Professional Documents

Culture Documents

(ITI) Midterm (Ch2-9)

(ITI) Midterm (Ch2-9)

Uploaded by

98amysCopyright:

Available Formats

You might also like

- Cement Industry Internship ReportDocument43 pagesCement Industry Internship ReportHaritha V H90% (10)

- Din en Iso 4287-2010Document31 pagesDin en Iso 4287-2010Gary LheureuxNo ratings yet

- ME Problem Set-1 (2019)Document2 pagesME Problem Set-1 (2019)pikuNo ratings yet

- Important Microeconomic TerminologiesDocument9 pagesImportant Microeconomic TerminologiesRana WaqasNo ratings yet

- Keywords: By: Submitted To: Nischal Gautam MRL SirDocument11 pagesKeywords: By: Submitted To: Nischal Gautam MRL SirNischalGautamNo ratings yet

- Reviewer in Taxation Unit 1Document8 pagesReviewer in Taxation Unit 1pepito manalotoNo ratings yet

- Economic Test ReviewDocument8 pagesEconomic Test ReviewY11A2 Jessica Yu-lin (Jessica) CHOUNo ratings yet

- MicroDocument9 pagesMicroNa ViNo ratings yet

- Economic System: (1) Factors of ProductionDocument19 pagesEconomic System: (1) Factors of ProductionEmma WongNo ratings yet

- A Glossary of Microeconomics TermsDocument9 pagesA Glossary of Microeconomics Termseconomics6969100% (1)

- New TradeDocument22 pagesNew TradesonaliNo ratings yet

- International Economics - Midterm NotesDocument18 pagesInternational Economics - Midterm NotesLonerStrelokNo ratings yet

- De Managerial Economics GlossaryDocument6 pagesDe Managerial Economics GlossaryV L Narayana RaoNo ratings yet

- EVERY ECON RESOURCE YOU'LL EVER NEED - Economics Definitions - SolutionsDocument11 pagesEVERY ECON RESOURCE YOU'LL EVER NEED - Economics Definitions - SolutionsHala ElhsNo ratings yet

- Key Terms MicroDocument7 pagesKey Terms Micro김지현No ratings yet

- Glossary: © The Institute of Chartered Accountants of IndiaDocument4 pagesGlossary: © The Institute of Chartered Accountants of Indiachhetribharat08No ratings yet

- ManeconshtDocument4 pagesManeconshtJancherr GalangNo ratings yet

- Economics HoDocument2 pagesEconomics HoLove JcwNo ratings yet

- Econ DictionaryDocument7 pagesEcon DictionaryJayapal ReddyNo ratings yet

- دارسات تجاريةDocument9 pagesدارسات تجاريةymhdz6hpj4No ratings yet

- ECODocument15 pagesECOtrantuancuong0509No ratings yet

- Economy 1-14Document14 pagesEconomy 1-14Lorman MaylasNo ratings yet

- EoG Extra NotesDocument20 pagesEoG Extra NotesVrishank JhunjhunwalaNo ratings yet

- Market Structure and PricingDocument5 pagesMarket Structure and PricingAbdulrahmanNo ratings yet

- Basic Concepts in Managerial Economics List of ConceptsDocument4 pagesBasic Concepts in Managerial Economics List of Conceptsghosh7171No ratings yet

- Econ StudyDocument10 pagesEcon Studyc2why985xhNo ratings yet

- Economics WorksheetDocument10 pagesEconomics WorksheetPandaNo ratings yet

- Summary Principles of Economics Book Economics Parking Powell MathewsDocument20 pagesSummary Principles of Economics Book Economics Parking Powell MathewsqalatiNo ratings yet

- Econ 201 (L02) Review List - Midterm Fall 2020Document10 pagesEcon 201 (L02) Review List - Midterm Fall 2020samantha davidsonNo ratings yet

- Ôn Thi GK CSTMQTDocument14 pagesÔn Thi GK CSTMQTK60 Võ Nguyễn Ngọc HânNo ratings yet

- IT Final Ch.4.2023Document5 pagesIT Final Ch.4.2023Amgad ElshamyNo ratings yet

- Glossary For Ca FoundationDocument4 pagesGlossary For Ca Foundationjansariyash55No ratings yet

- Economics Cheat Sheet Maddogz43Document2 pagesEconomics Cheat Sheet Maddogz43sh4dow.strid3r9581No ratings yet

- Economics Revision 2.2Document9 pagesEconomics Revision 2.2Pham Van HaNo ratings yet

- Abnormal Profit: Gillespie: Foundations of Economics 2e Microeconomics GlossaryDocument4 pagesAbnormal Profit: Gillespie: Foundations of Economics 2e Microeconomics GlossaryAamer SaddiqNo ratings yet

