Professional Documents

Culture Documents

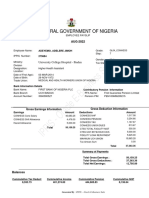

Screenshot - 2024 02 27 20 13 56 84

Screenshot - 2024 02 27 20 13 56 84

Uploaded by

Shubh tiwari TiwariCopyright:

Available Formats

You might also like

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDocument1 pageIPPIS - Oracle E-Business Suite: Federal Government of NigeriaHalleluyah HalleluyahNo ratings yet

- FAR 4320 Book Value Per Share Earnings Per Share PDFDocument3 pagesFAR 4320 Book Value Per Share Earnings Per Share PDFAnjolina BautistaNo ratings yet

- Case Studies On Tax Planning and Double TaxDocument19 pagesCase Studies On Tax Planning and Double TaxJayaNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Anticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)Document5 pagesAnticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)prialiapradeepNo ratings yet

- Declaration Form 12BB 2022 23Document4 pagesDeclaration Form 12BB 2022 23S S PradheepanNo ratings yet

- TDS TCS ADV TAX ROI SolutionDocument4 pagesTDS TCS ADV TAX ROI Solutionprajaktd19tagalpallewarNo ratings yet

- Form 16 1 1Document1 pageForm 16 1 1rahuleshNo ratings yet

- Cps Tax Form Format For 23-24Document11 pagesCps Tax Form Format For 23-24sr91919No ratings yet

- Income Tax Slab For FY 2024-25 - New and Old Regime Tax RatesDocument1 pageIncome Tax Slab For FY 2024-25 - New and Old Regime Tax RatesJackson AbrahamNo ratings yet

- M-1 - Unit-2A ADVANCE PAYMENT OF TAXDocument4 pagesM-1 - Unit-2A ADVANCE PAYMENT OF TAXAnanya SahooNo ratings yet

- Taxable - Income - Formula - Excel - TemplateDocument8 pagesTaxable - Income - Formula - Excel - TemplateFaizan AhmadNo ratings yet

- Salary Tax Calculator, NepalDocument1 pageSalary Tax Calculator, NepalRajiv SahNo ratings yet

- UCC E-Filling SolutionDocument5 pagesUCC E-Filling SolutionSibam BanikNo ratings yet

- Form 16 1 1Document1 pageForm 16 1 1venkatesh reddyNo ratings yet

- Nomisma Mobile Solutions Pvt. LTD Tax Payslip For December - 2018Document2 pagesNomisma Mobile Solutions Pvt. LTD Tax Payslip For December - 2018Dinesh SahuNo ratings yet

- Union Budget - 2023-24 - Direct Tax Proposals (K&Co)Document54 pagesUnion Budget - 2023-24 - Direct Tax Proposals (K&Co)Charul ChhajerNo ratings yet

- Dhruv Kumar COMPUTATION 2022-2023Document1 pageDhruv Kumar COMPUTATION 2022-2023RAHUL KUMARNo ratings yet

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNo ratings yet

- WB 68 A D 9916 DDocument1 pageWB 68 A D 9916 Dmdneyaz9831No ratings yet

- Basic Concepts PDFDocument14 pagesBasic Concepts PDFsumitNo ratings yet

- Normal Tax Rates For Individual & HUFDocument14 pagesNormal Tax Rates For Individual & HUFAdarsh PandeyNo ratings yet

- Tax Declaration Form 2021 22Document4 pagesTax Declaration Form 2021 22Kasiviswanathan ChinnathambiNo ratings yet

- Income Tax AY 2020-21 Sem III B.comh - Naveen MittalDocument99 pagesIncome Tax AY 2020-21 Sem III B.comh - Naveen MittalNisha PatelNo ratings yet

- RNPL IT Declaration (Old Tax Regime) FY 24-25Document3 pagesRNPL IT Declaration (Old Tax Regime) FY 24-25sumanNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24Aamer ShaikNo ratings yet

- Abdul Naushad SiddiquiDocument2 pagesAbdul Naushad Siddiquiahad siddiquiNo ratings yet

- How To Pay Zero Income Tax On 20 Lakhs SalaryDocument9 pagesHow To Pay Zero Income Tax On 20 Lakhs SalaryvijaytechskillupgradeNo ratings yet

