Professional Documents

Culture Documents

TAX Sel Declaration Non Taxable Seller Form

TAX Sel Declaration Non Taxable Seller Form

Uploaded by

sketchupa06Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAX Sel Declaration Non Taxable Seller Form

TAX Sel Declaration Non Taxable Seller Form

Uploaded by

sketchupa06Copyright:

Available Formats

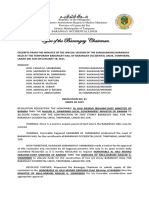

11/01/2024

Date: ………………….

Amazon Seller Services Private Limited

No.26/1, Brigade Gateway, World Trade Centre,

Dr. Rajkumar Road, Bangalore-560055

Undertaking to Sell GST Exempt Products on www.amazon.in

Dear Sir(s),

Raj Goswami

This is to confirm that I/ we ……………………………………………………………………………………………………. (“Seller”),

BYJPG5446E

with (PAN) ……………………………………………………….. having my/ our main place of business at

(address)…………………………………………………………………………………………..………………………………………………………

………………………………………..................................................................................................................., am/

are registered with Amazon Seller Services Private Limited (“Amazon”) as a seller exclusively selling non-

taxable products (“Products”) on www.amazon.in (“Amazon Marketplace”). I have agreed to avail

Fulfilment by Amazon (“FBA”) services from Amazon under the terms of the ‘Amazon Services Business

Solutions Agreement’ (“BSA”).

In order to claim exemption from GST procedures, I/ we hereby declare and confirm that:

1. I/We are sellers of non-taxable product only such as (add product name) (Ex: Books/Seeds/ Flags

etc.) …..……………………………… which are currently exempted under the GST law and which do not

attract levy of GST under the ………………………………………………

MAHARASHTRA state GST laws;

2. The products which I/we sell are manufactured and produced in India;

3. In the event I/we send any product(s) to Amazon’s Fulfillment Centre on which GST is

leviable, I/we shall be solely responsible to take care of the tax liability arising therefrom.

Further, the onus to obtain registration and additionally registering at the relevant

warehouseof Amazon (as an additional place of business) will rest upon me. We also

understand that, in such a case, Amazon reserves the right to discontinue the FBA

services to me/us if I/we do not register as a seller selling taxable goods/services;

4. We are responsible for all our transactions on Amazon Marketplace and will comply with

therequirements under the state GST law for the Products we sell, which currently are

exemptedfrom payment of GST under the ………… ……………………………… state GST laws;

MAHARASHTRA

5. We will register under state GST law if and when we deal with taxable products; and

6. We will intimate/notify Amazon of compliance to such tax registration requirement and

sharethe copy of relevant tax registration certificates immediately.

Regards,

For ………… ……………………………….

Raj Goswami

(...................................................)

Stamp & Signature

You might also like

- Joint Hindu Family Letter (State Bank of India)Document2 pagesJoint Hindu Family Letter (State Bank of India)rupeshtulshyan91% (11)

- Organic Farm Business Plan PDFDocument31 pagesOrganic Farm Business Plan PDFv30003v100% (1)

- Sole Trader'S Final AccountsDocument12 pagesSole Trader'S Final AccountsSheikh Mass Jah0% (1)

- SD To BE DocumentDocument63 pagesSD To BE DocumentPiyush JaniNo ratings yet

- Special Education Fund (SEF)Document22 pagesSpecial Education Fund (SEF)jende100% (2)

- Moot Memo KK LuthraDocument23 pagesMoot Memo KK LuthraMeghan Paul100% (1)

- El Oriente Vs Posadas DigestDocument2 pagesEl Oriente Vs Posadas DigestMan2x Salomon100% (1)

- Consent for Rent Free Use of Premises ProprietorshipDocument1 pageConsent for Rent Free Use of Premises ProprietorshipRiya SinghNo ratings yet

- Client Registration Form NbssiDocument5 pagesClient Registration Form NbssiRapture usNo ratings yet

- De-Registration Form For Companies-English 1Document2 pagesDe-Registration Form For Companies-English 1bihoyiki jean de dieuNo ratings yet

