Professional Documents

Culture Documents

B Giridhar Reddy M Chandana Take Over Salaried

B Giridhar Reddy M Chandana Take Over Salaried

Uploaded by

PRAJA rajyamCopyright:

Available Formats

You might also like

- IT Certificate 622197149Document1 pageIT Certificate 622197149karimshiekNo ratings yet

- Welcome LetterDocument4 pagesWelcome Letterchelladuraik25% (4)

- Education LoanDocument2 pagesEducation Loanzuheb80% (10)

- Sanctionletter 10045975 29-8-2023 113638Document3 pagesSanctionletter 10045975 29-8-2023 113638greenrootfinancialservicesNo ratings yet

- Car Loan ProposalDocument6 pagesCar Loan ProposalRolly Acuna100% (3)

- Up Credit Cooperative: OR For The Employee's RetirementDocument6 pagesUp Credit Cooperative: OR For The Employee's RetirementRolly AcunaNo ratings yet

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- New Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDocument17 pagesNew Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDominic Romero75% (4)

- Patna Retail Assets CentreDocument31 pagesPatna Retail Assets CentreSatyajit BanerjeeNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961Document2 pagesTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961Vinod Kumar PandeyNo ratings yet

- Car Loan WEBSITEDocument57 pagesCar Loan WEBSITENAVEEN ROYNo ratings yet

- State Bank of IndiaDocument20 pagesState Bank of Indiaapi-26453574100% (1)

- Most Important Terms 1Document5 pagesMost Important Terms 1newskishoreNo ratings yet

- E-Circular: Pradhan Mantri Awas Yojana Credit Linked Subsidy Scheme (CLSS)Document7 pagesE-Circular: Pradhan Mantri Awas Yojana Credit Linked Subsidy Scheme (CLSS)Ramya MaddulaNo ratings yet

- For Indiabulls Housing Finance LimitedDocument1 pageFor Indiabulls Housing Finance LimitedWild RaacNo ratings yet

- DineshDocument10 pagesDineshShubham TripathiNo ratings yet

- Application Transaction ProcedureDocument3 pagesApplication Transaction ProcedurefaridatunNo ratings yet

- Loan Information Sheet Mutual Aid QuickDocument4 pagesLoan Information Sheet Mutual Aid Quickdesmarais jean francoisNo ratings yet

- NBP Saibaan Product FeaturesDocument2 pagesNBP Saibaan Product FeaturesSyedah Maira ShahNo ratings yet

- LBTRU00005805276 IT Certificate 2021-22Document2 pagesLBTRU00005805276 IT Certificate 2021-22siva kumar reddy kNo ratings yet

- KCC CompleteDocument94 pagesKCC CompleteRonit HrishikeshNo ratings yet

- Cause Title - Judgement-Entry 6Document4 pagesCause Title - Judgement-Entry 6Lalsiemlien LungtauNo ratings yet

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDocument4 pagesFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeoooohlalaNo ratings yet

- 69 S K KAMRUZZAMAN Money SuitDocument9 pages69 S K KAMRUZZAMAN Money SuitSanjukta MajumdarNo ratings yet

- AHMEE00735693Document2 pagesAHMEE00735693mrfaster04757No ratings yet

- Staff Loan MattersDocument94 pagesStaff Loan MattersMalay Ranjan33% (3)

- Reserve Bank of IndiaDocument6 pagesReserve Bank of IndiaVasu Ram JayanthNo ratings yet

- Sbi Home Loan MitcDocument4 pagesSbi Home Loan MitcfeeldboyNo ratings yet

- MQL Info SheetDocument3 pagesMQL Info Sheetdesmarais jean francoisNo ratings yet

- Loan Sanction-Letter181240016761170869Document3 pagesLoan Sanction-Letter181240016761170869Sanjay MohapatraNo ratings yet

- IFB HL SanctionLetterDocument5 pagesIFB HL SanctionLetterShubhabrata NahaNo ratings yet

- Risalah Ansuran Bulanan Rumah Ogos 2012 EngDocument4 pagesRisalah Ansuran Bulanan Rumah Ogos 2012 EngcheqmateNo ratings yet

