Professional Documents

Culture Documents

The Youth Market For Internet Banking Services: Perceptions, Attitude and Behaviour

The Youth Market For Internet Banking Services: Perceptions, Attitude and Behaviour

Uploaded by

andra_deea90Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Youth Market For Internet Banking Services: Perceptions, Attitude and Behaviour

The Youth Market For Internet Banking Services: Perceptions, Attitude and Behaviour

Uploaded by

andra_deea90Copyright:

Available Formats

The youth market for internet banking services: perceptions, attitude and behaviour

Vinh Sum Chau

Norwich Business School, University of East Anglia, Norwich, UK, and

Liqing W .L.C. Ngai

KellinWell-HK Electronics and Computing Ltd, Kowloon, Hong Kong

Abstract Purpose This paper aims to investigate the perceptions, attitudes and behaviour of the youth market for internet banking services (IBS). Design/methodology/approach A survey was carried out to acquire data from 164 respondents. The respondents were competent computer users and studying for a degree at a university. Three additional in-depth interviews were subsequently carried out on interesting cases. Findings The authors nd that young people (age 16-29) have more positive attitudes and behavioural intentions towards using IBS than other usergroups. It has also conrmed that there is a positive impact of IBS quality on satisfaction and loyalty. Research limitations/implications The study focused on an isolated convenience sample of university students in the UK. The ndings might not therefore have worldwide signicance despite a large proportion of the students were international and from a good representation of minority ethic groups. Originality/value The research focused on a specic segment of the internet banking services market younger students at a UK university. The ndings are useful for bank services marketing as the young are likely to become the most important segment of users as the worldwide web and banking services become more advanced in the future. Keywords Virtual banking, United Kingdom, Customer satisfaction, Customer services quality, Market segmentation, Young adults Paper type Research paper

An executive summary for managers and executive readers can be found at the end of this article.

Introduction

It has been over a decade since the mass internet revolution, transforming mundane house-hold chores into point-andclick activities: internet banking services (IBS) was one of them. However, many customers are still not using IBS (Gerrard et al., 2006). For those who do, they are not necessarily fully satised with the quality or experience of use (Walker and Johnson, 2005), and there is a whole host of reasons for use relating to demographic and self-awareness concerns as capacity to engage, perceived risks, and potential advantages of use (Walker and Johnson, 2006). For the banking industry, the internet provides excellent opportunity for attracting a specic segment of customers, particularly the young, who hold the greatest prospect for loan and mortgage borrowing in the future (Lewis and Bingham, 1991). This paper focuses on the youth market (we regard this as the agegroup 16-29) with a good educational background. The success of a nancial service hinges on identifying the right segments and then targeting its marketing programs to reach the selected segments (McKechnie, 1992). The importance of

The current issue and full text archive of this journal is available at www.emeraldinsight.com/0887-6045.htm

segmentation in the nancial institution sector has been well documented (e.g. Gwin and Lindgren, 1982; Speed and Smith, 1992), but it is still not fully understood why some segments are not attracted by it (Polatoglu and Ekin, 2001; Rotchanakitumnuai and Speece, 2003; Sathye, 1999). This paper explores specically young customers beliefs, attitude and behaviour towards the adoption of IBS. We start by establishing some research hypotheses, based on extant literature, in the areas of services and banking marketing and service quality. With this research framework, we draw ndings from data collected from a questionnaire aimed at an institution where the respondent group is most likely to fall within a sample group of being young, educated, and have close vicinity to internet services a university.

Segmenting banking customers

Demography is a popular basis for segmentation, and is easier to recognise and measure than most other variables (Meidan, 1996), particularly the age of the consumer (Stanley et al., 1985). Financial institutions have responded to age segments with the development of a number of different products and services (Lewis, 1981; Lewis and Bingham, 1991). Lewis et al. (1994) suggest that young people have been characterised as emphasising the importance of material possessions, being more concerned with consumption than saving, and seeing money as vital for personal success. This inevitably leads to a variety of credit behaviours and borrowing requirements.

Received: June 2007 Revised: November 2007 Accepted: February 2008

Journal of Services Marketing 24/1 (2010) 42 60 q Emerald Group Publishing Limited [ISSN 0887-6045] [DOI 10.1108/08876041011017880]

42

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

With the increasing use of new technologies in marketing, traditional methods of segmentation are not adequate and efcient predictors of future buyer behaviour (McDougall and Levesque, 1994). Benet segmentation is proposed as a more effective method, which partitions customers according to the benets they seek when purchasing a product or service (Minhas and Jacobs, 1996). For banking services, four core customer segments exist: the branch segment, the telephone segment, the PC segment and the internet segment (Mols et al., 1999). With the widespread use and adoption of the internet, it is suggested the future retail banking structure will consist of a few banks and many banks will rely on the internet as their main distribution channel (Jayawardhena and Foley, 2000). Alfans and Sargeant (2000) nd that it is possible to relate perceived product/service benets to one or more general observable characteristics such as gender, age, and income, etc. McDougall and Levesque (1994) conrm this nding proportionally younger customers belonging to the convenience segment, such as the PC/internet segment (Katz and Aspden, 1997) and internet and e-commerce users, are predominantly young (cf. Crisp et al., 1997). In relation to internet banking in the youth market, we hypothesise that: H1a,b. There is a negative association between age and attitude/intention towards using internet banking services (IBS).

Attitude and behaviour

Being able to predict customers future behaviour is a critical aspect of developing successful marketing strategies. It is therefore important for a marketer to understand and inuence consumers behaviour. We focus on the theory of reasoned action (TRA) and the technology acceptance model (TAM) to postulate an internet banking adoption research framework to guide the study. Theory of reasoned action (TRA) An important concept in the study of consumer behaviour is consumer attitude, which has been dened as a persons overall evaluation of a concept (Peter et al., 1999), which assumes that the more positive a persons overall evaluation of a product/brand, the more likely the person is to buy or use it. In many cases, however, knowledge of a persons attitude is not a good predictor of behaviour. Fishbein and Ajzens (1975) theory of reasoned action (TRA) is a widely studied theoretical model of consumer behaviour (Ajzen and Fishbein, 1980; Davis, 1989; Ha, 1998). TRA was developed to explain how a consumer is lead to a certain buying behaviour. It asserts that actual behaviour follows from behavioural intention and that behavioural intention is formed by ones attitude towards behaviour and subjective norm. Technology acceptance model (TAM) The technology acceptance model (TAM) introduced by Davis (1989) is an adaptation of TRA specically tailored to explain the use of information technology. The purpose of TAM is to explain the determinants of computer acceptance and user behaviour across a broad range of new technologies (Davis and Venkatesh, 1996). Based on TRA, TAM focuses 43

on two perceptions perceived usefulness and perceived ease of use, to predict users acceptance of new technology. Perceived usefulness is seen as the degree to which a person believes that a particular system would enhance his or her job performance, and perceived ease of use, in contrast, refers to the degree to which a person believes that using a particular system would be free of effort (Davis, 1989), both of which are determinants of attitude towards usage intentions and actual information technology usage. Any other factors not explicitly included in the model are expected to inuence intentions and usage through perceived ease of use and usefulness (Davis et al., 1989). These external variables might include system design features, training, computer selfefcacy, user involvement in design, and the nature of the implementation process (Venkatesh and Davis, 1996). Some have over the years added constructs to TAM to enhance its predictive power, such as social inuence (Malhotra and Galletta, 1999), prior experience (Taylor and Todd, 1995a), and availability of user training and support (Karahanna and Straub, 1999). The internet is different from, and of course newer than, existing technologies, such as conventional telecommunications for which customer service expectations are well established (for example, see Chau, 2002). As the internet provides the promise of a new direct interactive shopping/communications channel that is not bounded by time or geography, studies that have applied a simple TAM approach for how people accept the web or e-commerce is unlikely to accurately predict acceptance; this is because a conventional TAM approach would normally take such issues as time taken for the transaction or the physical ease of accessing the technology as key factors of consideration, whereas access to the internet for banking services is immediate (for security and encryption purposes), operates in a real time context, and the banking service is accessible from any internet terminal located anywhere in the world. Internet banking adoption research framework Based on the above TRA and TAM, we postulate an internet banking adoption research framework (Figure 1) to establish further hypotheses. The variables for examination used in the study were as follows: Self-efcacy Self-efcacy refers to individuals beliefs in their ability to perform certain actions (Bandura, 1977, 1982), and is regarded as a major determinant of choice activities, degree of effort, period of persistence, and level of performance in challenging situations (Yi and Venkatesh, 1996). In this study, self-efcacy is referred to as an individuals perceived ability to use IBS. Studies on the effects of self-efcacy point to its crucial role in determining individual behaviour towards using information technologies (e.g. Compeau and Higgins, 1995; Taylor and Todd, 1995b). Venkatesh and Davis (1996) support the role of an individuals self-efcacy as an antecedent and determinant of ease-of-use of new technology. In other words, users with higher self-efcacy are more willing to learn a new technology. Hence, we hypothesise that: H2. Young customers self-efcacy is positively associated with their perceived ease of use of IBS.

