Professional Documents

Culture Documents

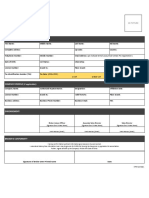

State of Delaware Division of Revenue Wholesale Exemption Certificate

State of Delaware Division of Revenue Wholesale Exemption Certificate

Uploaded by

ENGR KIRANCopyright:

Available Formats

You might also like

- 01 339 PDFDocument2 pages01 339 PDFvanderbrley100% (1)

- Instructions: This Affidavit Should Be Executed by The PersonDocument1 pageInstructions: This Affidavit Should Be Executed by The PersonDeviant LemurNo ratings yet

- VA Tax Exemption FormDocument1 pageVA Tax Exemption Formkristingreen2011No ratings yet

- Fedex Kyc Form (27657)Document2 pagesFedex Kyc Form (27657)Tumbin DilseNo ratings yet

- Affidavit For Cancellation of Registration: InstructionsDocument1 pageAffidavit For Cancellation of Registration: InstructionsJenalyn Tolentino EnopiaNo ratings yet

- AQ NotesDocument4 pagesAQ Notesjamesrodriguez1097No ratings yet

- Texas-Resale-Certificate Wasi LLCDocument2 pagesTexas-Resale-Certificate Wasi LLCSyed TouseefNo ratings yet

- Affidavit of Exempt Sale StandardDocument2 pagesAffidavit of Exempt Sale StandardAnna AtienzaNo ratings yet

- Purchases For Resale and by Exempt Organizations: Form S-3Document2 pagesPurchases For Resale and by Exempt Organizations: Form S-3David MorrisNo ratings yet

- AZ Resale License Form 5000ADocument1 pageAZ Resale License Form 5000AZeal CoNo ratings yet

- Manufacturing, Publishing, Research & Development, or Packaging Form S-3MDocument2 pagesManufacturing, Publishing, Research & Development, or Packaging Form S-3MTaha AlfalahNo ratings yet

- Resale Certificate: Form St-3Document2 pagesResale Certificate: Form St-3jesbmnNo ratings yet

- ST 3Document2 pagesST 3Hudasenna ChannelNo ratings yet

- 14 317Document2 pages14 317iwantsheetmusic1No ratings yet

- 01-909 Formato TaxsDocument4 pages01-909 Formato Taxsconstructora y representaciones del norteNo ratings yet

- OUT OF STATE - Form - ST-4Document1 pageOUT OF STATE - Form - ST-4robertbingjr3No ratings yet

- Texas Sales and Use Tax Exemption CertificationDocument2 pagesTexas Sales and Use Tax Exemption CertificationluherservicesNo ratings yet

- Tax Exempt PDFDocument2 pagesTax Exempt PDFLj Perrier100% (1)

- Tax ExemptDocument2 pagesTax ExemptLj PerrierNo ratings yet

- Resale Certificate and Seller Permit - Orbit Click IncDocument3 pagesResale Certificate and Seller Permit - Orbit Click IncM. JAWAD AFZALNo ratings yet

- Dealer Application Slip CYADocument2 pagesDealer Application Slip CYAGioNo ratings yet

- Forms TPT 5000a 10316 0Document1 pageForms TPT 5000a 10316 0timclbNo ratings yet

- Bid Card ApplicationDocument1 pageBid Card ApplicationsidhuNo ratings yet

- DVV ResaleDocument1 pageDVV ResaleMr. UmairNo ratings yet

- TX Tax Exempt FormDocument1 pageTX Tax Exempt FormDemo CreditManagerNo ratings yet

- Dealer Application Form-Apr 2019Document1 pageDealer Application Form-Apr 2019SITI HAJAR MOHD RAISNo ratings yet

- OCBC Credit Card Dispute FormDocument2 pagesOCBC Credit Card Dispute FormjckongstedtNo ratings yet

- Accreditation Form: Personal ProfileDocument1 pageAccreditation Form: Personal ProfileEG OngtecoNo ratings yet

- Instructions: This Affidavit Should Be Executed by The PersonDocument1 pageInstructions: This Affidavit Should Be Executed by The PersonspcbankingNo ratings yet

