Professional Documents

Culture Documents

PDS Bwe-1178

PDS Bwe-1178

Uploaded by

Mannat DhaliwalCopyright:

Available Formats

You might also like

- Sample-Loan Commitment LetterDocument3 pagesSample-Loan Commitment LetterJustice Williams100% (1)

- SBI Internet Banking ProjectDocument63 pagesSBI Internet Banking ProjectHiteshwar Singh Andotra82% (22)

- Promissory Note MSWord DownloadDocument4 pagesPromissory Note MSWord DownloadArvin GregorioNo ratings yet

- LS008201 2201Document3 pagesLS008201 2201Suntech Testing Limited STLNo ratings yet

- Notary Signing Agent ScriptDocument5 pagesNotary Signing Agent ScriptMyaW731100% (4)

- Banker AcceptanceDocument2 pagesBanker Acceptancecktee77100% (1)

- Bank Authorization (BA) FormDocument4 pagesBank Authorization (BA) FormAilec FinancesNo ratings yet

- Policy Surrender FormDocument2 pagesPolicy Surrender Formaife.ocubilloNo ratings yet

- Bosa Loan FormDocument4 pagesBosa Loan FormIsaac OkotNo ratings yet

- Broker Annual Recertification-V7.20.23Document7 pagesBroker Annual Recertification-V7.20.23Krist LlöydNo ratings yet

- Discharge Authority BankWest 5.10.12Document2 pagesDischarge Authority BankWest 5.10.12ganguly147147No ratings yet

- Electronic Payment (EP) Account Agreement: Things To Know Before You BeginDocument4 pagesElectronic Payment (EP) Account Agreement: Things To Know Before You BeginandryNo ratings yet

- Lending Checklist: Study ViaDocument8 pagesLending Checklist: Study Viapatrick wafulaNo ratings yet

- Personal Loan Application FormDocument4 pagesPersonal Loan Application FormFestus OrotanNo ratings yet

- Loan Terms & ConditionsDocument10 pagesLoan Terms & ConditionsTesting100% (1)

- Banking QuestionsDocument15 pagesBanking Questionsaparajita saha100% (1)

- Buy To Let Fact Find Feb 2023 Pask and PaskDocument4 pagesBuy To Let Fact Find Feb 2023 Pask and PaskTan Li XinNo ratings yet

- Credit Agreement - Iinitial Advance Into The Bank Account Whose Details You Have Provided To Us at The Time You Made Your ApplicationDocument10 pagesCredit Agreement - Iinitial Advance Into The Bank Account Whose Details You Have Provided To Us at The Time You Made Your ApplicationTestingNo ratings yet

- 308844contract SD3.00Document22 pages308844contract SD3.00Magnus AlbertNo ratings yet

- Terms & Conditions V1811 V2.1.1Document10 pagesTerms & Conditions V1811 V2.1.1Jane ColosNo ratings yet

- Ny Art SupplyDocument1 pageNy Art SupplynancymandinoNo ratings yet

- ClosingDocument18 pagesClosingrobert kingNo ratings yet

- Sav3062 4Document6 pagesSav3062 4MichaelNo ratings yet

- 1171439738484-Traders Easy Loan SchemeDocument4 pages1171439738484-Traders Easy Loan Schemekiran_vadeNo ratings yet

- Promissory Notes 1 PDFDocument3 pagesPromissory Notes 1 PDFTaran janagalNo ratings yet

- James WestDocument5 pagesJames Westflycody32No ratings yet

- Pay-Out Request Form Ver1.1Document2 pagesPay-Out Request Form Ver1.1Mahendra AsawaleNo ratings yet

- Installment Loan or NoteDocument4 pagesInstallment Loan or NoteambassyNo ratings yet

- Wa0047.Document2 pagesWa0047.daniellparisNo ratings yet

- OM UnitTrust DO AmendmentForm (FINAL) ElectronicDocument6 pagesOM UnitTrust DO AmendmentForm (FINAL) ElectronicMonika ShanikaNo ratings yet

- Proposal For Exports (IT Enabled Services) Policy-Specific CustomerDocument5 pagesProposal For Exports (IT Enabled Services) Policy-Specific CustomerSoundararajan SeeranganNo ratings yet

- Personal Loans: Standard Chartered Bank Zimbabwe LimitedDocument8 pagesPersonal Loans: Standard Chartered Bank Zimbabwe LimitedkarthickjothiNo ratings yet

