Professional Documents

Culture Documents

AcctgI Assignment 0224

AcctgI Assignment 0224

Uploaded by

planaantonette0Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AcctgI Assignment 0224

AcctgI Assignment 0224

Uploaded by

planaantonette0Copyright:

Available Formats

I.

Journalise the following transactions:

1 May: Ram started a paint business called Paint Points Inc. with Php500,000 cash.

3 May: Bought furniture Php5,000, machine for Php40,000, office equipment worth

Php10,000 and Building Php1000,000.

5 May: Sold goods to customers for 50,000 on account

10 May: Ram acquired a 3-year term loan of Php 200,000 for the business with an

interest of 20% PA.

12 May: Bought supplies for 30,000 in cash.

15 May: Customer paid 60% of the goods sold on 5 May.

18 May: Provided services to customers worth Php75,000.

20 May: Paid salaries to employees Php15,000 in cash.

23 May: Customer made an advance payment of Php 35,000 for a service to be

rendered by the end of July 2024.

25 May: Paint Points Inc. received the water bill worth Php 3,500 to be paid on 3

June.

II. Make the following adjustments on 31 May 2024.

A. Furniture purchased have a useful life of 3 years. Record the depreciation for the

month.

B. Machine will have a salvage value of 5,000 after 5 years.

C. The office equipment will have a useful life of 4 years and will be worthless after.

D. The loan interest for the month must be paid together with the principal amount of

Php 8,333.33.

E. Used a total of Php 12,000 for the month.

F. One employee was not paid his overtime pay for 4 hours. Hourly rate is Php120.

G. By the end of the month, Paint Points Inc has completed 40% of the services.

H. A customer made a rush order of paints and billed them for Php25,000.

Note: For the adjustments, format is the same as the journal entries except the dates.

Use the letters instead of the date to record the transactions.

Ex.

Debit Credit

A. Depreciation Expense Php XXX

Accumulated Depreciation Php XXX

You might also like

- Bookkeeping ActivityDocument11 pagesBookkeeping ActivityIest HinigaranNo ratings yet

- Mock QuizDocument11 pagesMock QuizMichelle MarquezNo ratings yet

- Work Sheet Class 1Document1 pageWork Sheet Class 1Smriti singhNo ratings yet

- Recording Transactions in A Financial Transaction WorksheetDocument1 pageRecording Transactions in A Financial Transaction WorksheetKizaru50% (2)

- AA Chap 11 Rev May 2016Document3 pagesAA Chap 11 Rev May 2016jbsantos09No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Problem #3 SciDocument2 pagesProblem #3 SciJhazz Kyll100% (1)

- Name: - Date: - Midterm Examination - Accounting 1 Set A Problem IDocument3 pagesName: - Date: - Midterm Examination - Accounting 1 Set A Problem ITrixie VasquezNo ratings yet

- Adjusting EntriesDocument27 pagesAdjusting Entriescristin l. viloriaNo ratings yet

- ACT 201 - Midterm Fall 2021Document3 pagesACT 201 - Midterm Fall 2021Ahnaf TazwarNo ratings yet

- Homework 17-05-2017Document2 pagesHomework 17-05-2017afif12No ratings yet

- Funda Manual Chapter 5 ExercisesDocument8 pagesFunda Manual Chapter 5 ExercisesRimuruNo ratings yet

- Business MathDocument3 pagesBusiness MathCharisse Gayle EstoyaNo ratings yet

- Problem 1Document14 pagesProblem 1SyedNo ratings yet

- Financial Accounting and Business Management 1 - Activity SheetsDocument5 pagesFinancial Accounting and Business Management 1 - Activity Sheetseric galenoNo ratings yet

- Accounting Equation - EworkbookDocument20 pagesAccounting Equation - EworkbookDENCY THOMASNo ratings yet

- Fundamentals of Abm 1 Quarter 2, Week 1Document2 pagesFundamentals of Abm 1 Quarter 2, Week 1Shiellai Mae PolintangNo ratings yet

- HO, Branch and Agency - Additional ProblemsDocument2 pagesHO, Branch and Agency - Additional ProblemsFrancisco PradoNo ratings yet

- Financial Accounting and Reporting Departmental Long TestDocument1 pageFinancial Accounting and Reporting Departmental Long TestRenalyn ParasNo ratings yet

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- Assignment No 1Document2 pagesAssignment No 1Devidas NarnawareNo ratings yet

- UntitledDocument1 pageUntitledHANNAH CHARIS CANOYNo ratings yet

- A. Objective Type Question: 10 MarksDocument5 pagesA. Objective Type Question: 10 MarksHem BhattNo ratings yet

- Learning Task 3 and 4Document3 pagesLearning Task 3 and 4Alyana NoraNo ratings yet

