Professional Documents

Culture Documents

Load Auto Estimate

Load Auto Estimate

Uploaded by

dvdmotoaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Load Auto Estimate

Load Auto Estimate

Uploaded by

dvdmotoaiCopyright:

Available Formats

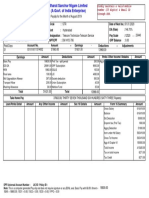

INCOME TAX

Assessment Summary Notification

Enquiries should be addressed to SARS

Contact Centre

ALBERTON

TD MOTOAI 1528

PO BOX 293 Tel: 0800007277 Website: www.sars.gov.za

MULDERSDRIFT

Details

1747

Reference number: 0098959232

Date of Assessment: 2023-07-01

Tax year: 2023

The South African Revenue Service (SARS) has raised an original assessment based on estimate, for tax year 2023, and this assessment summary tax result -6843.91 is based on the

information readily available to SARS. Balance of account after this assessment is -6843.91

Below are your bank account details currently at the disposal of SARS. Any refund due to you will be paid into this account.

Bank Account Details

Account Holder Name: D MOTOAI

Bank Name: CAPITEC BANK LTD

Account Number: 1430605675

Account Type: Savings

Branch Code: 470010

Income

Code Source Code Description Rand

3915 Retirement fund lump sum benefit on / after 1/10/2007 269892.00

3601 Income - taxable 102240.00

3605 Annual payment - taxable 14200.00

3607 Overtime 4449.00

4201 Interest excluding SARS Interest (Local) 643.00

Investment exemption -643.00

Total 390781.00

Deductions

Code Source Code Description Rand

Total 0.00

Taxable Income 390781.00

Taxable income - subject to retirement fund lump sum benefit tax rates 0.00

Taxable income - subject to retirement fund lump sum withdrawal benefit tax rates

Medical Aid Contributions

Code Source Code Description Rand

Assessment Calculation by SARS

Normal tax on taxable income 21760.02

Rebates: -16425.00

Primary 16425.00

Retirement fund lump sum benefit tax liability 0.00

Subtotal 5335.02

Employees' tax -12178.93

Assessment Summary Tax Result -6843.91

Notes

1. SARS prepared this assessment summary i.r.o. the 2023 year of assessment based on third party data returns received from your

employer(s)/retirement fund(s) / (IRP5(s) and/or IT3(a)), select "View Return" to display this information on eFiling and/or MobiApp.

2. If the information is complete and correct, you may exit the page. However, if you disagree with any information or there is additional

information that is not reflected, select "Edit Return", update the information and file your return.

3. Adjustments and carryover amount(s) from previous years not displayed on this assessment summary and impacting on your assessment

summary tax results, will be displayed on the Notice of Assessment (ITA34).

4. If the Assessment Summary Tax Result above is displayed with a minus (-) sign, it means that the amount is refundable to you by SARS,

however if the amount does not have a minus sign, it means is payable by you to SARS.

Reference Number 0098959232 SIM01_RO 2022.04.00 01/02

Disclaimer

- This assessment summary is based on information at the disposal of SARS as at the date of this notice, and it is only applicable to the year of

assessment stated above.

- Should you disagree with the information or there is any additional information that is not reflected in this notice, it is your responsibility to

declare this information to SARS by selecting "Edit Return."

- You are not relieved from your obligation to inform the Commissioner, by way of submitting provisional tax returns (IRP6), when you become

liable for provisional tax.

Reference Number 0098959232 SIM01_RO 2022.04.00 02/02

You might also like

- Mini Practice Set 3 QuickBooks Guide PDFDocument4 pagesMini Practice Set 3 QuickBooks Guide PDFJoseph SalidoNo ratings yet

- L4-M1 ProcScope PPT 6-19Document226 pagesL4-M1 ProcScope PPT 6-19Sorna Khan100% (3)

- Payslip MAY 2019 PDFDocument1 pagePayslip MAY 2019 PDFKushal Malhotra100% (1)

- Annexure 1B PDFDocument1 pageAnnexure 1B PDFFolaNo ratings yet

- Final Project InternationalTradeDocument21 pagesFinal Project InternationalTradeAssignment parttimeNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsVivek ViviNo ratings yet

- Amended Tax Credit Certificate 2020 7243210862511Document2 pagesAmended Tax Credit Certificate 2020 7243210862511Aurimas AurisNo ratings yet

- Basics of Power TradingDocument3 pagesBasics of Power TradingPulkit DhingraNo ratings yet

- K Sengwayo 1447 Shenge Drive Jabulani 1868: Contact CentreDocument2 pagesK Sengwayo 1447 Shenge Drive Jabulani 1868: Contact CentrekhanyisileNo ratings yet

- Load Auto EstimateDocument2 pagesLoad Auto EstimatedlovasibongileNo ratings yet