- 1629204622-1. Basic of MicroeconomicDocument5 pages1629204622-1. Basic of MicroeconomicTigerNo ratings yet

- Perfect and Imperfect MarketDocument10 pagesPerfect and Imperfect MarketMalde KhuntiNo ratings yet

- ACC08/FMS01 Lectures: Economic Foundation of Financial ManagementDocument15 pagesACC08/FMS01 Lectures: Economic Foundation of Financial ManagementmiolataNo ratings yet

- Man - Econ Finals Chapter 12-16Document10 pagesMan - Econ Finals Chapter 12-16nenzzmariaNo ratings yet

- Changes With Marginal Utility Held ConstantDocument6 pagesChanges With Marginal Utility Held ConstanthyNo ratings yet

- Chapter 7: Engineering EconomicsDocument1 pageChapter 7: Engineering EconomicsFrancisNo ratings yet

- Lund University - Introduction To International Business - Lecture 3Document11 pagesLund University - Introduction To International Business - Lecture 3Jarste BeumerNo ratings yet

- Unit 1: Theories of International TradeDocument25 pagesUnit 1: Theories of International TradeJoseph PrabhuNo ratings yet

- AC TC/Q, AFC FC/Q, AVC VC/Q: Between Pure Monopoly & Pure CompetitionDocument3 pagesAC TC/Q, AFC FC/Q, AVC VC/Q: Between Pure Monopoly & Pure CompetitionSadnima Binte Noman 2013796630No ratings yet

- Chapter No. 9: Forms of Market: Lilavatibai Podar High School. ISCDocument12 pagesChapter No. 9: Forms of Market: Lilavatibai Podar High School. ISCStephine BochuNo ratings yet

- Ktqt Ghét Nhất Trên ĐờiDocument12 pagesKtqt Ghét Nhất Trên Đời20. Lê Hải Linh NhiNo ratings yet

- Ebenstein and Ebenstein Chapter 8Document4 pagesEbenstein and Ebenstein Chapter 8David Bryan Tan OngNo ratings yet

- Memorization Test Study GuideDocument2 pagesMemorization Test Study GuideConorBurnsNo ratings yet

- IGCSE Economics RevisionDocument51 pagesIGCSE Economics RevisionZahra AliNo ratings yet

- Unit 2Document8 pagesUnit 2Martina PerezNo ratings yet

- Econ 200 Chap 1-6Document10 pagesEcon 200 Chap 1-6api-578941689No ratings yet

- Economics Exam Prep SuaDocument7 pagesEconomics Exam Prep SuaanagharavindvellayaniNo ratings yet

- Main Market FormsDocument9 pagesMain Market FormsP Janaki Raman50% (2)

- Section 1: Introduction To EconomicsDocument10 pagesSection 1: Introduction To EconomicsnaitosNo ratings yet

- Document 9 6Document7 pagesDocument 9 6grace lavisoresNo ratings yet

- KTQT 2Document37 pagesKTQT 2thuyntp22No ratings yet

- EconomicsimpimpDocument9 pagesEconomicsimpimpANUP MUNDENo ratings yet

- DMBA105Document9 pagesDMBA105chetan kansalNo ratings yet

- List of Economic Terms - V10Document32 pagesList of Economic Terms - V10weijuanshihkuNo ratings yet

- Economics Edexcel AS Level Microeconomics GlossaryDocument7 pagesEconomics Edexcel AS Level Microeconomics Glossarymarcodl18No ratings yet

- Theories of International Trade PD-1Document21 pagesTheories of International Trade PD-1Swathy SasikumarNo ratings yet

- Summary of Austin Frakt & Mike Piper's Microeconomics Made SimpleFrom EverandSummary of Austin Frakt & Mike Piper's Microeconomics Made SimpleNo ratings yet

- Valvulas Nacional 2015Document33 pagesValvulas Nacional 2015David Bottassi PariserNo ratings yet

- Steel Industry: Contribution in The Development of India's Economic GrowthDocument28 pagesSteel Industry: Contribution in The Development of India's Economic GrowthAditya YadavNo ratings yet

- Linear Arrangement - 2Document2 pagesLinear Arrangement - 2Hritik RawatNo ratings yet

- Economics Important Questions 2020 - Inter 1st Year .Copyrights To ReseenDocument3 pagesEconomics Important Questions 2020 - Inter 1st Year .Copyrights To ReseenLC groups100% (2)

- BureaucracyDocument4 pagesBureaucracyMarvinNo ratings yet

- Transportation Systems HandoutsDocument3 pagesTransportation Systems HandoutsKarla BuenaflorNo ratings yet

