Professional Documents

Culture Documents

MAHINDRA MANULIFE MANUFACTURING FUND-NFO-OnePager

MAHINDRA MANULIFE MANUFACTURING FUND-NFO-OnePager

Uploaded by

Nevaan ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MAHINDRA MANULIFE MANUFACTURING FUND-NFO-OnePager

MAHINDRA MANULIFE MANUFACTURING FUND-NFO-OnePager

Uploaded by

Nevaan ShahCopyright:

Available Formats

Distributed by:

NFO

MAHINDRA MANULIFE

MANUFACTURING FUND

Unlock the (An open-ended equity scheme following

manufacturing theme)

potential of India’s

Manufacturing

growth story!! NEW FUND OFFER

Opens on: May 31, 2024

Closes on: June 14, 2024

Scheme reopens for continuous sale and

repurchase from: June 26, 2024

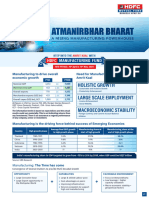

WHY MANUFACTURING THEME NOW? KEY OPPORTUNITIES IN MANUFACTURING THEME

GOVERNMENT POLICIES: Policies like Make in India,

Atmanirbhar Bharat, Production Linked Incentives etc. EXPORT PROMOTION: Focusing on companies that

could drive manufacturing in India. are manufacturing finished goods for export.

GLOBAL TAILWINDS: Diversification of production away IMPORT SUBSTITUTION: Substitution of imported

from China to avoid supply chain shocks and finished goods and raw materials with domestically

overdependence could boost manufacturing in India manufactured products and materials.

IMPROVED INFRASTRUCTURE: Push for improved DOMESTIC CONSUMPTION: Focus on Production of

physical and industrial infrastructure, increased power goods for used by domestic businesses and retail

capacity could be an important enabler for manufacturing. consumers.

INDIA’S GDP IS EXPECTED TO GROW RAPIDLY AND MANUFACTURING MAY HAVE A MAJOR ROLE TO PLAY

9

Nominal GDP in $ Trillions India Manufacturing Output Forecast 1822

(in $ Billions) 1766

1676

7 1632

1588

1545

1505

5

1434

1

India Germany Japan

2020 2030 2022 2023 2024 2025 2026 2027 2028 2029

Source: S&P Global Intelligence Source: Statista

Based on above data India’s GDP is expected to surpass that of Japan and Germany by 2030. A key driver of this growth could be a significant expansion in manufacturing output.

The above graphs are based on expectations and the actual results could vary materially. This is not indicating returns from any investments. There is no assurance as regards to performance of any company,

sector or investment.

INVESTMENT APPROACH WHY MAHINDRA MANULIFE MANUFACTURING FUND?

The Scheme will follow a bottom-up approach towards investing in PORTFOLIO ALLOCATION:

listed companies that:

● 80-100% of the Portfolio will be invested in companies engaged in

● Are engaged in manufacturing activity. the manufacturing theme

● May benefit from government incentives to encourage

MARKET CAP:

manufacturing opportunities.

● Flexible to invest across market capitalisation

● Are positioned to benefit from export promotion of domestic

industries and import substitution through domestic manufacturing. DIVERSIFIED UNIVERSE:

● May produce goods and materials for export. ● Portfolio shall comprise of diversified stock universe mapped to the

● Are establishing new manufacturing capacity or investing in new basic Industry list published by Asia Index Private Limited for S&P

plants and production technology. BSE India Manufacturing Index which includes sectors like Capital

● Are part of sectors which offer allied services associated with the goods, Metals & Mining, Consumer Durables, Construction etc.

entire manufacturing lifecycle. For further details, please refer Scheme Information Document of the Scheme

