings yet

- Talisay Central Eagles ClubDocument5 pagesTalisay Central Eagles ClubRheneir Mora0% (1)

- 2019notice New Forms and Pre EvaluationDocument29 pages2019notice New Forms and Pre EvaluationRheneir MoraNo ratings yet

- Amcham Phil. Membership SurveyDocument2 pagesAmcham Phil. Membership SurveyRheneir Mora100% (1)

- 1702EX2020Document5 pages1702EX2020Rheneir MoraNo ratings yet

- 77th ANC CebuDocument7 pages77th ANC CebuRheneir MoraNo ratings yet

- Session 2 - QAR Audit Methodology Manual - IsQMDocument49 pagesSession 2 - QAR Audit Methodology Manual - IsQMRheneir MoraNo ratings yet

- Session 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureDocument18 pagesSession 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureRheneir MoraNo ratings yet

- Session 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualDocument12 pagesSession 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualRheneir MoraNo ratings yet

- Session 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditDocument34 pagesSession 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditRheneir MoraNo ratings yet

- Session 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationDocument23 pagesSession 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationRheneir MoraNo ratings yet

- 04 Property PicturesDocument1 page04 Property PicturesRheneir MoraNo ratings yet

- Accountancy ImpQ CH04 Admission of A Partner 01Document18 pagesAccountancy ImpQ CH04 Admission of A Partner 01praveentyagiNo ratings yet

- Insurance Company Business PlanDocument36 pagesInsurance Company Business PlanS M Hasan Sayeed50% (2)

- Quiz: Corporate Liquidation Final Term: Problem 1Document3 pagesQuiz: Corporate Liquidation Final Term: Problem 1Eel GiNo ratings yet

- Gaisano Cagayan Inc. vs. Insurance Company of North AmericaDocument3 pagesGaisano Cagayan Inc. vs. Insurance Company of North Americajune bayNo ratings yet

- Term Sheet - Convertible Note - SkillDzireDocument5 pagesTerm Sheet - Convertible Note - SkillDzireMAツVIcKYツNo ratings yet

- Credit Creation Theory: The Concept of Money & How It Is CirculatedDocument2 pagesCredit Creation Theory: The Concept of Money & How It Is CirculatedMoud KhalfaniNo ratings yet

- Lovely Lucille Updated ResumeDocument1 pageLovely Lucille Updated ResumeG.Z. Lanting HardwareNo ratings yet

- Datasheet Financial Management SeDocument6 pagesDatasheet Financial Management SeALHNo ratings yet

- Classroom Discussion 1 - 04172021Document3 pagesClassroom Discussion 1 - 04172021LLYOD FRANCIS LAYLAYNo ratings yet

- MultiplierDocument47 pagesMultiplierShruti Saxena100% (3)

- Tata Communications Annual Report 2014Document172 pagesTata Communications Annual Report 2014varaprasad_ganjiNo ratings yet

- BIS Papers - Survey On Central Bank Digital CurrenciesDocument19 pagesBIS Papers - Survey On Central Bank Digital Currencieswbechara103No ratings yet

- Kotak Mahindra Bank Limited: Custodial ServicesDocument4 pagesKotak Mahindra Bank Limited: Custodial Servicesstiwari2010No ratings yet

- Chapter 7 Stock ValuationDocument67 pagesChapter 7 Stock ValuationMahmoud Yassen El GhannamNo ratings yet

- McGraw Hill Connect Question Bank Assignment 3Document2 pagesMcGraw Hill Connect Question Bank Assignment 3Jayann Danielle MadrazoNo ratings yet

- Macroeconomics 11th Edition Parkin Solutions ManualDocument21 pagesMacroeconomics 11th Edition Parkin Solutions Manualdencuongpow5100% (23)

- NCERT Financial Accounting Class 11Document412 pagesNCERT Financial Accounting Class 11Abhimanyu TyagiNo ratings yet

