Professional Documents

Culture Documents

Basel III - Disclosure-As On Ashwin-2076

Basel III - Disclosure-As On Ashwin-2076

Uploaded by

shresthanikhil078Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basel III - Disclosure-As On Ashwin-2076

Basel III - Disclosure-As On Ashwin-2076

Uploaded by

shresthanikhil078Copyright:

Available Formats

HIMALAYAN BANK LIMITED

DISCLOSURES UNDER BASEL III AS ON ASHWIN 2076 (17 OCTOBER 2019)

Based on Unaudited Financials

A. Capital Structure & Capital Adequacy as per Basel III

1. Tier 1 Capital and Breakdown of its Components:

SN Particulars Amount

A Core Capital (Tier 1) 15,086,102,805

1 Paid up Equity Share Capital 8,520,255,844

2 Share Premium -

3 Statutory General Reserves 3,736,889,575

4 Retained Earnings 2,171,146,876

5 Current year profit/(loss) 435,916,629

6 Capital Adjustment Reserve -

7 Debenture Redemption Reserve 600,000,000

8 Special Reserve -

9 Deferred Tax Reserve -

Less: Miscellaeous expenditure not written off -

Less: Deferred Tax Reserve -

Less: Investment in equity of institutions with financial interests 298,124,000

Less: Purchase of land & building in excess of limit and unutilized 79,982,119

Less: Other Deductions -

2. Tier 2 Capital and Breakdown of its Components

SN Particulars Amount

B Supplementary Capital (Tier 2) 3,757,865,801

1 Subordinated Term Debt 2,569,104,000

2 General loan loss provision 1,148,490,849

3 Exchange Equalization Reserve 39,056,093

4 Investment Adjustment Reserve 1,214,859

5 Other Reserves -

3. Information on Subordinated Term Debt:

Bond Issued HBL Bond 2077 HBL Bond 2083

Outstanding amount 600,000,000 2,569,104,000.00

Interest rate 8% 10%

Maturity Date Ashad 2077 Bhadra 2083

Interest payment Half yearly basis Half yearly basis

Tenor 7 years 7 years

Amount to be reckoned as capital - 2,569,104,000.00

4. Total deductions from Capital: N/a

5. Total Qualifying Capital

SN Particulars Amount

1 Core Capital (Tier 1) 15,086,102,805

2 Supplementary Capital (Tier 2) 3,757,865,801

Total 18,843,968,606

6. Capital Adequacy Ratio:

CAPITAL ADEQUACY RATIOS

Tier 1 Capital to Total Risk Weighted Exposures 11.27%

Tier 1 and Tier 2 Capital to Total Risk Weighted Exposures 14.08%

B. Risk Exposures

1. Risk Weighted Exposures for Credit Risk, Market Risk & Operational Risks)

RISK WEIGHTED EXPOSURES Amount

a Risk Weighted Exposure for Credit Risk 118,566,242,326

b Risk Weighted Exposure for Operational Risk 8,133,805,741

c Risk Weighted Exposure for Market Risk 319,121,097

Adjustment under Pillar II

Add 5% of gross income for operational risk 3,036,447,889

Add: 3% of total RWE for overalll risk 3,810,575,075

Total Risk Weighted Exposures 133,866,192,128

2. Risk Weighted Exposures under each of 12 categories of Credit Risk

SN Particulars Amount

1 Claims on government & central bank 331,710,898

2 Claims on other official entities 982,418,613

3 Claims on banks 3,809,807,748

4 Claims on domestic corporate and securities firms 78,824,583,284

5 Claims on regulatory retail portfolio 6,923,256,333

6 Claims secured by residential properties 3,251,548,208

7 Claims secured by commercial real estate 1,690,803,111

8 Past due claims 666,678,980

9 High risk claims 5,727,494,299

10 Lending against securities (Bonds and Shares) 1,310,044,219

11 Other assets 4,015,130,910

12 Off balance sheet items 11,032,765,722

TOTAL 118,566,242,326

3. Total Risk Weighted Exposures calculation table:

SN Particulars Amount

1 Total Risk Weighted Exposure 133,866,192,128

2 Total Core Capital Fund (Tier 1) 15,086,102,805

