Professional Documents

Culture Documents

Chase Manhattan Bank v. Israel British Bank (1981)

Chase Manhattan Bank v. Israel British Bank (1981)

Uploaded by

Sarah Mwende0 ratings0% found this document useful (0 votes)

2 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageChase Manhattan Bank v. Israel British Bank (1981)

Chase Manhattan Bank v. Israel British Bank (1981)

Uploaded by

Sarah MwendeCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

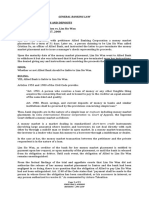

Chase Manhattan Bank v.

Israel British Bank (1981)

Facts

Chase Manhattan, the plaintiff, was instructed to pay $2m to the Israel-British Bank, the

defendant, but it paid the sum twice by mistake.

The Israel-British Bank subsequently became insolvent and entered into liquidation after the

managing director was convicted of embezzling from the bank.

Chase Manhattan wished to claim back the money which it had mistakenly paid.

However, because the Israel-British Bank was now insolvent, rather than make a claim for a

dividend in the liquidation, where it would have to compete with all of the other creditors of

the insolvent bank, Chase Manhattan sought to argue that the entire sums were held on trust

and so should be returned as part of a proprietary claim to the money.

The Israel-British bank had known about the mistake on the part of Chase Manhattan before

it went into liquidation.

Issue

Whether the plaintiff is entitled in equity to trace the mistaken payment and to recover what now

properly represents the money.

Holding

In this case, the court held that when money is paid under a mistake, the recipient becomes a

trustee. The payer retains an equitable property interest in the money, and the conscience of the

recipient is bound by a fiduciary duty to respect this proprietary right. Essentially, the recipient

must treat the funds as if held in trust for the payer.

Goulding J particularly said the following;

“In the circumstances, however, the depositors retained an equitable property in the funds they

parted with, and fiduciary relationships arose between them and the directors. In the same way, I

would suppose, a person who pays money to another under a factual mistake retains an equitable

property in it and the conscience of that other is subjected to a fiduciary duty to respect his

proprietary right.”

You might also like

- Cinco Vs CA, G.R. No. 151903Document2 pagesCinco Vs CA, G.R. No. 151903EcnerolAicnelav100% (1)

- Tracing 1Document4 pagesTracing 1Stupid 5No ratings yet

- wk9 Tutorial 6 SolutionsDocument5 pageswk9 Tutorial 6 SolutionsNatasha NadanNo ratings yet

- Allied Bank vs. Lim Sio Wan, G.R. No. 133179march 27, 2008Document19 pagesAllied Bank vs. Lim Sio Wan, G.R. No. 133179march 27, 2008Aleiah Jean Libatique100% (1)

- CREDIT Case Digests Art 1972-1991Document3 pagesCREDIT Case Digests Art 1972-1991andreaivydy1993No ratings yet

- Money Had and ReceivedDocument10 pagesMoney Had and ReceivedEric Ashalley TettehNo ratings yet

- Case 1-6Document12 pagesCase 1-6Garco ConconNo ratings yet

- Citizens' Central Nat. Bank of NY v. Appleton, 216 U.S. 196 (1910)Document6 pagesCitizens' Central Nat. Bank of NY v. Appleton, 216 U.S. 196 (1910)Scribd Government DocsNo ratings yet

- Banking Case DigestDocument6 pagesBanking Case DigestIsaac David GatchalianNo ratings yet

- Bankr. L. Rep. P 70,553 First National Bank of Louisville v. Hurricane Elkhorn Coal Corporation II Logan & Kanawha Coal Company, Inc., 763 F.2d 188, 1st Cir. (1985)Document5 pagesBankr. L. Rep. P 70,553 First National Bank of Louisville v. Hurricane Elkhorn Coal Corporation II Logan & Kanawha Coal Company, Inc., 763 F.2d 188, 1st Cir. (1985)Scribd Government DocsNo ratings yet

- Money Had and ReceivedDocument10 pagesMoney Had and ReceivedMohmed MbabaziNo ratings yet

