Professional Documents

Culture Documents

Chapter 12

Chapter 12

Uploaded by

Steve CouncilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 12

Chapter 12

Uploaded by

Steve CouncilCopyright:

Available Formats

CHAPTER 5: SPECIFIC TAX REFORMS

225 13

Presumably the original intent of imposing a tax rate schedule with graduated marginal tax rates was to make the income tax progressive. However, what progressivity exists in the states income tax structure is due to the zero tax on the first $2,630 of income, and because of the graduated marginal tax rates. However, since the marginal tax rate increases over such small steps in income, as shown in Figure 5.5, most of the progressivity occurs at lower income levels, not higher levels of income. At higher income levels, the average tax rate hardly increases at all. This nature of the current tax is directly contradictory to the goal of progressivity. So although on the surface it appears that the tax satisfies the CHAPTER 2 vertical equity condition, it really does this only at1the lower income levels reducing the wealth of these lowest income taxpayers, not the intended consequence.

CONSTITUTIONALLY CONSTRAIN Figure 5.5: South Carolina income tax: Current tax rates compared to GOVERNMENT TO inflation-indexed rates, 2009 UNLEASH CAPITALISM

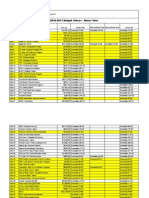

Income Tax Rates/Brackets if 1959 Tax Current Income Tax Schedule was Inflation Adjusted to Rates/Brackets and Andres Bello by Daniel S. Sutter 2009 Taxable Income $5,000 $10,000 $15,000 $20,000 $30,000 $50,000 $75,000 $100,000 $150,000 $200,000 Tax Amount $71 $290 $604 $954 $1,654 $3,054 $4,804 $6,554 $10,054 $13,554 Average Tax Rate 1.42% 2.90% 4.03% 4.77% 5.51% 6.10% 6.41% 6.56% 6.70% 6.77% Tax Amount $125 $250 $377 $527 $834 $1,695 $3,127 $4,877 $8,377 $11,877 Average Tax Rate 2.5% 2.5% 2.51% 2.63% 2.78% 3.39% 4.17% 4.88% 5.58% 5.94%

Figure 5.5 also shows what the average tax rates are for various incomes and taxes under the current tax system in South Carolina. In the right columns it also shows what the taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, especially at higher levels of incomes. It keeps tax rates extremely low for the lowest income individuals in the state. Figure 5.5 also shows that the current tax system charges all income groups more in taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the table. As South Carolina income taxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

226 18 18

UUNLEASHING CAPITALISM NLEASHING CAPITALISM

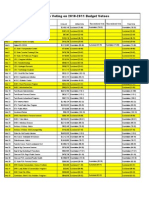

manufacturing property tax inin the country. In Figure 5.8 we present the effective property tax manufacturing property tax the country. In Figure 5.8 we present the effective property tax rates data for Southeastern states, for comparison. The ranks given for the states are out of all rates data for Southeastern states, for comparison. The ranks given for the states are out of all 50 states. The net tax and effective tax rate are calculated based on property valued atat $25 50 states. The net tax and effective tax rate are calculated based on property valued $25 million ($12.5 million ininmachinery and equipment, $12.5 million inininventories, and $2.5 million ($12.5 million machinery and equipment, $12.5 million inventories, and $2.5 million inin fixtures). Notice that South Carolinas effective tax rate on industrial property is million fixtures). Notice that South Carolinas effective tax rate on industrial property is over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware isis listed in over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware listed in the figure because it it is the lowest-tax state.) the figure because is the lowest-tax state.)

Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007 Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007

State Rank (of 50) State Rank (of 50) South Carolina 11 South Carolina Mississippi Mississippi Texas Texas Tennessee Tennessee West Virginia West Virginia Louisiana Louisiana Georgia Georgia Florida Florida Alabama Alabama North Carolina North Carolina Kentucky Kentucky Virginia Virginia Delaware Delaware 44 66 10 10 14 14 17 17 20 20 24 24 35 35 37 37 47 47 49 49 50 50 Net Tax Net Tax $1,864,900 $1,864,900 $1,291,050 $1,291,050 $1,264,358 $1,264,358 $1,033,544 $1,033,544 $833,234 $833,234 $783,407 $783,407 $760,381 $760,381 $677,683 $677,683 $533,776 $533,776 $491,071 $491,071 $327,100 $327,100 $241,498 $241,498 $238,840 $238,840 Effective Tax Rate Effective Tax Rate 3.73% 3.73% 2.58% 2.58% 2.53% 2.53% 2.07% 2.07% 1.67% 1.67% 1.57% 1.57% 1.52% 1.52% 1.36% 1.36% 1.11% 1.11% 0.98% 0.98% 0.65% 0.65% 0.48% 0.48% 0.48% 0.48%

Source: National Association ofof Manufacturers (2009) Source: National Association Manufacturers (2009) * Taxes measured inin the states largest city only. * Taxes measured the states largest city only.

Importantly, South Carolinas effective tax rate isisalmost 2.5 times greater than Importantly, South Carolinas effective tax rate almost 2.5 times greater than Georgias tax, and almost 4 4 times greater than North Carolinas. This puts South Carolina at a Georgias tax, and almost times greater than North Carolinas. This puts South Carolina at a serious disadvantage, inin terms of its ability to attract and keep industry. Since South Carolina serious disadvantage, terms of its ability to attract and keep industry. Since South Carolina has the highest tax inin the country on industrial property, it should be no surprise that it has has the highest tax the country on industrial property, it should be no surprise that it has one of the lowest per capita incomes and economic growth rates inin the country. one of the lowest per capita incomes and economic growth rates the country. Although it it is probably not critical that South Carolina set its tax rate to the lowest in Although is probably not critical that South Carolina set its tax rate to the lowest in the country, it itshould definitely make it itatatleast competitive for the Southeast. Since the country, should definitely make least competitive for the Southeast. Since Georgias rate isis effectively 1.52 percent and North Carolinas is just under 1 percent, a rate effectively 1.52 percent and North Carolinas is just under 1 percent, a rate Georgias rate atataround 1 1percent might be sufficient totoattract more industry. Working to reduce the around percent might be sufficient attract more industry. Working to reduce the various taxes applied toto industry would seriously improve the states competitiveness. various taxes applied industry would seriously improve the states competitiveness. Such a a significant reduction in taxes on industrial property would obviously lead to a Such significant reduction in taxes on industrial property would obviously lead to a reduction inintax revenues on industrial property, atatleast initially. However, the overall reduction tax revenues on industrial property, least initially. However, the overall revenue may ininfact increase once the growth rate inin the state begins to pick up andmore revenue may fact increase once the growth rate the state begins to pick up and more industry moves into the state. Furthermore, ifif the official tax rates are lowered, then the state industry moves into the state. Furthermore, the official tax rates are lowered, then the state

CHAPTER 5: SPECIFIC TAX REFORMS

227 13

Presumably the original intent of imposing a tax rate schedule with graduated marginal tax rates was to make the income tax progressive. However, what progressivity exists in the states income tax structure is due to the zero tax on the first $2,630 of income, and because of the graduated marginal tax rates. However, since the marginal tax rate increases over such small steps in income, as shown in Figure 5.5, most of the progressivity occurs at lower income levels, not higher levels of income. At higher income levels, the average tax rate hardly increases at all. This nature of the current tax is directly contradictory to the goal of progressivity. So although on the surface it appears that the tax satisfies the vertical equity condition, it really does this only at the lower income levels reducing the wealth of these lowest income taxpayers, not the intended consequence.

