Professional Documents

Culture Documents

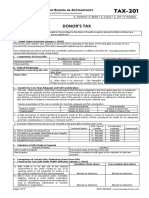

Donors Tax

Donors Tax

Uploaded by

Dwight Ursabia0 ratings0% found this document useful (0 votes)

1 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views2 pagesDonors Tax

Donors Tax

Uploaded by

Dwight UrsabiaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Page 1

DONOR’S TAXATION said gifts shall be used for

administration purposes;

Definition–DONATION is an act of liberality 2. The non-profit institutions must be

whereby a person disposes gratuitously of a accredited by the Philippine Council for

thing or a right in favor of another who NGO Certification (PCNC).

accepts it.

A non-profit institution is one which is:

Donor’s tax is a tax on the privilege to a. organized as a non-stock entity;

transmit property between two or more b. paying no dividends;

persons who are living at the time of the c. governed by trustees who receive no

donation; tax shall apply whether the compensation; and

transfer is in trust or otherwise, whether the d. devoting all income whether students’

gift is direct or indirect. fees or gifts, donation subsidies or

Formula in computing Donor’s Tax: other forms of philanthropy, to the

accomplishment of the purposes

First donation during the year: enumerated in its Articles of

Incorporation.

Gross Gift Pxx

Less: Deduction xx 3. P250,000 per year

Net gift xx

Less: Exemption 250,000 Exempt under special law – Donation to

1. Rural Farm School

Taxable xx

2. People’s Television Network, Inc.

x Tax rate 6%

3. People’s Survival Fund

Donor’s tax due xx

4. Aurora Pacific Economic Zone and Freeport

Succeeding donations during same year: Authority

5. Girl Scouts of the Philippines

Gross Gift Pxx

6. Philippine Red Cross

Less: Deduction xx

7. Tubbataha Reefs Natural Park

Present net gift xx

8. National Commission for Culture and the

Add: Prior net gifts during the xx

Arts

year

9. Philippine Normal University

Total net gifts xx

10. University of the Philippines

Less: Exemption 250,000

11. National Water Quality Management Fund

Taxable amount xx

12. Philippine Investors Commission

x Tax rate 6%

13. Ramon Magsaysay Award Foundation

Donor’s tax due xx

14. Philippine-American Cultural Foundation

Less: Tax/es paid during the xx

15. International Rice Research Institute

year

16. Task Force on Human Settlements

Donor’s tax payable xx

17. National Social Action Council

Composition of gross gifts (same with 18. Aquaculture Department of the Southeast

estate taxation) Asian Fisheries Development Center

19. Development Academy of the Philippines

Properties classified as intangibles 20. Integrated Bar of the Philippines

within (same with estate taxation)

RATE OF TAX: 6% computed on the basis

Deductions from gross gifts of total gifts in excess of P250,000 exempt

1. Mortgage on the property donated gift made during the calendar year.

assumed by the donee.

2. Amount specifically provided by the donor Donations made by spouses

as diminution on the property donated. In case of donation made by husband and

wife out of conjugal or community funds:

Exemptions from gross gifts

1. Gifts made to the national government or 1. Each is donor to the extent of 1/2 of the

any entity created by any of its agencies value of the donation.

which is not conducted for profit, or any 2. If only one spouse signed the deed of

political subdivision. donation, there is only one donor for

donor’s tax purposes, without prejudice to

2. Gifts in favor of the following non-profit the right of the other spouse to question

institutions: the validity of the donation.

a. Educational

b. Charitable Donation to several donees

c. Religious If the donor had made several donations to

d. Cultural different persons on the same date, the total

e. Social welfare net gift shall be computed together and

f. Accredited NGO contained in one donor’s tax return only.

g. Trust or philanthropic organization

Transfer for less than adequate

h. Research institution

consideration

Requisites:

Where property, other than real property

1. Provided, that not more than 30% of

(capital asset) is transferred for less than

Page 2

adequate consideration in money or money’s Filing and payment

worth, the amount by which the fair market 1. Filing and payment – within 30 days from

value exceeded the value of consideration date of gift, either manually or

shall be deemed a gift subject to donor’s tax. electronically.

