Professional Documents

Culture Documents

Navigating New Challenges in Medicare RX Drug Billing

Navigating New Challenges in Medicare RX Drug Billing

Uploaded by

Varinder KaurCopyright:

Available Formats

You might also like

- AHM 250 Course MaterialDocument285 pagesAHM 250 Course MaterialAnitha Viji73% (15)

- PBM Revenue Streams Lack TransparencyDocument4 pagesPBM Revenue Streams Lack Transparencyapi-165632810No ratings yet

- Medicare Part DDocument2 pagesMedicare Part DArnold VenturesNo ratings yet

- ACA SummaryDocument9 pagesACA SummaryScottRobertLaneNo ratings yet

- Medicaid: Health Policy BriefDocument2 pagesMedicaid: Health Policy BriefArnold VenturesNo ratings yet

- The Next Steps For Medicare Reform, Cato Policy AnalysisDocument24 pagesThe Next Steps For Medicare Reform, Cato Policy AnalysisCato InstituteNo ratings yet

- Fact Sheet - Health Care - FINALDocument6 pagesFact Sheet - Health Care - FINALsarahkliffNo ratings yet

- 2006 Medicare Part D Payments: Total Drug Spend Troop Out of Pocket Cost Portion Covered by MedicareDocument5 pages2006 Medicare Part D Payments: Total Drug Spend Troop Out of Pocket Cost Portion Covered by MedicareVinodh KumarNo ratings yet

- Medicare Prescription Drugs: Medical Necessity Meets Fiscal Insanity Cato Briefing Paper No. 91Document12 pagesMedicare Prescription Drugs: Medical Necessity Meets Fiscal Insanity Cato Briefing Paper No. 91Cato InstituteNo ratings yet

- Medicare Is Not BankruptDocument3 pagesMedicare Is Not BankruptMustaffah KabelyyonNo ratings yet

- Administration Outlines Plan To Lower Pharmaceutical Prices in Medicare Part B - Health AffairsDocument10 pagesAdministration Outlines Plan To Lower Pharmaceutical Prices in Medicare Part B - Health AffairsLeroy RogersNo ratings yet

- Summary, Analysis & Review of Philip Moeller’s Get What’s Yours for MedicareFrom EverandSummary, Analysis & Review of Philip Moeller’s Get What’s Yours for MedicareNo ratings yet

- 11522-p Closing The Coverage GapDocument8 pages11522-p Closing The Coverage GapJames LindonNo ratings yet

- Cost Control in Health Care......................................Document11 pagesCost Control in Health Care......................................Rifat ParveenNo ratings yet

- Mac Guineas Testimony Medicare Reform 12oct11Document12 pagesMac Guineas Testimony Medicare Reform 12oct11Committee For a Responsible Federal BudgetNo ratings yet

- Principle #5: Continued Vigilance in Health Reform March 31, 2010Document6 pagesPrinciple #5: Continued Vigilance in Health Reform March 31, 2010Committee For a Responsible Federal BudgetNo ratings yet

- AV Comment Letter On 2024 MA Advance Notice FINALDocument5 pagesAV Comment Letter On 2024 MA Advance Notice FINALArnold VenturesNo ratings yet

- Drug Pricing High Level Overview - 11-2Document2 pagesDrug Pricing High Level Overview - 11-2Peter SullivanNo ratings yet

- Drug Policy ProposalDocument10 pagesDrug Policy ProposalClay SpenceNo ratings yet

- Cost Sharing MotDocument9 pagesCost Sharing MotCommittee For a Responsible Federal BudgetNo ratings yet

- The Establishment Strikes Back: Medical Savings Accounts and Adverse Selection, Cato Briefing PaperDocument7 pagesThe Establishment Strikes Back: Medical Savings Accounts and Adverse Selection, Cato Briefing PaperCato InstituteNo ratings yet

- Comparison USInternational Prices Top Spending Part BDrugsDocument19 pagesComparison USInternational Prices Top Spending Part BDrugsTrisha LaragaNo ratings yet

- Policy BriefDocument9 pagesPolicy BriefvnkrnjNo ratings yet

- The Shifting Landscape of The US Healthcare System Through The ACA and Specific InitiativesDocument3 pagesThe Shifting Landscape of The US Healthcare System Through The ACA and Specific InitiativesPhoebe MwendiaNo ratings yet