12

CONSTITUTIONALLY CONSTRAIN GOVERNMENT TO UNLEASH CAPITALISM

Figure 5.5: South Carolina income tax: Current tax rates compared to inflation-indexed rates, 2009

Daniel Sutter and Andres Bello

Current Income Tax Rates/Brackets Income Tax Rates/Brackets if 1959 Tax Schedule was Inflation Adjusted to 2009

Tax Tax Average Tax Rate Average Tax Rate Taxable Income Amount Amount Society can either rely on private or public sector decision-making to allocate $5,000 $71 1.42% 2.5% resources. The chapters of this book have described$125 benefits of capitalism, or private the $290 $250 2.5% sector $10,000 decision-making. This chapter2.90% addresses the most direct way government can direct resources, by taxing and spending. Economists have documented the benefits of limiting the $15,000 $604 $377 4.03% 2.51% size and scope of government, and we begin by reviewing the evidence on how large $20,000 $954 $527 4.77% 2.63% government slows growth. Despite the cost of large government, public choice analysis $1,654 $834 5.51% 2.78% reveals$30,000 interactions of self-interested politicians, bureaucrats, citizens, and interest that the groups $50,000 excessive spending, or more spending than desired by the 3.39% citizen. We result in average $3,054 $1,695 6.10% examine three ways to counter the spending bias of representative democracy and benefit $75,000 $4,804 $3,127 6.41% 4.17% South Carolina: fiscal decentralization and competition between local governments; $100,000 6.56% 4.88% separation of powers; $6,554 and expenditure limits.$4,877 the way we specifically examine and tax Along the performance of South Carolina.6.70% Carolina scores about average overall on the South $8,377 $150,000 $10,054 5.58% economic freedom index of institutional quality, but South Carolinas poor record on $200,000 $13,554 $11,877 6.77% 5.94% government spending substantially lowers its ranking. South Carolina ranks below the national average on several measures of entrepreneurship, the mechanism through which Figure 5.5 translates what the average tax the are of various local government economic freedomalso shows into growth. Reducing rates size for state andincomes and taxes under the current in unleashing capitalism in South Carolina. columns it also shows what the will be important tax system in South Carolina. In the right taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, MARKET INSTITUTIONS AND keeps tax rates extremely low for especially at higher levels of incomes. ItECONOMIC PROSPERITY the lowest income individuals in the state. Adam Smith, shows that of economics, was charges proponent of the role in Figure 5.5 also the founder the current tax systeman early all income groups more of institutionsan indexed ratewealth for The only The last several $5,000 income witnessed the taxes than in generating schedule. nations. exception is the decades have earner in an explosion South Carolina income link continue to climb and specifically the institutions table. As of research examining thetaxes between institutions,while the tax brackets remain of the market state becomes a relatively high-tax state. This has a negative impact on stagnant, the economy, to economic growth, both across nations and within nations. Humans

INTRODUCTION

228 18 18

UUNLEASHING CAPITALISM NLEASHING CAPITALISM

manufacturing property tax inin improve the In Figure 5.8 we lives, and effective property tax have an inherent tendency to the country. Inquality of theirpresent the the institutions of tax manufacturing property tax the country. Figure 5.8 we present the effective property a rates data for Southeastern states, for comparison. The others given forthethe states are out of all marketdata for Southeastern states, for comparison. The ranksthroughfor profit incentive. all rates economy harness this self-interest in service of ranks given the states are out of 50 states. The ofnet tax andresearch on institutions calculated basedperformance valued at an Much net tax and effective tax rate are and economic on property employs $25 50 states. The the recent effective tax rate are calculated based on property valued at $25 million ($12.5 million ininmachinery and equipment, $12.5 million inininventories,theand$2.5 index of economic freedommachinery than equipment, $12.5 million compiled by and $2.5 for more and 140 countries worldwide million ($12.5 million inventories, Fraser million inin fixtures). Notice that2008).Carolinas effective tax rate on industrial property isis Institute (Gwartney and Lawson South The international economic freedom index property million fixtures). Notice that South Carolinas effective tax rate on industrial measures overqualitytimes higher than the most industry-friendly state, Delaware. (Delaware is listed in the 7.8 times institutions based on five component areas: the size of government, the legal over 7.8 of higher than the most industry-friendly state, Delaware. (Delaware is listed in the figure because it it is the lowest-tax state.) quality of the money supply, freedom to engage system and because is of property rights, the the figure protection the lowest-tax state.) in international trade, and economic regulation (e.g., of credit and labor markets). The index is a score from 0 to 10, with 10 representing a high level of economic freedom. The index allows comparisonsIndustrial Property way to in Southeastern having more2007 Figure 5.8: Industrial Property aTaxes classify countries as states*, 2007 Figure 5.8: between countries, or Taxes in Southeastern states*, or less economic freedom. A market economy requires a legal infrastructure protecting property Net Tax State Rank (of 50) Net many Effective Tax Rate rights andStatefreedomRank (of 50) the to trade. Internationally,Tax weak or Effective Tax Rate predatory governments fail to South basic framework 1 1 market exchange, with terrible consequences for human well$1,864,900 3.73% $1,864,900 3.73% supplySouth Carolina the Carolina for being,Mississippi by Figure 12.1. The figure reports Gross Domestic Product (GDP) per as illustrated Mississippi 44 $1,291,050 2.58% $1,291,050 2.58% capita, a measure of the standard of living across nations, averaged across quintiles of Texas $1,264,358 Texas 6 $1,264,358 2.53% countries as ranked by their6economic freedom score, as reported by2.53% Gwartney and Lawson Tennessee 10 $1,033,544 2.07% Tennessee 10 $1,033,544 (2008). GDP per capita is nearly ten times higher in the top 25 percent 2.07% of countries as ranked by economic freedom than 14 the bottom 25$833,234 of countries.1.67% differences in in percent These West Virginia 14 $833,234 1.67% West Virginia standard of living did not occur over night, and can reflect the cumulative impact over Louisiana 17 $783,407 1.57% Louisiana 17 $783,407 1.57% decades of an environment hospitable to a market economy. The difference between the top Georgia 20 $760,381 1.52% Georgia 20 $760,381 1.52% and bottom quartiles of nations reflects the effect of the lack of protection of property and the rule of law. But GDP per capita is still more than double in the freest1.36% 25 percent of countries Florida 24 $677,683 1.36% Florida 24 $677,683 than in the second 25 percent, so even among nations where the rule of law is reasonably well 1.11% Alabama 35 $533,776 Alabama 35 $533,776 1.11% established, limiting government spending and regulation is critical for growth and a high North Carolina1 37 0.98% 37 $491,071 0.98% North living. standard of Carolina Economic freedom does$491,071 not merely lead to the pursuit of a narrow measure of the standard of 47 living, or produce $327,100 some at the0.65% of poverty for growth for expense Kentucky Kentucky 47 $327,100 0.65% others. Norton and Gwartney (2008) show that economic freedom reduces extreme poverty Virginia 49 $241,498 0.48% 0.48% Virginia 49 $241,498 and improves a nations score on the United Nations Human Poverty Index. Delaware 50 $238,840 0.48% Delaware 50 $238,840 0.48%

Source: National Association ofof Manufacturers (2009) Source: National Association Manufacturers (2009) * Taxes measured inin the states largest city only. * Taxes measured the states largest city only.

Importantly, South Carolinas effective tax rate isisalmost 2.5 times greater than Importantly, South Carolinas effective tax rate almost 2.5 times greater than Georgias tax, and almost 4 4 times greater than North Carolinas. This puts South Carolina at a Georgias tax, and almost times greater than North Carolinas. This puts South Carolina at a serious disadvantage, inin terms of its ability to attract and keep industry. Since South Carolina serious disadvantage, terms of its ability to attract and keep industry. Since South Carolina has the highest tax inin the country on industrial property, it should be no surprise that it has has the highest tax the country on industrial property, it should be no surprise that it has one of the lowest per capita incomes and economic growth rates inin the country. one of the lowest per capita incomes and economic growth rates the country. Although it it is probably not critical that South Carolina set its tax rate to the lowest in Although is probably not critical that South Carolina set its tax rate to the lowest in the country, it itshould definitely make it itatatleast competitive for the Southeast. Since the country, should definitely make least competitive for the Southeast. Since Georgias rate isis effectively 1.52 percent and North Carolinas is just under 1 percent, a rate effectively 1.52 percent and North Carolinas is just under 1 percent, a rate Georgias rate atataround 1 1percent might be sufficient totoattract more industry. Working to reduce the around percent might be sufficient attract more industry. Working to reduce the various taxes applied toto industry would seriously improve the states competitiveness. various taxes applied industry would seriously improve the states competitiveness. Such a a significant reduction in taxes on industrial property would obviously lead to a Such significant reduction in taxes on industrial property would obviously lead to a reduction inintax revenues on industrial property, atatleast initially. However, the overall reduction tax revenues on industrial property, least initially. However, the overall revenue may ininfact increase once the growth rate inin the state begins to pick up andmore revenue may fact increase once the growth rate the state begins to pick up and more 1 Economists have into the investigated the relationship official tax rates are lowered, then the state industry moves into the state. Furthermore, ifif the betweentax rates are lowered,prosperity. For a industry movesextensivelystate. Furthermore, the official economic freedom and then the state

discussion of some of the findings of these studies, see Gwartney, Holcombe and Lawson (2004) and Lawson (2007).

