Professional Documents

Culture Documents

Afghanistan Economic Monitor 25 January 2023

Afghanistan Economic Monitor 25 January 2023

Uploaded by

hbukul2001Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Afghanistan Economic Monitor 25 January 2023

Afghanistan Economic Monitor 25 January 2023

Uploaded by

hbukul2001Copyright:

Available Formats

AFGHANISTAN ECONOMIC MONITOR

THE WORLD BANK January 25, 2023

The headline CPI inflation continues its downward trend while food and non-food items remain widely available. According to the

official statistics, headline year-on-year (YoY) inflation in November 2022 decelerated to 9.1 percent from its peak of 18.3 percent in July

2022. Both food and non-food segments contributed to this positive outcome. The 3.9 percentage point Y-o-Y decline between November

2022 and December 2022 can be explained by a drop in inflation of fuel (8 percentage points), wheat (5.1 percentage points), sugar (2.7

percentage points), cooking oil (2.2 percentage points), bread (1.5 percentage points), etc. According to the latest data collected by the

Third-Party Monitoring Agent (TPMA), most basic food and non-food commodities remain in the market.

The exchange rate remains substantially stable against major currencies. The AFN has slightly depreciated against the USD (by 1.5

percent), Euro (by 1.2 percent), and Chinese yuan (by 0.2 percent) between end-June and to end of December 2022 but appreciated against

the Pakistan rupee (24.8 percent) and Indian rupee (2.6 percent). The central bank (DAB) is undertaking occasional auctions in the forex

market. However, no data is available on the central bank website to confirm the frequency and auctioned amount. In the absence of regular

market interventions, the ITA continues to exert controls in the foreign exchange market to manage parity and liquidity, such as regulating the

MSP sector and prohibiting foreign currency-denominated domestic transactions. In parallel, the money service providers (MSPs) report some

foreign exchange shortages in the open market.

Cash withdrawals of pre-August 2021 deposits from banks continue to be regulated. While most individual depositors can access their

deposits within the allowed limits, selected financial institutions face difficulties honoring withdrawals. Firms, on the other hand, not only report

accessibility lower than allowed limits, but access to deposits declined further recently. Accordingly, no statutory withdrawal limit is imposed

on deposits made after August 28, 2021.

Civil servants’ salaries are reported to be paid on time for both men and women. Data collected by TPMA also shows that most civil

servants have reported receiving salaries regularly (as reported by 97 percent of the respondents). Moreover, females are reported to be

paid more regularly than males over the last two months. However, they reported the liquidity shortage as one of the significant challenges

in withdrawing salaries and crowding in the branches. Poor staff behavior is another key issue – particularly for female public servants when

they draw their salaries.

Demand for both skilled and unskilled labor has been declining since the beginning of the winter. Heavy snow and cold weather result

in a decline in agriculture, construction, and allied activities in most parts of the country. In parallel, data show a marginal increase in nominal

wages, which, coped with the decrease in inflation, results in a stronger increase in real wages.

Revenue collection in the first nine months of the fiscal year 2022 remains strong. Overall revenue collection reached AFN135.9 billion

(US$ 1.54 billion) between March 22, 2022, and December 21, 2022, in line with 2020 results. Afghanistan continued to rely relatively

heavily on revenue collected at the border — as opposed to inland revenue collection. For example, for the period under discussion, the

taxes at borders reached 58 percent of the total revenue. Revenue from inland sources reached AFN61 billion (US$ 0.7 billion) from March

21 till the end of December 2022, of which non-tax sources contributed the most. Non-tax revenue, comprising mainly revenues from ministries

in administration fees and royalties, contributes 54 percent of total inland revenues, compared to 45 percent in 2021. A rise in coal mining

royalties and fees likely drives the increase in ministries’ revenue.

Export performance remains strong: during Jan – Nov 2022, Afghanistan exported US$1.7 billion worth of goods, compared to US$

0.9 billion and US$ 0.8 billion for the full years 2021 and 2020. Data from customs authorities show that Pakistan (65 percent) and India

(20 percent) are the two main export destinations. Major exports include vegetable products (56 percent), mineral products (28 percent),

and textiles (10 percent) – collectively contributing 94 percent of total exports. Unfortunately, up-to-date import data is unavailable.

However, the Jan-June 2022 data shows that Afghanistan imported USD 2.9 billion of goods. Of the total imports, Iran (23 percent), Pakistan

(16 percent), and China (14 percent) were the main import origins. Major imports include mineral products (24 percent), vegetable products

(20 percent), and textiles (9 percent) – collectively contributing 54 percent of total imports.

