Professional Documents

Culture Documents

NFRS Applicability Adoption Timeline

NFRS Applicability Adoption Timeline

Uploaded by

Hardic Jajodia0 ratings0% found this document useful (0 votes)

7 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views2 pagesNFRS Applicability Adoption Timeline

NFRS Applicability Adoption Timeline

Uploaded by

Hardic JajodiaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Nepal Financial Reporting Standards (NFRS) Applicability and Adoption Timeline

Nepal Financial Reporting Standards (NFRS) What is Economic Significant?

1) The entity called entity having economic significant if any of the

Nepal Financial Reporting Standards (NFRS) are set of financial reporting standards developed by

following, conditions are satisfied

the Accounting Standards Board (ASB) with belief that the common global language for business

affairs so that company accountants are understandable and comparable within Nepal.

2) Borrowings from B&FIs or public funds or from entities holding an

assets in fiduciary capacity of NPR 50 Crore (500 Million) or more;

Those entities having Full NFRS

Public Accountability 3) Total of Financial Position (Balance Sheet) without offsetting

current assets and current liabilities) of NPR 1 Arab (1000 Million)

or more;

Applicability 4) Employing more than 300 employees including worker during the

Those entities not having NFRS for

of NFRS year on an average

public Accountability SME

5) Annual Turnover of NPR 1 Arab (1000 Million) or more

6) Holding an assets in fiduciary capacity in excess of NPR 50 Crore

(500 million) including security brokers handling Demat account,

Those entities not having NFRS for micro finance and co-operatives

public Accountability Micro Entity

other than SMEs Note: An entity which attains at least 1 of these limits in 2 consecutive

years shall be deemed to be an entity having economic significance

to qualify as an entity with public accountability and once qualified,

Who have Public Accountability? must fall below all of these limits for 2 consecutive years to cease to

1) Whose debt or equity instruments are traded in public market or is in process of issuing qualify.

such instruments (except listed Micro Finance not having economic significance)

What is Small and Medium-sized Entities (SMEs)?

2) It holds assets in a fiduciary capacity for broad group of outsiders as one of its primary Small and Medium-sized Entities (SMEs) are the entities that;

businesses:

1) Do not have public accountability; and

a. banks, credit unions, insurance companies, security dealers and mutual funds, 2) Publish general purpose financial statements for external users

investment banks (except Micro Finance and Cooperatives not having economic

significance) Note: General purpose financial statements are those directed to

general financial information of the wide range of users who are not

b. Pension and retirement fund

in position to demand reports tailored to meet their particular

3) Government Business Enterprises (GBEs), Public entities established under special acts information needs.

not preparing financial statements under NPSAS

Therefore, entity comply with the above definition of SMEs shall

4) Entities having economic significance prepare financial statements as per NFRS for SMEs issued by The

Institute of Chartered Accountant of Nepal.

What is Micro Entities? Adoption Timeline of NFRS

Micro entities are those entities, which fulfill all the following thresholds: The entities shall prepare its Financial Statements as per respective

1) Annual turnover of NPR 10 Crore (100 Million) or less applicable NFRS on or after the following timeline

Financial

2) Borrowing from B&FIs or Public Fund or from entity holding assets in fiduciary capacity of

Type Entity Type

Year

NPR 5 Crore (50 Million) or less

1) Listed Multinational Manufacturing

3) Total of financial position (Balance sheet) of NPR 10 Crore (100 Million) or less without Companies

offsetting current assets and current liabilities 2) Listed State Owned Enterprises (SOEs)

A 2014/15

with minimum paid up capital of NPR 5

4) Holding assets in fiduciary capacity of NPR 5 Crore (50 Million) or less including security billion (except Banks and Financial

broker handling demat account, micro finance and co-operatives. Institutions under BAFIA Act 2006)

Note: An entity must meet all of these limits in 2 consecutive years to qualify as a micro-entity and

once qualified, must exceed at least 1 of these limit for 2 consecutive years to cease to qualify. 1) Commercial Bank including State Owned

