Professional Documents

Culture Documents

Discussion Problems Investments

Discussion Problems Investments

Uploaded by

Samantha Nicole ValdezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Discussion Problems Investments

Discussion Problems Investments

Uploaded by

Samantha Nicole ValdezCopyright:

Available Formats

On June 1, 2017, MamaMoRC Company purchased bonds with a face amount of 3,000,000 to be held to

maturity. The stated rate on the bonds is 10% but the bonds are acquired to yield 11%. The bonds mature

at the rate of 1,000,000 annually every May 31 starting May 31, 2018 and interest is payable annually also

on May 31. The entity used the effective interest method of amortizing discount.

1. What is the total amortization for 2018?

2. What is the carrying amount of the bond investment on December 31, 2019?

On January 1, 2017, Ryujin Domingo Company purchased bonds with face amount of 5,000,000. The entity

paid 4,600,000 plus transaction cost of 142,290. The bonds mature on December 31, 2019 and pay 6%

interest annually on December 31 of each year with 8% effective yield. The bonds were quoted at 105 on

December 31, 2017 and 110 on December 31, 2018.

Assumption #1: Assume that the business model in managing financial asset is to collect contractual cash

flows that are solely for payment of principal and interest and also to sell the bonds in an open market

1. What is the balance of unrealized gain-OCI on December 31, 2017?

2. What is the balance of unrealized gain-OCI on December 31, 2018?

Assumption #2: The entity has irrevocably elected to use the fair value option

3. What amount of gain from change in fair value to be reported in 2017?

On January 1, 2020, Dos Company acquired 1,500,000 ordinary shares of B Company at P25 per share.

At the time of purchase, B Company had outstanding 6,000,000 shares with a carrying amount of

P90,000,000.

The following information pertains to year 2020:

Net income of B Company 2,200,500.00

Dos Company received cash dividend

P1.50 per ordinary share

from B Company

Market Value of B Company's shares 20

Dos Company has no significant influence and has elected irrevocably to measure the investment at fair

value through other comprehensive income.

1. What is the carrying amount of the investment at year-end?

2. How much is the unrealized loss on financial asset-OCI at year-end?

During 2019, Tres Company acquired marketable equity securities intended for trading. For the year ended

December 31, 2019 the entity recognized an unrealized loss of P100,000. There were no transactions

relating to trading securities during 2020.

Tres Company provided the following information on December 31, 2020:

Security Cost Market Value

1 1,970,000.00 2,100,000.00

2 1,100,000.00 1,500,000.00

3,070,000.00 3,600,000.00

1. How much is the market value of the trading securities on December 31, 2019?

2. In the 2020 income statement, what amount should be reported as unrealized gain or loss?

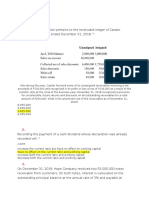

On January 1, 2018, Maria Antonee Company acquired the following equity investments:

Purchase Transaction Fair Value- Fair Value-

Price Cost 12/31/2018 12/31/2019

Trading

1,000,000 100,000 1,200,000 800,000

Investment A

Trading

2,000,000 200,000 2,300,000 2,400,000

Investment B

Non-trading

3,000,000 300,000 3,100,000 -

investment C

On July 1, 2019, the entity sold half of the Trading Investment A for 950,000. On the same date, it also sold

the all the Non-trading investment C for 3,600,000.

1. What amount should be reported as net gain or net loss presented in profit or loss in the 2019 income

statement?

Mikee D. La Pena Company received dividends from ordinary share investments during the current year:

5,000 shares of Tagpuan Company in lieu of cash dividend of P20 per share. The market price of the

share was P105. The entity had 50,000 shares of Tagpuan Company and owned 5% interest in

Company Tagpuan.

A liquidating dividend from Patawad Company amounting to P600,000. The entity owned a 10% interest

in Patawad Company.

The entity received from Ikaw Pa Rin Company a dividend in kind of one share of Paalam Company for

every 4 Ikaw Pa Rin Company shares held. The entity had 100,000 Ikaw Pa Rin Company shares which

have a market price of P50 per share. The market price of Paalam Company share was P10.