New addition – Health Service Delivery indicators

The Bank financed Health Emergency Response project provides critical mother & child related health services. The data collected by

the TPMA shows that the twenty-three hundred supported facilities received around 3.3 million antenatal visits and provided 691,234

assisted births in 2022. Also, according to third-party monitoring data, 98% of health facilities had a female health worker present during

verification visits between July and October 2022.

Issue #1/2023 THE WORLD BANK

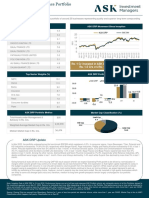

1. PRICE CHANGES AND AVAILABILITY OF BASIC HOUSEHOLD GOODS

The headline inflation has been easing since July 2022, helped by lower global oil and food prices and a

stable exchange rate.

1.1. CONSUMER PRICE INDEX 1.2. HEADLINE INFLATION Y-O-Y INFLATION

180.0 30

Over CPI Index Food Non-Food Headline inflation Food Non-food

170.0 25

160.0 20

150.0 15

Percent

140.0 10

130.0 5

120.0 0

110.0

-5

100.0

-10

Jan-19

Jan-20

Jan-21

Jan-22

May-19

May-20

Sep-20

Mar-21

May-21

May-22

Mar-19

Sep-19

Nov-19

Mar-20

Sep-21

Sep-22

Nov-20

Nov-21

Mar-22

Nov-22

Jul-19

Jul-20

Jul-21

Jul-22

Jan-19

May-19

May-22

Sep-22

Sep-19

Jan-20

May-20

Sep-20

Jan-21

May-21

Mar-21

Sep-21

Jan-22

Mar-19

Nov-19

Mar-20

Nov-20

Nov-21

Mar-22

Nov-22

Jul-19

Jul-20

Jul-21

Jul-22

Source: NSIA.

1.3. BASIC HOUSEHOLD GOODS – Y-O-Y INFLATION

Jan- Feb- Mar- Apr- May- Jun- Aug- Sep- Oct- Nov- Dec-

Jul-22

22 22 22 22 22 22 22 22 22 22 22

Bread 10.2 11.6 12.0 14.9 18.1 22.0 23.2 23.3 21.6 19.1 18.1 16.6

Fuel (diesel) 95.1 68.8 73.2 57.3 66.3 95.3 112.5 54.5 87.4 49.1 34.1 26.3

Oil (cooking) 62.3 47.3 43.9 46.4 50.3 51.3 32.3 16.1 0.8 -13.3 -12.2 -14.4

Pulses 28.7 27.6 24.1 23.8 22.9 23.7 23.3 17.7 16.1 11.6 10.6 10.6

Rice (high quality) 18.8 21.9 19.8 19.3 24.0 34.2 37.8 32.9 32.0 28.9 27.2 26.4

Rice (low quality) 14.3 10.1 9.6 7.9 9.6 14.6 13.1 10.9 14.1 12.5 18.5 21.9

Salt 30.2 25.2 23.4 18.9 21.3 22.9 19.0 18.0 16.0 17.8 10.8 20.0

Sugar 35.3 27.1 24.7 24.4 26.0 33.9 37.0 30.9 20.5 8.7 3.9 1.2

Wheat 40.2 31.0 27.8 35.5 40.3 58.1 49.8 43.5 37.9 19.1 16.8 11.8

Wheat flour (high quality) 42.2 27.6 31.6 44.0 50.5 65.1 49.4 41.7 31.9 12.3 12.1 5.8

Wheat flour (low quality) 45.1 32.3 32.1 44.7 52.7 68.2 50.8 41.5 36.0 14.3 13.4 6.5

Basic Household Goods Price Inflation 42.5 32.0 32.2 36.6 41.6 51.7 43.4 31.5 26.4 11.1 9.9 6.1

Source: Price data from WFP weekly report; index constructed by World Bank staff.

Note: This Index uses WFP price data for 11 critical household goods from all provinces. It applies consumption and population weights from NSIA to provide an

aggregate snapshot of basic household inflation trends.

Data from 48 markets in 21 provinces suggest that most basic food and non-food items remain available.

1.4. REPORTED AVAILABILITY OF FOOD & NON-FOOD ITEMS

100% Food Non-food 99% 99%

99% 99% 99%

98% 98% 98% 98% 98%

98% 98%

98%

97%

96% 96% 96%

95% 96% 96%

96% 95% 95%

93% 94%

94% 93%

93% 93% 93%

92%

92%

90%

88%

Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22

Source: Survey data collected by the World Bank’s Third-Party Monitoring Agent.

Issue #1/2023 THE WORLD BANK

AFGHANISTAN ECONOMIC MONITOR

2. LABOR MARKET CONDITIONS

Nominal and real wages slightly increased in December 2022.

