Professional Documents

Culture Documents

Challan 281

Challan 281

Uploaded by

prakashchandramahapatra2021Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Challan 281

Challan 281

Uploaded by

prakashchandramahapatra2021Copyright:

Available Formats

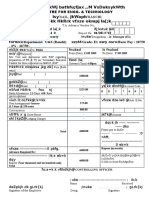

tqykbZ 2005 o vkxs ds Hkqxrkuksa ds fy, @ For payments from July 2005 onwards

* egRoiw.kZ % Ñi;k pkyku Hkjus ls igys fVIi.kh ihNs ns[ksa A

Important: Please see notes overleaf before

Ïksr ij@laxzg.k dj dVkSrh pkyku @ ,dy izfr ¼{ks-ys-vf/kdkjh ds ikl Hkstus ds fy,½

Single Copy (to be sent to the ZAO)

filling up the challan. T.D.S./TCS TAX CHALLAN

pkyku la- @ vkbZ mi;qDr dj (,d ij fu'kku yxkosa) @ Tax Applicable (Tick One) * fu/kkZj.k o"kZ

Vh ,u ,l Ïksr ij dkVk x;k @ laxzfgr dj @ TAX DEDUCTED / COLLECTED AT SOURCE FROM Assessment

CHALLAN NO. / Year

ITNS (0020) dEiuh dVkSrhnkrk (0021) xSj&dEiuh dVkSrhnkrk

-

281 COMPANY DEDUCTEES NON-COMPANY DEDUCTEES

dj dVkSrh ys[kk la[;k (VSu) @ Tax Deduction Account No. (T.A.N.)

iwjk uke @ Full Name

iwjk irk] uxj vkSj jkT; lfgr @ Complete Address with City & State

Qksu u-@Tel. No. fiu@Pin

Hkqxrku dk funZs'ku @ Type of Payment dks M @ Code*

(,d ij fu'kku yxkosa @ Tick One)

izkIrdrkZ cSad esa iz;ksx ds fy;s

d`i;k ihNs ns[ksa@(Please. see overleaf)

FOR USE IN RECEIVING BANK

djnkrk }kjk ns ; Vh Mh ,l@Vh lh ,l @ TDS/TCS Payable by Taxpayer (200)

Vh Mh ,l

,l@@ Vh lh ,l & fu;fer fu/kkZ j .k (vk;dj foHkkx }kjk mRiUu) @ [kkrs ls MschV @ psd ds ØsfMV dh rkjh[k

TDS/TCS Regular Assessment (Raised by I.T. Deptt.) (400) Debit to A/c / Cheque credited on

Hkqxrku dk fooj.k @ DETAILS OF PAYMENTS

jkf'k (dsoy :- esa) @ Amount (in Rs. Only)

rk- @ DD ek- @ MM o"kZ @ YY

vk;dj @ Income Tax

vf/Hkkj @ Surcharge cSad dh eksgj ds fy, LFkku

SPACE FOR BANK SEAL

f'k{kk midj @ Education Cess

C;kt @ Interest

'kkfLr @ Penalty

tksM+ @ Total

tksM+ ('kCnksa esa) @ Total (in words)

djksM @ CRORES yk[k @ LACS

gtkj @ lSdM+k @ ngkbZ @ TENS bdkbZ @ UNITS

THOUSANDS HUNDREDS

udn @ [kkrs ls MschV @ psd la- fnukad

Paid in Cash/ Debit to A/c /Cheque No. Dated

vnkdrkZ cSad @ Drawn on

(cSad ,oa 'kk[kk dk uke) @ (Name of the Bank and Branch)

}kjk tek fd;k A

fnukad @ Date : tek djus okys O;fDr ds gLrk{kj :-@Rs.

Signature of person making payment

;gka ls dkVsa @ Tear Here

(djnkrk }kjk Hkjk tk,xk)

djnkrk dk izfri.kZ @ Taxpayers Counterfoil (To be filled up by tax payer) cSad dh eksgj ds fy, LFkku

SPACE FOR BANK SEAL

dj dVkSrh ys[kk la- (VSu) @ TAN

Received from

(uke) @ (Name)

ls udn@[kkrs ls MschV @ psd la- :-

Cash/ Debit to A/c /Cheque No. For Rs.