- Home Loan MitcDocument4 pagesHome Loan Mitcdrgayen6042No ratings yet

- Pmay Subsidy ComplaintDocument3 pagesPmay Subsidy ComplaintAkshay HedauNo ratings yet

- Mitc PDFDocument3 pagesMitc PDFShreeNo ratings yet

- Mitc Auto LoansDocument1 pageMitc Auto LoansAmeer KhanNo ratings yet

- State Bank of India VS NAVJEEVAN TYRES PVT LTD NCLT MUMBAIDocument11 pagesState Bank of India VS NAVJEEVAN TYRES PVT LTD NCLT MUMBAISachika VijNo ratings yet

- Provisional Interest CertificateDocument2 pagesProvisional Interest Certificateashutosh sahuNo ratings yet

- Interest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansDocument19 pagesInterest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansapsagarNo ratings yet

- SSS Member Loan ApplicationDocument2 pagesSSS Member Loan ApplicationRj Santos95% (20)

- SBI FormDocument16 pagesSBI Formapi-373588783% (6)

- XYZHL Application Form - Editable - FinalDocument5 pagesXYZHL Application Form - Editable - FinalamiteshnegiNo ratings yet

- Anant Raj V Yes BankDocument10 pagesAnant Raj V Yes BankRishi SehgalNo ratings yet

- Theoretical Framework of Home LoanDocument8 pagesTheoretical Framework of Home LoanTulika GuhaNo ratings yet

- Circular No. 300 - Guidelines Implementing The Pag-IBIG Fund Housing Loan Restructuring and Penalty Condonation ProgramDocument10 pagesCircular No. 300 - Guidelines Implementing The Pag-IBIG Fund Housing Loan Restructuring and Penalty Condonation ProgramRogerMacadangdangGeonzonNo ratings yet

- Eos Andhra Pragathi: E.tqg&oaeqo$ Nrftu GfameerraDocument4 pagesEos Andhra Pragathi: E.tqg&oaeqo$ Nrftu Gfameerrakamakshi0735No ratings yet

- Sanction LetterDocument6 pagesSanction Lettersubhajitbarai0945No ratings yet

- 1708059296839Document1 page1708059296839pinjarissNo ratings yet

- Commercial Court Idbi Bank LTD VSDocument13 pagesCommercial Court Idbi Bank LTD VSvarun jangirNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- NotesDocument1 pageNotessrinath330440No ratings yet

- Home Loan - Master BCC BR 106 380Document158 pagesHome Loan - Master BCC BR 106 380binalamitNo ratings yet

- H LoanDocument136 pagesH LoanElango PaulchamyNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteFrom EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- European BanksDocument145 pagesEuropean BanksAbhishek BiswasNo ratings yet

- ThirdPartyRetrieveDocument - Asp 3Document4 pagesThirdPartyRetrieveDocument - Asp 3Elizabeth HilsonNo ratings yet

- Know Your CustomerDocument3 pagesKnow Your CustomerMardi RahardjoNo ratings yet

- Financial Literacy QuestionsDocument6 pagesFinancial Literacy Questionsarrow7330309grenaNo ratings yet

- Intern 1 PDFDocument81 pagesIntern 1 PDFNazmulHydierNeloyNo ratings yet

- Resume - Izella RuedaDocument2 pagesResume - Izella Ruedaapi-253502103No ratings yet

- Business Deposit Accounts Fee ScheduleDocument15 pagesBusiness Deposit Accounts Fee ScheduleJohnNo ratings yet

- Monzo Bank Statement 2023Document4 pagesMonzo Bank Statement 2023arcodtal20No ratings yet

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheAli AshrafNo ratings yet

- Micro Finance (Anu)Document29 pagesMicro Finance (Anu)AnvibhaNo ratings yet

- Bank Management Financial Services by Peter S. Rose, Sylvia C. Hudgins 1-3 (C1 - 3 - 5 - 6 - 7 - 8)Document244 pagesBank Management Financial Services by Peter S. Rose, Sylvia C. Hudgins 1-3 (C1 - 3 - 5 - 6 - 7 - 8)Viem Anh100% (1)