- Lecture 3Document10 pagesLecture 3HENCH GOHNo ratings yet

- 2022 Banking Law Digest For Prelim - AMORIO, Vikki Mae J.Document21 pages2022 Banking Law Digest For Prelim - AMORIO, Vikki Mae J.Vikki AmorioNo ratings yet

- Banking Law Case DigestsDocument4 pagesBanking Law Case DigestsZaira Gem Gonzales100% (1)

- ASSOCIATED BANK Vs TANDocument4 pagesASSOCIATED BANK Vs TANJules VosotrosNo ratings yet

- The Bank'S Right To Recover On Cheques Paid by MistakeDocument33 pagesThe Bank'S Right To Recover On Cheques Paid by MistakeLok LaserNo ratings yet

- Banking Law CasesDocument6 pagesBanking Law CasesCaesar Julius0% (1)

- DIGEST (For Recit)Document4 pagesDIGEST (For Recit)Danise PetateNo ratings yet

- Travel-On vs. CA Facts: Petitioner Was A Travel Agency Involved in Ticket Sales On ADocument8 pagesTravel-On vs. CA Facts: Petitioner Was A Travel Agency Involved in Ticket Sales On AMary Ann IsananNo ratings yet

- Case Digest For Banking LawsDocument4 pagesCase Digest For Banking LawsCooksNo ratings yet

- GBL 12 21Document10 pagesGBL 12 21Jay Mark Albis SantosNo ratings yet

- Nego DigestDocument5 pagesNego DigestMJ Dela CruzNo ratings yet

- Nego Digests For Friday Not CompleteDocument2 pagesNego Digests For Friday Not CompletekimuchosNo ratings yet

- United States Court of Appeals, Fifth CircuitDocument8 pagesUnited States Court of Appeals, Fifth CircuitScribd Government DocsNo ratings yet

- 2022 Banking Law Digest For PrelimDocument15 pages2022 Banking Law Digest For PrelimJem PagantianNo ratings yet

- NIL Syl Digested CasesDocument20 pagesNIL Syl Digested CasesJerik SolasNo ratings yet

- NEGO Gr. 11 - Assoc Bank and Conrado Cruz v. CADocument6 pagesNEGO Gr. 11 - Assoc Bank and Conrado Cruz v. CABiBi JumpolNo ratings yet

- Cesar v. Areza and Lolita B. Areza Vs - Express Savings Bank, Inc. and Michael PotencianoDocument4 pagesCesar v. Areza and Lolita B. Areza Vs - Express Savings Bank, Inc. and Michael PotencianoSam SaripNo ratings yet

- Breach of Trust PracticeDocument7 pagesBreach of Trust PracticeSyed Adnan ShahNo ratings yet

- Banking Laws CasesDocument118 pagesBanking Laws CasesJoann Saballero HamiliNo ratings yet

- Nego - Check CasesDocument3 pagesNego - Check CasesRizel C. BarsabalNo ratings yet

- Commercial Bank of Pa. v. Armstrong, 148 U.S. 50 (1893)Document6 pagesCommercial Bank of Pa. v. Armstrong, 148 U.S. 50 (1893)Scribd Government DocsNo ratings yet

- Article 1279Document6 pagesArticle 1279Danica BalinasNo ratings yet

- BPI Vs CA and ReyesDocument2 pagesBPI Vs CA and ReyesErnie GultianoNo ratings yet

- Tracing GeneralDocument4 pagesTracing Generalshahmiran99No ratings yet

- Banking Case Digest Pt. 2Document7 pagesBanking Case Digest Pt. 2Tien BernabeNo ratings yet

- DURAN Nego PDFDocument28 pagesDURAN Nego PDFDana DNo ratings yet

- Case Digest NIL - Without Rigor YetDocument3 pagesCase Digest NIL - Without Rigor YetKik EtcNo ratings yet

- CT (Mistaken Payment) FINALDocument3 pagesCT (Mistaken Payment) FINALshahmiran99No ratings yet