#- ('kCnks esa)

Rs. (in words)

vnkdrkZ cSad @ drawn on

(cSad ,oa 'kk[kk dk uke) @ (Name of the Bank and Branch)

rhnkrk@

}kjk ls Ïksr ij dj@dj laxgz .k (Vhlh,l) dVkSrh (sVh-Mh-,l-) dEiuh@Company / xSj&dEiuh@Non-Company dVkS

Deductees

on account of Tax Deducted at Source (TDS)/Tax Collected at source (TCS) from ........................... (Fill up Code)

(tks ykxw uk gks mls dkV nsa) @ (Strike out whichever is not applicable) :-@Rs.

ds :i esa fu/kZj.k o"kZ @ for the Assessment Year – ds fy, izkIr gqvk

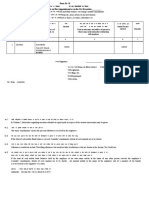

* fVIi.kh@NOTES

1. Ñi;k uksV djsa fd vk;dj vf/fu;e] 1961 dh /kjk 272 [k [k ds vuqlkj >wBk dj dVkSrh ys[kk la[;k (VSu) n'kkZus ij

10000@& :i;s dh 'kkfLr dh O;oLFkk gS A

Please note that quoting false TAN may attract a penalty of Rs. 10,000/- as per section 272BB of I.T.

Act, 1961.

2. Hkqxrku ds izR;sd izdkj (fun'kZu) ds fy, vyx pkyku dk iz;ksx djsa A

Use a Separate Challan for each Nature (Type) of Payment. The relevant Codes are:

lqlaxr dksM fuEufyf[kr gS%

/kjk@Section Hkqxrku dk izdkj @ Nature of Payment dksM@Code

192 la?k ljdkj ds deZpkjh dks NksM+dj ljdkjh deZpkfj;ksa dks lank; @

Payment to Govt. Employees other than Union Government Employees 9 2 A

192 ljdkjh deZpkfj;ksa dks NksM+dj deZpkfj;ksa dks lank; @

Payment of Employees other than Govt. Employees 9 2 B

193 izfrHkwfr;ksa ij C;kt @ Interest on securities 1 9 3

194 ykHkka'k @ Dividend 1 9 4

194A izfrHkwfr;ksa ls fHkUu C;kt @ Interest other than interest on securities 9 4 A

194B ykVjh o oxZ igsyh esa gqbZ thr @ Winnings from lotteries and crossword puzzles 9 4 B

194BB ?kqM+nkSM+ esa gqbZ thr @ Winnings from horse race 4 B B

194C Bsdsnkjksa o miBsdsnkjksa dk Hkqxrku @ Payment of contractors and sub-contractors 9 4 C

194D chek deh'ku @ Insurance Commission 9 4 D

194E vfuoklh [ksy laxeksa ;k laLFkkvksa dks lank; @ Payments to non-resident Sportsmen/Sport Associations 9 4 E

194EE jk"Vªh; cpr ;kstuk ds vUrxZr fu{ksiksa ls lacafèkr lank; @

Payments in respect of Deposits under National Savings Schemes 4 E E

194F E;wP;qvy iaQM ;k ;w-Vh-vkbZ- }kjk ;wfuVksa ds iqu% Ø; ds dkj.k @

Payments on account of Re-purchase of Units by Mutual Funds or UTI 9 4 F

194G ykVjh dh lsy ij deh'ku] buke bR;kfn @ Commision, prize etc. on sale of Lottery tickets 9 4 G

194H deh'ku ;k czksØst @ Commission or Brokerage 9 4 H

194 I fdjk;k @ Rent 9 4 I

194J o`fRrd vFkok rduhdh lsokvksa ds fy, iQhl @ Fees For Professional Or Technical Services 9 4 J

194K fofufnZ"V E;wP;qvy iQaM ;wfuVksa ;k ;w-Vh-vkbZ- dh ;wfuVksa ds laca/ esa fuoklh fu/kZfjrh dks lans; vk; @ Income payable to a