- Wa0001.Document5 pagesWa0001.Pratyush Prateem BhattaNo ratings yet

- Payslip For The Month of November 2020: Cms It Services Private LimitedDocument2 pagesPayslip For The Month of November 2020: Cms It Services Private LimitedKrishna AryanNo ratings yet

- SettlementReportDocument1 pageSettlementReportPraneeth Sasanka TadepalliNo ratings yet

- Adobe Scan Apr 16, 2024Document6 pagesAdobe Scan Apr 16, 2024SPYDER GRAPHICSNo ratings yet

- Adobe Scan Apr 16, 2024Document6 pagesAdobe Scan Apr 16, 2024SPYDER GRAPHICSNo ratings yet

- Adecco India Private Limited: Payslip For The Month of October 2022Document1 pageAdecco India Private Limited: Payslip For The Month of October 2022VeereshPammarNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- Draft Return For ReviewDocument4 pagesDraft Return For ReviewsajjadNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- Laetitia Kalunga - Payslip February 2021Document1 pageLaetitia Kalunga - Payslip February 2021officialteeyaNo ratings yet

- Detailed Computation BDJPS7350C 1870960 Old Regime 20230730161927Document4 pagesDetailed Computation BDJPS7350C 1870960 Old Regime 20230730161927suman.singh08031992No ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- I Mumd44312Document1 pageI Mumd44312dbind1999No ratings yet

- Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsDocument1 pageGhodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsSivi BabuNo ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- Comp FY 2019-2020Document2 pagesComp FY 2019-2020Tayal SahabNo ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONjaredford913No ratings yet

- Payslip IndiaApproved On30 Nov 2023 - UnlockedDocument3 pagesPayslip IndiaApproved On30 Nov 2023 - UnlockedrithulblockchainNo ratings yet

- PayslipsDocument6 pagesPayslipsbskapoor68No ratings yet

- 31 Jan 2024Document2 pages31 Jan 2024vikzNo ratings yet

- Payslip For The Month of June 2022: Kotak Mahindra Bank LTDDocument1 pagePayslip For The Month of June 2022: Kotak Mahindra Bank LTDshubham choure100% (1)

- IRPF 2022 2021 Origi Imagem Declaracao07Document1 pageIRPF 2022 2021 Origi Imagem Declaracao07BVC RoleplayNo ratings yet

- Compass India Food Services Private LimitedDocument1 pageCompass India Food Services Private LimitedBoopathi ChinnaduraiNo ratings yet

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit Sagar0% (2)

- L00368bi 20231227 85232 0001094215Document1 pageL00368bi 20231227 85232 0001094215Vikas NimbranaNo ratings yet

- Kahuta, District Kahuta, Pakistan Muhammad Mohsin Razzaq: Mon, 7 Dec 2020 21:17:28 +0500Document3 pagesKahuta, District Kahuta, Pakistan Muhammad Mohsin Razzaq: Mon, 7 Dec 2020 21:17:28 +0500Asif ShahzadNo ratings yet

- Payslip Bosch Car ServicesDocument1 pagePayslip Bosch Car Servicesambitious nkomoNo ratings yet

- Prasant Kumar Dakua: Pay Slip - February 2019Document1 pagePrasant Kumar Dakua: Pay Slip - February 2019biki222No ratings yet

- Payslip-Apr AvinashDocument1 pagePayslip-Apr AvinashCash monkeyNo ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- Pay Slip Dipankar Mondal 02Document1 pagePay Slip Dipankar Mondal 02Pritam GoswamiNo ratings yet

- CrystalReportViewer1 3Document1 pageCrystalReportViewer1 3Mehedi HasanNo ratings yet

- Order 3430259682085Document3 pagesOrder 3430259682085abuzar ranaNo ratings yet

- 218, K-1, WAPDA TOWN, Lahore Wapda Town Muhammad Omar QureshiDocument4 pages218, K-1, WAPDA TOWN, Lahore Wapda Town Muhammad Omar QureshiIkramNo ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- Report - 2024-05-06T070831.495Document2 pagesReport - 2024-05-06T070831.495EDWARD LUPASANo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument1 pageEPF Universal Account Number: LIC ID / Policy IDRapole DathatriNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Payslip: Employee Details Payment & Leave DetailsDocument1 pagePayslip: Employee Details Payment & Leave DetailsKushal MalhotraNo ratings yet

- Deepika3Document1 pageDeepika3chanduazad8808No ratings yet

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiNo ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- Invoice Voucher Detail: GritechDocument4 pagesInvoice Voucher Detail: GritechRana Ammar waheedNo ratings yet

- EPF Universal Account Number: 100618268345 LIC ID / Policy IDDocument1 pageEPF Universal Account Number: 100618268345 LIC ID / Policy IDHoly ReaperNo ratings yet