- Letter of Disclaimer Sbi Format DeceasedDocument2 pagesLetter of Disclaimer Sbi Format DeceasedHardeep KhatriNo ratings yet

- National Board For Small Scale Industries (Nbssi) Client Renewal FormDocument4 pagesNational Board For Small Scale Industries (Nbssi) Client Renewal FormBosmann GhNo ratings yet

- Gemm Business Centre NewDocument1 pageGemm Business Centre NewMartinNo ratings yet

- JPX1 - Noc JPX1Document1 pageJPX1 - Noc JPX1pr12021999No ratings yet

- ITC Model ContractsDocument23 pagesITC Model ContractsNguyen Gia LinhNo ratings yet

- Hop Dong Hàng Hóa ITC ShortDocument8 pagesHop Dong Hàng Hóa ITC Shortnhatue0602No ratings yet

- Indonesia: Wahyu Senoardhy PamungkasDocument1 pageIndonesia: Wahyu Senoardhy PamungkasWahyu PurnamaNo ratings yet

- Application To Trade CreditDocument1 pageApplication To Trade CreditKagiso MokalakeNo ratings yet

- 1 E.G. Sweets Factory Johannesburg 1 2 3: Clothing Furniture Food Beverages Beauty Anything Else?Document4 pages1 E.G. Sweets Factory Johannesburg 1 2 3: Clothing Furniture Food Beverages Beauty Anything Else?gaafeleNo ratings yet

- Umoja One Grace Self Group (U.O.G.S.H.G) Business/Properties Declaration FormDocument1 pageUmoja One Grace Self Group (U.O.G.S.H.G) Business/Properties Declaration Formmorgan ochondoNo ratings yet

- Franchise Application FormDocument3 pagesFranchise Application FormlaurcostyNo ratings yet

- Membership Form - 2018-2019Document1 pageMembership Form - 2018-2019sakshiaggarwal838389No ratings yet

- Form of Application For Registration of A Motor VehicleDocument5 pagesForm of Application For Registration of A Motor Vehiclebidar007No ratings yet

- "To Whom It May Concern": # Whether The Father Died or Suffered Permanent Incapacitation While in Service - Yes/NoDocument1 page"To Whom It May Concern": # Whether The Father Died or Suffered Permanent Incapacitation While in Service - Yes/NoRavi KantaNo ratings yet

- TL KOLKATA LICENCE Affidevite FormatDocument1 pageTL KOLKATA LICENCE Affidevite FormatVivekBardiaNo ratings yet

- Sales AgreementDocument5 pagesSales Agreementfra.spNo ratings yet

- Asistencia Cursantes ObservacionesDocument1 pageAsistencia Cursantes Observacionese.garridoNo ratings yet

- MunnaDocument2 pagesMunnarana_konwarNo ratings yet

- Chitanta ModelDocument2 pagesChitanta ModelAna Luiza UrucuNo ratings yet

- Development: VendorDocument6 pagesDevelopment: Vendorlalit maheshwariNo ratings yet

- Recruitment Poster 143Document2 pagesRecruitment Poster 143Hagar ShaltootNo ratings yet

- R&T Form ADocument2 pagesR&T Form ATanya DewaniNo ratings yet

- 1. Itc Model Contract for the International Sale of GoodsDocument7 pages1. Itc Model Contract for the International Sale of GoodsMy Đoàn Lê NgọcNo ratings yet

- Royal Thai Embassy, Riyadh, Saudi Arabia: Non-Immigrant Visa Tourist Visa Transit Visa (Underline Words Required)Document2 pagesRoyal Thai Embassy, Riyadh, Saudi Arabia: Non-Immigrant Visa Tourist Visa Transit Visa (Underline Words Required)Jennifer MartinNo ratings yet

- Questionnaire: 1. Are You Insured?Document2 pagesQuestionnaire: 1. Are You Insured?Surbhi SinghalNo ratings yet

- SellerDocument2 pagesSellerkikiliciousNo ratings yet

- Amreen Shehzadi Updated Cv123Document1 pageAmreen Shehzadi Updated Cv123Anonymous Jx7Q4sNmtNo ratings yet

