Professional Documents

Culture Documents

Chapter 1

Chapter 1

Uploaded by

Steve CouncilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1

Chapter 1

Uploaded by

Steve CouncilCopyright:

Available Formats

CHAPTER 5: SPECIFIC TAX REFORMS

7 13

Presumably the original intent of imposing a tax rate schedule with graduated marginal tax rates was to make the income tax progressive. However, what progressivity exists in the states income tax structure is due to the zero tax on the first $2,630 of income, and because of the graduated marginal tax rates. However, since the marginal tax rate increases over such small steps in income, as shown in Figure 5.5, most of the progressivity occurs at lower income levels, not higher levels of income. At higher income levels, the average tax rate hardly increases at all. This nature of the current tax is directly contradictory to the goal of progressivity. So although on the surface it appears that the tax satisfies the vertical equity condition, it reallyC H A P T E Rat 1 lower income levels reducing the does this only the wealth of these lowest income taxpayers, not the intended consequence.

Figure 5.5: South Carolina income tax: Current tax rates compared to inflation-indexed rates, 2009

Income Tax Rates/Brackets if 1959 Tax Current Income Tax Schedule was Inflation Adjusted to by Russell S. Sobel and Susane J. Leguizamon Rates/Brackets 2009 Taxable Income $5,000 $10,000 $15,000 $20,000 $30,000 $50,000 $75,000 $100,000 $150,000 $200,000 Tax Amount $71 $290 $604 $954 $1,654 $3,054 $4,804 $6,554 $10,054 $13,554 Average Tax Rate 1.42% 2.90% 4.03% 4.77% 5.51% 6.10% 6.41% 6.56% 6.70% 6.77% Tax Amount $125 $250 $377 $527 $834 $1,695 $3,127 $4,877 $8,377 $11,877 Average Tax Rate 2.5% 2.5% 2.51% 2.63% 2.78% 3.39% 4.17% 4.88% 5.58% 5.94%

THE CASE FOR GROWTH

Figure 5.5 also shows what the average tax rates are for various incomes and taxes under the current tax system in South Carolina. In the right columns it also shows what the taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, especially at higher levels of incomes. It keeps tax rates extremely low for the lowest income individuals in the state. Figure 5.5 also shows that the current tax system charges all income groups more in taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the table. As South Carolina income taxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

8 18 18

UUNLEASHING CAPITALISM NLEASHING CAPITALISM

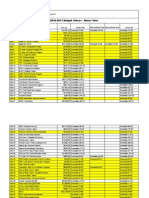

manufacturing property tax inin the country. In Figure 5.8 we present the effective property tax manufacturing property tax the country. In Figure 5.8 we present the effective property tax rates data for Southeastern states, for comparison. The ranks given for the states are out of all rates data for Southeastern states, for comparison. The ranks given for the states are out of all 50 states. The net tax and effective tax rate are calculated based on property valued atat $25 50 states. The net tax and effective tax rate are calculated based on property valued $25 million ($12.5 million ininmachinery and equipment, $12.5 million inininventories, and $2.5 million ($12.5 million machinery and equipment, $12.5 million inventories, and $2.5 million inin fixtures). Notice that South Carolinas effective tax rate on industrial property is million fixtures). Notice that South Carolinas effective tax rate on industrial property is over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware isis listed in over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware listed in the figure because it it is the lowest-tax state.) the figure because is the lowest-tax state.)

Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007 Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007

State Rank (of 50) State Rank (of 50) South Carolina 11 South Carolina Mississippi Mississippi Texas Texas Tennessee Tennessee West Virginia West Virginia Louisiana Louisiana Georgia Georgia Florida Florida Alabama Alabama North Carolina North Carolina Kentucky Kentucky Virginia Virginia Delaware Delaware 44 66 10 10 14 14 17 17 20 20 24 24 35 35 37 37 47 47 49 49 50 50 Net Tax Net Tax $1,864,900 $1,864,900 $1,291,050 $1,291,050 $1,264,358 $1,264,358 $1,033,544 $1,033,544 $833,234 $833,234 $783,407 $783,407 $760,381 $760,381 $677,683 $677,683 $533,776 $533,776 $491,071 $491,071 $327,100 $327,100 $241,498 $241,498 $238,840 $238,840 Effective Tax Rate Effective Tax Rate 3.73% 3.73% 2.58% 2.58% 2.53% 2.53% 2.07% 2.07% 1.67% 1.67% 1.57% 1.57% 1.52% 1.52% 1.36% 1.36% 1.11% 1.11% 0.98% 0.98% 0.65% 0.65% 0.48% 0.48% 0.48% 0.48%

Source: National Association ofof Manufacturers (2009) Source: National Association Manufacturers (2009) * Taxes measured inin the states largest city only. * Taxes measured the states largest city only.

Importantly, South Carolinas effective tax rate isisalmost 2.5 times greater than Importantly, South Carolinas effective tax rate almost 2.5 times greater than Georgias tax, and almost 4 4 times greater than North Carolinas. This puts South Carolina at a Georgias tax, and almost times greater than North Carolinas. This puts South Carolina at a serious disadvantage, inin terms of its ability to attract and keep industry. Since South Carolina serious disadvantage, terms of its ability to attract and keep industry. Since South Carolina has the highest tax inin the country on industrial property, it should be no surprise that it has has the highest tax the country on industrial property, it should be no surprise that it has one of the lowest per capita incomes and economic growth rates inin the country. one of the lowest per capita incomes and economic growth rates the country. Although it it is probably not critical that South Carolina set its tax rate to the lowest in Although is probably not critical that South Carolina set its tax rate to the lowest in the country, it itshould definitely make it itatatleast competitive for the Southeast. Since the country, should definitely make least competitive for the Southeast. Since Georgias rate isis effectively 1.52 percent and North Carolinas is just under 1 percent, a rate effectively 1.52 percent and North Carolinas is just under 1 percent, a rate Georgias rate atataround 1 1percent might be sufficient totoattract more industry. Working to reduce the around percent might be sufficient attract more industry. Working to reduce the various taxes applied toto industry would seriously improve the states competitiveness. various taxes applied industry would seriously improve the states competitiveness. Such a a significant reduction in taxes on industrial property would obviously lead to a Such significant reduction in taxes on industrial property would obviously lead to a reduction inintax revenues on industrial property, atatleast initially. However, the overall reduction tax revenues on industrial property, least initially. However, the overall revenue may ininfact increase once the growth rate inin the state begins to pick up andmore revenue may fact increase once the growth rate the state begins to pick up and more industry moves into the state. Furthermore, ifif the official tax rates are lowered, then the state industry moves into the state. Furthermore, the official tax rates are lowered, then the state

CHAPTER 5: SPECIFIC TAX REFORMS

9 13

Presumably the original intent of imposing a tax rate schedule with graduated marginal tax rates was to make the income tax progressive. However, what progressivity exists in the states income tax structure is due to the zero tax on the first $2,630 of income, and because of the graduated marginal tax rates. However, since the marginal tax rate increases over such small steps in income, as shown in Figure 5.5, most of the progressivity occurs at lower income levels, not higher levels of income. At higher income levels, the average tax rate hardly increases at all. This nature of the current tax is directly contradictory to the goal of progressivity. So although on the surface it appears that the tax satisfies the vertical equity condition, it really does this only at the lower income levels reducing the wealth of these lowestRussell taxpayers, andthe intended Leguizamon income S. Sobel not Susane J. consequence.

THE CASE FOR GROWTH

Figure 5.5: South Carolina income tax: Current tax rates compared to inflation-indexed rates, 2009

Income Tax Rates/Brackets if 1959 Tax South Carolina needs policy founded in a vision of a better future for its children and Current Income Tax Schedule was Inflation Adjusted to grandchildren. If done correctly, policy reform has the potential to drastically increase the Rates/Brackets 2009 well-being of South Carolinians within a generation. Within two generations the state could be at the top of the national income rankings, rather than the bottom. This progress requires Tax Tax Average Tax Rate Taxable Income policy reform undertaken withAverage Tax Rate Amount the explicit objective of increasing the rate of economic Amount growth and sustaining it over the long term. This reform must be based on science, not $5,000 $71 $125 1.42% politics. That is, South Carolina needs to adopt policies that have been 2.5% to increase proven $290 $250 2.5% growth$10,000 states, and to abandon2.90% that have decreased economic growth in South in other policies Carolina and in other states. $15,000 $604 $377 4.03% 2.51% To begin our quest to understand which policies promote, and which hinder, economic $20,000 $954 $527 4.77% 2.63% growth this introductory chapter outlines the main arguments for why economic growth $1,654 $834 5.51% 2.78% should $30,000 be considered as one of the most important policy priorities in the Palmetto State.1 If South $50,000 Carolina can get its policies in shape prior to the beginning of the recovery $3,054 $1,695 6.10% 3.39% from the current national economic downturn, it will be in a strong competitive position to $75,000 $4,804 $3,127 6.41% 4.17% attract the new businesses coming to life as the economy recovers. $100,000 $6,554 $4,877 6.56% 4.88% $150,000 $10,054 6.70% $8,377 $11,877 5.58% 5.94%

THE $200,000S AND THE HAVE NOTS HAVE $13,554 6.77%

How wide are the differences in standards of living across states? How does average Figure 5.5 also shows what the average tax rates are for various incomes and taxes income in current Carolina compare with that ofIn the right columns it also showsfollowing under the South tax system in South Carolina. other states? Figure 1.1 (on the what the page) shows the most recent data available on per capita personal income for all fifty U.S. taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The states. figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, With a 2008 per capita personal keeps of rates extremely low Carolina ranked 45th, especially at higher levels of incomes. Itincometax only $31,884, Southfor the lowest income making it the sixth poorest U.S. state. The only states with lower per capita personal incomes individuals in the state. are Kentucky, Arkansas, West Virginia, Utah, and Mississippi. Figure 5.5 also shows that the current tax system charges all income groups more in taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the table. As South Carolina income taxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

1

This chapter is based on Sobel and Daniels (2007).