- BBA G SEm 1 2012Document10 pagesBBA G SEm 1 2012sourabhmunjal0112No ratings yet

- IndiGrid Corp Deck QIPDocument17 pagesIndiGrid Corp Deck QIPNagesh WaghNo ratings yet

- Text Solutions - CH8Document16 pagesText Solutions - CH8Josef Galileo SibalaNo ratings yet

- Research ProposalDocument15 pagesResearch ProposalBonDocEldRicNo ratings yet

- ICICIDocument24 pagesICICIPaRas ChAuhanNo ratings yet

- Maths ProjectDocument6 pagesMaths ProjectAbhinav AgarwalNo ratings yet

- Actuary MagazineDocument32 pagesActuary MagazineanuiscoolNo ratings yet

- Theory in Action 6.2 Dan 5.2Document2 pagesTheory in Action 6.2 Dan 5.2zahra zhafiraNo ratings yet

- Micro Project: Government Polytechnic, VikramgadDocument11 pagesMicro Project: Government Polytechnic, VikramgadDibyas Sanjay DubeyNo ratings yet

OPS Registration Form 1

OPS Registration Form 1

Uploaded by

Rheneir MoraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OPS Registration Form 1

OPS Registration Form 1

Uploaded by

Rheneir MoraCopyright:

Available Formats

Form 1 ___

Page 1 of 2

APPLICATION FOR REGISTRATION AS OPERATOR OF A PAYMENT SYSTEM (OPS)

(To be completely filled up. Indicate “N/A” if an item is not applicable.

Thru: The Office of the Director Date:

Payment System Oversight Department (PSOD)

This form is to be accomplished by the Operator of a Payment System (OPS). An OPS refers to any person performing any of the activities as

defined in Section 4(1) of R.A. No. 11127 (The National Payment Systems Act). Kindly indicate in the checklist at the back of this form the activities

performed by your company.

1. FULL COMPANY NAME 2. TIN

3. COMPANY NAME

4. REGISTERED BUSINESS/TRADE NAME/S

5. COMPANY REGISTRATION NO. 6. DATE ISSUED 7. VALID UNTIL

8. BUSINESS LOCATION If within a Building, specify Street No. and Name Barangay City/Municipality

stall, room, floor number

9. BUSINESS CONTACT INFO Landline Mobile No. Email Address1 Website

10. BUSINESS PERMIT/TYPE OF BUSINESS Business Permit No. Date Issued Valid Until Type of Business Years in Business

11. Are you licensed to do business in the Yes If yes, indicate the type of license

Philippines? No issued to the company

12. FORM OF BUSINESS ORGANIZATION 13. AUTHORIZED CAPITAL STOCK

(e.g. Sole Proprietorship, Partnership, (in Php)

Corporation, Cooperative, etc.)

14. OWNERSHIP AND MANAGEMENT STRUCTURE

14.1 List of Board of Directors/Partners/Owners

Name Citizenship Address Position TIN % of Email Address

Ownership

14.2 List of Shareholders (with ownership of at least 10%)

Name Citizenship Address Position TIN % of Email Address

Ownership

14.3 List of Key Officers (President, Finance Officer, Treasurer and their equivalent)

Name Citizenship Address Position TIN Email Address

15. BRIEF DESCRIPTION ON HOW THE BUSINESS OPERATES AND TARGET MARKET

15.1 Primary Product/Service 15.2 Revenue Generating Activities 15.3 Target Market

16. NETWORK AND OPERATIONS

16.1 Number of branches or servicing units (over‐ 16.2 Number of payment terminals (self‐service – 16.3 Number of participants/users

the‐counter/teller assisted) ATM, Payment Kiosks)

17. TYPES OF PAYMENT Short Description of Payment Number of payment Average monthly Average monthly value of

INSTRUMENTS/MEDIA ISSUED Instruments/Media instruments/accounts volume of transactions transactions

1Shall be considered the official e‐mail address registered with BSP.