- FBCJ CustomizingDocument9 pagesFBCJ CustomizingGlowly bslNo ratings yet

- What Is GlobalizationDocument17 pagesWhat Is GlobalizationVktoria HalenNo ratings yet

- DiNapoli Announces $2B Strategic Partnership With Goldman Sachs Asset Management For Global Equity Investments, 9:10:14Document2 pagesDiNapoli Announces $2B Strategic Partnership With Goldman Sachs Asset Management For Global Equity Investments, 9:10:14Rick KarlinNo ratings yet

- ATRAM Investment Application FormDocument1 pageATRAM Investment Application FormValen ValibiaNo ratings yet

- GDLSK Names New PartnersDocument1 pageGDLSK Names New PartnersMary Joy Dela MasaNo ratings yet

- 08 SCI Chemistry Essay Final HadDocument3 pages08 SCI Chemistry Essay Final Had17SamanthaDNo ratings yet

- Unit 1. Travelling and HolidaysDocument5 pagesUnit 1. Travelling and HolidaysAndre PurNo ratings yet

- Environmental Laws in The Philippines - ContextDocument38 pagesEnvironmental Laws in The Philippines - ContextJenifer Paglinawan0% (1)

- Thesis Asean IntegrationDocument5 pagesThesis Asean Integrationsarahjimenezriverside100% (3)

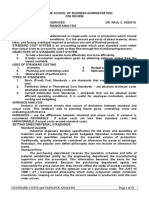

- TB Addatu - Standard Costs and Variable AnalysisDocument15 pagesTB Addatu - Standard Costs and Variable AnalysisJean Fajardo Badillo0% (3)

- Money-Related Problems: CE 1111: Mathematics of Engineering 1Document1 pageMoney-Related Problems: CE 1111: Mathematics of Engineering 1JHONIA MEJIANo ratings yet

- Servqual Research ProposalDocument19 pagesServqual Research ProposalMohammad Osman GoniNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet FebruaryDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Februaryapi-237717884No ratings yet

- Collocation ExercisesDocument4 pagesCollocation ExercisesJoy DarcyNo ratings yet

- Audit Committees ChecklistDocument8 pagesAudit Committees ChecklistTarryn Jacinth NaickerNo ratings yet

- IMDS Working Series Tapas MajumdarDocument144 pagesIMDS Working Series Tapas Majumdarpragya89No ratings yet

- One Small Town (OST) Creating A World of Abundance and Prosperity For EveryoneDocument7 pagesOne Small Town (OST) Creating A World of Abundance and Prosperity For EveryoneAudun BartnesNo ratings yet

- Department of Labor: Dol460Document1 pageDepartment of Labor: Dol460USA_DepartmentOfLaborNo ratings yet

- Strategic Management-Full Notes (PGDM)Document24 pagesStrategic Management-Full Notes (PGDM)Tisha TillmanNo ratings yet

- TurmericDocument11 pagesTurmericRachit ShivNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)gayNo ratings yet

(ITI) Midterm (Ch2-9)

(ITI) Midterm (Ch2-9)

Uploaded by

98amysOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(ITI) Midterm (Ch2-9)

(ITI) Midterm (Ch2-9)

Uploaded by

98amysCopyright:

Available Formats

Chapter 2

- Elasticity: a measure of responsiveness that is “unit-free” (the percent change in one

variable resulting from a 1 percent change in another variable)

- Price elasticity of demand: the percent change in quantity demanded resulting from a 1

percent increase in price

- Consumer surplus: the increase in the economic well-being of consumers who are able

to buy the product at a market price lower than the highest price that they are willing and

able to pay for the product (net gain; the difference between the value the consumers

place on the product and the payment that they must make to buy the product)

- Price elasticity of supply: the percent increase in quantity supplied resulting from a 1

percent increase in market price (“unit-free” measure)

- Opportunity cost: the value of other goods and services that are not produced because

resources are instead used to produce this product

- Producer surplus: increase in the economic well-being of producers who are able to sell

the product at a market price higher than the lowest price that would have drawn out their

supply (net gain; the difference between the revenues received and the costs incurred)

- Arbitrage: buying something in one market and reselling the same thing in another

market to profit from a price difference

- International price ( = world price): free-trade equilibrium price (if there are no

transport costs or other frictions)

- Demand for imports: excess demand (quantity demanded – quantity supplied) for a

product within the market; can be determined for each price at which the country might

import

- Supply of exports: the excess supply (quantity supplied – quantity demanded)

- One-dollar, one-vote metric: each dollar of gain or loss is valued equally, regardless of

who experiences it; implies a willing to judge trade issues on the basis of their effects on

aggregate well-being, without regard to their effects on the distribution of well-being

- Net national gains from trade: the difference between what one group gains and what

the other group loses

Chapter 3. Why Everybody Trades: Comparative Advantage

- Labor productivity : the number of units of output that a worker can produce in one

hour

- Absolute advantage: absolute advantage occurs when a country’s labor productivity in

producing a certain product is higher than that of the other country.

