Professional Documents

Culture Documents

Cash Flow Statements Solutions

Cash Flow Statements Solutions

Uploaded by

Harry ChaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow Statements Solutions

Cash Flow Statements Solutions

Uploaded by

Harry ChaoCopyright:

Available Formats

a

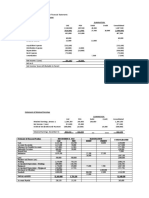

Calculation

Electricity 150

Insurance 180

Display cabinets 600

GST paid $ 930

b BOOF HEAD

Cash Flow Statement for the year ended 30 June 2025

$ $

OPERATING ACTIVITIES

Cash Sales 50 000

Receipts from Accounts Receivable 25 000

GST Received 5 000 80 000

Payments to Accounts Payable (24 000)

Wages (28 000)

GST Paid (930)

Electricity (1 500)

Insurance (1 800) (56 230)

Net Cash Flows from Operations 23 770

INVESTING ACTIVITIES

Display Cabinets (6 000)

Net Cash Flows from Investing Activities (6 000)

FINANCING ACTIVITIES

Capital Contribution 10 000

Drawings (12 000)

Net Cash Flows from Financing Activities (2 000)

Net Increase (Decrease) in Cash 15 770

Bank Balance at Start (13 500)

Bank Balance at End 2 270

c

Explanation Classified as a Financing Outflow

as it is a cash flow related to a change in the firm’s financial structure

(i.e. it decreases Owner’s Equity)

Reason To keep the bank balance out of overdraft

To help fund the purchase of the display cabinets

Explanation It aids decision-making by classifying sources and uses of funds, allowing the

owner to: identify whether Net Cash Flows from Operations is sufficient to

cover other cash requirements / assess its performance in meeting its cash

targets OR assists in planning for future cash activities by providing a basis

for cash targets for the future (in the next Budgeted Cash Flow Statement).

You might also like

- Unit 3 Study GuideDocument3 pagesUnit 3 Study Guide高瑞韩No ratings yet

- Working: Lunch Dinner Sales Units 7800 20280 Sales Price 12 25 93600 507000Document8 pagesWorking: Lunch Dinner Sales Units 7800 20280 Sales Price 12 25 93600 507000kudkhanNo ratings yet

- 2019 Unit 4 Budgeting SAC Solution BookDocument3 pages2019 Unit 4 Budgeting SAC Solution BookLachlan McFarlandNo ratings yet

- Agabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cDocument7 pagesAgabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cJasmine Cate JumillaNo ratings yet

- Akuntansi Keuangan Menengah 2 Asistensi - Tim Asdos Akm 2Document2 pagesAkuntansi Keuangan Menengah 2 Asistensi - Tim Asdos Akm 2Muhamad Rizal DinyatNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Activity - Financial StatementsDocument5 pagesActivity - Financial StatementsPhilip Jhon BayoNo ratings yet

- Statement of Accounting Cash FlowsDocument1 pageStatement of Accounting Cash FlowsUtkarsh GurjarNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsAira Dane VillegasNo ratings yet

- In Philippine PesoDocument4 pagesIn Philippine PesoAitanna Sophia LagunaNo ratings yet

- Activity For Chapter 3 (Financial Statements, Cash Flow and Taxes)Document2 pagesActivity For Chapter 3 (Financial Statements, Cash Flow and Taxes)pamela dequillamorteNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Ws CmaDocument11 pagesWs CmaVRNo ratings yet

- CFS DegieDocument3 pagesCFS DegieMarshall james G. RamirezNo ratings yet

- EconomicsDocument7 pagesEconomicsOmkar JhaNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- Completing The Accounting Cycle: Service Concern: Subject-Descriptive Title Subject - CodeDocument12 pagesCompleting The Accounting Cycle: Service Concern: Subject-Descriptive Title Subject - CodeRose LaureanoNo ratings yet

- 2 Cash Flow StatementDocument18 pages2 Cash Flow Statementchetan.200002No ratings yet

- Financial Accounting AOLDocument7 pagesFinancial Accounting AOLNatasha HerlianaNo ratings yet