- Bennet-Kaine Medicare-X Choice Act SummaryDocument1 pageBennet-Kaine Medicare-X Choice Act SummaryU.S. Senator Michael F. BennetNo ratings yet

- Medicare Part D DissertationDocument7 pagesMedicare Part D DissertationPayToWritePaperSingapore100% (1)

- MMMMDocument3 pagesMMMMMaria Galla'No ratings yet

- The Fiscal Challenges Facing Medicare: Entitlement Spending and MedicareDocument20 pagesThe Fiscal Challenges Facing Medicare: Entitlement Spending and MedicarelosangelesNo ratings yet

- Privatizing Medicaid in ColoradoDocument7 pagesPrivatizing Medicaid in ColoradoIndependence InstituteNo ratings yet

- Affordable Care Act - EditedDocument8 pagesAffordable Care Act - Editedjw3990725No ratings yet

- Prepplan PDFDocument12 pagesPrepplan PDFCommittee For a Responsible Federal BudgetNo ratings yet

- Thomas Lazarte Paper 1Document8 pagesThomas Lazarte Paper 1api-355446351No ratings yet

- Health System Reform Short SummaryDocument11 pagesHealth System Reform Short SummarySteve LevineNo ratings yet

- Overlapping Policies and Estimated Savings Across Fiscal PlansDocument12 pagesOverlapping Policies and Estimated Savings Across Fiscal PlansCommittee For a Responsible Federal BudgetNo ratings yet

- Community Catalyst 2/25/11 Letter To HHS Secretary With Medicaid Cost-Savings SuggestionsDocument7 pagesCommunity Catalyst 2/25/11 Letter To HHS Secretary With Medicaid Cost-Savings SuggestionsSandy CohenNo ratings yet

- The Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short TermDocument8 pagesThe Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short Termapi-227433089No ratings yet

- The HMO Act of 1973 Health Maintenance Organization Act of 1973Document3 pagesThe HMO Act of 1973 Health Maintenance Organization Act of 1973Sai PrabhuNo ratings yet

- 228ec2b3656874dff1b09ef4c4d69af3Document18 pages228ec2b3656874dff1b09ef4c4d69af3Dickson Mugo Wambui TU01SC21107032019No ratings yet

- Medicare Part BDocument2 pagesMedicare Part BArnold VenturesNo ratings yet

- Managed Healthcare: Industry OverviewDocument11 pagesManaged Healthcare: Industry Overviewt6166asNo ratings yet

- Overlapping Policies and Estimated Savings Across Fiscal PlansDocument13 pagesOverlapping Policies and Estimated Savings Across Fiscal PlansCommittee For a Responsible Federal BudgetNo ratings yet

- September 21, 2009 The Honorable Max Baucus Chairman Senate FinanceDocument13 pagesSeptember 21, 2009 The Honorable Max Baucus Chairman Senate Financeapi-26254299No ratings yet

- The Costs of Regulation and Centralization in Health Care by Scott AtlasDocument22 pagesThe Costs of Regulation and Centralization in Health Care by Scott AtlasHoover InstitutionNo ratings yet

- Medicaid Prescription Drug Spending and UseDocument16 pagesMedicaid Prescription Drug Spending and UseRobert AvramescuNo ratings yet

- A Comparison and Contrast of Medicare and Medicaid BenefitsDocument6 pagesA Comparison and Contrast of Medicare and Medicaid BenefitsLiam PaulNo ratings yet

- Research Paper On MedicaidDocument7 pagesResearch Paper On Medicaidafnkhujzxbfnls100% (1)

- High Deductible Health PlansDocument6 pagesHigh Deductible Health PlansiggybauNo ratings yet

- Ib 33 PDFDocument12 pagesIb 33 PDFLatinos Ready To VoteNo ratings yet

- Millman 2016 Analysis of Medicare IndustryDocument25 pagesMillman 2016 Analysis of Medicare Industrykhyati123No ratings yet

- AHM 250 Chapter 1Document9 pagesAHM 250 Chapter 1Paromita MukhopadhyayNo ratings yet