10 18

UNLEASHING CAPITALISM UNLEASHING CAPITALISM

manufacturing property tax 1.1: Average Income by State, the effective property tax Figure 1.1: country. In Income we State, 2008 Figure in the Average Figure 5.8 by present 2008 rates data for Southeastern states, for comparison. The ranks given for the states are out of all 50$60,000 The net tax and effective tax rate are calculated based on property valued at $25 states. $60,000 million ($12.5 million in machinery and equipment, $12.5 million in inventories, and $2.5 $55,000 $55,000 million in fixtures). Notice that South Carolinas effective tax rate on industrial property is over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware is listed in $50,000 $50,000 the figure because it is the lowest-tax state.)

$45,000 $45,000 $40,000 $40,000 $35,000 $35,000 $30,000 $30,000 $25,000 $25,000 $20,000 $20,000

Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007

State Rank (of 50) 1 4 6 10 14 17 20 24 Net Tax $1,864,900 $1,291,050 $1,264,358 $1,033,544 $833,234 $783,407 $760,381 $677,683 Effective Tax Rate 3.73% 2.58% 2.53% 2.07% 1.67% 1.57% 1.52% 1.36% South Carolina

Mississippi Texas Virginia

$15,000 $15,000 Tennessee $10,000 $10,000 West

Louisiana $5,000 $5,000 Georgia $0 $0 Florida

North Carolina 37 $491,071 0.98% Average South Carolina is about 80 percent of the U.S. average of $39,751. 0.65% Kentucky income in South Carolina is about 80 percent of the U.S. average of $39,751. $327,100 Average income in 47 South Carolina has a hard-working labor force, a bounty of natural resources, excellent ports, Carolina has a hard-working labor force, a bounty of natural resources, excellent ports, South Virginia 49 $241,498 0.48% major metropolitan areas, wonderful recreation opportunities, and other significant major metropolitan areas, wonderful recreation opportunities, and other significant Delaware $238,840 0.48% advantages. From a purely 50 economic perspective, there is no reason South Carolina should be advantages. From a purely economic perspective, there is no reason South Carolina should be near the bottom of the national income ranking. the bottom of Association of Manufacturers (2009) near Source: Nationalthe national income ranking. * Taxes measured in the states largest city only. Why does the average South Carolinian earn so much less than the average citizen in Why does the average South Carolinian earn so much less than the average citizen in other states? One fundamental problem is that despite its many advantages, South Carolina is that many advantages, South Carolina other states? One fundamental problemeffectivedespite its is almost 2.5 times greater than Importantly, South Carolinas tax rate has been unable to get its economic policies right. Getting these policies right is the key to get its right is the key has been unable toalmost 4economic policies right. Getting these policiesSouth Carolina atto Georgias tax, and times greater than North Carolinas. This puts a increasing prosperity. prosperity. increasing serious disadvantage, in terms of its ability to attract and keep industry. Since South Carolina has the highest tax in the country on industrial property, it should be no surprise that it has one of the lowest per capita incomes and economic growth rates in the country. HAS SOUTH Cis probably A critical thatRANKED AT set its BOTTOM? HAS SOUTH CAROLINAnot LWAYS RSouth Carolina THE BOTTOM? lowest in Although it AROLINA ALWAYS ANKED AT THE tax rate to the the country, it should definitely make it at least competitive for the Southeast. Since th While is effectively 1.52 percent in North Carolinas just under 1 percent, a by While South Carolina ranked 45th in per capita personal income in 2008, the path by Georgias rateSouth Carolina ranked 45 andper capita personalisincome in 2008, the pathrate which it 1 there interesting. Figure 1.2 shows the industry. Working to Carolinas which it got there is interesting. Figure to shows the entire history of South Carolinas at aroundgot percentismight be sufficient 1.2 attract moreentire history of South reduce the ranking. ranking. various taxes applied to industry would seriously improve the states competitiveness. Such a significant reduction in taxes on industrial property would obviously lead to a reduction in tax revenues on industrial property, at least initially. However, the overall revenue may in fact increase once the growth rate in the state begins to pick up and more industry moves into the state. Furthermore, if the official tax rates are lowered, then the state

Note: All per capita personal income data in Chapters 1 and 2 are adjusted for inflation to constant 2008 dollars using the All per capita 2 are adjusted constant Note: Alabama personal income data in Chapters 1 and $533,776 for inflation to 1.11% 2008 dollars using the 35 Consumer Price Index. Source: Bureau of Economic Analysis (2009). Consumer Price Index. Source: Bureau of Economic Analysis (2009).

CT NJ MA WY MD NY AK VA NH MN CA IL CO WA RI DE HI NV PA ND FL VT TX KS NE SD WI OK IA LA OR OH ME MI MO NC TN MT IN GA AL AZ ID NM SC KY AR WV UT MS

5: THE CASE FOR GROWTH CHAPTER 1: SPECIFIC TAX REFORMS

11 13

Presumably1.2: South Carolinas Historical Income Rankinggraduated Figure the original intent of imposing a tax rate schedule with marginal tax rates was to make the income tax progressive. However, what progressivity 36 exists in the states income tax structure is due to the zero tax on the first $2,630 of income, and because of the graduated marginal tax rates. However, since the marginal tax rate increases over such small steps in income, as shown in Figure 5.5, most of the progressivity 38 occurs at lower income levels, not higher levels of income. At higher income levels, the average tax rate hardly increases at all. This nature of the current tax is directly contradictory to40 goal of progressivity. So although on the surface it appears that the tax satisfies the the vertical equity condition, it really does this only at the lower income levels reducing the wealth of these lowest income taxpayers, not the intended consequence. 42

Figure 5.5: South Carolina income tax: Current tax rates compared to 44 inflation-indexed rates, 2009

46

45th

Current Income Tax Rates/Brackets Tax Amount

1940 $71

48

Income Tax Rates/Brackets if 1959 Tax Schedule was Inflation Adjusted to 2009 Tax Amount

1970$125 1980

50 1920 1930 $5,000

Taxable Income

Average Tax Rate

1950 1.42% 1960

Average Tax Rate

1990 2.5% 2000 2010

Note: This is South Carolinas $290 among U.S. states in real per capita personal income. Note 2.5% ranking is out of ranking that the $10,000 $250 2.90% 48 states prior to 1950. In 1950 the government began including Alaska and Hawaii in the data, even though they did not $15,000 $604 $377 4.03% 2.51% achieve statehood until 1959. Source: Bureau of Economic Analysis (2009).