2.1. NOMINAL AND REAL WAGES (AFN) FOR SKILLED AND UNSKILLED WORKERS

Nominal Wage(unskilled labour) Nominal Wage (Skilled labour) Nominal Wage(unskilled labour) Nominal Wage (Skilled labour)

700.0

Real wage (unskilled labour) Real wage (skilled labour)

700

600.0

600

500.0

400.0 500

300.0 400

200.0 300

100.0 200

0.0 100

Jul-21

Jul-22

Jan-22

May-22

Oct-21

Jun-21

Aug-21

Nov-21

Jun-22

Apr-22

Aug-22

Nov-22

Dec-21

Oct-22

Dec-22

Mar-22

Sep-21

Feb-22

Sep-22

May-21

Jul-21

May-22

Jul-22

Nov-21

Jan-22

Jun-21

Aug-21

Apr-22

Aug-22

Nov-22

Oct-21

Dec-21

Jun-22

Oct-22

Dec-22

Mar-22

Sep-21

Feb-22

Sep-22

Source: Wage data from WFP, World Bank staff elaboration. Real wages are calculated using price data from the NSIA. Inflation data for December 2022 is

projected. Note: Real wages to January 2022 are calculated based on CPI inflation reported by NSIA.

Demand for skilled and unskilled labor declined as construction and other allied activities slowed down due to

the winter.

2.2. LABOR DEMAND FOR SKILLED AND NON-SKILLED WORKERS BETWEEN NOVEMBER 2021 AND DECEMBER 2022

3.0 Demand for Skilled Labor Demand for Un-skilled labor

2.5 2.6 2.5 2.6

2.5 2.4 2.3 2.3

2.3

2.2 2.1 2.1 2.2

2.1

2.0 2.1 2.1 2.1 2.1 2.1 2.1 2.0

1.9 1.9 2.0

2.0 1.8 1.9

1.7

1.6

1.5

1.0

0.5

0.0

Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22

Source: Survey data collected by the World Bank’s Third-Party Monitoring Agent. Data for June 2022 was not collected.

Note: Data for June 22 is not available.

Note: Data reflects the number of available workdays reported by skilled and unskilled casual workers seeking work. Skilled workers include (i) carpenters, (ii)

electricians, (iii) masons, (iv) painters, (v) plumbers, and (vi) tile workers. Data for June 2022 was not collected.

THE WORLD BANK 3

AFGHANISTAN ECONOMIC MONITOR

3. REVENUES

The ITA collected AFN135.9 billion in the first nine months of the fiscal year 2022—with a higher share coming

from taxes collected at borders and non-tax sources.

3.2 SHARE OF INLAND & CUSTOMS REVENUES IN TOTAL

3.1. TOTAL REVENUE COLLECTION—CUMULATIVE (AFN BILLIONS)

COLLECTIONS

2020 2021 2022

200

160

ARD, 42%

120

80

40

0 ACD,

58%

M6 - Sunbula

M2 - Sawr

M8 - Aqrab

M9 - Qaws

M4 - Saratan

M3 - Jawza

M5 - Asad

M7 - Meezan

M1 - Hamal

Source: Ministry of Finance., Note: The Afghan fiscal calendar month, Hamal, runs from March 21-April 20.

3.2. REVENUE COLLECTED AT THE BORDER (AFN BILLION) 3.3 PERCENT SHARE OF COLLECTIONS AT BORDER CROSSINGS

Tajikistan, Others, 1%

Avg 2022 Avg 2021 Avg 2020 1%

12 Turkmenistan,

Avg 2022 Avg 2021 Avg 2020

10 Uzbekistan,

10%

8

6

Iran, 14% Pakistan,

52%

4

0

Sawr

Qaws

Saratan

Aqrab

Jawza

Meezan

Asad

Sunbula

Hamal

M5 -

M2 -

M9 -

Iran - Turkmenistan,

M8 -

M1 -

M3 -

M6 -

M4 -

M7 -

17%

3.4 INLAND REVENUE COLLECTION (AFN BILLIONS) 3.5 PERCENT SHARE OF ARD COLLECTIONS FROM SOURCES

2022 2021 2020 STO Audit Dept

20 3% 2%

Avg 2022 Avg 2021 Avg 2020

18

16

Mustofiats

14 15%

12

10

8

Ministries

6 54%

4

2 Tax Servics

0 Department,

M1 - M2 - M3 - M4 - M5 - M6 - M7 - M8 - M9 - 26%

Hamal Sawr Jawza Saratan Asad Sunbula Meezan Aqrab Qaws

Source: Ministry of Finance.

