Professional Documents

Culture Documents

Business Combination Reviewer

Business Combination Reviewer

Uploaded by

Sarah Jane Señido0 ratings0% found this document useful (0 votes)

1 views2 pagesnotes

Original Title

BUSINESS COMBINATION REVIEWER

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnotes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views2 pagesBusiness Combination Reviewer

Business Combination Reviewer

Uploaded by

Sarah Jane Señidonotes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

BUSINESS COMBINATION REVIEWER:

CHAPTER 1 (Recognition& Measurement)

Related standards:

PFRS 3 Deals with accounting for business combination at the acquisition date.

PFRS 10 Deals with preparation and presentation of consolidated financial statements

after the business combination.

Section 19 of the PFRS for SMEs

Define Business Combination:

Occurs when one company acquires another or when two or more companies

merge into one.

Business combinations are carried out either through:

1. Asset acquisition- the acquirer purchases the assets and assumes the liabilities

of the acquiree in exchange for cash or other non-cash consideration (which may

be the acquirer’s own shares).

Merger- when 2 or more companies merge into a single entity which shall be one

of the combining companies.

Consolidation- when 2 or more companies consolidate into a single entity which

shall be the consolidated company.

2. Stock acquisition- more than 50% in the voting rights of the acquiree, the

Acquirer obtains control over the acquiree is known as the subsidiary

Consolidated Financial Statements:

A report of company’s financial position using the aggregated financials of the

parent company and its subsidiaries, shareholders, creditors, executive

management, board members and stakeholders use consolidated financial

statements to gauge the health of the overall company.

Group:

A parent and its Subsidiaries.

Parent:

That has controlling interest in another company giving it control of its operations.

Subsidiary:

It’s a company owned and controlled by another company.

Owning company is called a parent or holding company.

Business combination may also be described as:

1. Horizontal combination- 2 or more entities with similar business (bank

acquires another bank).

2. Vertical combination- 2 or more entities operating at different levels in

marketing chain. (a manufacturing acquires its supplier of raw materials.

3. Conglomerate- two or more entities with dissimilar business. (real estate

developer acquires bank).

Advantage of business combination:

a. Competition is eliminated or lessened- competition between the combining

constituents with similar business. – eliminated competition from other market

participants is lessened.

b. Synergy-the whole is greater than the sum of its parts. 1plus 1= 3

c. Increased business opportunities and earnings potential- business

opportunity increased.

Variety products or services available, decreased dependency or limited number

of products and services.

Products or services and better access to new markets.

Research and development, secret processes, and other information.

Investment opportunities due to increased capital or

d. Combinations utilize economics.

You might also like

- Lesson 1: Concept of Business CombinationDocument20 pagesLesson 1: Concept of Business CombinationSHARMAINE CORPUZ MIRANDANo ratings yet

- Lecture Notes Lectures 1 9 Advanced Financial AccountingDocument22 pagesLecture Notes Lectures 1 9 Advanced Financial Accountingsir sahb100% (1)

- Accounting For Business CombinationsDocument52 pagesAccounting For Business CombinationsEliza Beth100% (1)

- Chapter 1 Business Combination Part 1 PDFDocument20 pagesChapter 1 Business Combination Part 1 PDFShane CharmedNo ratings yet

- Chapter 1-Business Combination (Part 1)Document9 pagesChapter 1-Business Combination (Part 1)May JennNo ratings yet

- Business Com Part 1Document39 pagesBusiness Com Part 1Peter GonzagaNo ratings yet

- Book AccountingDocument220 pagesBook Accountingcunbg vubNo ratings yet

- Business CombinationDocument9 pagesBusiness CombinationRoldan Arca PagaposNo ratings yet

- Define Business Combination, Identify Its ElementsDocument4 pagesDefine Business Combination, Identify Its ElementsAljenika Moncada GupiteoNo ratings yet

- Modules1 20 MergedDocument84 pagesModules1 20 MergedClaw MarksNo ratings yet

- Business CombinationDocument20 pagesBusiness Combinationprodiejigs36No ratings yet

- Notes For Mergers and Acquistions - CourseDocument9 pagesNotes For Mergers and Acquistions - CourseharjasNo ratings yet

- AFA II 3 (1)Document11 pagesAFA II 3 (1)Dere GurandaNo ratings yet

- Acct For BussCombiDocument37 pagesAcct For BussCombiVeta AkkountNo ratings yet

- MODULE 11 Accounting For Business Combination PART 1Document43 pagesMODULE 11 Accounting For Business Combination PART 121-39693No ratings yet

