Professional Documents

Culture Documents

Goods & Service Tax (GST) - User Dashboard

Goods & Service Tax (GST) - User Dashboard

Uploaded by

Kridl smgOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Goods & Service Tax (GST) - User Dashboard

Goods & Service Tax (GST) - User Dashboard

Uploaded by

Kridl smgCopyright:

Available Formats

Skip to Main Content

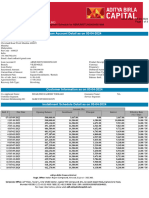

Goods and Services Tax MALTESH RANG

29HVVPK18

Dashboard Returns GSTR-1/IFF B2B

GSTIN - 29HVVPK1805G2Z2 Legal Name - MALTESH RANGDHOL KISHORE KUMAR Trade Name - R.K.CONSTRUCTION

FY - 2023-24 Return Period - April Status - Filed

4A, 4B, 6B, 6C - B2B, SEZ, DE Invoices HELP

Recipient wise count Document wise details

Processed Records

29AAACK5676RE23 KARNATAKA RURAL INFRASTRUCTURE DEVELOPMENT LIMITED HEAD OFFICE BANGALORE

Records Per Page :

Display/Hide Columns: Search...

Invoice no. Invoice date Total invoice value (₹) Total taxable value (₹) Integrated Tax (₹) Central tax (₹) State/UT Tax (₹) Cess (₹) Source Actions

92 10/04/2023 1,63,721.00 1,38,747.00 0.00 12,487.00 12,487.00 0.00

112 24/04/2023 2,82,677.00 2,39,557.00 0.00 21,560.00 21,560.00 0.00

95 11/04/2023 2,92,045.00 2,47,496.00 0.00 22,274.50 22,274.50 0.00

115 24/04/2023 4,08,624.00 3,46,292.00 0.00 31,166.00 31,166.00 0.00

120 29/04/2023 23,834.00 22,700.00 0.00 567.00 567.00 0.00

118 27/04/2023 51,922.00 49,450.00 0.00 1,236.00 1,236.00 0.00

89 01/04/2023 88,219.00 84,019.00 0.00 2,100.00 2,100.00 0.00

107 15/04/2023 72,450.00 69,000.00 0.00 1,725.00 1,725.00 0.00

93 11/04/2023 3,58,125.00 3,03,496.00 0.00 27,314.50 27,314.50 0.00

101 13/04/2023 2,50,728.00 2,12,482.00 0.00 19,123.00 19,123.00 0.00

96 11/04/2023 3,65,839.00 3,10,033.00 0.00 27,903.00 27,903.00 0.00

104 14/04/2023 1,46,132.00 1,23,842.00 0.00 11,145.00 11,145.00 0.00

108 15/04/2023 44,940.00 42,800.00 0.00 1,070.00 1,070.00 0.00

119 29/04/2023 1,71,696.00 1,45,505.00 0.00 13,095.50 13,095.50 0.00

99 11/04/2023 1,42,793.00 1,21,011.00 0.00 10,891.00 10,891.00 0.00

116 24/04/2023 52,500.00 50,000.00 0.00 1,250.00 1,250.00 0.00

110 15/04/2023 3,71,218.00 3,14,592.00 0.00 28,313.00 28,313.00 0.00

121 29/04/2023 24,674.00 23,500.00 0.00 587.00 587.00 0.00

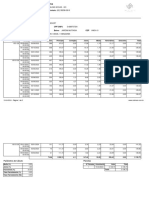

Invoice no. Invoice date Total invoice value (₹) Total taxable value (₹) Integrated Tax (₹) Central tax (₹) State/UT Tax (₹) Cess (₹) Source Actions