3 Total Capital Fund (Tier 1 & Tier 2) 18,843,968,606

4 Total Core Capital to Total Risk Weighted Exposures 11.27%

5 Total Capital to Total Risk Weighted Exposures 14.08%

4. Amount of NPA

SN Loan Classification Gross Amount Provision Held Net NPA

1 Restructured Loan 18,795,324 3,614,694 15,180,630

2 Substandard Loan 238,335,498 59,583,875 178,751,624

3 Doubtful Loan 39,415,329 19,707,664 19,707,664

4 Loss Loan 894,794,767 894,794,767 -

Total 1,191,340,918 977,701,000 213,639,918

5.NPA Ratios

Gross NPA to Gross Advances 1.16%

Net NPA to Net Advances : 0.21%

6. Movement of Non Performing Assets ( Ashad 2076 VS Ashwin 2076)

Previous quarter This quarter Ashwin Movement of non

S.N Loan Classification Ashad End 2076 End 2076 performing Assets

1 Restructured Loan 19,469,480 18,795,324 -3.46%

2 Substandard Loan 91,252,194 238,335,498 161.18%

3 Doubtful Loan 52,011,896 39,415,329 -24.22%

4 Loss Loan 935,845,119 894,794,767 -4.39%

Total 1,098,578,689 1,191,340,918 8.44%

7. Write Off of Loans & Interest upto Ashwin End 2076

SN Principal Interest Total

1 - - -

8. Movement in Loan Loss Provisioning:

Previous quarter This quarter Ashwin

SN Loan Loss Provision Ashad End 2076 End 2076 Movement in Loan loss

1 Pass 959,264,063 996,048,750 3.83%

2 Watchlist 112,566,008 163,142,099 44.93%

2 Restructured/ Rescheduled Loan 3,762,538 3,614,694 -3.93%

3 Substandard Loan 22,813,048 59,583,875 161.18%

4 Doubtful Loan 26,005,948 19,707,664 -24.22%

5 Loss Loan 935,845,119 894,794,767 -4.39%

Total 2,060,256,724 2,136,891,848 3.72%

ii. Movement in Interest Suspense

Previous quarter This quarter Ashwin Movement during the

Particular Ashad End 2076 End 2076 period

1 Interest Suspense 814,988,268 838,542,922 2.89%

9 Segregation of Investment Portfolio:

Particulars Ashwin 2076

Available for sale:

Investment in equity 442,818,348

Held to maturity:

Investment in treasury bills 6,851,841,965

Investment in Govt. bonds 9,009,075,000

Investment in Foreign Bonds 512,698,443

Placement 6,805,800,000

Total 23,179,415,408

Held for Trading -

You might also like

- ACC 309 FinalDocument42 pagesACC 309 FinalSalman Khalid77% (22)

- Basel Disclosure Ashad2080Document4 pagesBasel Disclosure Ashad2080Na Bee NaNo ratings yet

- FIM-CAR-NIBL-July-2019-Pillar 2 Added PDFDocument10 pagesFIM-CAR-NIBL-July-2019-Pillar 2 Added PDFPrakriti ShresthaNo ratings yet

- Basel IIDocument3 pagesBasel IIaNo ratings yet

- Rastriya Banijya Bank Ltd. (Document9 pagesRastriya Banijya Bank Ltd. (Pradip HamalNo ratings yet

- Chapter-Two Result and Findings: 4.1 Presentation and Analysis of DataDocument15 pagesChapter-Two Result and Findings: 4.1 Presentation and Analysis of Dataanujkhanal100No ratings yet

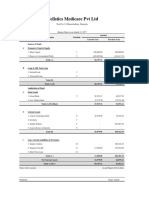

- Belstick Medicare PVT LTDDocument8 pagesBelstick Medicare PVT LTDGautam SaraffNo ratings yet

- Belstick Medicare PVT LTD 7778Document8 pagesBelstick Medicare PVT LTD 7778Gautam SaraffNo ratings yet

- HDFC Bank - Annex To Rar 2015Document8 pagesHDFC Bank - Annex To Rar 2015Moneylife FoundationNo ratings yet

- Bal Jyoti English School Hoklabari 078-79Document10 pagesBal Jyoti English School Hoklabari 078-79Ragnar LothbrokNo ratings yet

- NAV CalculationDocument1 pageNAV CalculationShohel MiahNo ratings yet

- 3rd QTR Published Report FY 2079-80Document1 page3rd QTR Published Report FY 2079-80Lalit SharmaNo ratings yet

- Pillar III 31st March 2019Document25 pagesPillar III 31st March 2019kannan sunilNo ratings yet

- Bashyal Emporium7677Document6 pagesBashyal Emporium7677Ravi KarnaNo ratings yet