- Income Tax Law - A Capsule For Quick Recap IPCC Nov 18Document28 pagesIncome Tax Law - A Capsule For Quick Recap IPCC Nov 18k moviesNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Module-1 - Introduction & Basic Tax ComputationDocument24 pagesModule-1 - Introduction & Basic Tax Computationshaswat sharmaNo ratings yet

- Income Tax A.Y. 2023-24Document6 pagesIncome Tax A.Y. 2023-24sandeepsbiradar100% (3)

- Income Tax Quick Recap CapsulDocument24 pagesIncome Tax Quick Recap CapsulAmanNo ratings yet

- Motilal Excel PlanDocument8 pagesMotilal Excel Plansourajit kunduNo ratings yet

- Interest On Hba U/S 24 (Max Up To Rs. 2,00000)Document2 pagesInterest On Hba U/S 24 (Max Up To Rs. 2,00000)Chhodup GiachhoNo ratings yet

- Income Tax Ready Reckoner - Budget 2023-1Document14 pagesIncome Tax Ready Reckoner - Budget 2023-1ಸೊಹನ್ ಕಲಂಗುಟ್ಕರ್No ratings yet

- Double TaxationDocument10 pagesDouble TaxationMintuNo ratings yet

- 2 Tax RatesDocument15 pages2 Tax RatesragerahulNo ratings yet

- E-Inc 2024 1023082Document1 pageE-Inc 2024 1023082cscjashipur1No ratings yet

- Taxation Class Test 2Document5 pagesTaxation Class Test 2ap.quatrroNo ratings yet

- Income Tax Calculation: Name: S. Ram Mohan ReddyDocument6 pagesIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvNo ratings yet

- Tax Calculator FY-2020-21Document12 pagesTax Calculator FY-2020-21Naveen Narasimha MurthyNo ratings yet

- Jammu Kashmir Employee From 16Document6 pagesJammu Kashmir Employee From 16mrnavkhanNo ratings yet

- CH 1 - BasicsDocument3 pagesCH 1 - BasicsHritik HarlalkaNo ratings yet

- Professionl Tax Challan (Employee)Document2 pagesProfessionl Tax Challan (Employee)ssca111No ratings yet

- Income Tax Sums Book ShrestaDocument272 pagesIncome Tax Sums Book ShrestaINTER SMARTIANSNo ratings yet

- 1 3+part+2Document28 pages1 3+part+2jaspreet kaurNo ratings yet

- Guidance Note On Option For Old Vs New Tax Regime - FY22-23 & AY23-24 PDFDocument3 pagesGuidance Note On Option For Old Vs New Tax Regime - FY22-23 & AY23-24 PDFgowtham DevNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Computation 2022-23Document2 pagesComputation 2022-23DKINGNo ratings yet

- Ajit Kumar SatapathyDocument32 pagesAjit Kumar Satapathyajitkumarsatapathy3No ratings yet

- Nadeem Bhai FamousDocument6 pagesNadeem Bhai Famoussarah IsharatNo ratings yet

- CCC CDocument5 pagesCCC CPrateek SinghalNo ratings yet

- ITR DocumentDocument6 pagesITR DocumentRamesh BabuNo ratings yet

- Chapter 12 - Computation of Total Income and Tax Payable - NotesDocument54 pagesChapter 12 - Computation of Total Income and Tax Payable - NotesDivya nraoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- A Comprehensive Assessment of Tax Capacity in Southeast AsiaFrom EverandA Comprehensive Assessment of Tax Capacity in Southeast AsiaNo ratings yet

- Chavara VidyapeethDocument1 pageChavara VidyapeethShubh tiwari TiwariNo ratings yet

- 8 ScienceDocument1 page8 ScienceShubh tiwari TiwariNo ratings yet

- Ix G2Document8 pagesIx G2Shubh tiwari TiwariNo ratings yet

- Blueprint VIII SanskritDocument2 pagesBlueprint VIII SanskritShubh tiwari TiwariNo ratings yet

- 8th GEOGRAPHY CH 4 Notes To StudentsDocument5 pages8th GEOGRAPHY CH 4 Notes To StudentsShubh tiwari TiwariNo ratings yet