MANUFACTURING THEME LISTED UNIVERSE – COVERS MORE THAN 10 SECTORS AND 32 INDUSTRIES1

Manufacturing Theme Market Cap3 to GDP Ratio2: ~54%

CAPITAL GOODS METALS & MINING FMCG

● Industrial Manufacturing ● Non - Ferrous Metals ● Food Products

● Electrical Equipment ● Ferrous Metals ● Agro, Food & other Products

● Agricultural, Commercial & ● Diversified Metals ● Household Products

Construction Vehicles ● Minerals & Mining ● Beverages ● Personal Product

● Industrial Products ● Diversified FMCG

● Aerospace & Defense ● Cigarettes & Tobacco

HEALTHCARE OIL & GAS AND CONSTRUCTION MATERIALS

● Pharmaceuticals & Biotech CONSUMABLE FUELS ● Cement & Cement Products

● Healthcare Equipment & ● Petroleum Products ● Other Construction Materials

Supplies ● Consumable Fuels ● Oil

CONSUMER DURABLES

CHEMICALS AUTOMOBILES & AUTO

● Chemicals & Petrochemicals COMPONENTS

● Fertilizers and Agrochemicals ● Automobiles ● Auto Components

CONSTRUCTION

TELECOM- EQUIPMENT &

TEXTILES FOREST MATERIALS IT- HARDWARE DIVERSIFIED

ACCCESSORIES

Market Capitalization of Manufacturing Theme3 : LARGE CAP: Rs. 97.2 Trillion | MIDCAP: Rs. 29.9 Trillion | SMALL CAP: Rs. 31.9 Trillion

Source: 1 S&P BSE Thematic Indices Methodology Document published by Asia Index Private Limited (last updated as on 31 March 2023) 2GDP Ratio as on 31st December 2023. GDP data sourced from Press Information Bulletin.

3

For the purpose of this data/calculation MarketCapitalization of companies mapped to sectors/industries defined for S&P BSE India Manufacturing Index in the S&P BSE Thematic Indices Methodology Document published by Asia Index

Private Limited has been considered. Market Capitalization numbers for the said data are as per AMFI classification list as on 31st December 2023.

ASSET ALLOCATION

The Asset Allocation Pattern of the Scheme under normal circumstances would be as under:

Indicative Allocation (% of assets) Risk Profile

Instrument

Minimum Maximum High/Moderate/Low

Equity and Equity-related securities of companies engaged in manufacturing theme^ 80 100 Very High

Equity and Equity related instruments of companies other than above* 0 20 Very High

Debt and Money Market Securities# (including TREPS (Tri-Party Repo) and Reverse Repo in

0 20 Low to Moderate

Government Securities)

Units issued by REITs & InvITs 0 10 Very High

^ including equity derivatives to the extent of 50% of the equity component of the Scheme.

Investment in derivatives shall be for hedging, portfolio balancing and such other purposes as maybe permitted from time to time under the Regulations and subject to guidelines issued by SEBI/RBI from time to time. The Scheme may utilize

the entire available equity derivatives exposure limit as provided above, for hedging purpose. However, the equity derivatives exposure towards non-hedging purpose shall not exceed 20% of the net assets of the Scheme, subject to maximum

derivatives exposure as defined above (i.e. 50% of the equity component of the Scheme). The margin money deployed on derivative positions would be included in the Debt and Money Market Securities category.

*The Scheme may invest in Foreign Securities (including units/securities issued by overseas mutual funds) up to 20% of the net assets of the Scheme in compliance with clause 12.19 of the SEBI Master Circular pertaining to overseas

investments by mutual funds, as amended from time to time. The Scheme intends to invest US$ 5 million in Overseas securities within six months from the date of the closure of the New Fund Offer (NFO) of the Scheme. Thereafter, the

Scheme shall invest in Foreign Securities as per the limits available to ‘Ongoing Schemes’ in terms of clause 12.19.1.3.c of SEBI Master Circular. Further, SEBI vide its clause 12.19.1.3.d of the SEBI Master Circular, clarified that the above

specified limit would be considered as soft limit(s) for the purpose of reporting only by mutual funds on monthly basis in the format prescribed by SEBI.