THE WORLD BANK 4

AFGHANISTAN ECONOMIC MONITOR

4. FOREIGN EXCHANGE AND FINANCIAL MARKET OPERATIONS

The average exchange rate AFN/USD for 2022 was 89.9, compared to 84.5 in 2021—a 6 percent

depreciation on average.

4.1. EXCHANGE RATE - INDEX JULY 2021 (HIGHER = DEPRECIATION)

AFN/Euro AFN/PKR AFN/INR AFN/IRT AFN/USD AFN/CY

160

140

120

100

80

60

12/31/2022

10/23/2021

11/20/2021

12/18/2021

10/22/2022

11/19/2022

12/17/2022

1/15/2022

4/23/2022

7/31/2021

8/14/2021

8/28/2021

9/11/2021

9/25/2021

10/9/2021

11/6/2021

12/4/2021

1/1/2022

1/29/2022

2/12/2022

2/26/2022

3/12/2022

3/26/2022

4/9/2022

5/7/2022

5/21/2022

6/4/2022

6/18/2022

7/2/2022

7/16/2022

7/30/2022

8/13/2022

8/27/2022

9/10/2022

9/24/2022

10/8/2022

11/5/2022

12/3/2022

4.2. EXCHANGE RATE – DEPRECIATION BY CURRENCY SINCE AUGUST 15, 2021

1-Feb- 28-Feb- 31-Mar- 27-Apr- 29-May- 29-Jun- 28-Jul- 30-Aug- 29-Sep- 27-Oct- 30-Nov- 31-Dec-

22 22 22 22 22 22 22 22 22 22 22 22

AFN/Eur -12.66 -5.41 -0.14 4.17 1.71 4.16 6.65 9.62 14.13 11.61 7.22 2.95

AFN/PKR -7.62 0.35 3.98 8.38 12.28 18.88 40.73 24.25 33.15 38.25 40.19 48.18

o

AFN/INR -4.25 7.63 9.53 11.41 9.55 10.55 9.05 11.23 12.50 13.26 15.18 13.41

AFN/IRT -13.51 -11.11 -8.57 -3.03 0.00 10.34 10.34 10.34 10.34 23.08 23.08 33.33

AFN/US$ -14.45 -6.16 -2.68 0.22 -3.38 -1.87 -3.98 -2.35 -2.36 -2.03 -2.61 -3.37

AFN/CY -14.72 -6.38 -4.59 2.33 -6.06 -0.32 -2.33 -1.22 2.80 1.65 2.40 -0.50

D

Source: Data from DAB, World Bank staff elaboration.

Money service providers continue to report some foreign currency shortages.

4.3. AVAILABILITY OF FOREIGN EXCHANGE ACCORDING TO MONEY SERVICE PROVIDERS

Adequate Limited Unavailable

100%

80%

60%

40%

20%

0%

UAE Dirhams

UAE Dirhams

UAE Dirhams

UAE Dirhams

UAE Dirhams

UAE Dirhams

UAE Dirhams

UAE Dirhams

UAE Dirhams

UAE Dirhams

US Dollars

Iranian Tomans

US Dollars

Iranian Tomans

US Dollars

Iranian Tomans

US Dollars

Iranian Tomans

US Dollars

Iranian Tomans

US Dollars

Iranian Tomans

US Dollars

Iranian Tomans

US Dollars

Iranian Tomans

US Dollars

Iranian Tomans

US Dollars

Iranian Tomans

Pakistani Rupees

Pakistani Rupees

Pakistani Rupees

Pakistani Rupees

Pakistani Rupees

Pakistani Rupees

Pakistani Rupees

Pakistani Rupees

Pakistani Rupees

Pakistani Rupees

March April May June July August September October November December

Source: Survey data collected by the World Bank’s Third-Party Monitoring Agent by visiting 144 MSPs in 48 markets in the country.

Note: Includes banks, hawala operators, and informal currency exchangers.

THE WORLD BANK 5

AFGHANISTAN ECONOMIC MONITOR

Firms still cannot withdraw AFN and US$ from pre-August bank deposits. However, the situation is much better

for individuals, as most banks can service their clients.

