Professional Documents

Culture Documents

Numerical Questions - Derivative Contract

Numerical Questions - Derivative Contract

Uploaded by

Alis0 ratings0% found this document useful (0 votes)

4 views2 pagesOriginal Title

Numerical Questions_Derivative Contract

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesNumerical Questions - Derivative Contract

Numerical Questions - Derivative Contract

Uploaded by

AlisCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

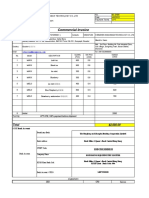

Derivative Contract- Numerical Questions

1. An investor buys a NIFTY futures contract for ₹2,80,000 (lot size 200

futures). On the settlement date, the Nifty closes at 1,378. Find out his

profit or loss if he pays ₹1,000 as brokerage. What would be the amount

of profit or loss if he sold the futures contract?

Ans: Loss if buy = ₹5,400; Gain if sale = ₹3,400

2. Nifty Index is currently quoting at 1329.78. Each lot is 250. Z purchases

a March contract at 1364. He has been asked to pay 10% initial margin.

What is the amount of initial margin? Nifty futures rise to 1370.What is

the percentage gain?

Ans: Margin = 34100; % Gain = 4.4%

3. The 3-month futures contract on NIFTY maturing in April 2009 is

currently trading at 2610. The current value of NIFTY is 2590. The one-

year risk free rate is 8% and the year -end dividend yield on the market

index is 4%. Find the theoretical futures price and comment on

arbitrage opportunity.

Ans: ₹2616.03

4. Tam buys 10000 shares of X Ltd. at ₹22 and obtains a hedge of shorting

400 Nifty at ₹1100 each. He closes out his position at the closing price of

the next day at which point the share of X Ltd. has dropped 2% and the

nifty future has dropped 1.5%. What is the overall profit/loss of this set of

transaction?

Ans: Net Gain = ₹ 2,200

5. The equity share of VCC Ltd. is quoted at ₹ 210. A 3-month call option is

available at a premium of ₹6 per share and a 3-month put option is available at

a premium of ₹ 5 per share. Ascertain the net payoffs to the option holder of a

call option and a holder of put option.

(i) the strike price in both cases is ₹ 220; and

(ii) the share price on the exercise day is ₹ 200, 210, 220, 230, 240.

Also indicate the price range at which the call and the put options may be

gainfully exercised.

Ans: (i) Net payoff for call option is ₹ -6, -6, -6, 4, 14 for exercise

price ₹ 200, 210, 220, 230, 240 respectively,

(ii) Net payoff for put option is ₹ 15, 5, -5, -5, -5 for exercise

price ₹200, 210, 220, 230, 240 respectively.

6. Dravid Investments Ltd deals in equity derivatives. Their Current Portfolio

comprises of the following instruments:

Infosys ₹5600 Call Expiry June 2004, 2,000 Units bought at ₹197 each (cost)

Infosys ₹ 5700 Call Expiry June 2004, 3,600 Units bought at ₹131 each (cost)

Infosys ₹ 5400 Put Expiry June 2004, 4,000 Units bought at ₹181 each (cost)

What will the profit or loss to Dravid Investments Ltd in the following

situations?

(i) Infosys closes on the expiry day at ₹6,041

(ii) Infosys closes on the expiry day at ₹ 5,812

(iii) Infosys closes on the expiry day at ₹ 5,085.

Ans: (i) ₹5,20,000; (ii) (-) ₹7,62,400 (iii) ₹ (-) 3,29,600

7. Calculate Profits and losses from the following transactions:

(i) Mr. X writes a call option to Sale share at an exercise price of ₹60 for a

premium of ₹12 per share. The share price rises to₹62 by the time the option

expires.

(ii) Mr. Y buys a put option at an exercise price of ₹80 for a premium of ₹8.50

per share. The share price falls to ₹60 by the time the option expires.

(iii) Mr Z writes a put option at an exercise price of ₹80 for a premium of ₹11

per share. The price of the share rises to ₹96 by the time the option expires.

(iv) Mr. XY writes a put option with an exercise price of ₹70 for a premium of

₹8 per share. The price falls to ₹48 by the time the option expires.

Ans: (i) ₹10; (ii) ₹11.50 (iii) ₹11; (iv) (-) ₹14.00

8. Mr. X established the following spread on the Delta Corporation’s stock:

(i) Purchased one 3-month call option with a premium of ₹30 and an exercise

price of ₹550.

