Professional Documents

Culture Documents

Law Assignment

Law Assignment

Uploaded by

brinjalbusinessCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law Assignment

Law Assignment

Uploaded by

brinjalbusinessCopyright:

Available Formats

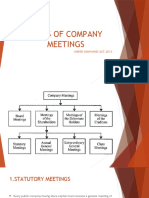

SHAREHOLDERS MEETINGS

1. Types of Meetings:

Shareholder meetings in India typically come in three main types:

- Annual General Meeting (AGM): An AGM is held once a year, within six months from the end of the

financial year. It is mandatory for every company, and its purpose is to discuss the financial statements,

elect directors, appoint auditors, and other matters of significance.

- Extraordinary General Meeting (EGM): An EGM is convened as and when necessary, outside the

regular AGM schedule, to discuss urgent matters that cannot wait until the next AGM. These could

include crucial decisions like changes in the company's capital structure, alteration of articles of

association, etc.

- Class Meetings: These are meetings held for specific classes of shareholders, such as preference

shareholders, debenture holders, etc., to discuss matters directly concerning their interests.

2. Convening Authority:

The power to convene shareholder meetings lies with different entities depending on the type of

meeting:

- AGM: The board of directors is responsible for convening the AGM within the stipulated time frame.

- EGM: The board can convene an EGM, or it may be convened upon requisition by shareholders

owning at least 10% of the total voting power, or as per the direction of the Company Law Tribunal

(NCLT).

- Class Meetings: These are usually convened by the board of directors based on the terms specified in

the articles of association or upon requisition by the shareholders of that class.

3. Conduct of Meetings:

The conduct of shareholder meetings is governed by various laws and regulations, including the

Companies Act and the company's articles of association. Some key points regarding the conduct of

meetings include:

- Proper notice must be given to all shareholders as per the statutory requirements and provisions of

the articles of association.

- The meeting must have a quorum, which is the minimum number of members required to be present

to validate the proceedings. Quorum requirements are specified in the articles of association.

- The chairman of the board or, in their absence, another director nominated by the board, usually

presides over the meeting. They ensure that the meeting proceeds smoothly, following the agenda and

maintaining order.

- Resolutions are proposed, discussed, and voted upon during the meeting. Each shareholder typically

has one vote per share held, unless the articles of association provide otherwise.

4. Requisites of a Valid Meeting:

Several prerequisites must be met for a shareholder meeting to be considered valid:

- Notice: Proper notice must be given to all shareholders as per the requirements of the Companies Act

and the company's articles of association. The notice must include the date, time, and venue of the

meeting, along with the agenda and explanatory notes on resolutions, if any.

- Quorum: There must be a quorum present to conduct business. The quorum requirement is usually

specified in the articles of association and must be met for the meeting to proceed.

- Chairperson: A chairperson must preside over the meeting, ensuring that it is conducted in an orderly

manner and in accordance with the law and the company's articles of association.

- Recording of Minutes: Detailed minutes of the proceedings of the meeting must be recorded and

maintained as per the Companies Act. The minutes must accurately reflect all decisions taken and

resolutions passed during the meeting.

5. Resolutions:

Resolutions are formal decisions made by the shareholders during the meeting. They can be classified

into two main types:

- Ordinary Resolutions: These are passed by a simple majority of shareholders present and voting at

the meeting. They are used for routine matters such as approval of financial statements, appointment of

auditors, etc.

- Special Resolutions: Special resolutions require a higher threshold for approval, typically a majority of

not less than 75% of the votes cast by shareholders entitled to vote. They are used for significant matters

such as alteration of the company's memorandum or articles of association, changes in share capital, etc.

In conclusion, shareholder meetings in India play a vital role in corporate governance and decision-

making. They provide shareholders with an opportunity to participate in the management of the

company, exercise their voting rights, and hold the management accountable. Adherence to legal

requirements and proper conduct of meetings are essential to ensure transparency, fairness, and

compliance with the law.