Chapter 12: Constitutionally Constrain government CHAPTER 5: SPECIFIC TAX REFORMS

229 13

Purchasing Power Adjusted Purchasing Power Adjusted GDP GDP per Capita, per Capita, 2006 2006

Presumably the original intent of imposing a tax rate schedule with graduated marginal tax rates was to make the income tax progressive. However, what progressivity exists in the states income tax structure is due to the zero tax on the first $2,630 of income, and becauseFigure graduated marginal tax rates. However, since the marginal tax rate of the Figure 12.1: Economic Freedom and Prosperityof 12.1: Economic Freedom Figure 5.5, most increases over such small steps in income, as shown in and Prosperity the progressivity occurs at lower income levels, not higher levels of income. At higher income levels, the $35,000 average tax rate hardly increases at all. This nature of the current tax is directly contradictory 35000 $30,000 to the goal of progressivity. So although on the surface it appears that the tax satisfies the 30000 vertical $25,000 condition, it really does this only at the lower income levels reducing the equity 25000 wealth of these lowest income taxpayers, not the intended consequence.

Figure 5.5: South Carolina income tax: Current tax rates compared to inflation-indexed rates, 2009

Least Current Income Tax Free Third Second Most Free Schedule was InflationFree Least Free Rates/Brackets Third Second Most Adjusted Quintiles of Countries Ranked by their Economic Freedom Index 2009 Quintiles of Countries Ranked by their Economic Freedom Index

$20,000 20000 $15,000 15000 $10,000 10000 $5,000 5000 $0 0

Income Tax Rates/Brackets if 1959 Tax to Tax Amount Average Tax Rate

Average Tax Rate Taxable Income Source: Gwartney and Lawson (2008) Amount

Source: $5,000 and Lawson (2008) Gwartney $71

Tax

$125 1.42% 2.5% The record also shows that a large state government slows economic growth. The $290 $250 2.5% impact $10,000 and local government2.90% of state on economic performance is surprising, given that all $15,000 $604 2.51% U.S. states share the same basic legal4.03% framework (the $377 of law, an independent judiciary), rule and that federal government spending, taxation and regulation are consistent across the states. $20,000 $954 $527 4.77% 2.63% Yet differences in economic freedom across states affect prosperity. $30,000 $1,654 $834 5.51% 2.78% $50,000 $3,054 $1,695 6.10% 3.39% $75,000 $100,000 $150,000 $200,000 $4,804 $6,554 $10,054 $13,554 6.41% 6.56% 6.70% 6.77% $3,127 $4,877 $8,377 $11,877 4.17% 4.88% 5.58% 5.94%

Figure 5.5 also shows what the average tax rates are for various incomes and taxes under the current tax system in South Carolina. In the right columns it also shows what the taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, especially at higher levels of incomes. It keeps tax rates extremely low for the lowest income individuals in the state. Figure 5.5 also shows that the current tax system charges all income groups more in taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the table. As South Carolina income taxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

230 18 18

UUNLEASHING CAPITALISM NLEASHING CAPITALISM

Per Captia Personal Income (2008) Per Captia Personal Income (2008)

manufacturing property tax inin the country. In Figure 5.8 we present the effective property tax manufacturing property tax the country. In Figure 5.8 we present the effective property tax rates data for Southeastern states, Capita Income (2008)givenSize of are out of all rates dataFigure 12.2: Per for comparison. The (2008) vs. for theof for Southeastern states, for comparison. The ranks vs. for the states are out of all Figure 12.2: Per Capita Income ranks given Size states 50 states. The net tax and effective tax rate are calculated based on property valued atat $25 50 states. The net tax and effective tax rate are calculated based on property valued $25 State Government (1977) million ($12.5 million ininmachinery and equipment, $12.5 million inininventories, and $2.5 million ($12.5 million State Government (1977) million machinery and equipment, $12.5 inventories, and $2.5 million inin fixtures). Notice that South Carolinas effective tax rate on industrial property is million fixtures). Notice that South Carolinas effective tax rate on industrial property is over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware isis listed in over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware listed in 60,000 60000 the figure because it it is the lowest-tax state.) the figure because is the lowest-tax state.) 55,000 55000

50,000 50000 Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007 Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007

State Rank (of 50) Rank (of 50) 45,000 45000State South Carolina 11 South Carolina 40,000 40000 Mississippi 44 Mississippi 35,000 35000 Texas 66 Texas Tennessee Tennessee 30,000 30000 West Virginia West Virginia 25,000 25000 Louisiana Louisiana 20,000 20000 Georgia Georgia Florida 4 4 Florida 10 10 14 14 17 17 20 20 624 246

Net Tax Net Tax $1,864,900 $1,864,900 $1,291,050 $1,291,050 $1,264,358 $1,264,358 $1,033,544 $1,033,544 $833,234 $833,234 $783,407 $783,407 $760,381 $760,381 8 $677,683 10 8 $677,683 10

Effective Tax Rate Effective Tax Rate 3.73% 3.73% 2.58% 2.58% 2.53% 2.53% 2.07% 2.07% 1.67% 1.67% 1.57% 1.57% 1.52% 1.52% 12 12 1.36% 1.36%

14 14

State Spending as Percent of Income (1977) State Spending as a a Percent of Income (1977) 1.11% Alabama 35 $533,776 Alabama 35 $533,776 1.11% Source: Carolina and Bureau Economic Analysis North U.S. Census 37 $491,071 0.98% 37 $491,071 0.98% North Carolina Source: U.S. Census and Bureau ofof Economic Analysis 0.65% Kentucky 47 $327,100 Kentucky 47 $327,100 0.65%

Virginia 12.2 illustrates the long run relationship between government size and the 49 $241,498 0.48% 0.48% Virginia 49 $241,498 Figure economy. The figure plots50 state in 2008 Delaware $238,840 0.48% Delaware 50 per capita personal income (PCPI) 0.48% against state $238,840 spending as National Association ofof Manufacturers (2009) Source: a percentage of personal income in 1977. This allows us to see the impact of Source: National Association Manufacturers (2009) Taxes measured inin in states on standards * Taxes measured the states largest city only. large* state government the 1977largest city only. of living three decades later. States with larger governments in 1977 had lower incomes 30 years later, as indicated by the negative slope to Importantly, South Carolinas effectivetax fitted line indicates that greater than almost 2.5 times large than the trendImportantly,South Carolinas effective The rate isisalmost 2.5 times a greaterstate line plotted through the scatter plot. tax rate Georgias tax, and almost 4 4 times greaterincome versus 5 percent, reducedSouth Carolina by a Georgias in and almost times greater than North Carolinas. This puts PCPI in 2008 a governmenttax,1977, about 12 percent of than North Carolinas. This puts South Carolina atat serious disadvantage, inin terms of its ability to attract and keep industry. Since South Carolina serious disadvantage, terms of its ability to attract and keep industry. Since South Carolina about $5,000. has the highest tax inin the country on industrial property, it should be no surprise that it has has the highest tax the country on industrial property, it should be no surprise that it has one of the lowest per capita incomes and economic growth rates inin the country. one of the lowest per capita incomes and economic growth rates the country. Although it it is probably not critical that South Carolina set its tax rate to the lowest in Although is probably not critical that South Carolina set its tax rate to the lowest in the country, it itshould definitely make it itatatleast competitive for the Southeast. Since the country, should definitely make least competitive for the Southeast. Since Georgias rate isis effectively 1.52 percent and North Carolinas is just under 1 percent, a rate effectively 1.52 percent and North Carolinas is just under 1 percent, a rate Georgias rate atataround 1 1percent might be sufficient totoattract more industry. Working to reduce the around percent might be sufficient attract more industry. Working to reduce the various taxes applied toto industry would seriously improve the states competitiveness. various taxes applied industry would seriously improve the states competitiveness. Such a a significant reduction in taxes on industrial property would obviously lead to a Such significant reduction in taxes on industrial property would obviously lead to a reduction inintax revenues on industrial property, atatleast initially. However, the overall reduction tax revenues on industrial property, least initially. However, the overall revenue may ininfact increase once the growth rate inin the state begins to pick up andmore revenue may fact increase once the growth rate the state begins to pick up and more industry moves into the state. Furthermore, ifif the official tax rates are lowered, then the state industry moves into the state. Furthermore, the official tax rates are lowered, then the state