- Ips Credit App 2017 (Genesis Version)Document1 pageIps Credit App 2017 (Genesis Version)GMG HoldingsNo ratings yet

- Requests For Additional Documentation.: Fax Number: (800) 253-1220Document2 pagesRequests For Additional Documentation.: Fax Number: (800) 253-1220derrick gilchristNo ratings yet

- Resale Certificate: Purchaser InformationDocument2 pagesResale Certificate: Purchaser InformationGlendaNo ratings yet

- Sales Tax Certificate 2024Document1 pageSales Tax Certificate 2024Francisco CedeñoNo ratings yet

- Conversion Form - IndDocument2 pagesConversion Form - IndSyed Mohsin SheraziNo ratings yet

- Nonresidence and Military Service Exemption From Specific Ownership Tax AffidavitDocument2 pagesNonresidence and Military Service Exemption From Specific Ownership Tax AffidavitWerewolfman 186No ratings yet

- Texas Sales and Use Tax Exemption Certificate 3 - BlueSnap - 27july2020 - v01Document1 pageTexas Sales and Use Tax Exemption Certificate 3 - BlueSnap - 27july2020 - v01mberchtoldNo ratings yet

- California Resale Cert-2017Document1 pageCalifornia Resale Cert-2017Jason PatrickNo ratings yet

- General Resale Certificate FormDocument2 pagesGeneral Resale Certificate Formm4r4nzn0No ratings yet

- Warrant CertDocument6 pagesWarrant Certacostachristian253No ratings yet

- Accreditation Form Local Licensed Broker: ProfileDocument13 pagesAccreditation Form Local Licensed Broker: Profileal bentulanNo ratings yet

- PW Credit Application FormDocument4 pagesPW Credit Application FormLarkin & Drought BuildersNo ratings yet

- Reseller CertificateDocument2 pagesReseller CertificateKatherine KilcullenNo ratings yet

- Purchase Order Rev OrigDocument2 pagesPurchase Order Rev Origsetiawanaji407No ratings yet

- Merchant Guide ToDocument2 pagesMerchant Guide Toakshay yadavNo ratings yet

- DR2395Document2 pagesDR2395Heryanto ChandrawarmanNo ratings yet

- NYS Resale CertificateDocument1 pageNYS Resale CertificateVanessa HernandezNo ratings yet

- Kori Engineering Credit Application FormDocument6 pagesKori Engineering Credit Application Formaj.ngadaNo ratings yet

- Tax Exempt Formsst4 and Sub st5 Sep 2012Document4 pagesTax Exempt Formsst4 and Sub st5 Sep 2012api-330859141No ratings yet

- NC - Certificate of ResaleDocument2 pagesNC - Certificate of ResaleChr FedNo ratings yet

- KYC Model 2020 (Corporate)Document31 pagesKYC Model 2020 (Corporate)Emilio BorgesNo ratings yet

- Dispute Resolution FormDocument3 pagesDispute Resolution Formmerlin masterchiefNo ratings yet

- Affidavit of Motor Vehicle Gift TransferDocument1 pageAffidavit of Motor Vehicle Gift TransferChristopher BernsNo ratings yet

- Customers Resale Certificate 2022Document1 pageCustomers Resale Certificate 2022John MorrisonNo ratings yet

- DELIVERY RECEIPT - FarmapacDocument1 pageDELIVERY RECEIPT - Farmapac2023charlutinNo ratings yet

- Outside Resale Certificate-OhioDocument8 pagesOutside Resale Certificate-OhioS S AliNo ratings yet

- CA Resale CertificateDocument1 pageCA Resale Certificateali razaNo ratings yet

- Sample - Token MOUDocument5 pagesSample - Token MOUViswanathanJayamohanNo ratings yet

- KYC FormDocument2 pagesKYC FormGirishNo ratings yet

- Just Fell Out of Escrow: Top 5 reasons a property does not sellFrom EverandJust Fell Out of Escrow: Top 5 reasons a property does not sellNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Revealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieFrom EverandRevealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieNo ratings yet

- Assignment2 SolutionDocument3 pagesAssignment2 SolutionJackline KhouryNo ratings yet

