Professional Documents

Culture Documents

BF 220 Test One Practice

BF 220 Test One Practice

Uploaded by

Prince Daniels TutorCopyright:

Available Formats

You might also like

- B7AF102 Financial Accounting May 2023Document11 pagesB7AF102 Financial Accounting May 2023gerlaniamelgacoNo ratings yet

- International Taxation OutlineDocument138 pagesInternational Taxation OutlineMa FajardoNo ratings yet

- FAR210 - July 2023 - QDocument8 pagesFAR210 - July 2023 - QafiqahNo ratings yet

- IAS 1 MAC LTDDocument2 pagesIAS 1 MAC LTDvuchiduc.contactNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far210Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Far210Bil hutNo ratings yet

- Bs 320 TutorialDocument4 pagesBs 320 TutorialPrince Daniels TutorNo ratings yet

- FAR210 - Feb 2022 - QDocument8 pagesFAR210 - Feb 2022 - Qqh2mtyprq8No ratings yet

- Bs 320 - 30th AprilDocument2 pagesBs 320 - 30th AprilPrince Daniels TutorNo ratings yet

- FA Dec 2022Document8 pagesFA Dec 2022Shawn LiewNo ratings yet

- Far210 Fe Feb23Document8 pagesFar210 Fe Feb23ediza adhaNo ratings yet

- BS 320Document3 pagesBS 320Prince Daniels TutorNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- MC 4 - Deferred Tax - A231Document4 pagesMC 4 - Deferred Tax - A231Patricia TangNo ratings yet

- MAN1068 Exam Paper 2021-22Document16 pagesMAN1068 Exam Paper 2021-22Praveena RavishankerNo ratings yet

- Bac 2211 Cat&assignment Sep 2023Document5 pagesBac 2211 Cat&assignment Sep 2023toniruii98No ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Far270 July2022Document8 pagesFar270 July2022Nur Fatin AmirahNo ratings yet

- Assignment FarDocument5 pagesAssignment FarALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- UOL ExamDocument11 pagesUOL ExamThant Hayman ThwayNo ratings yet

- BBF 313 Financial Reporting, Analysis and Planning: Code of The Name of The Module Date of Exam Time of Exam SetDocument4 pagesBBF 313 Financial Reporting, Analysis and Planning: Code of The Name of The Module Date of Exam Time of Exam Setkp107416No ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Far270 February 22 FaDocument8 pagesFar270 February 22 FarumaisyaNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- CPA 1 - Financial Accounting - Paper 1dec 2022Document9 pagesCPA 1 - Financial Accounting - Paper 1dec 2022Asaba GloriaNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- CPA Paper 1 Financial Accounting 2Document9 pagesCPA Paper 1 Financial Accounting 2philipisingomaNo ratings yet

- Spring 2024 - MGT401 - 1Document3 pagesSpring 2024 - MGT401 - 1Wahab AftabNo ratings yet

- AccrDocument2 pagesAccrlearningcantstop561No ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- Midterm - Far2 - AmendedDocument2 pagesMidterm - Far2 - AmendedmellNo ratings yet

- FA Dec 2021Document8 pagesFA Dec 2021Shawn LiewNo ratings yet

- FAR460 Jan 24Document8 pagesFAR460 Jan 24wan idharNo ratings yet

- Faculty Accountancy 2022 Session 1 - Diploma Far210Document8 pagesFaculty Accountancy 2022 Session 1 - Diploma Far210nafisah rahmanNo ratings yet

- MC 3 Topic 4 Def Tax Question A232Document4 pagesMC 3 Topic 4 Def Tax Question A232thanusri0103No ratings yet

- WP contentuploads202302FINANCIAL ACCOUNTING PAPER 1.1 Dec 2023 PDFDocument22 pagesWP contentuploads202302FINANCIAL ACCOUNTING PAPER 1.1 Dec 2023 PDFProsperity Thēë BwøyNo ratings yet

- Final Exam July 2021 QQDocument8 pagesFinal Exam July 2021 QQLampard AimanNo ratings yet