97 11/04/2023 3,66,298.00 3,10,422.00 0.00 27,938.00 27,938.00 0.00

113 24/04/2023 3,59,285.00 3,04,479.00 0.00 27,403.00 27,403.00 0.00

105 14/04/2023 88,578.00 84,360.00 0.00 2,109.00 2,109.00 0.00

117 27/04/2023 1,69,073.00 1,43,283.00 0.00 12,895.00 12,895.00 0.00

94 11/04/2023 2,31,453.00 1,96,147.00 0.00 17,653.00 17,653.00 0.00

100 13/04/2023 3,96,124.00 3,35,698.00 0.00 30,213.00 30,213.00 0.00

114 24/04/2023 2,47,211.00 2,09,501.00 0.00 18,855.00 18,855.00 0.00

91 10/04/2023 80,325.00 76,500.00 0.00 1,912.50 1,912.50 0.00

103 13/04/2023 2,66,163.00 2,53,489.00 0.00 6,337.00 6,337.00 0.00

111 24/04/2023 4,15,606.00 3,52,210.00 0.00 31,698.90 31,698.90 0.00

98 11/04/2023 4,27,888.00 3,62,617.00 0.00 32,635.50 32,635.50 0.00

106 14/04/2023 1,98,208.00 1,67,974.00 0.00 15,117.00 15,117.00 0.00

109 16/04/2023 43,154.00 41,100.00 0.00 1,027.00 1,027.00 0.00

BACK

© 2018-19 Goods and Services Tax Network Site Last Updated on 30-08-2023 Designed & Developed by GSTN

Site best viewed at 1024 x 768 resolution in Microsoft Edge, Google Chrome 49+, Firefox 45+ and Safari 6+

You might also like

- PE Civil Structural-4-6-8 Months Study Plan-Online-on DemandDocument1 pagePE Civil Structural-4-6-8 Months Study Plan-Online-on Demandapara_jitNo ratings yet

- Architectural Morphology - J.P Steadman PDFDocument148 pagesArchitectural Morphology - J.P Steadman PDFlaskerandNo ratings yet

- Estado de Cuentas VierciDocument2 pagesEstado de Cuentas VierciAnonimo XdNo ratings yet

- Estado Cuentas Saiv 1706Document2 pagesEstado Cuentas Saiv 1706Anonimo XdNo ratings yet

- LPXXXXXXXXXXXX24Document2 pagesLPXXXXXXXXXXXX24chandjk778No ratings yet

- Salesactivity JanDocument7 pagesSalesactivity JanKanishka BandaraNo ratings yet

- LnAmortSchedule02 12 2022Document2 pagesLnAmortSchedule02 12 2022Kaustubh ChaphalkarNo ratings yet

- BCE UpdateDocument6 pagesBCE UpdatePaing Soe ChitNo ratings yet

- Installment Schedule Document 3610302721000149Document2 pagesInstallment Schedule Document 3610302721000149Poetra Oetama BoestiantoNo ratings yet

- JANAKIRAMANDocument2 pagesJANAKIRAMANViralyNo ratings yet

- Repayment Schedule: Instl NumDocument2 pagesRepayment Schedule: Instl NumKishore KumarNo ratings yet

- 04 ReportBillingDetails 04269330270407 12 June 24Document7 pages04 ReportBillingDetails 04269330270407 12 June 24Hafiz muhammad zeshanNo ratings yet

- LnAmortSchedule06 01 2024Document1 pageLnAmortSchedule06 01 2024Meet ArdeshnaNo ratings yet

- LN Amort Schedule 05!05!2024Document2 pagesLN Amort Schedule 05!05!2024anandgpt36No ratings yet

- Statement (3202142) !Document1 pageStatement (3202142) !asa sscNo ratings yet

- MPZ08636 Mar 2024Document3 pagesMPZ08636 Mar 2024Ayush PatelNo ratings yet

- Daily Sale Report HH - NOV'23Document6 pagesDaily Sale Report HH - NOV'23tanmay sarkarNo ratings yet

- MuklisDocument2 pagesMuklisGustin ZulmawatiNo ratings yet

- RepaymentDocument2 pagesRepaymentIndrasis gunNo ratings yet

- Installment Schedule Document 2135912580 240109 072832Document2 pagesInstallment Schedule Document 2135912580 240109 072832Najwa KarimaNo ratings yet

- Repayment Schedule Abthastu000000676348 03042024 1221310Document3 pagesRepayment Schedule Abthastu000000676348 03042024 1221310futurefinance2017No ratings yet

- Icici 4Document2 pagesIcici 4hiteshvariya89No ratings yet

- Reconciled NO NEED TO WORKDocument158 pagesReconciled NO NEED TO WORKshubhamburnwal213No ratings yet

- Jayavarthana NDocument2 pagesJayavarthana NViralyNo ratings yet

- Caja CuscoDocument1 pageCaja CuscoJeff MaqueraNo ratings yet

- RepaymentDocument3 pagesRepaymentShiva PachudalaNo ratings yet

- Fecha Vta Fecha DepDocument14 pagesFecha Vta Fecha Depjose tobiasNo ratings yet