Chapter 12: Constitutionally Constrain government CHAPTER 5: SPECIFIC TAX REFORMS

231 13

Figure 5.5: South Carolina 50 income tax: Current tax rates compared to inflation-indexed rates, 2009 40 30 Income Tax Rates/Brackets if 1959 Tax Current Income Tax 20 Schedule was Inflation Adjusted to Rates/Brackets 2009 10 Tax Tax Average Tax Rate Average Tax Rate Taxable Income 0 Amount Amount -40 -20 0 20 40 60 $5,000 $71 $125 1.42% 2.5%

$10,000 $15,000 $290 $604 $250 2.90% 2.5% Growth in State Spending (1992-2006) 4.03% $377 2.51% 2.63%

Source: U.S. Census, Bureau of Economic Analysis and author's calcualations $20,000 $954 $527 4.77%

$30,000 $1,654 $834 5.51% 2.78% Figure $50,00012.3 considers the relationship between state spending growth and economic $3,054 $1,695 6.10% 3.39% growth. The figure plots the growth in real PCPI between 1992 and 2006 for the contiguous $75,000 $4,804 $3,127 6.41% 4.17% United States against the growth in state spending as a percentage of income over the same $100,000 6.56% 4.88% period. The trend line$6,554 a negative relationship $4,877 fast growing governments and shows between economic growth.2 $10,054 $8,377 $150,000 6.70% 5.58% Regulations and mandates can substitute for $11,877 government spending, so spending may $200,000 $13,554 6.77% 5.94% paint an incomplete portrait of government allocation of resources. For example, government could protect coastal barrier islands by purchasing private lands at fair market value, which Figure 5.5 also shows what the average tax rates are for various incomes and taxes Figure 12.3 considers the relationship between state spending growth and what the under the current tax system in South Carolina. In the right columns it also showseconomic 2 Vedder and Gallawayplots the growth in real PCPI between 1992 and 2006 for the contiguous growth. The figure (1997, would be the evidence tables were indexed growth of excessive taxes and average tax rates1998) provideiffurther1959 tax on the consequences for for inflation. The spending and references to other recent econometric studies. United States against the growth in state spending structure is more income over the same figure clearly shows that the 1959 indexed tax rateas a percentage of uniformly progressive, period. The higher levels of a negative keeps tax rates extremely low for governments and especially at trend 2line shows incomes. It relationship between fast growingthe lowest income economic growth. individuals in the state. Regulations and mandates the substitute system charges all income spending may Figure 5.5 also shows that can current taxfor government spending, sogroups more in paint than an indexed rate of government allocation of is the $5,000 income government taxes an incomplete portraitschedule. The only exceptionresources. For example,earner in the could As South Carolina income by purchasing private lands at the market value, which table. protect coastal barrier islandstaxes continue to climb while fair tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

2

Vedder and Gallaway (1997, 1998) provide further evidence on the consequences for growth of excessive spending and references to other recent econometric studies.

Growth in Per Capita Personal Income (1992-2006)

Presumably the original intent of imposing a tax rate schedule with graduated marginal tax rates was to make the income tax progressive. However, what progressivity exists in the states income tax structure is due to the zero tax on the first $2,630 of income, and because of the graduated marginal tax rates. However, since the marginal tax rate increases over such small steps in income, as shown in Figure 5.5, most of the progressivity occurs at lower income levels, not higher levels of income. At higher income levels, the average tax rate hardly increases at all. This nature of the current tax isGrowth in Figure 12.3: Growth in Per Capita Income vs. directly contradictory to the goal of progressivity. So although on the surface it appears that the tax satisfies the State Spending As a Percentage of Personal Income vertical equity condition, it really does this only at the lower income levels reducing the wealth of these lowest income taxpayers, not the intended consequence. 60

232 18 18

UUNLEASHING CAPITALISM NLEASHING CAPITALISM

manufacturing property tax inin the country. In Figureprohibit present the effective property tax would involve aproperty tax expenditure, or Figure 5.8 we present thefrom developing their manufacturing substantial the country. In simply 5.8 we owners effective property tax rates data Regulation affects states, for comparison. The ranks given for the states government property. for Southeastern states,use of private property as surely as if states are out of all rates data for Southeastern the for comparison. The ranks given for the state are out of all 50 states. The net lands. and effective tax ratestate calculated based on and growth discussed had purchased the tax and effective tax rate are calculated based on property valued atat $25 50 states. The net tax Thus the evidence on are economic freedom property valued $25 million ($12.5 relevant ininmachinery Lower equipment,$12.5 million inininventories, andlevel, inmillion ($12.5million to our topic. and equipment, freedom, even at the subnational $2.5 Chapter 2 is million machinery and economic $12.5 million inventories, and $2.5 million inin fixtures). Notice that South Carolinas effective tax rate on industrial property is reduces income and slows growth. million fixtures). Notice that South Carolinas effective tax rate on industrial property is over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware isis listed in over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware listed in the figure because it it is the lowest-tax state.) South Carolina and Its Neighbors the figure becauseEconomic Freedom: Figure 12.4: is the lowest-tax state.)