$20,000 $954 $527 4.77% 2.63% In 1929, the first year the data began being collected, South Carolina ranked as the $1,654 $834 5.51% 2.78% poorest$30,000 state among the then 48 states. For the majority of the early history shown in this $50,000 3.39% graph South Carolina$3,054 near 6.10% hovered the bottom of $1,695 the rankings. In 1979, South Carolina th ranked $75,000 only Mississippi having lower per capita income. 49 with $4,804 $3,127 6.41% 4.17% In the 1980s, however, things dramatically changed. Between 1979 and 1988 South $100,000 $6,554 $4,877 6.56% Carolina rose from 49th to 38th in the rankings, an impressive movement of4.88% upward in 11 spots $8,377 $150,000 $10,054 6.70% 5.58% 9 years. Unfortunately, these gains have slipped away since the mid-1990s, and from 1997 to 2008 South Carolina fell from 38th to 45th. $200,000 $13,554 $11,877 6.77% 5.94% Had South Carolina been able to maintain its upward trend that happened in the 1980s, jumping 11 places every nine years, in 2008 instead of ranking 45th in the nation, Figure 5.5 also shows what the average tax rates are for various incomes and taxes South Carolina would have ranked as the 14th richest state. While we will discuss the policies under the current tax system in South Carolina. In the right columns it also shows what the that may (or may not) have contributed to this pattern in the next chapter, the underlying taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The direct explanation is easy to uncoverthe differing rates of economic growth during these figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, periods. especially at higher levels of incomes. It keeps tax rates extremely low for the lowest income Figure 1.3 (on the following page) shows South Carolinas average growth rate of per individuals in the state. capita personal income for the decades of the 1980s, 1990s, and 2000s (through 2008). This is Figure 5.5 also shows that the current tax system charges all income groups more in the real growth rate, or the growth rate after adjusting for inflation. taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the table. As South Carolina income taxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

12 18

UNLEASHING CAPITALISM UNLEASHING CAPITALISM

Average Growth Rate (Real PCPI)

manufacturing property tax in theCarolinas Declining Rate the effective property tax Figure 1.3: South country. In Figure 5.8 we present of Growth Figure 1.3: South Carolinas Declining Rate of Growth rates data for Southeastern states, for comparison. The ranks given for the states are out of all 50 states. The net tax and effective tax rate are calculated based on property valued at $25 2.5% 2.5% million ($12.5 million 2.2% in machinery and equipment, $12.5 million in inventories, and $2.5 2.2% million in fixtures). Notice that South Carolinas effective tax rate on industrial property is over 7.82.0% higher than the most industry-friendly state, Delaware. (Delaware is listed in times 2.0% the figure because it is the lowest-tax state.)

1.5% 1.5%

1.5% 1.5%

Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007

State 1.0% 1.0% Rank (of 50) 1 4 6 10 14 1980s 1980s 17 Net Tax $1,864,900 $1,291,050 $1,264,358 $1,033,544 $833,234 1990s 1990s $783,407 Effective Tax Rate 0.8%

0.8%

South Carolina

3.73% 2.58% 2.53% 2.07% 1.67% 2000s 2000s 1.57%

Mississippi 0.5% 0.5% Texas Tennessee 0.0% West Virginia Louisiana

0.0%

Source: Bureau of Economic Analysis (2009). Source: Bureau of Economic Analysis (2009).

Georgia 20 $760,381 1.52% During the 1980s, South Carolinas $677,683 South Carolinas 2.2 percent average real rate of economic 2.2 percent average 1.36% real rate of economic During the 1980s, 24 Florida th th growththe 15 highest rate of growth among U.S. states at that timeis what propelled the growththe 15 highest rate of growth among U.S. states at that timeis what propelled the 1.11% 35 $533,776 state Alabama so rapidly in the income rankings during that decade. During the 1980s, South upward state upward so rapidly in the income rankings during that decade. During the 1980s, South North Carolina 37 Carolina experienced consecutive years of $491,071 rapid growth, each of over 2.2 percent, with over Carolina experienced 66 consecutive years of rapid growth, each of 0.98% 2.2 percent, with someyears above percent. years above some Kentucky 33percent.47 0.65% $327,100 Unfortunately, economic growth in South Carolina slowed after the 1980s, falling to Unfortunately, economic growth in South Carolina slowed after the 1980s, falling to Virginia 49 $241,498 0.48% 1.5 percent in the 1990s, and to less than percent so far in the 2000s. 2 Rather than being one 1.5 percent in the 1990s, and to less than 11percent so far in the 2000s. 2 Rather than being one 50 0.48% of thefastest growing states, South Carolinas $238,840 fastest growing states, South Carolinasrecent growth of 0.8 percent makes it the 12thth recent growth of 0.8 percent makes it the 12 of theDelaware slowest growing state during the2000s. slowest growing state during the Manufacturers (2009) Source: National Association of 2000s. * Taxes measuredmightstates largestthese differences seem trivial, say between 1.5 and 2.2 While some might think that these differences seem trivial, say between 1.5 and 2.2 While some in the think that city only. percent growth, nothing could be further from the truth. Even small differences in growth, percent growth, nothing could be further from the truth. Even small differences in growth, Importantly, South Carolinas effective tax rate This is the topic to which we now over long periods of time, add up to significant differences.is almost topic to which we than over long periods of time, add up to significant differences. This is the 2.5 times greater now Georgias tax, and turn our attention. turn our attention. almost 4 times greater than North Carolinas. This puts South Carolina at a serious disadvantage, in terms of its ability to attract and keep industry. Since South Carolina has the highest tax in the country on industrial property, it should be no surprise that it has one of the lowest per capita incomes and economic growth rates in the country. JUST AlthoughERCENTAGE POINT: ONE P it is probably not critical JUST ONE PERCENTAGE POINT:that South Carolina set its tax rate to the lowest in W country, HILDREN BE BETTER least WILL OURitCshould definitely BETTER OFF?competitive for the Southeast. Since the ILL OUR CHILDRENBE make it at OFF? Georgias rate is effectively 1.52 percent and North Carolinas is just under 1 percent, a rate Large changes in wealth and prosperity cannot be generated Working to reduce the Large percent might be sufficient to cannot be generated overnight. Places that are at around 1 changes in wealth and prosperityattract more industry.overnight.Places that are prosperous today went through stages of development. What prosperous areas prosperous today went industry would seriously improve the states competitiveness.have in various taxes applied to through stages of development. What prosperous areas have in Such a significant reduction in taxes on industrial property would obviously lead to a reduction in tax revenues on industrial property, at least initially. However, the overall revenue may in fact increase once the growth rate in the state begins to pick up and more 22 During moves economic recession, South Carolina experienced decline 1.3 percent (i.e., negative 1.3 During the recenteconomic recession, South Carolina experienced tax ratesof1.3 percent (i.e., negative 1.3 industrytherecent into the state. Furthermore, if the official aadecline ofare lowered, then the state

percent growth) in real per capita personal income from 2007 to 2008. Excluding this drop in 2008, average percent growth) in real per capita personal income from 2007 to 2008. Excluding this drop in 2008, average economic growth for 2000 through 2007 was 1.0 percent. economic growth for 2000 through 2007 was 1.0 percent.

CHAPTER 1: THE CASE TAX REFORMS 5: THE CASE FOR GROWTH CHAPTER 1: SPECIFIC FOR GROWTH

13 13

common is that they wereoriginal sustain higher rates of aeconomic growth overwith graduated Presumably were able to intent of imposing tax rate schedule longer periods common is that they the able to sustain higher rates of economic growth over longer periods of time. Let usrates wasato make the income tax progressive. However, what progressivity consider a few examples. marginalLet us consider few examples. of time. tax Figure 1.4 shows the history of income growth in on the first $2,630 of income, exists in the statesshows the history ofisincome the zero tax South Carolina, adjusted for Figure 1.4 income tax structure due to growth in South Carolina, adjusted for inflation, along with several alternative future projections. One projection simply takes South and because ofwith several alternative future projections. One projection simply takes South inflation, along the graduated marginal tax rates. However, since the marginal tax rate Carolinasover such small of real per capita economic Figure 5.5, most of the20 years, 1.2 increases historical rate steps in per capita economic growth over the last 20 years, 1.2 Carolinas historical rate of real income, as shown in growth over the last progressivity percent, at lower incomeinto the future. The other two projections show what the future would occurs and forecasts it into the future. The other two projections show what the future would percent, and forecasts it levels, not higher levels of income. At higher income levels, the hold if South Carolinas growthatrate This nature of the current taxpercent and contradictory average tax rateCarolinas growth rate could be increased to 1.7 percent and 2.2 percent hold if South hardly increases all. could be increased to 1.7 is directly 2.2 percent respectively.ofThese real growthalthough onnot unrealistic.appears are actual growth rates to the goal These real growth rates are not unrealistic. Both are actual growth rates respectively. progressivity. So rates are the surface it Both that the tax satisfies the experienced in other U.S. states overdoeslast two decades. lower income levels reducing the vertical equity other U.S. states over the last two decades. experienced in condition, it really the this only at the wealth of these lowest income taxpayers, not the intended consequence.