- InduSind BankDocument3 pagesInduSind Banksharmashubham170295No ratings yet

- RepaymentDocument4 pagesRepaymentDNYANESHWAR PATILNo ratings yet

- Nouveau Feuille de Calcul Microsoft ExcelDocument2 pagesNouveau Feuille de Calcul Microsoft ExcelAchraf MiryNo ratings yet

- Repayment Schedule Abn NPL 000000757784 08022024 2316992Document2 pagesRepayment Schedule Abn NPL 000000757784 08022024 2316992omp67157No ratings yet

- Repayment Schedule Abmumstu000000581689 03042024 1218485Document3 pagesRepayment Schedule Abmumstu000000581689 03042024 1218485futurefinance2017No ratings yet

- Power Information Technology Company (PITC) Payment Detail: 17-Apr-2024 Report - 6Document9 pagesPower Information Technology Company (PITC) Payment Detail: 17-Apr-2024 Report - 6Sattar KhanNo ratings yet

- Web Payslip 332429 202305 PDFDocument3 pagesWeb Payslip 332429 202305 PDFN.SATHYAMOORTHY MoorthyNo ratings yet

- RepaymentDocument3 pagesRepaymentfarid23khan1232563No ratings yet

- ExtratoDocument2 pagesExtratoBruno GuimaraesNo ratings yet

- Account Payable - May 2Document105 pagesAccount Payable - May 2bryaninmyanmarNo ratings yet

- Installment Schedule Document 0009854 2 17 09 2021Document2 pagesInstallment Schedule Document 0009854 2 17 09 2021DedeidarNo ratings yet

- View Customer CardDocument1 pageView Customer CardadvisNo ratings yet

- Amour BagusDocument2 pagesAmour BagusNabila SekarNo ratings yet

- Coil BalanceDocument345 pagesCoil BalanceAbdurahmanNo ratings yet

- Repayment Schedule Abbhopl 000000681188 06062024 148146Document3 pagesRepayment Schedule Abbhopl 000000681188 06062024 148146nikitachaudharyworldNo ratings yet

- Sarwoto - 023614Document5 pagesSarwoto - 023614Mardi AntoNo ratings yet

- AmorDocument1 pageAmorsyamsul hidayatNo ratings yet

- 05 ReportBillAdjustmentDetails 04269330270407 12 June 24Document4 pages05 ReportBillAdjustmentDetails 04269330270407 12 June 24Hafiz muhammad zeshanNo ratings yet

- Yr 2023Document202 pagesYr 2023erick lingNo ratings yet

- AmortizationSchedule TCFTW0537000012176730 04 10 2023 09 17 14Document2 pagesAmortizationSchedule TCFTW0537000012176730 04 10 2023 09 17 14sharifulhaque38No ratings yet

- View Asset DataDocument1 pageView Asset DataDina RasytaNo ratings yet

- TEX Weekly (15th July)Document18 pagesTEX Weekly (15th July)Cakuih SdakNo ratings yet

- 5yrs 40lakhs Standard SchemeDocument2 pages5yrs 40lakhs Standard SchemesenharrisNo ratings yet

- RepaymentDocument2 pagesRepaymentGetlozzAwabaNo ratings yet

- Repayment Schedule: Instl NumDocument2 pagesRepayment Schedule: Instl Numvasudev upadhyayNo ratings yet

- Rentel LedgerDocument3 pagesRentel LedgerSh SalahuddinNo ratings yet

- TabelasDocument2 pagesTabelasDjones GrubertNo ratings yet

- Relatorio Cobmais 130Document2 pagesRelatorio Cobmais 130Bruno Daniel CostaNo ratings yet

- AmortizationSchedule TCFPL0386000012256806 09 05 2024 11 39 19Document3 pagesAmortizationSchedule TCFPL0386000012256806 09 05 2024 11 39 19ajaypal0019No ratings yet

- Repayment Schedule 205228943Document3 pagesRepayment Schedule 205228943Gulam Sarwer SarwerNo ratings yet