Resident Assessee in respect of Units of a specified Mutual Fund or of the Units of the UTI 9 4 K

194LA dfri; vpy lEifÙk ds vtZu ij izfrdj dk lank; @ Payment of Compensation on Acquisition

of Certain Immovable Property 9 4 L

195 vfuoklh dks lank; vU; jde @ Other sums payable to a non-resident 1 9 5

196A vfuoklh dh ;wfuVksa ds laca/ esa vk; @ Income in respect of units of Non-Residents 9 6 A

196B virV fuf/ ds ;wfuVksa ds laca/ esa fd;k x;k lank; @ Payments in respect of Units to an Offshore Fund 9 6 B

196C fdlh vfuoklh dk lans; fons'kh djsUlh] ckaM~l ;k Hkkjrh; dEiuh ds 'ks;jksa ls vk; @

Income from foreign Currency Bonds or shares of Indian Company payable to Non-Resident 9 6 C

196D izfrHkwfr;ksa ls fons'kh laLFkkxr fuos'kdksa dh vk; @ Income of foreign institutional investors from securities 9 6 D

206C ekuo miHkksx ds fy, ,Ydksgkyh fydj ls Ïksr ij laxzg.k @

Collection at Source from Alcoholic Liquor for Human Consumption 6 C A

206C ou iV~Vs ds varxZr izkIr dk"B ls Ïksr ij laxzg.k @ Collection at Source from Timber obtained under Forest lease 6 C B

206C ou iV~Vs ds vykok vU; fdlh izdkj ls izkIr fd, x, dk"B ls Ïksr ij laxzg.k @ Collection at Source from Timber

obtained by any Mode other than a Forest Lease 6 C C

206C fdlh vU; ou mRikn (tks rsanw iRrk ugha gS) ls Ïksr ij laxzg.k @

Collection at source from any other Forest Produce (not being Tendu Leaves) 6 C D

206C LØSi ls lzksr ij laxzg.k @ Collection at Source from Scrap 6 C E

206C ik²dx ykVl ls lacaf/r Bsdksa vFkok ykbZlsal vFkok iV~Vs ls Ïksr ij laxzg.k @

Collection at Source from contractors or licensee or lease relating to Parking lots 6 C F

206C Vksy Iyktk ls lacaf/r Bsdksa vFkok ykbZlsal vFkok iV~Vs ls Ïksr ij laxzg.k @

Collection at Source from contractors or licensee or lease relating to toll plaza 6 CG

206C [kku vFkok [kfut ls lacaf/r Bsdksa vFkok ykbZlsal vFkok iV~Vs ls Ïksr ij laxzg.k @

Collection at Source from contractors or licensee or lease relating to mine or quarry 6 C H

206C rsanw iÙkksa ls Ïksr ij laxzg.k @

Collection at Source from tendu leaves 6 C I

Ñi;k pkyku ds mQij lqlaxr ckDl esa lgh dk fu'kku yxk;sa A dEiuh dVkSrhnkrk rFkk xSj&dEiuh dVkSrhnkrk ls Ïksr

ij dkVs x, dj dks tek djus ds fy;s vyx pkyku dk iz;ksx fd;k tkuk gS A

PLEASE TICK THE RELEVANT BOX AT THE TOP OF THE CHALLAN. SEPARATE CHALLANS SHOULD

BE USED FOR DEPOSITING TAX DEDUCTED AT SOURCE FROM COMPANY DEDUCTEES AND FROM

NON-COMPANY DEDUCTEES.

d` i ;k tka p djs a fd cS a d ikorh es a fuEufyf[kr lw p uk miyC/ gS %&

1- cS a d 'kk[kk dk 7 va d dh ch ,l vkj dks M

2- pkyku tek djus dh rkjh[k (fnu] ekg] o"kZ )

3- pkyku Øe la [ ;k

vkidks bldk vk; dh fooj.kh es a mYys [ k djuk gks x kA

KINDLY ENSURE THAT THE BANK'S ACKNOWLEDGEMENT CONTAINS THE FOLLOWING:-

1. 7 DIGIT BSR CODE OF THE BANK BRANCH

2. DATE OF DEPOSIT OF CHALLAN (DD MM YY)

3. CHALLAN SERIAL NUMBER

THESE WILL HAVE TO BE QUOTED IN YOUR RETURN OF INCOME.