2 Key officers include the President, Finance Officer, Treasurer (or their equivalent) and heads of internal audit, risk management, and compliance functions

Form 1 ___

Page 2 of 2

APPLICATION FOR REGISTRATION AS OPERATOR OF A PAYMENT SYSTEM (OPS)

(To be completely filled up. Indicate “N/A” if an item is not applicable)

A. Maintains the platform that enables payments or fund transfers, regardless of whether the source and destination accounts are

maintained with the same or different institutions

___ Owns or operates a computer application system that enables payments or fund transfers

___ Sets rules by which payments may be made or funds may be transferred

___ Allows customers to fund their accounts by submitting to the operator cash or its equivalent in exchange for the value to be

stored in their account

___ Allows accounts of system users to be linked to their accounts with other financial institutions (FIs) (e.g., deposit account, e‐

money account, credit card account)

B. Operates the system or network that enables payments or fund transfers to be made through the use of a payment instrument

___ Provides a system or network infrastructure that enables payments and financial services of FIs

___ Sets rules, functions, procedures, arrangements or devices that enable an account holder or holder of the payment instrument

to transact with a third party

___ Transfers payment information (e.g., card transaction details) to and from participating institutions.

___ Provides network participants with a listing of the amounts due to/from other participants.

___ Offers service/s to more than one (1) FI and enables them to perform payments or fund transfers among each other.

___ Enables the acceptance of specific payment instrument/s by institutions such as government, commercial establishments, and

other merchant/billers

C. Provides a system that processes payments on behalf of any person, or the government

___ Receives payment for or on behalf of the sellers of goods, providers of services, or creditors/billers in accordance with a written

agreement

___ Sets rules, provides arrangements or facilities to collect funds from the public and transmits the same to sellers of goods,

providers of services, or creditors/billers in accordance with the written agreement

___ Allows payments to be made to more than one commercial establishment or creditor/biller

I, [insert name], [insert designation] of [insert company name], hereby certify to the following:

1. I am authorized to submit this Application for Registration as OPS for and on behalf of [insert company name].

2. The completion of the Application for Registration as OPS was made after conduct of self‐assessment whereby it

was determined that [insert company name] is an OPS pursuant to R.A. No. 11127 (The National Payment Systems

Act) and BSP Circular No.1049. As OPS, [insert company name] performs: [insert activities performed as an OPS].

3. By submitting the personal information of our Board of Directors, partners, owners, shareholders and key officers,

the said persons are aware of their rights under R.A. No. 10173 (Data Privacy Act of 2012) and they authorize the

BSP to collect, process and store their personal information and share with and make them available to interested

parties for lawful purposes and legitimate interests and to comply with legal mandate.

4. The information provided herein are true, accurate, timely and complete.

Name

Designation of Authorized Officer

Draft OPS Registration Template as of 04 February 2019

You might also like

- Final Ems Gr. 7 Lesson Plans Term 2 Week 1 102Document20 pagesFinal Ems Gr. 7 Lesson Plans Term 2 Week 1 102Anonymous gPhRqg391% (11)

- Session 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsDocument55 pagesSession 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsRheneir Mora100% (1)

- The Ultimate Guide To P2P Lending PDFDocument112 pagesThe Ultimate Guide To P2P Lending PDFArthur Liew100% (1)

- Notes From - Trade Like A Stock Market Wizard - How To Achieve Super Performance in Stocks in Any MarketDocument4 pagesNotes From - Trade Like A Stock Market Wizard - How To Achieve Super Performance in Stocks in Any Marketvinayak p hNo ratings yet

- Application Form For Foreign Exchange Services: Specify)Document7 pagesApplication Form For Foreign Exchange Services: Specify)Reena Rizza Ocampo0% (1)

- Problem 1.6Document1 pageProblem 1.6SamerNo ratings yet

- Membership Application (On The Letterhead of The Applicant Member)Document29 pagesMembership Application (On The Letterhead of The Applicant Member)ShardaNo ratings yet