A sale, exchange, or other transfer of Except in cases where the Commissioner

property made in the ordinary course of otherwise permits, the return shall be filed

business (a transaction which is bona fide, at and the tax paid, either electronically or

arm’s length, and free from any donative manually, with any authorized agent bank,

intent) will be considered as made for an Revenue District Office through Revenue

adequate and full consideration in money or Collection Officer or authorized tax

money’s worth). software provider.

Valuation of property – at fair market Surcharges (ad valorem penalty)

value at the time of gift (see estate tax). 50% False or fraudulent return is willfully

OTHER MATTERS: filed.

1. Renunciation of inheritance - A Willful neglect to file the return on

renunciation of inheritance by surviving time.

spouse or an heir in favor of: 25% Failure to file any return and pay the

a. Co-heir - not a donation tax due thereon.

b. Not a co-heir – there is donation If the return is not filed with the

subject to donor’s tax proper internal revenue officer.

c. Renunciation by surviving spouse of Failure to pay on time the deficiency

his/her share in the conjugal tax shown in the notice of

partnership or absolute community assessment.

after the dissolution of the marriage in Interest for failure to pay tax per return

favor of the heirs of the deceased on time

spouse or any other person/s – subject

to donor’s tax RATE – 12% per annum, or such higher rate

as may be prescribed by rules and

2. Donations between spouses - Every regulations, computed from the date

donation or grant of gratuitous prescribed for payment until the amount is

advantage, direct or indirect, between the fully paid.

spouses during the marriage shall be

void, except moderate gifts which the Attachments

spouses may give each other on the 1. Proof of claimed tax credit, if applicable

occasion of any family rejoicing. 2. Certified true copies of OCT/TCT/CCT

(front and back pages) of the donated

The prohibition shall also apply to property, if applicable.

persons living together as husband and 3. Certified true copies of the latest tax

wife without a valid marriage. declaration of lot and/or improvement, if

applicable.

3. Other persons who cannot donate

property to each other (Void 4. “Certificate of No Improvement” issued by

donations) the Assessor’s Office where the donated

a. Those made between persons who real property/ies have no declared

were guilty of adultery or concubinage improvements, if applicable.

at the time of donation. 5. Proof of valuation of shares of stocks at

b. Those made between persons found the time of donation, if applicable.

guilty of the same criminal offense in 6. Proof of valuation of other types of

consideration thereof; and personal properties, if applicable.

c. Those made to a public officer or his 7. Proof of claimed deductions, if applicable.

wife, descendants and ascendants, by 8. Copy of tax debit memo used as payment,

reason of his office. if applicable.

Tax credit for donor’s tax paid to a

foreign country.

1. Who can claim? Only citizen or resident

alien donor.

2. Limitations on tax credit:

1st limitation

Net gift per foreign country x Phil tax

Total net gift

2nd limitation

Net gift all foreign countries x Phil tax

Total net gift

You might also like

- Solution Manual For Principles of Economics 9th Edition N Gregory MankiwDocument18 pagesSolution Manual For Principles of Economics 9th Edition N Gregory MankiwVeronicaBurchcekij100% (87)

- Sample Tax Declaration Form Philippines - Google SearchDocument1 pageSample Tax Declaration Form Philippines - Google Searchcristina maguicayNo ratings yet

- Donors Tax (Banggawan)Document11 pagesDonors Tax (Banggawan)Ja FranciscoNo ratings yet