- Medicare Revolution: Profiting from Quality, Not QuantityFrom EverandMedicare Revolution: Profiting from Quality, Not QuantityNo ratings yet

- Is Medicare The Right WayDocument2 pagesIs Medicare The Right Wayasifahsan772No ratings yet

- 1.evolution of Heath PlansDocument9 pages1.evolution of Heath PlansUtpal Kumar PalNo ratings yet

- Fan Understanding The Insurance ProcessDocument12 pagesFan Understanding The Insurance ProcessWill SackettNo ratings yet

- Department of Health & Human ServicesDocument31 pagesDepartment of Health & Human ServicesBrian AhierNo ratings yet

- Medigap John RadinDocument12 pagesMedigap John Radinjohnnyerstwild1393No ratings yet

- Affordable Care ActDocument5 pagesAffordable Care Actneha24verma3201No ratings yet

- AFL-CIO Letter SurpriseBillingDocument2 pagesAFL-CIO Letter SurpriseBillingPeter SullivanNo ratings yet

- Know Options Medicare Participation GuideDocument4 pagesKnow Options Medicare Participation Guidecharanmann9165No ratings yet

- Perspective: New England Journal MedicineDocument3 pagesPerspective: New England Journal MedicineAllen ZhuNo ratings yet

- NURS FPX 6612 Assessment 2 Quality Improvement ProposalDocument4 pagesNURS FPX 6612 Assessment 2 Quality Improvement Proposaljoohnsmith070No ratings yet

- NURS FPX 6612 Assessment 1 Triple Aim Outcome MeasuresDocument8 pagesNURS FPX 6612 Assessment 1 Triple Aim Outcome Measureszadem5266No ratings yet

- 2024 Choices Enrollment Guide - Rev 101623Document30 pages2024 Choices Enrollment Guide - Rev 101623Trisha LaragaNo ratings yet

- NHS FPX 4000 Assessment 4 - Analyzing A Current Health Care Problem or IssueDocument5 pagesNHS FPX 4000 Assessment 4 - Analyzing A Current Health Care Problem or Issuejoohnsmith070No ratings yet

- Servitization in Manufacturing - The Final FrontierDocument7 pagesServitization in Manufacturing - The Final FrontierDedar HossainNo ratings yet

- NHS FPX 4000 Assessment 4-Analyzing A Current Health Care Problem or IssueDocument7 pagesNHS FPX 4000 Assessment 4-Analyzing A Current Health Care Problem or Issuezadem5266No ratings yet

- Nhs FPX 4000 Assessment 2 Applying Research SkillsDocument5 pagesNhs FPX 4000 Assessment 2 Applying Research Skillsfarwaamjad771No ratings yet

- Reg - Imp - Vet DrugsDocument7 pagesReg - Imp - Vet DrugsGloria Rinchen ChödrenNo ratings yet

- NURS FPX 6412 Assessment 2 Presentation To The OrganizationDocument6 pagesNURS FPX 6412 Assessment 2 Presentation To The Organizationfarwaamjad771No ratings yet

- 205-SC-OSCM-01 - Services Operations Management-I SolvedDocument13 pages205-SC-OSCM-01 - Services Operations Management-I SolveddGNo ratings yet

- NURS FPX 6016 Assessment 1 Adverse Event or Near-Miss AnalysisDocument6 pagesNURS FPX 6016 Assessment 1 Adverse Event or Near-Miss Analysisjoohnsmith070No ratings yet

- NURS FPX 6016 Assessment 2 Quality Improvement Initiative EvaluationDocument4 pagesNURS FPX 6016 Assessment 2 Quality Improvement Initiative Evaluationjoohnsmith070No ratings yet

- NURS FPX 6410 Assessment 2 Executive Summary To AdministrationDocument5 pagesNURS FPX 6410 Assessment 2 Executive Summary To Administrationjoohnsmith070No ratings yet

- Marketing Management Module 6Document3 pagesMarketing Management Module 6Sharon Cadampog MananguiteNo ratings yet

- Nurs FPX 4040 Assessment 3 Annotated Bibliography On Technology in NursingDocument5 pagesNurs FPX 4040 Assessment 3 Annotated Bibliography On Technology in Nursingjoohnsmith070No ratings yet