#Money Market instruments includes commercial papers, commercial bills, treasury bills, Government securities having an unexpired maturity up to one year, call or notice money, certificate of deposit, usance bills, and any other like instruments

as specified by the Reserve Bank of India from time to time.

For detailed asset allocation, please refer Scheme Information Document available on our website www.mahindramanulife.com

SCHEME DETAILS

Investment Objective: The Scheme shall seek to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in

manufacturing theme. However, there is no assurance that the objective of the Scheme will be achieved.

Mr. Renjith Sivaram Radhakrishnan

Benchmark: S&P BSE India Manufacturing TRI (First Tier Benchmark) Fund Managers: Mr. Manish Lodha

Mr. Pranav Nishith Patel (Dedicated Fund Manager for

Plans: Regular & Direct Overseas Investments)

Options: Growth; IDCW Minimum Application ` 1,000 and in multiples of ` 1/- thereafter

Amount (Lumpsum):

IDCW Sub-options: IDCW Reinvestment & IDCW Payout

Minimum Amount

` 1,000/- and in multiples of ` 0.01/- thereafter.

for Switch in:

Entry Load: Not Applicable

Minimum Application 6 installments of ` 500 /- each and in

Exit Load: - An Exit Load of 0.5% is payable if Units are redeemed / Amount (SIP) forweekly

switched-out upto 3 months from the date of allotment; and monthly frequencies: multiples of ` 1/- thereafter

- Nil if Units are redeemed / switched-out after 3 months from

the date of allotment. Minimum Application

4 installments of ` 1,500/- each and in multiples

Amount (SIP) for

Redemption /Switch-Out of Units would be done on First in First of ` 1/- thereafter

out Basis (FIFO). quarterly frequency

IDCW: Income Distribution cum Capital Withdrawal

For more details please refer SID/KIM available on our website www.mahindramanulife.com Default Option

Scheme Riskometer**

Moderately

This product is suitable for investors who are seeking##

Moderate High

Long-term capital appreciation; Distributed by:

er to

e

H

at

ig

M ow

h

od

L

Investment in equity and equity-related securities of

Very

High

Low

companies engaged in manufacturing theme.

Riskometer

Cno.02013

Investors understand that their Investor should consult their financial advisers if in doubt about whether the

##

principal will be at Very high risk product is suitable for them.

**The product labelling /risk level assigned for the Scheme during the New Fund Offer is based on internal assessment of the Scheme’s

characteristics or model portfolio and the same may vary post New Fund Offer when the actual investments are made.

022 6632 7900 / 1800 419 6244 (Toll Free)Mon-Fri (9AM to 6PM) mfinvestors@mahindra.com

Corporate Office: Unit No. 204, 2nd Floor, Amiti Building, Piramal Agastya Corporate Park, LBS Road, Kamani Junction, Kurla (West), Mumbai – 400 070.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

You might also like

- CH 01Document4 pagesCH 01sompon12383% (6)

- Practice Quiz 5 Module 3 Financial MarketsDocument5 pagesPractice Quiz 5 Module 3 Financial MarketsMuhire KevineNo ratings yet

- Internship Report For MBADocument111 pagesInternship Report For MBABhaskar Gupta100% (1)

- Trust Account HandbookDocument104 pagesTrust Account HandbookDhulkifl Bey100% (2)

- Business Plan Report: VersembleDocument77 pagesBusiness Plan Report: VersembleShreyansh SanchetiNo ratings yet

- MAHINDRA MANULIFE MANUFACTURING FUND-NFO-Product PPTDocument30 pagesMAHINDRA MANULIFE MANUFACTURING FUND-NFO-Product PPTNevaan ShahNo ratings yet

- MAKE IN INDIA: New Paradigm For Socio-Economic Growth in IndiaDocument3 pagesMAKE IN INDIA: New Paradigm For Socio-Economic Growth in IndiaRakesh ThakurNo ratings yet

- Pidilite Industries: Ceo TrackDocument10 pagesPidilite Industries: Ceo TrackRajesh KumarNo ratings yet

- IB Research Paper FinalDocument33 pagesIB Research Paper FinalAKSHAT AGARWALNo ratings yet