- Songs LyricsDocument11 pagesSongs LyricsnatarajevNo ratings yet

- V65/V68/BBA401/EE/20170724: Time: 3 Hours Marks: 80 InstructionsDocument8 pagesV65/V68/BBA401/EE/20170724: Time: 3 Hours Marks: 80 Instructionspooja jambhaleNo ratings yet

- Financial Inclusion Bank of Baroda: Summer Training Project ReportDocument102 pagesFinancial Inclusion Bank of Baroda: Summer Training Project ReportHashmi SutariyaNo ratings yet

- Cif CircularDocument196 pagesCif CircularLalit Yadav67% (3)

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- Foreign Exchange ManagementDocument152 pagesForeign Exchange Managementhimanshugupta6No ratings yet

- Tachyon Communications PVT LTD: InvoiceDocument1 pageTachyon Communications PVT LTD: InvoiceVivek dubeyNo ratings yet

- Chellan Federal-BankDocument1 pageChellan Federal-BankAbhijith. ANo ratings yet

- Study Id90254 Digital-Challenger-BanksDocument46 pagesStudy Id90254 Digital-Challenger-BanksJAVIER FERNANDEZ MELONo ratings yet

- Individual AssignmentDocument2 pagesIndividual AssignmentHashashahNo ratings yet

- Module-1 Banker and Customer Relationship: Mrs - Yashaswini Dept of Commerce, Jindal College For WomenDocument11 pagesModule-1 Banker and Customer Relationship: Mrs - Yashaswini Dept of Commerce, Jindal College For WomenYugapreetha RNo ratings yet

- BanksDocument32 pagesBanksPratyush ParanjapeNo ratings yet

- Schedule of Charges - Retail - Banking - 25 - 11 - 2018Document5 pagesSchedule of Charges - Retail - Banking - 25 - 11 - 2018Md. FoyjullahNo ratings yet

- AWAIS Operation ManagementDocument9 pagesAWAIS Operation Managementawais tariqNo ratings yet

- January Hathway 2023Document1 pageJanuary Hathway 2023karthik_venkata2020No ratings yet

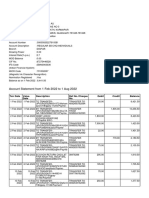

- Account Statement From 1 Feb 2022 To 1 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 1 Feb 2022 To 1 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceFIRDUS ALINo ratings yet

- NilnilnilnilDocument30 pagesNilnilnilnilMahakaal Digital PointNo ratings yet

- All FilesDocument24 pagesAll FilesvinayaklalganjNo ratings yet

B Giridhar Reddy M Chandana Take Over Salaried

B Giridhar Reddy M Chandana Take Over Salaried

Uploaded by

PRAJA rajyamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B Giridhar Reddy M Chandana Take Over Salaried

B Giridhar Reddy M Chandana Take Over Salaried

Uploaded by

PRAJA rajyamCopyright:

Available Formats

RLMS / FILE NO: 501240316029115 / 26660 BRANCH: COLLECTORATE COMPLEX – 21038

TAKEOVER OF HOME LOAN FROM PNB HFL RS.49,80,000/- @8.80% FOR 360 MONTHS

Applicants’ Name/s: MR. BATHI GIRIDHAR REDDY Guarantor: MRS. MANDA CHANDANA

Income - Salary:

The Applicant, Mr. B Giridhar Reddy, S/o Mr. B Desai Reddy, aged about 39 years is working as FM Gr II in MRT

Division of SPDCL of Telangana Ltd at Hyderabad for the last 14 years with Emp Code: 01071127. He is drawing a

Net Monthly Salary of Rs.1,33,054/- (Latest salary is Rs.1,18,800/-; He has recently closed his society loan and his

TDS deducted is more than applicable as per latest gross with respect to latest Form-16, TDS calculated is

Rs.16,978/-; LIC and Medical Insurance which are self-fund deductions are added back which is Rs.6,632/-; He is

receiving EL allowance of Rs.65,661/-, avg of last 2 years is 5,471/- per month). Salaries are being credited to

savings account with State Bank of India vide AC No.62093665976. He is the owner of the property.

Co-Applicant, Mrs. M Chandana, W/o Mr. B Giridhar Reddy, aged about 33 years is a housewife and is not an

owner of the property, but is added as a guarantor as she is one of the applicants in home loan with LIC HFL and is

required for obtaining original documents from that institution.