- Viii Chapter 16Document9 pagesViii Chapter 16Shubh tiwari TiwariNo ratings yet

- CamScanner 09-17-2022 13.41Document5 pagesCamScanner 09-17-2022 13.41Shubh tiwari TiwariNo ratings yet

- CamScanner 09-17-2022 13.46Document3 pagesCamScanner 09-17-2022 13.46Shubh tiwari TiwariNo ratings yet

- CamScanner 09-17-2022 13.38Document5 pagesCamScanner 09-17-2022 13.38Shubh tiwari TiwariNo ratings yet

- Vimal Grammar - Part 8 - AnswersDocument8 pagesVimal Grammar - Part 8 - AnswersShubh tiwari TiwariNo ratings yet

- Economics Ch1&2Document4 pagesEconomics Ch1&2Shubh tiwari TiwariNo ratings yet

- DrainageDocument5 pagesDrainageShubh tiwari TiwariNo ratings yet

- Ix G2Document8 pagesIx G2Shubh tiwari TiwariNo ratings yet

- Constitutional DesignDocument3 pagesConstitutional DesignShubh tiwari TiwariNo ratings yet

- All Subjects For B.Com TPP 6th SemDocument3 pagesAll Subjects For B.Com TPP 6th SemBaavaraja.KNo ratings yet

- Consolidation Q57Document6 pagesConsolidation Q57Krishna 11No ratings yet

- Financial Statements I Class 11 NotesDocument40 pagesFinancial Statements I Class 11 NotesAshna vargheseNo ratings yet

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsIVONNE RUBIO BLANCASNo ratings yet

- Accounting Grade 12 LAST MILE 2022 QP and MemoDocument225 pagesAccounting Grade 12 LAST MILE 2022 QP and MemomaboleunNo ratings yet

- XYZ TagumDocument8 pagesXYZ TagumBSA3Tagum MariletNo ratings yet

- John Njenga GathuraDocument2 pagesJohn Njenga GathuraJohn NjengaNo ratings yet

- Dividend Decision: HTET, UPTET Qualified)Document42 pagesDividend Decision: HTET, UPTET Qualified)KumarNo ratings yet

- Payslip Feb 2023Document1 pagePayslip Feb 2023rk41001No ratings yet

- RR 5-2021Document22 pagesRR 5-2021zelayneNo ratings yet

- Oslob. TaxationDocument3 pagesOslob. TaxationLina Marie PagalingNo ratings yet

- Starbucks FsaDocument9 pagesStarbucks Fsanori.victoriaNo ratings yet

- National Income Accounting AbelDocument12 pagesNational Income Accounting AbelKushagra AroraNo ratings yet

- MODULE 9-Compensation IncomeDocument4 pagesMODULE 9-Compensation IncomeReicaNo ratings yet

- Income Taxation Module Compilation FinalsDocument107 pagesIncome Taxation Module Compilation FinalsJasmine CardinalNo ratings yet

- Cash and Accrual Basis - ExercisesDocument2 pagesCash and Accrual Basis - ExercisesTrisha Mae AlburoNo ratings yet

- ASHS Financial Aid Application - 2022-2023Document6 pagesASHS Financial Aid Application - 2022-2023Aishelle ColumnaNo ratings yet

- Eco Project Government BudgetsDocument27 pagesEco Project Government BudgetsManyaNo ratings yet

- ICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- FM Lecture 3 & 4Document14 pagesFM Lecture 3 & 4mansi.kumavat22No ratings yet

- Wealth CheatsheetDocument1 pageWealth CheatsheetMaria EduardaNo ratings yet

- 5.05 Analyzing Statements of Cash Flows IIDocument5 pages5.05 Analyzing Statements of Cash Flows IIClaptrapjackNo ratings yet

- Eng. Econ Chapter 3 AnnuityDocument24 pagesEng. Econ Chapter 3 AnnuityNancy CuevasNo ratings yet

- The Fundamental Powers of The StateDocument12 pagesThe Fundamental Powers of The Statedaphnie lorraine ramosNo ratings yet