- Ahip Final Exam Test Questions Latest Version 2022Document32 pagesAhip Final Exam Test Questions Latest Version 2022dmen318j2022No ratings yet

- Information Systems For Healthcare Management Eighth Edition 8Th Edition Full ChapterDocument41 pagesInformation Systems For Healthcare Management Eighth Edition 8Th Edition Full Chapterarnold.kluge705100% (24)

- What Are The Potential Cost Savings From Legalizing Physician-Assisted Suicide - New England Journal of MedicineDocument2 pagesWhat Are The Potential Cost Savings From Legalizing Physician-Assisted Suicide - New England Journal of MedicineHiền Thương LêNo ratings yet

- Im Non Productive Sector AssignmentDocument4 pagesIm Non Productive Sector AssignmentImrul Huda AyonNo ratings yet

- NHS FPX 6004 Assessment 1 Dashboard Metrics EvaluationDocument6 pagesNHS FPX 6004 Assessment 1 Dashboard Metrics Evaluationfarwaamjad771No ratings yet

- NURS FPX 6412 Assessment 3 Manuscript For PublicationDocument5 pagesNURS FPX 6412 Assessment 3 Manuscript For Publicationfarwaamjad771No ratings yet

- Act Ch09 l04 EnglishDocument3 pagesAct Ch09 l04 Englishaubrymichalllllllllll44No ratings yet

- Regional Circular No. 2023 27 Disease Categorization Per Service CapabilityDocument1 pageRegional Circular No. 2023 27 Disease Categorization Per Service CapabilitySAMCH HEMSNo ratings yet

- Ivr - Answered - Lakhan JiDocument25 pagesIvr - Answered - Lakhan Jivishal vishalNo ratings yet

- Daftar Tilik Pemenuhan Minimal Untuk PPI Di PuskesmasDocument14 pagesDaftar Tilik Pemenuhan Minimal Untuk PPI Di PuskesmasrosnimalaNo ratings yet

- HealthCare Domain TestingDocument6 pagesHealthCare Domain TestingsubhabirajdarNo ratings yet

- dm2024 0149Document1 pagedm2024 0149سانو روديلNo ratings yet

- Dpo2024 0014 CHD DirectorsDocument3 pagesDpo2024 0014 CHD DirectorsArmand BudlaoNo ratings yet

- NURS FPX 6412 Assessment 3 Manuscript For PublicationDocument8 pagesNURS FPX 6412 Assessment 3 Manuscript For Publicationzadem5266No ratings yet

- SR Health Referral BrochureDocument4 pagesSR Health Referral BrochureEsmeraldaNo ratings yet

Navigating New Challenges in Medicare RX Drug Billing

Navigating New Challenges in Medicare RX Drug Billing

Uploaded by

Varinder KaurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Navigating New Challenges in Medicare RX Drug Billing

Navigating New Challenges in Medicare RX Drug Billing

Uploaded by

Varinder KaurCopyright:

Available Formats

Navigating New Challenges in Medicare Rx Drug Billing

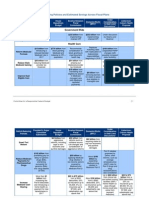

As people in the United States grow older at an incredible rate, with 10,000 new seniors every day, healthcare providers are facing

significant challenges with Medicare billing. The Inflation Reduction Act (IRA) helps by limiting Medicare Part D costs, but it also

complicates things. Providers need to change their strategies to keep up. Modern medicine helps people live longer but also increases

healthcare costs for older people.

The Inflation Reduction Act (IRA) addresses some of these issues by expanding Medicare benefits, improving sustainability, and

capping Medicare Part D expenses at $2,000 for out-of-pocket pharmacy costs. Starting in 2025, a new law requires all Medicare

prescription drug plans, including stand-alone plans and Medicare Advantage plans with drug coverage, to offer members the option

to pay out-of-pocket drug costs in monthly instalments. This will help Part D members manage high costs early in the year by

spreading expenses throughout the year.

When certain drug companies increase the prices of medications covered under Medicare Part B and Part D faster than inflation, they

will have to pay rebates to the Medicare Trust Fund. This is part of the Medicare Prescription Drug Inflation Rebate Program. Starting

in 2025, CMS will send invoices to these companies for rebates that cover the years 2022, 2023, and 2024. The rebate period for Part

D began on October 1, 2022, and for Part B, it started on January 1, 2023. Additionally, if prices for some Part B drugs rise faster than

inflation, CMS will lower the coinsurance costs for beneficiaries. So far, CMS has reduced coinsurance for 64 drugs and biologicals.