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocument5 pagesFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Control Test 1 - March 2022Document4 pagesControl Test 1 - March 2022yandisaNo ratings yet

- Q Far270 July2021 - Set 1Document8 pagesQ Far270 July2021 - Set 1nafisah rahmanNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- 2022 Grade 10 Controlled Test 3 QP EngDocument5 pages2022 Grade 10 Controlled Test 3 QP EngkellzylesediNo ratings yet

- Assignment Financial 2024 18TH MarchDocument6 pagesAssignment Financial 2024 18TH MarchBen Noah EuroNo ratings yet

- CAF 1 FAR1 Autumn 2022Document6 pagesCAF 1 FAR1 Autumn 2022QasimNo ratings yet

- Poa T - 12Document4 pagesPoa T - 12SHEVENA A/P VIJIANNo ratings yet

- FR Day 1Document9 pagesFR Day 1Fun DietNo ratings yet

- Corporate Reporting Nd-2022 QuestionDocument7 pagesCorporate Reporting Nd-2022 QuestionMDSadeq-ulIslamNo ratings yet

- 21NDocument22 pages21NWinnie GNo ratings yet

- Socw - 1263543589Document7 pagesSocw - 1263543589dolevov652No ratings yet

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- CAF 1 FAR1 Autumn 2023Document6 pagesCAF 1 FAR1 Autumn 2023z8qcsqfj8dNo ratings yet

- FAC612S - Test 3 2023Document5 pagesFAC612S - Test 3 2023simaneka.shilongoNo ratings yet

- Financial Accounting 2A Final OSA PDFDocument5 pagesFinancial Accounting 2A Final OSA PDFdamian.levendalNo ratings yet

- Shareholders' Equity p21 28Document19 pagesShareholders' Equity p21 28Rizalito SisonNo ratings yet

- Finance Assignment Due MarchDocument19 pagesFinance Assignment Due MarchJeenika S SingaravaluNo ratings yet

- CA Inter Adv Accounts Suggested Answer May 2022Document30 pagesCA Inter Adv Accounts Suggested Answer May 2022BILLU-YTNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageVamsi Krishna BNo ratings yet

- IRCTC E-Catering - Order Booked #36108741Document1 pageIRCTC E-Catering - Order Booked #36108741Debopriyo MukherjiNo ratings yet

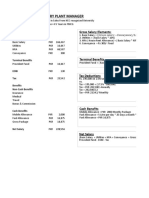

- Shoe Factory Plant Manager: Gross Salary ElementsDocument2 pagesShoe Factory Plant Manager: Gross Salary ElementsSukaina SalmanNo ratings yet

- OD225537427076154000Document1 pageOD225537427076154000Sandipan BiswasNo ratings yet

- Price List For Fiesta Homes by SJR PrimecorpDocument1 pagePrice List For Fiesta Homes by SJR PrimecorpAswath FarookNo ratings yet

- Trial Balance Ud Mudah HasilDocument1 pageTrial Balance Ud Mudah HasilSani SausanNo ratings yet

- AssignmentDocument3 pagesAssignmentDùķe HPNo ratings yet

- Invoice 197Document2 pagesInvoice 197miroljubNo ratings yet

- Basic Principles - Taxn01bDocument28 pagesBasic Principles - Taxn01bJericho PedragosaNo ratings yet

- Taxation Short Questions AnswersDocument4 pagesTaxation Short Questions AnswersSheetal IyerNo ratings yet

- Uttar Pradesh Budget Analysis 2019-20Document6 pagesUttar Pradesh Budget Analysis 2019-20AdNo ratings yet

- The VAT GuideDocument195 pagesThe VAT Guidestingray2No ratings yet

- New Tax Rates (TRAIN LAW) PDFDocument1 pageNew Tax Rates (TRAIN LAW) PDFphoebemariealhambra1475No ratings yet

- Bar Examination 2006 - TaxationlawDocument7 pagesBar Examination 2006 - TaxationlawLyraNo ratings yet

- Godrej Prana Price SheetDocument10 pagesGodrej Prana Price Sheetbigdealsin14No ratings yet