- Pre-Mature Exit Form Jan 19Document2 pagesPre-Mature Exit Form Jan 19antriksh82No ratings yet

- Success AgreementDocument5 pagesSuccess Agreementأبورؤس عبدالكاشفNo ratings yet

- Surrender FormDocument2 pagesSurrender FormpghoshNo ratings yet

- Success AgreementDocument5 pagesSuccess Agreementأبورؤس عبدالكاشفNo ratings yet

- Creative Arts Grade 7Document3 pagesCreative Arts Grade 7ntandomsibi600No ratings yet

- LAP Sanction Letter FixedDocument3 pagesLAP Sanction Letter Fixedpydimukkala SunilNo ratings yet

- 'How To Redeem A Savings Bond or NoteDocument3 pages'How To Redeem A Savings Bond or NoterndvdbNo ratings yet

- BofA Approval Letter 2Document3 pagesBofA Approval Letter 2Steve Mun GroupNo ratings yet

- SignedDocument14 pagesSignedtrumpu01No ratings yet

- Fannie Mae Document Custodian Protocol 08Document37 pagesFannie Mae Document Custodian Protocol 08mariandebonisNo ratings yet

- Guarantee & Indemnity AgreementDocument22 pagesGuarantee & Indemnity Agreementjingwen23No ratings yet

- Borrower Agreement-1Document4 pagesBorrower Agreement-1Keerthivasan KNo ratings yet

- Auto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Document2 pagesAuto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Dhruv SekhriNo ratings yet

- Promissory Note TemplateDocument2 pagesPromissory Note Templatemayor78No ratings yet

- If You Have Questions, Please Contact Us Directly Between The Hours of (Insert Hours) at (Insert Toll Free Number.)Document6 pagesIf You Have Questions, Please Contact Us Directly Between The Hours of (Insert Hours) at (Insert Toll Free Number.)Anthony Juice Gaston BeyNo ratings yet

- The Home Buying Process OverviewDocument2 pagesThe Home Buying Process OverviewJay VoglerNo ratings yet

- DIRECT PUR RESALE CONST ASSIGNMENT Ver 2 - 0 PDFDocument20 pagesDIRECT PUR RESALE CONST ASSIGNMENT Ver 2 - 0 PDFShakeer AhmedNo ratings yet

- Bank Confirmation Audit Request Treasury and Other Operations 10-Jun-10Document3 pagesBank Confirmation Audit Request Treasury and Other Operations 10-Jun-10davidooNo ratings yet

- Demand Draft Application FormDocument2 pagesDemand Draft Application FormKamran Atif PechuhoNo ratings yet

- PNB Policy Surrender FormDocument2 pagesPNB Policy Surrender FormJoseph Alejandro TrinidadNo ratings yet

- Customer Request Form MortgagesDocument1 pageCustomer Request Form Mortgagessanjaybhaskar037No ratings yet

- Alternate Mode Mandate Form - 21012023Document1 pageAlternate Mode Mandate Form - 21012023successinvestment2005No ratings yet

- Fixed Deposit Account: Personal Details of Account HolderDocument2 pagesFixed Deposit Account: Personal Details of Account HolderJaryd GovenderNo ratings yet

- 4 (A) Declaration (In Case of Assignment)Document1 page4 (A) Declaration (In Case of Assignment)sajeer n FORWARDNo ratings yet

- NG Account Opening Form April 2016Document4 pagesNG Account Opening Form April 2016jatin hakeyNo ratings yet

- Sanction LetterDocument3 pagesSanction Lettermareddy mohanNo ratings yet

- Forms Payout Others Web 23 AprilDocument2 pagesForms Payout Others Web 23 AprilYo PaisaNo ratings yet

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!From EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!No ratings yet

- BBA-108 - E-Commerce Unit THREE & FOURDocument34 pagesBBA-108 - E-Commerce Unit THREE & FOURA1cyb CafeNo ratings yet

- Redirection Manual Ver 1.1.3 enDocument72 pagesRedirection Manual Ver 1.1.3 enGiorgos GrivokostopoulosNo ratings yet

- Electronic Payment System & SecurityDocument39 pagesElectronic Payment System & SecurityVikram NenwaniNo ratings yet

- Tax Invoice: Invois CukaiDocument7 pagesTax Invoice: Invois CukaiZeehan ZakariaNo ratings yet