Additionally, a new option called the Medicare Prescription Payment Plan, or M3P, will let enrollees spread their OOP costs

throughout the year instead of paying everything upfront at the pharmacy. Although implementing these policies is complex and

affects many stakeholders, they could improve patient access to medications by making them more affordable and encouraging

medication adherence.

The OOP cap is a significant part of the broader redesign of the Part D program under the IRA. This redesign will eliminate the

coverage gap, known as the donut hole, and change how Medicare beneficiaries manage their drug costs. In 2025, the OOP cap will be

set at $2,000, but this amount will be adjusted for inflation over time.

This cap is expected to bring significant relief to beneficiaries who struggle with high prescription costs. However, it’s essential to

understand that changes in healthcare policy often have complex effects. While the OOP cap and M3P are expected to benefit

enrollees significantly, there could be mixed outcomes. For example, there is concern that enrollees might face higher Part D

premiums because plans will have to cover more of the drug costs above the spending cap. However, the IRA includes measures to

help stabilise premiums. Plans might also respond by increasing the use of generic drugs or other cost-saving measures.

CMS sought input on how to handle challenges that drug companies might face due to drug shortages and supply chain issues,

especially those beyond their control. The revised guidance includes measures to reduce rebates in such cases, consistent with the

Inflation Reduction Act. It also contains rules to prevent drug companies from staying on shortage lists or delaying the resolution of

supply chain issues to avoid paying rebates. While inflation rebates don’t apply to multi-source generic drugs (the ones most likely to

be in shortage), there are more significant rebate reductions for Part D sole-source generic drugs and Part B and Part D plasma-derived

products that are in shortage.

You might also like

- AHM 250 Course MaterialDocument285 pagesAHM 250 Course MaterialAnitha Viji73% (15)

- PBM Revenue Streams Lack TransparencyDocument4 pagesPBM Revenue Streams Lack Transparencyapi-165632810No ratings yet

- Medicare Part DDocument2 pagesMedicare Part DArnold VenturesNo ratings yet

- ACA SummaryDocument9 pagesACA SummaryScottRobertLaneNo ratings yet

- Medicaid: Health Policy BriefDocument2 pagesMedicaid: Health Policy BriefArnold VenturesNo ratings yet

- The Next Steps For Medicare Reform, Cato Policy AnalysisDocument24 pagesThe Next Steps For Medicare Reform, Cato Policy AnalysisCato InstituteNo ratings yet

- Fact Sheet - Health Care - FINALDocument6 pagesFact Sheet - Health Care - FINALsarahkliffNo ratings yet

- 2006 Medicare Part D Payments: Total Drug Spend Troop Out of Pocket Cost Portion Covered by MedicareDocument5 pages2006 Medicare Part D Payments: Total Drug Spend Troop Out of Pocket Cost Portion Covered by MedicareVinodh KumarNo ratings yet

- Medicare Prescription Drugs: Medical Necessity Meets Fiscal Insanity Cato Briefing Paper No. 91Document12 pagesMedicare Prescription Drugs: Medical Necessity Meets Fiscal Insanity Cato Briefing Paper No. 91Cato InstituteNo ratings yet

- Medicare Is Not BankruptDocument3 pagesMedicare Is Not BankruptMustaffah KabelyyonNo ratings yet

- Administration Outlines Plan To Lower Pharmaceutical Prices in Medicare Part B - Health AffairsDocument10 pagesAdministration Outlines Plan To Lower Pharmaceutical Prices in Medicare Part B - Health AffairsLeroy RogersNo ratings yet

- Summary, Analysis & Review of Philip Moeller’s Get What’s Yours for MedicareFrom EverandSummary, Analysis & Review of Philip Moeller’s Get What’s Yours for MedicareNo ratings yet

- 11522-p Closing The Coverage GapDocument8 pages11522-p Closing The Coverage GapJames LindonNo ratings yet

- Cost Control in Health Care......................................Document11 pagesCost Control in Health Care......................................Rifat ParveenNo ratings yet