- Formst 1Document3 pagesFormst 1arulantonyNo ratings yet

- Chapter 16 Practice Problems Solution Manual 2020Document29 pagesChapter 16 Practice Problems Solution Manual 2020James SeelosNo ratings yet

- Transfer Pricing Country Profile BulgariaDocument16 pagesTransfer Pricing Country Profile BulgariaIoanna ZlatevaNo ratings yet

- Osmena vs. OrbosDocument2 pagesOsmena vs. OrbosDana Denisse RicaplazaNo ratings yet

- Od 225991033389305000Document1 pageOd 225991033389305000Iqbal khanNo ratings yet

- Synopsis of Project GSTDocument4 pagesSynopsis of Project GSTamarjeet singhNo ratings yet

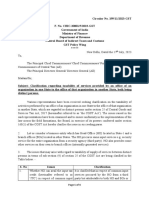

- Circular CGST 199Document4 pagesCircular CGST 199Jaipur-B Gr-2No ratings yet

- Chapter 3 Charge Under GSTDocument10 pagesChapter 3 Charge Under GSTabhay javiyaNo ratings yet

- Paper4 - Taxation - MTP - All Attempts - May23Document335 pagesPaper4 - Taxation - MTP - All Attempts - May23devaaNo ratings yet

- Quote: 2215 Paseo de Las Americas Suite # 29 San Diego, CA 92154 PH# (858) 513-7748 FX# (858) 513-7757Document1 pageQuote: 2215 Paseo de Las Americas Suite # 29 San Diego, CA 92154 PH# (858) 513-7748 FX# (858) 513-7757Armenta EdwinNo ratings yet

- US Internal Revenue Service: I1040se - 1997Document5 pagesUS Internal Revenue Service: I1040se - 1997IRSNo ratings yet

- Respondent: Raja Benoy Kumar Sahas RoyDocument3 pagesRespondent: Raja Benoy Kumar Sahas RoysontineniNo ratings yet

- Complete Taxation PrelimDocument59 pagesComplete Taxation PrelimJOSHUA M. ESCOTONo ratings yet

- DATE: 19.12.2021 JOB NO: 192-9203-000 Invoice No.: 192-9203-FPC-191221Document1 pageDATE: 19.12.2021 JOB NO: 192-9203-000 Invoice No.: 192-9203-FPC-191221Mohammad MudassarNo ratings yet

BF 220 Test One Practice

BF 220 Test One Practice

Uploaded by

Prince Daniels TutorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BF 220 Test One Practice

BF 220 Test One Practice

Uploaded by

Prince Daniels TutorCopyright:

Available Formats

BF 220 TEST ONE PRACTICE

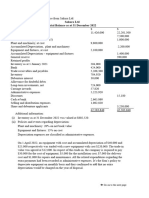

The following trial balance has been extracted from the accounting records of Comrade plc at

31 March 2022, before the preparation of financial statements.

K’ 000 K’ 000

Sales Revenue 221,500

Cost of sales 14,556

Freehold land at 2010 revaluation 90,500

Buildings at cost 75,600

Buildings-Accumulated depreciation 45,360

Administrative expenses 15,400

Distribution expenses 11,200

Research and development 42,500

Inventories as at 31 March 2014 7,865

Interest 1,310

Retained earnings 23,457

Trade Receivables and payables 59,045 8,720

Bank 58,100

Treasury Bills 116,812

8% bank loan repayable 2021 26,200

Corporation tax 2,300

Provision for liabilities as at 1 April 2021 62,500

Revaluation Reserve 25,000

Share capital (K 1 each) 70,370

Share premium 7,481

______ ______

402,888 402,888

The following information is also available

i. Research and development expenditure for the year to 31 March 2022 comprises the

following:

• K 15,000,000 spent on a joint project with a university investigating the potential use of a

certain chemical to reduce pollution levels in mine areas

PRINCE DANIELS 2023

• K 22,500,000 spent on developing a new high speed hard drive which, in the opinion of