- Opportunity cost: the opportunity cost of producing more of a product in a country is

the amount of the other product that is given up.

- Principle of comparative advantage: A country will export the goods and services that

it can produce at a low opportunity cost and import the goods and services that it would

otherwise produce at a high opportunity cost.

- Relative price: the ratio of one product price to another product price

- Arbitrage: buying at the low price in one place and selling at the high price in the other

place

- Production-possibility curve (PPC): production-possibility curve shows all

combinations of amounts of different products that an economy can produce with full

employment of its resources and maximum feasible productivity of these resources.

Chapter 4 Trade: Factor Availability and Factor Proportions Are Key

- increasing marginal costs: As one industry expands at the expense of others, increasing

amounts of the other products must be given up to get each extra unit of the expanding

industry’s product.

- production-possibility curve (ppc): the combinations of amounts of different products

that a country can produce, given the country’s available factor resources and maximum

feasible productivities.

- Indifference curve: the various combinations of consumption quantities that lead to the

same level of well-being or happiness.

- Community indifference curve: how the economic well-being of a whole group

depends on the whole group’s consumption of products.

- Terms of trade: the price the country receives from foreign buyers for its export

product(s), relative to the price that the country pays foreign sellers for its import

product(s).

- Heckscher–Ohlin (H-O) theory: 1) predicts that a country exports the product (or

products) that uses its relatively abundant factor(s) intensively and imports the product

(or products) that uses its relatively scarce factor(s) intensively.

2) predicts that a country exports products that are produced with more intensive use of

the country’s relatively abundant factors in exchange for imports of products that use the

country’s relatively scarce factors more intensively.

- labor-abundant: A country is relatively labor-abundant if it has a higher ratio of labor to

other factors than does the rest of the world.

- labor-intensive: A product is relatively labor-intensive if labor costs are a greater share

of its value than they are of the value of other products.

Chapter 5) Who Gains and Who loses from trade?

Who Gains and Who Loses Within a Country

- Short run: laborers, plots of land, other inputs are tied to their current lines of

production. As a result, all groups tied to the rising sectors gain, and all groups tied to

declining sectors lose.

- Long run: factors can move between sectors in response to differences in returns. As a

result, due to the imbalance in the changes in factor supply and demand, the gainers and

losers in the long run are different from the ones in the short run.

Three Implications of the H-O Theory (Heckscher-Ohlin Theory)

- The Stolper-Samuelson Theorem: given certain conditions and assumptions, including

full adjustment to a new long-run equilibrium, an event that changes relative product

prices in a country unambiguously has two effects; 1) It raises the real return to the factor

used intensively in the rising-price industry / 2) It lowers the real return to the factor used

intensively in the falling-price industry.

- The Specialized-Factor Pattern: 1) the more a factor is specialized (=concentrated), in

the production of a product whose relative price is rising, the more this factor stands to

gain from the change in the product price. / 2) the more a factor is concentrated into the

production of a product whose relative price is falling, the more it stands to lose from the

change in product price.

- The Factor-Price Equalization Theorem: given certain conditions and assumptions,

free trade equalizes not only product prices, but also the prices of individual factors

between the two countries. 1) Laborers (of the same skill level) earn the same wage rate

in both countries. / 2) Units of Land (of comparable quality) earn the same rental return

in both countries.

Chapter 6

- Constant returns to scale: Input use and total cost rise in the same proportion as output

increases. For an industry such as production of basic clothing items, production is

probably very close to constant returns to scale.

- Scale economy: output quantity goes up by a larger proportion than does total cost, as

output increases.

- Internal scale economies: First, scale economies can be internal to the individual firm.

The actions and decisions of the individual firm itself result in internal scale economies.

- Monopolistic competition: a mild form of imperfect competition; a type of market

structure in which a large number of firms compete vigorously with each other in

producing and selling varieties of the basic product

- Oligopoly: Global oligopoly can arise when there are substantial scale economies

internal to each firm.

- External scale economies: The second type of scale economies is external to any

individual firm. External scale economies are based on the size of an entire industry

within a specific geographic area.

- Inter-industry trade: a country exports some products in trade for imports of other,

quite different products.

- Intra-industry trade (IIT): two-way trade in which a country both exports and imports

the same or very similar products (product varieties that are such close substitutes that

they are classified within the same industry).

- Product differentiation: consumers view the varieties of a product offered by different

firms in an industry as close but not perfect substitutes for each other.