- Mac Guineas Testimony Medicare Reform 12oct11Document12 pagesMac Guineas Testimony Medicare Reform 12oct11Committee For a Responsible Federal BudgetNo ratings yet

- Principle #5: Continued Vigilance in Health Reform March 31, 2010Document6 pagesPrinciple #5: Continued Vigilance in Health Reform March 31, 2010Committee For a Responsible Federal BudgetNo ratings yet

- AV Comment Letter On 2024 MA Advance Notice FINALDocument5 pagesAV Comment Letter On 2024 MA Advance Notice FINALArnold VenturesNo ratings yet

- Drug Pricing High Level Overview - 11-2Document2 pagesDrug Pricing High Level Overview - 11-2Peter SullivanNo ratings yet

- Drug Policy ProposalDocument10 pagesDrug Policy ProposalClay SpenceNo ratings yet

- Cost Sharing MotDocument9 pagesCost Sharing MotCommittee For a Responsible Federal BudgetNo ratings yet

- The Establishment Strikes Back: Medical Savings Accounts and Adverse Selection, Cato Briefing PaperDocument7 pagesThe Establishment Strikes Back: Medical Savings Accounts and Adverse Selection, Cato Briefing PaperCato InstituteNo ratings yet

- Comparison USInternational Prices Top Spending Part BDrugsDocument19 pagesComparison USInternational Prices Top Spending Part BDrugsTrisha LaragaNo ratings yet

- Policy BriefDocument9 pagesPolicy BriefvnkrnjNo ratings yet

- The Shifting Landscape of The US Healthcare System Through The ACA and Specific InitiativesDocument3 pagesThe Shifting Landscape of The US Healthcare System Through The ACA and Specific InitiativesPhoebe MwendiaNo ratings yet

- Bennet-Kaine Medicare-X Choice Act SummaryDocument1 pageBennet-Kaine Medicare-X Choice Act SummaryU.S. Senator Michael F. BennetNo ratings yet

- Medicare Part D DissertationDocument7 pagesMedicare Part D DissertationPayToWritePaperSingapore100% (1)

- MMMMDocument3 pagesMMMMMaria Galla'No ratings yet

- The Fiscal Challenges Facing Medicare: Entitlement Spending and MedicareDocument20 pagesThe Fiscal Challenges Facing Medicare: Entitlement Spending and MedicarelosangelesNo ratings yet

- Privatizing Medicaid in ColoradoDocument7 pagesPrivatizing Medicaid in ColoradoIndependence InstituteNo ratings yet

- Affordable Care Act - EditedDocument8 pagesAffordable Care Act - Editedjw3990725No ratings yet

- Prepplan PDFDocument12 pagesPrepplan PDFCommittee For a Responsible Federal BudgetNo ratings yet

- Thomas Lazarte Paper 1Document8 pagesThomas Lazarte Paper 1api-355446351No ratings yet

- Health System Reform Short SummaryDocument11 pagesHealth System Reform Short SummarySteve LevineNo ratings yet

- Overlapping Policies and Estimated Savings Across Fiscal PlansDocument12 pagesOverlapping Policies and Estimated Savings Across Fiscal PlansCommittee For a Responsible Federal BudgetNo ratings yet

- Community Catalyst 2/25/11 Letter To HHS Secretary With Medicaid Cost-Savings SuggestionsDocument7 pagesCommunity Catalyst 2/25/11 Letter To HHS Secretary With Medicaid Cost-Savings SuggestionsSandy CohenNo ratings yet

- The Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short TermDocument8 pagesThe Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short Termapi-227433089No ratings yet

- The HMO Act of 1973 Health Maintenance Organization Act of 1973Document3 pagesThe HMO Act of 1973 Health Maintenance Organization Act of 1973Sai PrabhuNo ratings yet

- 228ec2b3656874dff1b09ef4c4d69af3Document18 pages228ec2b3656874dff1b09ef4c4d69af3Dickson Mugo Wambui TU01SC21107032019No ratings yet

- Medicare Part BDocument2 pagesMedicare Part BArnold VenturesNo ratings yet

- Managed Healthcare: Industry OverviewDocument11 pagesManaged Healthcare: Industry Overviewt6166asNo ratings yet