Comrade Ltd, has an assured and profitable market. Work has been suspended pending the

development of a new glue suitable for the construction of the disk drives

• K 5,000,000 on the development of new computer software that will enable the company to

operate an Inventory control system that will greatly reduce the costs associated with holding

excessive amounts of inventory. Comrade Ltd expects the system to come into operation on

1 June 2022.

ii. The inventories at the close of business on 31 March 2022 include inventory items that cost

K 4,480,000 but according to new information that has just been received, Comrade Ltd will

only be able to sell these inventory items for K 2,380,000 after incurring selling costs of K280,

000.

iii. Buildings are depreciated at 25% on a reducing balance basis. The company uses the

revaluation model for its property, plant and equipment. After a review of the value of the

buildings at the year end, it was determined that they had a value of K30, 000, 000. The

buildings were used solely for rental purposes and capital appreciation for 8 months of the

year, after which they were used as offices for the company.

iv. Freehold land is considered to have an infinite useful life. Land is re-valued regularly in

accordance with the requirements of IAS 16 Property, Plant and Equipment. Comrade Ltd

acquired land for K 65,500,000 10 years ago. This land was revalued at K 90,500,000 on

31March 2010 and during 2022 land was re-valued at K 52,500,000 and.

v. Interest on the bank loan for the last six months of the year has not been included in the trail

balance

vi. Since April 2012 Comrade Ltd has been involved in a legal dispute with one of its customers,

Kimmi Ltd for failure to supply goods on agreed time. Although the outcome of the dispute

is unknown, Comrade’s lawyer’s advice suggests that Comrade Ltd will have to pay

compensation to Kimmi Ltd. At 31 March 2021 legal advice estimated that compensation

would amount to K 62,500,000. The case is due to be heard in June 2022 and at 31 March

2022 the most up to date legal advice suggested that Comrade Ltd will instead have to pay

compensation of around K 55,000,000.

vii. The corporation tax balance in the trial balance relates to an unpaid balance for 2021.

Corporation tax for the year ended 31 March 2022 is estimated to be 35% of taxable profit.

Required

Prepare the statement of profit or loss and other comprehensive income, statement of financial

position and statement of changes in equity for Comrade Plc for the year ended 31st March

2022.

PRINCE DANIELS 2023

You might also like

- B7AF102 Financial Accounting May 2023Document11 pagesB7AF102 Financial Accounting May 2023gerlaniamelgacoNo ratings yet

- International Taxation OutlineDocument138 pagesInternational Taxation OutlineMa FajardoNo ratings yet

- FAR210 - July 2023 - QDocument8 pagesFAR210 - July 2023 - QafiqahNo ratings yet

- IAS 1 MAC LTDDocument2 pagesIAS 1 MAC LTDvuchiduc.contactNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far210Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Far210Bil hutNo ratings yet

- Bs 320 TutorialDocument4 pagesBs 320 TutorialPrince Daniels TutorNo ratings yet

- FAR210 - Feb 2022 - QDocument8 pagesFAR210 - Feb 2022 - Qqh2mtyprq8No ratings yet

- Bs 320 - 30th AprilDocument2 pagesBs 320 - 30th AprilPrince Daniels TutorNo ratings yet

- FA Dec 2022Document8 pagesFA Dec 2022Shawn LiewNo ratings yet

- Far210 Fe Feb23Document8 pagesFar210 Fe Feb23ediza adhaNo ratings yet

- BS 320Document3 pagesBS 320Prince Daniels TutorNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- MC 4 - Deferred Tax - A231Document4 pagesMC 4 - Deferred Tax - A231Patricia TangNo ratings yet

- MAN1068 Exam Paper 2021-22Document16 pagesMAN1068 Exam Paper 2021-22Praveena RavishankerNo ratings yet

- Bac 2211 Cat&assignment Sep 2023Document5 pagesBac 2211 Cat&assignment Sep 2023toniruii98No ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Far270 July2022Document8 pagesFar270 July2022Nur Fatin AmirahNo ratings yet

- Assignment FarDocument5 pagesAssignment FarALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- UOL ExamDocument11 pagesUOL ExamThant Hayman ThwayNo ratings yet