Residence:

They are residing in H No 5-116/51, Road No 2, Kakatiya Colony, Medipally, Hyderabad - 500008, which is an own

house.

The above-mentioned property is purchased by availing loan from PNB HFL of Rs.50,03,924/- on

30.04.2022 vide Loan AC No: HOU/HYD/0422/979387, with present O/s of Rs.49,68,592/- as on

30.04.2024 (as per latest O/s amount in CIC reports), which is applied for take over. They have also availed

a Top up loan of Rs.13,43,754/- on 21.04.2022 with present O/s of Rs.13,15,299/-, vide A/c No.

NHL/HYD/0422/979497 which will be taken over separately with the proceeds of Top up loan applied along

with this Home Loan Take over.

Documents submitted:

→ The applicant and Co-applicant have submitted PAN Cards, Aadhar Cards, Employee Identity card, last 3

months’ Salary slips, last 6 months’ Bank account statements, Last 2 years’ Form-16s.

→ They have submitted Home Loan sanction letter and Loan Account statement from PNB HFL.

KYC & Verification:

Applicants’ Residence and Office verifications are conducted by Shakambari Consultancy Services on

19.03.2024 and the reports are POSITIVE.

NETWORTH: Applicant – Rs.1,55,80,118/- NMI: Rs.1,33,054/- => NAI: Rs.15,96,648/-

Guarantor – Rs.21,40,000/- EMI/NMI is 70%, which is Rs.93,137/-

CREDIT RATING SCORE/S: CIBIL / CRIF: 1) 725 / 444 2) 785 / 735; Dt: 03.06.2024

Existing Liabilities of the Applicants:

Applicant:

1) Home loan (Take over) from PNB HFL of Rs.50,03,924/-, O/s is Rs.49,68,592/- (EMI is not considered)

2) Home loan Top up of Rs.13,43,754/-, O/s of Rs.13,15,299/- (EMI not considered, will be taken over)

3) Auto loan of Rs.11,69,900/-, O/s of Rs.10,59,000/-, EMI of Rs.19,315/-

4) Auto loan of Rs.5,00,000/-, O/s of Rs.4,43,145/-, EMI of Rs.10,739/- (To be closed with the Top up

proceeds)

5) Personal loan of Rs.14,90,000/-, O/s of Rs.13,85,684/-, EMI of Rs.28,783/- (To be closed with Top up)

6) 4 Gold loans of Rs.6,00,500/-, Rs.52,525/-, O/s of Rs.1,24,250/-, Rs.2,18,000/-, which are regular.

7) 2 Credit Cards which are regular and standard as on date of CIC reports.

Co-Applicant / Guarantor:

8) Home & Home Top up loans with PNB HFL (Joint) as mentioned above.

Total EMI obligations considered: Rs.19,315/-

Takeover Details:

Applicants have availed a housing loan in joint from PNB HFL of Rs.50,03,924/- on 30.04.2022 vide Loan

AC No: HOU/HYD/0422/979387, with present O/s of Rs.49,68,592/- as on 30.04.2024.

They have submitted Loan sanction letter, Loan statement from PNB HFL.

Disbursement of Take-over loan is to be made directly to PNB HFL Home loan account –

HOU/HYD/0422/979387.

Interest Rate:

Current External Benchmark Lending rate is 9.15% vide circular No CCO/CPPD-ADV/120/2022-23, Dated:

14.02.2023, w.e.f.15.02.2023, with CIBIL Score of 750-799, Applicable interest rate is EBR + 0 bps. Concession of

65bps as per campaign and 10bps special campaign for Take over home loans vide Circular No NBG/RE, H^HD-HL

CAMPA/41/2023-24, Dt: 01.02.2024. Hence, Effective ROI 9.15 – 0.65 – 0.10 = 8.40%

Processing Fee:

100% waiver in basic processing fees No circular no. NBG/RE, H^HD-HL CAMPA/41/2023-24, Dt: 01.02.2024, Real

Estate and Housing Business Unit Concession in Home Loans and Top Up loans during Campaign from 01.02.2024

to 31.03.2024 subject to recovery of actual expenses (for TIR & Valuation) (related TIR and valuation) - NIL