- Airport Authority of India Advt 02 2012Document8 pagesAirport Authority of India Advt 02 2012Azad SinghNo ratings yet

- P MLZ 2 WDWMZ 3 KDIMUDocument7 pagesP MLZ 2 WDWMZ 3 KDIMUDaniel CookNo ratings yet

- Bank Reconciliation: There Are Three Kinds of Bank Deposits, NamelyDocument2 pagesBank Reconciliation: There Are Three Kinds of Bank Deposits, NamelyWimrod CanenciaNo ratings yet

- Oracle AR Basic ConecptDocument253 pagesOracle AR Basic Conecpthamzaali227004No ratings yet

- UVOCCET Documents For TNEA 2021-FinalDocument9 pagesUVOCCET Documents For TNEA 2021-FinalAksha RaviNo ratings yet

- Chargeback Process FlowDocument11 pagesChargeback Process FlowguyNo ratings yet

- XXXXXXX 4172Document5 pagesXXXXXXX 4172Appam GopiNo ratings yet

- BSLMF One Time Mandate ReviseDocument6 pagesBSLMF One Time Mandate Revisesanjay901No ratings yet

- Cloud Based Bus Pass SystemDocument2 pagesCloud Based Bus Pass SystemSanket GhatteNo ratings yet

- Form Center: Products Making Payments Apply Now Locate Us Ways To Bank Customer CareDocument3 pagesForm Center: Products Making Payments Apply Now Locate Us Ways To Bank Customer CaremohangboxNo ratings yet

- Travel Currency Card TNCDocument10 pagesTravel Currency Card TNCKrishna RamaNo ratings yet

- Dragonpay APIDocument31 pagesDragonpay APIhaizea obreinNo ratings yet

- Bank of Baroda FastagDocument2 pagesBank of Baroda FastagKaushik JoshiNo ratings yet

- Bank Promotion Exam Recollected Questions Part 4Document11 pagesBank Promotion Exam Recollected Questions Part 4RADHA KRISHNANNo ratings yet

- Transaction MaintenanceDocument4 pagesTransaction MaintenancedonbabaNo ratings yet

- DDDDDDDDDocument24 pagesDDDDDDDDdenekew lesemiNo ratings yet

- E Ticket Converti ConvertiDocument3 pagesE Ticket Converti ConvertieranNo ratings yet

- Jio 6Document1 pageJio 6dwall29292No ratings yet

- Sbi Atm FormDocument2 pagesSbi Atm Formfazlurrahman2370No ratings yet

- T Vra 3 Ku ZLZ FV 9 D WDocument2 pagesT Vra 3 Ku ZLZ FV 9 D WAnonymous zy3rAYHNo ratings yet

- Prepaid Cards & Money Management App Money NetworkDocument1 pagePrepaid Cards & Money Management App Money NetworkAdrian Gutierrez sanchezNo ratings yet

- Virtual CardDocument58 pagesVirtual CardRachitha Shetty67% (3)

- PK Saadiq Soc Jan To July 2024 EngDocument48 pagesPK Saadiq Soc Jan To July 2024 Engwaqas wattooNo ratings yet

- 1st Week Front OfficeDocument12 pages1st Week Front Officeryan nodaNo ratings yet

- pg1269 PDFDocument2 pagespg1269 PDFLori CarlsonNo ratings yet

PDS Bwe-1178

PDS Bwe-1178

Uploaded by

Mannat DhaliwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDS Bwe-1178

PDS Bwe-1178

Uploaded by

Mannat DhaliwalCopyright:

Available Formats

Discharge Authority

(Release of Security and/or Funds Distribution) Bankwest, a division of Commonwealth Bank of Australia

ABN 48 123 123 124 AFSL/Australian credit licence 234945

Bankwest Reference Number

All borrowers, guarantors and owners need to sign this form and return it to Bankwest (see return instructions on the last page of

this form).

Incomplete instructions or signatures or failure to return this form in time may delay settlement.

If you need more fields, please complete and submit additional forms as required.

Your settlement representative (agent, conveyancer or solicitor) will organise settlement. They may need to invite us to an

electronic settlement.

Section 1: Discharge type

- Full discharge is when you pay out your loan and want to release any properties securing the loan. If there’s a property sale or refinance, the

full discharge will include a settlement - otherwise please select ‘Full discharge without settlement’ below.