4.4. WEEKLY WITHDRAWALS - FIRMS (AFN MILLIONS) 4.5. WEEKLY WITHDRAWALS – FIRMS (USD)

Reported amount able to be withdrawn in Million AFS Reported amount able to be withdrawn in USD

Regulated limit in AFS Regulated limit in USD

3.0 30,000

2.5 25,000

2.0 20,000

1.5 15,000

1.0

10,000

0.5

5,000

0.0

-

July

February

August

January

October

March

April

June

November

May

December

September

December

July

January

August

October

February

March

April

June

November

May

December

December

September

4.6. MONTHLY WITHDRAWALS - INDIVIDUALS (AFN MILLIONS) 4.7. MONTHLY WITHDRAWALS – INDIVIDUALS (USD)

Reported amount able to be withdrawn in AFS Reported amount able to be withdrawn in USD

Regulated limit in AFS Regulated limit in USD

30,000 400

25,000 350

300

20,000 250

15,000 200

150

10,000

100

5,000 50

0 0

July

February

January

April

August

March

October

November

May

June

December

September

December

July

February

August

January

April

October

November

March

May

June

December

December

September

4.8. AVERAGE MONTHLY WITHDRAWAL – INDIVIDUAL (AFS)

Source: Survey data collected by the World Bank’s Third-Party Monitoring Agent.

Note: Regulated limit as stipulated by DAB. Reported amount able to be withdrawn as reported by individual respondents to the Third-Party Monitoring Agent

survey.

THE WORLD BANK 6

AFGHANISTAN ECONOMIC MONITOR

Cash and bank accounts are the two most common means to receive salary payments. However, female civil

servants also mentioned Hawala as a key mode of salary payment.

4.9. MODE OF SALARY PAYMENT (2165 RESPONDENTS) 4.10. COMPOSITION OF MODE OF PAYMENT (BY GENDER)

Bank Account In Cash

Male Female

In Cash & Bank Account Bank Account & Hawala

Hawala Mobile Money Operator (MMO)

100% 91%

87%

90%

0.9% 0.0%

0.2% 80%

70%

1.2%

10.9% 60%

50%

40%

30%

20% 11%

10% 5% 5% 1.5%

1% 0.0%

0%

86.8% Bank Account In Cash Hawala Others

The key challenges when withdrawing salaries are crowding in branches and the liquidity shortage. Poor staff

behavior is another key issue – particularly in the case of females.

4.11. CHALLENGES FACED WHEN WITHDRAWING SALARIES

Crowding at the bank

80% Male Female

Lack of funds at the bank

Crowding and lack of funds at the bank 70%

Damaged or old notes provided 60%

Crowding at the bank and Damaged or old notes provided 50%

Others 40%

Dec-22

30%

Nov-22 20%

Oct-22 10%

Sep-22 0%

Damaged or old notes

Crowding at the bank and

Lack of funds at the bank

Crowding at the bank

Others

Crowding and lack of

Poor bank staff behaviour

Aug-22

Damaged or old notes

funds at the bank

Jul-22

Jun-22 provided

provided

May-22

Apr-22

Mar-22

0% 20% 40% 60% 80% 100%

Since the beginning of 2022, salaries for all civil servants have been paid regularly and in most cases.

Moreover, females are reported to be paid more regularly than males over the last two months.

4.12. CIVIL SERVANTS RECEIVED SALARIES DURING THE LAST 4.13. MALE VS FEMALE RESPONDENTS RECEIVING SALARIES IN

THREE MONTHS THE LAST THREE MONTHS

No, 3% 120% Female Yes (%) Male Yes (%)

100%

80%

60%

40%

Yes, 97% 20%

0%

Aug-22

May-22

Sep-22

Oct-22

Nov-22

Mar-22

Jun-22

Apr-22

Dec-22

Jul-22

Source: Survey data collected by the World Bank’s Third-Party Monitoring Agent.

Note: Data for civil servants for June 2022 is not available.

THE WORLD BANK 7

AFGHANISTAN ECONOMIC MONITOR

5. TRADE DEVELOPMENTS

The imports and exports rebounded since Q4-2021 and remained on an upward trajectory in 2022. The

country exhibited strong export performance during 2022.

5.1. AFGHANISTAN’S MAJOR EXPORT DESTINATIONS (2019 – 2022) 5.2. AFGHANISTAN EXPORTS (US$ 1.7 BILLION) - JAN – NOV 2022

2019 2020 2021 2022* Others 109.5

Major Export Destination

1200 Iran 26.9

Tajikistan 34.1

1000 United Arab Emirates 36.7

Uzbekistan 41.9

800 India 339.2

1086.4

USD Million

Pakistan

600

Other 41.5

Base Metals 28.7

400

Major Exports

Prepared Foodstuffs 37.5

200 Textiles 163.1

Mineral Products 470.0

0 Vegetable Products 933.9

Uzbekistan

UAE

Iran

Pakistan

Turkey

Other

India

China

1200.0

200.0

400.0

600.0

1000.0

800.0

0.0

Source: NSIA data. The 2022 data is for 11 months and sourced from customs Source: ASYCUDA.

(ASYCUDA)

6. PROVISION OF HEALTH SERVICES

The Health Emergency Response (HER) project supports critical services at 2300 facilities.