- BBF 313 Financial Reporting, Analysis and Planning: Code of The Name of The Module Date of Exam Time of Exam SetDocument4 pagesBBF 313 Financial Reporting, Analysis and Planning: Code of The Name of The Module Date of Exam Time of Exam Setkp107416No ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Far270 February 22 FaDocument8 pagesFar270 February 22 FarumaisyaNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- CPA 1 - Financial Accounting - Paper 1dec 2022Document9 pagesCPA 1 - Financial Accounting - Paper 1dec 2022Asaba GloriaNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- CPA Paper 1 Financial Accounting 2Document9 pagesCPA Paper 1 Financial Accounting 2philipisingomaNo ratings yet

- Spring 2024 - MGT401 - 1Document3 pagesSpring 2024 - MGT401 - 1Wahab AftabNo ratings yet

- AccrDocument2 pagesAccrlearningcantstop561No ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- Midterm - Far2 - AmendedDocument2 pagesMidterm - Far2 - AmendedmellNo ratings yet

- FA Dec 2021Document8 pagesFA Dec 2021Shawn LiewNo ratings yet

- FAR460 Jan 24Document8 pagesFAR460 Jan 24wan idharNo ratings yet

- Faculty Accountancy 2022 Session 1 - Diploma Far210Document8 pagesFaculty Accountancy 2022 Session 1 - Diploma Far210nafisah rahmanNo ratings yet

- MC 3 Topic 4 Def Tax Question A232Document4 pagesMC 3 Topic 4 Def Tax Question A232thanusri0103No ratings yet

- WP contentuploads202302FINANCIAL ACCOUNTING PAPER 1.1 Dec 2023 PDFDocument22 pagesWP contentuploads202302FINANCIAL ACCOUNTING PAPER 1.1 Dec 2023 PDFProsperity Thēë BwøyNo ratings yet

- Final Exam July 2021 QQDocument8 pagesFinal Exam July 2021 QQLampard AimanNo ratings yet

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocument5 pagesFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Control Test 1 - March 2022Document4 pagesControl Test 1 - March 2022yandisaNo ratings yet

- Q Far270 July2021 - Set 1Document8 pagesQ Far270 July2021 - Set 1nafisah rahmanNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- 2022 Grade 10 Controlled Test 3 QP EngDocument5 pages2022 Grade 10 Controlled Test 3 QP EngkellzylesediNo ratings yet

- Assignment Financial 2024 18TH MarchDocument6 pagesAssignment Financial 2024 18TH MarchBen Noah EuroNo ratings yet

- CAF 1 FAR1 Autumn 2022Document6 pagesCAF 1 FAR1 Autumn 2022QasimNo ratings yet

- Poa T - 12Document4 pagesPoa T - 12SHEVENA A/P VIJIANNo ratings yet

- FR Day 1Document9 pagesFR Day 1Fun DietNo ratings yet

- Corporate Reporting Nd-2022 QuestionDocument7 pagesCorporate Reporting Nd-2022 QuestionMDSadeq-ulIslamNo ratings yet

- 21NDocument22 pages21NWinnie GNo ratings yet

- Socw - 1263543589Document7 pagesSocw - 1263543589dolevov652No ratings yet

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- CAF 1 FAR1 Autumn 2023Document6 pagesCAF 1 FAR1 Autumn 2023z8qcsqfj8dNo ratings yet

- FAC612S - Test 3 2023Document5 pagesFAC612S - Test 3 2023simaneka.shilongoNo ratings yet

- Financial Accounting 2A Final OSA PDFDocument5 pagesFinancial Accounting 2A Final OSA PDFdamian.levendalNo ratings yet

- Shareholders' Equity p21 28Document19 pagesShareholders' Equity p21 28Rizalito SisonNo ratings yet

- Finance Assignment Due MarchDocument19 pagesFinance Assignment Due MarchJeenika S SingaravaluNo ratings yet

- CA Inter Adv Accounts Suggested Answer May 2022Document30 pagesCA Inter Adv Accounts Suggested Answer May 2022BILLU-YTNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageVamsi Krishna BNo ratings yet