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Figure 1 Research framework 1: internet banking adoption research framework

Perceived risk The concept of perceived risk was rst introduced to explain such phenomena as information seeking, brand loyalty, opinion leaders, reference groups and pre-purchase deliberations (Bauer, 1964), asserting that consumer behaviour involves a risk that any action of a consumer may lead to unpleasant consequences (Ho and Ng, 1994; Cox, 1967; Peter and Ryan, 1976; Stone and Gronhaug, 1993). Jarvennpaa and Todd (1996) identify ve types of risk in online shopping: 1 Economic risk (the risk of monetary loss arising from online shopping). 2 Social risk (acceptance of online shopping behaviour by other society members, such as family members, friends, etc.). 3 Performance risk (whether the purchased products or services are able to meet customers expectation). 4 Personal risk (risk of any harm to the customers because of the purchase behaviour). 5 Privacy risk (loss of right of privacy). These risks are used in the present study and assumed appropriate for IBS. Consumers are more likely to associate a higher level of risk with non-store purchases, such as through the internet (Cox and Rich, 1964; Engel and Blackwell, 1970; Simpson and Lakner, 1993; Tan, 1999), than with in-store purchase decisions (Akaah and Korgaonkar, 1988). Purchasing methods that are riskier are therefore assumed to be less used (to avoid the risk), and by analogy are perceived as less useful. Hence, we expect that customers perceive a higher level of risk when using IBS than through in-store means, and therefore nd IBS less useful. We hypothesise the same analogy for young customers that: H3. Young customers perceived risk is negatively associated with their perceived usefulness of IBS.

inuence on technology acceptance behaviours has been acknowledged (Schmitz and Fulk, 1991). Karahanna and Straub (1999) report that the existence of a strong relationship between social inuence and technology usage via perceived usefulness suggests that social inuence might be operating via the process of internalisation. TRA posits that social inuence has a direct effect on behavioural intention (Ajzen and Fishbein, 1980; Fishbein and Ajzen, 1975). Davis et al. (1989) anticipate that social inuence might inuence behavioural intention directly via compliance. However, Malhotra and Galletta (1999) suggest that processes of social inuence have no direct effect on behavioural intention. Thus, this study tests the following two hypotheses: H4a,b,c. Young customers feeling of compliance/ identication/internalisation generated by social inuence is positively associated with their perceived usefulness of IBS. Young customers feeling of compliance/ identication/internalisation generated by social inuence is positively associated with their behavioural intention to the use of IBS.

H5a,b,c.

Perceived ease of use and perceived usefulness To gain a better understanding of the cognitive processes people use to respond to IT regarding beliefs, attitudes, intention and behaviour, the effects of perceived ease of use/ perceived usefulness on attitude and usage intention are both considered. The easier to use the technology, and the more useful it is perceived to be, the more positive ones attitude and intention towards using that technology. Correspondingly, the usage of the technology increases. Therefore, this study tests the following ve hypotheses: Young customers perceived ease of use (EOU) of IBS is positively associated with their attitude towards the use of IBS. H7 Young customers perceived usefulness (U) of IBS is positively associated with their attitude towards the use of IBS. H8. Young customers perceived ease of use (EOU) of IBS is positively associated with their behavioural intention to the use of IBS. H9. Young customers perceived usefulness (U) of IBS is positively associated with their behavioural intention to the use of IBS. H10. Young customers attitude towards the use of IBS is positively associated with their behavioural intention to the use of IBS. H6. 44

Social inuence Social inuence attempts to understand the changes brought about in individuals attitude by external inputs, such as information communicated to them. In TRA, Fishbein and Ajzen (1975) used the term subjective norm to describe social inuence. Kelman (1958) suggested that individual behaviour affected by social inuence might occur at three different stages: compliance, identication and internalisation. Applied to a new information system, the social inuence process determines the individual users commitment to the use of any new information technology (Malhotra and Galletta, 1999). The salience of social

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Service quality, customer satisfaction and customer loyalty

E-commerce changes the relationships between sellers and buyers dramatically. One of the business sectors most heavily affected is banking (Methlie and Nysveen, 1999), and as the web becomes more mainstream and increasingly larger proportions of the population become web users, the more complex the challenge of establishing and maintaining customer loyalty becomes (Windham, 2000). The relationship between service quality and customer satisfaction Product/service quality is a key element of a business achievement (Dale, 1999). As a critical measure of organisational performance, service quality remains at the forefront of the services marketing (Jensen and Markland, 1996; Cox and Dale, 2001). Adequate tools for measuring service quality are one of the important issues of service quality (Lee et al., 2000). The two most well-known and widely accepted measurement tools are the SERVQUAL model (Parasuraman et al., 1985, 1988) and the technical/ functional quality model (Gro nroos, 1983, 1990). SERVQUAL regards service quality as a function of customer pre-purchase expectations, perceived process quality and perceived output quality. Service quality is the gap between customers expectations of service and their perceptions of the service experience. In the functional/ technical quality model, what the consumer receives in his/her interactions with the service rm is the technical quality and how the customer receives a service is the functional quality; it is used less extensively than SERVQUAL (Lassar et al., 2000), and is argued to be less useful than SERVQUAL (Joseph et al., 1999; Cronin and Taylor, 1992), although perhaps a combination of the models may be helpful (Berry and Parasuraman, 1997). Service quality is especially important for the interface between customer and internet (Cox and Dale, 2001). The differences between the physical service environment and the website interface are key factors in suggesting whether previous service quality research is applicable to the ebusiness environment. In the technical/functional quality model, the technical quality of IBS is the quality of the nancial service provided by the bank through its website. In a traditional banking service, the interaction between bank and customers is interpersonal, that is, between the representatives of the bank and the customers. Lassar et al. (2000) measure a banks functional quality by assessing customers views of the bank representatives. Since IBS is delivered over the internet, the representative of the bank is its website. Thus, the quality of the bank website determines the functional quality of this service. WebQual is a method introduced by Barnes and Vidgen (2000a, b, c, 2001) for assessing the quality of websites. Customer satisfaction is regarded as the feeling or attitude of a consumer towards a product/service after it has been used (Solomon, 1996; Wells and Prensky, 1996), and this is important for establishing customer loyalty (Metawa and Almossawi, 1998; Cronin and Taylor, 1992). Although the relationship of the quality/satisfaction (i.e. quality leads to satisfaction) is fairly well understood for services, there is a dearth of empirical research on the quality/satisfaction relationship for IBS. This is particularly so for IBS quality/ 45

satisfaction from the technical/functional quality model perspective. If this relationship is consistent with previous studies, marketers can identify which categories of IBS quality is more important to young customers (i.e. technical or functional). Thus, the study tests the hypothesis: H11a,b. Young customers evaluation of technical/ functional quality of IBS is positively associated with their technical/functional quality satisfaction of IBS.

The relationship between customer satisfaction and customer loyalty Draker et al. (1998) divide the construct of loyalty into its behavioural, cognitive and affective elements. Behavioural loyalty is a customers actual purchase behaviour; cognitive loyalty is the intentions of future behaviour expressed by the customer; and affective loyalty is the attitude of the customer to the company. Customer satisfaction is considered a necessary condition for customer retention and loyalty. Stauss and Neuhaus (1997) argue that although it seems perfectly logical that dissatised customers are more willing to break up a relationship than satised customers (e.g. Bloemer et al. 1998; Nguyen and LeBlanc, 1998), it is doubted if satisfaction is a sufcient guarantee for customer loyalty. We therefore hypothesise that: H12a,b. Young customers technical/functional quality satisfaction of IBS provided by an internet bank is positively associated with their loyalty to this bank.