- 118 - Sfi 17 A 2017 PDFDocument137 pages118 - Sfi 17 A 2017 PDFFery Ann C. BravoNo ratings yet

- RFM SEC 17-Q 3rd Quarter 2022Document54 pagesRFM SEC 17-Q 3rd Quarter 2022Carissa May Maloloy-onNo ratings yet

- Global-Estate Resorts, Inc. SEC Form 17-A 2021Document191 pagesGlobal-Estate Resorts, Inc. SEC Form 17-A 2021Mard Argueza GaliciaNo ratings yet

- Certificate of Incorporation: Hotels and Restaurants Association in Pampanga (Harp) IncDocument17 pagesCertificate of Incorporation: Hotels and Restaurants Association in Pampanga (Harp) IncLablee CatzNo ratings yet

- 17-A Annual Report As of December 31 2020 5.7.21Document380 pages17-A Annual Report As of December 31 2020 5.7.21Jonabel Lenares BorresNo ratings yet

- Cover Sheet: For Audited Financial StatementsDocument2 pagesCover Sheet: For Audited Financial StatementsKris Anne Delos SantosNo ratings yet

- ENTITY - User ManualDocument31 pagesENTITY - User ManualSameer KhanNo ratings yet

- Supplier Accreditation Form - CorporationDocument2 pagesSupplier Accreditation Form - CorporationTerence Jhon TabonNo ratings yet

- Application New Bus. Permit NewDocument3 pagesApplication New Bus. Permit NewDadz CoraldeNo ratings yet

- 2020 DITO CME SEC FS REISSUED - Separate - FinalDocument56 pages2020 DITO CME SEC FS REISSUED - Separate - FinalPaulNo ratings yet

- Emperador Inc. Annual Report 2016Document167 pagesEmperador Inc. Annual Report 2016grail.donaelNo ratings yet

- Disclosure No. 996 2019 Annual Report For Fiscal Year Ended December 31 2018 SEC Form 17 ADocument320 pagesDisclosure No. 996 2019 Annual Report For Fiscal Year Ended December 31 2018 SEC Form 17 ASamael LightbringerNo ratings yet

- Word - ISS Application For Authorized Persons - BSE - 01-JULY-2015Document35 pagesWord - ISS Application For Authorized Persons - BSE - 01-JULY-2015meera nNo ratings yet

- BEL MT 2023 Results 29feb24 For Website-2Document106 pagesBEL MT 2023 Results 29feb24 For Website-2PrinceNo ratings yet

- Universal Robina Corporation and Subsidiaries 17 A FY2014Document174 pagesUniversal Robina Corporation and Subsidiaries 17 A FY2014StellaNo ratings yet

- Chapter 13 Property Plant and Equi PDFDocument234 pagesChapter 13 Property Plant and Equi PDFMary MariaNo ratings yet

- Cover Sheet: Company NameDocument54 pagesCover Sheet: Company Namekenneth pugalNo ratings yet

- MSRD - Manila Electric Company - 2023 - 17-A Report and Sustainability ReportDocument553 pagesMSRD - Manila Electric Company - 2023 - 17-A Report and Sustainability ReportMard Argueza GaliciaNo ratings yet

- Taxpayer Registration Form OrganisationDocument4 pagesTaxpayer Registration Form OrganisationMagdalene AmewodzoNo ratings yet

- BRCS 2019 SEC Form 17A PDFDocument201 pagesBRCS 2019 SEC Form 17A PDFJiordan Gabriel SimonNo ratings yet

- Taxpayer Registration Form TRF 01 For STRNNTNDocument8 pagesTaxpayer Registration Form TRF 01 For STRNNTNHammad Nazir MalikNo ratings yet

- F 13551Document2 pagesF 13551IRSNo ratings yet

- Form 1594777111Document1 pageForm 1594777111Evcillove Mangubat100% (1)