6.1. SERVICES DELIVERED AT 2300 HER FINANCED HEALTH FACILITIES DURING 2022

Ante-natal care visits Births at project facilities

350,000

300,000

250,000

200,000

150,000

100,000

50,000

0

July

August

February

January

April

October

November

March

May

June

December

September

Source: Survey data collected by the World Bank’s Third-Party Monitoring Agent.

THE WORLD BANK 8

AFGHANISTAN ECONOMIC MONITOR

Data notes: The Afghanistan Economic Monitor is produced by World Bank staff, drawing from a range of data sources. Reflecting

limited data availability, data sources and coverage may vary between editions. Data sources are cited for each chart. The

Afghanistan Economic Monitor uses data from the following sources: (i) official statistics on prices produced by the NSIA; (ii) data on

prices and wages collected from all provinces by the World Food Program; (iii) data on the availability of foreign exchange and

cash collected from 22 provinces by the World Bank’s Third Party Monitoring Agent; (iv) data on exchange rates collected and

reported by DAB; and (v) data on trade from the NSIA.

For analytical products on Afghanistan, kindly visit https://www.worldbank.org/en/country/afghanistan.

THE WORLD BANK 9

You might also like

- Analysis of CHF Exchange Rate, 2010-11Document12 pagesAnalysis of CHF Exchange Rate, 2010-11Joshua GonsalvesNo ratings yet

- HDL Buspro Wireless Price List Rev1.0 Feb 2021Document3 pagesHDL Buspro Wireless Price List Rev1.0 Feb 2021Necko VejzaNo ratings yet

- Vietnam Hotel MarketView - Q1 - 2020 PDFDocument4 pagesVietnam Hotel MarketView - Q1 - 2020 PDFmtuấn_606116No ratings yet

- MacroScenario-BRAZIL Apr22Document5 pagesMacroScenario-BRAZIL Apr22Matheus AmaralNo ratings yet

- Afghanistan Economic Monitor 25 August 2022Document7 pagesAfghanistan Economic Monitor 25 August 2022Hussain AliNo ratings yet

- The Annual Economic Bulletin FY2020/21Document79 pagesThe Annual Economic Bulletin FY2020/21Mai El RihanyNo ratings yet

- CRISIL Trade First Cut-Oct2020Document4 pagesCRISIL Trade First Cut-Oct2020KARTHIK PRASADNo ratings yet

- India - Sectoral Deployment of Bank Credit - March 2024Document10 pagesIndia - Sectoral Deployment of Bank Credit - March 2024purveshparekhNo ratings yet

- Chapter 1 PDFDocument18 pagesChapter 1 PDFiqra waseemNo ratings yet

- WheatDocument22 pagesWheattegenNo ratings yet

- EE-lecture 3-Inflation Cost of Living-16Apr23Document11 pagesEE-lecture 3-Inflation Cost of Living-16Apr23Paramjit SinghNo ratings yet

- China Balance-of-PaymentsDocument8 pagesChina Balance-of-Paymentsdaniela.montiel.gomezNo ratings yet

- Sectoral Deployment of Bank Credit - January 2024Document10 pagesSectoral Deployment of Bank Credit - January 2024purveshparekhNo ratings yet

- November 2021 Uk Economy Property Market UpdateDocument7 pagesNovember 2021 Uk Economy Property Market Update344clothingNo ratings yet

- Sectoral Deployment of Bank Credit - April 2024Document10 pagesSectoral Deployment of Bank Credit - April 2024purveshparekhNo ratings yet

- Coanc 8Document75 pagesCoanc 8Devilrinaldo associatesNo ratings yet

- 1638528631MRE Nov 2021Document18 pages1638528631MRE Nov 2021Diksha SinghNo ratings yet

- Air Transport Outlook Q23Document18 pagesAir Transport Outlook Q23Greg VenanceNo ratings yet

- Aviation Insider Newsletter Jan2022Document20 pagesAviation Insider Newsletter Jan2022Ismael GouwsNo ratings yet

- Jsil FMR Apr 2024-3Document26 pagesJsil FMR Apr 2024-3alicashcowexpertNo ratings yet

- Economic Research - IndiaCPIIIP June - Centrum 12072023Document5 pagesEconomic Research - IndiaCPIIIP June - Centrum 12072023OIC TestNo ratings yet

- Bulletin - CPI December 2021.Document11 pagesBulletin - CPI December 2021.kingsleyNo ratings yet

- Indonesia Trade Policies and UpdatesDocument27 pagesIndonesia Trade Policies and UpdateskennydoggyuNo ratings yet

- Global Economic Outlook 2021Document44 pagesGlobal Economic Outlook 2021malimalineeNo ratings yet