- Overlapping Policies and Estimated Savings Across Fiscal PlansDocument13 pagesOverlapping Policies and Estimated Savings Across Fiscal PlansCommittee For a Responsible Federal BudgetNo ratings yet

- September 21, 2009 The Honorable Max Baucus Chairman Senate FinanceDocument13 pagesSeptember 21, 2009 The Honorable Max Baucus Chairman Senate Financeapi-26254299No ratings yet

- The Costs of Regulation and Centralization in Health Care by Scott AtlasDocument22 pagesThe Costs of Regulation and Centralization in Health Care by Scott AtlasHoover InstitutionNo ratings yet

- Medicaid Prescription Drug Spending and UseDocument16 pagesMedicaid Prescription Drug Spending and UseRobert AvramescuNo ratings yet

- A Comparison and Contrast of Medicare and Medicaid BenefitsDocument6 pagesA Comparison and Contrast of Medicare and Medicaid BenefitsLiam PaulNo ratings yet

- Research Paper On MedicaidDocument7 pagesResearch Paper On Medicaidafnkhujzxbfnls100% (1)

- High Deductible Health PlansDocument6 pagesHigh Deductible Health PlansiggybauNo ratings yet

- Ib 33 PDFDocument12 pagesIb 33 PDFLatinos Ready To VoteNo ratings yet

- Millman 2016 Analysis of Medicare IndustryDocument25 pagesMillman 2016 Analysis of Medicare Industrykhyati123No ratings yet

- AHM 250 Chapter 1Document9 pagesAHM 250 Chapter 1Paromita MukhopadhyayNo ratings yet

- Medicare Revolution: Profiting from Quality, Not QuantityFrom EverandMedicare Revolution: Profiting from Quality, Not QuantityNo ratings yet

- Is Medicare The Right WayDocument2 pagesIs Medicare The Right Wayasifahsan772No ratings yet

- 1.evolution of Heath PlansDocument9 pages1.evolution of Heath PlansUtpal Kumar PalNo ratings yet

- Fan Understanding The Insurance ProcessDocument12 pagesFan Understanding The Insurance ProcessWill SackettNo ratings yet

- Department of Health & Human ServicesDocument31 pagesDepartment of Health & Human ServicesBrian AhierNo ratings yet

- Medigap John RadinDocument12 pagesMedigap John Radinjohnnyerstwild1393No ratings yet

- Affordable Care ActDocument5 pagesAffordable Care Actneha24verma3201No ratings yet

- AFL-CIO Letter SurpriseBillingDocument2 pagesAFL-CIO Letter SurpriseBillingPeter SullivanNo ratings yet

- Know Options Medicare Participation GuideDocument4 pagesKnow Options Medicare Participation Guidecharanmann9165No ratings yet

- Perspective: New England Journal MedicineDocument3 pagesPerspective: New England Journal MedicineAllen ZhuNo ratings yet

- NURS FPX 6612 Assessment 2 Quality Improvement ProposalDocument4 pagesNURS FPX 6612 Assessment 2 Quality Improvement Proposaljoohnsmith070No ratings yet

- NURS FPX 6612 Assessment 1 Triple Aim Outcome MeasuresDocument8 pagesNURS FPX 6612 Assessment 1 Triple Aim Outcome Measureszadem5266No ratings yet

- 2024 Choices Enrollment Guide - Rev 101623Document30 pages2024 Choices Enrollment Guide - Rev 101623Trisha LaragaNo ratings yet

- NHS FPX 4000 Assessment 4 - Analyzing A Current Health Care Problem or IssueDocument5 pagesNHS FPX 4000 Assessment 4 - Analyzing A Current Health Care Problem or Issuejoohnsmith070No ratings yet

- Servitization in Manufacturing - The Final FrontierDocument7 pagesServitization in Manufacturing - The Final FrontierDedar HossainNo ratings yet

- NHS FPX 4000 Assessment 4-Analyzing A Current Health Care Problem or IssueDocument7 pagesNHS FPX 4000 Assessment 4-Analyzing A Current Health Care Problem or Issuezadem5266No ratings yet

- Nhs FPX 4000 Assessment 2 Applying Research SkillsDocument5 pagesNhs FPX 4000 Assessment 2 Applying Research Skillsfarwaamjad771No ratings yet