Figure 12.4: Economic Freedom: South Carolina and Its Neighbors

Takings and Size State State Overall Index Size of of Takings and Overall Index Discriminatory Labor Market Figure 5.8: Industrial Property Taxes inDiscriminatory states*, 2007 Figure 5.8: Industrial Property Taxes inSoutheastern Labor Market Southeastern states*, 2007 Government Government Taxation State Rank (of 50) Net Tax Effective Tax Rate State Rank (of 50) Net Tax Taxation Effective Tax Rate st South Carolina 6.8 (T-25th) 6.0 (T-40th) 6.7 (T-34th) 8.4 (T-1 ) th South South Carolina (T-25th)1rd Carolina 6.8 6.0 (T-40$1,864,900 (T-34th) th 3.73% (T-1st) th ) th 6.7 8.4 South Carolina 7.6 (T-3 ) 1 $1,864,900 7.5 (T-11 ) 3.73% 7.3 (9 ) North Carolina 7.5 (T-14 ) North Carolina 7.6 (T-3rd) rd 7.5 (T-14th)th 7.5 (T-11th) th 7.3 (9th) Georgia 7.6 (T-3 ) 7.7th(12 ) 7.5 (T-11 )2.58%7.4 (T-10th) rd 4 4 Mississippi $1,291,050 (T-11th) Mississippi 2.58% (T-10th) Georgia 7.7 (12 6.9 ) $1,291,050 7.5 7.4 U.S. Average 7.6 (T-3 ) 6.9 7.0 6.8 2.53% 66 $1,264,358 Texas $1,264,358 2.53% U.S. Texas Average 6.9 7.0 6.8 Source: Karabegovic 6.9 McMahon (2008). and $1,033,544 2.07% 2.07% $1,033,544 West Virginia displays the 2008 annual all$833,234 14 $833,234 1.67% West Virginia 14 Figure 12.4 government economic1.67% scores (from freedom 3 2005) Louisiana Carolina, North Carolina and Georgia. South Carolinas overall score of 6.8 of South Louisiana 17 $783,407 1.57% 17 $783,407 1.57% Figure nationally and is just below the national average of 6.9. But both Georgia ranks Georgia 25th 12.5: Economic Freedom and Entrepreneurship tied for Georgia 20 $760,381 1.52% 20 $760,381 1.52% Measure 3 Entrepreneurship and North Carolina score 7.6 and tie forof rd nationally, ranking higher than South Carolina. Florida also 24 $677,683 1.36% each State Ranked reports the 24Index ofnational$677,683allPercentage1.36% FigureFlorida on 12.4 score and Productive of rank three statesof Sole of the three on Economic of state 1.11% Alabama $533,776 componentsFreedom and 35 Entrepreneurship local economic freedom: the size of government, takings and Alabama 35 $533,776 Proprietorships, 1990 & 1.11% discriminatory taxation, and labor market regulation. South 2000 North Carolina 37 $491,071 0.98% 37 $491,071 Carolina has a mixed institutional 0.98% North Carolina Most Free 15.0 environment. On the one hand, 29.2 Carolinas score of 8.4 in labor market regulation ties it South Kentucky 47 21.4 $327,100 47 $327,100 14.8 0.65% Least Freespot for theKentuckynationally. However, the state ranks 40th in the size of0.65% top government area with a th McMahon (2008), Sobel (2008), Garrett and Wall (2006). Sources: Karabegovic and Virginia 49a $241,498 0.48% 0.48% score Virginia and 34 with 49 score of 6.7 on$241,498 and discriminatory taxation. South of 6.0, takings Carolina thus has a problem with the size of government and high tax 0.48%The states taxing rates. Delaware 50 $238,840 Delaware 50 $238,840 0.48% and spending National Association of Manufacturers (2009) Carolina and Georgia rank among the top problem is exacerbated because North Source: National Association of Manufacturers (2009) Source: 15 states nationally inin the states largest city only. * Taxes measured in the states largest city only. * Taxes measured each of these areas. The importance of limiting the size of government for economic prosperity cannot be overstated. Economists Richard Veddereffectivetax rate isisalmost 2.5 conclude based than Importantly, South Carolinas effective tax Gallaway (1998) times greater than Importantly, South Carolinas and Lowell rate almost 2.5 times greater on evidence tax, and almost 4 times greater than North Carolinas. This puts South Carolina atat Georgias at tax, and almost 4 times greater than North Carolinas. This puts South relationship a Georgias the state, federal, and international level that a stable, hill-shaped Carolina a 4 between income and inin terms the its ability to attract and keep industry. Since South Carolina serious disadvantage,the terms of itspublic sector. serious disadvantage, size of of ability to attract and keep industry. Since South Carolina has the As governmentthe country on very low level, the growth providessurprise courts it has highest tax in the country on industrial property, should be no surprise that has has the highest tax in grows from a industrial property, it it should be no police, that it and national the lowest per sustain the framework the growth rates in the country.stable property one of the lowest whichcapita incomes and economic growth rates in the country. one of defense per capita incomes and economic market economy requires: rights, Although it it is probably not and protection from foreign its tax rate and the lowest in enforcementis of contracts, critical that South Carolina set invaders toto marauders. Although probably not critical that South Carolina set its tax rate the lowest in Government it itshould definitely make it itatatleast roads and for the schools, and Since like competitive for the Southeast. fire the country, provided infrastructure and services leastcompetitivehighways, Southeast. Since the country, should definitely make protection also increase the 1.52 percent of North Carolinas asjust under 1 1 expands past Georgias rate isis effectivelyproductivity andthe economy. Yet isis governmentpercent, a a rate effectively 1.52 percent and North Carolinas just under percent, rate Georgias rate these core functions, however, the expansion attract more industry. Working toreduce the of government reduces growth atataround 1 1percent might be sufficient totoattract more industry. Working toand income around percent might be sufficient reduce the 5 begins taxes applied to industry wouldhurts the economy the three competitiveness. various totaxes applied to industry would seriously improve in states ways. First, government various fall. Government growth seriously improve the states competitiveness. Such a a significant reduction in taxes on industrial property would obviously lead to a Such significant reduction in taxes on industrial property would obviously lead to a 3 reduction inintax revenues on industrial property, atatleast initially. and availablethe overall reduction indices are contained in Karabegovic and McMahon initially.However, the overall tax revenues on industrial property, least (2008) However, on-line at The full www.freetheworld.com/efna.html. once the growth rate in the state begins to pick up and more revenue may ininfact increase once the growth rate in the state begins to pick up and more revenue may fact increase 4 Vedder moves into the state. Furthermore, the official tax rates are lowered, Congressman industry and Gallaway the state. Furthermore, ifif the official tax economistlowered, then the state industry moves into(1998) call this the Armey curve in honor ofrates are and former then the state

Richard Armey, who hypothesized the existence of such a relationship. 5 Olson (1982) examines democratic rent seeking and economic stagnation. Source:Tennessee and McMahon (2008). Karabegovic Tennessee 10 10

Chapter 12: Constitutionally Constrain government CHAPTER 5: SPECIFIC TAX REFORMS

233 13

Presumably the original intent of imposing a tax rate schedule with graduated increasingly makes resource allocation decisions, and these decisions are made for political marginal not profit was to make the income tax progressive. However, what progressivity reasons, tax rates or loss considerations. Second, government must tax to fund spending. exists in the states income tax structurethe due to the zero tax on the first $2,630exceeds the Taxes distort choices in the market, and is cost to the economy of this distortion of income, and because of the graduated marginalspend. Higher taxes since the marginal freedom, dollars collected for government to tax rates. However, reduce economic tax rate increases over such small and Wallincome, andshown in(Poulson5.5, most of the progressivity entrepreneurship (Garrett steps in 2006), as growth Figure and Kaplan 2008). Marginal occurs at the tax income levels, they higher levels of income.ifAt businessincome an extra the tax rates, lower people pay if not earn an extra $1,000 or a higher earns levels, $1 average in profit,hardly increases at all. This nature of the current tax is directly contradictory million tax rate determine how much taxes reduce economic activity. The disruptive effect to taxes increases more than proportionally with the tax rate, so that that distortion from a the of the goal of progressivity. So although on the surface it appears the the tax satisfies 20 vertical income condition, itmore than double only from a lower income levelsand Gallaway percent equity tax rate is really does this that at the 10 percent. Vedder reducing the wealth of these loweston the available evidence that the cost of taxes may be 40 cents or more (1999) contend based income taxpayers, not the intended consequence. per dollar of revenue raised. Third, interest groups use resources to lobby politicians for increased 5.5: South CarolinaTullock (1967) labeled rent seeking. compared to Figure spending, what Gordon income tax: Current tax rates Resources spent trying to secure favors from government cannot be used to produce things of value like cars, inflation-indexed rates, 2009 clothes, homes, and computers, making society poorer. Income F Rates/Brackets if 1959 ENTREPRENEURSHIP: TURNING ECONOMICTaxREEDOM INTO Tax Current Income Tax Schedule was Inflation Adjusted to PROSPERITY Rates/Brackets 2009 Tax Tax Average Tax Rate Economists Average Tax Rate Taxable Income have made considerable progress over the past several years establishing Amount Amount entrepreneurship as the link between economic freedom and prosperity. This is not surprising as previously economists like Joseph Schumpeter, Ludwig von Mises, 2.5% and Israel Kirzner $5,000 $71 $125 1.42% Figure the entrepreneur is the agent of creative destruction and progress in the market argued that 12.4: Economic Freedom: South Carolina and Its Neighbors $10,000 $290 2.90%ideas for $250 Takings and 2.5% economy. The entrepreneur is the source of Size of new or improved products, new uses for Discriminatory 2.51% Market Labor $15,000 and new forms of economic organization. Entrepreneurship requires a free $604 existingState products, Overall Index 4.03% Government $377 Taxation market, because we cannot know what new ideas will be discovered, or from where these $20,000 $954 $527 4.77% 2.63% 6.0 (T-40th) how 6.7 (T-34th) freedom (T-1st) 8.4 increases South Carolina 6.8 (T-25th) ideas will come. Recent research documents economic th $30,000 $1,654 rd) 5.51% (T-14th) $834 entrepreneurial activity, (9th) 2.78% including North Carolina 7.5 7.3 entrepreneurship, using7.6variety of different measures of 7.5 (T-11th) a (T-3 th 7.7 7.5 7.4 Georgia sole proprietorships, 6.10% (12th) formation, (T-11 ) and venture capital.6 7.6 (T-3rd) $50,000 $3,054 $1,695 patents, 3.39% (T-10 ) the number of net business U.S. Average Taxes $75,000 and regulations like6.9 economic freedom) $4,804minimum wages6.9 $3,127 7.0 6.41% particularly (which affect 4.17% 6.8 Source: Karabegovic and McMahon (2008). negatively impact entrepreneurship. $100,000 $6,554 $4,877 6.56% 4.88% $150,000 $10,054 6.70% $8,377 5.58% $200,000 $13,554 $11,877 6.77% 5.94% Figure 12.5: Economic Freedom and Entrepreneurship