There is some work on the indirect effect of service quality on customer loyalty and the mediating role of corporate image on customers loyalty (e.g. Bloemer et al., 1998; Nguyen and LeBlanc, 1998), focusing on the complex relationships between image, service quality, customer satisfaction and customer loyalty. For simplicity, our study investigates only the direct relationship between IBS quality, customer satisfaction and customer loyalty, as shown in Figure 2.

Methodology

Sample and data collection A face-to-face administered questionnaire was used to collect data from a quota sample of at least 50 respondents from the young and non-young age groups (to ensure a more than statistically signicant comparison can be made between the groups); it was also a convenience sample because data collection took place at an IT suite of a university located in the East Anglia region of the UK where it was certain that a young, well-educated and IT-minded sample would be found. Data collection took place over a one-week period, with a response rate of approximately 70 per cent of those approached, and data collection ceased when there did not seem to be any new people available. Data from 164 respondents were collected, of which 84 were from the younger group (aged 16-29 years) and the remainder were from non-young group (aged 30 ). Of the 84 young respondents, 41 were IBS users and 43 were nonIBS users. To test our hypotheses, the data were separated as follows: (dataset A) a sample which includes four age groups (ages 16-29, 30-39, 40-49, 50 ); (dataset B) a sample aged 16-29 years (based on dataset A); and (dataset C) a sample

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Figure 2 Research framework 2: service quality-customer satisfaction-customer loyalty relationship

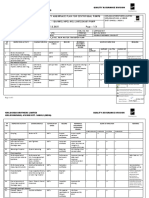

aged 16-29 who used IBS (based on dataset B). Three additional in-depth interviews (dataset Q) were conducted on interesting cases that helped to clarify the points made in the discussion of the ndings. No specic interview schedule was used for this as this would have over-burdened the respondent; instead, questions were only asked to clarify matters. Table I summarises the demographics of the sample. Measures used in the questionnaire The questionnaire design was based primarily on multipleitem measurement scales taken from previous research (Baker, 1991; Churchill, 1979), and all the instruments were developed using seven-point rating scales (Green and Rao, 1970). To ensure adequate wording for the questionnaire (Oppenhein, 1996), a pilot test was conducted on 20 respondents and one practice interview, after which modications were made before the real data collection. The questionnaire (Appendix 1) is composed of three sections. Section 1 was to determine whether age is related to attitude and behavioural intentions towards using IBS. Based on Ajzen and Fishbein (1980), a four-item attitude scale was developed. A semantic differential bi-polar rating scale was used to measure the respondents attitude towards using IBS (Churchill, 1995). The instrument asked the individuals to rate the four items according to their views on IBS. These items used a seven-point scale with the following adjectives: bad/good, harmful/benecial, foolish/wise, and negative/ positive, consistent with extant TAM research (e.g. Malhotra and Galletta, 1999). Behavioural intention was measured by asking to indicate how likely respondents were to use IBS in the future (ceteris paribus). Section 2 was to measure the following components of our research framework: external variables (self-efcacy, perceived risk and social inuence), perceived usefulness, Table I Sample demographics

Dataset A Questions Section 1 Respondent age range 16-291 30-39 40-49 50 16-292 16-293

and perceived ease of use of IBS, so to examine how these relate to one another and to respondent attitudes and behavioural intentions towards the use of IBS. To limit the number of questions in the study, self-efcacy was measured using a three-item scale based on Taylor and Todd (1995b), and the respondents were asked to give their level of agreement or disagreement on a seven-point Likert scale anchored with the values strongly disagree (value 1) and strongly agree (value 7). The instrument used to measure consumers perceived risk was developed from Jarvenpaa and Todds (1996) descriptions of types of perceived risk in online shopping. The respondents were given three unfavourable statements and asked to indicate the likelihood of each happening. An extra statement was given to measure the respondents overall risk perceptions when considering all the factors combined. Social inuence was measured in terms of Kelmans (1958) three processes of social inuence compliance, identication and internalisation. Malhotra and Gallettas (1999) 12-item scale was adjusted to measure the social inuence on the adoption of IBS. The items used to construct perceived usefulness (U) and perceived ease of use (EOU) were adopted from Davis and Venkatesh (1996). Individuals were asked to indicate the extent of agreement or disagreement with four statements for U and four statements for EOU, also based on a seven-point scale. Section 3 was to determine the relationship of IBS users opinions of the quality of IBS, their satisfaction with IBS and loyalty to the internet bank. IBS quality was measured from the technical/functional quality perspective of service quality. Based on Lassar et al. (2000), an eight-item, seven-point Likert-type scale was developed to measure the technical quality of IBS (shown at Appendix 2). Functional quality of IBS was measured using WebQual 4.0, developed by Barnes and Vidgen (2001), to assess the quality of the websites. The respondents were asked to evaluate the website of the bank by

Total 84 27 27 26 164 84 84 41

Number Male 43 14 14 13 84 43 43 21

Female 41 13 13 13 80 41 41 20

Percentage of sample 51.2 16.5 16.5 15.9 100 100 100 100

Total B Total C

Total Q Total Notes:

1, 2

Section 1 Section 2 Section 1 Section 2 Section 3 Open interview

16-294

41 3 3

21 1 1

20 2 2

100 100 100

Were the same group of respondents; 3Was chosen from 2; 4Was chosen from 3

46

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

using a 20-item, seven-point Likert scale (shown as Appendix 3) where the anchors are 1 strongly disagree and 7 strongly agree. Customer satisfaction was measured using a two-item, seven-point numeric rating Likert-type scale. These two items were to capture the respondents overall satisfaction with the functional quality of IBS and their overall satisfaction with the technical quality of IBS which accords with Nguyen and LeBlanc (1998) so two behavioural intention items were also used as surrogate indicators of loyalty.

a more positive intention to use IBS in the future than people in other age groups. Dataset B: internet banking adoption research framework We assume a linear relationship between self-efcacy and perceived ease of use. To test H2 for the correlation between these two variables, each respondents average self-efcacy score and average perceived ease of use score was calculated. The Pearson correlation coefcient (r) for the relationship of self-efcacy to perceived ease of use was 0.689 ( p , 0.01), accepting H2 that self-efcacy and perceived ease of use are strongly and positively related. The correlation coefcients for all the other variables were also calculated, and presented in Table IV. An overview of the correlation between perceived risk and perceived usefulness, and the correlation between compliance/identication/internalisation and perceived usefulness shows that all of the correlation coefcients are signicant ( p , 0.01). There is a negative relationship between perceived risk and perceived usefulness (r 20:576), compliance and perceived usefulness (r 20:261), and a positive relationship between identication and perceived usefulness (r 0:569), and internalisation and perceived usefulness (r 0:579). Therefore, H3 and H4b/H4c may be accepted, while H4a must be rejected. Some independent sample t-tests were conducted to explore the signicant differences between those who use (yes) and do not (no) for each of the test variables (as shown in Table V). The mean scores of self-efcacy experienced by IBS users and non-IBS users were 5.861 and 4.581 respectively. An observed t-value of 4.678 was attained ( p , 0.05; df 82) concluding that IBS users do experience signicantly higher levels of self-efcacy than nonIBS users. To gain further insight into the effects of the relevant variables on perceived usefulness of IBS, the multiple regression analysis was used. Thus, a regression model can be specied: U b0 b1 RISK b2 SOCOM b3 SOIDE b4 SOINT 1. . . 1

