Professional Documents

Culture Documents

1012 Tuition

1012 Tuition

Uploaded by

Steve CouncilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1012 Tuition

1012 Tuition

Uploaded by

Steve CouncilCopyright:

Available Formats

FACT SHEET

South Carolina Policy Council

1323 Pendleton St., Columbia, SC 29201 803-779-5022 scpolicycouncil.com

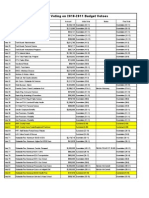

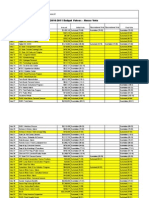

How Higher Tuition Translates into More Debt for State Universities By Simon Wong The S.C. Budget and Control Board recently announced a moratorium halting construction at fouryear public institutions that raised tuition by 7 percent or more for the 2010-2011 school year. The moratorium applies only to institutions that raised tuition by 7 percent or more. This means it does not apply to the University of South Carolina, which raised tuition by 6.9 percent. But it does apply to Clemson, which raised tuition by 7.5 percent. So how is tuition connected to capital building projects? Strictly speaking, state institutions issue bonds to raise the cash needed for capital building projects. As dictated by section 59-107-40 of the state code, however, bond applications must contain a schedule of tuition fees that shows how the annual principal and interest requirements on the proposed bonds and on all outstanding state institution bonds issued shall be financed. In turn, state law caps annual debt service to a formula gauged against tuition fees. Reads S.C. Code of Law, section 59-107-90: The maximum amount of annual debt service on all outstanding state institution bonds for each state institution shall not exceed ninety percent of the sums received by such state institution from tuition fees for the preceding fiscal year, as provided in Section 13(6)(b) of Article X of the South Carolina Constitution. In other words, the maximum amount of annual bond debt service for each institution cannot exceed 90 percent of whats collected from tuition fees specifically pledged to cover additional debt services. The more tuition collected, the more debt may be issued. In Clemsons case, raising tuition by 7.5 percent would enable the school to raise its borrowing levels by a significant amount. As of FY2009, Clemson collected $205.488 million in student tuition and fees, excluding receipts from scholarships. (Tuition and fees are reported together, and its unclear whether they are considered separately for the purpose of calculating bond debt.) A tuition increase of 7.5 percent would translate into $15.412 million in additional revenue if the entire increase were allocated to debt service. In itself, thats not a lot of money. If Clemson had followed USCs lead and only raised tuition by 6.9 percent, the result would have been $1.233 million in reduced revenue.

FACT SHEET: Tuition and Capital Costs

South Carolina Policy Council

That $1 million-plus difference, however, can be leveraged to borrow millions more using institutional bonds. This is how it works: Note that the law uses the phrase, annual debt service. This is very different from the term, principal outstanding. Annual debt service means the amount paid per year to cover principal and interest payments. Because an institutional general obligation bond may have a maturity of up to 20 years, this means that for every $1 in additional tuition revenue, an institution may increase its cumulative debt service by $18 (that is, 90 percent of 20). Thats a 1 to 18 ratio. In Clemsons case, $1.233 million in additional revenue translates into a maximum of $22.194 million in cumulative debt service for capital projects. This $22.194 million is the maximum in additional debt that could be leveraged from the tuition increase. But historically, Clemson has pledged about 4 percent to 8 percent of tuition revenue for general obligation bond service (from FY04-2005 to FY08-2009). If Clemson allocated 8 percent of additional tuition revenue for annual debt service for FY10-2011 (as was done in FY08-2009), the 7.5 percent tuition increase would increase annual debt service by $1.165 million which translates into $15.411 million in cumulative debt service over 20 years.1 Generally speaking, each institution that has reached its maximum debt service limit must raise its tuition fees pledged to general obligation bonds in order to borrow more money. Normally, the bond proceeds that result are used to acquire/build capital assets. In FY08-2009, for instance, South Carolina State University exceeded its legal debt service limit by about $223,000. As a result, S.C. State explicitly acknowledged in the South Carolina Comprehensive Annual Financial Report that it would adjust tuition fees in subsequent years to cover the debt requirement. S.C. State raised tuition by 5.7 percent for the 2010-2011 school year. And, so, the cycle continues. Over the past five years (FY2004 to FY2009), the states university system has acquired over $1.845 billion in capital assets. During the same period, the total depreciation of capital assets was about $712 million. Thus, the net acquired assets amounted to about $1.133 billion. Cumulatively, universities issued about $1.083 billion in bonds to acquire these capital assets. During the same period, in-state tuition increased by 52 percent at South Carolinas public, 4-year institutions.