- Press 'CTRL' + ' (' On The Next Cell For Notes To Accounts: III. Total Revenue (I + II)Document28 pagesPress 'CTRL' + ' (' On The Next Cell For Notes To Accounts: III. Total Revenue (I + II)Anoushka LakhotiaNo ratings yet

- Belstick Medicare PVT LTDDocument8 pagesBelstick Medicare PVT LTDGautam SaraffNo ratings yet

- Statement August 31 2020Document30 pagesStatement August 31 2020NicolasNo ratings yet

- Fund Flow Statement Company (Standalone) : Sources of FundsDocument1 pageFund Flow Statement Company (Standalone) : Sources of FundsGayatri BeheraNo ratings yet

- Assignment Basal Norm Analysis (Dhanlaxmi Bank)Document18 pagesAssignment Basal Norm Analysis (Dhanlaxmi Bank)amisha saxenaNo ratings yet

- Receipts and Payments AccountDocument2 pagesReceipts and Payments AccountUmapathi MNo ratings yet

- Rafiki MFB Audited Financials FY 2022 31.03.2023Document1 pageRafiki MFB Audited Financials FY 2022 31.03.2023EdwinNo ratings yet

- Bhaivav Laxmi Ma Galla Bhandar7677Document14 pagesBhaivav Laxmi Ma Galla Bhandar7677Ravi KarnaNo ratings yet

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly)Document3 pagesAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly)sanjiv sahNo ratings yet

- Karnataka Bank LimitedDocument9 pagesKarnataka Bank LimitedDhanusha RajuNo ratings yet

- Development AssignmentDocument19 pagesDevelopment AssignmentMuhammad hanzla mehmoodNo ratings yet

- 2022 BD Pillar 3 DisclosureDocument15 pages2022 BD Pillar 3 DisclosuremmozupurNo ratings yet

- Co Operative Bank of Kenya LTD Audited Financial Results For The Period Ended 31 Dec 2021Document3 pagesCo Operative Bank of Kenya LTD Audited Financial Results For The Period Ended 31 Dec 2021gilton amadadiNo ratings yet

- PT Bank Central Asia TBK and Subsidiaries Leverage Ratio - Basel IIIDocument3 pagesPT Bank Central Asia TBK and Subsidiaries Leverage Ratio - Basel IIIDwi UdayanaNo ratings yet

- Fourth Quarter 2009 Financial ResultsDocument26 pagesFourth Quarter 2009 Financial ResultsZerohedgeNo ratings yet

- CaseDocument4 pagesCaseteklay asmelashNo ratings yet

- Budget Office of The Federation Fed. Min. of Fin. Budget and Nat. PlanningDocument10 pagesBudget Office of The Federation Fed. Min. of Fin. Budget and Nat. PlanningOseni MomoduNo ratings yet

- Commercial BankingDocument2 pagesCommercial BankingTanishqa JoganiNo ratings yet

- 2016 Pillar III DisclosureDocument13 pages2016 Pillar III Disclosureahsan habibNo ratings yet

- Lucena City Annual Budget 2022Document277 pagesLucena City Annual Budget 2022Kakam PwetNo ratings yet

- Capital Adequacy and Liquidity Disclosures Unconsolidated2021Document14 pagesCapital Adequacy and Liquidity Disclosures Unconsolidated2021Syed FadiNo ratings yet

- Case Submission On: Mellon Financial and The Bank of New YorkDocument3 pagesCase Submission On: Mellon Financial and The Bank of New Yorkneelakanta srikarNo ratings yet

- CommentaryDocument6 pagesCommentarySachit KCNo ratings yet

- QCT Energy Private Limited Balance Sheet As at 31 MARCH 2021Document10 pagesQCT Energy Private Limited Balance Sheet As at 31 MARCH 2021Swapnil WankhedeNo ratings yet

- 3.nuventures CFS FINALoldDocument32 pages3.nuventures CFS FINALoldNagendra KoreNo ratings yet

- Financials - IRDA - PD For June 17Document53 pagesFinancials - IRDA - PD For June 17mtashNo ratings yet

- SCB Strategic Review 2015Document24 pagesSCB Strategic Review 2015amirentezamNo ratings yet

- 1st Qtr.2021 ReportDocument31 pages1st Qtr.2021 ReportMurad HasanNo ratings yet

- A04 T86uxmwsyll4x6ve.1Document44 pagesA04 T86uxmwsyll4x6ve.1citybizlist11No ratings yet

- 21 Problems - and - Answers - Reclassification - of - Financial - AssetDocument30 pages21 Problems - and - Answers - Reclassification - of - Financial - AssetSheila Grace BajaNo ratings yet