- UnknownDocument1 pageUnknownFiroz ShaikhNo ratings yet

- SalarySlipwithTaxDetails 5Document1 pageSalarySlipwithTaxDetails 5Kiran NoraNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAmrit RajNo ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctRahul RajawatNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- Declaration 3840321246075Document7 pagesDeclaration 3840321246075Qais NasirNo ratings yet

- SRL Limited: Payslip For The Month of JANUARY 2019Document1 pageSRL Limited: Payslip For The Month of JANUARY 2019Giri PriyaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Paranginan Partners Tax Law FirmDocument5 pagesParanginan Partners Tax Law FirmBram SostenesNo ratings yet

- Plan Abu Dhabi 2030Document185 pagesPlan Abu Dhabi 2030Thanasate Prasongsook100% (1)

- Ethic Slide FinalDocument25 pagesEthic Slide FinalLola CarolinaNo ratings yet

- Muhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofDocument3 pagesMuhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofsyahrinNo ratings yet

- International Business EnvironmentDocument68 pagesInternational Business EnvironmentGamers N2No ratings yet

- CFAF Std. T&C (EL) - Standard Terms and Conditions Governing Education LoanDocument5 pagesCFAF Std. T&C (EL) - Standard Terms and Conditions Governing Education LoanAvinab PandeyNo ratings yet

- ILACDocument8 pagesILACMUHAMMAD ADIB IZUDINNo ratings yet

- Evaluated Receipt Settlement: Vendor Master Data Info Record Purchase OrderDocument6 pagesEvaluated Receipt Settlement: Vendor Master Data Info Record Purchase OrderBenny KhorNo ratings yet

- Chapter 14 QuizDocument7 pagesChapter 14 QuizSherri BonquinNo ratings yet

- Profitability Analysis of NMB Bank LimitedDocument9 pagesProfitability Analysis of NMB Bank LimitedRam Adhikary100% (2)

- Web SurveyorDocument3 pagesWeb SurveyorChittagong Port AgentNo ratings yet

- Lecture No5 - Equal-Payment - Series-ModifiedDocument13 pagesLecture No5 - Equal-Payment - Series-Modifiedpoqwuradfo apdsoaafNo ratings yet

- On August 31 2015 The Rijo Equipment Repair Corp S Post ClosingDocument1 pageOn August 31 2015 The Rijo Equipment Repair Corp S Post ClosingMiroslav GegoskiNo ratings yet

- Post-Commencement Analysis of The Dutch Mission-Oriented Topsector and Innovation Policy' StrategyDocument55 pagesPost-Commencement Analysis of The Dutch Mission-Oriented Topsector and Innovation Policy' StrategyjlskdfjNo ratings yet

- "A Highly Skilled Workforce Is A Must ... ": - Rohan Gulati, Projects Director, Sundex Process Engineers Pvt. LTDDocument2 pages"A Highly Skilled Workforce Is A Must ... ": - Rohan Gulati, Projects Director, Sundex Process Engineers Pvt. LTDPrashant Bansod100% (1)

- Kanwal Yousaf MPA-4Document38 pagesKanwal Yousaf MPA-4shakeelNo ratings yet

- 31.05.2023 Notificari Sunset PT - Postat Incepand Cu Luna IUNIE 2016Document20 pages31.05.2023 Notificari Sunset PT - Postat Incepand Cu Luna IUNIE 2016Anca ToaderNo ratings yet

- Stephanie LetterDocument3 pagesStephanie Letterroshayyan24No ratings yet

- Document-Understanding Deconsolidation in SAP EWMDocument7 pagesDocument-Understanding Deconsolidation in SAP EWMAnonymous u3PhTjWZRNo ratings yet

- Eco-244 Course-Outline Spring2012Document2 pagesEco-244 Course-Outline Spring2012Madiha Kabir ChowdhuryNo ratings yet

- Ductile Iron Pipe Iso en Standards 5c348f95 PDFDocument24 pagesDuctile Iron Pipe Iso en Standards 5c348f95 PDFASHIL PRABHAKARNo ratings yet

- Fooddepo-Zimbabwe's Only App in Trying To Reduce Food WastageDocument14 pagesFooddepo-Zimbabwe's Only App in Trying To Reduce Food WastageRowan RootNo ratings yet

- Consolidation-Wholly Owned SubsidiaryDocument3 pagesConsolidation-Wholly Owned Subsidiarysheenal naickerNo ratings yet

- Retail Media Company Profile PDFDocument76 pagesRetail Media Company Profile PDFYasir OptpNo ratings yet

- 436号令 PDFDocument93 pages436号令 PDFtoddflyNo ratings yet

- Urc DiscussionDocument3 pagesUrc DiscussionME ValleserNo ratings yet