- Net trade: The difference between the value of its exports and the value of its imports

over a specific period, usually a year.

Chapter 7: Growth and Trade

Economic growth: expansion of a country’s production capabilities

: changes in productive capabilities

: production-side changes

- Rybczynski theorem: statement that a kind of very biased growth, in which the

endowment of only one factor is growing, results in a decrease in production by the

sector that is not intensive in the growing factor.

: In a two-good world, and assuming that product prices are constant, growth in the

country’s endowment of one factor of production, with the other factor unchanged, has

two results:

o An increase in the output of the good that uses the growing factor intensively.

o A decrease in the output of the other good.2

- Dutch disease: apparent problem in which new production of a natural resource results in

a decline in production of manufactured products (deindustrialization).

: a real-world example. (In the Dutch case the endowment growth was the discovery of

natural gas deposits. Shifting labor and capital to the extraction of this gas led to a decline

in the country’s manufacturing sector.)

- Small country: one whose trade does not affect the international price ratio

- Large country: one whose trade can have an impact on the relative international price

ratio

- Immiserizing growth: growth that expands the country’s willingness to trade can result

in such a large decline in the country’s terms of trade that the country is worse off.

- Research and development (R&D): organized efforts from which most industrially

useful new technology now comes

- Diffusion: international spread or “trade” in technology

- Product cycle hypothesis: an attempt to offer a dynamic theory of technology and trade

by emphasizing that the location of production of a product is likely to shift from the

leading developed countries to developing countries as the product moves from its

introduction to maturity and standardization. (first advanced by Raymond Vernon)

- [ Economic growth ] results from increases in the country’s endowments of factors of

production or from technological improvements

- [ Balanced growth ] shifts the country’s production-possibility curve outward in a

proportionate manner.

- [ Biased growth ] shifts the ppc outward in a manner that is skewed toward one product

Chapter 8

- Tariff : tax on importing a good or service into a country, usually collected by customs

officials at the place of entry

- Specific Tariff : money amount per unit of import

- Ad valorem tariff : percentage of the estimated market value of the goods when they

reach the importing country

- Producer surplus : amount that producers gain from being able to sell products at the

market price

- Consumer surplus : amount that consumers gain from being able to buy products at the

market price

- One-dollar, one-vote metric : every dollar of gain or loss is just as important as every

other dollar gain or loss, regardless of who the gainers or losers are

- Effective rate of protection (of an individual industry) : percentage by which the entire

set of a nation’s trade barriers raises the industry’s value added per unit of output

- Consumption effect (of the tariff) : shows the loss to consumers in the importing nation

(=loss of consumer surplus)

- Production effect (of the tariff) : extra cost of shirting to more expensive home

production

- Monopsony power : a nation having a large enough share of the world market for one of

its import products that the country’s buying an affect the world price unilaterally

- Terms-of-trade effect : Case where a large country can affect the world price of a good

it imports, just by imposing a tariff

- National optimal tariff : yields the largest possible gain. However, it is only optimal

only if foreign governments do not retaliate with tariffs on our exports

- World Trade Organization (WTO) : formed in 1955, successor of General Agreement

on Tariffs and Trade (GATT), oversees the global rules of government policies toward

trade and provides a forum for negotiating global agreements to reduce barriers to trade

Chapter 9 Nontariff Barriers to Imports

-Nontariff barrier (NTB):

Short Ver.: Reduce imports by limiting quantities, increasing costs, or creating uncertainties.

Detail ver: Any policy used by the government to reduce imports, other than a simple tariff

on imports. Nontariff barriers can take many forms, including import quotas, discriminatory

product standards, buy-at-home rules for government purchases, and administrative red tape

to harass importers of foreign products. An NTB reduces imports through one or more of the

following direct effects: • Limiting the quantity of imports. • Increasing the cost of getting

imports into the market. • Creating uncertainty about the conditions under which imports will

be permitted.

- Import Quota:

Short ver.: Sets a maximum quantity of imports. Quantitative limit on imports giving direct

effects on the quantity.

Detail ver.: The best-known nontariff barrier or just quota, a limit on the total quantity of

imports of a product allowed into the country during a period of time (for instance, a year).

- Fixed Favoritism: A way of allocating import licenses adding up to the total quota. The

Government simply assigns the liceses to firms (and/or individuals) without competition,

applications, or negotiation.

- Import license auction: Selling of import licenses on a competitive basis to the highest

bidders.