- Quiz 2 Financial ManagementDocument6 pagesQuiz 2 Financial ManagementMARVIE JUNE CARBONNo ratings yet

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizDocument4 pagesFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizLevi AlvesNo ratings yet

- Articles of Incorporation TemplateDocument2 pagesArticles of Incorporation TemplatePaola Morales100% (1)

- Financial Analysis Ratios For The Year Ended 31 DecDocument6 pagesFinancial Analysis Ratios For The Year Ended 31 DecAmirah MaisarahNo ratings yet

Screenshot - 2024 02 27 20 13 56 84

Screenshot - 2024 02 27 20 13 56 84

Uploaded by

Shubh tiwari TiwariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Screenshot - 2024 02 27 20 13 56 84

Screenshot - 2024 02 27 20 13 56 84

Uploaded by

Shubh tiwari TiwariCopyright:

Available Formats

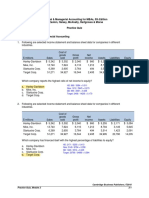

17. |U/s 80 CCE- Write total of 15 or 1,50,000/- whichever is less + 50000/- Extra on 80CCD (1B) Rs.

150000)

18 C/o Total of 16 & 17/Rs. 200000

Premium paid for Insurance of health upto Rs. 25000/- & Sr.citizen

19 |U/s 80D 50000/- (Medical Exp) i. Rs} 30000

U/s 80DD Exp. on medical Treatment /maintenance of handicapped Rs. .

Dependent Rs. 75000/- In case of disability over 80% Rs. 125000/-

Medical Expanses on specified disease etc Rs. 40000/- (attach form

Uls B0DDB 40.1) if depended poapsinteiner upto Rs, 100000/- ‘ _ 7

Uls 80E Payment of interest for loan taken for self spouse & children higher Rs. .

education (Full Time Study Course)

U/s 80G Donation to organizations approved by I.T. Deptt.(Ref. Ceiling & Rs. -

Cee

a [aT Oe

Uls 80GG Employee who is not on receipt of HRA & pays rent for accomodation S .

(Conditions apply, file Declaration in form 10BA) Max Rs.60000/- ”

Uls 80U Deduction to totally Blind / Physically / Mentally handicapped Rs .

Rs. 75000/- In case of severe disability rebate is Rs. 125000/- °

U/s 80TTA _|Interest on Saving Bank upto 10000/- Rs. -

U/s 80TTB Sr.citizen Interest on Saving/FDR/RD upto 50000/- Rs. -

Any other deduction Rs. =

Total|Rs. 30,000

20. |Total of Deductions of Including Section 24 (b) & (14+18+19) Rs. 230000

21. |Net Taxable Income (13-20) Rs. 496636,

22. |Net Taxable Income rounded upto Rs. 10/- Rs. 496640

23. |Net agriculture income for tax rate purposes (see rules) Rs. )

24. {Total (17+18) Rs. 496640

25. |Income Tax on Taxable Income

2,50,000/- 3,00,000/- (for male & female) (Senior Citizen) Rs. -

'2,50,001/- , 3,00,000/- (for male & female) to 5,00,000/- 5% Rs. 12332

'5,00,001/- to 10,00,000/- 20% Rs. 0

10,00,001/- to above 30% Rs. 0

Total Rs. 12332

26. |U/s 87A (Rs. 12500/- or less than the amount of income tax) Rs. 12332

127. |Income Tax Payable (25-26) Rs. )

28. |Health and Education Cess' at 4% (27 to 4%) “IRs. )

29, [Total (27+28) Rs. 0

30. {Relief u/s 89 (Arrear, Diff. Of tax) (Form 10E Enclosed) Rs. 0

31. |Net Income Tax Payable (29 -30) Rs. ')

32. |Tax Already deducted Rs. i)

December -2023 Rs.