- Dabur India LTD: Be The ChangeDocument37 pagesDabur India LTD: Be The ChangeAditya Singh0% (1)

- PG 4. Gccs in India - To Be or Not To Be... PG 41. Interview: MR Sashidharan Balasundaram, Isg ResearchDocument52 pagesPG 4. Gccs in India - To Be or Not To Be... PG 41. Interview: MR Sashidharan Balasundaram, Isg ResearchRaghvendra N DhootNo ratings yet

- Indian Manufacturing 110512 PDFDocument41 pagesIndian Manufacturing 110512 PDFmanaNo ratings yet

- Innovation in Indian Manufacturing 310512Document18 pagesInnovation in Indian Manufacturing 310512Manish PrasadNo ratings yet

- Research Report Pidilite Industries LTDDocument7 pagesResearch Report Pidilite Industries LTDAnirudh PatilNo ratings yet

- Vivel Itc AssignmentDocument24 pagesVivel Itc AssignmentMayank LalwaniNo ratings yet

- Harvesting Golden Opportunities in Indian AgricultureDocument24 pagesHarvesting Golden Opportunities in Indian AgricultureArushi295No ratings yet

- Alucast Association of Die CastingDocument33 pagesAlucast Association of Die CastingIt's me DJNo ratings yet

- Manufacturing July 2019Document34 pagesManufacturing July 2019AkshayNo ratings yet

- Manufacturing - Beacon Sector Special 2021Document43 pagesManufacturing - Beacon Sector Special 2021Mammen Vergis PunchamannilNo ratings yet

- India - Strategy 4qfy23 20230405 Mosl RP PG0238Document238 pagesIndia - Strategy 4qfy23 20230405 Mosl RP PG0238Aditya HalwasiyaNo ratings yet

- Manufacturing Industry Report Feb 2019Document34 pagesManufacturing Industry Report Feb 2019KAUSTUBH TIRPUDENo ratings yet

- Company Overview: Investment Thesis PI Industries Ltd. 10th May 2020Document2 pagesCompany Overview: Investment Thesis PI Industries Ltd. 10th May 2020Saurabh SinghNo ratings yet

- Indian Manufacturing Report IBEFDocument25 pagesIndian Manufacturing Report IBEFMadhur AggarwalNo ratings yet

- Seven Stocks To Profit From The Rebirth of IndiaDocument37 pagesSeven Stocks To Profit From The Rebirth of Indiarusheekesh3497No ratings yet

- Make in India Advantages, Disadvantages and Impact On Indian EconomyDocument8 pagesMake in India Advantages, Disadvantages and Impact On Indian EconomyAkanksha SinghNo ratings yet

- Why Agro - in Make in IndiaDocument14 pagesWhy Agro - in Make in IndiaastuteNo ratings yet

- Pidilite-Apr21 2020Document8 pagesPidilite-Apr21 2020KRUTIK MEHTANo ratings yet

- Marketing and Branding Strategies of Consumer Durable CompaniesDocument101 pagesMarketing and Branding Strategies of Consumer Durable CompaniesAnkaj AroraNo ratings yet

- Manufacturing August 2020Document34 pagesManufacturing August 2020saty16No ratings yet

- Prince PipesDocument46 pagesPrince Pipessherwinmitra0% (1)

- India - Ready To Step Into China'S Shoes?: Global Macro MattersDocument8 pagesIndia - Ready To Step Into China'S Shoes?: Global Macro MattersmfsrajNo ratings yet

- Group 7 Final Project Presentation - HULDocument24 pagesGroup 7 Final Project Presentation - HULRikhabh DasNo ratings yet

- Sectoral Analysis India Riding The Growth WaveDocument32 pagesSectoral Analysis India Riding The Growth WaveRajeev DudiNo ratings yet

- Research ReportDocument71 pagesResearch ReportVedikaNo ratings yet

- PFMT - Pidilite - Apo 7 - Sec FDocument19 pagesPFMT - Pidilite - Apo 7 - Sec FAbhi AgarwalNo ratings yet