- Sec 20-Is 2018 (RFM-SSM) - DefinitiveDocument444 pagesSec 20-Is 2018 (RFM-SSM) - DefinitiveDominic RomeroNo ratings yet

- Application Form 220319Document6 pagesApplication Form 220319suppaman1984No ratings yet

- 2020 Eei Corporation Sec 17aDocument258 pages2020 Eei Corporation Sec 17aGabriel SebastianNo ratings yet

- Aceph-Sec17-Q-Q2 2020 PDFDocument92 pagesAceph-Sec17-Q-Q2 2020 PDFPeter Paul RecaboNo ratings yet

- CNVRG - 9M22 - 17Q VFDocument42 pagesCNVRG - 9M22 - 17Q VFJose BorjaNo ratings yet

- Schedule 1Document1 pageSchedule 1Gourav KalaNo ratings yet

- VAT Application FormDocument2 pagesVAT Application Formyudamwambafula30No ratings yet

- IWH M.FO 1.1 Membership ApplicationDocument5 pagesIWH M.FO 1.1 Membership Applicationtiisetsomatlali12No ratings yet

- PDF New Profile FormDocument5 pagesPDF New Profile FormAyesha AsadNo ratings yet

- Business Permit App FormDocument1 pageBusiness Permit App FormcheansiaNo ratings yet

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- SIP Form DebtDocument6 pagesSIP Form DebtNilesh MahajanNo ratings yet

- Merchant Onboarding Form - Revised v1.4Document4 pagesMerchant Onboarding Form - Revised v1.4odboworldNo ratings yet

- Payment Options: (Include Tax, TDS, TCS, Corporate Tax Etc.) (Central Excise & Service Tax)Document4 pagesPayment Options: (Include Tax, TDS, TCS, Corporate Tax Etc.) (Central Excise & Service Tax)Raju Ram PrajapatNo ratings yet

- PAL Holdings, Inc.: CertificationDocument53 pagesPAL Holdings, Inc.: CertificationJerryJoshuaDiaz100% (1)

- Cover Sheet: Unaudited Financial StatementsDocument70 pagesCover Sheet: Unaudited Financial StatementsDan GammadNo ratings yet

- Business Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Document2 pagesBusiness Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Ren Michelle Villaverde PaleracioNo ratings yet

- HDFC Sip FormDocument3 pagesHDFC Sip FormspeedenquiryNo ratings yet

- Annual Report 2012 ATI - 17A - Dec2012Document103 pagesAnnual Report 2012 ATI - 17A - Dec2012cuonghienNo ratings yet

- Thrift Savings Plan Tsp-65: Request To Combine Civilian and Uniformed Services TSP AccountsDocument2 pagesThrift Savings Plan Tsp-65: Request To Combine Civilian and Uniformed Services TSP AccountsjustinfuNo ratings yet

- SEC 17-C - Formation of A Subsidiary March 2023Document3 pagesSEC 17-C - Formation of A Subsidiary March 2023anne anneNo ratings yet

- Far Eastern University, Inc. Annual Report FY 2019-2020Document370 pagesFar Eastern University, Inc. Annual Report FY 2019-2020Llanzana EVersonNo ratings yet

- Cover Sheet: For Audited Financial StatementsDocument1 pageCover Sheet: For Audited Financial StatementsKir KirNo ratings yet

- Unified Business Application FormDocument2 pagesUnified Business Application FormKahlila-Keon Morabor-Estorninos100% (1)

- Cover Sheet: Audited Financial StatementsDocument1 pageCover Sheet: Audited Financial StatementsWennie ValdezNo ratings yet

- Cover Sheet For AFS 2015Document1 pageCover Sheet For AFS 2015ELSA BENDAÑANo ratings yet