You might also like

- LeonDocument2 pagesLeonRoberto AstudilloNo ratings yet

- Challan 281Document2 pagesChallan 281Paymaster ServicesNo ratings yet

- Challan 282Document2 pagesChallan 282api-3854061No ratings yet

- Challan280 060705Document2 pagesChallan280 060705Uttam AuddyNo ratings yet

- Challan 280Document2 pagesChallan 280api-3854061No ratings yet

- Challan 282Document2 pagesChallan 282prakashchandramahapatra2021No ratings yet

- Lksuvj QKWJ Bathfu Fjax ,.M Vsduksykwth Lsy Jkwaph K KK HKRRK Vfxze Okmpj La ( KDocument2 pagesLksuvj QKWJ Bathfu Fjax ,.M Vsduksykwth Lsy Jkwaph K KK HKRRK Vfxze Okmpj La ( KscNo ratings yet

- TFR TaDocument2 pagesTFR TaRAKHI KUMARINo ratings yet

- Okidksl Fyfevsm: Wapcos KRK KR HKRRK Fcy@Document2 pagesOkidksl Fyfevsm: Wapcos KRK KR HKRRK Fcy@Shivani Sumitt MittalNo ratings yet

- Golden Rules of Accounting From Fardeen 2Document2 pagesGolden Rules of Accounting From Fardeen 2FUTURE POINTNo ratings yet

- Earnedleaveform 22Document1 pageEarnedleaveform 22Akhilesh YadavNo ratings yet

- Form - A: Signature of ApplicantDocument2 pagesForm - A: Signature of ApplicantPrabhaskar JhaNo ratings yet

- Union Bank Account Opening FormDocument4 pagesUnion Bank Account Opening FormRishin Ahammed0% (1)

- SVS Term and ConditionsDocument36 pagesSVS Term and ConditionsAskand SolankiNo ratings yet

- Advertisement PDFDocument7 pagesAdvertisement PDFGourang SahuNo ratings yet

- Dkfyunhiqje Vkokl Kstuk Ds Xksdqy LSDVJ Esa Ek0 Iz/Kkuea H Vkokl Kstuk Ds Vurxzr 04 Eaftys Nqczy VK Oxz Ds 312 Hkouksa DK Fuekz.K, Oa Fodkl DK ZaDocument29 pagesDkfyunhiqje Vkokl Kstuk Ds Xksdqy LSDVJ Esa Ek0 Iz/Kkuea H Vkokl Kstuk Ds Vurxzr 04 Eaftys Nqczy VK Oxz Ds 312 Hkouksa DK Fuekz.K, Oa Fodkl DK Zaupavp cd14No ratings yet

- LH-,L-VKBZ-VKJ-&JK"V H Oulifr Vuqla/Kku Lalfkku: Osclkbv@Document7 pagesLH-,L-VKBZ-VKJ-&JK"V H Oulifr Vuqla/Kku Lalfkku: Osclkbv@Rajat TripathiNo ratings yet

- Dezpkjh Hkfo" Fuf/K Laxbu) NRRHLX - : Qkez&9 La'KksfèkrDocument1 pageDezpkjh Hkfo" Fuf/K Laxbu) NRRHLX - : Qkez&9 La'KksfèkrTaru MehtaNo ratings yet

- Xq#Dqy Dkaxm+H Lefo'Ofo - Ky ) GFJ) Kj&249404: Gurukula Kangri (Deemed To Be Univeristy), Haridwar-249404Document3 pagesXq#Dqy Dkaxm+H Lefo'Ofo - Ky ) GFJ) Kj&249404: Gurukula Kangri (Deemed To Be Univeristy), Haridwar-249404Jumba JumbaNo ratings yet