Therefore, entity not having public accountability and not SMEs shall prepare financial statements Commercial Bank

as per NAS for Micro-entity issued by the Institute of Chartered Account of Nepal . B 2015/16

2) All other listed State Owned Enterprise

(SOEs)

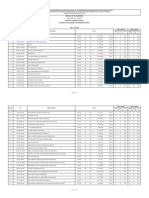

Summary of NFRS Applicability

Public Accountability

1) Debt or Equity traded in public market 1) All Other Financial Institution not covered

2) Hold assets in fiduciary capacity (Bank, Insurance, Mutual fund etc. under A&B above

Full 2) All other State Owned Entity (SOEs)

PF/R/P)

3) Government Business Entities NFRS 3) Insurance Companies

4) Economic Significance C 4) All other listed companies 2016/17

Economic Significance 5) All other corporate bodies/entity not

defined as SMEs or entities having

Particulars NFRS SMEs ME borrowing with minimum of NPR 500

Loan/ Borrowings 50 Cr <= # 5 Cr < # < 50 Cr 5 Cr >= # Million

Financial Position (Balance Sheet) Total 10 Cr < # < 100

100 Cr <= # Cr 10 Cr >= # D SMEs as defined and classified by ASB 2078/79

Number of Employees 300 < # N/A N/A

Annual Turnover 10 Cr < # < 100 E Micro-entity as defined and classified by ASB 2078/79

100 Cr <= # Cr 10 Cr >= # Note: SMEs, Micro-entity & NPOs can prepare its financial statements

Holding and Assets in Fiduciary Capacity 5 Cr < # < = 50 as per respective NFRS for the FY 2077-78 as voluntarily.

50 Cr < # Cr 5 Cr >= # The Institute of Chartered Accountant of Nepal has extended the due

Qualify At least 1 for 2 ………….. All for 2 CY date of applicability of NFRS to FY 2020-21 for SMEs and Non-Profit

CY Organization.

Disqualify Below all of ……………… At least exceed

these for 2 CY for 2 CY**

**CY= Consecutives Year

Note: - NFRS-9, NFRS-14, NFRS-15, NFRS-16, NFRS-17 and NAS-29 shall be applicable form 1st Shrawan 2078 and rest of NFRS standards are applicable from 1st Shrawan 2077.

- The entity should compulsory applied related IFRIC and SIC while preparing financial statements from 1st shrawan 2077.

You might also like

- Waldo Case SolDocument3 pagesWaldo Case Solvishal nigam100% (2)

- Full PFRS vs. PFRS For Medium Entities vs. PFRS For Small EntitiesDocument101 pagesFull PFRS vs. PFRS For Medium Entities vs. PFRS For Small EntitiesMark Gelo WinchesterNo ratings yet

- Inverse Concentric Zone Theory (Regional Planning)Document6 pagesInverse Concentric Zone Theory (Regional Planning)mrkkenflo100% (1)

- SME Week-1Document3 pagesSME Week-1akimahgozonNo ratings yet

- Chapter 30 - PFRS For SEs, PFRS For SEs and Reporting For MicroenterprisesDocument6 pagesChapter 30 - PFRS For SEs, PFRS For SEs and Reporting For MicroenterprisesNoella Marie BaronNo ratings yet

- 6.1 PFRS For SmeDocument9 pages6.1 PFRS For SmecookiedoughNo ratings yet

- Small & Medium-Sized Entities (Smes)Document8 pagesSmall & Medium-Sized Entities (Smes)Levi Emmanuel Veloso BravoNo ratings yet

- October 13, 2009 - The Adoption of IFRS ForDocument12 pagesOctober 13, 2009 - The Adoption of IFRS Formjay moredoNo ratings yet

- Financial Accounting and Reporting: Small and Medium-Sized EntitiesDocument19 pagesFinancial Accounting and Reporting: Small and Medium-Sized EntitiesDan DiNo ratings yet