BY RUSHAD NADEEM

B.Com (Hons)

202307681

You might also like

- Company Meeting NotesDocument14 pagesCompany Meeting NotesManish RoydaNo ratings yet

- Articles of AssociationDocument4 pagesArticles of AssociationChandrakant HakeNo ratings yet

- Presentation On Meetings: Presented By:-Yusuf Ali Gheewala Hardik Parekh Ramesh RajpurohitDocument22 pagesPresentation On Meetings: Presented By:-Yusuf Ali Gheewala Hardik Parekh Ramesh RajpurohitRajpurohit RameshNo ratings yet

- CL GCT - IiDocument9 pagesCL GCT - IiHarsh RNo ratings yet

- Lecture No. 7Document3 pagesLecture No. 7mayar.mamdouh1215No ratings yet

- FEDERAL UNIVERS-WPS OfficeDocument11 pagesFEDERAL UNIVERS-WPS Officetersoobenard150No ratings yet

- Valid MeetingsDocument4 pagesValid Meetings18 Pranav mlalNo ratings yet

- MeetingsDocument14 pagesMeetingsrmwsrwz2k2No ratings yet

- Corporate Law Unit 5Document16 pagesCorporate Law Unit 5Jasjeet SinghNo ratings yet

- Importance of Meeting, Proceeding and AuditorDocument18 pagesImportance of Meeting, Proceeding and Auditorb26shantnusharmaNo ratings yet

- What Is A MeetingDocument17 pagesWhat Is A Meetingutpal_50No ratings yet

- Company Meetings NavinDocument12 pagesCompany Meetings NavinNavin SureshNo ratings yet

- Company Law-Kinds of MeetingDocument8 pagesCompany Law-Kinds of MeetingIrfan Baari100% (1)

- 6meetings - Yg Law - LLMDocument4 pages6meetings - Yg Law - LLMaanchal kalraNo ratings yet

- Corporate Administration and Management 2008Document11 pagesCorporate Administration and Management 2008azmat18No ratings yet

- CompanyDocument7 pagesCompanyaditim1308No ratings yet

- Meetings in CorporateDocument13 pagesMeetings in CorporateNeeraj KumarNo ratings yet

- Unit 4 CA NotesDocument10 pagesUnit 4 CA NotesProfessorNo ratings yet

- Company MeetingsCompany MeetingsDocument17 pagesCompany MeetingsCompany Meetingsa38346440No ratings yet

- 76 DavidsonDocument13 pages76 DavidsonTejas BaldaniyaNo ratings yet

- Company Unit-2Document6 pagesCompany Unit-2thehackerdude09No ratings yet

- Presentation On Meetings in The Companies ActDocument16 pagesPresentation On Meetings in The Companies ActGokul SoodNo ratings yet

- How Many Types of Meetings Are Regulated Under Companies Act 2013Document3 pagesHow Many Types of Meetings Are Regulated Under Companies Act 2013Pawan SaxenaNo ratings yet

- Mod 2 CGDocument16 pagesMod 2 CGNeha MakeoversNo ratings yet

- Chapter FiveDocument2 pagesChapter FivesakibarsNo ratings yet

- Lecture 9 - Meetings and ResolutionsDocument27 pagesLecture 9 - Meetings and ResolutionsZale EzekielNo ratings yet

- NotesDocument19 pagesNotesKaustubh GaikwadNo ratings yet

- Meeting-Company LawDocument17 pagesMeeting-Company Lawramesh.kNo ratings yet

- Company Meeting and ResolutionDocument32 pagesCompany Meeting and ResolutionTawsif AnikNo ratings yet

- MeetingsDocument14 pagesMeetingsAsim AliNo ratings yet

- A Study ON: Corporate Legal Enviroment "General Meetings"Document26 pagesA Study ON: Corporate Legal Enviroment "General Meetings"Mukesh AgrawalNo ratings yet

- Company Meetings: Group - 9 Group MembersDocument12 pagesCompany Meetings: Group - 9 Group Memberssandeep kumarNo ratings yet

- Meetings and ResolutionsDocument5 pagesMeetings and Resolutionsabhishek singh100% (1)

