Professional Documents

Culture Documents

XII Depreciation

XII Depreciation

Uploaded by

sameerhussain.a4Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

XII Depreciation

XII Depreciation

Uploaded by

sameerhussain.a4Copyright:

Available Formats

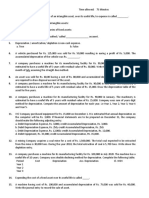

CHAPTER # 1:

Q: 1: Depreciation:

On March 30, 2017 Kenwood Company purchased a machine at a list price of Rs.500,000, subject to a

trade discount of 10% under the credit term 2/10, n/30. The payment was made on April 5, 2017. The

paid the following expenditure to acquire machine:

(a) Sales tax @ 17% (b) Transportation in Rs.20,230

(c) Insurance in transit Rs.3,800 (d) Custom duty and import duty Rs.7,000

(e) Fine on negligent driving Rs.1,000 (f) Installation and testing charges Rs.15,000

(g) Labour charges Rs.8,000 (h) Foundation cost Rs.3,000

(i) 3 Year fire insurance Rs.9,000 (j) Repair charges during installation Rs.6,000

Its residual value was estimated at Rs.73,000. The life is to be estimated in 10 years, in units 250,000

and in hours 100,000. The company’s accounting year ends on December 31 each year.

REQUIRED

(a) Compute the cost of machine.

(b) Record the purchase of machine.

(c) Classify the above payments into capital expenditure and revenue expenditure.

(d) Calculate the depreciation expense for 2017, 2018 and 2019 under the following methods separately:

(i) Straight Line Method.

(ii) Diminishing Balance Method @ 20%.

(iii) Units Production Method assuming machine produced 17,000 units in the year 2017,

20,000 units in the year 2018 and 18,000 units in the year 2019.

(iv) Working Hours Methods assuming that machine has worked 1,500 hours in the year 2017,

2,000 hours in the year 2018 and 2,300 hours in the year 2019.

(e) Prepare adjusting and closing journal entries on December 31, 2017, 2018 and 2019 under Diminishing

Balance Method.

(f) Prepare allowance for depreciation account from 2017 to 2019 under Diminishing Balance Method.

(g) Prepare partial balance sheet on December 31, 2019 under each method separately.

You might also like

- NYIF Accounting Module 8 Quiz With AnswersssDocument4 pagesNYIF Accounting Module 8 Quiz With AnswersssShahd OkashaNo ratings yet

- Praktikum Kerta Kerja Sesi 1 Shared After ClassDocument13 pagesPraktikum Kerta Kerja Sesi 1 Shared After ClassDian Permata SariNo ratings yet

- PpeDocument7 pagesPpeJasmine Marie Ng CheongNo ratings yet

- Solved Problems and Exercises-DepreciationDocument7 pagesSolved Problems and Exercises-DepreciationKaranNo ratings yet

- Depreciation Reviewer, Empeo-WPS OfficeDocument5 pagesDepreciation Reviewer, Empeo-WPS OfficeMarian RentoyNo ratings yet

- Exercise Chap 11Document7 pagesExercise Chap 11JF FNo ratings yet

- Depreciation AccountingDocument14 pagesDepreciation AccountingsheebaNo ratings yet

- AbdulSamad 12 15796 1 DepreciationDocument12 pagesAbdulSamad 12 15796 1 DepreciationSyed SumamaNo ratings yet

- DEPRECIATIONDocument5 pagesDEPRECIATIONjdjdbNo ratings yet

- CPT Chapter - DepreciationDocument6 pagesCPT Chapter - DepreciationCacptCoachingNo ratings yet

- Accounting For DepreciationDocument6 pagesAccounting For DepreciationKaran GNo ratings yet

- Problem 30-1 (IAA)Document7 pagesProblem 30-1 (IAA)Quinnie Apuli0% (1)

- Accounting 102 Intermediate Accounting Depreciation QuizDocument6 pagesAccounting 102 Intermediate Accounting Depreciation QuizApril Mae Intong TapdasanNo ratings yet

- DEPRECIATION2Document2 pagesDEPRECIATION2PearlNo ratings yet

- Chapter 8Document7 pagesChapter 8jeanNo ratings yet

- © Ucles 2018 9706/33/insert/o/n/18Document2 pages© Ucles 2018 9706/33/insert/o/n/18Ayesha sheikhNo ratings yet

- Adjusting Entries ProblemsDocument5 pagesAdjusting Entries ProblemsDirck VerraNo ratings yet

- A192-Mc1 PpeDocument4 pagesA192-Mc1 PpeTeo ShengNo ratings yet

- Depreciation TutorialsDocument4 pagesDepreciation TutorialsTifran JuniorNo ratings yet

- DEPRECIATION2Document9 pagesDEPRECIATION2Darlianne Klyne BayerNo ratings yet

- Applied - 4 Semi-FinalDocument8 pagesApplied - 4 Semi-FinalMarjorieNo ratings yet