- Chapter 3 Business Combination Edited 2Document24 pagesChapter 3 Business Combination Edited 2Qabsoo Finiinsaa100% (1)

- Module I. Business Combination Date of Acquisition NADocument13 pagesModule I. Business Combination Date of Acquisition NAmax pNo ratings yet

- AFAR Business-CombinationsDocument12 pagesAFAR Business-CombinationsPhia CustodioNo ratings yet

- Acct 513 Module Part 1Document25 pagesAcct 513 Module Part 1lyzel kayeNo ratings yet

- Chap 1Document42 pagesChap 1Villanueva, Jane G.No ratings yet

- Business Combination MillanDocument48 pagesBusiness Combination MillanHeart EspineliNo ratings yet

- MZ-Chapter Four BC-STDocument93 pagesMZ-Chapter Four BC-STfeyisab409No ratings yet

- AFAR-08: BUSINESS COMBINATIONS (PFRS 3: Statutory Merger and Statutory Consolidation)Document12 pagesAFAR-08: BUSINESS COMBINATIONS (PFRS 3: Statutory Merger and Statutory Consolidation)Jhekka FerrerNo ratings yet

- Identifying A Business CombinationDocument5 pagesIdentifying A Business CombinationPauline PauloNo ratings yet

- Business Combination - Part 1Document40 pagesBusiness Combination - Part 1santosashleymay7No ratings yet

- Mergers and Acquisitions of Companies Under The Joint Stock Companies Act 1956Document4 pagesMergers and Acquisitions of Companies Under The Joint Stock Companies Act 1956Remiz GeorgeNo ratings yet

- Business Combination-Lesson 1 Business Combination-Lesson 1Document11 pagesBusiness Combination-Lesson 1 Business Combination-Lesson 1heyheyNo ratings yet

- ABC-01 Business CombinationDocument19 pagesABC-01 Business CombinationJoshuji LaneNo ratings yet

- Adv ch-4Document15 pagesAdv ch-4Prof. Dr. Anbalagan ChinniahNo ratings yet

- Ho 01 Business CombinationsDocument5 pagesHo 01 Business CombinationsDiana Rose BassigNo ratings yet

- Group Accounts & Consolidation - v.2Document69 pagesGroup Accounts & Consolidation - v.2rameelamirNo ratings yet

- ABC 01 Accounting For Business Combination 20230123121552Document18 pagesABC 01 Accounting For Business Combination 20230123121552Joshuji LaneNo ratings yet

- Business Combinations: Advanced Accounting IIDocument21 pagesBusiness Combinations: Advanced Accounting IIMina MichealNo ratings yet

- Revised Bus - Comb. NotesDocument18 pagesRevised Bus - Comb. Notesselman Arega100% (1)

- CH-5 Business CombinationsDocument52 pagesCH-5 Business CombinationsRam KumarNo ratings yet

- BUSCOMDocument5 pagesBUSCOMGeoreyGNo ratings yet

- Business Combinations : Ifrs 3Document45 pagesBusiness Combinations : Ifrs 3alemayehu100% (1)

- Business CombinationDocument3 pagesBusiness CombinationJane Layug CabacunganNo ratings yet

- Reviewer BUSINESS COMBINATIONDocument50 pagesReviewer BUSINESS COMBINATIONRamos JovelNo ratings yet

- Lecture 1Document94 pagesLecture 1NeceiaNo ratings yet

- Chapter 3 Business CombinationDocument13 pagesChapter 3 Business CombinationDawit AmahaNo ratings yet

- Module 1 4 BUSCOMDocument40 pagesModule 1 4 BUSCOMNoeme LansangNo ratings yet

- Merger and AcquisitionDocument29 pagesMerger and Acquisitionrashmi k murthyNo ratings yet

- Advance IiDocument110 pagesAdvance Iitemedebere75% (4)

- Advanced Chapter-4Document35 pagesAdvanced Chapter-4Yeber MelkemiyaNo ratings yet

- Group Accounts (IFRS)Document10 pagesGroup Accounts (IFRS)Yaz CarlomanNo ratings yet