- CRB 2023Document6 pagesCRB 2023bro chillNo ratings yet

- EMIloanDocument2 pagesEMIloanAnkit KumarNo ratings yet

- Rakeshkaydalwar Repayment Schedule 4Document1 pageRakeshkaydalwar Repayment Schedule 4rakeshkaydalwarNo ratings yet

- Rakeshkaydalwar Repayment Schedule 2Document1 pageRakeshkaydalwar Repayment Schedule 2rakeshkaydalwarNo ratings yet

- 5.installing Oracle Grid 11gR2 On Red Hat EnterpDocument35 pages5.installing Oracle Grid 11gR2 On Red Hat EnterpPraveen ChandranNo ratings yet

- Biology SyllabusDocument21 pagesBiology SyllabusForla MiNo ratings yet

- Braille PDFDocument6 pagesBraille PDFSarah SalamatNo ratings yet

- IEHG - Encoding Guide 2.2.0 (2010) PDFDocument281 pagesIEHG - Encoding Guide 2.2.0 (2010) PDFMarcelo L. OliveraNo ratings yet

- 2024 03 06 Introduction Lecture Series Climate Protection SS2024Document45 pages2024 03 06 Introduction Lecture Series Climate Protection SS2024Abdullah Khan QadriNo ratings yet

- Brand ManagementDocument4 pagesBrand ManagementahmadmujtabamalikNo ratings yet

- 1 STCW OverviewDocument19 pages1 STCW OverviewJosh SebastianNo ratings yet

- Unit Title Reading and Use of English WritingDocument1 pageUnit Title Reading and Use of English WritingAOCNo ratings yet

- Reading Unit 4 Week 3 3 2 2020-3 6 2020Document10 pagesReading Unit 4 Week 3 3 2 2020-3 6 2020api-422625647No ratings yet

- Leadership CritiqueDocument4 pagesLeadership Critiqueahmadzaher1100% (1)

- 3M ManualDocument12 pages3M ManualpanikeeNo ratings yet

- Chemical Engineering Department, Faculty of Engineering, Universitas Indonesia, Depok, West Java, IndonesiaDocument6 pagesChemical Engineering Department, Faculty of Engineering, Universitas Indonesia, Depok, West Java, IndonesiaBadzlinaKhairunizzahraNo ratings yet

- Week2 Exame 1Document16 pagesWeek2 Exame 1keyurkNo ratings yet

- Codirectores y ActasDocument6 pagesCodirectores y ActasmarcelaNo ratings yet

- Chinese Class Survey (Completed)Document4 pagesChinese Class Survey (Completed)Yibing ZhangNo ratings yet

- Communication Styles Document - 11-09-07Document5 pagesCommunication Styles Document - 11-09-07Srikanth AvsNo ratings yet

- Flusser - Crisis of LinearityDocument12 pagesFlusser - Crisis of LinearitynatelbNo ratings yet

- How SCOR Model Enhance Global Sourcing EffectivenessDocument46 pagesHow SCOR Model Enhance Global Sourcing EffectivenessNguyen Hai HaNo ratings yet

- Exercice 3Document2 pagesExercice 3Quang Anh LêNo ratings yet

- Dear Admissions Committee Chat GPT - 1Document1 pageDear Admissions Committee Chat GPT - 1Ganesh PolinaNo ratings yet

- LLP Act 2008Document28 pagesLLP Act 2008Mohit MittalNo ratings yet

- YavorskyDocument544 pagesYavorskyFilipe PadilhaNo ratings yet

- Shri Mahakali Khadagmala Stotram & Ma Kali Beej Mantra Kreem Sadhna Vidhi in HindiDocument34 pagesShri Mahakali Khadagmala Stotram & Ma Kali Beej Mantra Kreem Sadhna Vidhi in Hindisumit girdharwal87% (23)

- Firms and Managerial ObjectivesDocument33 pagesFirms and Managerial ObjectiveshemantbaidNo ratings yet

- Package Contents Instruction Installation / Technical SupportDocument1 pagePackage Contents Instruction Installation / Technical SupportXseed02No ratings yet

- Guide JCT 2005 Design Built Rev 2009Document44 pagesGuide JCT 2005 Design Built Rev 2009seanbeagNo ratings yet

- ApplicationDocument3 pagesApplicationAllen AntolinNo ratings yet

- Mazda CX-30 BrochureDocument7 pagesMazda CX-30 BrochurenisaNo ratings yet