- TA13 New Accounting Reports Decrypted OptDocument14 pagesTA13 New Accounting Reports Decrypted OptMarsha Sabrina LillahNo ratings yet

- Final Thesis Submission UclDocument8 pagesFinal Thesis Submission Uclafktciaihzjfyr100% (1)

- Sop PurchasingDocument5 pagesSop PurchasingShivam GaurNo ratings yet

- RKSV Securities Annexure To KycDocument21 pagesRKSV Securities Annexure To KycKrutayNo ratings yet

- Letter Writing-Placing An OrderDocument12 pagesLetter Writing-Placing An OrderArudra NarangNo ratings yet

- FINA2010 Financial Management: Lecture 5: Capital Budgeting IIDocument54 pagesFINA2010 Financial Management: Lecture 5: Capital Budgeting IImoonNo ratings yet

- Analisis Faktor-Faktor Yang Mempengaruhi Ekspor Sarang Burung Di IndonesiaDocument13 pagesAnalisis Faktor-Faktor Yang Mempengaruhi Ekspor Sarang Burung Di IndonesiaPasmadaBaeJambiNo ratings yet

- Barclays US and European Banks Shaken, and StirredDocument25 pagesBarclays US and European Banks Shaken, and StirredS CNo ratings yet

- Pre Mixed Asset Allocation FSDocument1 pagePre Mixed Asset Allocation FSWill HannsNo ratings yet

- FDIDocument15 pagesFDIpankajgaur.iabm30982% (11)

- Receiving User GuideDocument76 pagesReceiving User GuideKamal MeshramNo ratings yet

- Health Care Funding: Federal Funding For Certain Organizations Providing Health-Related Services, 2019 Through 2022Document60 pagesHealth Care Funding: Federal Funding For Certain Organizations Providing Health-Related Services, 2019 Through 2022Veronica SilveriNo ratings yet

- Steps For Successful Career Planning: ANSWER: There Are Many Things That I Would Enjoy Doing The Most, But The TopDocument9 pagesSteps For Successful Career Planning: ANSWER: There Are Many Things That I Would Enjoy Doing The Most, But The TopGian Paula MonghitNo ratings yet

- Media Planning ObjectivesDocument13 pagesMedia Planning ObjectivesSudhanshu JaiswalNo ratings yet

- Become Certified Personality Development TrainerDocument2 pagesBecome Certified Personality Development Trainertrainer0801t0% (1)

- FP Lec 3Document42 pagesFP Lec 3engbabaNo ratings yet

- Mess ApplicationDocument2 pagesMess ApplicationAbhishekNo ratings yet

- Manager Resume ExamplesDocument5 pagesManager Resume Examplesplpymkzcf100% (2)

- Agro ChemicalsDocument24 pagesAgro ChemicalsnikhiljainbemechNo ratings yet

- Application True2xDocument2 pagesApplication True2xAngie DouglasNo ratings yet

- Bangladesh News Flash - 290420Document8 pagesBangladesh News Flash - 290420Shafiqud DoulahNo ratings yet

- KLM Hazop Rev 3 PDFDocument3 pagesKLM Hazop Rev 3 PDFWisam HusseinNo ratings yet

- What Is BootstrappingDocument3 pagesWhat Is BootstrappingCharu SharmaNo ratings yet

- Chapter 18 Bond Fundamentals & ValuationDocument76 pagesChapter 18 Bond Fundamentals & ValuationShahriar PhenomenallNo ratings yet

- Group 3 MKT330Document28 pagesGroup 3 MKT330MD. MOWDUD HASAN LALON 1632830630No ratings yet

- Marketing Management SyllabusDocument5 pagesMarketing Management SyllabusHannah jean Enabe100% (1)

- Problems and Prospects of Private Investmsnt in Case of Sibu Sire DistrictsDocument41 pagesProblems and Prospects of Private Investmsnt in Case of Sibu Sire DistrictsChaltu ChemedaNo ratings yet

- Big Data - Big InsightsDocument54 pagesBig Data - Big InsightsKshitija DoshiNo ratings yet

State of Delaware Division of Revenue Wholesale Exemption Certificate

State of Delaware Division of Revenue Wholesale Exemption Certificate

Uploaded by

ENGR KIRANOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State of Delaware Division of Revenue Wholesale Exemption Certificate

State of Delaware Division of Revenue Wholesale Exemption Certificate

Uploaded by

ENGR KIRANCopyright:

Available Formats

Form 373 STATE OF DELAWARE

DIVISION OF REVENUE

WHOLESALE EXEMPTION CERTIFICATE

Name of Seller Check Applicable Box

Address Single Purchase Certificate

City State Zip Code Invoice No.