1Other

schools allocate a much greater percentage of tuition revenue for maximum annual debt service. In FY08-2009, for example, Lander University pledged $19 million out of $19 million (or 100 percent) in student tuition and fees generated from the prior fiscal year.

FACT SHEET: Tuition and Capital Costs

South Carolina Policy Council

The irony in all this is that as tuition increases, fewer students will be able to afford to attend college in South Carolina. That means new buildings and facilities will be underutilized. A better solution, as we discuss in our new report on higher education, is to look to current building utilization reports with any eye toward maximizing existing resources, investing in distance/virtual education programs, and reducing spending and borrowing.

Simon Wong is a Policy Analyst with SCPC and may be contacted at: simon@scpolicycouncil.com

Nothing in the foregoing should be construed as an attempt to aid or hinder passage of any legislation. Copyright 2010 South Carolina Policy Council

1323 Pendleton St., Columbia, SC 29201 803-779-5022 scpolicycouncil.com

South Carolina Policy Council

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Data Import Template BLDocument94 pagesData Import Template BLdavender kumarNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Exec Summ Recorded Votes 082610Document1 pageExec Summ Recorded Votes 082610Steve CouncilNo ratings yet

- Exec Summ Shorten The Session 082610Document1 pageExec Summ Shorten The Session 082610Steve CouncilNo ratings yet

- Chapter 10Document24 pagesChapter 10Steve CouncilNo ratings yet

- Chapter 1Document14 pagesChapter 1Steve CouncilNo ratings yet

- Workforce Development Requires Educational Reform: by L. Brooke ConawayDocument14 pagesWorkforce Development Requires Educational Reform: by L. Brooke ConawaySteve CouncilNo ratings yet

- Chapter 8Document22 pagesChapter 8Steve CouncilNo ratings yet

- Fact Sheet: Which Counties Spend The Most of Your Tax Dollars?Document7 pagesFact Sheet: Which Counties Spend The Most of Your Tax Dollars?Steve CouncilNo ratings yet

- Chapter 6Document19 pagesChapter 6Steve CouncilNo ratings yet

- Mployment Security Organization of Southern StatesDocument6 pagesMployment Security Organization of Southern StatesSteve CouncilNo ratings yet

- Chapter 2Document28 pagesChapter 2Steve CouncilNo ratings yet

- Chapter 3Document22 pagesChapter 3Steve CouncilNo ratings yet

- Chapter 7Document20 pagesChapter 7Steve CouncilNo ratings yet

- Chapter 5Document21 pagesChapter 5Steve CouncilNo ratings yet

- 4478 Fact Sheet 061010Document4 pages4478 Fact Sheet 061010Steve CouncilNo ratings yet

- Best Worst 2011Document20 pagesBest Worst 2011Steve CouncilNo ratings yet

- Best/Worst of 2010: South Carolina Policy CouncilDocument47 pagesBest/Worst of 2010: South Carolina Policy CouncilSteve CouncilNo ratings yet

- The $21 Billion State Budget: South Carolina's Three Spending CategoriesDocument25 pagesThe $21 Billion State Budget: South Carolina's Three Spending CategoriesSteve CouncilNo ratings yet

- Senate Budget Veto VotingDocument2 pagesSenate Budget Veto VotingSteve CouncilNo ratings yet

- BudgetWatchObesityMandate 052710Document2 pagesBudgetWatchObesityMandate 052710Steve CouncilNo ratings yet

- Aiken Fact SheetDocument2 pagesAiken Fact SheetSteve CouncilNo ratings yet

- Budget Watch I95 052510Document3 pagesBudget Watch I95 052510Steve CouncilNo ratings yet

- HealthcareDocument2 pagesHealthcareSteve CouncilNo ratings yet

- House Budget Veto VotingDocument3 pagesHouse Budget Veto VotingSteve CouncilNo ratings yet

- Budget Veto HouseDocument4 pagesBudget Veto HouseSteve CouncilNo ratings yet

- BudgetDocument2 pagesBudgetSteve CouncilNo ratings yet

- Sat Scores Report 091010Document5 pagesSat Scores Report 091010Steve CouncilNo ratings yet