- Afar 08Document14 pagesAfar 08RENZEL MAGBITANGNo ratings yet

- ACCT 1113 (Accounting For Business Combination) Lesson 1: Business Combination Part 1Document6 pagesACCT 1113 (Accounting For Business Combination) Lesson 1: Business Combination Part 1cooperNo ratings yet

- BucoDocument49 pagesBucoJessie MacoNo ratings yet

- Chapter - 1: Meaning and DefinitionDocument12 pagesChapter - 1: Meaning and DefinitionShilpa S RaoNo ratings yet

- Biss CombDocument10 pagesBiss CombHussen AbdulkadirNo ratings yet

- CH 2 - Group Financial StatmentDocument47 pagesCH 2 - Group Financial StatmentWedaje AlemayehuNo ratings yet

- Chapter - 4: Business of Combination 4.1 Business of Combination: An Overview 4.1.1 Definition of Business CombinationDocument32 pagesChapter - 4: Business of Combination 4.1 Business of Combination: An Overview 4.1.1 Definition of Business CombinationYeber MelkemiyaNo ratings yet

- Chapter 1 - Accounting For Business CombinationsDocument6 pagesChapter 1 - Accounting For Business CombinationsLyaNo ratings yet

- Merger FinalDocument24 pagesMerger FinalMd SufianNo ratings yet

- A. Course Code - Title: B. Module No - Title: C. Time FrameDocument9 pagesA. Course Code - Title: B. Module No - Title: C. Time FramePoison IvyNo ratings yet

- Unit 5 6TH Sem CemDocument6 pagesUnit 5 6TH Sem CemParas HarsheNo ratings yet

- BUSINESS COMBINATION-lesson 1Document10 pagesBUSINESS COMBINATION-lesson 1Rhea Mae CarantoNo ratings yet

- Introduction To Business CombinationDocument15 pagesIntroduction To Business CombinationDELFIN, LORENA D.No ratings yet

- Name: Sarah Jane B. Señido Date: May 26' 2024Document13 pagesName: Sarah Jane B. Señido Date: May 26' 2024Sarah Jane SeñidoNo ratings yet

- It Tools Activity MidtermDocument1 pageIt Tools Activity MidtermSarah Jane SeñidoNo ratings yet

- Government Accounting Assignment 2Document4 pagesGovernment Accounting Assignment 2Sarah Jane SeñidoNo ratings yet

- Auditing and Assurance Concepts ApplicationsDocument2 pagesAuditing and Assurance Concepts ApplicationsSarah Jane SeñidoNo ratings yet

- Activity 2 - Audit Planning and Internal Control SENIDODocument3 pagesActivity 2 - Audit Planning and Internal Control SENIDOSarah Jane SeñidoNo ratings yet

- Files ReviewerDocument24 pagesFiles ReviewerSarah Jane SeñidoNo ratings yet

- Brewer IMA 8e Chap011 PPT Differential-AnalysisDocument43 pagesBrewer IMA 8e Chap011 PPT Differential-AnalysisSarah Jane SeñidoNo ratings yet

- ITREA SENIDOAct2 Part3Document2 pagesITREA SENIDOAct2 Part3Sarah Jane SeñidoNo ratings yet

- Fundamentals of Acc. 1 ReviewerDocument22 pagesFundamentals of Acc. 1 ReviewerSarah Jane SeñidoNo ratings yet

- Itera Senido Act2 Part2 Ex1Document1 pageItera Senido Act2 Part2 Ex1Sarah Jane SeñidoNo ratings yet

- Seatwork IncometaxDocument4 pagesSeatwork IncometaxSarah Jane SeñidoNo ratings yet

- Acc For Spe TransacDocument4 pagesAcc For Spe TransacSarah Jane SeñidoNo ratings yet

- Itera Senidoact2 Part2 Ex2Document1 pageItera Senidoact2 Part2 Ex2Sarah Jane SeñidoNo ratings yet

- Itera Senido Act2 Part1Document2 pagesItera Senido Act2 Part1Sarah Jane SeñidoNo ratings yet

- Chapter Eight: Functional and Activity-Based BudgetingDocument43 pagesChapter Eight: Functional and Activity-Based BudgetingRecki SeptiandaNo ratings yet

- What Is The Difference Between Lapping and KitingDocument2 pagesWhat Is The Difference Between Lapping and KitingBenjie SilvaNo ratings yet

- Solutions To Problem Set 7Document4 pagesSolutions To Problem Set 7Manuel BoahenNo ratings yet