Figure 1.4: Which Future for South Carolina? Figure 1.4: Which Future for South Carolina? Figure 5.5: South Carolina income tax: Current tax rates compared to $100,000 $100,000 inflation-indexed rates, 2009

$90,000 $90,000 $80,000 $80,000 $60,000 $60,000 Taxable Income $50,000 $50,000 $5,000 $40,000 $40,000 $10,000 $30,000 $30,000 $15,000 $20,000 $20,000 $20,000 $10,000 $10,000 $30,000 $50,000$0 $0

1925 Per Capita Income

$70,000 $70,000

Current Income Tax Rates/Brackets Tax Amount $71 $290 $604 $954 $1,654 $3,054

1935 1945 1955

Income Tax Rates/Brackets if 1959 Tax Schedule was Inflation Adjusted to 2009 Tax Amount $125 $250 $377 $527 $834 $1,695

1975 1985 1995 2005 2015

Average Tax Rate 1.42% 2.90% 4.03% 4.77% 5.51% 6.10%

1965

Average Tax Rate 2.5% 2.5% 2.51% 2.63% 2.78% 3.39%

2025 2035 2045

$75,000 $100,000

$4,804 $6,554

6.41% 6.56%

$3,127 $4,877

4.17%

4.88%

Historical Historical $150,000 $10,054

1.2% Growth 1.2% Growth 6.70%

1.7% Growth 1.7% Growth $8,377

2.2% Growth 2.2% Growth 5.58%

Note: Per capita income is adjusted for inflation to 6.77%2008 dollars. Note: Per capita income is adjusted for inflation to constant 2008 dollars. constant $200,000 $13,554 $11,877

5.94%

adjusted to take out the impact of inflation on the purchasing power of money in the future because we are using adjusted to take out the impact of inflation on the purchasing power of money in the future because we are using a real, inflation adjusted, growth rate. a real, inflation adjusted, growth rate.

The last year of historical data shown in the figure is 2008, a year in which the The last year of historical data shown in the figure is 2008, a year in which the also shows what the average tax rates are for various incomes and taxes average Figure 5.5 South Carolina was $31,884. Let us consider the simple question of what average income in South Carolina was $31,884. Let us consider the simple question of what income in under the current tax system one generation, or In the years into the it also in 2028. At the the average income will be in in South Carolina. twenty right columns future, shows what the the average income will be in one generation, or twenty years into the future, in 2028. At the taxes and average tax rates would be if the income tables were indexed for inflation. The historical growth rate of 1.2 percent, average 1959 taxin South Carolina would be $40,475 in historical growth rate of 1.2 percent, average income in South Carolina would be $40,475 in figure What instead growth could be increased structure is more percent? progressive, 2028.33 clearlyifshows that the 1959 indexed tax rateto 1.7 or even 2.2 uniformly Under these 2028. What higher levels of incomes. increased to 1.7 or even 2.2 percent? Under these if instead especially scenarios, growth could be keeps tax rates instead low for the and income alternative atscenarios, average incomeIt in 2028 wouldextremelybe $44,668 lowest$49,271 alternative average income in 2028 would instead be $44,668 and $49,271 individuals the state. respectively.inThus, a one percentage point higher rate of economic growth results in a respectively. Thus, a one percentage point higher rate of economic growth results in a Figure 5.5 also shows that the current tax income groups in difference of almost $8,800 one generation into system charges all remember that moreare difference of almost $8,800 one generation into the future. Also remember that we are the future. Also we taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the table. As South Carolina income taxes continue to climb while the tax brackets remain 33 stagnant, the state future years aare given in todays dollarsor This dollarsthat have already been relatively high-tax state. real has a negative impact on All dollar values for future years are given in todays dollarsor real dollarsthat have already been All dollar values for becomes

2055

14 18

UNLEASHING CAPITALISM UNLEASHING CAPITALISM

manufacturing property tax per person. The average family size in South Carolina is 3.02 considering average income the country. In average family size the effective property tax considering average income inper person. The Figure 5.8 we presentin South Carolina is 3.02 rates data the impact of this difference on the average family is three the states amountor persons, so the impact of this difference on the average family is three times this amountor persons, sofor Southeastern states, for comparison. The ranks given for times this are out of all 50 states. The net tax and effective tax rate areunder the two alternative scenarios 20 years a substantial $26,564 difference in family income calculated based on property valued years a substantial $26,564 difference in family income under the two alternative scenarios 20 at $25 million ($12.5 into the future. into the future. million in machinery and equipment, $12.5 million in inventories, and $2.5 millionWhat if we look even farther into the future? What about two generations? By 2048 in fixtures). Notice that South Carolinas effective about two industrial property is What if we look even farther into the future? What tax rate ongenerations? By 2048 overdifferences higher even the mostInstead of average state, Delaware.$51,380 in 2048 at in 7.8 times grow than larger. Instead of average income being $51,380 in is listed a the the differences grow even larger. industry-friendly income being (Delaware 2048 at a the figure because it is the it would be $62,576 at 1.7 percent, or a whopping $76,139 at 2.2 growth rate of 1.2 percent, it would state.) growth rate of 1.2 percent, lowest-taxbe $62,576 at 1.7 percent, or a whopping $76,139 at 2.2 percent. Make no mistake about it, over two generations a one percentage point increase in percent. Make no mistake about it, over two generations a one percentage point increase in South Carolinas rate of economic growth means a difference of almost $25,000 in per capita South Carolinas rate of economic growth means a difference of almost $25,000 in per capita income. income. Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007 Perhaps a better way of looking at the data is to ask, at what date in the future will Perhaps a better way of looking at the data is to ask, at what date in the future will State Rank (of 50) Net Tax Effective Tax Rate average income in South Carolina hit $50,000? To put this figure in perspective, it is average income in South Carolina hit $50,000? To put this figure in perspective, it is South Carolina 1 approximately the current average income $1,864,900 levels in Wyoming and New Jersey. At South New approximately the current average income levels in Wyoming and 3.73%Jersey. At South Carolinas historical 1.2 percent rate of growth it will hit $50,000 in 2.58% 2046. At a 1.7 the year Carolinas historical 1.2 percent rate of growth it will hit $50,000 in the year 2046. At a 1.7 Mississippi 4 $1,291,050 percent rate of economic growth, this date would instead be 2035or eleven years earlier. At percent rate of economic growth, this date would instead be 2035or eleven years earlier. At 2.53% Texas 6 a 2.2 percent rate of growth it becomes$1,264,358 seventeen years earlier. Increasing 2029or a 2.2 percent rate of growth it becomes 2029or seventeen years earlier. Increasing Tennessee 10 $1,033,544 2.07% economic growth by just one percentage point moves the date at which the average South economic growth by just one percentage point moves the date at which the average South Carolinianwill have an income level of $50,000 forward by almost anentire generation. entire Carolinian Virginia an income level of $50,000 forward by almost an 1.67%generation. West will have 14 $833,234 Rather than relying entirely on future projections, it is also useful to consider a few than relying entirely on future projections, it is also useful to consider a few Rather Louisiana 17 $783,407 1.57% specific historical income comparisons. Consider the cases of South Carolina and two states specific historical income comparisons. Consider the cases of South Carolina and two states Georgia 20 1.52% that twenty years ago, in 1988, were virtually identical to it in terms of income, Oklahoma identical that twenty years ago, in 1988, were virtually$760,381 to it in terms of income, Oklahoma and Florida Dakota. Figure 1.5 presents this data. In 1988 the average income in South South 1.5 data. In and South Dakota. Figure 24 presents this $677,683 1988 the average income in South 1.36% Carolina was $25,341, while Oklahoma and South Dakota had average incomes of $25,872 Carolina was $25,341, while Oklahoma and South Dakota had average incomes of $25,872 1.11% Alabama 35 $533,776 and $24,964 respectively. South Carolina ranked 38th in per capita income that year, with and $24,964 respectively. South Carolina ranked 38th in per capita income that year, with North Carolina 37 $491,071 0.98% Oklahoma one spot ahead of South Carolina (37th and South Dakota one spot behind (39th). Oklahoma one spot ahead of South Carolina (37th))and South Dakota one spot behind (39th). 0.65% Kentucky 47 $327,100 Virginia Delaware $40,000 $40,000

Figure 1.5: State Growth Comparisons Figure 1.5: State Growth Comparisons 49 $241,498 0.48%

50 $238,840

$36,899 $36,899

0.48%

$37,375 $37,375

Source: National Association of Manufacturers (2009) $38,000 $38,000 * Taxes measured in the states largest city only.

Importantly, South Carolinas effective tax rate is almost 2.5 times greater than $34,000 $34,000 Georgias tax, and almost 4 times greater than North Carolinas. This puts South Carolina at a $31,884 $31,884 serious disadvantage, in terms of its ability to attract and keep industry. Since South Carolina $32,000 $32,000 has the highest tax in the country on industrial property, it should be no surprise that it has $30,000 $30,000 one of the lowest per capita incomes and economic growth rates in the country. $28,000 $28,000 Although it is probably not critical that South Carolina set its tax rate to the lowest in $25,872 the country, it should$25,341 definitely make it at$25,872 competitive for $24,964 least the Southeast. Since $25,341 $24,964 $26,000 $26,000 Georgias rate is effectively 1.52 percent and North Carolinas is just under 1 percent, a rate $24,000 $24,000 at around 1 percent might be sufficient to attract more industry. Working to reduce the various $22,000 taxes applied to industry would seriously improve the states competitiveness. $22,000 Such a significant reduction in taxes on industrial property would obviously lead to a $20,000 $20,000 reduction in tax revenues on industrial property, at least initially. However, the overall South Carolina Oklahoma South Dakota South Carolina Oklahoma revenue may in fact increase once the growth rate in the state beginsSouth Dakotaand more to pick up industry moves into the state. Furthermore, if the1988 2008 rates are lowered, then the state official2008 tax 1988

Note: Per capita income is adjusted for inflation to 2008 constant dollars. Note: Per capita income is adjusted for inflation to 2008 constant dollars.