- Working Paper Part 2Document3 pagesWorking Paper Part 2KEITH JEROME VIERNESNo ratings yet

- UntitledDocument13 pagesUntitledTejasree SaiNo ratings yet

- Master Budgeting - Blades Pty LTDDocument14 pagesMaster Budgeting - Blades Pty LTDAdi KurniawanNo ratings yet

- Financial Reporting, Statement and Analysis Assignment For 2 Semester Name: Dishant Tibrewal SUBMISSION DATE - 16/07/21Document3 pagesFinancial Reporting, Statement and Analysis Assignment For 2 Semester Name: Dishant Tibrewal SUBMISSION DATE - 16/07/21Dishant TibrewalNo ratings yet

- ACT320 Assignment ProjectDocument11 pagesACT320 Assignment ProjectMd. Shakil Ahmed 1620890630No ratings yet

- Castillo, Erica Miles - Bsais 1aDocument29 pagesCastillo, Erica Miles - Bsais 1aMiles CastilloNo ratings yet

- Ipsas 2&3 (Q&a)Document10 pagesIpsas 2&3 (Q&a)VannyNo ratings yet

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Document7 pages1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- Cash Flow Master Question With SolutionDocument6 pagesCash Flow Master Question With Solutionft2vny7nytNo ratings yet

- Lembar JWB PD ANGKASADocument53 pagesLembar JWB PD ANGKASAernyNo ratings yet

- Audit of FS QuizDocument3 pagesAudit of FS QuizGwyneth TorrefloresNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Fabm 1Document5 pagesFabm 1Lady Aleah Naharah P. AlugNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- LkhgyDocument2 pagesLkhgyDynNo ratings yet

- Yearly Ledger Changes: AssetsDocument8 pagesYearly Ledger Changes: AssetsMiguel OrjuelaNo ratings yet

- Financial Management Economics For Finance 2023 1671444516Document36 pagesFinancial Management Economics For Finance 2023 1671444516RADHIKANo ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Government Accounting (Chapter 13 and 14) - Florentin, Shaniah Racelle D. - BSA 3BDocument10 pagesGovernment Accounting (Chapter 13 and 14) - Florentin, Shaniah Racelle D. - BSA 3BRacelle FlorentinNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- FAR 05 Task PerformanceDocument2 pagesFAR 05 Task PerformanceCla JoyceNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- B2 2022 May AnsDocument15 pagesB2 2022 May AnsRashid AbeidNo ratings yet

- Irma2 104935Document1 pageIrma2 104935Al QadriNo ratings yet

- FINANCIAL MANAGEMENT AssignmentDocument2 pagesFINANCIAL MANAGEMENT Assignmentfinn mertensNo ratings yet

- Evi2 104950Document1 pageEvi2 104950Al QadriNo ratings yet

- Statement of CFDocument1 pageStatement of CFnr1520122No ratings yet

- Cash Flow PDFDocument1 pageCash Flow PDFichaNo ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- Cash Flow Indirect and DirectDocument2 pagesCash Flow Indirect and DirectKatherine Borja0% (1)

- Unit VI CashFlowStatementDocument32 pagesUnit VI CashFlowStatementSmiti RupaNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocument6 pagesFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaNo ratings yet

- Chegg SolutionsDocument4 pagesChegg SolutionsZenika PetersNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Identify Angle Relationship - QuizizzDocument12 pagesIdentify Angle Relationship - QuizizzHarry ChaoNo ratings yet

- Force and Momentum - QuizizzDocument15 pagesForce and Momentum - QuizizzHarry ChaoNo ratings yet

- Refraction & Snell's Law - QuizizzDocument8 pagesRefraction & Snell's Law - QuizizzHarry ChaoNo ratings yet

- Similar Triangle ExerciseDocument4 pagesSimilar Triangle ExerciseHarry ChaoNo ratings yet

- Grey Kangaroo 2022 PaperDocument4 pagesGrey Kangaroo 2022 PaperHarry ChaoNo ratings yet

