Professional Documents

Culture Documents

Auto Insurance Brochure

Auto Insurance Brochure

Uploaded by

brightkeysCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auto Insurance Brochure

Auto Insurance Brochure

Uploaded by

brightkeysCopyright:

Available Formats

4 Benefits: 7

Vision:

Provides financial comfort in the

To be Nigeria’s first choice in wealth

event of a loss/claim.

creation and financial security.

Fleet discount of 5% for 5 Vehicles

and above.

Drawing from the knowledge and

experience of our owners, FBN General

5 Requirements: Insurance has positioned itself as a

market leader in:

Insured's name/contact details.

Product Innovation

List of vehicle(s) to be insured

Technology Driven Operations

indicating vehicle make/type, vehicle Efficient Service Delivery

registration number and the value of Prompt Claims Settlement

the vehicle.

The type of cover required. Other policies now available from FBNInsurance:

6 About Us:

Family

Shield

FBN General Insurance is a subsidiary

of FBNInsurance; a limited liability

company licensed to transact life

and general insurance businesses in

Buy Auto Insurance

Nigeria. online with ease

The company is jointly owned by the

FBNHoldings Plc (65%) and the

Sanlam Group (35%), one of the Auto

largest financial institutions in Africa. Insurance www.fbninsurance.com

FBN General Insurance Limited 298, Ikorodu Road,

Anthony Village, Lagos, Nigeria FBNInsurance

Tel +234 (1) 905 4810, +234 (1) 291 4538 @FBNInsurance

Email insuranceinfo@fbninsurance.com FBNInsurance

Web www.fbninsurance.com

FBNInsurance

FBN General Insurance is a Subsidiary of

Terms and conditions apply FBNInsurance, An FBNHolding Company RC 208278 FBNInsurance

1 Introduction: 2 You can choose from three classes 3 Features:

of cover under the FBN General Covers loss and /or damage to

FBN General Insurance Auto

Insurance Auto policy: insured vehicles resulting from

Insurance covers all types of

automobiles for both private and

commercial uses. Cover Features Rate accidents,

Third party Cover This class of insurance is made N5000 flat theft or any

Why do YOU need FBN General compulsory by Government premium per

through the legislation known as vehicle a t t e m p t

Insurance Auto Policy?

the Motor Vehicle (Third Party) thereat, flood

To give you financial succor in the Insurance Act. damage, riot

event of damage or theft of your The Third Party -only cover , which and strike etc.

car. is the minimum type of insurance

legislated upon , provides 3rd party

To provide financial support for you indemnity to policy holder against l i a b i l i t y

when you damage other people's legal liability to Third Parties for

death, bod ily injury and property coverage for

property.

damage. bodily injuries,

Re-imbursement of litigation Th is policy covers death, death and/or

expenses involved in any suit accidental bodily injury and

damage to the property of a third

property

brought about by third parties, damage.

party

arising out of the use of your Third Party Fire This provides cover to the insured 1.8% of value of

vehicle. AA Rescue

and Theft Cover vehicle for loss or damage vehicle insured

resulting from theft or damages membership

Tailor-made auto policies. for vehicles

(resulting from attempted theft),

It is compulsory for all automobile fire damage or third party liability. valued N7M

owners. (Motor Vehicle Insurance Act Comprehensive The most popular type of cover 3% of value of and above.

of 1945) Cover under the Motor insurance class is vehicle insured

comprehensive insurance which, Auto tracking

in addition to the cover provided d e v i c e

under the Third Party-only and

third party fire and theft, will also installation for

compensate the policy holder for vehicles valued

loss or damage to the vehicle N4M and

resulting from road accident, fire,

above.

theft, vandalism, malicious

damage, medical expenses and Simplified

cost of towing follow ing accident.

c l a i m s

The policy can also be extended to

cover loss or damage resulting management

from riot, strike, civil commotion process.

and flood .