- Sample FORM A2Document11 pagesSample FORM A2Trinidad InspectionNo ratings yet

- COL Financial Group - SECForm 17-A - 2019 - Consolidated Copy For FilingDocument153 pagesCOL Financial Group - SECForm 17-A - 2019 - Consolidated Copy For FilingGab RielNo ratings yet

- KYC Onboarding Form (The Latest)Document5 pagesKYC Onboarding Form (The Latest)admiraldin putraNo ratings yet

- Report Tax Fraud: Court OfficialsDocument5 pagesReport Tax Fraud: Court Officialslane.moreau29No ratings yet

- Pal Holdings Inc (Phi) 17a-Dec 2019Document235 pagesPal Holdings Inc (Phi) 17a-Dec 2019Joshua CadenaNo ratings yet

- Ani Annual ReportDocument172 pagesAni Annual ReportTreasury ApamiNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- 04 Property PicturesDocument1 page04 Property PicturesRheneir MoraNo ratings yet

- GMM ProgramDocument1 pageGMM ProgramRheneir MoraNo ratings yet

- CVR-16 InviteDocument3 pagesCVR-16 InviteRheneir MoraNo ratings yet

- Peach Confirmation EU88X5Document3 pagesPeach Confirmation EU88X5Rheneir MoraNo ratings yet

- Fun Golf SolicitationDocument2 pagesFun Golf SolicitationRheneir MoraNo ratings yet

- Peach Confirmation QQ5775Document3 pagesPeach Confirmation QQ5775Rheneir MoraNo ratings yet

- Differences PFRSDocument11 pagesDifferences PFRSRheneir MoraNo ratings yet

- 49 Insights July 2022Document41 pages49 Insights July 2022Rheneir MoraNo ratings yet

- Electronic Ticket Receipt 26MAR For RHENEIR PARAN MORADocument3 pagesElectronic Ticket Receipt 26MAR For RHENEIR PARAN MORARheneir MoraNo ratings yet

- MS Call CardsDocument3 pagesMS Call CardsRheneir MoraNo ratings yet

- GMM ProgramDocument1 pageGMM ProgramRheneir MoraNo ratings yet

- Cebu Pacific Air MoraDocument4 pagesCebu Pacific Air MoraRheneir MoraNo ratings yet

- New Auto-Loan-Application-Form - IndividualDocument2 pagesNew Auto-Loan-Application-Form - IndividualRheneir MoraNo ratings yet

- PAREB AMLC Online Registration System GuideDocument72 pagesPAREB AMLC Online Registration System GuideRheneir MoraNo ratings yet

- SourceTech Consultancy LLCDocument11 pagesSourceTech Consultancy LLCRheneir MoraNo ratings yet

- 1MSADocument1 page1MSARheneir MoraNo ratings yet

- Certificate SphinxDocument1 pageCertificate SphinxRheneir MoraNo ratings yet

- CVR16 PresentationDocument8 pagesCVR16 PresentationRheneir MoraNo ratings yet

- Talisay Central Eagles ClubDocument5 pagesTalisay Central Eagles ClubRheneir Mora0% (1)

- 2019notice New Forms and Pre EvaluationDocument29 pages2019notice New Forms and Pre EvaluationRheneir MoraNo ratings yet

- Amcham Phil. Membership SurveyDocument2 pagesAmcham Phil. Membership SurveyRheneir Mora100% (1)

- 1702EX2020Document5 pages1702EX2020Rheneir MoraNo ratings yet

- 77th ANC CebuDocument7 pages77th ANC CebuRheneir MoraNo ratings yet

- Session 2 - QAR Audit Methodology Manual - IsQMDocument49 pagesSession 2 - QAR Audit Methodology Manual - IsQMRheneir MoraNo ratings yet

- Session 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureDocument18 pagesSession 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureRheneir MoraNo ratings yet

- Session 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualDocument12 pagesSession 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualRheneir MoraNo ratings yet

- Session 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditDocument34 pagesSession 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditRheneir MoraNo ratings yet