- Partial discharge is when you have more than one property attached to a loan and not all are being discharged. This means your loan with

Bankwest will still exist, but you’ll have a reduced limit from removing one or more properties. Please note that, where you want a partial

discharge and are selling a property, we may need to complete an assessment and up to 100% of the money from the sale may be used to

reduce your remaining loans with Bankwest.

- Related party transfer is when you’re adding or removing a person or entity from the property.

- Portability is when you want to keep your current lending with Bankwest but change the properties securing the loan (owner occupied

security only).

Other payment types

Full discharge with settlement Full discharge without settlement Partial discharge

Related party transfer Portability

Section 2: Form purpose

Use the space below to tell us more about your current situation, why you’re using this form and what you’re hoping to do.

Section 3: Relevant party details

Please provide the full name of ALL borrowers and guarantors associated with this loan. For business loans, please provide the full name

of the company/trust.

Title Full name Relationship to loan (Borrower, guarantor) Contact number

Page 1 of 4 BWE-1178 310723

Section 3: Relevant party details (continued)

Full name of company/trust (business loans): Contact number:

Section 4: Property details

Please provide details for all properties/securities you want released from this loan.

Security (property, guarantor, security interest) Security details (property address, guarantor name, security interest serial number)

Section 5: Release details

Choose from the options below your reason for this release, and complete the relevant details. Please tick one option only out of property

sale, refinancing or debt has been repaid.

Property sale - you’ve sold a property secured to the loan

Is the sale unconditionally approved/have contracts been exchanged? Yes No

Is a new purchase/finance dependant on this sale? Yes No

Sale price Balance left on closing loan/s at settlement

Expected settlement date Your address after settlement (if changing)

Please provide details for your settlement representative (settlement agent, conveyancer or solicitor). Note: By providing your settlement representative

details, you authorise us to deal directly with them and to take instructions from them for this release.

Settlement representative company name Settlement representative email Settlement representative phone

Refinancing - you’re transferring your loan to another financial institution

Please provide details for the financial institution you’re wanting to transfer your loan to.

Financial institution name Broker name

Broker phone Broker email

Debt has been repaid* - you no longer owe money to Bankwest for this security

1. Is the title required for a pending settlement? Yes (please provide settlement representative details) No (skip to question 2)

Settlement representative company name Settlement representative address

2. Is your debt with Bankwest closed? Yes (for non-electronic titles, we’ll return the title to the address below) No

Address

*We may need to contact you for more info.

Page 2 of 4 BWE-1178 310723

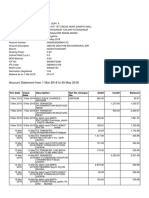

Section 6: Fund distribution

Please indicate any accounts you want to repay in full and close, and any accounts for which you want to reduce your loan limit.

BSB Account number Do you want to close this account? If no, what do you want to reduce the limit to?*

Yes No

Yes No

Yes No

Yes No

Yes No

*Reducing your limit will affect the amount accessible in your available funds.

Where should we deposit any surplus funds not used for settlement?

Are these details correct? Check the BSB and account number are correct as we don’t check, match or verify the account name and number when

making a payment. If you enter or select an incorrect BSB or account number, funds may be sent to the wrong account, and we may not be able to

recover funds from an unintended recipient.

Financial institution name Account holder name BSB Account number

Section 7: Fees, charges and shortfalls

This might include settlement fees, termination fees, prepayment break costs or government fees and charges, and any payment shortfalls.

We’ll let you know what fees are applicable after we’ve received this form.

I/we authorise Bankwest to collect a settlement fee, plus any additional fees owning (like early termination fees, prepayment break costs and

government fees and charges), and any payment shortfalls from the funds received at settlement. I/we understand Bankwest will let me/us

know of any applicable fees.

How would you like your fees and charges to be paid? (please select one)

From the settlement proceeds

By direct debit from the following account:

Note: Funds cannot be taken from a Bankwest Term Deposit, Telenet, Smart eSaver account or credit card account. Funds debited from

non-Bankwest accounts may take up to 3 business days to transfer - make sure the money is in the account in time for settlement.

Financial institution name Account holder name BSB Account number

Page 3 of 4 BWE-1178 310723

Section 8: Authorisation and consent to release

This form must be signed by ALL borrowers, guarantors and security owners listed in Section 3.