Resource-using application procedures: Allocating quota licenses on a first-come, first-

served basis; on the basis of demonstrationg need or worthiness or on the basis of

negotiations instead of holding an auction. (If the govt. has a complicated process for

obtaining import liceses, then some of this amount is lost to resource-using application

procedures.

a) With first come, first-served allocation: those seeking the licesenses use resources to get to

and stay at the front of the line.

b) Allocation by worthiness is awarding quota licenses for materials or componetns based on

production capacity of firms= leads to resource wastage because it causes firms to overinvest

in production capacity in the hope of obtaining more quota licenses. E.g.: time and money

spent on lobbying with government officials to press each firm’s case for receiving quota

licenses.

c) Resources-using procedures encourage rent-seeking activites.

- A voluntary export restraint (VER):

Short ver.: Quantitative limit on foreign exports (based on threat of import restriciton)

Detail ver: An odd-looking trade barrier in which the importing country government

compels the foreign exporting country to agree “voluntarily” to restrict its exports to this

country. Through the VER the importing country actually gives foreigners monopoly power,

forces them to take it, and calls their compliance voluntary. E.g.: VERs have been used by

large countries as a rear-guard action to protect their industries that are having trouble

competing against a rising tide of imports

- Domestic content requirement:

Short ver.: Government procurement favoring domestic products, and a host of quality and

safety standards that have protectionist effects.

Detail ver.: Mandates a product produced and sold in a country must have a specified

minimum amount of domestic production value, in the form of wages paid to local workers

or materials and components produced within the country. This creates import protection at

two levels. 1) barrier to imports of the products that do not meet the content rules. 2) limit the

import of materials and components that otherwise would have been used in domestic

production of the products.

- Mixing requirement:

Short ver.: Require specified use of local labor, materials, or other products.

Detail ver.: A closely related NTB (Nontariff barrier) stipulating importer or import distributor

to buy (must) a certain percentage of the product locally. e.g.: Indonesia adopting regulations

that 80% of sales by modern retails stores must be domestic products.

- Section 301: Part of Trade Act of 1974, which gives the U.S president the power to

negotiate to eliminate “unfair trade practices” of foreign governments after becoming

frustrated with the shortcomings of the GATT dispute resolution process. This was

American’s unilateral pressure trying to resolve its complaints about foreign countries’ trade

practices and policies. (Other countries have resented U.S unilateral approach)

You might also like

- Cement Industry Internship ReportDocument43 pagesCement Industry Internship ReportHaritha V H90% (10)

- Din en Iso 4287-2010Document31 pagesDin en Iso 4287-2010Gary LheureuxNo ratings yet

- ME Problem Set-1 (2019)Document2 pagesME Problem Set-1 (2019)pikuNo ratings yet

- Important Microeconomic TerminologiesDocument9 pagesImportant Microeconomic TerminologiesRana WaqasNo ratings yet

- Keywords: By: Submitted To: Nischal Gautam MRL SirDocument11 pagesKeywords: By: Submitted To: Nischal Gautam MRL SirNischalGautamNo ratings yet

- Reviewer in Taxation Unit 1Document8 pagesReviewer in Taxation Unit 1pepito manalotoNo ratings yet

- Economic Test ReviewDocument8 pagesEconomic Test ReviewY11A2 Jessica Yu-lin (Jessica) CHOUNo ratings yet

- MicroDocument9 pagesMicroNa ViNo ratings yet

- Economic System: (1) Factors of ProductionDocument19 pagesEconomic System: (1) Factors of ProductionEmma WongNo ratings yet

- A Glossary of Microeconomics TermsDocument9 pagesA Glossary of Microeconomics Termseconomics6969100% (1)

- New TradeDocument22 pagesNew TradesonaliNo ratings yet

- International Economics - Midterm NotesDocument18 pagesInternational Economics - Midterm NotesLonerStrelokNo ratings yet

- De Managerial Economics GlossaryDocument6 pagesDe Managerial Economics GlossaryV L Narayana RaoNo ratings yet

- EVERY ECON RESOURCE YOU'LL EVER NEED - Economics Definitions - SolutionsDocument11 pagesEVERY ECON RESOURCE YOU'LL EVER NEED - Economics Definitions - SolutionsHala ElhsNo ratings yet

- Key Terms MicroDocument7 pagesKey Terms Micro김지현No ratings yet

- Glossary: © The Institute of Chartered Accountants of IndiaDocument4 pagesGlossary: © The Institute of Chartered Accountants of Indiachhetribharat08No ratings yet

- ManeconshtDocument4 pagesManeconshtJancherr GalangNo ratings yet

- Economics HoDocument2 pagesEconomics HoLove JcwNo ratings yet

- Econ DictionaryDocument7 pagesEcon DictionaryJayapal ReddyNo ratings yet

- دارسات تجاريةDocument9 pagesدارسات تجاريةymhdz6hpj4No ratings yet

- ECODocument15 pagesECOtrantuancuong0509No ratings yet

- Economy 1-14Document14 pagesEconomy 1-14Lorman MaylasNo ratings yet

- EoG Extra NotesDocument20 pagesEoG Extra NotesVrishank JhunjhunwalaNo ratings yet