- Railway Nala NirmanDocument7 pagesRailway Nala NirmanArjun PatelNo ratings yet

- MRRJK (K.M Eqdr Fo"Ofo - Ky : Lelr Ikb Øeksa GSRQ Izos"K Vkosnu&IDocument4 pagesMRRJK (K.M Eqdr Fo"Ofo - Ky : Lelr Ikb Øeksa GSRQ Izos"K Vkosnu&IZez SamuelNo ratings yet

- SSC Cpo Complete Maths BookDocument267 pagesSSC Cpo Complete Maths Bookbibek kumarNo ratings yet

- Egkrek Xka/Kh DK'KH Fo - Kihb) Okjk - KLH: Lukrd Ikb Øe LHV La ( K) Ikb Øe DKSM RFKK Kqyd Fooj.KDocument8 pagesEgkrek Xka/Kh DK'KH Fo - Kihb) Okjk - KLH: Lukrd Ikb Øe LHV La ( K) Ikb Øe DKSM RFKK Kqyd Fooj.KAbhijeet RawatNo ratings yet

- Tendernotice 1Document1 pageTendernotice 1Keshav SoniNo ratings yet

- Examination, 2021: VfkokDocument8 pagesExamination, 2021: Vfkoktech with yashNo ratings yet

- 2022092394Document2 pages2022092394Syed AhmadNo ratings yet

- MRRJK (K.M Eqdr Fo"Ofo - Ky : Uttarakhand Open University Lelr Ikb Øeksa GSRQ Izos"K Vkosnu&IDocument4 pagesMRRJK (K.M Eqdr Fo"Ofo - Ky : Uttarakhand Open University Lelr Ikb Øeksa GSRQ Izos"K Vkosnu&IjotaNo ratings yet

- Form - A: Signature of Applicant: - DateDocument2 pagesForm - A: Signature of Applicant: - Datekanilkumarf8No ratings yet

- Technical 266179Document1 pageTechnical 266179samaksh proNo ratings yet

- Notice No.-9 - JGGLCCE-2021 - 24.06Document1 pageNotice No.-9 - JGGLCCE-2021 - 24.06sonumonuu096No ratings yet

- MumtDocument7 pagesMumtkashyapdevish24No ratings yet

- Jain Gazette 10 Feb All PG Web PDFDocument14 pagesJain Gazette 10 Feb All PG Web PDFSiddarth JainNo ratings yet

- Railway Saptic TankDocument9 pagesRailway Saptic TankArjun PatelNo ratings yet

- Patch Progress CorrectedDocument3 pagesPatch Progress CorrecteddaisyNo ratings yet

- DK Kzy Lahkkxh Ifj Kstuk A H Yksd Fuekz.K Fohkkx) Ifj Kstuk Fø Kuo U BDKBZ) U K Dysdvj DK Kzy Ds Ikl Flfoy Ykbzu Ckyk?Kkv E-IzDocument2 pagesDK Kzy Lahkkxh Ifj Kstuk A H Yksd Fuekz.K Fohkkx) Ifj Kstuk Fø Kuo U BDKBZ) U K Dysdvj DK Kzy Ds Ikl Flfoy Ykbzu Ckyk?Kkv E-Izfemetib312No ratings yet

- KJ (K.M Dezpkjh P U VK KSXDocument34 pagesKJ (K.M Dezpkjh P U VK KSXHariom YadavNo ratings yet

- Epf 10CDocument4 pagesEpf 10Csandee1983No ratings yet

- High Court VigyapanDocument24 pagesHigh Court Vigyapanrahul tyagiNo ratings yet

- Leave Application FormDocument1 pageLeave Application FormRehmat RattuNo ratings yet

- IEC Monitoring Form HindiDocument3 pagesIEC Monitoring Form HindiDeepkamal JaiswalNo ratings yet

- Jkeèkkjh Flag Fnudj: Li'kZDocument5 pagesJkeèkkjh Flag Fnudj: Li'kZShrirang ShuklaNo ratings yet

- (Vitamins) PDFDocument5 pages(Vitamins) PDFBhim KumarNo ratings yet

- Salamevatan 101 15 OctDocument6 pagesSalamevatan 101 15 Octapi-26894863100% (1)