33. |Balance tax to be deducted from salary ee rm =

March -2024 Rs. Rs. 0

34. |Tax Refundable/Tax payable Rs. 0]

Verification

*lwe hereby declare that the contents of the true to the best of *my/our knowledge and belief

Place SEONI

Narsinghpur Signature of Assessee

Date SONU TIWARI

Page 2

You might also like

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDocument1 pageIPPIS - Oracle E-Business Suite: Federal Government of NigeriaHalleluyah HalleluyahNo ratings yet

- FAR 4320 Book Value Per Share Earnings Per Share PDFDocument3 pagesFAR 4320 Book Value Per Share Earnings Per Share PDFAnjolina BautistaNo ratings yet

- Case Studies On Tax Planning and Double TaxDocument19 pagesCase Studies On Tax Planning and Double TaxJayaNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Anticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)Document5 pagesAnticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)prialiapradeepNo ratings yet

- Declaration Form 12BB 2022 23Document4 pagesDeclaration Form 12BB 2022 23S S PradheepanNo ratings yet

- TDS TCS ADV TAX ROI SolutionDocument4 pagesTDS TCS ADV TAX ROI Solutionprajaktd19tagalpallewarNo ratings yet

- Form 16 1 1Document1 pageForm 16 1 1rahuleshNo ratings yet

- Cps Tax Form Format For 23-24Document11 pagesCps Tax Form Format For 23-24sr91919No ratings yet

- Income Tax Slab For FY 2024-25 - New and Old Regime Tax RatesDocument1 pageIncome Tax Slab For FY 2024-25 - New and Old Regime Tax RatesJackson AbrahamNo ratings yet

- M-1 - Unit-2A ADVANCE PAYMENT OF TAXDocument4 pagesM-1 - Unit-2A ADVANCE PAYMENT OF TAXAnanya SahooNo ratings yet

- Taxable - Income - Formula - Excel - TemplateDocument8 pagesTaxable - Income - Formula - Excel - TemplateFaizan AhmadNo ratings yet

- Salary Tax Calculator, NepalDocument1 pageSalary Tax Calculator, NepalRajiv SahNo ratings yet

- UCC E-Filling SolutionDocument5 pagesUCC E-Filling SolutionSibam BanikNo ratings yet

- Form 16 1 1Document1 pageForm 16 1 1venkatesh reddyNo ratings yet

- Nomisma Mobile Solutions Pvt. LTD Tax Payslip For December - 2018Document2 pagesNomisma Mobile Solutions Pvt. LTD Tax Payslip For December - 2018Dinesh SahuNo ratings yet

- Union Budget - 2023-24 - Direct Tax Proposals (K&Co)Document54 pagesUnion Budget - 2023-24 - Direct Tax Proposals (K&Co)Charul ChhajerNo ratings yet

- Dhruv Kumar COMPUTATION 2022-2023Document1 pageDhruv Kumar COMPUTATION 2022-2023RAHUL KUMARNo ratings yet

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNo ratings yet

- WB 68 A D 9916 DDocument1 pageWB 68 A D 9916 Dmdneyaz9831No ratings yet

- Basic Concepts PDFDocument14 pagesBasic Concepts PDFsumitNo ratings yet

- Normal Tax Rates For Individual & HUFDocument14 pagesNormal Tax Rates For Individual & HUFAdarsh PandeyNo ratings yet

- Tax Declaration Form 2021 22Document4 pagesTax Declaration Form 2021 22Kasiviswanathan ChinnathambiNo ratings yet

- Income Tax AY 2020-21 Sem III B.comh - Naveen MittalDocument99 pagesIncome Tax AY 2020-21 Sem III B.comh - Naveen MittalNisha PatelNo ratings yet

- RNPL IT Declaration (Old Tax Regime) FY 24-25Document3 pagesRNPL IT Declaration (Old Tax Regime) FY 24-25sumanNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24Aamer ShaikNo ratings yet

- Abdul Naushad SiddiquiDocument2 pagesAbdul Naushad Siddiquiahad siddiquiNo ratings yet

- How To Pay Zero Income Tax On 20 Lakhs SalaryDocument9 pagesHow To Pay Zero Income Tax On 20 Lakhs SalaryvijaytechskillupgradeNo ratings yet

- Income Tax Law - A Capsule For Quick Recap IPCC Nov 18Document28 pagesIncome Tax Law - A Capsule For Quick Recap IPCC Nov 18k moviesNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Module-1 - Introduction & Basic Tax ComputationDocument24 pagesModule-1 - Introduction & Basic Tax Computationshaswat sharmaNo ratings yet