You might also like

- Dps Custodial Terms and Conditions June2022 v28Document7 pagesDps Custodial Terms and Conditions June2022 v28Arasu Chess0% (1)

- 01 Property Casualty Insurance Basics-14Document28 pages01 Property Casualty Insurance Basics-14kandurimaruthiNo ratings yet

- Assignment On Insurance Policy On The Basis of Northern General Insurance Co. LTDDocument18 pagesAssignment On Insurance Policy On The Basis of Northern General Insurance Co. LTDBristir Majhe TumiNo ratings yet

- Motor Insurance Handbook (English) PDFDocument10 pagesMotor Insurance Handbook (English) PDFNikilesh ReddyNo ratings yet

- Explore NsuranceDocument22 pagesExplore NsuranceShailesh DubeyNo ratings yet

- Car InsurancesDocument10 pagesCar InsurancesAlex SatheeshNo ratings yet

- Cis Ofis Ip202 25083 7 PDFDocument4 pagesCis Ofis Ip202 25083 7 PDFMloNo ratings yet

- M008-Consumer Mathematics (Insurance)Document8 pagesM008-Consumer Mathematics (Insurance)Tan Jun YouNo ratings yet

- Bảo Hiểm Ô TôDocument26 pagesBảo Hiểm Ô TôDieu hangNo ratings yet

- AutomobileInsuranceGuide WEBDocument16 pagesAutomobileInsuranceGuide WEBmaria-bellaNo ratings yet

- HDFC SL Insurance Co.Document77 pagesHDFC SL Insurance Co.sonal jindalNo ratings yet

- Motor Insurance: Brief Summary Prepared by Tsegaye AmdeDocument10 pagesMotor Insurance: Brief Summary Prepared by Tsegaye AmdeMan TKNo ratings yet

- Types of Insurance - Different Types of Insurance Policies in India PDFDocument14 pagesTypes of Insurance - Different Types of Insurance Policies in India PDFHS AspuipluNo ratings yet

- Banking and InsuranceDocument17 pagesBanking and InsuranceDeepak GhimireNo ratings yet

- IBFS Presentation 21244 21264Document15 pagesIBFS Presentation 21244 21264arpita.vermaa04No ratings yet

- Property & Casualty Insurance BasicsDocument28 pagesProperty & Casualty Insurance Basics邵晨冬No ratings yet

- Irda Test EnglishDocument8 pagesIrda Test EnglishKaranveer SinghNo ratings yet

- Third Party InsuranceDocument22 pagesThird Party InsurancePulkit Mago 1703887No ratings yet

- Insurance HandbookDocument28 pagesInsurance HandbookGreat VivekanandaNo ratings yet

- BFI Lec 6 InsuranceDocument28 pagesBFI Lec 6 InsuranceJanesza MarceloNo ratings yet

- Vehicle InsuranceDocument14 pagesVehicle InsuranceRyan CalicaNo ratings yet

- NFo BJT1bt7PsZ69 AOU024Kv3zMsPKF9 Ilp D 1 S 2 Fundamentals of Insurance Updated 01-30-2018Document13 pagesNFo BJT1bt7PsZ69 AOU024Kv3zMsPKF9 Ilp D 1 S 2 Fundamentals of Insurance Updated 01-30-2018Tech VisionNo ratings yet

- Commercial Law (Ii)Document6 pagesCommercial Law (Ii)Icekid BwalyaNo ratings yet

- Product Disclosure Sheet: Prepared For: Print DateDocument4 pagesProduct Disclosure Sheet: Prepared For: Print DatePhua Kien HanNo ratings yet

- What Is Insurance - Meaning, Types, Importance & BenefitsDocument7 pagesWhat Is Insurance - Meaning, Types, Importance & BenefitsAyush VermaNo ratings yet

- Report On Motor Insurence of Phoenix Insurance Company LTDDocument22 pagesReport On Motor Insurence of Phoenix Insurance Company LTDvvv NainaNo ratings yet

- Insurance Law ProjectDocument5 pagesInsurance Law Projectshubhankar negiNo ratings yet

- Unnati Khajanchi-Features of Insurance Contracts 1Document10 pagesUnnati Khajanchi-Features of Insurance Contracts 1SAURABH SINGHNo ratings yet

- Sanjay Patel - Principle of InsuranceDocument10 pagesSanjay Patel - Principle of InsuranceSanjay PatelNo ratings yet

- Insurance CompaniesDocument11 pagesInsurance CompaniesPricia AbellaNo ratings yet

- Executive SummaryDocument41 pagesExecutive SummaryAnonymous CgJjQiCu5ANo ratings yet

- Financial InstitutionsDocument13 pagesFinancial Institutionsr3ewrhymesNo ratings yet

- A Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceDocument88 pagesA Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceNinad Patil50% (2)