- Taj Nepal Pvt. LTD 76 TaxDocument31 pagesTaj Nepal Pvt. LTD 76 TaxSunny DesharNo ratings yet

- Review of Financial PerformanceDocument2 pagesReview of Financial Performancemian UmairNo ratings yet

- Cash FlowDocument6 pagesCash FlowRazi KamrayNo ratings yet

- Case 21: Maynard Company (A) : Our Objective Is To Look at The Concept of Balance SheetDocument6 pagesCase 21: Maynard Company (A) : Our Objective Is To Look at The Concept of Balance SheetAranhav SinghNo ratings yet

- Capital Adequacy and Liquidity Disclosures Unconsolidated2020Document14 pagesCapital Adequacy and Liquidity Disclosures Unconsolidated2020Syed FadiNo ratings yet

- Tobias Co. Problem AssignmentDocument2 pagesTobias Co. Problem AssignmentMiss MegzzNo ratings yet

- Ifrs9 For BanksDocument58 pagesIfrs9 For BanksMiladNo ratings yet

- Consolidated Financial Highlights: - Amortized Cost: Investment SecuritiesDocument2 pagesConsolidated Financial Highlights: - Amortized Cost: Investment SecuritiesRimsha SiafNo ratings yet

- Capital Adequacy and Liquidity Disclosures Unconsolidated2019Document14 pagesCapital Adequacy and Liquidity Disclosures Unconsolidated2019Syed FadiNo ratings yet

- Ratio Analysis SumsDocument8 pagesRatio Analysis Sumshabibi 101No ratings yet

- TAX 2202E TBS02 01.solutionDocument4 pagesTAX 2202E TBS02 01.solutionZhitong LuNo ratings yet

- SummaryDocument1 pageSummarymkhalid1970No ratings yet

- A04 Zur57zgu4yzwvtfj.1Document47 pagesA04 Zur57zgu4yzwvtfj.1Paul BluemnerNo ratings yet

- Clavax Power - TAR - 2023 - Provisional - 10.09Document7 pagesClavax Power - TAR - 2023 - Provisional - 10.09Naresh nath MallickNo ratings yet

- IFRS 9 For Banks: Illustrative DisclosuresDocument56 pagesIFRS 9 For Banks: Illustrative DisclosuresSergio VinsennauNo ratings yet

- 24th Annual ReportDocument104 pages24th Annual Reportshresthanikhil078No ratings yet

- A.116 NESDO Sambridha Laghubitta Bittiya SansthaDocument3 pagesA.116 NESDO Sambridha Laghubitta Bittiya Sansthashresthanikhil078No ratings yet

- Provided by Digital Library of Open University of TanzaniaDocument109 pagesProvided by Digital Library of Open University of Tanzaniashresthanikhil078No ratings yet

- Effect of Social Media On Student PreprintDocument43 pagesEffect of Social Media On Student Preprintshresthanikhil078No ratings yet

- Oibn Annualreport 2021 22pdf 6936 019 1691595964Document134 pagesOibn Annualreport 2021 22pdf 6936 019 1691595964shresthanikhil078No ratings yet

- 3rd Quarter of Fiscal Year 079-80 (2022-23)Document26 pages3rd Quarter of Fiscal Year 079-80 (2022-23)shresthanikhil078No ratings yet

- A JackovaDocument4 pagesA Jackovashresthanikhil078No ratings yet

- Financial Performance of Rural Saving and Credit Cooperatives in Tigray, EthiopiaDocument13 pagesFinancial Performance of Rural Saving and Credit Cooperatives in Tigray, Ethiopiashresthanikhil078No ratings yet

- Everest Bank. NPDocument55 pagesEverest Bank. NPshresthanikhil078No ratings yet

- NCHL - Annual Report 79 80Document116 pagesNCHL - Annual Report 79 80shresthanikhil078No ratings yet

- Factors Determining Profitability of Commercial Banks: Evidence From Nepali Banking SectorDocument14 pagesFactors Determining Profitability of Commercial Banks: Evidence From Nepali Banking Sectorshresthanikhil078No ratings yet

- Vol 3 No 1 Yeak Narayan SharmaDocument14 pagesVol 3 No 1 Yeak Narayan Sharmashresthanikhil078No ratings yet

- Working Capital Management and Profitability of Commercial Banks in NepalDocument13 pagesWorking Capital Management and Profitability of Commercial Banks in Nepalshresthanikhil078No ratings yet