Findings and data analysis

Dataset A: segmentation To test H1a/H1b for the difference between the means of respondents attitude and behavioural intention towards using IBS, a one-way analysis of variance test (ANOVA) was used. The mean scores of the attitude of the respondents aged 1629, 30-39, 40-49, and 50 , were 5.693, 5.509, 4.444 and 3.567 (F 38:860, p , 0.01) respectively (shown at Table II). This suggests that most people aged 16-29 and 30-39 have a positive attitude towards using IBS whereas most people aged 40-49 have a neutral attitude and most people aged 50 have a negative attitude. A Tukey HSD post hoc test was then conducted to make multiple pairwise comparisons among the means of the attitude variable of each age group to establish which were signicantly different from each other. The multiple comparisons indicate that the average mean scores of the attitude for both age groups of 16-29 and 30-39 are signicantly different from those of the other age groups but not from each others (Table III). The average mean score of the attitude of the age group of 40-49 differed signicantly from that of the age group 50 . The age group 16-29 recorded the highest attitude scores with the age group 50 recording the lowest. Therefore, H1a can be accepted that there is a negative association between age and attitude towards using IBS. Similarly, the calculated mean scores of behavioural intention of the respondent ages 16-29, 30-39, 40-49 and 50 were 5.333, 4.543, 3.481 and 2.205 respectively (shown at Table II) (F 33:336, p , 0.01), and indicates that most people aged 16-29 were more likely to use IBS in the future than other age groups. The average intention mean scores for age groups 16-29 and 30-39 are signicantly different from those of other age groups, but not from each other (shown at Table III). The average intention mean score for the age group of 40-49 differed signicantly from that of the age group of 50 . The ANOVA results suggest that H1b can be accepted, that there is a negative association between age and behavioural intention to use IBS and people aged 16-29 have Table II Descriptive data on attitude and intention towards the use of IBS

Age 16-29 30-39 40-49 50 1 Total

The explained variance of U by RISK, SOCOM, SOIDE and SOINT is 60.2 per cent (R2 0:602, R2 0:581). The adj ANOVA values (shown in Table VI) indicate that regression model 1 is signicant (F 29:814, p , 0.01), and R2 is signicantly different from zero; there is a linear relationship between the predictors and the dependent variable. The beta

n

84 27 27 26 164

% 51.1 16.5 16.5 15.9 100.0

Mean 5.694 5.509 4.444 3.567 5.120

Attitude SD

Std error

Mean 5.333 4.543 3.482 2.205 4.402

Intention SD

Std error

0.924 0.101 0.548 0.106 1.427 0.275 0.773 0.152 1.246 0.000 ANOVA: F 38:860, p , 0.01

1.431 0.156 1.977 0.380 1.224 0.236 1.330 0.261 1.881 0.147 ANOVA: F 33:336, p , 0.01

47

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Table III Multiple comparisons (Tukey HSD post hoc tests) of attitude and intention of four age groups

Independent variables (I) Age 16-29 J (Age) 30-39 40-49 50 16-29 40-49 50 16-29 30-39 50 16-29 30-39 50 Attitude Mean difference (I-J) 0.184 1.249 * * 2.126 * * 20.184 1.064 * * 1.942 * * 21.249 * * 21.064 * * 0.877 * * 22.126 * * 21.942 * * 20.877 Sig NS 0.000 0.000 NS 0.000 0.000 0.000 0.000 0.005 0.000 0.000 0.005 Intention Mean difference (I-J) 0.790 1.851 * * 3.128 * * 20.790 1.061 * 2.338 * * 21.851 * * 21.061 * 1.276 * * 23.128 * * 22.338 * * 21.276 * * Sig NS 0.000 0.000 NS 0.044 0.000 0.000 0.044 0.010 0.000 0.000 0.010

30-39

40-49

50 1

Notes: *p , 0.05 level; * *p , 0.01 level; NS not signicant

Table IV Correlation coefcients between variables for research framework 1

Variables 1. 2. 3. 4. 5. 6. 7. 8. 9. SELF EOU RISK U SOCOM SOIDE SOINT ATTITUDE INTENTION 1 0.689 * * NS NS NS NS NS NS NS 2 NS NS NS NS NS 0.700 * * 0.574 * * 3 4 5 6 7 8

2 0.576 * * NS NS NS NS NS

20.261 * 0.569 * * 0.577 * * 0.469 * * 20.636 * *

NS NS NS NS

NS 0.435 * *

NS 0.438 * *

0.472 * *

Notes: NS not signicant; *p , 0.05 (2-tailed); * *p , 0.01 (2-tailed); Where: SELF self-efcacy; EOU perceived ease of use; RISK perceive risk; U= perceived usefulness; SOCOM social inuence-compliance; SOIDE social inuence-identication; SOINT social inuence-internalisation; ATTITUDE attitude towards use; INTENTION intention to use IBS

Table V Independent sample t-tests

Test variables Self-efcacy Perceived risk Perceived ease of use Perceived usefulness Attitude Intention Use Yes No Yes No Yes No Yes No Yes No Yes No Mean 5.861 4.581 3.085 3.517 5.414 4.401 5.378 4.773 6.134 5.273 6.065 4.635

t

4.678 * * 22.001 * 4.492 * * 2.736 * * 4.857 * * 5.259 * *

df 82 82 82 82 82 82

Sig. (two-tailed) 0.000 0.049 0.000 0.008 0.000 0.000

Notes: *p , 0.05 (two-tailed); * *p , 0.01 (two-tailed)

48

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Table VI Multiple regression results for regression models 1-5

ANOVA Regression model 1 Dependent variable U Predictor variables RISK SOCOM SOIDE SOINT EOU U ATTITUDE SOIDE SOINT EOU U FQUSA FQINF FQINT TQS FQS Beta 20.317 20.227 0.286 0.340 0.616 0.179 0.356 0.348 0.441 0.491 Sig. 0.000 0.006 0.004 0.000 0.000 0.044 0.002 0.003 0.012 0.004

R2

0.602

R2 adj

0.581

F

29.814

Sig. 0.000

2 3

ATTITUDE INTENTION

0.516 0.522

0.504 0.491

43.109 17.031

0.000 0.000

FQS

0.467

0.424

10.805

0.000

LOYALTY

0.462

0.434

16.344

0.000

coefcients shown in regression model 1 indicate that both SOIDE (b 0:286, p , 0.01) and SOINT (b 0:340, p , 0.01) have a signicantly positive impact on U, and that both RISK (b 20:317, p , 0.01) and SOCOM (b 20:227, p , 0.01), have a negative impact on U. The other hypotheses belonging to the same dataset were interpreted in the same way. Hence the following regression models were also employed: ATTITUDE b0 b1 EOU b2 U 1. . . INTENTION b0 b1 SOIDE b2 SOINTE b3 ATTITUDE b4 EOU b5 U 1. . . 3 2

FQS b0 b1 FQUSA b2 FOINF b3 FQINT 1. . . 4

(where FQS functional quality satisfaction; FQUSA functional quality-usability; FQINF functional quality-information; FQINT functional qualityinteraction), and to compare the effects of technical/ functional quality satisfaction of IBS on loyalty: LOYALTY b0 b1 TQS b2 FQS 1. . . 5

EOU in regression model 2 shows a strong positive inuence upon ATTITUDE (b 0:616, p , 0.01) whereas U has only a small inuence (b 0:179, p , 0.05). With regression model 3, only EOU (b 0:356, p , 0.01) and U (b 0:348, p , 0.01) have a signicant (positive) inuence upon INTENTION. From the results of the regression analyses, we accept H5, H6, H7, H8, H9 and H10. Dataset C: service quality ! customer satisfaction ! customer loyalty To explore the answers for the hypotheses relating to research framework 2 on the relationship between service quality and customer satisfaction, and between customer satisfaction and customer loyalty, further correlation coefcients were sought; these are shown at Table VII. The results indicate that all H11a (r 0:672, p , 0.01), H11b (for all three variables, r 0:573, r 0:578 and r 0:638, p , 0.01), and H12a/ H12b (r 0:656, r 0:577, p , 0.01) may all be accepted. Further regressions models were formulated: rstly, to compare the contribution of the three components of the functional quality of IBS to the prediction of functional quality satisfaction, in the form of: 49

(where TQS technical quality satisfaction and FQS functional quality satisfaction). Only FQINT in regression model 4 shows any signicant inuence on FQS (b 0:441, p 0:012). With regression model 5, only TQS shows any signicant inuence on loyalty (b 0:491, p , 0.01). Dataset Q: qualitative interviews The three interviews conducted on respondents considered interesting were tape recorded, and a full transcription was kept. Each interview lasted about 40 minutes, and respondents commented mainly on the reasons they chose to use IBS, what they expected from their banks, and if their internet bank met their expectations. On balance, they commented mostly on factors such as security, convenience, and functional use (quality of the web site) as the key reasons for their use or non-use. These qualitative ndings were supportive of the regression models, as well as being consistent with the literature (Rotchanakitumnuai and Speece, 2003; Sathye, 1999).