(ii) Purchased one 3-month put option with a premium of ₹5 and an exercise

price of ₹450.

Delta Corporation’s stock is currently selling at ₹500. Determine profit or loss,

if the price of Delta Corporation’s:

(i) remains at ₹500 after 3 months.

(ii) falls at ₹350 after 3 months.

(iii) rises to ₹600.

Assume the size option is 100 shares of Delta Corporation.

Ans: (i) Net loss = ₹3,500; (ii) net Gain = ₹6,500, (iii) Net Gain = ₹1,500

You might also like

- Questions - Answers - Financial EngineeringDocument7 pagesQuestions - Answers - Financial EngineeringSidharth Choudhary100% (1)

- Test Bank Financial InstrumentDocument13 pagesTest Bank Financial InstrumentMasi100% (1)

- Security Law Practical QuestionsDocument18 pagesSecurity Law Practical QuestionsIsha YadavNo ratings yet

- Test 1 DERIVATIVES & INTEREST RATE RISK MANAGEMENTDocument6 pagesTest 1 DERIVATIVES & INTEREST RATE RISK MANAGEMENTprakhar rawatNo ratings yet

- Nism VIII Test 3Document12 pagesNism VIII Test 3Ashish Singh50% (2)

- Numerical AssignmentDocument2 pagesNumerical AssignmentPS FITNESS100% (1)

- Numerical AssignmentDocument2 pagesNumerical AssignmentPS FITNESSNo ratings yet

- Nism Viii Test 1Document14 pagesNism Viii Test 1Ashish Singh100% (1)

- Derivatives and Risk Management: Options - Basics and StrategiesDocument8 pagesDerivatives and Risk Management: Options - Basics and StrategiesRakshith PsNo ratings yet

- Lecture 1Document24 pagesLecture 1krupaoswal36No ratings yet

- 1 RMFDDocument27 pages1 RMFDArchin PadiaNo ratings yet

- Derivatives RevisionDocument14 pagesDerivatives RevisionshankruthNo ratings yet

- Options Trading Strategies: Long Stock - Long PutDocument7 pagesOptions Trading Strategies: Long Stock - Long PutDebasish SahooNo ratings yet

- CA Final Paper 2Document32 pagesCA Final Paper 2MM_AKSINo ratings yet

- TEST Paper 1Document7 pagesTEST Paper 1Abhu ArNo ratings yet

- Introduction To Capital MarketsDocument41 pagesIntroduction To Capital MarketsnisantiNo ratings yet

- Curency Derivatives - Forwards, Futures, Forward Rate Agreement, Options, Swaps - Foreign Exchange Management ActDocument34 pagesCurency Derivatives - Forwards, Futures, Forward Rate Agreement, Options, Swaps - Foreign Exchange Management ActChintakunta PreethiNo ratings yet

- International FinanceDocument68 pagesInternational FinanceVenkata Raman RedrowtuNo ratings yet

- NISM Sample Question-1Document7 pagesNISM Sample Question-1nanda100% (1)

- DerivativesDocument53 pagesDerivativesnikitsharmaNo ratings yet

- Hull: Options, Futures, and Other Derivatives, Ninth Edition Chapter 2: Mechanics of Futures Markets Multiple Choice Test Bank: Question With AnswersDocument2 pagesHull: Options, Futures, and Other Derivatives, Ninth Edition Chapter 2: Mechanics of Futures Markets Multiple Choice Test Bank: Question With Answersnew england brickNo ratings yet

- Adobe Scan 20-Mar-2024Document3 pagesAdobe Scan 20-Mar-2024BhagyaNo ratings yet

- Shares and DividendsDocument3 pagesShares and DividendssanathkothariNo ratings yet

- ProblemsDocument6 pagesProblemsPradeep BulleNo ratings yet

- DerivativesDocument41 pagesDerivativesRajib MondalNo ratings yet

- ExamDocument12 pagesExamAnonymous qh2DyTNo ratings yet

- PSINDocument46 pagesPSINTaeyeon KimNo ratings yet

- Question Bank - Third Sem B.com Computer Applications & TaxationDocument47 pagesQuestion Bank - Third Sem B.com Computer Applications & TaxationsnehaNo ratings yet

- Derivatives & Derivatives MarketDocument52 pagesDerivatives & Derivatives MarketManjunath Shettigar100% (1)

- 2023 - Hedge Funds, NAV and TaxationDocument54 pages2023 - Hedge Funds, NAV and TaxationChriselle D'souzaNo ratings yet