- DONORs TAXDocument3 pagesDONORs TAXUbalda AbuboNo ratings yet

- Donors TaxDocument3 pagesDonors TaxJude TanNo ratings yet

- Donors Tax DWCLDocument6 pagesDonors Tax DWCLKyle Jezrel GimaoNo ratings yet

- UntitledDocument4 pagesUntitledKayla sofia AsturiasNo ratings yet

- DonorDocument2 pagesDonoryes it's kaiNo ratings yet

- Donor's TaxDocument2 pagesDonor's TaxIsobel CoNo ratings yet

- TX 201 PDFDocument5 pagesTX 201 PDFFriedeagle OilNo ratings yet

- Lecture 5 - Donor - S TaxDocument4 pagesLecture 5 - Donor - S TaxBhosx KimNo ratings yet

- Lecture 3 - Donor's TaxDocument6 pagesLecture 3 - Donor's TaxLady Chen GordoveNo ratings yet

- Taxation ReviewerDocument55 pagesTaxation ReviewerAlissa Joy BonaobraNo ratings yet

- Who Are Relatives?Document4 pagesWho Are Relatives?Jean CabigaoNo ratings yet

- INTGR TAX 023 Donor's TaxationDocument7 pagesINTGR TAX 023 Donor's TaxationJohn Paul SiodacalNo ratings yet

- PART 2 Donors TaxDocument6 pagesPART 2 Donors TaxrhieelaaNo ratings yet

- Module 4. Donors Tax-Gross Gifts, Examptions and Tax RatesDocument5 pagesModule 4. Donors Tax-Gross Gifts, Examptions and Tax RatesYolly DiazNo ratings yet

- TAX-201 (Donor's Tax)Document7 pagesTAX-201 (Donor's Tax)Edith DalidaNo ratings yet

- TAX-201 (Donor's Tax)Document6 pagesTAX-201 (Donor's Tax)Princess ManaloNo ratings yet

- Ch08 Donor's TaxDocument8 pagesCh08 Donor's TaxHazel CruzNo ratings yet

- Tax 2 Reviewer LectureDocument12 pagesTax 2 Reviewer LectureAnonymous aRheeMNo ratings yet

- Module Author: Charles C. Onda, MD, CpaDocument11 pagesModule Author: Charles C. Onda, MD, CpaCSJNo ratings yet

- Donation ReviewerDocument6 pagesDonation ReviewerronaldNo ratings yet

- Basic Concept of Donation and Donor's TaxDocument20 pagesBasic Concept of Donation and Donor's TaxKarl BasaNo ratings yet

- Lecture 6 - Donor TaxDocument4 pagesLecture 6 - Donor Taxsujulove foreverNo ratings yet

- HQ 2 Donors TaxationDocument12 pagesHQ 2 Donors TaxationDharel GannabanNo ratings yet

- Lesson 5 StudentsDocument6 pagesLesson 5 StudentsIris Lavigne RojoNo ratings yet

- In-House Cpa Review Taxation Donor'S Tax - Notes: E.A.Dg - MateoDocument2 pagesIn-House Cpa Review Taxation Donor'S Tax - Notes: E.A.Dg - MateoMina ValenciaNo ratings yet

- Accounting Review: TaxationDocument3 pagesAccounting Review: TaxationPatriciaNo ratings yet

- Module 3 - Donors TaxDocument6 pagesModule 3 - Donors TaxMaryrose SumulongNo ratings yet

- Donors TaxDocument4 pagesDonors TaxkjabbugaoNo ratings yet

- BA 128 2 Donor's TaxDocument5 pagesBA 128 2 Donor's TaxEyriel CoNo ratings yet

- Donation and Donor's TaxationDocument5 pagesDonation and Donor's Taxationyatot carbonelNo ratings yet

- Donors To PercentageDocument24 pagesDonors To PercentageFrayladine TabagNo ratings yet

- Demo FinalDocument25 pagesDemo FinalVannesa Ronquillo CompasivoNo ratings yet

- Bsa2105-Fs2021-Donor'staxtax-Da010 - 1Document3 pagesBsa2105-Fs2021-Donor'staxtax-Da010 - 1ela kikayNo ratings yet

- TAX-101 (Estate Tax)Document11 pagesTAX-101 (Estate Tax)Princess ManaloNo ratings yet