- PWC News Alert 19 January 2019 Changes To The Ecb FrameworkDocument4 pagesPWC News Alert 19 January 2019 Changes To The Ecb FrameworkShweta AgarwalNo ratings yet

- Mudra Eligibility Criteria For Partner Institutions: I. Scheduled Commercial BanksDocument6 pagesMudra Eligibility Criteria For Partner Institutions: I. Scheduled Commercial BanksI. SarithaNo ratings yet

- Acccob 2 ReviewerDocument14 pagesAcccob 2 Revieweranika bordaNo ratings yet

- BUSINESS FINANCE Reviewer PrelimsDocument3 pagesBUSINESS FINANCE Reviewer Prelimssushi nakiriNo ratings yet

- NBFC Note RBI MAT 2Document19 pagesNBFC Note RBI MAT 2Prashant RatnpandeyNo ratings yet

- CHAPTER 23 SMEs (Concept Map)Document2 pagesCHAPTER 23 SMEs (Concept Map)kateyy99No ratings yet

- Chapter 1 - Financial StatementsDocument2 pagesChapter 1 - Financial StatementsclarizaNo ratings yet

- Financial Market Reviewer AllDocument11 pagesFinancial Market Reviewer AllPrincess SagunNo ratings yet

- 08 MF NBFC - UnlockedDocument23 pages08 MF NBFC - UnlockedBittu SharmaNo ratings yet

- NAS For MEs ChecklistDocument4 pagesNAS For MEs Checklistsumankandel015100% (1)

- Notes To Financial Powerventure-2014Document12 pagesNotes To Financial Powerventure-2014M C Dela CrzNo ratings yet

- Business Finance Prelim ReviewerDocument7 pagesBusiness Finance Prelim ReviewerYannah Hidalgo100% (1)

- Advanced Auditing and Professional Ethics 1688653213Document28 pagesAdvanced Auditing and Professional Ethics 1688653213mdasifraza3196No ratings yet

- NBFC - Vinay Kumar MouryaDocument8 pagesNBFC - Vinay Kumar Mouryamadhurkj1512No ratings yet

- MSME OUTPUT 2 and 3 Prelim - SingsonDocument15 pagesMSME OUTPUT 2 and 3 Prelim - SingsonDonna Mae SingsonNo ratings yet

- Financial Accounting and Reporting 1 and Income TaxationDocument15 pagesFinancial Accounting and Reporting 1 and Income TaxationGianJoshuaDayritNo ratings yet

- Finals Module Part 1Document12 pagesFinals Module Part 1Claire BarbaNo ratings yet

- Finac Final Handouts 1 PDFDocument2 pagesFinac Final Handouts 1 PDFRamm Raven CastilloNo ratings yet

- FAR 001 Conceptual FrameworkDocument4 pagesFAR 001 Conceptual FrameworkdreianyanmaraNo ratings yet

- Finon Week2 Financial SystemDocument27 pagesFinon Week2 Financial SystemAebilTaskari RNo ratings yet

- Babe1-4 Conceptual FrameworkDocument7 pagesBabe1-4 Conceptual FrameworkJanelle Lyn MalapitanNo ratings yet

- Disclosures Under IFRS 9: What's The Aim?Document16 pagesDisclosures Under IFRS 9: What's The Aim?Ishtiaq AzamNo ratings yet

- FM Reviewer PDFDocument6 pagesFM Reviewer PDFDerick FontanillaNo ratings yet

- Understanding Financial StatementsDocument3 pagesUnderstanding Financial StatementsRenelyn C. CasNo ratings yet

- Final DT 100 Important Questions Final Audit Practice Questions Financial Reporting Conceptual NotesDocument14 pagesFinal DT 100 Important Questions Final Audit Practice Questions Financial Reporting Conceptual NotesDheeraj TurpunatiNo ratings yet