-

Shipping Location Invoice Date - -

City State Zip Code Blanket Certificate

-

Date and State of Incorporation Employer Identification Number

- -

THE UNDERSIGNED CERTIFIES THAT:

1. The purchaser’s employees and vehicles receiving the goods within Delaware are not

headquartered – or dispatched from within Delaware; and

2. No portion of the goods received will be inventoried, warehoused, or otherwise come

to substantial rest within the State prior to ultimate delivery outside Delaware; and

3. The purchaser has no business facility or goods on consignment or warehoused within

Delaware, if this is a blanket certificate.

Name of Purchaser

Address

City State Zip Code

-

Date and State of Incorporation Employer Identification Number

- -

Name of Business

Under penalties or perjury, I declare that I have examined this Certificate, including accompanying schedules

and statements, and to the best of my knowledge and belief it is true, correct and complete.

- -

Date Signature of Officer or Authorized Individual of the Purchaser Title

- -

Date Signature of Officer or Authorized Individual of the Seller Title

(Revised 12/26/13) *DF41314019999*

INSTRUCTIONS FOR FORM 373 WHOLESALE EXEMPTION CERTIFICATE

Form 373 - Wholesale Exemption Certificate-is to be used to substantiate exempt sales to out of state purchasers

which are picked up in Delaware. Sales made to out of state purchasers who pickup the goods in Delaware for

subsequent delivery and consumption outside this state are exempt from the wholesale gross receipts tax.

Form 373 - Wholesale Exemption Certificate-must be completed to document such exempt sales and must be completed

prior to or concurrent with the sale. Form 373 must be completed by the seller with all pertinent information and must

contain the signature of an officer or authorized individual attesting to the accuracy of the information relating to the

purchaser. A purchaser’s exemption certificate does not extend to any of its subordinate or affiliated entities or

officers or employees of the purchaser. When making purchases, subordinate entities may not use an exemption

claimed by a parent or affiliated organization.

Form 373 may be used to substantiate a single sale or multiple sales to the same wholesaler. Check the applicable box

to indicate if Form 373 is a single purchase or blanket certificate.

Form 373 must contain the name, mailing address, shipping location, the state and date of incorporation and employer

identification number of the seller. The seller must check the applicable box to indicate the type of exemption claimed,

and in the case of a single purchase, the invoice number and date. An officer or authorized individual must sign and

date Form 373 certifying that the statements relating to the seller contained on the form are accurate and correct.

Form 373 must contain the name, address, date and state of incorporation, federal employer identification number and

nature of business of the purchaser. The purchase orders on which an exemption from the tax is claimed, by reason of

this certificate, must contain the name and address of the destination if different from the purchaser’s address. An

officer or authorized individual must sign and date Form 373 certifying that the statements relating to the purchaser

contained on the form are accurate and correct.

A blanket exemption certificate may be used to substantiate multiple exempt sales to the same out-of-state purchaser

provided the seller maintains a duly executed exemption certificate dated within one year prior to the date of the sale

for which exemption is claimed. Each subsequent sales slip or invoice to which the blanket certificate applies must

contain a notation that an exemption is being claimed. Failure by the seller to maintain a list of valid exemption

certificates and to note on each sales invoice that an exemption is being claimed will cause the sale to be taxable.

The Director of Revenue has the right to review exempt certificates to request information pertaining to the nature of

the sale and organizational structure of the purchaser. Failure to submit the information can result in the revocation of

the exemption. The tax records, invoices or accounting records of the wholesaler must be adequately maintained and

accessible to Delaware Division of Revenue personnel to enable efficient matching to a true, correct and complete

wholesaler exemption certificate(s) of all sales to which the seller takes an exemption from tax.