- Market Structure and PricingDocument5 pagesMarket Structure and PricingAbdulrahmanNo ratings yet

- Basic Concepts in Managerial Economics List of ConceptsDocument4 pagesBasic Concepts in Managerial Economics List of Conceptsghosh7171No ratings yet

- Econ StudyDocument10 pagesEcon Studyc2why985xhNo ratings yet

- Economics WorksheetDocument10 pagesEconomics WorksheetPandaNo ratings yet

- Summary Principles of Economics Book Economics Parking Powell MathewsDocument20 pagesSummary Principles of Economics Book Economics Parking Powell MathewsqalatiNo ratings yet

- Econ 201 (L02) Review List - Midterm Fall 2020Document10 pagesEcon 201 (L02) Review List - Midterm Fall 2020samantha davidsonNo ratings yet

- Ôn Thi GK CSTMQTDocument14 pagesÔn Thi GK CSTMQTK60 Võ Nguyễn Ngọc HânNo ratings yet

- IT Final Ch.4.2023Document5 pagesIT Final Ch.4.2023Amgad ElshamyNo ratings yet

- Glossary For Ca FoundationDocument4 pagesGlossary For Ca Foundationjansariyash55No ratings yet

- Economics Cheat Sheet Maddogz43Document2 pagesEconomics Cheat Sheet Maddogz43sh4dow.strid3r9581No ratings yet

- Economics Revision 2.2Document9 pagesEconomics Revision 2.2Pham Van HaNo ratings yet

- Abnormal Profit: Gillespie: Foundations of Economics 2e Microeconomics GlossaryDocument4 pagesAbnormal Profit: Gillespie: Foundations of Economics 2e Microeconomics GlossaryAamer SaddiqNo ratings yet

- 1629204622-1. Basic of MicroeconomicDocument5 pages1629204622-1. Basic of MicroeconomicTigerNo ratings yet

- Perfect and Imperfect MarketDocument10 pagesPerfect and Imperfect MarketMalde KhuntiNo ratings yet

- ACC08/FMS01 Lectures: Economic Foundation of Financial ManagementDocument15 pagesACC08/FMS01 Lectures: Economic Foundation of Financial ManagementmiolataNo ratings yet

- Man - Econ Finals Chapter 12-16Document10 pagesMan - Econ Finals Chapter 12-16nenzzmariaNo ratings yet

- Changes With Marginal Utility Held ConstantDocument6 pagesChanges With Marginal Utility Held ConstanthyNo ratings yet

- Chapter 7: Engineering EconomicsDocument1 pageChapter 7: Engineering EconomicsFrancisNo ratings yet

- Lund University - Introduction To International Business - Lecture 3Document11 pagesLund University - Introduction To International Business - Lecture 3Jarste BeumerNo ratings yet

- Unit 1: Theories of International TradeDocument25 pagesUnit 1: Theories of International TradeJoseph PrabhuNo ratings yet

- AC TC/Q, AFC FC/Q, AVC VC/Q: Between Pure Monopoly & Pure CompetitionDocument3 pagesAC TC/Q, AFC FC/Q, AVC VC/Q: Between Pure Monopoly & Pure CompetitionSadnima Binte Noman 2013796630No ratings yet

- Chapter No. 9: Forms of Market: Lilavatibai Podar High School. ISCDocument12 pagesChapter No. 9: Forms of Market: Lilavatibai Podar High School. ISCStephine BochuNo ratings yet

- Ktqt Ghét Nhất Trên ĐờiDocument12 pagesKtqt Ghét Nhất Trên Đời20. Lê Hải Linh NhiNo ratings yet

- Ebenstein and Ebenstein Chapter 8Document4 pagesEbenstein and Ebenstein Chapter 8David Bryan Tan OngNo ratings yet

- Memorization Test Study GuideDocument2 pagesMemorization Test Study GuideConorBurnsNo ratings yet

- IGCSE Economics RevisionDocument51 pagesIGCSE Economics RevisionZahra AliNo ratings yet

- Unit 2Document8 pagesUnit 2Martina PerezNo ratings yet

- Econ 200 Chap 1-6Document10 pagesEcon 200 Chap 1-6api-578941689No ratings yet

- Economics Exam Prep SuaDocument7 pagesEconomics Exam Prep SuaanagharavindvellayaniNo ratings yet

- Main Market FormsDocument9 pagesMain Market FormsP Janaki Raman50% (2)