- What Is A "Meeting": Kinds of Company's MeetingDocument12 pagesWhat Is A "Meeting": Kinds of Company's MeetinggcuusmanNo ratings yet

- Company Law AsnDocument4 pagesCompany Law AsnAgna gandhiNo ratings yet

- AOA, Prospectus, MettingsDocument20 pagesAOA, Prospectus, MettingsNeha NayakNo ratings yet

- Appointment of Directors Section 152 of The Companies ActDocument1 pageAppointment of Directors Section 152 of The Companies Actvishal guptaNo ratings yet

- Prepared By: Riddhi Modi (B-28) Dimple Thadhani (B-49)Document37 pagesPrepared By: Riddhi Modi (B-28) Dimple Thadhani (B-49)dimplethadhaniNo ratings yet

- Meetings & Resolutions: 1. Statutory MeetingDocument5 pagesMeetings & Resolutions: 1. Statutory MeetingMostafa Ahmed SuntuNo ratings yet

- MS Belab 2Document7 pagesMS Belab 250 Mohit SharmaNo ratings yet

- H 08 MeetingsDocument7 pagesH 08 MeetingsDataNo ratings yet

- Unit III-Part 2Document26 pagesUnit III-Part 2Aman RaiNo ratings yet

- WK 8 & 9 Meeting & ResolutionDocument22 pagesWK 8 & 9 Meeting & ResolutionkkNo ratings yet

- Board and Its PowersDocument43 pagesBoard and Its PowersKALYAN SREEPADANo ratings yet

- JJ Irani Committee RecommendationsDocument3 pagesJJ Irani Committee Recommendationsmuffin muffinNo ratings yet

- Types of Meetings in Companies: BY Anandbabu.V 1 MBADocument21 pagesTypes of Meetings in Companies: BY Anandbabu.V 1 MBAramesh.k100% (1)

- Class 5 Company MeetingsDocument31 pagesClass 5 Company MeetingsSwati Sucharita DasNo ratings yet

- AGM and EGM of A CompanyDocument8 pagesAGM and EGM of A CompanyPooja BoharaNo ratings yet

- Presentation On Meetings: Presented ByDocument16 pagesPresentation On Meetings: Presented ByRajpurohit RameshNo ratings yet

- Constitution: 1. NameDocument7 pagesConstitution: 1. NameLetlhogonolo Molokomme MokhuseNo ratings yet

- Company Meetings: Meaning and Definition of CompanyDocument14 pagesCompany Meetings: Meaning and Definition of CompanyMohsin AliNo ratings yet

- Dr. Arti Singh Assistant Professor Kristu Jayanti College BengaluruDocument16 pagesDr. Arti Singh Assistant Professor Kristu Jayanti College BengaluruArti SinghNo ratings yet

- What Is An Annual General Meeting (AGM) ?: AuditorsDocument3 pagesWhat Is An Annual General Meeting (AGM) ?: AuditorsAmirNo ratings yet

- Short Company MeetingDocument6 pagesShort Company MeetingKomal NandanNo ratings yet

- Meetings and ResolutionsDocument13 pagesMeetings and ResolutionsRaghu GowdaNo ratings yet

- Unit 5 &6Document11 pagesUnit 5 &6chethanraaz_66574068No ratings yet

- Unit 5Document9 pagesUnit 5chethanraaz_66574068No ratings yet

- Company Management & Winding Up: Dr. K Ashok AnandDocument22 pagesCompany Management & Winding Up: Dr. K Ashok AnandTALAVANE SRIRAMANo ratings yet

- Case Business Valuation - ArcorDocument23 pagesCase Business Valuation - ArcorWahyutri IndonesiaNo ratings yet

- e-StatementBRImo 368701025697538 Des2023 Feb202420240325 174454Document8 pagese-StatementBRImo 368701025697538 Des2023 Feb202420240325 174454Ganang WibowoNo ratings yet