Failure by a wholesale licensee to pay tax in reliance on an untrue or incomplete exemption certificate furnished by a

purchaser does not relieve the wholesaler of liability for the tax or for penalty or interest with regard to such tax.

Vendors must retain Form 373 for a period of three years from the end of the calendar year in which the sale occurs.

Additional copies of Form 373 may be obtained from the Division of Revenue. This form may be reproduced without

prior permission from the Division of Revenue.

Doc. No. 25-06-02-85-08-01 - DR-373

You might also like

- 01 339 PDFDocument2 pages01 339 PDFvanderbrley100% (1)

- Instructions: This Affidavit Should Be Executed by The PersonDocument1 pageInstructions: This Affidavit Should Be Executed by The PersonDeviant LemurNo ratings yet

- VA Tax Exemption FormDocument1 pageVA Tax Exemption Formkristingreen2011No ratings yet

- Fedex Kyc Form (27657)Document2 pagesFedex Kyc Form (27657)Tumbin DilseNo ratings yet

- Affidavit For Cancellation of Registration: InstructionsDocument1 pageAffidavit For Cancellation of Registration: InstructionsJenalyn Tolentino EnopiaNo ratings yet

- AQ NotesDocument4 pagesAQ Notesjamesrodriguez1097No ratings yet

- Texas-Resale-Certificate Wasi LLCDocument2 pagesTexas-Resale-Certificate Wasi LLCSyed TouseefNo ratings yet

- Affidavit of Exempt Sale StandardDocument2 pagesAffidavit of Exempt Sale StandardAnna AtienzaNo ratings yet

- Purchases For Resale and by Exempt Organizations: Form S-3Document2 pagesPurchases For Resale and by Exempt Organizations: Form S-3David MorrisNo ratings yet

- AZ Resale License Form 5000ADocument1 pageAZ Resale License Form 5000AZeal CoNo ratings yet

- Manufacturing, Publishing, Research & Development, or Packaging Form S-3MDocument2 pagesManufacturing, Publishing, Research & Development, or Packaging Form S-3MTaha AlfalahNo ratings yet

- Resale Certificate: Form St-3Document2 pagesResale Certificate: Form St-3jesbmnNo ratings yet

- ST 3Document2 pagesST 3Hudasenna ChannelNo ratings yet

- 14 317Document2 pages14 317iwantsheetmusic1No ratings yet

- 01-909 Formato TaxsDocument4 pages01-909 Formato Taxsconstructora y representaciones del norteNo ratings yet

- OUT OF STATE - Form - ST-4Document1 pageOUT OF STATE - Form - ST-4robertbingjr3No ratings yet

- Texas Sales and Use Tax Exemption CertificationDocument2 pagesTexas Sales and Use Tax Exemption CertificationluherservicesNo ratings yet

- Tax Exempt PDFDocument2 pagesTax Exempt PDFLj Perrier100% (1)

- Tax ExemptDocument2 pagesTax ExemptLj PerrierNo ratings yet

- Resale Certificate and Seller Permit - Orbit Click IncDocument3 pagesResale Certificate and Seller Permit - Orbit Click IncM. JAWAD AFZALNo ratings yet

- Dealer Application Slip CYADocument2 pagesDealer Application Slip CYAGioNo ratings yet

- Forms TPT 5000a 10316 0Document1 pageForms TPT 5000a 10316 0timclbNo ratings yet

- Bid Card ApplicationDocument1 pageBid Card ApplicationsidhuNo ratings yet

- DVV ResaleDocument1 pageDVV ResaleMr. UmairNo ratings yet

- TX Tax Exempt FormDocument1 pageTX Tax Exempt FormDemo CreditManagerNo ratings yet

- Dealer Application Form-Apr 2019Document1 pageDealer Application Form-Apr 2019SITI HAJAR MOHD RAISNo ratings yet

- OCBC Credit Card Dispute FormDocument2 pagesOCBC Credit Card Dispute FormjckongstedtNo ratings yet

- Accreditation Form: Personal ProfileDocument1 pageAccreditation Form: Personal ProfileEG OngtecoNo ratings yet