- ?KKS"K.KK I K: 4-Tue DH FRFFK Fnu Eghuk O"Kz 5 - Osokfgd Fookfgr@ Izkflfkfr Vfookfgr Fo/KokDocument4 pages?KKS"K.KK I K: 4-Tue DH FRFFK Fnu Eghuk O"Kz 5 - Osokfgd Fookfgr@ Izkflfkfr Vfookfgr Fo/KokHarsha VardhanNo ratings yet

- Form-1 Declaration FormDocument2 pagesForm-1 Declaration FormDaphne Anderson25% (4)

- D349liquid AssetsDocument2 pagesD349liquid AssetsMukeshChauhanNo ratings yet

- Sambhav GleDdFGRSIKDoGTDocument2 pagesSambhav GleDdFGRSIKDoGTchuramoninayak.kathiNo ratings yet

- TALLY (An Accounting SoftwareDocument25 pagesTALLY (An Accounting SoftwarePratibha ThakurNo ratings yet

- Generate PDFStudentDocument3 pagesGenerate PDFStudentrohitbandhi012No ratings yet

- Raisen GumastaDocument1 pageRaisen Gumastamahakaal digital point bhopalNo ratings yet

- RajeDocument9 pagesRajeNEERAJ KUMARNo ratings yet

- ESIC SPECIMEN - Form-1 Declaration FormDocument2 pagesESIC SPECIMEN - Form-1 Declaration FormnimishshrivastavNo ratings yet

- Ch.4 प्रत्ययDocument21 pagesCh.4 प्रत्ययfaker790719No ratings yet

- Kautilya Arthshastra: Utkirith Prasasn Vidhi Evam Sasan PradhliFrom EverandKautilya Arthshastra: Utkirith Prasasn Vidhi Evam Sasan PradhliNo ratings yet

- Smran Shakti Kaise Badhaye: Manshik Chamta Badhane Hetu Saral Evam Prabhavi KorshFrom EverandSmran Shakti Kaise Badhaye: Manshik Chamta Badhane Hetu Saral Evam Prabhavi KorshNo ratings yet

- Sankshipt Prayavachi Evam Vilom Shabadkosh: Civil Service, Bank Po, Railway, Tet, School Va College Ke Chatr-Chatro Evam Sabhi Pratiyogi Parichao Ke Liye Upyogi PustakFrom EverandSankshipt Prayavachi Evam Vilom Shabadkosh: Civil Service, Bank Po, Railway, Tet, School Va College Ke Chatr-Chatro Evam Sabhi Pratiyogi Parichao Ke Liye Upyogi PustakNo ratings yet

- Vidyarthi Jeevan Main Maansik Vikas Avam Sharirik Swastha: Vidyathi Ke Sharirik Yavm Mansik Vikas Hetu Jaruri TipsFrom EverandVidyarthi Jeevan Main Maansik Vikas Avam Sharirik Swastha: Vidyathi Ke Sharirik Yavm Mansik Vikas Hetu Jaruri TipsNo ratings yet

- Aadhunik Naari Evam Khushhal Pariwar: Sukhi Dampayt Jeevan Ke Liye Vishetha Upyogi PustakFrom EverandAadhunik Naari Evam Khushhal Pariwar: Sukhi Dampayt Jeevan Ke Liye Vishetha Upyogi PustakNo ratings yet

- The Universal Declaration of Human Rights (UdhrDocument7 pagesThe Universal Declaration of Human Rights (UdhrSanskruti JagtapNo ratings yet

- 2 - AUYONG HIAN Vs CtaDocument9 pages2 - AUYONG HIAN Vs CtaEmmanuel MabolocNo ratings yet

- PRAN-RFL Group PRAN-RFL Center, 105, Progoti Sarani, Middle Badda, Dhaka 1212, BangladeshDocument3 pagesPRAN-RFL Group PRAN-RFL Center, 105, Progoti Sarani, Middle Badda, Dhaka 1212, BangladeshSharif 087No ratings yet