The company owns 10,000 shares costing 1,100,000 from Malaya Company. Subsequently, the

company receives P150,000 in lieu of 1,000 shares originally declared as 10% stock dividend.

The entity owned a 20% interest in Paubaya Company which declared and paid a P4,000,000 cash

dividend to shareholders on December 31.

1. What amount should be reported as dividend income for the current year?

You might also like

- Acccob2 Quiz 2Document7 pagesAcccob2 Quiz 2John Eliel Baladjay100% (1)

- Answers To Workbook Exercises: Cambridge Checkpoint English 8Document2 pagesAnswers To Workbook Exercises: Cambridge Checkpoint English 8Mustafa Al QadyNo ratings yet

- Solutions (Quiz1 &2)Document8 pagesSolutions (Quiz1 &2)Aaron Arellano50% (2)

- Use The Following Information To Answer Items 3 and 4Document15 pagesUse The Following Information To Answer Items 3 and 4charlies parrenoNo ratings yet

- PROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheDocument4 pagesPROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheMargaveth P. Balbin75% (4)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Allapacan Company Bought 20Document18 pagesAllapacan Company Bought 20Carl Yry BitzNo ratings yet

- Financial Asset Debt Securities Practice QuizDocument3 pagesFinancial Asset Debt Securities Practice QuizMarjorie PalmaNo ratings yet

- MCQ - Vernacular ArchitectureDocument3 pagesMCQ - Vernacular ArchitectureMatilda Correya0% (1)

- FAR Practical Exercises InvestmentDocument5 pagesFAR Practical Exercises InvestmentAB CloydNo ratings yet

- What I Learnt as an Analyst: Sharing of Experience in Investment and AnalysisFrom EverandWhat I Learnt as an Analyst: Sharing of Experience in Investment and AnalysisRating: 5 out of 5 stars5/5 (2)

- Investments Problem 1Document9 pagesInvestments Problem 1Rex AdarmeNo ratings yet

- Takehome Quiz Ae 121Document3 pagesTakehome Quiz Ae 121Crissette RoslynNo ratings yet

- InvestmentsDocument5 pagesInvestmentsEdmar HalogNo ratings yet

- Conceptual FrameworkDocument9 pagesConceptual FrameworkAveryl Lei Sta.Ana0% (1)

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- Audprob Diy5 PDFDocument2 pagesAudprob Diy5 PDFFrosterSmile WPNo ratings yet

- IA 2 Quiz #1 - Investment in BondsDocument2 pagesIA 2 Quiz #1 - Investment in BondsSkeeter Britney CostaNo ratings yet

- Equity and Debt Investment On Securities ProblemsDocument5 pagesEquity and Debt Investment On Securities ProblemsPepperNo ratings yet

- Midterm Exam Intermediate Accounting 2Document10 pagesMidterm Exam Intermediate Accounting 2Juan Dela cruzNo ratings yet

- Investment PDFDocument15 pagesInvestment PDFLenrey Cobacha100% (1)

- Chapter 21 Reclassification of Financial Assets PDFDocument1 pageChapter 21 Reclassification of Financial Assets PDFRonNo ratings yet

- Finals Q1 - Investment in Equity PDFDocument4 pagesFinals Q1 - Investment in Equity PDFCzerielle QueensNo ratings yet

- Unit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Document9 pagesUnit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Alyna JNo ratings yet

- A. 65,000 Loss B. 5,000 Loss D. 65,000 GainDocument3 pagesA. 65,000 Loss B. 5,000 Loss D. 65,000 GainLyn AbudaNo ratings yet

- INTACCTG2 Assignment Statement of Comprehensive Income Financial Position Final Revised PDFDocument2 pagesINTACCTG2 Assignment Statement of Comprehensive Income Financial Position Final Revised PDFUnnamed homosapienNo ratings yet

- CIA1Document9 pagesCIA1course hero0% (1)

- Audit of InvestmentsDocument3 pagesAudit of InvestmentsJasmine Marie Ng Cheong50% (2)