- Follow Us @: IG: Gts - Classes Contact Us: 6393469634 / 9415471342 / 8765677644Document1 pageFollow Us @: IG: Gts - Classes Contact Us: 6393469634 / 9415471342 / 8765677644Shashwat KhuranaNo ratings yet

- DLF Limited (Delhi Land & Finance) Is Based Developer. It Was Founded by Chaudhary Raghvendra Singh in 1946 and Is Based inDocument5 pagesDLF Limited (Delhi Land & Finance) Is Based Developer. It Was Founded by Chaudhary Raghvendra Singh in 1946 and Is Based inAbhishek RajputNo ratings yet

- Q1. MCQ: TH TH TH ST THDocument4 pagesQ1. MCQ: TH TH TH ST THSayali RaneNo ratings yet

- 20-06-2024 (Chapter 3&4) HW ProblemsDocument2 pages20-06-2024 (Chapter 3&4) HW ProblemsMohanNo ratings yet

- Seminar 8 - AnswersDocument4 pagesSeminar 8 - AnswersSlice LeNo ratings yet

- Summer 2019 (06-05-2019)Document2 pagesSummer 2019 (06-05-2019)Grishma BhindoraNo ratings yet

- TVM and No-Arbitrage Principle: Practice Questions and ProblemsDocument2 pagesTVM and No-Arbitrage Principle: Practice Questions and ProblemsMavisNo ratings yet

- End Term Examination - Financial Management The Paper Has 3 Questions Carrying Equal MarksDocument6 pagesEnd Term Examination - Financial Management The Paper Has 3 Questions Carrying Equal MarksabhishekNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversitysuchipatelNo ratings yet

- Derivatives All Lectures 202325Document181 pagesDerivatives All Lectures 202325ashmitgupta411No ratings yet

- Lecture 02Document31 pagesLecture 02jamshed20No ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- Futures & OptionsDocument32 pagesFutures & OptionsSwati Singh100% (1)

- FM AssignmentDocument3 pagesFM Assignmentjeaner2008No ratings yet

- 2840202Document4 pages2840202lathigara jayNo ratings yet

- MFIN6003 AssignmentsDocument4 pagesMFIN6003 AssignmentscccNo ratings yet

- SFM Mixed Compilation QTSDocument25 pagesSFM Mixed Compilation QTSBijay AgrawalNo ratings yet

- $P Mayank Gautam 16117047Document62 pages$P Mayank Gautam 16117047Rachit SemaltyNo ratings yet

- Financial Engeneering AssignmentDocument8 pagesFinancial Engeneering AssignmentGautam TandonNo ratings yet

- Smaliraza - 3622 - 18945 - 1 - Lecture 13 - Investement Ana & Portfolio ManagementDocument20 pagesSmaliraza - 3622 - 18945 - 1 - Lecture 13 - Investement Ana & Portfolio ManagementSadia AbidNo ratings yet

- Assignment 2Document2 pagesAssignment 2Dhruv SharmaNo ratings yet

- Unit 20 and 21 - Derivatives and CommoditiesDocument6 pagesUnit 20 and 21 - Derivatives and CommoditiesHemant bhanawatNo ratings yet

- C1 - M4 - Organization of Financial Markets and Securities Trading - Answer KeyDocument4 pagesC1 - M4 - Organization of Financial Markets and Securities Trading - Answer KeytfdsgNo ratings yet

- NSE - Forex & Derivatives Quiz 1 QuestionsDocument3 pagesNSE - Forex & Derivatives Quiz 1 QuestionsDHRUV SONAGARANo ratings yet

- Final TestDocument22 pagesFinal Testguruswamy.ayyapanNo ratings yet

- FIN B488F-Tutorial Answers - Ch01 - Autumn 2023Document4 pagesFIN B488F-Tutorial Answers - Ch01 - Autumn 2023Gabriel FungNo ratings yet

- NCFM Test: (B) T+3 To T+2Document18 pagesNCFM Test: (B) T+3 To T+2Upasana KollanaNo ratings yet

- EB Record 1Document23 pagesEB Record 1AlisNo ratings yet

- Unit-5 - Code of EthicsDocument12 pagesUnit-5 - Code of EthicsAlisNo ratings yet