- BR NBFCDocument23 pagesBR NBFCJatin DaveNo ratings yet

- Difference B.W NBFC and NBMFCDocument2 pagesDifference B.W NBFC and NBMFCAdvAleem KhanNo ratings yet

- 006 - Chapter 6Document24 pages006 - Chapter 6male PampangaNo ratings yet

- NBFC PDFDocument44 pagesNBFC PDFayushi guptaNo ratings yet

- To Indian Financial System: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Document12 pagesTo Indian Financial System: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Aishwarya SharmaNo ratings yet

- CH 06Document26 pagesCH 06k 3117No ratings yet

- Financial Market ReviewerDocument7 pagesFinancial Market ReviewerPrincess SagunNo ratings yet

- E-Portfolio (PAS 1)Document6 pagesE-Portfolio (PAS 1)Kaye NaranjoNo ratings yet

- IBE Ind SicknessDocument5 pagesIBE Ind SicknessSwat1211100% (2)

- To Indian Financial System: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Document41 pagesTo Indian Financial System: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2ramNo ratings yet

- NBFCDocument24 pagesNBFCmanishNo ratings yet

- Conceptual Framew Ork and Accountin G Standards: Justiniano L. Santos, CPA, MBADocument46 pagesConceptual Framew Ork and Accountin G Standards: Justiniano L. Santos, CPA, MBACarmela BuluranNo ratings yet

- Intermediate Accounting 3 Chapter 1Document3 pagesIntermediate Accounting 3 Chapter 1Lea EndayaNo ratings yet

- (Finals) General Banking LawDocument3 pages(Finals) General Banking LawJohn Rick Dayondon100% (1)

- NBFCDocument52 pagesNBFCDrRajdeep SinghNo ratings yet

- Topic - 1 Introduction To Financial System-SummaryDocument21 pagesTopic - 1 Introduction To Financial System-SummaryAnh NguyenNo ratings yet

- Financial Markets Chapter 1Document5 pagesFinancial Markets Chapter 1Maricar PanganibanNo ratings yet

- Non-Banking Finance Companies in India's Financial LandscapeDocument18 pagesNon-Banking Finance Companies in India's Financial Landscapeshubham moonNo ratings yet

- Financial Reporting Framework-SMES and SMALL ENTITIES - SssssssssssssssssssDocument14 pagesFinancial Reporting Framework-SMES and SMALL ENTITIES - SsssssssssssssssssschiNo ratings yet

- FATCA and CRS - Your Obligations Now and in The FutureDocument8 pagesFATCA and CRS - Your Obligations Now and in The Futureyin920No ratings yet

- Frequently Asked QuestionsDocument4 pagesFrequently Asked QuestionspradeepNo ratings yet

- bsp2018 PDFDocument97 pagesbsp2018 PDFLyn RNo ratings yet

- Far0 Chapter2Document3 pagesFar0 Chapter2yeeaahh56No ratings yet

- Accounting and ASC FrameworkDocument10 pagesAccounting and ASC FrameworkGwen Cabarse PansoyNo ratings yet

- Sreview of Financial Accounting Theory and Practice: Framework For The Preparation and Presentation of FsDocument10 pagesSreview of Financial Accounting Theory and Practice: Framework For The Preparation and Presentation of FsGwen Cabarse PansoyNo ratings yet

- FIN2Document14 pagesFIN2pritish mohantyNo ratings yet

- Conceptual Framework For Financial ReportingDocument2 pagesConceptual Framework For Financial ReportingNahanni EllamaNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- MBA - Brochure-A4Landscape - 9 Jan 2023 FNLDocument20 pagesMBA - Brochure-A4Landscape - 9 Jan 2023 FNLRavaka Harivololona AndrianaivojaonaNo ratings yet

- Commissioner of Internal Revenue Vs St. Luke's Medical Center, Inc. GR No. 195909, September 26, 2012Document8 pagesCommissioner of Internal Revenue Vs St. Luke's Medical Center, Inc. GR No. 195909, September 26, 2012Mesuella BugaoNo ratings yet