- Chapter 10Document11 pagesChapter 10Saharin Islam ShakibNo ratings yet

- 4 Property Plant Equipment Classification Acquisition Govt Grant and Borrowing CostDocument11 pages4 Property Plant Equipment Classification Acquisition Govt Grant and Borrowing CostElvie PepitoNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- Acct CH.7 H.W.Document8 pagesAcct CH.7 H.W.j8noelNo ratings yet

- Illustrations - Accounting For Depreciation-23-24 - 124236Document2 pagesIllustrations - Accounting For Depreciation-23-24 - 124236mosespaul66019No ratings yet

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument11 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNo ratings yet

- Poa T - 6Document2 pagesPoa T - 6SHEVENA A/P VIJIANNo ratings yet

- Module 5 - PpsDocument4 pagesModule 5 - PpsMIGUEL JOSHUA VILLANUEVANo ratings yet

- Engineering EconomyDocument1 pageEngineering EconomyLilian Mae Lacno AdanNo ratings yet

- TestDocument3 pagesTestMehak AliNo ratings yet

- POA2TSDocument3 pagesPOA2TSMazin AminNo ratings yet

- GST Post Q 20 May PDF - 29979560Document4 pagesGST Post Q 20 May PDF - 29979560priya02sharma22No ratings yet

- Assig1 Fall20Document3 pagesAssig1 Fall20Rakht e SafrNo ratings yet

- 9 Depreciation 08-2022 Regular Ca FoundationDocument6 pages9 Depreciation 08-2022 Regular Ca FoundationjahnaviNo ratings yet

- Audit of PPE ExercisesDocument3 pagesAudit of PPE ExercisesMARCUAP Flora Mel Joy H.No ratings yet

- Comprado Ia Wk14 Les 16 A1Document3 pagesComprado Ia Wk14 Les 16 A1Charlize Adriele C. Comprado3210183No ratings yet

- Chapter 15 and 16 IA Valix Sales Type LeaseDocument13 pagesChapter 15 and 16 IA Valix Sales Type LeaseMiko ArniñoNo ratings yet

- Chapter 15,16, & 17 IA Valix Sales Type LeaseDocument15 pagesChapter 15,16, & 17 IA Valix Sales Type LeaseMiko ArniñoNo ratings yet

- Adjusting EntiresDocument9 pagesAdjusting EntiresIqra MughalNo ratings yet

- 52593bos42131 Finalold p8Document13 pages52593bos42131 Finalold p8Rakesh MauryaNo ratings yet

- QUIZ - CHAPTER 16 - PPE PART 2 - 2020edDocument5 pagesQUIZ - CHAPTER 16 - PPE PART 2 - 2020edjanna napiliNo ratings yet

- Test Bank 10Document9 pagesTest Bank 10mahmodsobhy121212No ratings yet

- MCQs of ch8 ITCDocument20 pagesMCQs of ch8 ITCAman AgarwalNo ratings yet

- Individual Assignment 1Document2 pagesIndividual Assignment 1Getiye LibayNo ratings yet

- Finacc4 Assignment 2 Property, Plant and Equipment, Part 2 Submit All Your Answers in An Excel File. Use One Worksheet (Not File) For Each ProblemDocument3 pagesFinacc4 Assignment 2 Property, Plant and Equipment, Part 2 Submit All Your Answers in An Excel File. Use One Worksheet (Not File) For Each ProblemAlrac GarciaNo ratings yet

- Acc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long QuizDocument5 pagesAcc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long Quizemielyn lafortezaNo ratings yet

- depreciationDocument3 pagesdepreciationusama.50844No ratings yet

- 2021 COAF 4201 GroupsDocument16 pages2021 COAF 4201 GroupsTawanda Tatenda HerbertNo ratings yet

- BBA Sem I QPDocument3 pagesBBA Sem I QPyogeshgharpureNo ratings yet

- EXERCISES - PPE, Part 2Document5 pagesEXERCISES - PPE, Part 2Meeka CalimagNo ratings yet

- As Depreciation PP SumsDocument29 pagesAs Depreciation PP SumsMangesh RahateNo ratings yet

- Week 10 Tutorial QuestionsDocument3 pagesWeek 10 Tutorial QuestionsIsha ChandNo ratings yet

- Depreciation UDDocument20 pagesDepreciation UDrizwan ul hassanNo ratings yet

- UIA Chaps 8-9-10 Aact 1161for StudentsDocument6 pagesUIA Chaps 8-9-10 Aact 1161for StudentsPatricia TorresNo ratings yet

- DepreciationDocument3 pagesDepreciationAdnan ShabeerNo ratings yet

- IDT 2 New Question PaperDocument11 pagesIDT 2 New Question Paperneha manglaniNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet