Professional Documents

Culture Documents

Hemant 10

Hemant 10

Uploaded by

Adrine KingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hemant 10

Hemant 10

Uploaded by

Adrine KingCopyright:

Available Formats

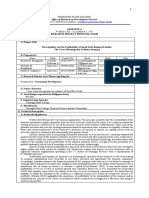

Effect of Financial Literacy on Employees' Investment

Decisions at Kenya Ports Authority, Mombasa

Abstract:

The study examined the impact of financial literacy on investment decisions among Kenya Ports

Authority employees. Results showed that increasing finance skills, debt management knowledge,

savings knowledge, and budgeting knowledge positively impacted investment decisions. The study

recommends regular financial training and education on debt management and borrowing costs.

Key Words:

Cash Management, Debt Management, Savings, Budgeting, Investment Decision Making

Objective:

The study investigates the impact of financial literacy on employees' investment decisions at Kenya

Ports Authority, focusing on cash management, debt management, savings, and budgeting literacy.

Methodology:

The study used a descriptive survey to gather data from 326 Kenya Ports Authority employees, using

simple random sampling and semi-structured questionnaires. Data was analysed using SPSS, Pearson

correlation coefficient, and multiple regression.

Result:

The study aimed to determine the impact of cash management literacy on investment decisions,

using a Likert scale to rate respondents' agreement on various aspects.

REFERENCE:

Kamuzu, B. I., & Kariuki, G. (2019). Effect of financial literacy on employees investment decisions at

Kenya Ports Authority, Mombasa Kenya. The Strategic Journal of Business & Change Management,

6(2), 640–657.

➢ ENROLMENT NO: 237550592149

➢ NAME: HEMNT SOLANKI

➢ MOBILE NO: 8780922621

You might also like

- The Process of Financial Planning, 2nd Edition: Developing a Financial PlanFrom EverandThe Process of Financial Planning, 2nd Edition: Developing a Financial PlanNo ratings yet

- Reserch Methodology LDocument1 pageReserch Methodology LAdrine KingNo ratings yet

- Financial Practices Among Foundation University Employees Basis For Financial PlanDocument9 pagesFinancial Practices Among Foundation University Employees Basis For Financial PlanJournal of Interdisciplinary PerspectivesNo ratings yet

- New Abstract Honorable 19524Document1 pageNew Abstract Honorable 19524robertjeff313No ratings yet

- Improving Savings Mobilization of Micro and Small Enterprises Through Entrepreneurial Financial Literacy1Document18 pagesImproving Savings Mobilization of Micro and Small Enterprises Through Entrepreneurial Financial Literacy1Roel SisonNo ratings yet

- Internship of Canara BankDocument42 pagesInternship of Canara BankSachin KanojiyaNo ratings yet

- Fidelity Bank Budgetary Control PDFDocument25 pagesFidelity Bank Budgetary Control PDFShriya RNo ratings yet

- RRL (Foreign Literature)Document6 pagesRRL (Foreign Literature)Joy QuitorianoNo ratings yet

- AKPK - Financial Behaviour and State of Finanical Well-Being of Malaysian Working Adult PDFDocument70 pagesAKPK - Financial Behaviour and State of Finanical Well-Being of Malaysian Working Adult PDFBazli Hashim100% (1)

- Harambee University: School of Post Graduate Studies Department of Project ManagementDocument5 pagesHarambee University: School of Post Graduate Studies Department of Project ManagementFrikotnaf WakkenNo ratings yet

- Kavya S ReportDocument56 pagesKavya S Reportlakshmankm67No ratings yet

- Relationship Between Financial PlanningDocument24 pagesRelationship Between Financial PlanningabuadamsabbahNo ratings yet

- Research Paper On Banking Sector PDFDocument8 pagesResearch Paper On Banking Sector PDFafmcsmvbr100% (1)

- 10 11648 J Ijefm 20170503 16Document9 pages10 11648 J Ijefm 20170503 16Emmanuel Kweku OdoomNo ratings yet

- Literature Review On Smes FinancingDocument8 pagesLiterature Review On Smes Financingea3j015d100% (1)

- Notes SemDocument16 pagesNotes Semanna.quarshieNo ratings yet

- Title Proposal 1Document22 pagesTitle Proposal 1Robert S CabaluNo ratings yet

- Influence Individual Investors' Financial Statement UsageDocument27 pagesInfluence Individual Investors' Financial Statement UsageSiti KalsomNo ratings yet

- DocumentDocument2 pagesDocumentAmina AliNo ratings yet

- Viado Emgt 220 Activity 1 Article ReviewDocument3 pagesViado Emgt 220 Activity 1 Article ReviewNiña Lei LunaNo ratings yet

- Thesis Belanja ModalDocument9 pagesThesis Belanja Modalfjoxrygig100% (2)

- Synopsis Somashekara MDocument9 pagesSynopsis Somashekara Mswamy yashuNo ratings yet

- Commercial Bank Research PaperDocument5 pagesCommercial Bank Research Paperjppawmrhf100% (1)

- The Value of An Accounting Internship: What Do Accounting Students Really Gain?Document1 pageThe Value of An Accounting Internship: What Do Accounting Students Really Gain?ALYZA ANGELA ORNEDONo ratings yet

- Business Research Ba 304Document12 pagesBusiness Research Ba 304dhanacruz2009No ratings yet

- The Effect of Financial Secrecy and IFRS Adoption On Earnings Quality: A Comparative Study Between Indonesia, Malaysia and SingaporeDocument24 pagesThe Effect of Financial Secrecy and IFRS Adoption On Earnings Quality: A Comparative Study Between Indonesia, Malaysia and SingaporeMarwiyahNo ratings yet

- Course: Business Research MethodsDocument9 pagesCourse: Business Research MethodsBhuvnesh KumawatNo ratings yet

- Relationship Between Financial Literacy and Borrowing Behaviour of Small-Scale Business Owners in Homa Bay Town, KenyaDocument11 pagesRelationship Between Financial Literacy and Borrowing Behaviour of Small-Scale Business Owners in Homa Bay Town, Kenya6bzpxxd5y5No ratings yet

- Effect of Financial Literacy On Utilisation of Financial Services in Kaski DistrictDocument15 pagesEffect of Financial Literacy On Utilisation of Financial Services in Kaski DistrictRajendra LamsalNo ratings yet

- Approved Proposal The Liquidity Issues by Michael Bongalonta - As Revised 2018Document4 pagesApproved Proposal The Liquidity Issues by Michael Bongalonta - As Revised 2018Michael BongalontaNo ratings yet

- Review of Literature (F)Document28 pagesReview of Literature (F)Hussain Wadiwala (Academic Team)No ratings yet

- 1200 Harbin Vol44No10Document15 pages1200 Harbin Vol44No10TitiNo ratings yet

- Determinnt of Banking Profitability - 2Document5 pagesDeterminnt of Banking Profitability - 2thaonguyenpeoctieuNo ratings yet

- Summry of ArticlesDocument3 pagesSummry of Articlesmuhammad amjadNo ratings yet

- Analisis Jurnal AkuntansiDocument21 pagesAnalisis Jurnal AkuntansiAnggi LalitaNo ratings yet

- RESEARCH PAPER GROUP 1Document45 pagesRESEARCH PAPER GROUP 1Princess YmasNo ratings yet

- Honey BingDocument5 pagesHoney Binghanifah putriNo ratings yet

- Effect of Risk, Capital, Good Corporate Governance, Efficiency On Financial Performance at Islamic Banks in IndonesiaDocument8 pagesEffect of Risk, Capital, Good Corporate Governance, Efficiency On Financial Performance at Islamic Banks in IndonesiaInternational Journal of Business Marketing and ManagementNo ratings yet

- The Effect of Commissions and Fees On The Financial Performance of Commercial Banks in Kenya: The Moderating Role of Virtual BankingDocument16 pagesThe Effect of Commissions and Fees On The Financial Performance of Commercial Banks in Kenya: The Moderating Role of Virtual BankingVDC CommerceNo ratings yet

- Cash Planning and Financial Performance of Private Secondary Schools in Ibanda Municipality, Ibanda District-Western UgandaDocument5 pagesCash Planning and Financial Performance of Private Secondary Schools in Ibanda Municipality, Ibanda District-Western Ugandaajmrr editorNo ratings yet

- Effects of Internal Control Systems On Credibility of Financial Statements in SACCOS. A Case of Kyamuhunga People's Co-Operative Savings and Credit Society Limited BushenyDocument18 pagesEffects of Internal Control Systems On Credibility of Financial Statements in SACCOS. A Case of Kyamuhunga People's Co-Operative Savings and Credit Society Limited BushenyKIU PUBLICATION AND EXTENSIONNo ratings yet

- Role of Agent Banking Services in Promot PDFDocument27 pagesRole of Agent Banking Services in Promot PDFAyesha AsifNo ratings yet

- 1 PBDocument18 pages1 PBsamobenjamin26No ratings yet

- Research Proposal Key WordsDocument4 pagesResearch Proposal Key WordsLorainne ParungaoNo ratings yet

- Research Papers Related To Sri Lanka Software IndustryDocument7 pagesResearch Papers Related To Sri Lanka Software Industryefeq3hd0No ratings yet

- Assessing The Impact of Mobile Money Services On The Profitability of Banks in Ghana: A Case Study of GCB BankDocument35 pagesAssessing The Impact of Mobile Money Services On The Profitability of Banks in Ghana: A Case Study of GCB Bankindex PubNo ratings yet

- Cash Management Practices-7250Document10 pagesCash Management Practices-7250Eyob FirstNo ratings yet

- Chapter TwoDocument21 pagesChapter Twoafolabidairo5No ratings yet

- Sukaina - Business ResearchDocument2 pagesSukaina - Business ResearchVarun AVNo ratings yet

- Dissertation On Impact of Capital Structure On ProfitabilityDocument5 pagesDissertation On Impact of Capital Structure On ProfitabilityWriteMyPaperForMeUKNo ratings yet

- A Graduate Research Project Proposal On "Financial Literacy Among Business Graduate Students of Kathmandu"Document7 pagesA Graduate Research Project Proposal On "Financial Literacy Among Business Graduate Students of Kathmandu"Binay Acharya100% (5)

- 1.1 Introduction About The Internship:: "A Study On Financial Statement Analysis"Document69 pages1.1 Introduction About The Internship:: "A Study On Financial Statement Analysis"Brian Shepherd50% (2)

- Literature Review On Financial InnovationDocument6 pagesLiterature Review On Financial Innovationc5mr3mxf100% (1)

- Literature Review On Agency Banking in KenyaDocument9 pagesLiterature Review On Agency Banking in Kenyaafdtywgdu100% (1)

- AbstractDocument1 pageAbstractgudataaNo ratings yet

- Capital BudjetingDocument120 pagesCapital BudjetingSammeta Jagan MohanNo ratings yet

- Thesis On Working Capital Management PDFDocument5 pagesThesis On Working Capital Management PDFgj4m3b5b100% (2)

- Key Words: International Financial Reporting Standard, Financial Reporting, Comparability, Accounting Quality, Financial Statements of BanksDocument19 pagesKey Words: International Financial Reporting Standard, Financial Reporting, Comparability, Accounting Quality, Financial Statements of BanksAbdullah Hish ShafiNo ratings yet

- Assessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanDocument5 pagesAssessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanSunita MishraNo ratings yet

- Share MM Module 2Document52 pagesShare MM Module 2Adrine KingNo ratings yet

- Chap 003Document20 pagesChap 003Adrine KingNo ratings yet

- 11 HemantDocument1 page11 HemantAdrine KingNo ratings yet

- Dairy Se 2023 Mba 2.0Document19 pagesDairy Se 2023 Mba 2.0Adrine KingNo ratings yet

- Ultra VisionDocument7 pagesUltra VisionAdrine KingNo ratings yet

- INFLATIONDocument19 pagesINFLATIONAdrine KingNo ratings yet