RECOMMENDED LOAN AMOUNT:

70% of the net monthly income is Rs.93,197/-, EMIs considered are Rs.19,315/- (Not considering the EMI

of HL, Top up which is applied for take over & EMIs of PL & AL which will be closed with Top up proceeds),

the eligible home loan @8.80% for a period of 360 months is Rs.90Lakhs

Property Valuation as per latest valuation report submitted: Rs.1,23,80,000/-

LTV applicable is 75% i.e., Eligible amount after 25% Margin is Rs.92,85,000/-

Outstanding amount of Loan which is being taken over as on 30.04.2024: Rs.49,68,000/-

General Insurance over the property of Rs.20,000/-, it is considered under LTV for adding under project

cost, 75% of that considered, which is Rs.16,000/-

Total Take over amount considered including General Insurance is Rs.49,84,000/-

Loan amount applied for Rs.49,80,000/-

Hence, Loan amount recommended for sanction is the least of above 3, i.e., Rs.49,80,000/- for takeover of

Home-loan from PNB HFL (Including General Insurance of Rs.20,000/-)

OBSERVATIONS:

Updated Closure Letter to be obtained before disbursement to arrive at correct amount.

Disbursement of Take-over loan is to be made directly to PNB HFL Home loan account –

HOU/HYD/0422/979387.

YONO REGISTRATION TO BE ENSURED.

STANDING INSTRUCTION TO BE CREATED FOR COLLECTION OF EMIs THROUGH THEIR SAVINGS

ACCOUNT WITH SBI vide A/C No. 62019965355.

There is a Top up loan attached with this Take over home loan which will be processed separately after

sanction and opening of account of this loan proposal, through which Top up @PNB HFL will be taken over

/ closed with the proceeds along with Personal loan with SBI of Rs.14,90,000/- and Auto loan of

Rs.5,00,000/- will be closed as per their request

THE PROPOSAL FALLS UNDER THE DISCRETIONARY POWERS OF CHIEF MANAGER, SANCTIONS

You might also like

- IT Certificate 622197149Document1 pageIT Certificate 622197149karimshiekNo ratings yet

- Welcome LetterDocument4 pagesWelcome Letterchelladuraik25% (4)

- Education LoanDocument2 pagesEducation Loanzuheb80% (10)

- Sanctionletter 10045975 29-8-2023 113638Document3 pagesSanctionletter 10045975 29-8-2023 113638greenrootfinancialservicesNo ratings yet

- Car Loan ProposalDocument6 pagesCar Loan ProposalRolly Acuna100% (3)

- Up Credit Cooperative: OR For The Employee's RetirementDocument6 pagesUp Credit Cooperative: OR For The Employee's RetirementRolly AcunaNo ratings yet

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- New Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDocument17 pagesNew Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDominic Romero75% (4)

- Patna Retail Assets CentreDocument31 pagesPatna Retail Assets CentreSatyajit BanerjeeNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961Document2 pagesTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961Vinod Kumar PandeyNo ratings yet

- Car Loan WEBSITEDocument57 pagesCar Loan WEBSITENAVEEN ROYNo ratings yet

- State Bank of IndiaDocument20 pagesState Bank of Indiaapi-26453574100% (1)

- Most Important Terms 1Document5 pagesMost Important Terms 1newskishoreNo ratings yet

- E-Circular: Pradhan Mantri Awas Yojana Credit Linked Subsidy Scheme (CLSS)Document7 pagesE-Circular: Pradhan Mantri Awas Yojana Credit Linked Subsidy Scheme (CLSS)Ramya MaddulaNo ratings yet

- For Indiabulls Housing Finance LimitedDocument1 pageFor Indiabulls Housing Finance LimitedWild RaacNo ratings yet

- DineshDocument10 pagesDineshShubham TripathiNo ratings yet

- Application Transaction ProcedureDocument3 pagesApplication Transaction ProcedurefaridatunNo ratings yet

- Loan Information Sheet Mutual Aid QuickDocument4 pagesLoan Information Sheet Mutual Aid Quickdesmarais jean francoisNo ratings yet