- MacroScenario-BRAZIL Jan22Document5 pagesMacroScenario-BRAZIL Jan22Matheus AmaralNo ratings yet

- State of The Market Presentation - September 2022Document23 pagesState of The Market Presentation - September 2022Emmanuel Manex KubikwaNo ratings yet

- Measuring Money SupplyDocument22 pagesMeasuring Money SupplyElvin DavidNo ratings yet

- Markets at 60000 Level Our View and RecommendationDocument7 pagesMarkets at 60000 Level Our View and Recommendationamit raviNo ratings yet

- Bank of Tanzania: AaaaaDocument30 pagesBank of Tanzania: AaaaaaureliaNo ratings yet

- MER February 2022Document29 pagesMER February 2022Arden Muhumuza KitomariNo ratings yet

- NAMC Food Price Monitor May 2023Document16 pagesNAMC Food Price Monitor May 2023xolaneNo ratings yet

- The Richest 20 Percent Facing More Inflation Than The Poorest 20 PercentDocument4 pagesThe Richest 20 Percent Facing More Inflation Than The Poorest 20 PercentUttiya RoyNo ratings yet

- Royal Government of Bhutan National Statistics Bureau: Consumer Price Index (CPI) : December 2020Document8 pagesRoyal Government of Bhutan National Statistics Bureau: Consumer Price Index (CPI) : December 2020Ojhal RaiNo ratings yet

- Thematic NBFC Mar2022 FinalDocument28 pagesThematic NBFC Mar2022 FinalAjaya SahuNo ratings yet

- Grain and Feed Annual - Hanoi - Vietnam - VM2023-0019Document24 pagesGrain and Feed Annual - Hanoi - Vietnam - VM2023-0019Chin YeeNo ratings yet

- Monthly Economic Review - Jun 2022Document30 pagesMonthly Economic Review - Jun 2022Dan FordNo ratings yet

- Impact and Challenges of Covid-19 On Healthcare Waste Management in A Tertiary Care Teaching Hospital, Hyderabad IndiaDocument10 pagesImpact and Challenges of Covid-19 On Healthcare Waste Management in A Tertiary Care Teaching Hospital, Hyderabad IndiaIJAR JOURNALNo ratings yet

- Jsil FMR Nov 2022Document25 pagesJsil FMR Nov 2022Krrish LaraieNo ratings yet

- The Coming Collapse of Inflation and How To Benefit From It July 2022Document29 pagesThe Coming Collapse of Inflation and How To Benefit From It July 2022Dinesh RupaniNo ratings yet

- Oilseeds and Products Annual Jakarta Indonesia 03-15-2021Document24 pagesOilseeds and Products Annual Jakarta Indonesia 03-15-2021adimas baruNo ratings yet

- Presentacion-4 LIDocument30 pagesPresentacion-4 LIAlexssdud FloertsNo ratings yet

- India Oil Prices - Research Note - FINALDocument10 pagesIndia Oil Prices - Research Note - FINALBharat NarrativesNo ratings yet

- Inflation and Infection To Influence Fed DecisionDocument4 pagesInflation and Infection To Influence Fed DecisionSushant PatilNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- July 2021 MerDocument32 pagesJuly 2021 MerArden Muhumuza KitomariNo ratings yet

- GASF2 ND QTR FY2023Document39 pagesGASF2 ND QTR FY2023Newsweek TimesNo ratings yet

- AKDOF2 ND QTR FY2023Document38 pagesAKDOF2 ND QTR FY2023Newsweek TimesNo ratings yet

- Et - Mar 23Document2 pagesEt - Mar 23coureNo ratings yet

- EU Trade With Vietnam2021Document40 pagesEU Trade With Vietnam2021leehonsoNo ratings yet

- Monetary Policy Mar-21-3Document1 pageMonetary Policy Mar-21-3kalimNo ratings yet

- Monthly Economic Review - Jan 2021Document32 pagesMonthly Economic Review - Jan 2021Carl RossNo ratings yet

- Jsil FMR Dec 2022Document24 pagesJsil FMR Dec 2022MUHAMMAD QASIMNo ratings yet

- InflationDocument42 pagesInflationTwinkle MehtaNo ratings yet

- Boosting The Economy Through Direct InvestmentsDocument36 pagesBoosting The Economy Through Direct InvestmentsreyramshaNo ratings yet

- Wholesale Inflation - June 2022Document5 pagesWholesale Inflation - June 2022vrititrikhaNo ratings yet

- Echap 04Document39 pagesEchap 04EuphoriaNo ratings yet

- Grain and Feed Update - Bangkok - Thailand - TH2023-0070Document11 pagesGrain and Feed Update - Bangkok - Thailand - TH2023-0070dicky muharamNo ratings yet