$36,000 $36,000

Per Capita Income

5: THE CASE FOR GROWTH CHAPTER 1: SPECIFIC TAX REFORMS

15 13

Presumably the original period, of imposing a was able toschedulea withpercent rate Over the next twenty year intent South Carolina tax rate sustain 1.2 graduated marginal tax rates was topercent the income Dakota 2.1 percent. After twenty years, or one of growth, Oklahoma 1.8 make and South tax progressive. However, what progressivity exists in theSouth Carolinas 2008 average due to the zero tax on the first $2,630 of than the generation, states income tax structure is income of $31,884 is about $5,000 less income, and because of in these other two states tax rates. and $37,375 respectively). The tax rate average income the graduated marginal ($36,899 However, since the marginal result is increases over such small stepsfallen to 45th in the national income most of the progressivity that while South Carolina has in income, as shown in Figure 5.5, rankings, Oklahoma has occurs at lower South Dakota to notth. risen to 28th and income levels, 26 higher levels of income. At higher income levels, the averageIt almost hardly increases at all. This nature ofdifferences in growth can produce such tax rate seems unbelievable that such small the current tax is directly contradictory to the differences through time, but they can.the surface it appears that formula satisfies the large goal of progressivity. So although on A well-known financial the tax called The vertical equity condition,understand the this only at of time and economic growth ratesthe Rule of 70 helps us to it really does importance the lower income levels reducing in wealth of these lowest4 income taxpayers, rule,the intended consequence. will double every X generating prosperity. According to this not an areas standard of living years, where X equals 70 divided by the rate of economic growth:

Figure 5.5: South Carolina income tax: Current tax rates compared to 70 The Rule of 70: Years it takes for income to doublerates, 2009 inflation-indexed =

Annual rate of economic growth

Income Tax Rates/Brackets if doubles So, a state that sustains a 1.2 percent growth rate, as has South Carolina,1959 Tax its Current Income Tax living standards roughly every 58 years (70 divided bySchedulestate that sustains an economic 1.2). A was Inflation Adjusted to Rates/Brackets growth rate of 1.7 percent sees its living standards double approximately every 41 years, and 2009 a state that sustains a growth rate of 2.2 percent doubles its income in only 32 Tax Rate Tax Tax Average years. Average Tax Rate Taxable these numbers clearly illustrate, small differences in the rate of economic growth Income As Amount Amount produce big differences in standards of living when they are sustained over long periods of $5,000 $71 $125 1.42% 2.5% time. The principle at work here is the same one responsible for the miracle of compound $10,000 $290 $250 interest. South Carolina currently ranks 45th in average income. If all states continue their 2.90% 2.5% current$15,000 rates, 20 years into the future, South Carolina will have fallen to 48th. If growth $604 $377 4.03% 2.51% instead South Carolina could increase growth to just 1.7 percent, its ranking in twenty years $954 $527 4.77% would $20,000 If South Carolina could manage to grow at 2.2 percent, it2.63% rank 23rd in be 34th. would $30,000 $1,654 $834 5.51% 2.78% the nation within one generation. If that 2.2 percent could be sustained for forty years, South Carolina would rank as the 13th richest state in the nation in 2048. $50,000 $3,054 $1,695 6.10% 3.39% As the experiences of other states illustrate, these large leaps in the income rankings $75,000 $3,127 6.41% 4.17% are possible. Between $4,804and 2008, Wyoming moved up 31 places from 35th to 4th, North 1988 th th $100,000 $6,554 $4,877 6.56% 4.88% Dakota jumped 28 places from 48 to 20 , Louisiana rose 16 places from 46th to 30th, South th th Dakota improved 13 places from 39 6.70%, and Texas moved up 10 places from 33rd to 23rd. to 26 $8,377 $150,000 $10,054 5.58% All of them did this the same wayby sustaining high rates of economic growth. $200,000 $13,554 $11,877 6.77% 5.94% Figure 5.5 also shows what the AN B D rates FROM RAGS TO RICHES: IT CaverageEtax ONE are for various incomes and taxes

under the current tax system in South Carolina. In the right columns it also shows what the taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The Because economic growth rates vary considerably more across countries than across figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, U.S. states, some international comparisons of long-run growth are even more impressive. An especially at higher levels of incomes. It keeps tax rates extremely low for the lowest income often cited example is the comparison between Hong Kong and Argentina. Approximately individuals in the state. fifty years ago, Argentina was almost as rich as many European nations, while Hong Kong Figure 5.5 also shows that the current tax system charges all income groups more in was relatively poor. Due to their differing policy climates, today Hong Kong is one of the taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the richest countries in the world while Argentina has fallen behind. This example is often table. As South Carolina income taxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

4

Alternatively this is sometimes referred to as the Rule of 72 which produces similar results, but is divisible by more whole numbers making it easier to use in simple calculations.

16 18

UNLEASHING CAPITALISM

manufacturing property tax little a country. In Figureresources matterthe effective Hong Kong, pointed to as proof of how in the countrys natural 5.8 we present for growth. property tax rates data is essentially a rock island comparison. The ranks given for the states arewealth all after all, for Southeastern states, for in the ocean. Argentina, in contrast, has a out of of 50 states. The net Like and effective tax rate are calculated based natural resources byatitself natural resources. tax Argentina, South Carolinas abundance of on property valued $25 million guarantee a fast rate of economic growth. cannot ($12.5 million in machinery and equipment, $12.5 million in inventories, and $2.5 million Figure 1.6 shows thethat Southper capita income in 1960 andon industrial property is in fixtures). Notice levels of Carolinas effective tax rate 2002 for five countries: over 7.8 times higher than the Argentina, Japan, and Hong Kong. In 1960, while thelisted in the United States, Venezuela, most industry-friendly state, Delaware. (Delaware is United the figure because it is thethe group with a per capita income of almost $15,000, Venezuela States was the richest of lowest-tax state.) was not far behind at $10,600. Japan and Hong Kong, on the other hand, were relatively poor. Their average citizens had only 25 percent as much income as the average citizen in the United States (perIndustrial Property Taxes in Southeastern states*, 2007 Figure 5.8: capita incomes of roughly $5,000 and $3,750 respectively). State Mississippi Texas

United States

South Carolina

Figure 1.6: International Growth Comparisons

1 6 10 14 17 20 24 35 37 $4,939 47 49

$7,460 $9,338 $9,502

Rank (of 50) 4

Net Tax

Effective Tax Rate 3.73% 2.58% 2.53% 2.07% 1.67% 1.57% 1.52% 1.36% 1.11% 0.98% 0.65% $27,204 0.48% 0.48%

$32,800 $33,447

$1,864,900 $1,291,050 $14,971 $1,264,358 $1,033,544

Tennessee West Virginia

Venezuela

Per Capita Income

$10,597 $833,234

Louisiana Georgia Florida Argentina Alabama North Carolina

Japan Kentucky

$783,407 $760,381 $677,683 $533,776 $491,071 $327,100 $241,498

Virginia Delaware

50 $238,840 $3,757 Hong Kong Source: National Association of Manufacturers (2009)

* Taxes measured in the states largest city only.

$0 $5,000 $10,000 $15,000 $20,000 is almost 2.5 $35,000 $40,000 Importantly, South Carolinas effective tax rate $25,000 $30,000 times greater than Georgias tax, and almost 4 times greater than2002 1960 North Carolinas. This puts South Carolina at a serious disadvantage, in terms of its ability to attract and keep industry. Since South Carolina Note: Per highest tax adjusted for inflation industrial property, it Sources: Heston surprise that it and has the capita income isin the country on to 2005 constant U.S. dollars. should be no and Summers (1994)has World Bank lowest one of the(2004). per capita incomes and economic growth rates in the country. Although it is probably not critical that South Carolina set its tax rate to the lowest in These countries definitely make it at paths over the next forty-two years. Growth the country, it should followed very different least competitive for the Southeast. Since rates were rate is rapid in Hong Kong (5.3%) North Carolinas is while growthpercent, a rate Georgias most effectively 1.52 percent and and Japan (4.1%), just under 1 was virtually non-existent percent might be sufficient actually more industry. Working to reduce the at around 1 in Argentina (0.5%), and wasto attract negative in Venezuela (-0.3%). Over the same period applied capita income growth averaged somewhere in competitiveness. various taxesU.S. per to industry would seriously improve the states the middle of these other countries (1.9%). Such a significant reduction in taxes on industrial property would obviously lead to a Fast tax revenues on industrial property, at least initially. as rich as the United reduction inforward two generations. By 2002, Hong Kong was nearlyHowever, the overall States (and wealthier than most European countries), and state begins far behind. Both are revenue may in fact increase once the growth rate in theJapan was notto pick up and more true rags to riches the state. contrast, the if the official tax Argentina is only then the state industry moves into stories. In Furthermore, average citizen in rates are lowered, $2,000 richer than his or her grandparents and the average citizen in Venezuela is almost $1,000 poorer.