Discussion and managerial implications

The signicance of segmentation Our results are consistent with the opinion of Crisp et al. (1997) that older individuals have to exert more cognitive and emotional effort to learn new behaviours and dissociate themselves from their daily routines. These also support Katz

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Table VII Correlation coefcients between variables for research model 2

Variables 1. 2. 3. 4. 5. 6. 7. TQ TQS FQUSA FQINF FQINT FQS LOYALTY 1 0.672 * * NS NS NS NS NS 2 NS NS NS NS 0.656 * * 3 4 5 6

NS NS 0.573 * * NS

NS 0.578 * * NS

0.638 * * NS

0.577 * *

Notes: NS not signicant; *p , 0.05 (two-tailed); * *p , 0.01 (two-tailed)

and Aspdens (1997) ndings that the internet banking segments consist mostly of younger customers. Although people aged 30-39 years have a less positive attitude and intention towards using IBS than the younger group, they have a more positive attitude and intention than the other two age groups (aged 40-49 and 50 years). Those aged 30-39 years have been in their careers for some years, and have higher levels of income than those of the younger group, who are typically highly mobile in their early careers. This inevitably leads to a variety of nancial service requirements of the people aged 30-39 years. This supports the assumption of Lewis and Bingham (1991) that attracting young customers should be protable for nancial institutions in the future. The younger customers disposable incomes are seen to be low (relative to non-younger customers), but their discretionary incomes and purchasing power are high. We suggest that IBS marketers see the longer term gains by attracting young customers as future revenues which can be generated from loyal customers. With the growth of the IBS younger customers segment, IBS marketers must focus on comprehending this target customer base and deliver consistently to their specic demands. In the case of our sample (university students), the offer of student and graduate account benets (e.g. interest-free overdrafts, offer of credit cards, and discounted loans and mortgages, etc.) is strongly encouraged. The exact composition of such account benets may be the result of further market research into what exactly graduate students require. Internet banking adoption research framework Self-efcacy ! perceived ease of use Self-efcacy plays an important role in shaping individuals feelings about using IBS. This result supports Venkatesh and Davis (1996) ndings that self-efcacy is an antecedent and determinant of EOU. Hence, we argue that there is value in IBS marketers to focus their strategies on enhancing young customers self-efcacy of using IBS. To many nancial institutions, internet banking as a newly-emerging delivery channel of nancial services, is still at the introduction or early growth stage of the product lifecycle. The well-known marketing principle is that it costs ve times as much to obtain a new customer than to retain an existing one: so by targeting innovators and early adopters of IBS (who are typically young people) during the early stages of the IBS lifecycle will be highly invaluable in gaining a stronger future acceptance during the growth and maturity stages of the life cycle. The IBS users in this study were found to have higher levels of self-efcacy perception of using IBS than non-IBS users. As for the potential customers who might not have a 50

high level of self-efcacy of using IBS, IBS marketers can enhance customers condence in their ability to use IBS (Jun and Cai, 2001; Pikkarainen et al., 2006), perhaps in the form of handing out preprepared instruction leaets. Perceived risk, social inuence ! perceived usefulness (regression model 1) Our study suggests that customers who have higher levels of perceive risk about using IBS perceive IBS to be less useful. IBS marketers should attract more young customers by developing risk-reducing strategies. The ANOVA results used to test whether young customers perceived equally all of the three types of risk are afrmative. If the test had found that young customers perceive one risk type signicantly higher than other risk types, IBS marketers could devise specic strategies to reduce the particular risk type. However, because that was not the case, using the specic strategies to reduce only one particular risk type would be cost ineffective. Thus, it would be better for IBS marketers to use the appropriate risk relieving strategies to lower customers overall risk perceptions. The ndings derived from the correlation analysis to examine the relationship between compliance/identication/ internalisation generated by social inuence and perceived usefulness of IBS suggest that social inuence negatively inuences young customers perceived usefulness of IBS. In contrast, their willingness to use IBS and their appreciation of using IBS would yield identication and internalisation that have a positive effect on their perceived usefulness of IBS. Young customers perceive using IBS to be useful because using IBS may serve to maintain an individuals relationship with a group in which their self-denition is anchored, or it is congruent with their value system. They adopt it because they nd it useful for the solution of a problem, or because it is demanded by their own value. For instance, the internet has transformed over the last decade from simple HTML statistic kinds of web pages to very advanced forms (using XML, asp, php, etc.) of dynamic web interface interactions, which have attracted mostly the high-technology industry and of course the younger generation into personal internet use. Typical examples would include blogs, le share sites, real time messengers, etc., all of which make up the self-denition and value system of the young. Training professional information technologists, who are knowledgeable about these types of web facilities, about a banks nancial products and seeking their assistance in persuading young customers to adopt IBS is probably a successful strategy for the internet bank. Similarly, the multiple regression analysis shows that both perceived risk and social inuence constructs exert an

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

inuence on young customers perceived usefulness of IBS. Again, internet bank marketers are advised to concentrate on strategies that enhance young customers perceptions of the usefulness of IBS; this may be in the form of using computer animated demonstrations of a large range of sophisticated transactions IBS can provide. Perceived ease of use, perceived usefulness ! attitude (regression model 2) As hypothesised, our results indicate that both perceived ease of use and perceived usefulness of IBS are signicantly correlated with young customers attitude towards IBS use. One of the most signicant ndings is the relative strength of the ease of use-attitude relationship (r 0:700) and usefulness-attitude relationship (r 0:469). Comparing the contribution of the two predictor variables to young customers attitude, this difference was also signicant: the ease of use-attitude relationship remained large, while the usefulness-attitude relationship was much smaller. This contradicts extant TAM research, which suggests that the effect of perceived usefulness on system usage is more prominent than that of perceived ease of use. A possible reason for this may be that young customers value the benets of convenience, accessibility and time saved achieved from using IBS more than other benets (Waite and Harrison, 2004). A possible explanation for this is that of transaction cost implications. For example, the theory of transaction costs (dating as far back as Coase, 1937) argues that an entity (rm or person) makes a rational decision based on giving priority to minimising transaction costs involved (Ng, 2007). These benets are consequences of being able to handle banking needs at home rather than visiting a branch; access to computing services for the young age group, especially in a university environment, is better than that of older groups who do not have as good facilities or nd it more complicated to use computers (hence, increasing time spent on it, and any opportunity costs, therefore having higher overall transaction costs). Thus, their attitude towards using IBS depends primarily on whether using IBS is time saved and without physical and mental effort the ease of IBS use. The results also show that IBS users have higher levels of perceived ease of use/perceived usefulness of IBS than nonIBS users, and this was stronger for the experienced than inexperienced users. IBS-users employ knowledge accumulated from past experience to form their attitude; this knowledge helps to reinforce their attitude towards using IBS and moderate their future intention and behaviour. IBS marketers should develop strategies that reinforce specically IBS-users beliefs about ease of use and usefulness of IBS. Two strategies for this may be possible: 1 Change the strength of already existing salient beliefs about ease of use (e.g. emphasising time saving and effortfree transactions). 2 Reinforcing or changing customers attitude to make an existing favourable belief more salient (linking attributes of IBS to valued consequences). Social inuence, perceived ease of use, perceived usefulness, attitude ! intention (regression model 3) Our results show that identication/internalisation generated by social inuence directly affects young customers behavioural intention. Hence, young customers are more likely to use IBS at some point in the future if they want to 51