- Assignment: Name-Vishlesh Hukmani ENROLLMENT NO.-03014901819 Course-Bba (B&I) Subject-Principles of Insurance 2 SemsterDocument4 pagesAssignment: Name-Vishlesh Hukmani ENROLLMENT NO.-03014901819 Course-Bba (B&I) Subject-Principles of Insurance 2 SemsterVishlesh 03014901819No ratings yet

- Module - Ch-9Document25 pagesModule - Ch-9Gedion MelkamuNo ratings yet

- Kinds of Insurance: Unit-4Document64 pagesKinds of Insurance: Unit-4EdenNo ratings yet

- Assignment 1Document18 pagesAssignment 1Gokul SriramNo ratings yet

- Principles of Insurance GENERAL INSURANCE (Non Life)Document4 pagesPrinciples of Insurance GENERAL INSURANCE (Non Life)Nipun DhingraNo ratings yet

- InsuranceDocument45 pagesInsurancegech95465195No ratings yet

- Micro Insurance ProjectDocument12 pagesMicro Insurance ProjectSushil PrajapatNo ratings yet

- Chapter.1. Introduction To Insurance IndustryDocument64 pagesChapter.1. Introduction To Insurance IndustryKunal KaduNo ratings yet

- Motor Vehicle Insurance (9930380385 Contac Me - ) ) - 80754995-1Document70 pagesMotor Vehicle Insurance (9930380385 Contac Me - ) ) - 80754995-1RiSHI KeSH GawaINo ratings yet

- Karan Patel - SIPDocument11 pagesKaran Patel - SIPKaran PatelNo ratings yet

- Accidental InsuranceDocument33 pagesAccidental InsuranceHarinarayan PrajapatiNo ratings yet

- Impacts of Claim Settlements On Profitability in The Nigerian Insurance IndustryDocument63 pagesImpacts of Claim Settlements On Profitability in The Nigerian Insurance IndustrySinmiloluwa S.No ratings yet

- Aasi 03Document10 pagesAasi 03Hannah GarciaNo ratings yet

- East West Insurance Company2Document16 pagesEast West Insurance Company2Faraz RiazNo ratings yet

- Insurance and It'S Importance: SANHITH REDDY (191127) Sec.ADocument13 pagesInsurance and It'S Importance: SANHITH REDDY (191127) Sec.AsanhithNo ratings yet

- Auto Coverages: Confusing? They Don't Have To BeDocument1 pageAuto Coverages: Confusing? They Don't Have To BeLorie Smith WilliamsonNo ratings yet

- IC 38 Jan QuestionDocument37 pagesIC 38 Jan QuestionDeepaNo ratings yet

- Q & A Insurance LawDocument37 pagesQ & A Insurance LawChevy MacalmaNo ratings yet

- Insurance Reviewer Notes by Atty. SaclutiDocument12 pagesInsurance Reviewer Notes by Atty. SaclutiGayFleur Cabatit RamosNo ratings yet

- Takaful First PartyDocument3 pagesTakaful First Partyahrafza91No ratings yet

- 9th Chap Insurance & Business RiskDocument9 pages9th Chap Insurance & Business Riskbaigz0918No ratings yet

- ComGI 6th Ed Ver 1.2 - Chapter 4Document38 pagesComGI 6th Ed Ver 1.2 - Chapter 4AndyNo ratings yet

- A Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceDocument90 pagesA Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceshreyaNo ratings yet

- BD30703 - Motor InsuranceDocument8 pagesBD30703 - Motor InsuranceNurShazreen NishaNo ratings yet

- Insurance Promotion - IIIDocument8 pagesInsurance Promotion - IIIAditi JainNo ratings yet

- Ch2. Insurance MechanisamDocument7 pagesCh2. Insurance MechanisamRaghda HussienNo ratings yet

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!From EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Rating: 5 out of 5 stars5/5 (1)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- UntitledDocument229 pagesUntitledbrightkeysNo ratings yet

- Procedural Manual: in Respect of The Operation of Constantly MonitoredDocument30 pagesProcedural Manual: in Respect of The Operation of Constantly MonitoredbrightkeysNo ratings yet

- Seven Signposts To Your AssignmentDocument34 pagesSeven Signposts To Your Assignmentbrightkeys100% (2)

- V - Visualize I - Inspire S - Sacrifice I - Internalize O - Overwhelmed N - Never Give UpDocument2 pagesV - Visualize I - Inspire S - Sacrifice I - Internalize O - Overwhelmed N - Never Give UpbrightkeysNo ratings yet