Figure 12.5: Economic Freedom and Entrepreneurship

Measure Figure 5.5 also shows Measure of of Entrepreneurship various incomes and taxes what the average tax rates are for Entrepreneurship State Ranked tax Index of Productive under Ranked onon system in South Carolina. In the right Percentage also shows what the the current columns of of Sole State Index of Productive Percentage it Sole Economic Freedomrates would be if the 1959 tax tables Proprietorships, 1990 & The Entrepreneurship taxes and average tax were indexed 1990 & Economic Freedom Entrepreneurship Proprietorships,for inflation. 2000 figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, 2000 Most Free 29.2 15.0 especially at higher levels of incomes. It keeps tax rates extremely low for the lowest income Most Free 29.2 15.0 Least Free the state. 21.4 14.8 individuals in Least FreeKarabegovic and McMahon (2008), Sobel (2008), Garrett and Wall (2006). 21.4 14.8 Sources: Sources: Figure 5.5 and McMahonthat theSobel (2008), Garrett and Wall (2006).income groups more in Karabegovic also shows (2008), current tax system charges all taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the table. As South Carolina income taxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

6

For evidence on the relationship between economic freedom and entrepreneurship see Kreft and Sobel (2005), Garrett and Wall (2006), Campbell and Rodgers (2007), and Sobel (2008).

234 18 18

UUNLEASHING CAPITALISM NLEASHING CAPITALISM

10

manufacturing property tax inin the country. In Figure 5.8 wefreedom the effective property of Figure property tax the country. In of economic present effective property tax manufacturing12.5 illustrates the impact Figure 5.8 we present theon two measures tax rates data for Southeastern states, for comparison. byThe ranks given for the states are index all entrepreneurship, sole proprietorships as reported The ranks and Wall (2006), and anout of of rates data for Southeastern states, for comparison. Garrett given for the states are out of all 50 states. The net tax and effective tax rate are calculated The Figureproperty valued mean productive The net tax and effective taxby Sobel calculated based on compares the atat $25 50 states. entrepreneurship constructed rate are (2008). based on property valued $25 millionof ($12.5million ininmachinery and equipment, $12.5 million inininventories, and $2.5 levels ($12.5 million in the five states with the highest million million entrepreneurship machinery and equipment, $12.5 economic freedom scores and inventories, and $2.5 million inin fixtures). Notice that South Carolinas effective taxeachon industrial property isis five states with the lowest economic freedom scores (plus ties in rate case). million fixtures). Notice that South Carolinas effective tax rate on industrial property over 7.8 timesCarolinathan the most industry-friendly state, Delaware. (Delaware isis listed in South higher than an most industry-friendly state, state ranked tied for listed in over 7.8 times higher faces the entrepreneurship deficit. TheDelaware. (Delaware last with the figure because it it is the lowest-tax state.) ahead of only West Virginia in 2000 (Garrett Mississippi becauseproprietorships in state.)and the figure in sole is the lowest-tax 1990 and Wall 2008), and tied for 29th in Sobels (2008) index of productive entrepreneurship. The entrepreneurship deficit must be closed for South Carolina to capture the full benefits of the market economy. Industrial Property Taxes in Southeastern states*, 2007 Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007 Figure 5.8: Can South Carolina take direct steps to generate entrepreneurship? Would-be State Rank (of 50) Net Tax State Net new Effective Tax Rate entrepreneurs will pointRank (of they could startTax businessesEffective Tax Rate access to out that 50) if they could obtain South Carolina 11 $1,864,900 3.73% South Carolina 3.73% venture capital or other types of subsidies. $1,864,900 State development policies were examined in detail Mississippi 7, and have an indistinguished record. Development incentives often in Chapter Mississippi 44 $1,291,050 2.58% $1,291,050 2.58% disadvantage new and small businesses, which lack the political clout to obtain such favors, 2.53% Texas 6 for $1,264,358 Texas $1,264,358 2.53% and face higher taxes to pay 6 the programs. Kreft and Sobel (2005) specifically examine Tennessee 10 $1,033,544 2.07% Tennessee 10 the relationship between venture capital and $1,033,544 entrepreneurship across 2.07% and found that states entrepreneurship attracts venture capital, while an increase in venture capital does not West Virginia 14 $833,234 1.67% West Virginia 14 $833,234 1.67% increase entrepreneurship. Kreft and Sobel (2005, 603) observe, entrepreneurial activity Louisiana 17 $783,407 1.57% 17 $783,407 1.57% must Louisiana be the focus of development efforts and venture funding will automatically, and Georgia 20 to $760,381 1.52% Georgia $760,381 1.52% naturally flow into the area20 support this activity. Entrepreneurship requires ideas and alertness for new profit opportunities, tasks for$677,683 governments have no comparative which state Florida 24 1.36% 1.36% Florida 24 $677,683 advantage. 1.11% Alabama 35 $533,776 Alabama 35 $533,776 1.11% Politicization of the economy affects entrepreneurship in a second way beyond simply North productive, wealth-generating activities. The human drive0.98% 37 $491,071 0.98%self-improvement 37 $491,071 North Carolina disrupting Carolina for does Kentucky not disappear as opportunities to pursue $327,100 the market are blocked. Instead, as profit in 0.65% 47 $327,100 Kentucky 47 0.65% William Baumol (1990) has argued, and as examined in Chapter 2, politicization of the Virginia 49 $241,498 0.48% 0.48% Virginia 49 $241,498 economy shifts entrepreneurship to socially unproductive forms like litigation or the pursuit Delaware 50 $238,840 Delaware 50 $238,840 0.48% of government subsidies and favors. The same creativity, alertness 0.48% and intelligence which Source: National Association of Manufacturers (2009) Source: generate newNational Association ofeconomy under good institutions become a drain on the wealth for the Manufacturers (2009) * Taxes measured inin the states largest city only. * Taxes measured We states largest city only. productive economy. the see political entrepreneurship at work when companies exploit state development incentives, and in the successful efforts of banks and automakers to obtain Importantly, South Carolinas effective tax rate Importantly, almost 2.5 times greater than government bailouts.South Carolinas effective tax rate isisalmost 2.5 times greater than Georgias tax, and almost 4 4 times greater than North Carolinas. This puts South Carolina at a Georgias tax, and almost times greater than North Carolinas. This puts South Carolina at a serious disadvantage, inin terms of its ability to attract and keep industry. Since South Carolina serious disadvantage, terms of its ability to attract and keep industry. Since South Carolina THEthehighest tax ininthe country Ponindustrial property,XCESSIVE no OVERNMENThas has theIMPERFECTIONS OF on industrial property, it should beG surprise that it it has highest tax the country OLITICS AND E it should be no surprise that has one of the lowest per capita incomes and economic growth rates inin the country. Sone of the lowest per capita incomes and economic growth rates the country. PENDING Although it it is probably not critical that South Carolina set its tax rate to the lowest in Although is probably not critical that South Carolina set its tax rate to the lowest in the country, it itshould definitely make it itandleast competitive for what governmentSince the country, should definitely make least demonstrates the Southeast. Since The economic analysis of institutions atat growthcompetitive forthe Southeast. must Georgias rate isis effectively 1.52 percent and North Carolinas isefficient courtpercent, a rate effectively 1.52secure property rights, provide is just under 1 1 system, rate percent and North Carolinas an just under percent, a and Georgias rate do to facilitate growth: maintain atataround 1 1percent might be like national toattract or moreindustry. Working to reduce the around percent might sufficient attract infrastructure. Working to reduce the supply important public goodsbesufficient todefense more industry. Then government must various taxes applied toto industry would seriously improve the states competitiveness. would seriously improve the states competitiveness. various taxes applied industryby taxing, spending, and regulating too much. South Carolina avoid politicizing the economy, Such a a significant reduction spending and addressing its entrepreneurship deficit. It Such significant reduction in taxes on industrial property would obviously lead to a particularly must control government in taxes on industrial property would obviously lead to a reduction inintax in revenueson industrial property, atatleast initially. However, the to overall reduction that revenues unleash capitalism, South Carolina voters need to work overall least initially. However, the elect might seem tax order to on industrial property, revenue may ininfactreduce spending. the growth rateinin the state begins to pick up andmore the state begins to pick up and more revenue who fact increase once politiciansmay will increase once the growth rate industry moves into the state. Furthermore, ifif the official tax attainare lowered, then the state official tax rates are lowered, then the state industry moves into the state. Furthermore, theis unlikely to rates this goal. To understand Yet direct political action, paradoxically, why, we must consider insights from the application of economic analysis to the political