maintain a reciprocal-role relationship through meeting the expectation of their friendship role, or those of their occupational role. The ndings conrm the importance of social inuence as a basis to predict behavioural intention. Both EOU and U are signicantly correlated with behavioural intention, as hypothesised, as are the correlation coefcients strong between EOU and U. This observation contrasts the results on the relationship between EOU/U and attitude, which suggests that EOU performs a more important function in forming positive attitude than U. Davis (1989) study of TAM suggests that ease of use may be an antecedent of usefulness rather than a parallel, direct determinant of usage. Our ndings suggest that young customers value ease of use and usefulness of IBS equally. The regression results suggest that young customers behavioural intention is jointly determined by their perception of ease of use and usefulness of IBS. Again, the reason for this may be due to transaction cost thinking: the degree of perceived usefulness is likely to be inuenced by the expected cost (in either real nancial terms or a time expenditure) of carrying out the transaction this is likely to be lower for university students who are experienced users of ` IBS vis-a-vis the older age group who have yet to fully grasp or gain access to the technology. While such a nding is commonsense, it has important implications for IBS marketers, who may attempt to over-emphasise ease of use and overlook usefulness in devising their marketing strategies when both are actually equally important. The attitude-intention relationship in this study for young customers correlated 0.472; this is a signicant, albeit a weak correlation. Young customers who have a favourable attitude towards using IBS are more likely to adopt IBS or continue to use IBS in the future. According to the theory of reasoned action (TRA), predicting consumers purchase behaviour is a matter of measuring their intentions to purchase just before they make a purchase. Unfortunately, predicting the actual behaviour based on intentions measured too soon before the behaviour occurs may not be accurate. One strategy for encouraging the use of IBS may be to provide direct incentives for doing so, perhaps in the form of free gifts or additional charge-free services. The independent sample t-tests indicate that IBS users have a more positive attitude and intention towards using IBS than non-IBS users. This implies that once customers have adopted IBS it would be comparatively easier to retain their custom. This conrms the benet of targeting young people because of their potential as future customers, supporting Lewis and Binghams (1991) view that nancial institutions target young people to catch them early in the hope that they will remain loyal. Once young customers are acquired, it is important to develop retention marketing strategies as existing customers. An obvious approach to retain existing customers is to focus on service quality and satisfaction. Service quality-customer satisfaction-customer loyalty relationship Technical/functional quality ! technical/functional quality satisfaction Young customers perceptions of technical quality of IBS have a positive impact on their satisfaction judgment of technical quality; hence, the higher the level of young customers perception of technical quality of IBS, the more likely they will be satised with the technical quality of IBS. They seem

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

to believe that using IBS is more favourable than other forms of nancial services. The primary reasons given are that customer accounts are more active and users feel the need to reconcile more frequently, and they can be assured of a private, quick and efcient service at any time. IBS should therefore focus on providing regular transactional details, such as real time balances. When customers have tried IBS and value the benet from it, they are more likely to continue using it and purchase additional nancial services, such as insurances, provided by an internet bank. The correlation coefcients on the relationship between three components of functional quality and respondents functional quality satisfaction of IBS indicate that the higher the level of customers perception of the usability/information/ interaction quality of IBS, the higher the level of their satisfaction with the functional quality of IBS. As the functional quality of IBS is determined by the web site quality of the bank, IBS marketers need to pay attention to the quality of their web site in these three areas (Jun and Cai, 2001). Similarly, the regression analysis on the three components of functional quality to young customers functional quality satisfaction suggests that only interaction quality of IBS is a satisfactory predictor of satisfaction. Whereas usability and information quality of IBS are addressed largely through the internal change (the website features of the internet bank), interaction quality requires a stronger external perspective. That external perspective is probably affected by trust, as suggested by Barnes and Vidgen (2001) who identify it as the strongest differentiator of website quality, among other things. In turn, trust itself may be inuenced by the banks overall image and reputation, the customers previous transactional experience with the bank, and a whole range of communications generated by the internet bank. Technical/functional quality satisfaction ! loyalty Our results show that both technical and functional quality satisfactions are signicantly correlated with young customers loyalty to the internet bank. Young customers are more likely to be retained as their technical/functional quality satisfaction increases. The offering of reliable nancial services through the internet should thus reinforce customers condence in using IBS. Similarly, the regression analysis suggests a relative importance of technical/functional quality satisfaction of IBS to young customers loyalty to the bank. Although the functional quality dimension might offer an internet bank a signicant opportunity to exceed customer expectations, what contributes more to young customers loyalty is their evaluation of the reliable delivery of the core service, that is the technical quality satisfaction of IBS. Thus, internet banks should not neglect the quality of their core services.

attract new ones. The research has conrmed prior expectations about service quality and loyalty, and we continue to advocate such a need for the continued development of IBS website quality for the long-term benets of the bank and retention of young customers. We are aware of the obvious limitation of the study of having only a sample of 164 respondents, of which only 84 were relevant to research framework 1, and of which only 41 for research framework 2, and that data collection took place only within one location over one period of time. Nevertheless, the study still provides valuable insights on young customers of the IBS context. We suggest further research in the segment of experienced IBS users, possibly in the form of a longitudinal qualitative approach (e.g. Chau and Witcher, 2005) that can track the changing views of customers as IBS strategies are modied over time. This is likely to enhance our understanding of customer retention strategies.

References

Ajzen, I. and Fishbein, M. (1980), Understanding Attitudes and Predicting Social Behavior, Prentice-Hall, Englewood Cliffs, NJ. Akaah, I.P. and Korgaonkar, P. (1988), A conjoint investigation of the relative importance of risk relieves in direct marketing, Journal of Advertising Research, August/ September, pp. 34-44. Alfans, L. and Sargeant, A. (2000), Market segmentation in the indonesian banking sector: the relationship between demographics and desired customer benets, International Journal of Bank Marketing, Vol. 18 No. 2, pp. 64-74. Bandura, A. (1977), Self-efcacy: toward a unifying theory of behavioral change, Psychological Review, Vol. 84 No. 2, pp. 191-215. Bandura, A. (1982), Self-efcacy mechanism in human agency, American Psychologist, Vol. 37 No. 2, pp. 122-47. Baker, M.J. (1991), Research for Marketing, Macmillan Press, London. Barnes, S.J. and Vidgen, R.T. (2000a), WebQual: an exploration of web site quality, proceedings of the Eighth European Conference on Information Systems, available at: www.WebQual.co.uk/index.htm Barnes, S.J. and Vidgen, R.T. (2000b), Information and interaction quality: evaluating internet bookshop web sites with WebQual, paper presented at 13th International Bled Electronic Commerce Conference, Bled, available at: www. WebQual.co.uk/index.htm Barnes, S.J. and Vidgen, R.T. (2000c), Assessing the quality of auction web sites, proceedings of the Hawaii International Conference on Systems Sciences, available at: www.WebQual. co.uk/index.htm Barnes, S.J. and Vidgen, R.T. (2001), An integrative approach to the assessment of e-commerce quality, available at: www.WebQual.co.uk/index.htm Bauer, R.A. (1964), Consumer behavior as risk taking dynamic marketing for a changing world, American Marketing Association Proceedings, pp. 389-98. Berry, L.L. and Parasuraman, A. (1997), Listening to the customer: the concept of a service-quality information system, Sloan Management Review, Spring, pp. 65-76. Bloemer, J., Ruyter, K.D. and Peters, P. (1998), Investing drives of bank loyalty: the complex relationship between 52

Conclusions

We conclude that there is a signicant difference in the perceptions, attitude and behaviour of young customers (aged 16-29) towards IBS than any other age group in the study. We therefore argue that there is value in focussing marketing effort on this segment of the nancial services industry, particularly as they provide the greatest promise of future protability. As we nd that customers are more likely to be retained once they use IBS, so similarly marketing effort should also be asserted to retain existing customers as well as