- NBP Saibaan Product FeaturesDocument2 pagesNBP Saibaan Product FeaturesSyedah Maira ShahNo ratings yet

- LBTRU00005805276 IT Certificate 2021-22Document2 pagesLBTRU00005805276 IT Certificate 2021-22siva kumar reddy kNo ratings yet

- KCC CompleteDocument94 pagesKCC CompleteRonit HrishikeshNo ratings yet

- Cause Title - Judgement-Entry 6Document4 pagesCause Title - Judgement-Entry 6Lalsiemlien LungtauNo ratings yet

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDocument4 pagesFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeoooohlalaNo ratings yet

- 69 S K KAMRUZZAMAN Money SuitDocument9 pages69 S K KAMRUZZAMAN Money SuitSanjukta MajumdarNo ratings yet

- AHMEE00735693Document2 pagesAHMEE00735693mrfaster04757No ratings yet

- Staff Loan MattersDocument94 pagesStaff Loan MattersMalay Ranjan33% (3)

- Reserve Bank of IndiaDocument6 pagesReserve Bank of IndiaVasu Ram JayanthNo ratings yet

- Sbi Home Loan MitcDocument4 pagesSbi Home Loan MitcfeeldboyNo ratings yet

- MQL Info SheetDocument3 pagesMQL Info Sheetdesmarais jean francoisNo ratings yet

- Loan Sanction-Letter181240016761170869Document3 pagesLoan Sanction-Letter181240016761170869Sanjay MohapatraNo ratings yet

- IFB HL SanctionLetterDocument5 pagesIFB HL SanctionLetterShubhabrata NahaNo ratings yet

- Risalah Ansuran Bulanan Rumah Ogos 2012 EngDocument4 pagesRisalah Ansuran Bulanan Rumah Ogos 2012 EngcheqmateNo ratings yet

- Home Loan MitcDocument4 pagesHome Loan Mitcdrgayen6042No ratings yet

- Pmay Subsidy ComplaintDocument3 pagesPmay Subsidy ComplaintAkshay HedauNo ratings yet

- Mitc PDFDocument3 pagesMitc PDFShreeNo ratings yet

- Mitc Auto LoansDocument1 pageMitc Auto LoansAmeer KhanNo ratings yet

- State Bank of India VS NAVJEEVAN TYRES PVT LTD NCLT MUMBAIDocument11 pagesState Bank of India VS NAVJEEVAN TYRES PVT LTD NCLT MUMBAISachika VijNo ratings yet

- Provisional Interest CertificateDocument2 pagesProvisional Interest Certificateashutosh sahuNo ratings yet

- Interest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansDocument19 pagesInterest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansapsagarNo ratings yet

- SSS Member Loan ApplicationDocument2 pagesSSS Member Loan ApplicationRj Santos95% (20)

- SBI FormDocument16 pagesSBI Formapi-373588783% (6)

- XYZHL Application Form - Editable - FinalDocument5 pagesXYZHL Application Form - Editable - FinalamiteshnegiNo ratings yet

- Anant Raj V Yes BankDocument10 pagesAnant Raj V Yes BankRishi SehgalNo ratings yet

- Theoretical Framework of Home LoanDocument8 pagesTheoretical Framework of Home LoanTulika GuhaNo ratings yet

- Circular No. 300 - Guidelines Implementing The Pag-IBIG Fund Housing Loan Restructuring and Penalty Condonation ProgramDocument10 pagesCircular No. 300 - Guidelines Implementing The Pag-IBIG Fund Housing Loan Restructuring and Penalty Condonation ProgramRogerMacadangdangGeonzonNo ratings yet

- Eos Andhra Pragathi: E.tqg&oaeqo$ Nrftu GfameerraDocument4 pagesEos Andhra Pragathi: E.tqg&oaeqo$ Nrftu Gfameerrakamakshi0735No ratings yet

- Sanction LetterDocument6 pagesSanction Lettersubhajitbarai0945No ratings yet

- 1708059296839Document1 page1708059296839pinjarissNo ratings yet

- Commercial Court Idbi Bank LTD VSDocument13 pagesCommercial Court Idbi Bank LTD VSvarun jangirNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- NotesDocument1 pageNotessrinath330440No ratings yet