- NFO Leaflet - HDFC Manufacturing Fund - 240422 - 142358Document2 pagesNFO Leaflet - HDFC Manufacturing Fund - 240422 - 142358bitsthechampNo ratings yet

- Make in IndiaDocument6 pagesMake in Indiaகண்ணதாசன் தயாளன்No ratings yet

- Gillette General Management ReportDocument48 pagesGillette General Management ReportSharvil Panvekar100% (1)

- 2019 Annual Manufacturing ReportDocument40 pages2019 Annual Manufacturing ReportVignesh RajasekharanNo ratings yet

- Impact of "Make in India" in Indian EconomyDocument4 pagesImpact of "Make in India" in Indian EconomyEditor IJTSRDNo ratings yet

- Fabindia Case StudyDocument3 pagesFabindia Case StudyNeeraj SharmaNo ratings yet

- 07ijems V7i2p114Document6 pages07ijems V7i2p114Yashaswi KumarNo ratings yet

- InvestIndia - PLI Textiles - VFDocument44 pagesInvestIndia - PLI Textiles - VFTushar JoshiNo ratings yet

- Dec 23 - Jan 5Document84 pagesDec 23 - Jan 5Ramesh KhemkaNo ratings yet

- PC - Innerwear Industry Report (Phillip Capital India PVT LTD) 20211006143344Document70 pagesPC - Innerwear Industry Report (Phillip Capital India PVT LTD) 20211006143344PriyankaNo ratings yet

- IEC GRP Assignment - SECB - MAKE IN INDIADocument27 pagesIEC GRP Assignment - SECB - MAKE IN INDIASunny ShuklaNo ratings yet

- Abbott India: FY20 Performance Reflects Strength of Power BrandsDocument5 pagesAbbott India: FY20 Performance Reflects Strength of Power BrandspremNo ratings yet

- Business Opportunities Updated 07 Mac 2022 11amDocument39 pagesBusiness Opportunities Updated 07 Mac 2022 11amazim ireadyNo ratings yet

- Industrial IOT in IndiaDocument21 pagesIndustrial IOT in IndiaSUPRIYA SONINo ratings yet

- Itc LTD.: Minor Project Report (Pg34) ONDocument28 pagesItc LTD.: Minor Project Report (Pg34) ONBhavya BhartiNo ratings yet

- Knowledge Papers: Series 5/2020Document5 pagesKnowledge Papers: Series 5/2020Deep NagNo ratings yet

- Make in India - India's Image Will ChangeDocument6 pagesMake in India - India's Image Will Changeutsavaarohan07No ratings yet

- Equity Research: Group AssignmentDocument16 pagesEquity Research: Group AssignmentMuskan BhartiaNo ratings yet

- IC Indigo - Paints - MOSLDocument34 pagesIC Indigo - Paints - MOSLShreyash ShahNo ratings yet

- Sectoral Snippets: India Industry InformationDocument18 pagesSectoral Snippets: India Industry InformationdatppNo ratings yet

- HDFC Manufacturing Fund - NFO - Leaflet - HDFC BankDocument2 pagesHDFC Manufacturing Fund - NFO - Leaflet - HDFC Bankyeheji8177No ratings yet

- Star India PVTLTD - BsprojectDocument52 pagesStar India PVTLTD - BsprojectOmpraksh YadavNo ratings yet

- Effect On The Sales of Indianoil Bitumen Due To Import in West BengalDocument57 pagesEffect On The Sales of Indianoil Bitumen Due To Import in West BengalPriyanka Mullick67% (3)

- Manufacturing Sector-KDocument9 pagesManufacturing Sector-Kpiyush rawatNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaNo ratings yet

- Keown Perfin5 Im 05Document15 pagesKeown Perfin5 Im 05a_hslrNo ratings yet

- Patricia A Seitz Financial Disclosure Report For 2010Document7 pagesPatricia A Seitz Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- All You Need To Know About UBL Funds ATM Redemption CardDocument3 pagesAll You Need To Know About UBL Funds ATM Redemption CardMohammad UsmanNo ratings yet