- Audit of Other Income Statement ComponentsDocument7 pagesAudit of Other Income Statement ComponentsIbratama Sukses PratamaNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Comprehensive Exam QuestionsDocument33 pagesComprehensive Exam QuestionsTrisha Mae LandichoNo ratings yet

- BONDSDocument3 pagesBONDSjdjdbNo ratings yet

- Long Quiz For InvestmentDocument2 pagesLong Quiz For InvestmentBarbie BleuNo ratings yet

- ACC111 Finals ExaminationDocument4 pagesACC111 Finals ExaminationVan De LeonNo ratings yet

- Questions 3 - 5 Are Based On The Following InformationDocument7 pagesQuestions 3 - 5 Are Based On The Following InformationRuthshe Dela CruzNo ratings yet

- AFAR PracDocument13 pagesAFAR PracTeofel John Alvizo PantaleonNo ratings yet

- 9.1 Equity Investments at Fair Value PDFDocument4 pages9.1 Equity Investments at Fair Value PDFJorufel PapasinNo ratings yet

- Quiz No. 4 Problems & SolutionsDocument5 pagesQuiz No. 4 Problems & SolutionsRiezel PepitoNo ratings yet

- 1911 Investments Investment in Associate and Bond InvestmentDocument13 pages1911 Investments Investment in Associate and Bond InvestmentCykee Hanna Quizo LumongsodNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument3 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionAbigail Ann PasiliaoNo ratings yet

- ACCTG 104 Quiz Answer Review - MidtermsDocument6 pagesACCTG 104 Quiz Answer Review - MidtermsJyNo ratings yet

- Module 5 - Assessment ActivitiesDocument4 pagesModule 5 - Assessment Activitiesaj dumpNo ratings yet

- SynthesisDocument19 pagesSynthesisMej AgaoNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacNo ratings yet

- Shareholdersx27 Equity Prac 1 PDF FreeDocument10 pagesShareholdersx27 Equity Prac 1 PDF FreeIllion IllionNo ratings yet

- Quiz No. 4 Problems & SolutionsDocument5 pagesQuiz No. 4 Problems & SolutionsRiezel PepitoNo ratings yet

- Intacc Questions To AnswerDocument12 pagesIntacc Questions To AnswerMichelle Esternon0% (2)

- Acc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - CainDocument2 pagesAcc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - Cainslow dancerNo ratings yet

- Investment Questionnaire FinalDocument4 pagesInvestment Questionnaire FinalKy DulzNo ratings yet

- AdditionalDocument18 pagesAdditionaldarlene floresNo ratings yet

- Afar First TakeDocument14 pagesAfar First TakePau CaisipNo ratings yet

- Intermediateaccounting2 Debt Investments - Fafvoci 793 1665904389Document2 pagesIntermediateaccounting2 Debt Investments - Fafvoci 793 1665904389Annie MalinaoNo ratings yet

- Quiz Inventories and InvestmentsDocument13 pagesQuiz Inventories and InvestmentsRinconada Benori ReynalynNo ratings yet

- AUD PROB Activity May 18Document2 pagesAUD PROB Activity May 18Kent Judehilee BacalNo ratings yet

- FAR MOCK Edited PDFDocument21 pagesFAR MOCK Edited PDFKorinth BalaoNo ratings yet

- Seatwork - Module 1Document5 pagesSeatwork - Module 1Alyanna Alcantara100% (1)

- Intermediate Accounting 1 Sample Problem For Debt Investments - CompressDocument55 pagesIntermediate Accounting 1 Sample Problem For Debt Investments - CompresslerabadolNo ratings yet

- 4 Audit of InvestmentsDocument11 pages4 Audit of InvestmentsMarcus MonocayNo ratings yet

- Investment in Associate 2022Document3 pagesInvestment in Associate 2022lirva cantonaNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- Be My Lady: F#/A# F#7 BM Bm7 E7sus E7Document2 pagesBe My Lady: F#/A# F#7 BM Bm7 E7sus E7Marinel Dominguez LacanariaNo ratings yet

- EDFS - Request Memento For Reassigned Personnel of 205THWDocument1 pageEDFS - Request Memento For Reassigned Personnel of 205THWRomeo GarciaNo ratings yet