- FABMDocument8 pagesFABMMary Grace DegamoNo ratings yet

- As 11..Document14 pagesAs 11..krithika vasanNo ratings yet

- PDF 01Document4 pagesPDF 01Hiruni LakshaniNo ratings yet

- LK Ppro Sept 2020 - AuditedDocument147 pagesLK Ppro Sept 2020 - AuditedDEYLA VIOLANo ratings yet

- FM AssDocument3 pagesFM AssBitta Saha HridoyNo ratings yet

- PT MBSS TBK - 31 Desember 2022 (FINAL)Document98 pagesPT MBSS TBK - 31 Desember 2022 (FINAL)Reza RizaldiNo ratings yet

- Accenture - 1 B Com ProfileDocument7 pagesAccenture - 1 B Com ProfileTHIMMAIAH B CNo ratings yet

- Pmsbazaar PMS & AIF Special Edition July23Document101 pagesPmsbazaar PMS & AIF Special Edition July23SukumarNo ratings yet

- CAMPERDOWN HIGH SCHOOL - Accounting Grade 9 TestDocument6 pagesCAMPERDOWN HIGH SCHOOL - Accounting Grade 9 TestLatoya SmithNo ratings yet

- Take Away Assignment Managerial AccountingDocument4 pagesTake Away Assignment Managerial AccountingawalebuuxNo ratings yet

- SLLC - 2021 - Acc - C - Review Question 2 - Ratio AnalysisDocument3 pagesSLLC - 2021 - Acc - C - Review Question 2 - Ratio AnalysisChamela MahiepalaNo ratings yet

- Unit - 1 Accounting Equations & Journal & Ledger & TBDocument43 pagesUnit - 1 Accounting Equations & Journal & Ledger & TBShreyash PardeshiNo ratings yet

- Financial Statement Analysis On Icici Bank: Submitted As A Part of MBA 1 Year Course Requirement byDocument62 pagesFinancial Statement Analysis On Icici Bank: Submitted As A Part of MBA 1 Year Course Requirement byBharath WajNo ratings yet

- AFAR QuizDocument7 pagesAFAR QuizCerise SNo ratings yet

- Analysis of Reformulated Financial StatementsDocument46 pagesAnalysis of Reformulated Financial StatementsAkib Mahbub KhanNo ratings yet

- Mega KPI BundleDocument11 pagesMega KPI Bundlepepito.supermarket.baliNo ratings yet

- Estimating Cash Flows (Autosaved)Document28 pagesEstimating Cash Flows (Autosaved)jay-ar dimaculanganNo ratings yet

- Handouts 169Document15 pagesHandouts 169Rio Cyrel CelleroNo ratings yet

- Solution Manual For Corporate Finance Linking Theory To What Companies Do 3rd Edition by GrahamDocument9 pagesSolution Manual For Corporate Finance Linking Theory To What Companies Do 3rd Edition by GrahamMariaMasontwfj100% (49)

- BOR Settlements RPRT Roh8-12 FY22Document10 pagesBOR Settlements RPRT Roh8-12 FY22Honolulu Star-AdvertiserNo ratings yet

- Abst Paper 1Document2 pagesAbst Paper 1Pankaj KhileriNo ratings yet

- Latihan CH 19Document12 pagesLatihan CH 19laurentinus fikaNo ratings yet

- Mock Departmental Part 1Document7 pagesMock Departmental Part 1Mikee RizonNo ratings yet

- Kunooz ProfileDocument12 pagesKunooz ProfileIbrahim DaasNo ratings yet

- BP PLASTICS HOLDING BHD Income Statement - MYX - BPPLAS - TradingViewDocument4 pagesBP PLASTICS HOLDING BHD Income Statement - MYX - BPPLAS - TradingViewyasmin nabilahNo ratings yet

- Capbudgeting For Smart DiapersDocument8 pagesCapbudgeting For Smart Diapersمحمد عليNo ratings yet

- The Role of Managerial Finance: ProfessionalDocument39 pagesThe Role of Managerial Finance: ProfessionalYoong Xuen XuenNo ratings yet

- Private Equity StructureDocument14 pagesPrivate Equity Structurewww.pubg3.co.inNo ratings yet