- Session 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationDocument23 pagesSession 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationRheneir MoraNo ratings yet

- 04 Property PicturesDocument1 page04 Property PicturesRheneir MoraNo ratings yet

- Accountancy ImpQ CH04 Admission of A Partner 01Document18 pagesAccountancy ImpQ CH04 Admission of A Partner 01praveentyagiNo ratings yet

- Insurance Company Business PlanDocument36 pagesInsurance Company Business PlanS M Hasan Sayeed50% (2)

- Quiz: Corporate Liquidation Final Term: Problem 1Document3 pagesQuiz: Corporate Liquidation Final Term: Problem 1Eel GiNo ratings yet

- Gaisano Cagayan Inc. vs. Insurance Company of North AmericaDocument3 pagesGaisano Cagayan Inc. vs. Insurance Company of North Americajune bayNo ratings yet

- Term Sheet - Convertible Note - SkillDzireDocument5 pagesTerm Sheet - Convertible Note - SkillDzireMAツVIcKYツNo ratings yet

- Credit Creation Theory: The Concept of Money & How It Is CirculatedDocument2 pagesCredit Creation Theory: The Concept of Money & How It Is CirculatedMoud KhalfaniNo ratings yet

- Lovely Lucille Updated ResumeDocument1 pageLovely Lucille Updated ResumeG.Z. Lanting HardwareNo ratings yet

- Datasheet Financial Management SeDocument6 pagesDatasheet Financial Management SeALHNo ratings yet

- Classroom Discussion 1 - 04172021Document3 pagesClassroom Discussion 1 - 04172021LLYOD FRANCIS LAYLAYNo ratings yet

- MultiplierDocument47 pagesMultiplierShruti Saxena100% (3)

- Tata Communications Annual Report 2014Document172 pagesTata Communications Annual Report 2014varaprasad_ganjiNo ratings yet

- BIS Papers - Survey On Central Bank Digital CurrenciesDocument19 pagesBIS Papers - Survey On Central Bank Digital Currencieswbechara103No ratings yet

- Kotak Mahindra Bank Limited: Custodial ServicesDocument4 pagesKotak Mahindra Bank Limited: Custodial Servicesstiwari2010No ratings yet

- Chapter 7 Stock ValuationDocument67 pagesChapter 7 Stock ValuationMahmoud Yassen El GhannamNo ratings yet

- McGraw Hill Connect Question Bank Assignment 3Document2 pagesMcGraw Hill Connect Question Bank Assignment 3Jayann Danielle MadrazoNo ratings yet

- Macroeconomics 11th Edition Parkin Solutions ManualDocument21 pagesMacroeconomics 11th Edition Parkin Solutions Manualdencuongpow5100% (23)

- NCERT Financial Accounting Class 11Document412 pagesNCERT Financial Accounting Class 11Abhimanyu TyagiNo ratings yet

- BBA G SEm 1 2012Document10 pagesBBA G SEm 1 2012sourabhmunjal0112No ratings yet

- IndiGrid Corp Deck QIPDocument17 pagesIndiGrid Corp Deck QIPNagesh WaghNo ratings yet

- Text Solutions - CH8Document16 pagesText Solutions - CH8Josef Galileo SibalaNo ratings yet

- Research ProposalDocument15 pagesResearch ProposalBonDocEldRicNo ratings yet

- ICICIDocument24 pagesICICIPaRas ChAuhanNo ratings yet

- Maths ProjectDocument6 pagesMaths ProjectAbhinav AgarwalNo ratings yet

- Actuary MagazineDocument32 pagesActuary MagazineanuiscoolNo ratings yet

- Theory in Action 6.2 Dan 5.2Document2 pagesTheory in Action 6.2 Dan 5.2zahra zhafiraNo ratings yet

- Micro Project: Government Polytechnic, VikramgadDocument11 pagesMicro Project: Government Polytechnic, VikramgadDibyas Sanjay DubeyNo ratings yet