- Common QuestionsDocument3 pagesCommon QuestionsAlisNo ratings yet

- Annuity TablesDocument12 pagesAnnuity TablesAlisNo ratings yet

- RM Syllabus - Bba FMDocument2 pagesRM Syllabus - Bba FMAlisNo ratings yet

- Pom Unit 5Document11 pagesPom Unit 5AlisNo ratings yet

- Projects For Teen StartupDocument1 pageProjects For Teen StartupAlisNo ratings yet

- Problem 1 - Pre-Incorporation Subscription Requirement Minimum Subscription Minimum Paid-InDocument5 pagesProblem 1 - Pre-Incorporation Subscription Requirement Minimum Subscription Minimum Paid-InYvonne Duyao100% (1)

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthrustomNo ratings yet

- Forms of MergersDocument9 pagesForms of MergersVinit BansalNo ratings yet

- ISLAMIC BANKING Product TerminologyDocument6 pagesISLAMIC BANKING Product TerminologyRafeeq MuhammadhNo ratings yet

- ch1 Acc WsDocument4 pagesch1 Acc WspranjalNo ratings yet

- CinePro CaseDocument4 pagesCinePro Casemoshe1.bendayanNo ratings yet

- EAGLE 2018 Annual Report (SEC Form 17-A) PDFDocument208 pagesEAGLE 2018 Annual Report (SEC Form 17-A) PDFRafael Obusan IINo ratings yet

- Infosys Revenue To Hit A Snag On Its Sales AimDocument3 pagesInfosys Revenue To Hit A Snag On Its Sales AimSubham MazumdarNo ratings yet

- Investment Deck - Ambassador 6Document14 pagesInvestment Deck - Ambassador 6Tom ChoiNo ratings yet

- Incentives and SubsidyDocument27 pagesIncentives and SubsidyKrishnan VelavanNo ratings yet

- Assignment On: Financial Statement Analysis and Valuation Course Code: (F-401)Document7 pagesAssignment On: Financial Statement Analysis and Valuation Course Code: (F-401)Md Ohidur RahmanNo ratings yet

- Ci-Hqd 0405Document1 pageCi-Hqd 0405Juan Carlos Canarte LeonNo ratings yet

- Macroeconomics and The Financial System 1st Edition Mankiw Test BankDocument35 pagesMacroeconomics and The Financial System 1st Edition Mankiw Test Bankmilordaffrapy3ltr3100% (26)

- Levis Financial AnalysisDocument18 pagesLevis Financial AnalysisAnantNo ratings yet

- Chapter 1: Why Study Financial Markets and Institutions?Document2 pagesChapter 1: Why Study Financial Markets and Institutions?nicNo ratings yet

- Transaction Complexity and The Movement To Fair Value AccountingDocument39 pagesTransaction Complexity and The Movement To Fair Value AccountingVania Dinda AzuraNo ratings yet

- AssignmentDocument3 pagesAssignmentjanineNo ratings yet

- CFA Exam Level 1: 2018 Cram NotesDocument48 pagesCFA Exam Level 1: 2018 Cram NotesMani ManandharNo ratings yet

- 3-PDIC-LAW' With YouDocument15 pages3-PDIC-LAW' With YoubeachyliarahNo ratings yet

- AT 2nd Monthly AssessmentDocument8 pagesAT 2nd Monthly AssessmentCiena Mae AsasNo ratings yet

- SBI SIP Registration FormDocument3 pagesSBI SIP Registration FormPrakash JoshiNo ratings yet

- FRIA Case Digests 2020Document21 pagesFRIA Case Digests 2020Mae100% (1)

- Simp Ar 2011Document245 pagesSimp Ar 2011Holis AdeNo ratings yet

- Health Insurance Sector Post CovidDocument19 pagesHealth Insurance Sector Post CovidGourima BabbarNo ratings yet

- Brief Introduction - Online Stock Market TradingDocument24 pagesBrief Introduction - Online Stock Market TradingGouri ShankarNo ratings yet

- Certificate of Increase in Capital Stock-Sample FormDocument2 pagesCertificate of Increase in Capital Stock-Sample FormvenaphaniaglysdimungcalNo ratings yet

- BB ECCS GMM Workshop ResultDocument41 pagesBB ECCS GMM Workshop ResultAllan TaufiqNo ratings yet

- CH 21 FroyenDocument24 pagesCH 21 FroyenRamadhan Der ErobererNo ratings yet

- User BankDocument7 pagesUser BankHamza SandliNo ratings yet

- Course Primer - PSE CSSCDocument9 pagesCourse Primer - PSE CSSCRon CatalanNo ratings yet