- Business Name FormIndividualDocument3 pagesBusiness Name FormIndividualpauljaynesNo ratings yet

- Business Name FormIndividualDocument3 pagesBusiness Name FormIndividualpauljaynesNo ratings yet

- Realestate Membership FormDocument1 pageRealestate Membership FormTikoo AdityaNo ratings yet

- Nominee MembershipDocument2 pagesNominee MembershipkmfmktgdepotNo ratings yet

- Estate Agents Affairs Board Complaints FormDocument7 pagesEstate Agents Affairs Board Complaints FormpaulNo ratings yet

- Business Name Registration Firm or Corporation 1639049602Document2 pagesBusiness Name Registration Firm or Corporation 1639049602Anthony MuhweziNo ratings yet

- Mind Map Training PeriodDocument1 pageMind Map Training PeriodLucca CalzagheNo ratings yet

- Implementation of Excise For Dealers in TallyERP 9Document172 pagesImplementation of Excise For Dealers in TallyERP 9Manoj PansareNo ratings yet

- Questionairre and General ObservationsDocument6 pagesQuestionairre and General ObservationsShachi ShahNo ratings yet

- International Sale ContractDocument15 pagesInternational Sale Contractmahmoud naaemNo ratings yet

- M-PESA AuthorizationDocument1 pageM-PESA Authorizationrisksentinel.objNo ratings yet

- Statement of Particulars Required To Be Given Pursuant To The Business Name Registration Act IN CASE OF A FIRMDocument2 pagesStatement of Particulars Required To Be Given Pursuant To The Business Name Registration Act IN CASE OF A FIRMBRENo ratings yet

- H P Đ NG Hàng Hóa ITC (Standard)Document14 pagesH P Đ NG Hàng Hóa ITC (Standard)Anh HuynhNo ratings yet

- RTO Form TCR PDFDocument1 pageRTO Form TCR PDFKalimuthu PsNo ratings yet

- "FORM" TCR': Intimation of Transfer of Ownership of A Motor Vehicle by TransferorDocument1 page"FORM" TCR': Intimation of Transfer of Ownership of A Motor Vehicle by TransferorSriram V SwaminathanNo ratings yet

- Rto Form TCRDocument1 pageRto Form TCRClary RobNo ratings yet

- Ebrahim Al-Sharafi Rental AppDocument2 pagesEbrahim Al-Sharafi Rental Appbstcpw2snnNo ratings yet

- Group 4 - ITC ContractDocument10 pagesGroup 4 - ITC ContractMY PHAN NGUYỄN THẢONo ratings yet

- Declaration For Joint OwnershipDocument1 pageDeclaration For Joint OwnershipKelly HoffmanNo ratings yet

- Basic Speaking U1u5Document20 pagesBasic Speaking U1u5loc dinhNo ratings yet

- Form of ProxyDocument1 pageForm of ProxyReneesh KcNo ratings yet

- cos37_partnership_letterDocument2 pagescos37_partnership_letterInnovation UnlimitedNo ratings yet

- Ballard Interview FormDocument3 pagesBallard Interview FormSadaqt ZainNo ratings yet

- Amazon Fba Guide For Beginners : A Beginners Guide To Selling On Amazon, Making Money And Finding Products That Turns Into Cash (Fulfillment by Amazon Business)From EverandAmazon Fba Guide For Beginners : A Beginners Guide To Selling On Amazon, Making Money And Finding Products That Turns Into Cash (Fulfillment by Amazon Business)No ratings yet

- American Credit Repair: Everything U Need to Know About Raising Your Credit ScoreFrom EverandAmerican Credit Repair: Everything U Need to Know About Raising Your Credit ScoreRating: 3 out of 5 stars3/5 (3)

- SC Judgment Dated 21.10.2010 - D. Velusamy vs. D. Patchaiammal - Live-In RelationshipDocument16 pagesSC Judgment Dated 21.10.2010 - D. Velusamy vs. D. Patchaiammal - Live-In RelationshipsalimwazedNo ratings yet