- Instructions: This Affidavit Should Be Executed by The PersonDocument1 pageInstructions: This Affidavit Should Be Executed by The PersonspcbankingNo ratings yet

- Ips Credit App 2017 (Genesis Version)Document1 pageIps Credit App 2017 (Genesis Version)GMG HoldingsNo ratings yet

- Requests For Additional Documentation.: Fax Number: (800) 253-1220Document2 pagesRequests For Additional Documentation.: Fax Number: (800) 253-1220derrick gilchristNo ratings yet

- Resale Certificate: Purchaser InformationDocument2 pagesResale Certificate: Purchaser InformationGlendaNo ratings yet

- Sales Tax Certificate 2024Document1 pageSales Tax Certificate 2024Francisco CedeñoNo ratings yet

- Conversion Form - IndDocument2 pagesConversion Form - IndSyed Mohsin SheraziNo ratings yet

- Nonresidence and Military Service Exemption From Specific Ownership Tax AffidavitDocument2 pagesNonresidence and Military Service Exemption From Specific Ownership Tax AffidavitWerewolfman 186No ratings yet

- Texas Sales and Use Tax Exemption Certificate 3 - BlueSnap - 27july2020 - v01Document1 pageTexas Sales and Use Tax Exemption Certificate 3 - BlueSnap - 27july2020 - v01mberchtoldNo ratings yet

- California Resale Cert-2017Document1 pageCalifornia Resale Cert-2017Jason PatrickNo ratings yet

- General Resale Certificate FormDocument2 pagesGeneral Resale Certificate Formm4r4nzn0No ratings yet

- Warrant CertDocument6 pagesWarrant Certacostachristian253No ratings yet

- Accreditation Form Local Licensed Broker: ProfileDocument13 pagesAccreditation Form Local Licensed Broker: Profileal bentulanNo ratings yet

- PW Credit Application FormDocument4 pagesPW Credit Application FormLarkin & Drought BuildersNo ratings yet

- Reseller CertificateDocument2 pagesReseller CertificateKatherine KilcullenNo ratings yet

- Purchase Order Rev OrigDocument2 pagesPurchase Order Rev Origsetiawanaji407No ratings yet

- Merchant Guide ToDocument2 pagesMerchant Guide Toakshay yadavNo ratings yet

- DR2395Document2 pagesDR2395Heryanto ChandrawarmanNo ratings yet

- NYS Resale CertificateDocument1 pageNYS Resale CertificateVanessa HernandezNo ratings yet

- Kori Engineering Credit Application FormDocument6 pagesKori Engineering Credit Application Formaj.ngadaNo ratings yet

- Tax Exempt Formsst4 and Sub st5 Sep 2012Document4 pagesTax Exempt Formsst4 and Sub st5 Sep 2012api-330859141No ratings yet

- NC - Certificate of ResaleDocument2 pagesNC - Certificate of ResaleChr FedNo ratings yet

- KYC Model 2020 (Corporate)Document31 pagesKYC Model 2020 (Corporate)Emilio BorgesNo ratings yet

- Dispute Resolution FormDocument3 pagesDispute Resolution Formmerlin masterchiefNo ratings yet

- Affidavit of Motor Vehicle Gift TransferDocument1 pageAffidavit of Motor Vehicle Gift TransferChristopher BernsNo ratings yet

- Customers Resale Certificate 2022Document1 pageCustomers Resale Certificate 2022John MorrisonNo ratings yet

- DELIVERY RECEIPT - FarmapacDocument1 pageDELIVERY RECEIPT - Farmapac2023charlutinNo ratings yet

- Outside Resale Certificate-OhioDocument8 pagesOutside Resale Certificate-OhioS S AliNo ratings yet

- CA Resale CertificateDocument1 pageCA Resale Certificateali razaNo ratings yet

- Sample - Token MOUDocument5 pagesSample - Token MOUViswanathanJayamohanNo ratings yet

- KYC FormDocument2 pagesKYC FormGirishNo ratings yet

- Just Fell Out of Escrow: Top 5 reasons a property does not sellFrom EverandJust Fell Out of Escrow: Top 5 reasons a property does not sellNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Revealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieFrom EverandRevealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieNo ratings yet