- Home Loan - Master BCC BR 106 380Document158 pagesHome Loan - Master BCC BR 106 380binalamitNo ratings yet

- H LoanDocument136 pagesH LoanElango PaulchamyNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteFrom EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- European BanksDocument145 pagesEuropean BanksAbhishek BiswasNo ratings yet

- ThirdPartyRetrieveDocument - Asp 3Document4 pagesThirdPartyRetrieveDocument - Asp 3Elizabeth HilsonNo ratings yet

- Know Your CustomerDocument3 pagesKnow Your CustomerMardi RahardjoNo ratings yet

- Financial Literacy QuestionsDocument6 pagesFinancial Literacy Questionsarrow7330309grenaNo ratings yet

- Intern 1 PDFDocument81 pagesIntern 1 PDFNazmulHydierNeloyNo ratings yet

- Resume - Izella RuedaDocument2 pagesResume - Izella Ruedaapi-253502103No ratings yet

- Business Deposit Accounts Fee ScheduleDocument15 pagesBusiness Deposit Accounts Fee ScheduleJohnNo ratings yet

- Monzo Bank Statement 2023Document4 pagesMonzo Bank Statement 2023arcodtal20No ratings yet

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheAli AshrafNo ratings yet

- Micro Finance (Anu)Document29 pagesMicro Finance (Anu)AnvibhaNo ratings yet

- Bank Management Financial Services by Peter S. Rose, Sylvia C. Hudgins 1-3 (C1 - 3 - 5 - 6 - 7 - 8)Document244 pagesBank Management Financial Services by Peter S. Rose, Sylvia C. Hudgins 1-3 (C1 - 3 - 5 - 6 - 7 - 8)Viem Anh100% (1)

- Songs LyricsDocument11 pagesSongs LyricsnatarajevNo ratings yet

- V65/V68/BBA401/EE/20170724: Time: 3 Hours Marks: 80 InstructionsDocument8 pagesV65/V68/BBA401/EE/20170724: Time: 3 Hours Marks: 80 Instructionspooja jambhaleNo ratings yet

- Financial Inclusion Bank of Baroda: Summer Training Project ReportDocument102 pagesFinancial Inclusion Bank of Baroda: Summer Training Project ReportHashmi SutariyaNo ratings yet

- Cif CircularDocument196 pagesCif CircularLalit Yadav67% (3)

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- Foreign Exchange ManagementDocument152 pagesForeign Exchange Managementhimanshugupta6No ratings yet

- Tachyon Communications PVT LTD: InvoiceDocument1 pageTachyon Communications PVT LTD: InvoiceVivek dubeyNo ratings yet

- Chellan Federal-BankDocument1 pageChellan Federal-BankAbhijith. ANo ratings yet

- Study Id90254 Digital-Challenger-BanksDocument46 pagesStudy Id90254 Digital-Challenger-BanksJAVIER FERNANDEZ MELONo ratings yet

- Individual AssignmentDocument2 pagesIndividual AssignmentHashashahNo ratings yet

- Module-1 Banker and Customer Relationship: Mrs - Yashaswini Dept of Commerce, Jindal College For WomenDocument11 pagesModule-1 Banker and Customer Relationship: Mrs - Yashaswini Dept of Commerce, Jindal College For WomenYugapreetha RNo ratings yet

- BanksDocument32 pagesBanksPratyush ParanjapeNo ratings yet

- Schedule of Charges - Retail - Banking - 25 - 11 - 2018Document5 pagesSchedule of Charges - Retail - Banking - 25 - 11 - 2018Md. FoyjullahNo ratings yet

- AWAIS Operation ManagementDocument9 pagesAWAIS Operation Managementawais tariqNo ratings yet

- January Hathway 2023Document1 pageJanuary Hathway 2023karthik_venkata2020No ratings yet

- Account Statement From 1 Feb 2022 To 1 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 1 Feb 2022 To 1 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceFIRDUS ALINo ratings yet

- NilnilnilnilDocument30 pagesNilnilnilnilMahakaal Digital PointNo ratings yet

- All FilesDocument24 pagesAll FilesvinayaklalganjNo ratings yet