- ThesisDocument100 pagesThesisMwema MellaNo ratings yet

- California v. Texas - OyezDocument68 pagesCalifornia v. Texas - OyezMohamed MohamedNo ratings yet

- Naranja V CADocument1 pageNaranja V CAK-phrenCandariNo ratings yet

- US v. Don Fernando de La Maza Arredondo & Others, 31 U.S. 691 (1832)Document58 pagesUS v. Don Fernando de La Maza Arredondo & Others, 31 U.S. 691 (1832)Scribd Government DocsNo ratings yet

- Declaration of Heirship, Extra-Judicial Settlement of Estate With Absolute Sale (Abino)Document2 pagesDeclaration of Heirship, Extra-Judicial Settlement of Estate With Absolute Sale (Abino)Finch AtticusNo ratings yet

- 2018 (G.R. No. 204759, People's General Insurance V Guansing) PDFDocument13 pages2018 (G.R. No. 204759, People's General Insurance V Guansing) PDFFrance SanchezNo ratings yet

- Circular Power Delegation Field Officers 07.03.2019Document2 pagesCircular Power Delegation Field Officers 07.03.2019strganeshkumarNo ratings yet

- Co. Vs LLP Vs FirmDocument11 pagesCo. Vs LLP Vs FirmchintanpNo ratings yet

- Rodriguez v. CADocument1 pageRodriguez v. CALilla Dan ContrerasNo ratings yet

- Divorce Agreement: "A Complete Divorce Service"Document2 pagesDivorce Agreement: "A Complete Divorce Service"jatin patwaNo ratings yet

- Commissioner of Internal Revenue, Petitioner, vs. Philippinelong Distance Telephone CompanyDocument4 pagesCommissioner of Internal Revenue, Petitioner, vs. Philippinelong Distance Telephone CompanyRaymond AlhambraNo ratings yet

- Researched Public InterestDocument1 pageResearched Public InterestchristineNo ratings yet

- United States v. Fennell, 10th Cir. (2003)Document11 pagesUnited States v. Fennell, 10th Cir. (2003)Scribd Government DocsNo ratings yet

- State Magazine, October 2011Document52 pagesState Magazine, October 2011State Magazine100% (1)

- James M. Proctor v. Colonial Refrigerated Transportation, Inc., 494 F.2d 89, 4th Cir. (1974)Document7 pagesJames M. Proctor v. Colonial Refrigerated Transportation, Inc., 494 F.2d 89, 4th Cir. (1974)Scribd Government DocsNo ratings yet

- Beyond RedemptionDocument9 pagesBeyond RedemptionEmpressInI57% (7)

- Office of The Barangay ChairmanDocument2 pagesOffice of The Barangay ChairmanMonjamen Licawat100% (1)

- Manila: Malaca AngDocument4 pagesManila: Malaca AngMaria Ana PulidoNo ratings yet

- MCQ Remedial Law ReviewDocument24 pagesMCQ Remedial Law ReviewJonathan Goodwin100% (2)

- Legal Forms Forms 1 To 6Document7 pagesLegal Forms Forms 1 To 6Lovely CondeNo ratings yet

- MRC - ILO/GMS TRIANGLE ProjectDocument6 pagesMRC - ILO/GMS TRIANGLE ProjectSalam Salam Solidarity (fauzi ibrahim)No ratings yet

- FeaewfwefwefDocument245 pagesFeaewfwefwefEros Freuy B. AnchetaNo ratings yet

- Local Elections UpdatedDocument46 pagesLocal Elections UpdatedCheska Almira J. Arellano100% (1)

- 1:14-cv-00406 #46Document218 pages1:14-cv-00406 #46Equality Case FilesNo ratings yet

- 04.a. Uy Tioco vs. Imperial (G.R. No. L-29414)Document2 pages04.a. Uy Tioco vs. Imperial (G.R. No. L-29414)RonStephaneMaylonNo ratings yet

- Legal Method - NehaDocument23 pagesLegal Method - NehaNeha PanchpalNo ratings yet