11

Chapter 12: Constitutionally Constrain government CHAPTER 5: SPECIFIC TAX REFORMS

235 13

Presumably the economics. The vision of democracy emerging from public choice process, or public choiceoriginal intent of imposing a tax rate schedule with graduated marginal tax rates was to make the income school civics class. Political decision making scholarship contrasts sharply with the high tax progressive. However, what progressivity exists in the states income tax structure is duecomparison with market decision making and suffers from a number of serious problems in to the zero tax on the first $2,630 of income, and because of lead governmentmarginal tax rates. However,more than the average citizen these problems the graduated to spend too much, that is, since the marginal tax rate increases over such small steps inRepresentative government resultsmost budget progressivity would like government to spend. income, as shown in Figure 5.5, in a of the which is not occurs at lower income levels, not higher levels of income. At higher income levels, the merely larger than fiscal conservatives desire, but larger than the majority of voters prefer. average tax rate hardly increases ataall. This nature of the current tax is directly contradictory Democratic politics fails to deliver government of the size we desire.7 to the goal first element of politics leadingon the surface it appearsthe considerable powerthe The of progressivity. So although to excessive spending is that the tax satisfies to vertical equity condition, it possessed by this only agenda setters. income levels reducing that shape government decisions really does political at the lower Politics is like sports in the wealth upsthese lowest income taxpayers, not the intended consequence. match of matter. Some teams match up very well against some opponents but very poorly against others. If you could set the matchups in a playoff tournament, you could create a bracket to 5.5: South Carolina You couldtax:a Current tax rates compared to Figure help your favorite team. income go long way toward getting your favorite team to the championship merely by setting the matchups, even without blatantly cheating in inflation-indexed play short handed). A similar dynamic your teams favor (e.g., making their opponents rates, 2009 prevails in politics. Legislators can limit what bills their colleagues get to vote on, or if their colleagues can offer amendments during floor debate. Legislative leaders canifassign Tax Income Tax Rates/Brackets 1959 a bill Current Income Tax that the bill dies; agenda setting explains why they oppose to a hostile committee to ensure Schedule was Inflation Adjusted to Rates/Brackets the majority party in Congress or a state legislature has so much2009 power. Politicians and bureaucrats can also manipulate the ballot propositions and tax measures which citizens get to Tax Average Tax Rate vote on in elections. Voting andAverage Tax Rate down one outcome, allowing politicians elections never pin Tax Taxable Income Amount Amount to influence the eventual outcome. Given that politicians can benefit from spending money $5,000 $71 $125 1.42% 2.5% (providing benefits to grateful constituents or bureaucrats), they will take advantage of agenda power $10,000 government spending. to increase $290 $250 2.90% 2.5% We live in a representative and not a direct democracy, and this creates a second $15,000 $604 $377 2.51% problem, the control of politicians. A 4.03% can pursue his or her interests at constituents legislator $20,000 $527 4.77% 2.63% expense on some issues$954 because voters have only relatively weak means to control politicians. Reelection is the main$1,654 incentive citizens have to control their representatives; other types of $30,000 $834 5.51% 2.78% political action like sending letters or making phone calls and working for (or contributing to) $50,000 $3,054 $1,695 6.10% 3.39% a candidate eventually affect reelection prospects. Yet we elect legislators once every two or $75,000 $4,804 $3,127 6.41% 4.17% four years. Consequently all the votes, committee work, bills sponsored and hearings held over two (or four) years by an incumbent legislator $4,877 combined into one vote for or must be $100,000 $6,554 6.56% 4.88% against, and turning out the incumbent may mean electing a weak opponent. Citizens might $8,377 $150,000 $10,054 6.70% 5.58% have one or two issues which matter most to them, and vote for or against their legislator $13,554 $11,877 6.77% based $200,000 on their position on these issues. Beyond ones vote, the citizen has5.94% no further leverage to reward or punish any other actions by their representative. By contrast, firms can have their employees work for a shows what the average taxor pay are for various incomes and taxes Figure 5.5 also salary, or on commission, rates bonuses based on profit or team performance, offer promotions South Carolina. In the right columns also shows what for under the current tax system in and raises, and terminate employmentitrelatively quickly the unacceptable performance. would be if the 1959 years is a poor indexed for inflation. The taxes and average tax ratesOne election every two tax tables were control, leaving legislators comparatively broad discretion to indexed tax rate structure they or special interest groups figure clearly shows that the 1959 pursue policies that either is more uniformly progressive, prefer at the higher of constituents. especially at expenselevels of incomes. It keeps tax rates extremely low for the lowest income The third problem of politics is a lack of decisiveness for individual action, that is, individuals in the state. individuals can not directly decidethe current tax system charges all income groups more in Figure 5.5 also shows that political outcomes. In the market, our choices or actions decide what happens torate largely if not totally.exception is the you choose to buy soft drinks taxes than an indexed us, schedule. The only For example, if $5,000 income earner in the table. As South Carolina income taxes continue to climb while the tax brackets remain 7 stagnant, the state becomes a democracy ishigh-tax state. This (1962).aMueller (2003) provides a negative impact on The classic public choice analysis of relatively Buchanan and Tullock has

recent synthesis and overview, while Mitchell and Simmons (1994) provide a very readable treatment. For an analysis of the differences in the pathologies of politics at the level of the individual citizen, see Caplan (2007).