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

image, service quality and satisfaction, International Journal of Bank Marketing, Vol. 10 No. 7, pp. 276-86. Chau, V.S. (2002), Report on customer service performance measures in uk network industries: squeezing hard to improve quality, working paper, Centre for Competition and Regulation, University of East Anglia, Norwich. Chau, V.S. and Witcher, B.J. (2005), Longitudinal tracer studies: research methodology of the middle range, British Journal of Management, Vol. 16 No. 4, pp. 343-55. Churchill, G.A. Jr (1979), A paradigm for developing better measures of marketing constructs, Journal of Marketing Research, Vol. 16 No. 1, pp. 64-73. Churchill, G.A. Jr (1995), Marketing Research: Methodological Foundation, 6th Ed., The Dryden Press, Orlando, FL. Coase, R.H. (1937), The nature of the rm, Economica, Vol. 4 No. 16, pp. 389-405. Compeau, D.R. and Higgins, C.A. (1995), Computer selfefcacy: development of a measure and initial test, MIS Quarterly, Vol. 19 No. 2, pp. 189-211. Cox, D.F. (1967), Risk Taking and Information Handling in Consumer Behavior, Harvard University Press, Boston, MA. Cox, D.F. and Rich, S.U. (1964), Perceived risk and consumer decision making: the case of telephone shopping, Journal of Marketing Research, Vol. 1 No. 4, pp. 32-9. Cox, J. and Dale, B.G. (2001), Service quality and ecommerce: an exploratory analysis, Managing Service Quality, Vol. 11 No. 2, pp. 121-31. Crisp, C.B., Jarvenpaa, S.L. and Todd, P.A. (1997), Individual differences and internet shopping attitudes and intentions, available at: http://ccwf.cc.utexas.edu/ , crisp/Indiv_Shop.htm Cronin, J.J. and Taylor, S.A. (1992), Measuring service quality: a reexamination and extension, Journal of Marketing, Vol. 56, July, pp. 55-68. Dale, B.G. (Ed.) (1999), Managing Quality, 3rd ed., Basil Blackwell, Oxford. Davis, F.D. (1989), Perceived usefulness, perceived ease of use, and user acceptance of information technology, MIS Quarterly, Vol. 13 No. 3, pp. 319-39. Davis, F.D., Bagozzi, R.P. and Warshaw, P.R. (1989), User acceptance of computer technology: a comparison of two theoretical models, Management Science, Vol. 35, August, pp. 982-1003. Davis, F.D. and Venkatesh, V. (1996), A critical assessment of potential measurement biases in the technology acceptance model: three experiments, International Journal of Human-Computer Studies, Vol. 45 No. 1, pp. 19-45. Draker, C., Gwynne, A. and Waite, N. (1998), Barclays life customer satisfaction and loyalty tracking survey: a demonstration of customer loyalty research in practice, International Journal of Bank Marketing, Vol. 16 No. 7, pp. 287-92. Engel, J.F. and Blackwell, R.D. (1970), Perceived risk in mail-order and retail store buying, Journal of Marketing Research, Vol. 7, August, pp. 49-58. Fishbein, M. and Ajzen, I. (1975), Belief, Attitude, Intention and Behavior: An Introduction to Theory and Research, Addison-Wesley, Reading, MA. Gerrard, P., Cunningham, J.B. and Devlin, J.F. (2006), Why consumers are not using internet banking: a qualitative 53

study, Journal of Services Marketing, Vol. 20 No. 3, pp. 160-8. Green, P.E. and Rao, V.R. (1970), Rating scales and information recovery: how many scales and response categories to use?, Journal of Marketing, Vol. 34 No. 3, pp. 33-9. Gronroos, C. (1983), Strategic Management and Marketing in the Service Sector, Chartwell-Bratt, Bromley. Gronroos, C. (1990), Service Management and Marketing, Lexington Books, Lexington. Gwin, J.M. and Lindgren, J.H. (1982), Bank market segmentation: methods and strategies, Journal of Retailing Banking, Vol. 4 No. 4, pp. 8-13. Ha, C.L. (1998), The theory of reasoned action applied to brand loyalty, Journal of Product & Brand Management, Vol. 7 No. 1, pp. 51-61. Ho, S.S. and Ng, V.T.F. (1994), Customers risk perceptions of electronic payment systems, International Journal of Bank Marketing, Vol. 12 No. 8, pp. 26-38. Jarvennpaa, S.L. and Todd, P.A. (1996), Consumer reactions to electronic shopping on the world wide web, International Journal of Electronic Commerce, Vol. 1 No. 2, pp. 59-88. Jayawardhena, C. and Foley, P. (2000), Changes in the banking sector: the case of internet banking in the UK, Internet Research: Electronic Networking Applications and Policy, Vol. 10 No. 1, pp. 19-30. Jensen, J.B. and Markland, R.E. (1996), Improving the application of quality conformance tools in service rms, Journal of Service Marketing, Vol. 10 No. 1, pp. 35-55. Joseph, M., McClure, C. and Joseph, B. (1999), Service quality in the banking sector: the impact of technology on service delivery, International Journal of Bank Marketing, Vol. 17 No. 4, pp. 182-91. Jun, M. and Cai, S. (2001), The key determinants of internet banking service quality: a content analysis, International Journal of Bank Marketing, Vol. 19 No. 7, pp. 276-91. Karahanna, E. and Straub, D.W. (1999), The psychological origins of perceived usefulness and ease-of-use, Information and Management, Vol. 35 No. 4, pp. 237-50. Katz, J. and Aspden, P. (1997), Motivations for and barriers to internet usage: results of a national public opinion survey, Internet Research: Electronic Networking Application and Policy, Vol. 7 No. 3, pp. 170-88. Kelman, H.C. (1958), Compliance, identication and internalization: three processes of attitude change, Journal of Conict Resolution, Vol. 2, pp. 51-60. Lassar, W.M., Manolis, C. and Winsor, R.D. (2000), Service quality perspectives and satisfaction in private banking, Journal of Services Marketing, Vol. 14 No. 3, pp. 244-71. Lee, H., Lee, Y. and Yoo, D. (2000), The determinants of perceived service quality and its relationship with satisfaction, Journal of Services Marketing, Vol. 14 No. 3, pp. 217-31. Lewis, B.R. (1981), Students accounts: a protable segment?, European Journal of Marketing, Vol. 16 No. 3, pp. 63-72. Lewis, B.R. and Bingham, G.H. (1991), The youth market for nancial services, International Journal of Bank Marketing, Vol. 9 No. 2, pp. 3-11. Lewis, B.R., Orledge, J. and Mitchell, V.W. (1994), Service quality: students assessment of banks and building

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

societies, International Journal of Bank Marketing, Vol. 12 No. 4, pp. 3-12. McDougall, G.H.G. and Levesque, T.J. (1994), Benet segmentation using service quality dimensions: an investigation in retail banking, International Journal of Bank Marketing, Vol. 12 No. 2, pp. 15-23. McKechnie, S. (1992), Consumer buyer behavior in nancial services: an overview, International Journal of Bank Marketing, Vol. 10 No. 5, pp. 4-12. Malhotra, Y. and Galletta, D.F. (1999), Extending the technology acceptance model to account for social inuence: theoretical bases and empirical validation, Proceedings of 32nd Hawaii International Conference on System Sciences, available at: http://dlib.computer.org/ conferen/hicss/0001/pdf/00011006.pdf Meidan, A. (1996), Marketing Financial Services, Anthony Rower, Wiltshire. Metawa, S.A. and Almossawi, M. (1998), Banking behavior of Islamic bank customers: perspectives and implications, International Journal of Bank Marketing, Vol. 16 No. 7, pp. 299-313. Methlie, L.B. and Nysveen, H. (1999), Loyalty of on-line bank customers, Journal of Information Technology, Vol. 14, pp. 375-86. Minhas, R.S. and Jacobs, E. (1996), Benet segmentation by factor analysis: an improved method of targeting customers for nancial services, International Journal of Bank Marketing, Vol. 14 No. 3, pp. 3-13. Mols, N.P., Bukh, P.N.D. and Nielsen, J.F. (1999), Distribution channel strategies in Danish retail banking, International Journal of Retail & Distribution Management, Vol. 27 No. 1, pp. 37-47. Ng, I.C.L. (2007), Establishing a service channel: a transaction cost analysis of a channel contract between a cruise line and a tour operator, Journal of Services Marketing, Vol. 21 No. 1, pp. 4-14. Nguyen, N. and LeBlanc, G. (1998), The mediating role of corporate image on customers retention decisions: an investigation in nancial services, International Journal of Bank Marketing, Vol. 16 No. 2, pp. 52-65. Oppenhein, H.N. (1996), Questionnaire Design and Attitude Measurement, Heinemann Educational Books, London. Parasuraman, A., Zeithaml, V.A. and Berry, L.L. (1985), A conceptual model of service quality and its implications for future research, Journal of Marketing, Vol. 49, Fall, pp. 41-50. Parasuraman, A., Zeithaml, V.A. and Berry, L.L. (1988), SERVQUAL: a multiple-item scale for measuring consumer perceptions of service quality, Journal of Retailing, Vol. 64, Spring, pp. 12-40. Peter, J.P., Olson, J.C. and Grunert, K.G. (1999), Consumer Behavior and Marketing Strategy, McGraw-Hill, London. Peter, J.P. and Ryan, M.J. (1976), An investigation of perceived risk at the brand level, Journal of Marketing Research, Vol. 13, May, pp. 29-37. Pikkarainen, K., Pikkarainen, T., Karjaluoto, H. and Pahnila, S. (2006), The measurement of end-user computing satisfaction of online banking services: empirical evidence from Finland, International Journal of Bank Marketing, Vol. 24 No. 3, pp. 158-72. Polatoglu, V.N. and Ekin, S. (2001), An empirical investigation of the Turkish consumers acceptance of 54