- ASSOCIATED BANK VS. CA and MERLE REYESDocument5 pagesASSOCIATED BANK VS. CA and MERLE REYESArvy VelasquezNo ratings yet

- Credit Transaction CasesDocument27 pagesCredit Transaction CasesBernadette Panes DunqueNo ratings yet

- Assignment DigestDocument23 pagesAssignment Digestmuton20No ratings yet

- ASSOCIATED BANK Vs CADocument5 pagesASSOCIATED BANK Vs CAKeej DalonosNo ratings yet

- Hi-Cement Corp. V Insular Bank of AsiaDocument7 pagesHi-Cement Corp. V Insular Bank of AsiaJJNo ratings yet

- Facts:: Bpi vs. Intermediate Appellate Court 164 SCRA 630 (1988)Document9 pagesFacts:: Bpi vs. Intermediate Appellate Court 164 SCRA 630 (1988)Bluebells33No ratings yet

- Cinco Vs CA G R No 151903Document2 pagesCinco Vs CA G R No 151903Paul PhoenixNo ratings yet

- Banking DigestsDocument9 pagesBanking DigestsMiguel ManzanoNo ratings yet

- Nego Last CasesDocument8 pagesNego Last CasesnikkeesNo ratings yet

- Newport Bank v. Herkimer Bank, 225 U.S. 178 (1912)Document6 pagesNewport Bank v. Herkimer Bank, 225 U.S. 178 (1912)Scribd Government DocsNo ratings yet

- G.R. No. 89802 May 7, 1992 Associated Bank Vs CADocument4 pagesG.R. No. 89802 May 7, 1992 Associated Bank Vs CApreiquencyNo ratings yet

- Nego Case Digests For CommrevDocument22 pagesNego Case Digests For CommrevDianne Bernadeth Cos-agonNo ratings yet

- Citibank (New York State), N.A. v. Interfirst Bank of Wichita Falls, N.A. F/k/a City National Bank in Wichita Falls, 784 F.2d 619, 1st Cir. (1986)Document6 pagesCitibank (New York State), N.A. v. Interfirst Bank of Wichita Falls, N.A. F/k/a City National Bank in Wichita Falls, 784 F.2d 619, 1st Cir. (1986)Scribd Government DocsNo ratings yet

- Banking Law Case Digests Simex International (Manila) Inc Vs Ca FactsDocument22 pagesBanking Law Case Digests Simex International (Manila) Inc Vs Ca FactsbictorNo ratings yet

- Energetics, Inc. v. Allied Bank of Texas, Defendant-Third Party v. Credit Suisse, Third Party, 784 F.2d 1300, 3rd Cir. (1986)Document8 pagesEnergetics, Inc. v. Allied Bank of Texas, Defendant-Third Party v. Credit Suisse, Third Party, 784 F.2d 1300, 3rd Cir. (1986)Scribd Government DocsNo ratings yet

- Negotiable Instrument Compiled CasesDocument3 pagesNegotiable Instrument Compiled CasesAL IribaniNo ratings yet

- Bank v. Kennedy, 84 U.S. 19 (1873)Document8 pagesBank v. Kennedy, 84 U.S. 19 (1873)Scribd Government DocsNo ratings yet

- 2022 Banking Law Digest For Prelim - AMORIO, Vikki Mae J.Document45 pages2022 Banking Law Digest For Prelim - AMORIO, Vikki Mae J.Vikki AmorioNo ratings yet

- In the Matter of Thelton Coutee and Emogene Coutee, Debtors. Security First National Bank, Appellant-Cross-Appellee v. Brett Brunson and Fuhrer Flournoy Hunter & Morton, Appellees-Cross-Appellants, 984 F.2d 138, 1st Cir. (1993)Document7 pagesIn the Matter of Thelton Coutee and Emogene Coutee, Debtors. Security First National Bank, Appellant-Cross-Appellee v. Brett Brunson and Fuhrer Flournoy Hunter & Morton, Appellees-Cross-Appellants, 984 F.2d 138, 1st Cir. (1993)Scribd Government DocsNo ratings yet