- CMS Report 2024Document20 pagesCMS Report 2024Nilesh KumarNo ratings yet

- SFMRDocument6 pagesSFMRAli RazaNo ratings yet

- 03FMR - March 2021Document1 page03FMR - March 2021Ali RazaNo ratings yet

- AllfmrDocument11 pagesAllfmrAli RazaNo ratings yet

- Review of The Subject International EconomicsDocument64 pagesReview of The Subject International EconomicsPhan Hà TrangNo ratings yet

- 100 Deposit Bonus TNCDocument4 pages100 Deposit Bonus TNCNaufal TsabitadzNo ratings yet

- Lecture 21 ME Ch.15 Foreign Exchange MarketDocument50 pagesLecture 21 ME Ch.15 Foreign Exchange MarketAlif SultanliNo ratings yet

- Sovereign 1 Redemption OverviewDocument8 pagesSovereign 1 Redemption OverviewLinda Deavers100% (2)

- Masala BondsDocument3 pagesMasala Bondsayantripathi29No ratings yet

- Housing in Argentina Augusto CarosiDocument8 pagesHousing in Argentina Augusto CarosiSebastianVvvNo ratings yet

- Ariba Network SMP Quadrem Fee Schedule ChileDocument1 pageAriba Network SMP Quadrem Fee Schedule ChileHugo MuñozNo ratings yet

- Rva Academy Kenya Fee StructureDocument1 pageRva Academy Kenya Fee StructureCynthia Ligaga100% (1)

- Economics NSC P1 Memo Nov 2022 EngDocument22 pagesEconomics NSC P1 Memo Nov 2022 Engxhanti classenNo ratings yet

- U2. Basic Business VocabularyDocument6 pagesU2. Basic Business VocabularyCiubotaru AlexNo ratings yet

- The Goldenberg Conspiracy The Goldenberg Conspiracy The Game of Paper, Gold, Money and Power - Peter Warutere - September 2005Document16 pagesThe Goldenberg Conspiracy The Goldenberg Conspiracy The Game of Paper, Gold, Money and Power - Peter Warutere - September 2005surambayaNo ratings yet

- SFM Question Book CA Nagendra SahDocument270 pagesSFM Question Book CA Nagendra SahSuman SharmaNo ratings yet

- African Water Utilities: Regional Comparative Utility Creditworthiness Assessment ReportDocument113 pagesAfrican Water Utilities: Regional Comparative Utility Creditworthiness Assessment ReportBakerNo ratings yet

- Islamiya English School, Abu Dhabi.: Grade: 9 Using Money 16Document1 pageIslamiya English School, Abu Dhabi.: Grade: 9 Using Money 16everly.No ratings yet

- 31 USC 5118 D 2 - US CODE Title 31Document2 pages31 USC 5118 D 2 - US CODE Title 31Freeman Lawyer100% (5)

- 6.2 John M. Keynes: Proposal For An International Currency UnionDocument21 pages6.2 John M. Keynes: Proposal For An International Currency UnionGanbayar JavkhlanNo ratings yet

- You Entered Complaint.: Judge HolwellDocument114 pagesYou Entered Complaint.: Judge Holwellkitty katNo ratings yet

- International Economics!!!!!!!!!Document31 pagesInternational Economics!!!!!!!!!Michelle LamsisNo ratings yet

- Resume William JakelDocument3 pagesResume William JakelwkjakelNo ratings yet

- Chapter 15 HW SolutionDocument5 pagesChapter 15 HW SolutionZarifah FasihahNo ratings yet

- Final Project Mukhammadazam 12225188Document14 pagesFinal Project Mukhammadazam 12225188Muhammadazam ShavkatovNo ratings yet

- Brain Quest PaperDocument5 pagesBrain Quest Papergame4gopalNo ratings yet

- International Financial Market Support LectureDocument19 pagesInternational Financial Market Support LectureHa Giang NguyenNo ratings yet

- Hand Sanitizer - Vietnam - Statista Market ForecastDocument1 pageHand Sanitizer - Vietnam - Statista Market ForecastTrần QuỳnhNo ratings yet

- Email From ZimbabweDocument2 pagesEmail From ZimbabweNevin100% (1)

- WEEK-5 Grade 11Document7 pagesWEEK-5 Grade 11Jannelle Kylie LeonoNo ratings yet

- Whose Car Is That? - It's Bill'sDocument14 pagesWhose Car Is That? - It's Bill'sMohammad JunidNo ratings yet

- BellonDocument7 pagesBellonValeria Rendon NoyolaNo ratings yet