internet banking services, International Journal of Bank Marketing, Vol. 19 No. 4, pp. 156-65. Rotchanakitumnuai, S. and Speece, M. (2003), Barriers to internet banking adoption: a qualitative study among corporate customers in Thailand, International Journal of Bank Marketing, Vol. 21 Nos 6/7, pp. 312-23. Sathye, M. (1999), Adoption of internet banking by Australian consumers: an empirical investigation, International Journal of Bank Marketing, Vol. 17 No. 7, pp. 324-34. Schmitz, J. and Fulk, J. (1991), Organizational colleagues, media richness, and electronic mail: a test of the social inuence model of technology use, Communication Research, Vol. 18 No. 4, pp. 487-523. Simpson, L. and Lakner, H.B. (1993), Perceived risk and mail order shopping for apparel, Journal of Consumers Studies and Home Economics, Vol. 17, pp. 377-98. Solomon, M.R. (1996), Consumer Behavior, 2nd ed., Allyn & Bacon, Boston, MA. Speed, R. and Smith, G. (1992), Retail nancial services segmentation, The Services Industries Journal, Vol. 12 No. 3, pp. 368-83. Stanley, T.O., Ford, J.K. and Richards, S.K. (1985), Segmentation of bank customers by age, International Journal of Bank Marketing, Vol. 3 No. 3, pp. 56-63. Stauss, B. and Neuhaus, P. (1997), The qualitative satisfaction model, International Journal of Service Industry Management, Vol. 8 No. 3, pp. 236-49. Stone, R.N. and Gronhaug, K. (1993), Perceived risk: further considerations for the marketing discipline, European Journal of Marketing, Vol. 27 No. 3, pp. 39-50. Tan, S.T. (1999), Strategies for reducing consumers risk aversion in internet shopping, Journal of Consumer Marketing, Vol. 16 No. 2, pp. 163-80. Taylor, S. and Todd, P. (1995a), Assessing IT usage: the role of prior experience, MIS Quarterly, Vol. 19 No. 4, pp. 561-70. Taylor, S. and Todd, P. (1995b), Understanding information technology usage: a test of competing models, Information System Research, Vol. 6 No. 2, pp. 144-76. Venkatesh, V. and Davis, F.D. (1996), A model of the antecedents of perceived ease of use: development and test, Decision Sciences, Vol. 27 No. 3, pp. 451-81. Waite, K. and Harrison, T. (2004), Online banking information: what we want and what we get, Qualitative Marketing Research, Vol. 7 No. 1, pp. 67-79. Walker, R.H. and Johnson, L.W. (2005), Towards understanding attitudes of consumers who use internet banking services, Journal of Financial Services Marketing, Vol. 10 No. 1, pp. 84-94. Walker, R.H. and Johnson, L.W. (2006), Why consumers use and do not use technology-enabled services, Journal of Services Marketing, Vol. 20 No. 2, pp. 125-35. Windham, L. (2000), The Soul of the New Consumer: The Attitudes, Behaviors, and Preferences of E-customers, Allworth Press, New York, NY. Wells, W. and Prensky, D. (1996), Consumer Behavior, John Wiley & Sons, New York, NY. Yi, M.Y. and Venkatesh, V. (1996), Role of computer selfefcacy in predicting user acceptance and use of information technology, available at: http://hsb.baylor. edu/ramsower/ais.ac.96/papers/mun.htm

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Appendix 1

Figure A1 Questionnaire

55

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Figure A1

56

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Figure A1

57

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Figure A1

58

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

Appendix 2

Table AI Development of questions to measure technical/functional quality of IBS

Questions to measure technical quality of nancial services 1. Fast account/balance information 2. Condentiality of information 3. Overdraft facility 4. Cost of services 5. Interests results 6. Reporting of results 7. Attentiveness to your bank needs 8. Ease of handling your banking needs 9. Ease and frequency of contact Source: Lassar et al. (2000) ! ! ! ! ! ! ! ! b Questions to measure technical quality of IBS 1. The IBS provides fast and accurate account/balance information 2. The condentiality of information transfer is high 3. Loan application facility of IBS is high 4. Charges of IBS are reasonable 5. Interests result provided are good 6. Reporting of results is good 7. The bank gives high attentiveness to your internet banking needs 8. It is easy to do what I want to do with IBS (perceived ease of use item 3)

Appendix 3

Table AII Development of questions to measure functional quality of IBS

WebQual 4.0 questions Questions to measure functional quality of IBS ! 1. I nd the site easy to navigate ! 2. The site has an attractive appearance ! 3. The design is appropriate to the type of site ! 4. The site conveys a sense of competency ! 5. The site create a positive experience for me ! 6. Learning to use IBS is easy for me (perceived ease of use item 1) ! 7. How to use IBS is clear and understandable (perceived ease of use item 2) ! 8. The IBS is easy to use (perceived ease of use item 4)

Usability 1. I nd the site easy to navigate 2. The site has an attractive appearance 3. The design is appropriate to the type of site 4. The site conveys a sense of competency 5. The site creates a positive experience for me 6. I nd the site easy to learn to operate 7. My interaction with the site is clear and understandable 8. I nd the site easy to use Information 9. Provides accurate information 10. Provides believable information 11. Provides timely information 12. Provides relevant information 13. Provides easy to understand information 14. Provides information at the right level of detail 15. Presents the information in an appropriate format

! 9. Provides accurate information ! 10. Provides believable information ! 11. Provides timely information ! 12. Provides relevant information ! 13. Provides easy to understand information ! 14. Provides information at the right level of detail ! 15. Presents the information in an appropriate format

Interaction 16. Has a good reputation ! 16. Has a good reputation 17. It feels safe to complete transactions ! 17. It feels safe to complete transactions 18. My personal information feels secure ! 18. My personal information would/is secure (the reverse of perceived risk item 3) 19. Conveys a sense of personalisation ! 19. Conveys a sense of personalisation 20. Creates a sense of community ! 20. Creates a sense of community 21. Makes it easy to communicate with the organisation ! 21. It is easy to do what I want to do with IBS (perceived ease of use item 3) 22. I feel condent that the goods/services will be delivered as promised ! 22. I feel condent that the services will be delivered as promised

Source: Barnes and Vidgen (2001)

About the authors

Vinh Sum Chau is Lecturer in Strategy and Strategic Management at the Norwich Business School, University of East Anglia, and faculty member of the UK ESRC Centre for Competition Policy. He is also Chair of the British Academy of Managements special interest group and conference track on performance management. He teaches strategic 59

management at bachelor and masters levels and business research methods at masters and doctorate levels. His research interests are in performance management, strategy implementation, service quality, and customer satisfaction. Vinh Sum Chau is the corresponding author and can be contacted at: v.chau@uea.ac.uk Liqing W.L.C. Ngai was formerly at the Norwich Business School, University of East Anglia, where she obtained her

The youth market for internet banking services Vinh Sum Chau and Liqing W .L.C. Ngai

Journal of Services Marketing Volume 24 Number 1 2010 42 60

postgraduate qualication. She is now an executive manager of KellinWell-HK Electronics & Computing, Hong Kong, which specialises in general computer hardware and internet software.

Executive summary and implications for managers and executives