- Donor's Tax 2024Document6 pagesDonor's Tax 2024Michael BongalontaNo ratings yet

- H11-Donor S-TaxationDocument7 pagesH11-Donor S-Taxationaira mei blasNo ratings yet

- Module 5 - Donors TaxDocument5 pagesModule 5 - Donors TaxBella RonahNo ratings yet

- TX 201Document8 pagesTX 201Lhivanne LamintadNo ratings yet

- Govern The Imposition of The Donor's TaxDocument5 pagesGovern The Imposition of The Donor's TaxjuliNo ratings yet

- CTT - Donor's TaxDocument8 pagesCTT - Donor's TaxMary Ann GalinatoNo ratings yet

- Btax302 Lesson3 DonorstaxDocument5 pagesBtax302 Lesson3 DonorstaxJr Reyes PedidaNo ratings yet

- 10 Donors TaxDocument39 pages10 Donors TaxClaira LebrillaNo ratings yet

- Module 3 - Donors Tax PDFDocument5 pagesModule 3 - Donors Tax PDFIo AyaNo ratings yet

- Donors' Tax (NA)Document6 pagesDonors' Tax (NA)Diane PascualNo ratings yet

- Donor's TaxDocument29 pagesDonor's TaxPETERWILLE CHUANo ratings yet

- Donor's Tax HandoutDocument14 pagesDonor's Tax HandoutJamesiversonNo ratings yet

- Questions and Answers On Philippine Donor S TaxDocument3 pagesQuestions and Answers On Philippine Donor S TaxMariela LiganadNo ratings yet

- Ch10 Donor's TaxDocument9 pagesCh10 Donor's TaxRenelyn FiloteoNo ratings yet

- Donor's TaxDocument4 pagesDonor's TaxEunice ParraNo ratings yet

- Donor's TaxDocument15 pagesDonor's TaxMary Fatima LiganNo ratings yet

- Donors Taxation: Mr. James Dane T. AdayoDocument32 pagesDonors Taxation: Mr. James Dane T. AdayoMiko ArniñoNo ratings yet

- Donor's TXDocument5 pagesDonor's TXdorie shane sta. mariaNo ratings yet

- M7 - Introduction To Donation and Donor's Tax Prof'sDocument15 pagesM7 - Introduction To Donation and Donor's Tax Prof'smicaella pasionNo ratings yet

- CHAPTER 6 - Donor's Tax ReportDocument58 pagesCHAPTER 6 - Donor's Tax ReportheyheyNo ratings yet

- Handout 07 - Donor's TaxDocument6 pagesHandout 07 - Donor's TaxJelyn RuazolNo ratings yet

- Gamilkisser ETDTDocument5 pagesGamilkisser ETDTKisser Gail GamilNo ratings yet

- The Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryFrom EverandThe Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryNo ratings yet

- A Stiptick for a Bleeding Nation A safe and speedy way to restore publick credit, and pay the national debtsFrom EverandA Stiptick for a Bleeding Nation A safe and speedy way to restore publick credit, and pay the national debtsNo ratings yet

- COMPAÑIA GENERAL DE TABACOS DE FILIPINAS Vs ManilaDocument2 pagesCOMPAÑIA GENERAL DE TABACOS DE FILIPINAS Vs ManilaLau NunezNo ratings yet

- Reagan VS Tax Commissioner GR-L26379Document1 pageReagan VS Tax Commissioner GR-L263792F SABELLANO, ALVINNo ratings yet

- Cta 3D CV 09384 D 2018sep28 RefDocument18 pagesCta 3D CV 09384 D 2018sep28 RefmarjNo ratings yet

- Abm 11 - Fabm2 2ND Semester Finals Module 4 (Pielago)Document11 pagesAbm 11 - Fabm2 2ND Semester Finals Module 4 (Pielago)edjay.mercado85No ratings yet

- Tax4861 2022 TL 103 0 BDocument99 pagesTax4861 2022 TL 103 0 BFlorence ApleniNo ratings yet