By signing this form:

– I/we acknowledge that if more than one property secures my/our loans, the total amount secured may be reduced using funds

received at settlement.

– I/we confirm my/our consent to release the security, property, funds distribution and other matters contained in this form.

– I/we agree that any other security (including guarantee, mortgage and general security interest) given by me/us to Bankwest

which is not listed in Section 4 of this form will continue

Please ensure all parties include their full name, their signature and the date.

Borrower Director Partner Proprietor Trustee Guarantor Other

Signed by Signature Date

X

Borrower Director Partner Proprietor Trustee Guarantor Other

Signed by Signature Date

X

Borrower Director Partner Proprietor Trustee Guarantor Other

Signed by Signature Date

X

Borrower Director Partner Proprietor Trustee Guarantor Other

Signed by Signature Date

How to return this form to Bankwest

Personal customers:

– Email supportingdocs@bankwest.com.au

– Fax 1300 130 885

– Take it to your local branch.

Small business customers:

– Email small.business.maintenance.team@bankwest.com.au

– Fax 1300 683 435.

Relationship managed customers:

– Contact your relationship manager.

Office use only

Relationship manager signature (if applicable) Regional sales manager signature (if applicable)

Page 4 of 4 BWE-1178 310723

You might also like

- Sample-Loan Commitment LetterDocument3 pagesSample-Loan Commitment LetterJustice Williams100% (1)

- SBI Internet Banking ProjectDocument63 pagesSBI Internet Banking ProjectHiteshwar Singh Andotra82% (22)

- Promissory Note MSWord DownloadDocument4 pagesPromissory Note MSWord DownloadArvin GregorioNo ratings yet

- LS008201 2201Document3 pagesLS008201 2201Suntech Testing Limited STLNo ratings yet

- Notary Signing Agent ScriptDocument5 pagesNotary Signing Agent ScriptMyaW731100% (4)

- Banker AcceptanceDocument2 pagesBanker Acceptancecktee77100% (1)

- Bank Authorization (BA) FormDocument4 pagesBank Authorization (BA) FormAilec FinancesNo ratings yet

- Policy Surrender FormDocument2 pagesPolicy Surrender Formaife.ocubilloNo ratings yet

- Bosa Loan FormDocument4 pagesBosa Loan FormIsaac OkotNo ratings yet

- Broker Annual Recertification-V7.20.23Document7 pagesBroker Annual Recertification-V7.20.23Krist LlöydNo ratings yet

- Discharge Authority BankWest 5.10.12Document2 pagesDischarge Authority BankWest 5.10.12ganguly147147No ratings yet

- Electronic Payment (EP) Account Agreement: Things To Know Before You BeginDocument4 pagesElectronic Payment (EP) Account Agreement: Things To Know Before You BeginandryNo ratings yet

- Lending Checklist: Study ViaDocument8 pagesLending Checklist: Study Viapatrick wafulaNo ratings yet

- Personal Loan Application FormDocument4 pagesPersonal Loan Application FormFestus OrotanNo ratings yet

- Loan Terms & ConditionsDocument10 pagesLoan Terms & ConditionsTesting100% (1)

- Banking QuestionsDocument15 pagesBanking Questionsaparajita saha100% (1)

- Buy To Let Fact Find Feb 2023 Pask and PaskDocument4 pagesBuy To Let Fact Find Feb 2023 Pask and PaskTan Li XinNo ratings yet

- Credit Agreement - Iinitial Advance Into The Bank Account Whose Details You Have Provided To Us at The Time You Made Your ApplicationDocument10 pagesCredit Agreement - Iinitial Advance Into The Bank Account Whose Details You Have Provided To Us at The Time You Made Your ApplicationTestingNo ratings yet

- 308844contract SD3.00Document22 pages308844contract SD3.00Magnus AlbertNo ratings yet

- Terms & Conditions V1811 V2.1.1Document10 pagesTerms & Conditions V1811 V2.1.1Jane ColosNo ratings yet

- Ny Art SupplyDocument1 pageNy Art SupplynancymandinoNo ratings yet

- ClosingDocument18 pagesClosingrobert kingNo ratings yet

- Sav3062 4Document6 pagesSav3062 4MichaelNo ratings yet

- 1171439738484-Traders Easy Loan SchemeDocument4 pages1171439738484-Traders Easy Loan Schemekiran_vadeNo ratings yet