5: THE CASE FOR GROWTH CHAPTER 1: SPECIFIC FOR GROWTH CHAPTER 1: THE CASETAX REFORMS

17 13

Presumably the original intent of imposing a BEING ECONOMIC GROWTH AND HUMAN WELL-tax rate ECONOMIC GROWTH AND HUMAN WELL-BEING schedule with graduated marginal tax rates was to make the income tax progressive. However, what progressivity exists in the states income tax structure is be questioning tax on the first $2,630 of income, At this point, some readers might be to the zero whether income is really a good point, some readers might due is really a At thisof the graduated marginal tax questioning whether incomemarginal taxgood and becausepersonal well-being. While increasing income certainly helps everyone afford rates. However, since the rate measure of measure of personalsmall steps inWhile increasing income certainly helps the progressivity increasesthe things they want, there is more to life than material possessions. We also care over such well-being. income, as shown in Figure 5.5, most of everyone afford more of the things they more ofat lower income want, there is morelevels of income. At possessions. Welevels,care occursour families, our health, and our overall safety. While growth may increase our income levels, not higher to life than material income also the about our families, our health, and our overall safety. While growthhigherincrease our income about tax rate hardly increases at all. This nature of the current tax is directly contradictory may average and standard of living, how does it affect these other measures of personal well-being? By standard these well-being? andthe goal ofof living, how does it affect on the other measures of personal tax satisfies By to progressivity. Soachieve other goals as well? appears thatatthe evidence. the although surface it Let us look the focusing on growth can we also on growth we focusing equity condition, it really does this goals as well? Let us look atlevels reducing the verticalPeople wantcan leadalso achieve other only this requires access to the evidence. to lead long healthy lives and thisthe lower access to quality healthcare. long healthy lives and at requires income quality healthcare. People lowest wealth of thesewant to income taxpayers, not the intendedand longevity differ between groups Figure 1.7 shows how two important measures of health consequence. Figure 1.7 shows how two important measures of health and longevity differ between groups of the highest income and lowest income states. Without exception, citizens in high income of the highest income and lowest income states. Without exception, citizens in high income Figure longer, healthier lives. Because South Carolina is one of rates compared to states live longer, healthier lives. Because South Carolina is one of the lowest income states, states live 5.5: South Carolina income tax: Current taxthe lowest income states, it is also one of the least healthy. It ranks near the bottom of the U.S. health rankings, at 46th inflation-indexed rates, 2009 it is also one of the least healthy. It ranks near the bottom of the U.S. health rankings, at 46th.. Citizens in lower income states also have shorter lives. The average high income state (in the Citizens in lowerthincome states also have shorter lives. The average high income state (in the top 10) ranks 19 out of 50 in terms of the life expectancy of its citizens. The average low top 10) ranks 19th out of 50 in terms of the life expectancy of its citizens. The average low Income health care quality, 1959 Tax income state (in the bottom 10) ranks only 35th In terms of health care quality, the picture is income state (in the bottom 10) ranks only 35th.. In terms of Tax Rates/Brackets ifthe picture is Current Income Tax Schedule was Carolina do worse. the same. Richer states do better, while poorer states like South Carolina do worse. The better, while the same. Richer states do Rates/Bracketspoorer states like South Inflation Adjusted to The th 2009 average high-income state ranks 19 in terms of health care quality. The average low-income average high-income state ranks 19th in terms of health care quality. The average low-income th th . state ranks 35 Tax Tax Average Tax Rate state ranks 35 . Average Tax Rate Taxable Income Amount Amount $5,000

8% 7st 1$10,000

Figure 1.7: Health Indicators by Income Level by Figure 1.7: Health Indicators $125Income Level $71 1.42% 2.5%

$290 $604 $954 $1,654 $3,054 $4,804 $6,554 $10,054 $13,554

WY NJ MD MA

2.90% 4.03% 4.77% 5.51% 6.10% 6.41% 6.56% 6.70% 6.77%

AR WV KY SC

$250 $377 $527 $834 $1,695 $3,127 $4,877 $8,377 $11,877

MS Avg. Top 10

2.5% 2.51% 2.63% 2.78% 3.39% 4.17% 4.88% 5.58% 5.94%

Avg. Bottom 10

$15,000 $20,000 $30,000 $50,000 $75,000 $100,000 $150,000

9:%& 50th $200,000

Figure 5.5 also shows what the average tax rates are for various incomes and taxes under the current tax system in South Carolina. In the right columns it also shows what the taxes and average tax rates would be1,2"'345"6%#/6-'.#/0 tables were indexed for inflation. The if the 1959 tax !"#$%&'(#)"'*+#$,%-'.#/0 Health Carethat the 1959 indexed tax rate structure is more uniformly progressive, Quality Rank Life Expectancy Rank figure clearly shows especially at higher levels of incomes. It keeps tax rates extremely low for the lowest income individuals in the state. th Sources: Morgan and Morgan (2009) and U.S. Census Bureau (2005). Note Mississippi ranks income groups bar height. Sources: Morgan and Morgan (2009) andthat Census Bureau (2005). Note Mississippi ranks 50th and thus has no bar height. Figure 5.5 also shows U.S. the current tax system charges all 50 and thus has no more in taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the This difference is income taxes to physical health; it also appears in measures of This difference is not limited only to physical health; it also appears in measures of table. As South Carolinanot limited onlycontinue to climb while the tax brackets remain mental health. state becomes a income states suffer from the highest a negative impact on mental health. People in lower income states suffer from the highest rates of mental illness stagnant, the People in lower relatively high-tax state. This has rates of mental illness (almost 13 percent in the lower income states compared with only 9 percent in the richer (almost 13 percent in the lower income states compared with only 9 percent in the richer

CT

18 18

UNLEASHING CAPITALISM

manufacturing propertyis likely due to the lower levels ofwe present the effective property tax states). This difference tax in the country. In Figure 5.8 stress at home and in the workplace rateshigherfor Southeastern states, for comparison. The ranks given for the states are out of all that data income brings. 50 states. The net tax and effective tax rate are calculated based on property valued at $25 In addition to our own health, we also care about the well-being of our families and million ($12.5 million in machinery to have stable families, million safe neighborhoods,$2.5 children. All parents want their kids and equipment, $12.5 live in in inventories, and and million a good education. Does having higher income levelstax rate these as well?property is receive in fixtures). Notice that South Carolinas effective lead to on industrial Figure 1.8 over 7.8 the evidence. than the most industry-friendly state, Delaware. (Delaware experience presents times higher Families living in the five states with the highest incomes is listed in the figure because itthan families in the five lowest income states (2.8 versus 4.8 on average). lower divorce rates is the lowest-tax state.) Richer families have fewer money problems destroying their marriages and more money to spend on family vacations and leisure activities. Furthermore, higher income leads to safer neighborhoods. For instance, states with higher incomes have lower rates of violent crime Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007 (3.4 versus 4.8 on average). State Rank from Net Tax Effective safety and Our children benefit (of 50)economic growth not only in terms ofTax Rate stability South the area 1 3.73% but also inCarolina of education. Children $1,864,900 in high income states are far more growing up likely to graduate from high 4 school. The five$1,291,050 highest income states have higher percentages of Mississippi 2.58% the population graduating from high school than all five of the lowest income states. Higher 2.53% Texas 6 $1,264,358 income states have more children graduating from college as well (33.6 percent versus 19.6 Tennessee 10 $1,033,544 2.07% percent college educated population, not shown in figure). Not only does more education increase a Virginiafuture earning potential, enhancing the states prospects for growth in the West childs 14 $833,234 1.67% future, but people with higher levels of education report higher levels of job satisfaction and Louisiana 17 $783,407 1.57% overall happiness in their lives. Georgia 20 $760,381 1.52% Florida

6 Alabama

$677,683 1.36% Figure 24 Divorce, Crime, and Education 1.8: 35 37 47 49 50 $533,776 $491,071 $327,100 $241,498 $238,840 1.11% 0.98% 0.65% 0.48% 0.48%

84 82 80 90 88 86

Divorce/Crime Rate (per 1,000 pop.)

North Carolina

5

4 Virginia

Delaware 3

Source: National Association of Manufacturers (2009) *2Taxes measured in the states largest city only.