- Income Tax A.Y. 2023-24Document6 pagesIncome Tax A.Y. 2023-24sandeepsbiradar100% (3)

- Income Tax Quick Recap CapsulDocument24 pagesIncome Tax Quick Recap CapsulAmanNo ratings yet

- Motilal Excel PlanDocument8 pagesMotilal Excel Plansourajit kunduNo ratings yet

- Interest On Hba U/S 24 (Max Up To Rs. 2,00000)Document2 pagesInterest On Hba U/S 24 (Max Up To Rs. 2,00000)Chhodup GiachhoNo ratings yet

- Income Tax Ready Reckoner - Budget 2023-1Document14 pagesIncome Tax Ready Reckoner - Budget 2023-1ಸೊಹನ್ ಕಲಂಗುಟ್ಕರ್No ratings yet

- Double TaxationDocument10 pagesDouble TaxationMintuNo ratings yet

- 2 Tax RatesDocument15 pages2 Tax RatesragerahulNo ratings yet

- E-Inc 2024 1023082Document1 pageE-Inc 2024 1023082cscjashipur1No ratings yet

- Taxation Class Test 2Document5 pagesTaxation Class Test 2ap.quatrroNo ratings yet

- Income Tax Calculation: Name: S. Ram Mohan ReddyDocument6 pagesIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvNo ratings yet

- Tax Calculator FY-2020-21Document12 pagesTax Calculator FY-2020-21Naveen Narasimha MurthyNo ratings yet

- Jammu Kashmir Employee From 16Document6 pagesJammu Kashmir Employee From 16mrnavkhanNo ratings yet

- CH 1 - BasicsDocument3 pagesCH 1 - BasicsHritik HarlalkaNo ratings yet

- Professionl Tax Challan (Employee)Document2 pagesProfessionl Tax Challan (Employee)ssca111No ratings yet

- Income Tax Sums Book ShrestaDocument272 pagesIncome Tax Sums Book ShrestaINTER SMARTIANSNo ratings yet

- 1 3+part+2Document28 pages1 3+part+2jaspreet kaurNo ratings yet

- Guidance Note On Option For Old Vs New Tax Regime - FY22-23 & AY23-24 PDFDocument3 pagesGuidance Note On Option For Old Vs New Tax Regime - FY22-23 & AY23-24 PDFgowtham DevNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Computation 2022-23Document2 pagesComputation 2022-23DKINGNo ratings yet

- Ajit Kumar SatapathyDocument32 pagesAjit Kumar Satapathyajitkumarsatapathy3No ratings yet

- Nadeem Bhai FamousDocument6 pagesNadeem Bhai Famoussarah IsharatNo ratings yet

- CCC CDocument5 pagesCCC CPrateek SinghalNo ratings yet

- ITR DocumentDocument6 pagesITR DocumentRamesh BabuNo ratings yet

- Chapter 12 - Computation of Total Income and Tax Payable - NotesDocument54 pagesChapter 12 - Computation of Total Income and Tax Payable - NotesDivya nraoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- A Comprehensive Assessment of Tax Capacity in Southeast AsiaFrom EverandA Comprehensive Assessment of Tax Capacity in Southeast AsiaNo ratings yet

- Chavara VidyapeethDocument1 pageChavara VidyapeethShubh tiwari TiwariNo ratings yet

- 8 ScienceDocument1 page8 ScienceShubh tiwari TiwariNo ratings yet

- Ix G2Document8 pagesIx G2Shubh tiwari TiwariNo ratings yet

- Blueprint VIII SanskritDocument2 pagesBlueprint VIII SanskritShubh tiwari TiwariNo ratings yet

- 8th GEOGRAPHY CH 4 Notes To StudentsDocument5 pages8th GEOGRAPHY CH 4 Notes To StudentsShubh tiwari TiwariNo ratings yet

- Viii Chapter 16Document9 pagesViii Chapter 16Shubh tiwari TiwariNo ratings yet

- CamScanner 09-17-2022 13.41Document5 pagesCamScanner 09-17-2022 13.41Shubh tiwari TiwariNo ratings yet

- CamScanner 09-17-2022 13.46Document3 pagesCamScanner 09-17-2022 13.46Shubh tiwari TiwariNo ratings yet