- Promissory Notes 1 PDFDocument3 pagesPromissory Notes 1 PDFTaran janagalNo ratings yet

- James WestDocument5 pagesJames Westflycody32No ratings yet

- Pay-Out Request Form Ver1.1Document2 pagesPay-Out Request Form Ver1.1Mahendra AsawaleNo ratings yet

- Installment Loan or NoteDocument4 pagesInstallment Loan or NoteambassyNo ratings yet

- Wa0047.Document2 pagesWa0047.daniellparisNo ratings yet

- OM UnitTrust DO AmendmentForm (FINAL) ElectronicDocument6 pagesOM UnitTrust DO AmendmentForm (FINAL) ElectronicMonika ShanikaNo ratings yet

- Proposal For Exports (IT Enabled Services) Policy-Specific CustomerDocument5 pagesProposal For Exports (IT Enabled Services) Policy-Specific CustomerSoundararajan SeeranganNo ratings yet

- Personal Loans: Standard Chartered Bank Zimbabwe LimitedDocument8 pagesPersonal Loans: Standard Chartered Bank Zimbabwe LimitedkarthickjothiNo ratings yet

- Pre-Mature Exit Form Jan 19Document2 pagesPre-Mature Exit Form Jan 19antriksh82No ratings yet

- Success AgreementDocument5 pagesSuccess Agreementأبورؤس عبدالكاشفNo ratings yet

- Surrender FormDocument2 pagesSurrender FormpghoshNo ratings yet

- Success AgreementDocument5 pagesSuccess Agreementأبورؤس عبدالكاشفNo ratings yet

- Creative Arts Grade 7Document3 pagesCreative Arts Grade 7ntandomsibi600No ratings yet

- LAP Sanction Letter FixedDocument3 pagesLAP Sanction Letter Fixedpydimukkala SunilNo ratings yet

- 'How To Redeem A Savings Bond or NoteDocument3 pages'How To Redeem A Savings Bond or NoterndvdbNo ratings yet

- BofA Approval Letter 2Document3 pagesBofA Approval Letter 2Steve Mun GroupNo ratings yet

- SignedDocument14 pagesSignedtrumpu01No ratings yet

- Fannie Mae Document Custodian Protocol 08Document37 pagesFannie Mae Document Custodian Protocol 08mariandebonisNo ratings yet

- Guarantee & Indemnity AgreementDocument22 pagesGuarantee & Indemnity Agreementjingwen23No ratings yet

- Borrower Agreement-1Document4 pagesBorrower Agreement-1Keerthivasan KNo ratings yet

- Auto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Document2 pagesAuto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Dhruv SekhriNo ratings yet

- Promissory Note TemplateDocument2 pagesPromissory Note Templatemayor78No ratings yet

- If You Have Questions, Please Contact Us Directly Between The Hours of (Insert Hours) at (Insert Toll Free Number.)Document6 pagesIf You Have Questions, Please Contact Us Directly Between The Hours of (Insert Hours) at (Insert Toll Free Number.)Anthony Juice Gaston BeyNo ratings yet

- The Home Buying Process OverviewDocument2 pagesThe Home Buying Process OverviewJay VoglerNo ratings yet

- DIRECT PUR RESALE CONST ASSIGNMENT Ver 2 - 0 PDFDocument20 pagesDIRECT PUR RESALE CONST ASSIGNMENT Ver 2 - 0 PDFShakeer AhmedNo ratings yet

- Bank Confirmation Audit Request Treasury and Other Operations 10-Jun-10Document3 pagesBank Confirmation Audit Request Treasury and Other Operations 10-Jun-10davidooNo ratings yet

- Demand Draft Application FormDocument2 pagesDemand Draft Application FormKamran Atif PechuhoNo ratings yet

- PNB Policy Surrender FormDocument2 pagesPNB Policy Surrender FormJoseph Alejandro TrinidadNo ratings yet

- Customer Request Form MortgagesDocument1 pageCustomer Request Form Mortgagessanjaybhaskar037No ratings yet

- Alternate Mode Mandate Form - 21012023Document1 pageAlternate Mode Mandate Form - 21012023successinvestment2005No ratings yet

- Fixed Deposit Account: Personal Details of Account HolderDocument2 pagesFixed Deposit Account: Personal Details of Account HolderJaryd GovenderNo ratings yet

- 4 (A) Declaration (In Case of Assignment)Document1 page4 (A) Declaration (In Case of Assignment)sajeer n FORWARDNo ratings yet