- C) The Higher Prices of Foreign Goods Spurs Domestic Competitors To Cut PricesDocument10 pagesC) The Higher Prices of Foreign Goods Spurs Domestic Competitors To Cut PriceskbogdanoviccNo ratings yet

- CAMEL Analysis For Indian BanksDocument10 pagesCAMEL Analysis For Indian BanksAbhishek Anand75% (4)

- Chapter 1 Partnership Formation, Operations, Dissolution-PROFE01Document7 pagesChapter 1 Partnership Formation, Operations, Dissolution-PROFE01Steffany RoqueNo ratings yet

- Afar 2 Quizzes Acgsbdjxjcudhdh - CompressDocument26 pagesAfar 2 Quizzes Acgsbdjxjcudhdh - CompressWishNo ratings yet

- Date Description Amount BalanceDocument1 pageDate Description Amount BalanceAzfar ZhafranNo ratings yet

- What Are The Pros and Cons of Investing in The Money Market?Document3 pagesWhat Are The Pros and Cons of Investing in The Money Market?Franciska AdeliaNo ratings yet

- Aggregate To Handover Fürst To Creditors 150m Senior Debt Raise To Complete Project (9fin)Document7 pagesAggregate To Handover Fürst To Creditors 150m Senior Debt Raise To Complete Project (9fin)vitacoco127No ratings yet

- Meaning of NBFCDocument30 pagesMeaning of NBFCRaj SakpalNo ratings yet

- CH 1 Accounting of Partnership Basic ConceptDocument15 pagesCH 1 Accounting of Partnership Basic Concepthk6206131516No ratings yet

- Statement RequestDocument2 pagesStatement RequestParveshNo ratings yet

- What Is A Good or Bad Gearing Ratio? PDFDocument8 pagesWhat Is A Good or Bad Gearing Ratio? PDFKainos MuradzikwaNo ratings yet

- CL Exercises SolutionDocument32 pagesCL Exercises SolutionJas AlbosNo ratings yet

- Reading 71.9 Guidance For Standard VIIDocument12 pagesReading 71.9 Guidance For Standard VIIAmineNo ratings yet

- Pension & Salary FormetDocument5 pagesPension & Salary FormetGeneral ManagerNo ratings yet

- Headhunt (?) : Over To YouDocument2 pagesHeadhunt (?) : Over To YouHanu ClaudiaNo ratings yet

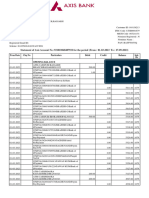

- Statement of Axis Account No:921010048487932 For The Period (From: 01-03-2023 To: 27-09-2023)Document10 pagesStatement of Axis Account No:921010048487932 For The Period (From: 01-03-2023 To: 27-09-2023)anita vermaNo ratings yet

- Law On SalesDocument13 pagesLaw On SalesLau OardeNo ratings yet

- MANAC Session 1Document19 pagesMANAC Session 1Abhinav ChauhanNo ratings yet

- Chapter 2Document7 pagesChapter 2Trần NanamiNo ratings yet

- Tutorial 1. FA2Document11 pagesTutorial 1. FA2bolaemil20No ratings yet

- Real Estate Finance Lecture - 3 - 2021Document14 pagesReal Estate Finance Lecture - 3 - 2021Zigma NetworkNo ratings yet

- Matching TypeDocument2 pagesMatching Type채문길No ratings yet

- A Study On Role of Technology in Banking SectorDocument6 pagesA Study On Role of Technology in Banking SectorEditor IJTSRD50% (2)

- Exam in Taxation Exam in Taxation: Business Tax (Naga College Foundation) Business Tax (Naga College Foundation)Document29 pagesExam in Taxation Exam in Taxation: Business Tax (Naga College Foundation) Business Tax (Naga College Foundation)jhean dabatosNo ratings yet

- Virtual Currencies Islamic Law Origin Features and Sharia RulingsDocument10 pagesVirtual Currencies Islamic Law Origin Features and Sharia Rulingshafeez arshadNo ratings yet

- An Overview of Banks and Financial Sector Service.Document22 pagesAn Overview of Banks and Financial Sector Service.Mahmudur RahmanNo ratings yet

- Statement of Principal Interest Rates and Service Charges For Domestic OperationsDocument12 pagesStatement of Principal Interest Rates and Service Charges For Domestic Operationsanon_431276397No ratings yet