- 2023 Chapter Competition Answer KeyDocument8 pages2023 Chapter Competition Answer KeyHarry ChaoNo ratings yet

- 2 - Dividing Income Among Partners - ExamplesDocument4 pages2 - Dividing Income Among Partners - ExamplesJohnNo ratings yet

- 09 CH08Document22 pages09 CH08girmayadane7No ratings yet

- YSf PX XJW Wupb 1627408405774Document4 pagesYSf PX XJW Wupb 1627408405774Yuddhaveer Singh SuryavanshiNo ratings yet

- Personal Account Opening Form - 221219 - 113037Document6 pagesPersonal Account Opening Form - 221219 - 113037Tounkara MohamedNo ratings yet

- Managerial EconomicsDocument15 pagesManagerial EconomicsAditi WaliaNo ratings yet

- Joint VentureDocument42 pagesJoint Ventureadityaupreti2003No ratings yet

- BillDocument1 pageBillTabrez AhamadNo ratings yet

- Statement Bank MARCH Just White LLC 7d68313aa6Document8 pagesStatement Bank MARCH Just White LLC 7d68313aa6Madelyn VasquezNo ratings yet

- Tsigereda TsehayDocument112 pagesTsigereda Tsehaymetekyamarkos0947No ratings yet

- 2016Document224 pages2016ashwin moviesNo ratings yet

- Agreement For China To Use U.S. Chips To Build SupercomputersDocument139 pagesAgreement For China To Use U.S. Chips To Build SupercomputersjohnNo ratings yet

- Accounting For Merchandising Operations - Chapter 6 Test QuestionsDocument31 pagesAccounting For Merchandising Operations - Chapter 6 Test QuestionsNoyb71% (7)

- Export Mktg. PPT Slides (18!10!2020) (Dr. DHOND)Document94 pagesExport Mktg. PPT Slides (18!10!2020) (Dr. DHOND)vishrut.damaniNo ratings yet

- Unit 1.4 - Procedure For Procuring Capital GoodsDocument18 pagesUnit 1.4 - Procedure For Procuring Capital Goodsmusonza murwiraNo ratings yet

- Instructions To Bidder ITB - Rev.01Document20 pagesInstructions To Bidder ITB - Rev.01stegenNo ratings yet

- ECOMMERCEDocument6 pagesECOMMERCESushwet AmatyaNo ratings yet

- Puerto Madero A Project CritqueDocument6 pagesPuerto Madero A Project CritqueSimonaNo ratings yet

- Rutas Group 5Document17 pagesRutas Group 5akshatNo ratings yet

- Lessons Learned Over The Last 36 YearsDocument8 pagesLessons Learned Over The Last 36 YearsScribd-downloadNo ratings yet

- Money AnswersDocument1 pageMoney AnswersAya LarosaNo ratings yet

- Q4 Tle 9 WK3Document5 pagesQ4 Tle 9 WK3Mj MartNo ratings yet

- Bono AptDocument64 pagesBono Aptjosue henry vasquez neyeraNo ratings yet

- How Africa TradesDocument245 pagesHow Africa TradesUchennaNo ratings yet

- Ishares Core Growth Etf Portfolio: Key FactsDocument2 pagesIshares Core Growth Etf Portfolio: Key FactsTushar PatelNo ratings yet

- Entrepreneurship Module6Document24 pagesEntrepreneurship Module6Marilou YanocNo ratings yet

- REVIEWERDocument3 pagesREVIEWERMa. Cristina PanganNo ratings yet

- Common Stock Cash Note Payable Cash Cash Services Cash Note Payable Services A/P Services A/R A/P A/R Cash CashDocument3 pagesCommon Stock Cash Note Payable Cash Cash Services Cash Note Payable Services A/P Services A/R A/P A/R Cash CashĐàm Quang Thanh TúNo ratings yet

- CG - Rating - BECGDocument30 pagesCG - Rating - BECGVaidehi Shukla100% (1)

- Investment Models - GS 3 AICSCCDocument18 pagesInvestment Models - GS 3 AICSCCArav-வும் Sri-யும்No ratings yet