- Chapter 6 - Dissolution of Partnership Firm - Volume IDocument41 pagesChapter 6 - Dissolution of Partnership Firm - Volume IVISHNUKUMAR S VNo ratings yet

- Problem SolvingDocument1 pageProblem SolvingDonna BunayogNo ratings yet

- Transactions List - Service and MerchandisingDocument7 pagesTransactions List - Service and MerchandisingRavann Codera NañolaNo ratings yet

- Question Tax OnlyDocument4 pagesQuestion Tax Onlykillmobile16No ratings yet

- CBSE Class 11 Accountancy Worksheet - Question BankDocument17 pagesCBSE Class 11 Accountancy Worksheet - Question BankUmesh JaiswalNo ratings yet

- Fin Act Rev ArDocument10 pagesFin Act Rev ArdfsdfdsfNo ratings yet

- Tutorial 05Document3 pagesTutorial 05Janidu KavishkaNo ratings yet

- Soal AccountingDocument1 pageSoal Accountingazana0271.pnlNo ratings yet

- Exercises RECEIVABLEDocument10 pagesExercises RECEIVABLEMon WeneeNo ratings yet

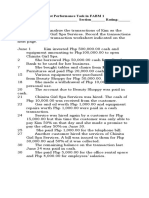

- First Performance Task in FABM 1Document2 pagesFirst Performance Task in FABM 1Roly Jr PadernaNo ratings yet

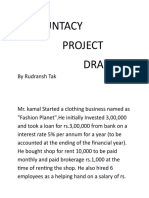

- Accountancy ProjectDocument10 pagesAccountancy ProjectAham GamingNo ratings yet

- Exercises On Accounting EquationDocument4 pagesExercises On Accounting EquationNeelu AggrawalNo ratings yet

- Accounting Equation Problems and SolutionDocument7 pagesAccounting Equation Problems and SolutionNilrose EscartinNo ratings yet

- General Instructions: This Question Paper Contains Questions From 1 To 20Document5 pagesGeneral Instructions: This Question Paper Contains Questions From 1 To 20Mihal HegdeNo ratings yet

- Example of Accounting TransactionDocument3 pagesExample of Accounting TransactionMylen Noel Elgincolin Manlapaz100% (1)

- Projects For Board Examinations 22 - 23 SWPSDocument3 pagesProjects For Board Examinations 22 - 23 SWPSI'm HaiseNo ratings yet

- Answer Sheet in Fundamentals of Accountancy, Business and Management 1 Quarter1 Week 8Document1 pageAnswer Sheet in Fundamentals of Accountancy, Business and Management 1 Quarter1 Week 8Florante De LeonNo ratings yet

- Accounting Review 2024 1Document4 pagesAccounting Review 2024 1Jovie Ann MateoNo ratings yet

- UntitledDocument2 pagesUntitledLucela InocNo ratings yet

- Basics of AccountingDocument3 pagesBasics of AccountingAjesh Mukundan PNo ratings yet

- Accounting 3Document3 pagesAccounting 3hahaniNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- Acctg 1 Problems - JMCDocument1 pageAcctg 1 Problems - JMCJohn Alfred CastinoNo ratings yet

- Trial Balance AssignmentDocument4 pagesTrial Balance AssignmentAdil Khan LodhiNo ratings yet

- QuizDocument2 pagesQuizGio SantosNo ratings yet

- Assignment 1Document1 pageAssignment 1Tamjid RahmanNo ratings yet

- June 2017 1 5: Problem 5Document2 pagesJune 2017 1 5: Problem 5Roqui M. GonzagaNo ratings yet

- Activity ABMDocument2 pagesActivity ABMRoqui M. GonzagaNo ratings yet

- IACCTG 1 Partnership and Corporation AccountingDocument3 pagesIACCTG 1 Partnership and Corporation AccountingPAGDATO, Ma. Luisa R. - 1FMBNo ratings yet

- FABM 1-Answer Sheet-Q1-W8Document1 pageFABM 1-Answer Sheet-Q1-W8Florante De LeonNo ratings yet

- Rule of Debit and CreditDocument6 pagesRule of Debit and CreditPrafulla Man PradhanNo ratings yet

- AccDocument6 pagesAccNeha DobeeNo ratings yet

- Portfolio Output10Document1 pagePortfolio Output10lexierodriguez43No ratings yet

- BAF CPT - 2021 NovemberDocument3 pagesBAF CPT - 2021 Novemberlol hahaNo ratings yet

- Pedro Journal (Uan Yllaq D. de LunaDocument1 pagePedro Journal (Uan Yllaq D. de LunaYleighnna DelunaNo ratings yet

- Chapter 8 - Journal and LedgerDocument75 pagesChapter 8 - Journal and LedgerRiya AggarwalNo ratings yet