Importantly, South Carolinas effective tax rate is almost 2.5 times greater than 78 Georgias tax, and almost 4 times greater than North Carolinas. This puts South Carolina at a serious disadvantage, in terms of its ability to attract and keep industry. Since South Carolina 0 76 has the highest tax in the country on industrial property, it should be no surprise that it has one of the lowest per capita incomes and economic growth rates in the country. Although it is probably not critical that South Carolina set its tax rate to the lowest in the country, it should definitely make it at least competitive for the Southeast. Since Divorce Violent North HS Education Georgias rate is effectively 1.52 percent andCrime Carolinas is just under 1 percent, a rate at around 1 Bureau of Investigation (2005) and U.S. to attract more industry. Working to reduce the Sources: Federal percent might be sufficient Census Bureau (2004, 2006). various taxes applied to industry would seriously improve the states competitiveness. Suchevidence is overwhelming. taxes on industrial not only makes us materially richer; The a significant reduction in Economic growth property would obviously lead to a reduction accomplish our other industrial property, at leastof growth is really about creating it helps to in tax revenues on goals as well. The objective initially. However, the overall revenue for South Carolina where families are not onlythe state begins to pick up and more a future may in fact increase once the growth rate in wealthier, but also happier, healthier, industry moves into the state. Furthermore, if the official tax rates are lowered, then the state safer, and better educated.

1

High Income States

High Income States

High Income States

Low Income States

Low Income States

Low Income States

High School Graduates (%)

Kentucky

5: THE CASE FOR GROWTH CHAPTER 1: SPECIFIC TAX REFORMS Presumably CONCLUSION

19 13

the original intent of imposing a tax rate schedule with graduated marginal tax rates was to make the income tax progressive. However, what progressivity exists in the states income tax structure is due to howzero tax on the first $2,630 of income, This introductory chapter has explained the even small differences in economic and because can the graduated marginal tax rates. the quality of life the marginal tax rate growth rates of produce substantial differences in However, since within a generation or increases overCarolina refuses to undertakeas shown in Figure 5.5, most of the progressivity two. If South such small steps in income, policy reform, and continues its current trend, in occurs at lower incomewill have fallen to levelsinof income. At higher income, levels, the twenty years the state levels, not higher 48th per capita personal income and South average tax will hardly increases at all. This economic ladder. Carolinians rate remain at the bottom of the nature of the current tax is directly contradictory to the goalcontrast, a better So althoughSouth Carolina it appears that the tax satisfies our In of progressivity. and richer on the surface is possible to achieve within the vertical equity condition, it really does thisincrease in the rate of real per capita economic lifetimes. A one-half of a percentage point only at the lower income levels reducing the wealth of these lowest income taxpayers,would result in a ranking of 34th twenty years into the growth, from 1.2 percent to 1.7 percent, not the intended consequence. future, and a one percentage point increase in growth to 2.2 percent would result in South Figure 5.5: South 23rd richest state in the nation within one compared to Carolina becoming the Carolina income tax: Current tax ratesgeneration. More importantly, this growth does not have to come at the expense of other things people value inflation-indexed rates, 2009 to the contrary, these other areas are also enhanced by economic growth. But can policy reform actually increase growth by a meaningful amount? One of the Income Tax Rates/Brackets so successful best examples is the country of Ireland. Irelands free market reforms have beenif 1959 Tax Current Income Tax Schedule was Inflation 1980s and that many refer to it as the Irish Miracle. Irelands policy reform in the late Adjusted toearly Rates/Brackets 2009 1990s enabled its economic growth rate to rise from 2.3 percent to 7.9 percent. The country saw its unemployment rate fall from 17 percent to 4 percent. Irelands futureTaxbrighter than Tax Tax Average is Rate Average Tax Rate decade Taxable Income ever and the benefit of these reforms took less than a Amount to unfold. In the next chapter we Amount turn to the next important question: Which policies are most conducive to creating and $5,000 $71 $125 1.42% 2.5% sustaining long-term economic growth in a state? $10,000 $290 $250 2.90% 2.5% $15,000 $604 $377 4.03% 2.51% $20,000 $30,000 $50,000 $75,000 $100,000 $150,000 $200,000 $954 $1,654 $3,054 $4,804 $6,554 $10,054 $13,554 4.77% 5.51% 6.10% 6.41% 6.56% 6.70% 6.77% $527 $834 $1,695 $3,127 $4,877 $8,377 $11,877 2.63% 2.78% 3.39% 4.17% 4.88% 5.58% 5.94%

Figure 5.5 also shows what the average tax rates are for various incomes and taxes under the current tax system in South Carolina. In the right columns it also shows what the taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, especially at higher levels of incomes. It keeps tax rates extremely low for the lowest income individuals in the state. Figure 5.5 also shows that the current tax system charges all income groups more in taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the table. As South Carolina income taxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

20 18

UNLEASHING CAPITALISM

manufacturing property tax in the country. In Figure 5.8 we present the effective property tax REFERENCES rates data for Southeastern states, for comparison. The ranks given for the states are out of all 50 states. The net tax and effectiveDepartment of Commerce. 2009. property valued at $25 Bureau of Economic Analysis, U.S. tax rate are calculated based on Annual State Personal million Income million in machinery and equipment, $12.5 million in inventories, and $2.5 ($12.5 [electronic file]. Washington, DC: U.S. Department of Commerce. Online: million http://www.bea.gov/regional/spi/default.cfm?selTable=SA30 on(cited: August 22, in fixtures). Notice that South Carolinas effective tax rate industrial property is over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware is listed in 2009). the figure because Investigation, U.S. state.) Federal Bureau of it is the lowest-tax Department of Justice. 2005. Crime in the United States 2004. Washington DC: Government Printing Office. Heston, Alan, and Robert Summers. 1994. The Penn World Tables (Mark 5.6) [electronic Figure 5.8: IndustrialNational Bureau of Economic Research. states*, 2007 file]. Cambridge, MA: Property Taxes in Southeastern Morgan, Scott, and Kathleen O'Leary Morgan Tax 2009. Health Care StateRate State Rank (of 50) Net (eds.). Effective Tax Rankings 2009. Washington DC: CQ Press. South Carolina 1 $1,864,900 Sobel, Russell S. and Susane J. Daniels. 2007.The Case for Growth, 3.73% 1 in Russell S. Chapter Mississippi 4 $1,291,050 Sobel (ed.), Unleashing Capitalism: Why Prosperity Stops2.58% West Virginia at the Border and How to6 Fix It. Morgantown, WV: Center for Economic Growth, The 2.53% Texas $1,264,358 Public Policy Foundation of West Virginia, pp. 1-12. $1,033,544 2.07% U.S. Tennessee Census Bureau. 2004.10 Education Attainment in the United States 2004 [electronic file]. West Virginia DC: U.S. Census Bureau. Online: www.census.gov/population/www/ 14 $833,234 1.67% Washington, socdemo/education/cps2004.html (cited: December 22, 2006). 1.57% Louisiana 17 $783,407 U.S. Census Bureau. 2005. Interim State Population Projections [electronic file]. Georgia 20 $760,381 1.52% Washington, DC: U.S. Census Bureau. Online: www.census.gov/population/ Florida 24 $677,683 1.36% projections/MethTab2.xls (cited: December 22, 2006). U.S. AlabamaBureau. 2006. Statistical Abstract of the United States, 2006 [electronic file]. Census 1.11% 35 $533,776 Washington, DC: U.S. Census Bureau. Online: www.census.gov/compendia/ North Carolina 37 $491,071 0.98% statab/2006/2006edition.html (cited: December 22, 2006). 0.65% Kentucky 47 $327,100 World Bank. 2004. World Development Indicators [CD-ROM]. Virginia 49 $241,498 0.48% Delaware 50 $238,840 0.48%

Source: National Association of Manufacturers (2009) * Taxes measured in the states largest city only.