- Assignment2 SolutionDocument3 pagesAssignment2 SolutionJackline KhouryNo ratings yet

- TA13 New Accounting Reports Decrypted OptDocument14 pagesTA13 New Accounting Reports Decrypted OptMarsha Sabrina LillahNo ratings yet

- Final Thesis Submission UclDocument8 pagesFinal Thesis Submission Uclafktciaihzjfyr100% (1)

- Sop PurchasingDocument5 pagesSop PurchasingShivam GaurNo ratings yet

- RKSV Securities Annexure To KycDocument21 pagesRKSV Securities Annexure To KycKrutayNo ratings yet

- Letter Writing-Placing An OrderDocument12 pagesLetter Writing-Placing An OrderArudra NarangNo ratings yet

- FINA2010 Financial Management: Lecture 5: Capital Budgeting IIDocument54 pagesFINA2010 Financial Management: Lecture 5: Capital Budgeting IImoonNo ratings yet

- Analisis Faktor-Faktor Yang Mempengaruhi Ekspor Sarang Burung Di IndonesiaDocument13 pagesAnalisis Faktor-Faktor Yang Mempengaruhi Ekspor Sarang Burung Di IndonesiaPasmadaBaeJambiNo ratings yet

- Barclays US and European Banks Shaken, and StirredDocument25 pagesBarclays US and European Banks Shaken, and StirredS CNo ratings yet

- Pre Mixed Asset Allocation FSDocument1 pagePre Mixed Asset Allocation FSWill HannsNo ratings yet

- FDIDocument15 pagesFDIpankajgaur.iabm30982% (11)

- Receiving User GuideDocument76 pagesReceiving User GuideKamal MeshramNo ratings yet

- Health Care Funding: Federal Funding For Certain Organizations Providing Health-Related Services, 2019 Through 2022Document60 pagesHealth Care Funding: Federal Funding For Certain Organizations Providing Health-Related Services, 2019 Through 2022Veronica SilveriNo ratings yet

- Steps For Successful Career Planning: ANSWER: There Are Many Things That I Would Enjoy Doing The Most, But The TopDocument9 pagesSteps For Successful Career Planning: ANSWER: There Are Many Things That I Would Enjoy Doing The Most, But The TopGian Paula MonghitNo ratings yet

- Media Planning ObjectivesDocument13 pagesMedia Planning ObjectivesSudhanshu JaiswalNo ratings yet

- Become Certified Personality Development TrainerDocument2 pagesBecome Certified Personality Development Trainertrainer0801t0% (1)

- FP Lec 3Document42 pagesFP Lec 3engbabaNo ratings yet

- Mess ApplicationDocument2 pagesMess ApplicationAbhishekNo ratings yet

- Manager Resume ExamplesDocument5 pagesManager Resume Examplesplpymkzcf100% (2)

- Agro ChemicalsDocument24 pagesAgro ChemicalsnikhiljainbemechNo ratings yet

- Application True2xDocument2 pagesApplication True2xAngie DouglasNo ratings yet

- Bangladesh News Flash - 290420Document8 pagesBangladesh News Flash - 290420Shafiqud DoulahNo ratings yet

- KLM Hazop Rev 3 PDFDocument3 pagesKLM Hazop Rev 3 PDFWisam HusseinNo ratings yet

- What Is BootstrappingDocument3 pagesWhat Is BootstrappingCharu SharmaNo ratings yet

- Chapter 18 Bond Fundamentals & ValuationDocument76 pagesChapter 18 Bond Fundamentals & ValuationShahriar PhenomenallNo ratings yet

- Group 3 MKT330Document28 pagesGroup 3 MKT330MD. MOWDUD HASAN LALON 1632830630No ratings yet

- Marketing Management SyllabusDocument5 pagesMarketing Management SyllabusHannah jean Enabe100% (1)

- Problems and Prospects of Private Investmsnt in Case of Sibu Sire DistrictsDocument41 pagesProblems and Prospects of Private Investmsnt in Case of Sibu Sire DistrictsChaltu ChemedaNo ratings yet

- Big Data - Big InsightsDocument54 pagesBig Data - Big InsightsKshitija DoshiNo ratings yet