- Reg - Imp - Vet DrugsDocument7 pagesReg - Imp - Vet DrugsGloria Rinchen ChödrenNo ratings yet

- NURS FPX 6412 Assessment 2 Presentation To The OrganizationDocument6 pagesNURS FPX 6412 Assessment 2 Presentation To The Organizationfarwaamjad771No ratings yet

- 205-SC-OSCM-01 - Services Operations Management-I SolvedDocument13 pages205-SC-OSCM-01 - Services Operations Management-I SolveddGNo ratings yet

- NURS FPX 6016 Assessment 1 Adverse Event or Near-Miss AnalysisDocument6 pagesNURS FPX 6016 Assessment 1 Adverse Event or Near-Miss Analysisjoohnsmith070No ratings yet

- NURS FPX 6016 Assessment 2 Quality Improvement Initiative EvaluationDocument4 pagesNURS FPX 6016 Assessment 2 Quality Improvement Initiative Evaluationjoohnsmith070No ratings yet

- NURS FPX 6410 Assessment 2 Executive Summary To AdministrationDocument5 pagesNURS FPX 6410 Assessment 2 Executive Summary To Administrationjoohnsmith070No ratings yet

- Marketing Management Module 6Document3 pagesMarketing Management Module 6Sharon Cadampog MananguiteNo ratings yet

- Nurs FPX 4040 Assessment 3 Annotated Bibliography On Technology in NursingDocument5 pagesNurs FPX 4040 Assessment 3 Annotated Bibliography On Technology in Nursingjoohnsmith070No ratings yet

- Ahip Final Exam Test Questions Latest Version 2022Document32 pagesAhip Final Exam Test Questions Latest Version 2022dmen318j2022No ratings yet

- Information Systems For Healthcare Management Eighth Edition 8Th Edition Full ChapterDocument41 pagesInformation Systems For Healthcare Management Eighth Edition 8Th Edition Full Chapterarnold.kluge705100% (24)

- What Are The Potential Cost Savings From Legalizing Physician-Assisted Suicide - New England Journal of MedicineDocument2 pagesWhat Are The Potential Cost Savings From Legalizing Physician-Assisted Suicide - New England Journal of MedicineHiền Thương LêNo ratings yet

- Im Non Productive Sector AssignmentDocument4 pagesIm Non Productive Sector AssignmentImrul Huda AyonNo ratings yet

- NHS FPX 6004 Assessment 1 Dashboard Metrics EvaluationDocument6 pagesNHS FPX 6004 Assessment 1 Dashboard Metrics Evaluationfarwaamjad771No ratings yet

- NURS FPX 6412 Assessment 3 Manuscript For PublicationDocument5 pagesNURS FPX 6412 Assessment 3 Manuscript For Publicationfarwaamjad771No ratings yet

- Act Ch09 l04 EnglishDocument3 pagesAct Ch09 l04 Englishaubrymichalllllllllll44No ratings yet

- Regional Circular No. 2023 27 Disease Categorization Per Service CapabilityDocument1 pageRegional Circular No. 2023 27 Disease Categorization Per Service CapabilitySAMCH HEMSNo ratings yet

- Ivr - Answered - Lakhan JiDocument25 pagesIvr - Answered - Lakhan Jivishal vishalNo ratings yet

- Daftar Tilik Pemenuhan Minimal Untuk PPI Di PuskesmasDocument14 pagesDaftar Tilik Pemenuhan Minimal Untuk PPI Di PuskesmasrosnimalaNo ratings yet

- HealthCare Domain TestingDocument6 pagesHealthCare Domain TestingsubhabirajdarNo ratings yet

- dm2024 0149Document1 pagedm2024 0149سانو روديلNo ratings yet

- Dpo2024 0014 CHD DirectorsDocument3 pagesDpo2024 0014 CHD DirectorsArmand BudlaoNo ratings yet

- NURS FPX 6412 Assessment 3 Manuscript For PublicationDocument8 pagesNURS FPX 6412 Assessment 3 Manuscript For Publicationzadem5266No ratings yet

- SR Health Referral BrochureDocument4 pagesSR Health Referral BrochureEsmeraldaNo ratings yet