Importantly, South Carolinas effective tax rate is almost 2.5 times greater than Georgias tax, and almost 4 times greater than North Carolinas. This puts South Carolina at a serious disadvantage, in terms of its ability to attract and keep industry. Since South Carolina has the highest tax in the country on industrial property, it should be no surprise that it has one of the lowest per capita incomes and economic growth rates in the country. Although it is probably not critical that South Carolina set its tax rate to the lowest in the country, it should definitely make it at least competitive for the Southeast. Since Georgias rate is effectively 1.52 percent and North Carolinas is just under 1 percent, a rate at around 1 percent might be sufficient to attract more industry. Working to reduce the various taxes applied to industry would seriously improve the states competitiveness. Such a significant reduction in taxes on industrial property would obviously lead to a reduction in tax revenues on industrial property, at least initially. However, the overall revenue may in fact increase once the growth rate in the state begins to pick up and more industry moves into the state. Furthermore, if the official tax rates are lowered, then the state

You might also like

- Original PDF Economics of Money Banking and Financial Markets 12th Edition PDFDocument41 pagesOriginal PDF Economics of Money Banking and Financial Markets 12th Edition PDFwendy.ramos733100% (28)

- Barclays Equity Gilt Study 2018Document147 pagesBarclays Equity Gilt Study 2018elizabethrasskazova100% (1)

- Introduction To Financial ManagementDocument9 pagesIntroduction To Financial ManagementRitesh ShreshthaNo ratings yet

- Chapter 2Document28 pagesChapter 2Steve CouncilNo ratings yet

- Chapter 3Document22 pagesChapter 3Steve CouncilNo ratings yet

- Chapter 5Document21 pagesChapter 5Steve CouncilNo ratings yet

- Chapter 7Document20 pagesChapter 7Steve CouncilNo ratings yet

- Chapter 8Document22 pagesChapter 8Steve CouncilNo ratings yet

- Chapter 10Document24 pagesChapter 10Steve CouncilNo ratings yet

- Chapter 6Document19 pagesChapter 6Steve CouncilNo ratings yet

- Workforce Development Requires Educational Reform: by L. Brooke ConawayDocument14 pagesWorkforce Development Requires Educational Reform: by L. Brooke ConawaySteve CouncilNo ratings yet

- Business Organization and TaxesDocument22 pagesBusiness Organization and TaxesChieMae Benson QuintoNo ratings yet

- Wrong Choice For MEDocument16 pagesWrong Choice For MEMaine Policy InstituteNo ratings yet

- ITEP Testimony NH HB 642-1Document7 pagesITEP Testimony NH HB 642-1Dean BarkerNo ratings yet

- Repealing The Death Tax Will Create Jobs and Boost EconomyDocument22 pagesRepealing The Death Tax Will Create Jobs and Boost EconomyFamily Research CouncilNo ratings yet

- KRC Econ101 BudgetCutsDocument2 pagesKRC Econ101 BudgetCutsprice_laboreconNo ratings yet

- Answers To Chapter 12 QuestionsDocument5 pagesAnswers To Chapter 12 QuestionsManuel SantanaNo ratings yet

- Assess The Economic Effects of A Significant Increase in Taxation On The UK EconomyDocument3 pagesAssess The Economic Effects of A Significant Increase in Taxation On The UK EconomyCalebP12No ratings yet

- 2009 State Tax TrendsDocument16 pages2009 State Tax TrendsArgyll Lorenzo BongosiaNo ratings yet

- Tax Reform and BudgetDocument13 pagesTax Reform and BudgetDaggett For GovernorNo ratings yet

- The California State Budget and Revenue Volatility: Fiscal Health in A Deficit ContextDocument16 pagesThe California State Budget and Revenue Volatility: Fiscal Health in A Deficit ContextHoover InstitutionNo ratings yet

- Fiscal Policy and The Federal BudgetDocument26 pagesFiscal Policy and The Federal BudgetDevillz AdvocateNo ratings yet

- School of LawDocument4 pagesSchool of LawSri MuganNo ratings yet

- Reforming The New York Tax Code: A Fiscal Policy Institute Report December 5, 2011Document25 pagesReforming The New York Tax Code: A Fiscal Policy Institute Report December 5, 2011fmauro7531No ratings yet

- BTC Reports - Final Tax Plan2013Document10 pagesBTC Reports - Final Tax Plan2013CarolinaMercuryNo ratings yet

- New Analysis Shows Economic Impact of Obama's 2016 Budget by The Tax FoundationDocument8 pagesNew Analysis Shows Economic Impact of Obama's 2016 Budget by The Tax FoundationBarbara EspinosaNo ratings yet

- Milligan Budget 2009Document26 pagesMilligan Budget 2009lesmiserables24601No ratings yet

- Effects Income Tax Changes Economic Growth Gale Samwick PDFDocument16 pagesEffects Income Tax Changes Economic Growth Gale Samwick PDFArpit BorkarNo ratings yet

- Tricia SnyderDocument8 pagesTricia SnyderTurkanAliyevaNo ratings yet

- Financial Management For Decision MakersDocument3 pagesFinancial Management For Decision MakerssgdrgsfNo ratings yet

- Incidence Analysis of Minnesota Governor Budget 2019Document11 pagesIncidence Analysis of Minnesota Governor Budget 2019FluenceMediaNo ratings yet

- An Analysis of The House GOP Tax Plan PDFDocument37 pagesAn Analysis of The House GOP Tax Plan PDFDavid carlssonNo ratings yet

- Ten Tax Mistakes - Part 1Document17 pagesTen Tax Mistakes - Part 1bomseriesNo ratings yet

- Rev-E News OctoberDocument4 pagesRev-E News OctoberRob PortNo ratings yet

- The Federal Income Tax System For Individuals: WebextensionDocument5 pagesThe Federal Income Tax System For Individuals: WebextensionBecky Bergeon SteeleNo ratings yet

- Longest Recession Since Great Depression: How To Deal With Very Large DebtDocument31 pagesLongest Recession Since Great Depression: How To Deal With Very Large DebtAkshay ShahNo ratings yet

- Raising Revenue From Higher Earners 11 15-2Document9 pagesRaising Revenue From Higher Earners 11 15-2Robert ShawNo ratings yet

- Scott Hodge, President Will Mcbride, Chief EconomistDocument20 pagesScott Hodge, President Will Mcbride, Chief EconomistTax FoundationNo ratings yet

- Agriculture Law: RS20609Document3 pagesAgriculture Law: RS20609AgricultureCaseLawNo ratings yet

- Fundamental State Tax ReformDocument40 pagesFundamental State Tax ReformPaul BedardNo ratings yet

- Effects of TaxDocument4 pagesEffects of TaxShreyash KumarNo ratings yet

- Measuring The Revenue Shortfall 04-19-10Document4 pagesMeasuring The Revenue Shortfall 04-19-10Grant BosseNo ratings yet

- New Jersey - Corporation Business Tax OverviewDocument14 pagesNew Jersey - Corporation Business Tax OverviewrajinusaNo ratings yet

- Chapter 4 PDFDocument14 pagesChapter 4 PDFJay BrockNo ratings yet

- Types of TaxesDocument133 pagesTypes of TaxesArsLaN AsHraFNo ratings yet

- Progressive Principles of Tax ReformDocument3 pagesProgressive Principles of Tax ReformNational JournalNo ratings yet

- Citizens For Tax Justice: Compromise Tax Cut Plan Tilts Heavily in Favor of The Well-OffDocument4 pagesCitizens For Tax Justice: Compromise Tax Cut Plan Tilts Heavily in Favor of The Well-OffdocdumpsterNo ratings yet

- HF2480 Article 1 Section 8-9 Incidence Analysis 1 PDFDocument5 pagesHF2480 Article 1 Section 8-9 Incidence Analysis 1 PDFminnesoda238No ratings yet

- T E I B I S C: HE Conomic Mpact of The EER Ndustry in Outh ArolinaDocument44 pagesT E I B I S C: HE Conomic Mpact of The EER Ndustry in Outh ArolinaSushant RaneNo ratings yet

- Windes 2021 Year End Year Round Tax Planning GuideDocument20 pagesWindes 2021 Year End Year Round Tax Planning GuideBrian SneeNo ratings yet

- TaxesDocument3 pagesTaxesapi-300191512No ratings yet

- Theoretical FrameworkDocument14 pagesTheoretical Frameworkfadi786No ratings yet

- Comprehensive Tax Reform ProgramDocument6 pagesComprehensive Tax Reform ProgramAngeli Lou Joven VillanuevaNo ratings yet

- Agriculture Law: RS20593Document6 pagesAgriculture Law: RS20593AgricultureCaseLawNo ratings yet

- Joint Tax Hearing-Ron DeutschDocument18 pagesJoint Tax Hearing-Ron DeutschZacharyEJWilliamsNo ratings yet

- Oklahoma Task Force On Comprehensive Tax Reform: September 15, 2011Document32 pagesOklahoma Task Force On Comprehensive Tax Reform: September 15, 2011okpolicyNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- Quick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”From EverandQuick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”No ratings yet

- Workforce Development Requires Educational Reform: by L. Brooke ConawayDocument14 pagesWorkforce Development Requires Educational Reform: by L. Brooke ConawaySteve CouncilNo ratings yet

- Chapter 10Document24 pagesChapter 10Steve CouncilNo ratings yet

- Exec Summ Shorten The Session 082610Document1 pageExec Summ Shorten The Session 082610Steve CouncilNo ratings yet

- Mployment Security Organization of Southern StatesDocument6 pagesMployment Security Organization of Southern StatesSteve CouncilNo ratings yet

- Exec Summ Recorded Votes 082610Document1 pageExec Summ Recorded Votes 082610Steve CouncilNo ratings yet

- Chapter 8Document22 pagesChapter 8Steve CouncilNo ratings yet

- Fact Sheet: Which Counties Spend The Most of Your Tax Dollars?Document7 pagesFact Sheet: Which Counties Spend The Most of Your Tax Dollars?Steve CouncilNo ratings yet

- Chapter 3Document22 pagesChapter 3Steve CouncilNo ratings yet