- 3d Panel SystemDocument25 pages3d Panel Systemprobir100% (3)

- OswaldDocument101 pagesOswaldVo HaianhNo ratings yet

- United States v. Delwright T. Dyman, Cosimo Mezzapella, A/K/A Joe Cosimo, A/K/A Joseph Rusello, Richard D. Spainhower and Joseph A. Valentino, 739 F.2d 762, 2d Cir. (1984)Document15 pagesUnited States v. Delwright T. Dyman, Cosimo Mezzapella, A/K/A Joe Cosimo, A/K/A Joseph Rusello, Richard D. Spainhower and Joseph A. Valentino, 739 F.2d 762, 2d Cir. (1984)Scribd Government DocsNo ratings yet

- SkyEdge II - Hub Architecture-6 5 7Document5 pagesSkyEdge II - Hub Architecture-6 5 7Jenster ImarcloudNo ratings yet

- Pension Papers UAPDocument14 pagesPension Papers UAPgms313No ratings yet

- SubcontractsDocument59 pagesSubcontractsvamshiNo ratings yet

- VarmaDocument86 pagesVarmanandy39No ratings yet

- Unnatural Nature of ScienceDocument5 pagesUnnatural Nature of ScienceXia AlliaNo ratings yet

- Strangers To Patrons Bishop Damasus andDocument22 pagesStrangers To Patrons Bishop Damasus andValentin RascalNo ratings yet

- Design BriefDocument216 pagesDesign BriefGia Vinh Bui TranNo ratings yet

- Activity Week 14 PROJECT 2-9ºDocument3 pagesActivity Week 14 PROJECT 2-9ºTheSeul SNo ratings yet

- Jacob Dean Curtis Instacart: Consumer Report For Requestor Company StatusDocument6 pagesJacob Dean Curtis Instacart: Consumer Report For Requestor Company StatusJAKE CURTISNo ratings yet

- Primary Sources of ShariahDocument15 pagesPrimary Sources of ShariahAeina FaiiziNo ratings yet

- 000 PreliminariesDocument7 pages000 PreliminariesSteffiNo ratings yet

- Q3 - W2 - Grade9 - CSS - Carry Out VariationDocument10 pagesQ3 - W2 - Grade9 - CSS - Carry Out VariationREYNALDO R. DE LA CRUZ JR.No ratings yet

- Middle East Architect 201203Document68 pagesMiddle East Architect 201203Lays SesanaNo ratings yet

- About Datanet2Document1 pageAbout Datanet2ferdaus_rahimNo ratings yet

- Lesson 1 - Ielts Reading in GeneralDocument28 pagesLesson 1 - Ielts Reading in GeneralTrangNo ratings yet

- Jleonen Case Digest Civil LawDocument97 pagesJleonen Case Digest Civil LawfeeerNo ratings yet

- State of Tennessee Department of TransportationDocument24 pagesState of Tennessee Department of TransportationFOX 17 NewsNo ratings yet

- SEMINARSKI RAD PREDMET: POSLOVNI ENGLESKI JEZIK 5 TEMA: Why Is Smoking Harmful/aronia/10 Foods For Healthy BodyDocument7 pagesSEMINARSKI RAD PREDMET: POSLOVNI ENGLESKI JEZIK 5 TEMA: Why Is Smoking Harmful/aronia/10 Foods For Healthy BodymeveeNo ratings yet

- Basic Cooking Principles For Creating A Social Innovation LabDocument5 pagesBasic Cooking Principles For Creating A Social Innovation LabclarityfacilitationNo ratings yet

- Gina Endaya vs. Ernesto VillaosDocument6 pagesGina Endaya vs. Ernesto VillaosMuffinNo ratings yet

- Newsounds Broadcasting Network V DyDocument3 pagesNewsounds Broadcasting Network V DyadeeNo ratings yet

- 1 Shuttering/ Formwork: Direct Labour HoursDocument11 pages1 Shuttering/ Formwork: Direct Labour HoursCherryl Chrissie JamesNo ratings yet

- Hepatology MRCP1Document87 pagesHepatology MRCP1Raouf Ra'fat SolimanNo ratings yet