- 10 First Planters Pawnshop Vs BIR CaseDocument2 pages10 First Planters Pawnshop Vs BIR CaseRenato C. Silvestre Jr.No ratings yet

- Professional Ethics Case LawDocument17 pagesProfessional Ethics Case LawJatan HundalNo ratings yet

- Fisher, William, Theories of Intellectual Property Available atDocument11 pagesFisher, William, Theories of Intellectual Property Available atArunaMLNo ratings yet

- Writ of MandamusDocument5 pagesWrit of MandamusMukesh TomarNo ratings yet

- Moa Book GivingDocument5 pagesMoa Book GivingrholifeeNo ratings yet

- In The High Court of Calcutta: I.P. Mukerji and Md. Nizamuddin, JJDocument4 pagesIn The High Court of Calcutta: I.P. Mukerji and Md. Nizamuddin, JJsid tiwariNo ratings yet

- Chapter 7 COMMON UNETHICAL PRACTICES OF BUSINESS ESTABLISHMENTSDocument3 pagesChapter 7 COMMON UNETHICAL PRACTICES OF BUSINESS ESTABLISHMENTSKristine Allen D. ArmandoNo ratings yet

- Nego 2nd WeekDocument35 pagesNego 2nd WeekElyn ApiadoNo ratings yet

- 5 Libro Reading Explorer 2Document16 pages5 Libro Reading Explorer 2watch2303No ratings yet

- 2 Interim ConstitutionDocument24 pages2 Interim ConstitutionSyed Muhammad Shoaib ZaidiNo ratings yet

- Imamul Hai Khan Law College: Amission FormDocument2 pagesImamul Hai Khan Law College: Amission FormPrakash KumarNo ratings yet

- Glover v. Crawford, 98 F.3d 1333, 1st Cir. (1996)Document1 pageGlover v. Crawford, 98 F.3d 1333, 1st Cir. (1996)Scribd Government DocsNo ratings yet

- Draft Terms & Conditions of Crawler Crane 100MT-CG049120Document12 pagesDraft Terms & Conditions of Crawler Crane 100MT-CG049120JalajNo ratings yet

- United States District Court Northern District of California San Francisco DivisionDocument16 pagesUnited States District Court Northern District of California San Francisco DivisionJohn SmithNo ratings yet

- 406) Frivaldo vs. COMELEC (174 SCRA 245 (1989)Document13 pages406) Frivaldo vs. COMELEC (174 SCRA 245 (1989)Carmel Grace KiwasNo ratings yet

- Cinematography ActDocument4 pagesCinematography Actvedanshasinghal -No ratings yet

- EITAI Lithium Battery Warranty File1Document6 pagesEITAI Lithium Battery Warranty File1Evan KaungMyatNo ratings yet

- Heirs of Calixto Mejia VS Spouses Eugenio GeronimoDocument2 pagesHeirs of Calixto Mejia VS Spouses Eugenio Geronimohaydee100% (1)

- Crime Detection and InvestigationDocument4 pagesCrime Detection and InvestigationZefren Botilla100% (3)

- Legal Forms Assign 2Document41 pagesLegal Forms Assign 2Alyssa joy TorioNo ratings yet

- Estate TaxDocument48 pagesEstate TaxBhosx Kim100% (1)

- Motor Vehicle Accident - Damages For Personal InjuryDocument99 pagesMotor Vehicle Accident - Damages For Personal InjurySiti Aisyah Sidek100% (1)

- AckoPolicy-DCOR00527451874 00Document6 pagesAckoPolicy-DCOR00527451874 00Bon BenNo ratings yet

- GO 336 Duty To InterveneDocument2 pagesGO 336 Duty To InterveneNews 8 WROCNo ratings yet

- Sale and Purchase Agreement - : Judul AktaDocument8 pagesSale and Purchase Agreement - : Judul AktaSafrita DeviNo ratings yet

- Asia Brewery, Inc. v. Tunay Na Pagkakaisa NG Mga Manggagawa Sa AsiaDocument15 pagesAsia Brewery, Inc. v. Tunay Na Pagkakaisa NG Mga Manggagawa Sa Asia149890No ratings yet