- UpdateDocument1 pageUpdateSteve CouncilNo ratings yet

- Laos 1003 Eu-Laos Ipip MT199 110221Document22 pagesLaos 1003 Eu-Laos Ipip MT199 110221TerenzNo ratings yet

- Seagull OptionDocument3 pagesSeagull OptionabrNo ratings yet

- Weekly Credit Outlook - June 25, 2012Document56 pagesWeekly Credit Outlook - June 25, 2012jspectorNo ratings yet

- The Acquisition of Consolidated Rail Corporation (A)Document15 pagesThe Acquisition of Consolidated Rail Corporation (A)tuhin14078No ratings yet

- Economic Survey of Pakistan: Executive SummaryDocument12 pagesEconomic Survey of Pakistan: Executive SummaryBadr Bin BilalNo ratings yet

- Countries, Capitals and CurrenciesDocument12 pagesCountries, Capitals and CurrenciesKhaja SuhearNo ratings yet

- International Finance - FINC 4521 - Chapter 5 - Sample Problems and AnswersDocument3 pagesInternational Finance - FINC 4521 - Chapter 5 - Sample Problems and AnswersANUSHANo ratings yet

- Banking Banana Skins 2012 ResultsDocument43 pagesBanking Banana Skins 2012 Resultsankur4042007No ratings yet

- Early-Stage Startup Valuation - Jeff FaustDocument15 pagesEarly-Stage Startup Valuation - Jeff FausthelenaNo ratings yet

- 20230410-20240411-9128 Eur enDocument14 pages20230410-20240411-9128 Eur enmarsovnaka2016No ratings yet

- Cityam 2012-02-23Document36 pagesCityam 2012-02-23City A.M.No ratings yet

- TB Chapter 01Document28 pagesTB Chapter 01josephnikolaiNo ratings yet

- Ethnic Minorities in The Context of Georgia's European Integration: Is There A Room For Skepticism?Document17 pagesEthnic Minorities in The Context of Georgia's European Integration: Is There A Room For Skepticism?GIPNo ratings yet

- EU Task Force For Greece - Quarterly Report December 2012Document40 pagesEU Task Force For Greece - Quarterly Report December 2012Yannis KoutsomitisNo ratings yet

- Mgt325 m4 Solutions Ch8Document25 pagesMgt325 m4 Solutions Ch8Matt DavisNo ratings yet

- ERM Case Study - Enterprise Risk Management at ABN AMRODocument20 pagesERM Case Study - Enterprise Risk Management at ABN AMROiam027No ratings yet

- Mark Plan and Examiner'S Commentary: General CommentsDocument9 pagesMark Plan and Examiner'S Commentary: General Commentscima2k15100% (1)

- Fao, 2010 PDFDocument186 pagesFao, 2010 PDFVaio SonyNo ratings yet

- CryptoCurrency CashOutDocument26 pagesCryptoCurrency CashOutbizgains100% (1)

- European Union - Evolution & Geopolitical Impact - Project ReportDocument5 pagesEuropean Union - Evolution & Geopolitical Impact - Project ReportVazrapu RavikanthNo ratings yet

- IFC AnnRep2013 Volume2 PDFDocument134 pagesIFC AnnRep2013 Volume2 PDFcarlonewmannNo ratings yet

- Question 3Document6 pagesQuestion 3Fierdzz Xieera100% (1)

- WEO FMI Perspectivas de La Economía Mundial Abril 2024Document42 pagesWEO FMI Perspectivas de La Economía Mundial Abril 2024Juan Manuel CoccoNo ratings yet

- Quarterly Outlook Q2 2009Document11 pagesQuarterly Outlook Q2 2009Anuta CostinelNo ratings yet

- Cost of Diabetic Foot in France, Spain, Italy, Germany and United Kingdom A Systematic ReviewDocument8 pagesCost of Diabetic Foot in France, Spain, Italy, Germany and United Kingdom A Systematic ReviewTony Miguel Saba SabaNo ratings yet

- TradeacademyDocument32 pagesTradeacademyapi-335292143No ratings yet

- White PaperDocument41 pagesWhite PaperParnasree ChowdhuryNo ratings yet

- 2 Reading Starbucks Case StudyDocument35 pages2 Reading Starbucks Case StudyJiaJien LeongNo ratings yet

- Q1-2020 Financial ReportDocument13 pagesQ1-2020 Financial Reportvikasaggarwal01No ratings yet