- IRCTC E-Catering - Order Booked #36108741Document1 pageIRCTC E-Catering - Order Booked #36108741Debopriyo MukherjiNo ratings yet

- Shoe Factory Plant Manager: Gross Salary ElementsDocument2 pagesShoe Factory Plant Manager: Gross Salary ElementsSukaina SalmanNo ratings yet

- OD225537427076154000Document1 pageOD225537427076154000Sandipan BiswasNo ratings yet

- Price List For Fiesta Homes by SJR PrimecorpDocument1 pagePrice List For Fiesta Homes by SJR PrimecorpAswath FarookNo ratings yet

- Trial Balance Ud Mudah HasilDocument1 pageTrial Balance Ud Mudah HasilSani SausanNo ratings yet

- AssignmentDocument3 pagesAssignmentDùķe HPNo ratings yet

- Invoice 197Document2 pagesInvoice 197miroljubNo ratings yet

- Basic Principles - Taxn01bDocument28 pagesBasic Principles - Taxn01bJericho PedragosaNo ratings yet

- Taxation Short Questions AnswersDocument4 pagesTaxation Short Questions AnswersSheetal IyerNo ratings yet

- Uttar Pradesh Budget Analysis 2019-20Document6 pagesUttar Pradesh Budget Analysis 2019-20AdNo ratings yet

- The VAT GuideDocument195 pagesThe VAT Guidestingray2No ratings yet

- New Tax Rates (TRAIN LAW) PDFDocument1 pageNew Tax Rates (TRAIN LAW) PDFphoebemariealhambra1475No ratings yet

- Bar Examination 2006 - TaxationlawDocument7 pagesBar Examination 2006 - TaxationlawLyraNo ratings yet

- Godrej Prana Price SheetDocument10 pagesGodrej Prana Price Sheetbigdealsin14No ratings yet

- Formst 1Document3 pagesFormst 1arulantonyNo ratings yet

- Chapter 16 Practice Problems Solution Manual 2020Document29 pagesChapter 16 Practice Problems Solution Manual 2020James SeelosNo ratings yet

- Transfer Pricing Country Profile BulgariaDocument16 pagesTransfer Pricing Country Profile BulgariaIoanna ZlatevaNo ratings yet

- Osmena vs. OrbosDocument2 pagesOsmena vs. OrbosDana Denisse RicaplazaNo ratings yet

- Od 225991033389305000Document1 pageOd 225991033389305000Iqbal khanNo ratings yet

- Synopsis of Project GSTDocument4 pagesSynopsis of Project GSTamarjeet singhNo ratings yet

- Circular CGST 199Document4 pagesCircular CGST 199Jaipur-B Gr-2No ratings yet

- Chapter 3 Charge Under GSTDocument10 pagesChapter 3 Charge Under GSTabhay javiyaNo ratings yet

- Paper4 - Taxation - MTP - All Attempts - May23Document335 pagesPaper4 - Taxation - MTP - All Attempts - May23devaaNo ratings yet

- Quote: 2215 Paseo de Las Americas Suite # 29 San Diego, CA 92154 PH# (858) 513-7748 FX# (858) 513-7757Document1 pageQuote: 2215 Paseo de Las Americas Suite # 29 San Diego, CA 92154 PH# (858) 513-7748 FX# (858) 513-7757Armenta EdwinNo ratings yet

- US Internal Revenue Service: I1040se - 1997Document5 pagesUS Internal Revenue Service: I1040se - 1997IRSNo ratings yet

- Respondent: Raja Benoy Kumar Sahas RoyDocument3 pagesRespondent: Raja Benoy Kumar Sahas RoysontineniNo ratings yet

- Complete Taxation PrelimDocument59 pagesComplete Taxation PrelimJOSHUA M. ESCOTONo ratings yet

- DATE: 19.12.2021 JOB NO: 192-9203-000 Invoice No.: 192-9203-FPC-191221Document1 pageDATE: 19.12.2021 JOB NO: 192-9203-000 Invoice No.: 192-9203-FPC-191221Mohammad MudassarNo ratings yet