- Figure5 NPDocument9 pagesFigure5 NPshresthanikhil078No ratings yet

- Jenita. NPDocument7 pagesJenita. NPshresthanikhil078No ratings yet

- Capital Structure of - NPDocument47 pagesCapital Structure of - NPshresthanikhil078No ratings yet

- Financial Position of Everest Bank Limited - NPDocument7 pagesFinancial Position of Everest Bank Limited - NPshresthanikhil078No ratings yet

- C Project-2-2Document44 pagesC Project-2-2Rajesh Kumar roulNo ratings yet

- Student: Assumptions / InputsDocument10 pagesStudent: Assumptions / InputsAnuj BhattNo ratings yet

- Bahrain Financing Company's Financial Condition Analysis For The Period From 01.01.2007 To 31.12.2011Document17 pagesBahrain Financing Company's Financial Condition Analysis For The Period From 01.01.2007 To 31.12.2011Lakshmi LekhaNo ratings yet

- 2440120041-Raynerd Cornelius Week 3Document8 pages2440120041-Raynerd Cornelius Week 3Drenyar ScoutNo ratings yet

- Dwnload Full Principles of Real Estate Accounting and Taxation Second Edition PDFDocument48 pagesDwnload Full Principles of Real Estate Accounting and Taxation Second Edition PDFfrancisco.landa492100% (24)

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of AccountsKathleen PardoNo ratings yet

- Fuji-Phama OM 4Q182018Document31 pagesFuji-Phama OM 4Q182018Subhanjan BhattacharyaNo ratings yet

- Exercises - Master BudgetDocument5 pagesExercises - Master BudgetUng Goy100% (1)

- Practice Exercise 6 Topic 4 - 2Document6 pagesPractice Exercise 6 Topic 4 - 2fayaa zainurinNo ratings yet

- Cost Volume ProfitDocument4 pagesCost Volume ProfitProf_RamanaNo ratings yet

- OncaDocument6 pagesOncaVinylcoated ClipsNo ratings yet

- Post. Date Description Ref. Debit CreditDocument6 pagesPost. Date Description Ref. Debit CreditkinantiiNo ratings yet

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Document38 pagesNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraNo ratings yet

- Session 1Document35 pagesSession 1martinNo ratings yet

- Slides Topic 3 MFRS116 Ppe (Part 2)Document31 pagesSlides Topic 3 MFRS116 Ppe (Part 2)NUR AYUNI BALQISH AHMAD MULIADINo ratings yet

- Company Name Delta AirlinesDocument17 pagesCompany Name Delta AirlinesHarshit GuptaNo ratings yet

- A Review of The Accounting CycleDocument46 pagesA Review of The Accounting CycleLiezl MaigueNo ratings yet

- Advanced Accounting 7e Hoyle - Chapter 1Document47 pagesAdvanced Accounting 7e Hoyle - Chapter 1Leni Rosiyani100% (8)

- Tally GST Module Question Set-1Document3 pagesTally GST Module Question Set-1Boni HalderNo ratings yet

- Variable Costing and Segment Reporting: Tools For ManagementDocument20 pagesVariable Costing and Segment Reporting: Tools For ManagementAbed Al-Rahman SalehNo ratings yet

- Accountants Divide The Economic Life of A Business Into Reporting PeriodsDocument36 pagesAccountants Divide The Economic Life of A Business Into Reporting PeriodsCNo ratings yet

- Exercises (7-27-18)Document2 pagesExercises (7-27-18)Justin ManaogNo ratings yet

- Dynamic-Asset Allocation FundDocument8 pagesDynamic-Asset Allocation FundArmstrong CapitalNo ratings yet

- Caso Iese FinancieroDocument5 pagesCaso Iese FinancieroJohnatanSolorzanoNo ratings yet

- Illustration KK Co. Perpetual ClosingDocument9 pagesIllustration KK Co. Perpetual ClosingNAOL BIFTUNo ratings yet

- A Je Worksheet Illustration 1Document17 pagesA Je Worksheet Illustration 1Nichole TanNo ratings yet

- BKAL1013 (A172) - ppt-T4Document27 pagesBKAL1013 (A172) - ppt-T4Heap Ke XinNo ratings yet

- Final Requirement ProblemsDocument5 pagesFinal Requirement ProblemsYoite MiharuNo ratings yet

- Fsapm Ols 7: Holding Company Accounts Under Mergers & AcquisitionsDocument14 pagesFsapm Ols 7: Holding Company Accounts Under Mergers & AcquisitionsLakshmi Narasimhan SrinivasachariNo ratings yet

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)