- BOPYMJUNE0602086 Inspection Call of L&T Valves LTD 08.06.23Document2 pagesBOPYMJUNE0602086 Inspection Call of L&T Valves LTD 08.06.23YokeshAnandNo ratings yet

- An Emperical Study On Consumer's Perception Towards Health Insurance in Gwalior District of Madhya PradeshDocument6 pagesAn Emperical Study On Consumer's Perception Towards Health Insurance in Gwalior District of Madhya PradeshPARTH PATELNo ratings yet

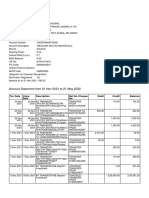

- Account Statement: Penyata AkaunDocument3 pagesAccount Statement: Penyata AkaunMuhd ShahrulNo ratings yet

- Mukesh Mishra Dipjyoti Talukdar Vivek Sinha Aman Agrawal Kumar GauravDocument39 pagesMukesh Mishra Dipjyoti Talukdar Vivek Sinha Aman Agrawal Kumar GauravAbhishek BhatnagarNo ratings yet

- Negociation RulesDocument2 pagesNegociation Rules4Ever Comissária de DespachosNo ratings yet

- Accresm Research Chap 1 & 2Document24 pagesAccresm Research Chap 1 & 2Eijoj MaeNo ratings yet

- Karate1 Online Registration Karate1 Youth League - A Coruña 2023Document1 pageKarate1 Online Registration Karate1 Youth League - A Coruña 2023ElinaNo ratings yet

- Accounting StandardsDocument12 pagesAccounting StandardsAshish SaxenaNo ratings yet

- Insurance: M.J.Malik-Sba-Ahmedabad-09879094925MWPADocument21 pagesInsurance: M.J.Malik-Sba-Ahmedabad-09879094925MWPAkrunalk2003100% (1)

- E BankingDocument8 pagesE BankingAnonymous BWTBnGNo ratings yet

- CH 07Document4 pagesCH 07flrnciairnNo ratings yet

- BNRMap Route053Document2 pagesBNRMap Route053fodayjalloh52No ratings yet

- Pradhan Mantri Suraksha Bima YojanaDocument2 pagesPradhan Mantri Suraksha Bima YojanaRavindra ParmarNo ratings yet

- Lecture 7 - 8 High Speed WLANs and SecurityDocument58 pagesLecture 7 - 8 High Speed WLANs and SecurityAbdulrahmanNo ratings yet

- 1.spain Documents (General)Document2 pages1.spain Documents (General)alps9999No ratings yet

- Account Statement of Recieving PartyDocument15 pagesAccount Statement of Recieving PartyAssistant EngineerNo ratings yet

- Fewer Links in The Supply ChainDocument4 pagesFewer Links in The Supply ChainAfthab Sakheel PadiyathNo ratings yet

- Contemporary Music (Advertising)Document17 pagesContemporary Music (Advertising)Joseph Machado CabreraNo ratings yet

- Resume For Shawn AndersonDocument2 pagesResume For Shawn AndersonShawn AndersonNo ratings yet

- Go2 Statement 023-12.pdf - 1Document1 pageGo2 Statement 023-12.pdf - 1ahmedkanewwiseNo ratings yet

- Zimbra EmailDocument2 pagesZimbra EmailAlbert AlvincentNo ratings yet

- Role & Function of IRDADocument2 pagesRole & Function of IRDAadityavik67% (6)

- DBP Vs CA DigestDocument1 pageDBP Vs CA DigestJoms TenezaNo ratings yet

- Blue White Color Blocks Software Engineer CVDocument2 pagesBlue White Color Blocks Software Engineer CVSanjay Rathnam SingaramNo ratings yet

- Assignment 2023 For BPOI - 103 (003) (DBPOFA Prog)Document1 pageAssignment 2023 For BPOI - 103 (003) (DBPOFA Prog)Pawar ComputerNo ratings yet

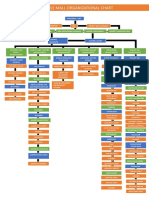

- Organizational ChartDocument2 pagesOrganizational Chartsheila roxasNo ratings yet

- Cired-1241 23032Document2 pagesCired-1241 23032farzinhafezNo ratings yet

- μATM Tender Ver 5.3Document44 pagesμATM Tender Ver 5.3Andy_sumanNo ratings yet

- KKAO Calculate WIP Prodn Order CollectiveDocument5 pagesKKAO Calculate WIP Prodn Order CollectiveZhang JimNo ratings yet