- Letter To Tp-Nonvat To Vat - 3Document1 pageLetter To Tp-Nonvat To Vat - 3Chris RodriguezNo ratings yet

- History of TaxationDocument11 pagesHistory of TaxationJonela LazaroNo ratings yet

- Bishop of Nueva Segovia Vs The Provincial Board of Ilocos Norte, Et AlDocument2 pagesBishop of Nueva Segovia Vs The Provincial Board of Ilocos Norte, Et AlSarah Jane UsopNo ratings yet

- Mandanas vs. Ochoa, GR No. 199802Document1 pageMandanas vs. Ochoa, GR No. 199802michael jan de celis100% (1)

- Income Tax Reviewer-1Document1 pageIncome Tax Reviewer-1Sano ManjiroNo ratings yet

- Ghana - Corporate - Withholding TaxesDocument3 pagesGhana - Corporate - Withholding TaxesFrancisNo ratings yet

- ACT 184 - QUIZ 4 (SET A) - 50 CopiesDocument3 pagesACT 184 - QUIZ 4 (SET A) - 50 CopiesAthena Fatmah AmpuanNo ratings yet

- Terminal Report - BirDocument92 pagesTerminal Report - BirBen Ritche LayosNo ratings yet

- TAXREV SYLLABUS - LOCAL TAXATION AND REAL PROPERTY TAXATION ATTY CabanDocument6 pagesTAXREV SYLLABUS - LOCAL TAXATION AND REAL PROPERTY TAXATION ATTY CabanPatrick GuetaNo ratings yet

- General Principles of Taxation Taxation DefinedDocument10 pagesGeneral Principles of Taxation Taxation DefinedGraceNo ratings yet

- Income Taxes For Individuals: ObjectivesDocument15 pagesIncome Taxes For Individuals: ObjectivesChristelle JosonNo ratings yet

- PBCOM Vs CIRDocument2 pagesPBCOM Vs CIRMichael DonascoNo ratings yet

- Department of Legal Management College of Arts and Sciences San Beda University Tax1 Course Syllabus First Semester, AY 2021-2022Document15 pagesDepartment of Legal Management College of Arts and Sciences San Beda University Tax1 Course Syllabus First Semester, AY 2021-2022nayhrbNo ratings yet

- University Physician Services M V CIRDocument15 pagesUniversity Physician Services M V CIRYoo Si JinNo ratings yet

- Some Important Abbreviation For ITP ExamDocument3 pagesSome Important Abbreviation For ITP ExamMuhammed Abul Kalam AcmaNo ratings yet

- Lecture 5 - 2023Document39 pagesLecture 5 - 2023Lê Thiên Giang 2KT-19No ratings yet

- Status in Canada and Income Information: For The Canada Child Benefits Application Do You Have To Fill Out This Form?Document4 pagesStatus in Canada and Income Information: For The Canada Child Benefits Application Do You Have To Fill Out This Form?jose Reyes HernandezNo ratings yet

- This Content Downloaded From 99.232.75.51 On Mon, 16 May 2022 02:48:29 UTCDocument22 pagesThis Content Downloaded From 99.232.75.51 On Mon, 16 May 2022 02:48:29 UTCSaif NNo ratings yet

- Income Tax On IndividualsDocument12 pagesIncome Tax On IndividualsJames GuiruelaNo ratings yet

- Philippine Airlines v. CIRDocument61 pagesPhilippine Airlines v. CIRBeltran KathNo ratings yet

- ACCA TX Assignment Samantha, Peter and AeDocument14 pagesACCA TX Assignment Samantha, Peter and AeRich KishNo ratings yet

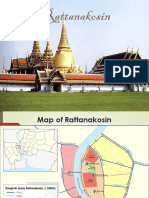

- Early Rattanakosin PeriodDocument54 pagesEarly Rattanakosin Periodputana kesornsitNo ratings yet

- Gross Estate For Married DecedentsDocument6 pagesGross Estate For Married DecedentsLeilalyn NicolasNo ratings yet