- Shs ResearchDocument20 pagesShs ResearchChara etangNo ratings yet

- The Term Structure of Interest Rates: Investments - Bodie, Kane, MarcusDocument37 pagesThe Term Structure of Interest Rates: Investments - Bodie, Kane, MarcusMohammed Al-YagoobNo ratings yet

- Current Affairs-FEBRUARY 2024Document13 pagesCurrent Affairs-FEBRUARY 2024unknownspecies314No ratings yet

- The Ultimate Guide To Outsourcing Content CreationDocument11 pagesThe Ultimate Guide To Outsourcing Content CreationNarrato SocialNo ratings yet

- Commercial Banks Research PaperDocument4 pagesCommercial Banks Research Papergz8te40w100% (1)

- Dev Package 2023-24 MarchDocument464 pagesDev Package 2023-24 MarchApp SoulsNo ratings yet

- Arch Ehab Mahmoud C.VDocument8 pagesArch Ehab Mahmoud C.VEhab MahmoudNo ratings yet

- Entrep Chapters 1 4Document19 pagesEntrep Chapters 1 4Joylene Dayao DayritNo ratings yet

- BUSINESS eTHICS CASE STUDY FinalDocument8 pagesBUSINESS eTHICS CASE STUDY FinalNAMIT CHAUHANNo ratings yet

- AsianetBill - nw-Aug-Nov21Document2 pagesAsianetBill - nw-Aug-Nov21John XavierNo ratings yet

- City Treasurer of Taguig v. BCDADocument11 pagesCity Treasurer of Taguig v. BCDAYang AlcoranNo ratings yet

- 07 FOR PORTAL-JULY 1-31v33Document140 pages07 FOR PORTAL-JULY 1-31v33Darvie Joy ElleviraNo ratings yet

- Adhyayan April 2 June 20Document129 pagesAdhyayan April 2 June 20Mohammad AaryanNo ratings yet

- P1 Accounting ScannerDocument286 pagesP1 Accounting Scannervishal jalan100% (1)

- Abhay Retail Assignment2Document2 pagesAbhay Retail Assignment2Abhay SinghNo ratings yet

- International Financial Management Abridged 10 Edition: by Jeff MaduraDocument13 pagesInternational Financial Management Abridged 10 Edition: by Jeff MaduraHiếu Nhi TrịnhNo ratings yet

- Final Pricing 23rd May 2022Document2 pagesFinal Pricing 23rd May 2022Rajmachhole MPCNo ratings yet

- Faizul's ResumeDocument1 pageFaizul's ResumeHenry CaneNo ratings yet

- Engineering EconomicsDocument153 pagesEngineering EconomicsRJ MCNo ratings yet

- NRI Investment in Indian StartupsDocument10 pagesNRI Investment in Indian StartupsAdityaNo ratings yet

- 7453 RSA Data Discovery For Archer - Customer Presentation v4Document19 pages7453 RSA Data Discovery For Archer - Customer Presentation v4Tarpan Stefan AlexandruNo ratings yet

- Tailings Management: Good Practice GuideDocument142 pagesTailings Management: Good Practice GuideAlibek MeirambekovNo ratings yet

- Solved Skiles Company S Weekly Payroll Amounts To 15 000 and Payday IsDocument1 pageSolved Skiles Company S Weekly Payroll Amounts To 15 000 and Payday IsAnbu jaromiaNo ratings yet

- Valuation of Stressed Assets: The Institute of Cost Accountants of IndiaDocument43 pagesValuation of Stressed Assets: The Institute of Cost Accountants of IndiaAny YnaNo ratings yet

- Fundamentals of Marketing: Epp/Tle 9Document42 pagesFundamentals of Marketing: Epp/Tle 9katherine corveraNo ratings yet

- Unit 1 - HRMDocument43 pagesUnit 1 - HRMbalajiNo ratings yet