- Section 1: Introduction To EconomicsDocument10 pagesSection 1: Introduction To EconomicsnaitosNo ratings yet

- Document 9 6Document7 pagesDocument 9 6grace lavisoresNo ratings yet

- KTQT 2Document37 pagesKTQT 2thuyntp22No ratings yet

- EconomicsimpimpDocument9 pagesEconomicsimpimpANUP MUNDENo ratings yet

- DMBA105Document9 pagesDMBA105chetan kansalNo ratings yet

- List of Economic Terms - V10Document32 pagesList of Economic Terms - V10weijuanshihkuNo ratings yet

- Economics Edexcel AS Level Microeconomics GlossaryDocument7 pagesEconomics Edexcel AS Level Microeconomics Glossarymarcodl18No ratings yet

- Theories of International Trade PD-1Document21 pagesTheories of International Trade PD-1Swathy SasikumarNo ratings yet

- Summary of Austin Frakt & Mike Piper's Microeconomics Made SimpleFrom EverandSummary of Austin Frakt & Mike Piper's Microeconomics Made SimpleNo ratings yet

- Valvulas Nacional 2015Document33 pagesValvulas Nacional 2015David Bottassi PariserNo ratings yet

- Steel Industry: Contribution in The Development of India's Economic GrowthDocument28 pagesSteel Industry: Contribution in The Development of India's Economic GrowthAditya YadavNo ratings yet

- Linear Arrangement - 2Document2 pagesLinear Arrangement - 2Hritik RawatNo ratings yet

- Economics Important Questions 2020 - Inter 1st Year .Copyrights To ReseenDocument3 pagesEconomics Important Questions 2020 - Inter 1st Year .Copyrights To ReseenLC groups100% (2)

- BureaucracyDocument4 pagesBureaucracyMarvinNo ratings yet

- Transportation Systems HandoutsDocument3 pagesTransportation Systems HandoutsKarla BuenaflorNo ratings yet

- FBCJ CustomizingDocument9 pagesFBCJ CustomizingGlowly bslNo ratings yet

- What Is GlobalizationDocument17 pagesWhat Is GlobalizationVktoria HalenNo ratings yet

- DiNapoli Announces $2B Strategic Partnership With Goldman Sachs Asset Management For Global Equity Investments, 9:10:14Document2 pagesDiNapoli Announces $2B Strategic Partnership With Goldman Sachs Asset Management For Global Equity Investments, 9:10:14Rick KarlinNo ratings yet

- ATRAM Investment Application FormDocument1 pageATRAM Investment Application FormValen ValibiaNo ratings yet

- GDLSK Names New PartnersDocument1 pageGDLSK Names New PartnersMary Joy Dela MasaNo ratings yet

- 08 SCI Chemistry Essay Final HadDocument3 pages08 SCI Chemistry Essay Final Had17SamanthaDNo ratings yet

- Unit 1. Travelling and HolidaysDocument5 pagesUnit 1. Travelling and HolidaysAndre PurNo ratings yet

- Environmental Laws in The Philippines - ContextDocument38 pagesEnvironmental Laws in The Philippines - ContextJenifer Paglinawan0% (1)

- Thesis Asean IntegrationDocument5 pagesThesis Asean Integrationsarahjimenezriverside100% (3)

- TB Addatu - Standard Costs and Variable AnalysisDocument15 pagesTB Addatu - Standard Costs and Variable AnalysisJean Fajardo Badillo0% (3)

- Money-Related Problems: CE 1111: Mathematics of Engineering 1Document1 pageMoney-Related Problems: CE 1111: Mathematics of Engineering 1JHONIA MEJIANo ratings yet

- Servqual Research ProposalDocument19 pagesServqual Research ProposalMohammad Osman GoniNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet FebruaryDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Februaryapi-237717884No ratings yet

- Collocation ExercisesDocument4 pagesCollocation ExercisesJoy DarcyNo ratings yet

- Audit Committees ChecklistDocument8 pagesAudit Committees ChecklistTarryn Jacinth NaickerNo ratings yet

- IMDS Working Series Tapas MajumdarDocument144 pagesIMDS Working Series Tapas Majumdarpragya89No ratings yet

- One Small Town (OST) Creating A World of Abundance and Prosperity For EveryoneDocument7 pagesOne Small Town (OST) Creating A World of Abundance and Prosperity For EveryoneAudun BartnesNo ratings yet

- Department of Labor: Dol460Document1 pageDepartment of Labor: Dol460USA_DepartmentOfLaborNo ratings yet

- Strategic Management-Full Notes (PGDM)Document24 pagesStrategic Management-Full Notes (PGDM)Tisha TillmanNo ratings yet

- TurmericDocument11 pagesTurmericRachit ShivNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)gayNo ratings yet