- NG Account Opening Form April 2016Document4 pagesNG Account Opening Form April 2016jatin hakeyNo ratings yet

- Sanction LetterDocument3 pagesSanction Lettermareddy mohanNo ratings yet

- Forms Payout Others Web 23 AprilDocument2 pagesForms Payout Others Web 23 AprilYo PaisaNo ratings yet

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!From EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!No ratings yet

- BBA-108 - E-Commerce Unit THREE & FOURDocument34 pagesBBA-108 - E-Commerce Unit THREE & FOURA1cyb CafeNo ratings yet

- Redirection Manual Ver 1.1.3 enDocument72 pagesRedirection Manual Ver 1.1.3 enGiorgos GrivokostopoulosNo ratings yet

- Electronic Payment System & SecurityDocument39 pagesElectronic Payment System & SecurityVikram NenwaniNo ratings yet

- Tax Invoice: Invois CukaiDocument7 pagesTax Invoice: Invois CukaiZeehan ZakariaNo ratings yet

- Airport Authority of India Advt 02 2012Document8 pagesAirport Authority of India Advt 02 2012Azad SinghNo ratings yet

- P MLZ 2 WDWMZ 3 KDIMUDocument7 pagesP MLZ 2 WDWMZ 3 KDIMUDaniel CookNo ratings yet

- Bank Reconciliation: There Are Three Kinds of Bank Deposits, NamelyDocument2 pagesBank Reconciliation: There Are Three Kinds of Bank Deposits, NamelyWimrod CanenciaNo ratings yet

- Oracle AR Basic ConecptDocument253 pagesOracle AR Basic Conecpthamzaali227004No ratings yet

- UVOCCET Documents For TNEA 2021-FinalDocument9 pagesUVOCCET Documents For TNEA 2021-FinalAksha RaviNo ratings yet

- Chargeback Process FlowDocument11 pagesChargeback Process FlowguyNo ratings yet

- XXXXXXX 4172Document5 pagesXXXXXXX 4172Appam GopiNo ratings yet

- BSLMF One Time Mandate ReviseDocument6 pagesBSLMF One Time Mandate Revisesanjay901No ratings yet

- Cloud Based Bus Pass SystemDocument2 pagesCloud Based Bus Pass SystemSanket GhatteNo ratings yet

- Form Center: Products Making Payments Apply Now Locate Us Ways To Bank Customer CareDocument3 pagesForm Center: Products Making Payments Apply Now Locate Us Ways To Bank Customer CaremohangboxNo ratings yet

- Travel Currency Card TNCDocument10 pagesTravel Currency Card TNCKrishna RamaNo ratings yet

- Dragonpay APIDocument31 pagesDragonpay APIhaizea obreinNo ratings yet

- Bank of Baroda FastagDocument2 pagesBank of Baroda FastagKaushik JoshiNo ratings yet

- Bank Promotion Exam Recollected Questions Part 4Document11 pagesBank Promotion Exam Recollected Questions Part 4RADHA KRISHNANNo ratings yet

- Transaction MaintenanceDocument4 pagesTransaction MaintenancedonbabaNo ratings yet

- DDDDDDDDDocument24 pagesDDDDDDDDdenekew lesemiNo ratings yet

- E Ticket Converti ConvertiDocument3 pagesE Ticket Converti ConvertieranNo ratings yet

- Jio 6Document1 pageJio 6dwall29292No ratings yet

- Sbi Atm FormDocument2 pagesSbi Atm Formfazlurrahman2370No ratings yet

- T Vra 3 Ku ZLZ FV 9 D WDocument2 pagesT Vra 3 Ku ZLZ FV 9 D WAnonymous zy3rAYHNo ratings yet

- Prepaid Cards & Money Management App Money NetworkDocument1 pagePrepaid Cards & Money Management App Money NetworkAdrian Gutierrez sanchezNo ratings yet

- Virtual CardDocument58 pagesVirtual CardRachitha Shetty67% (3)

- PK Saadiq Soc Jan To July 2024 EngDocument48 pagesPK Saadiq Soc Jan To July 2024 Engwaqas wattooNo ratings yet

- 1st Week Front OfficeDocument12 pages1st Week Front Officeryan nodaNo ratings yet

- pg1269 PDFDocument2 pagespg1269 PDFLori CarlsonNo ratings yet