- CamScanner 09-17-2022 13.38Document5 pagesCamScanner 09-17-2022 13.38Shubh tiwari TiwariNo ratings yet

- Vimal Grammar - Part 8 - AnswersDocument8 pagesVimal Grammar - Part 8 - AnswersShubh tiwari TiwariNo ratings yet

- Economics Ch1&2Document4 pagesEconomics Ch1&2Shubh tiwari TiwariNo ratings yet

- DrainageDocument5 pagesDrainageShubh tiwari TiwariNo ratings yet

- Ix G2Document8 pagesIx G2Shubh tiwari TiwariNo ratings yet

- Constitutional DesignDocument3 pagesConstitutional DesignShubh tiwari TiwariNo ratings yet

- All Subjects For B.Com TPP 6th SemDocument3 pagesAll Subjects For B.Com TPP 6th SemBaavaraja.KNo ratings yet

- Consolidation Q57Document6 pagesConsolidation Q57Krishna 11No ratings yet

- Financial Statements I Class 11 NotesDocument40 pagesFinancial Statements I Class 11 NotesAshna vargheseNo ratings yet

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsIVONNE RUBIO BLANCASNo ratings yet

- Accounting Grade 12 LAST MILE 2022 QP and MemoDocument225 pagesAccounting Grade 12 LAST MILE 2022 QP and MemomaboleunNo ratings yet

- XYZ TagumDocument8 pagesXYZ TagumBSA3Tagum MariletNo ratings yet

- John Njenga GathuraDocument2 pagesJohn Njenga GathuraJohn NjengaNo ratings yet

- Dividend Decision: HTET, UPTET Qualified)Document42 pagesDividend Decision: HTET, UPTET Qualified)KumarNo ratings yet

- Payslip Feb 2023Document1 pagePayslip Feb 2023rk41001No ratings yet

- RR 5-2021Document22 pagesRR 5-2021zelayneNo ratings yet

- Oslob. TaxationDocument3 pagesOslob. TaxationLina Marie PagalingNo ratings yet

- Starbucks FsaDocument9 pagesStarbucks Fsanori.victoriaNo ratings yet

- National Income Accounting AbelDocument12 pagesNational Income Accounting AbelKushagra AroraNo ratings yet

- MODULE 9-Compensation IncomeDocument4 pagesMODULE 9-Compensation IncomeReicaNo ratings yet

- Income Taxation Module Compilation FinalsDocument107 pagesIncome Taxation Module Compilation FinalsJasmine CardinalNo ratings yet

- Cash and Accrual Basis - ExercisesDocument2 pagesCash and Accrual Basis - ExercisesTrisha Mae AlburoNo ratings yet

- ASHS Financial Aid Application - 2022-2023Document6 pagesASHS Financial Aid Application - 2022-2023Aishelle ColumnaNo ratings yet

- Eco Project Government BudgetsDocument27 pagesEco Project Government BudgetsManyaNo ratings yet

- ICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- FM Lecture 3 & 4Document14 pagesFM Lecture 3 & 4mansi.kumavat22No ratings yet

- Wealth CheatsheetDocument1 pageWealth CheatsheetMaria EduardaNo ratings yet

- 5.05 Analyzing Statements of Cash Flows IIDocument5 pages5.05 Analyzing Statements of Cash Flows IIClaptrapjackNo ratings yet

- Eng. Econ Chapter 3 AnnuityDocument24 pagesEng. Econ Chapter 3 AnnuityNancy CuevasNo ratings yet

- The Fundamental Powers of The StateDocument12 pagesThe Fundamental Powers of The Statedaphnie lorraine ramosNo ratings yet

- Quiz 2 Financial ManagementDocument6 pagesQuiz 2 Financial ManagementMARVIE JUNE CARBONNo ratings yet

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizDocument4 pagesFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizLevi AlvesNo ratings yet

- Articles of Incorporation TemplateDocument2 pagesArticles of Incorporation TemplatePaola Morales100% (1)

- Financial Analysis Ratios For The Year Ended 31 DecDocument6 pagesFinancial Analysis Ratios For The Year Ended 31 DecAmirah MaisarahNo ratings yet