236 18 18

UUNLEASHING CAPITALISM NLEASHING CAPITALISM

12 12

manufacturing water at tax grocery store, Inyouwill 5.8 we present witheffective property can and not bottled propertyatthe inin the country.youFigurecome home with soft drinks. We cantax and not bottled property tax grocery store, In will 5.8 wehome the soft drinks. We tax the the country. Figure come present the effective property manufacturing water rates what for Southeastern states, if comparison. The aranks giveneventhe states we cannot all decide data for careerto pursue, or forwe want to start ranks given for thethough are out of all decide data career to pursue, orifforwe want to start abusiness, for states are out of rates what Southeastern states, comparison. The business, even though we cannot 50 states. The net tax and effective tax can are or volunteer or on propertymoney to your guarantee ourselves success. Ineffectiveyourate votecalculated based contribute money to atat $25 guarantee ourselves success. In politics tax rate votecalculated basedcontribute valued your 50 states. The net tax and politics you can are or volunteer or on property valued $25 million ($12.5 million in yet still endandequipment,other outcome. In inventories, actions favorite candidate million inmachinery endup equipment,$12.5 outcome.inInpolitics, our and $2.5 favorite candidateor cause, machinery upwith the other million in inventories, and $2.5 with the $12.5 million politics, our actions million ($12.5 or cause, yet still and million inin fixtures). Notice thatvote only actually effective tie election,industrial property rarely determine outcomes: your vote onlyCarolinasdecides ataxelection, and elections almostisis rarely determine outcomes: your South Carolinas decides a tie rate on and elections almost million fixtures). Notice that South actually effective tax rate on industrial property over end in ties.higher weak the most industry-friendly state, outcomes gives people little never 7.8 timesties.The than the correlationbetween action and Delaware. (Delaware is listed in never end times The than correlation between action and outcomes gives people little over 7.8 in higher weak most industry-friendly state, Delaware. (Delaware is listed in the figure participateitinthe lowest-tax take time off work to go stand in line your vote reasonfigure because inis politicswhy state.)time off work to go stand in line ififyour vote isis reasonto participate is politics why take the to because it the lowest-tax state.) unlikely to matter? This also reduces the incentive for people to become informed about unlikely to matter? This also reduces the incentive for people to become informed about politics candidates in elections, ballot propositions, and bills under consideration. The lack politics candidates in elections, ballot propositions, and bills under consideration. The lack of incentive to5.8: Industrial known as rational ignorance. The lack of decisiveness also of Figure 5.8: Industrial is Propertyrational in Southeastern ofstates*, 2007 incentive tofollow politics isProperty Taxes ignorance. The lack states*, 2007 Figure follow politics known as Taxes in Southeastern decisiveness also lowers the cost of voting to make a astatement without regard to the actual consequences of a a lowers the cost of voting to make statement without regard to the actual consequences of State Rank (of Net Tax policy. ThusState might vote to50) policy. Thuspeople might vote50) increasethe Tax people Rank (of toincrease Net minimum wage toEffectivethatthey care about the minimum wageEffectivethat Rate care about toshow Tax they show Tax Rate South Carolina 11 $1,864,900 South poor, $1,864,900 3.73% the workingCarolina eventhough a ahigher minimum wage increases unemployment for low the workingpoor, even though higher minimum wage increases 3.73% unemployment for low 88 wage workers. wage workers. Mississippi 44 $1,291,050 2.58% Mississippi $1,291,050 2.58% Together the problems of politics create a a bias toward excessive spending in Together the problems of politics create bias toward excessive spending in Texas 66 Texas $1,264,358 2.53% representative democracy through the law $1,264,358 representative democracy through the lawof concentrated benefits2.53% dispersedcosts.9 9 of concentrated benefitsand dispersed costs. and Tennessee $1,033,544 2.07% 2.07% 10 $1,033,544 AgendaTennesseecreatesthe ability for politicians to pursue policies benefitting themselves or Agendacontrol creates the 10 control ability for politicians to pursue policies benefitting themselves or interestWest Virginia infrequent elections are a$833,234deviceto prevent such manipulation. interestgroups, and infrequent elections are aweak device to prevent such manipulation. groups, and weak West Virginia 14 1.67% 14 $833,234 1.67% Bureaucrats and government employees will favor increased spending which leads to higher Bureaucrats and government employees will favor increased spending which leads to higher Louisiana 17 $783,407 1.57% Louisiana 17 1.57% salaries, larger staffs, greater prestige from controlling a a larger budget, and additional salaries, larger staffs, greater prestige from $783,407 controlling larger budget, and additional Georgia 1.52% Georgia 20 $760,381 resources to pursue their mission, and will $760,381 representatives1.52% deliver larger resources to pursue their 20 mission, and will support representatives who deliver larger support who 10 10 budgets. Politicians can take24creditfor government spending to address a a problem,like say budgets. Politicians can take Florida 24credit for government spending to address problem, like say $677,683 1.36% 1.36% Florida $677,683 hiring more police officers to fight crime, building more prisons, or raising teacher salaries. hiring more police officers to fight crime, building more prisons, or raising teacher salaries. 1.11% Alabama 35 $533,776 Alabama 35 $533,776 1.11% Because of the weak connection between participation and outcomes in politics, only people Because of the weak connection between participation and outcomes in politics, only people 37 follow the issue and get involved. Generally these are the 0.98% $491,071 0.98% North atstake with a a lot atCarolina tend to 37 with North Carolina tend tofollow the issue$491,071 involved. Generally these are the lot stake and get beneficiaries of government 47 beneficiaries of government spending, as the costs of government spending - higher taxes and spending, as the costs of government spending - higher taxes and 0.65% Kentucky $327,100 Kentucky 47 $327,100 0.65% reduced disposable income for families - -are widely dispersed, and rarely result in press reduced disposable income for families are widely dispersed, and rarely result in press Virginia 49 $241,498 0.48% 0.48% Virginia 49 $241,498 conferences or photo opportunities. For example, there are about 70,000 full-time public conferences or photo opportunities. For example, there are about 70,000 full-time public Delaware teachers in South Carolina, andabout 1.77 million households in the state. 50 0.48% 50 $238,840 0.48% school (K-12) teachers in South Carolina, and $238,840 million households in the state. IfIf schoolDelaware (K-12) about 1.77 Source: National appropriated funds to give each Source: National appropriated funds to (2009) the state governmentAssociation ofof Manufacturers (2009) teacher a a $5,000 per year raise, the cost the state government Association Manufacturersgive each teacher $5,000 per year raise, the cost * Taxes measured inin the states largest city only. * Taxes would be about $200 per year. per household measured be about $200 per year. Two hundred dollars is not a trivial sum, but the per household would the states largest city only.Two hundred dollars is not a trivial sum, but the average teacher has much more at stake than the average taxpayer. So itit is notsurprising that average teacher has much more at stake than the average taxpayer. So is not surprising that Importantly, South rally at the effective tax when thelegislature times greater than teachers Importantly, South rally at the effective tax when isisalmost 2.5 times greater than teachersand not taxpayers Carolinas state capitol rate the almost 2.5 considers school and not taxpayers Carolinas state capitol rate legislature considers school GeorgiasPowerful almost 4unionswill lobby Northmake campaign contributionsto support a Georgias tax, and almost times will than North Carolinas. This puts South to support funding. Powerful teachers4unions greaterlobbyand make campaign contributionsCarolina atat a funding. tax, and teachers times greater than and Carolinas. This puts South Carolina serious disadvantage, inin terms of itson public schools.11 keep industry. Since South Carolina serious disadvantage, terms of its on public schools. Politicians will find South Carolina legislators votes to increase spendingability to attract and11 keep industry. find that voting for legislators votes to increase spending ability to attract and Politicians willSincethat voting for has the spendingtax in the country on industrial property, it should be no surprise that it has has the spending in the country on industrial property, it should be no surprise that it has increasedhighest tax brings them benefits. increased highest brings them benefits. one of the lowest per capita incomes and economic growth rates inin the country. one of the lowest per capita incomes and economic growth rates the country. Although it it is probably not critical that South Carolina set its tax rate to the lowest in Although is probably not critical that South Carolina set its tax rate to the lowest in the country, it itshould definitely make it itatatleast competitive for the Southeast. Since the country, should definitely make least competitive for the Southeast. Since Georgias rate isis effectively 1.52 percent and North Carolinas is just under 1 percent, a rate effectively 1.52 percent and North Carolinas is just under 1 percent, a rate Georgias rate atataround 1 1percent might be sufficient totoattract more industry. Working to reduce the around percent might be sufficient attract more industry. Working to reduce the various taxes Lomasky(1993) call this would ofvoting expressive the states competitiveness. applied industry would variousand Lomasky toto industry type of seriously improvevoting and analyze such incentives inin taxes applied(1993) call this typeseriously improve the states competitiveness. 8 8 Brennan and Brennan voting expressive voting and analyze such incentives Such a a Caplan (2007) on howin lackofofindustrial property far-ranging effects lead to taxes industrial can have would obviously voters democracy. Such alsoCaplan (2007) on howin thelack on decisiveness property far-ranging effects on lead to a democracy. Seealso significant reduction the taxes on decisivenesscan have would obviously onvoters a See significant reduction reduction views. revenues on industrial property, reduction tax least initially. However, the overall political worldinviews. revenues on industrial property, atatleast initially. However, the overall political world intax 9 9 Buchanan and Wagner (1977) offer an once thedissection of democratic politics pro-spending bias. and more Buchanan and Wagner (1977) offeronce the growth rate democratic politics pro-spending up and more an excellent dissectionrate in the state begins to pickbias. excellent growth of in the state begins to pick up revenue may ininfact increase revenue may fact increase 1010 Niskanen (1971) into the thestate. Furthermore, the official tax rates are lowered, then the state Niskanen moves into the pro-spending bias government bureaucracy. industry movesanalyzes the pro-spending bias ofof ifif the official tax rates are lowered, then the state industry (1971) analyzes state. Furthermore,government bureaucracy. 1111

For a a discussion of how these forces over time affect representatives and generate a Culture of Spending, For discussion of how these forces over time affect representatives and generate a Culture of Spending, see Payne (1991). see Payne (1991).

13

Chapter 12: Constitutionally Constrain government CHAPTER 5: SPECIFIC TAX REFORMS

237 13