- CH 3 (Qamar Abbas) - Investment and Security Analysis or Portfolio ManagmentDocument18 pagesCH 3 (Qamar Abbas) - Investment and Security Analysis or Portfolio Managmentفہد ملکNo ratings yet

- Ananthu RDocument45 pagesAnanthu RAnanthu RNo ratings yet

- Chap 013 Financial Accounting (Statement of Cash Flow)Document39 pagesChap 013 Financial Accounting (Statement of Cash Flow)salman saeed100% (2)

- Meezan Rozana Amdani FundDocument2 pagesMeezan Rozana Amdani FundAbdur rehmanNo ratings yet

- Financial Market and Banking OperationsDocument9 pagesFinancial Market and Banking OperationsShreya JoriNo ratings yet

- Investment AdvisorsDocument16 pagesInvestment AdvisorsMarketsWikiNo ratings yet

- Credit Rating Agencies PDFDocument17 pagesCredit Rating Agencies PDFAkash SinghNo ratings yet

- LIC Mutual FundDocument127 pagesLIC Mutual FundShikha PradhanNo ratings yet

- How To Build Your Own BRKDocument13 pagesHow To Build Your Own BRKmilandeepNo ratings yet

- Public Islamic Opportunities Fund (Piof)Document6 pagesPublic Islamic Opportunities Fund (Piof)Cheng Wei JunNo ratings yet

- Outcome Requirements Chapter 2 & 3: A Requirement in The SubjectDocument11 pagesOutcome Requirements Chapter 2 & 3: A Requirement in The SubjectYamateNo ratings yet

- ZETSCHE, D. BUCKLEY, R. ARNER, D. Regulating LibraDocument29 pagesZETSCHE, D. BUCKLEY, R. ARNER, D. Regulating LibratuliobozolaNo ratings yet

- Performance Overview: As of Sep 14, 2023Document3 pagesPerformance Overview: As of Sep 14, 2023Tirthkumar PatelNo ratings yet

- Saunders Notes PDFDocument162 pagesSaunders Notes PDFJana Kryzl DibdibNo ratings yet

- Money Market: Chapter 6 - GROUP 1 - PresentationDocument65 pagesMoney Market: Chapter 6 - GROUP 1 - PresentationThanh XuânNo ratings yet

- Mutual Funds and Other Investment CompaniesDocument5 pagesMutual Funds and Other Investment Companiespiepkuiken-knipper0jNo ratings yet

- Project Report On Mutual FundDocument60 pagesProject Report On Mutual FundBaldeep KaurNo ratings yet

- Performance Update: Fidelity Investments (R) Mutual Funds Investment OptionsDocument10 pagesPerformance Update: Fidelity Investments (R) Mutual Funds Investment OptionsAnonymous RT1MEWoN1eNo ratings yet

- Dombivli Shikshan Prasarak Mandal'S K. V. Pendharkar College of Arts, Science and Commerce (Autonomous)Document17 pagesDombivli Shikshan Prasarak Mandal'S K. V. Pendharkar College of Arts, Science and Commerce (Autonomous)Nayna PanigrahiNo ratings yet

- Assessment Task 1: Cash & Cash Equivalent Questions: Investment Rating Asset StocksDocument20 pagesAssessment Task 1: Cash & Cash Equivalent Questions: Investment Rating Asset StocksDaisy Ann Cariaga SaccuanNo ratings yet

- Unit 2 Money Market 2Document9 pagesUnit 2 Money Market 2mkmahesh813No ratings yet

- Chapter Five: Management of Monetary AssetsDocument30 pagesChapter Five: Management of Monetary AssetsSwati PorwalNo ratings yet

- KarvyDocument66 pagesKarvypadmini_selvarajNo ratings yet

- Sponsored Membership ListDocument60 pagesSponsored Membership ListserpzenNo ratings yet