Professional Documents

Culture Documents

Partnership Handout Week 3

Partnership Handout Week 3

Uploaded by

yuvita.prasadCopyright:

Available Formats

You might also like

- Unit Test 4 Answer KeyDocument1 pageUnit Test 4 Answer Keyalesenan0% (1)

- Fedex AssignmentDocument20 pagesFedex AssignmentAibak Irshad100% (2)

- Chapter 8: Admission of Partner: Rohit AgarwalDocument3 pagesChapter 8: Admission of Partner: Rohit AgarwalbcomNo ratings yet

- Ncert Sol Class 12 Accountancy Chapter 3 PDFDocument66 pagesNcert Sol Class 12 Accountancy Chapter 3 PDFAnupam DasNo ratings yet

- Module 3 - Partnership DissolutionDocument54 pagesModule 3 - Partnership DissolutionMaluDyNo ratings yet

- NCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 2Document70 pagesNCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 2ROo SonNo ratings yet

- Profit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership FirmDocument10 pagesProfit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership Firmd-fbuser-65596417No ratings yet

- 23 PartnershiptheoryDocument10 pages23 PartnershiptheorySanjeev MiglaniNo ratings yet

- NCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 2Document70 pagesNCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 2The stuff unlimitedNo ratings yet

- Unit V PartnershipDocument11 pagesUnit V PartnershipMUDITSAHANINo ratings yet

- Hsslive-CHAPTER 3.2 Admission of A Partner - NotesDocument8 pagesHsslive-CHAPTER 3.2 Admission of A Partner - NotesPES FOOTBALLNo ratings yet

- Accounting For Partnerships 2Document35 pagesAccounting For Partnerships 2Lazarus Henga100% (1)

- Ncert Solutions For Class 12 Accountancy 22 May Chapter 3 Reconstruction of A Partnership Firm Admission of A PartnerDocument86 pagesNcert Solutions For Class 12 Accountancy 22 May Chapter 3 Reconstruction of A Partnership Firm Admission of A PartnerHome Grown CreationNo ratings yet

- Partnership NotesDocument10 pagesPartnership NotesannabellNo ratings yet

- Accounting For Partnership - Basic ConceptsDocument19 pagesAccounting For Partnership - Basic ConceptsAashutosh PatodiaNo ratings yet

- Key Terms and Chapter Summary-3Document3 pagesKey Terms and Chapter Summary-3AbhiNo ratings yet

- Fundamantal of Partnership PPT As On 21 12 2020Document50 pagesFundamantal of Partnership PPT As On 21 12 2020jeevan varma100% (1)

- NCERT Solutions For Class 12 Accountancy Chapter 3 - Reconstitution of A Partnership Firm - Admission of A Partner - 69pDocument69 pagesNCERT Solutions For Class 12 Accountancy Chapter 3 - Reconstitution of A Partnership Firm - Admission of A Partner - 69pshanmugam PalaniappanNo ratings yet

- Detailed Handouts in Partnership DissolutionDocument14 pagesDetailed Handouts in Partnership DissolutionVinz Ray PitargueNo ratings yet

- Chapter 3 Chapter 3.admission of A Partner-1599071940612Document9 pagesChapter 3 Chapter 3.admission of A Partner-1599071940612gyannibaba2007No ratings yet

- Accountancy Chap 3 Theory NotesDocument17 pagesAccountancy Chap 3 Theory NotesRevati MenghaniNo ratings yet

- Admission of A Partner Assignment 3Document9 pagesAdmission of A Partner Assignment 3Arun KCNo ratings yet

- Accountancy Notes PDF Class 12 Chapter 3Document5 pagesAccountancy Notes PDF Class 12 Chapter 3Rishi ShibdatNo ratings yet

- 12 AccountancyDocument4 pages12 AccountancygattulokhandeNo ratings yet

- A. Retirement Notes 2023Document4 pagesA. Retirement Notes 2023Nishtha GargNo ratings yet

- Partnership Accounts PDFDocument12 pagesPartnership Accounts PDFDecereen Pineda RodriguezaNo ratings yet

- Chapterwise Theory Accounts by Sunil Panda - 240227 - 171656Document191 pagesChapterwise Theory Accounts by Sunil Panda - 240227 - 171656kawaljeetsingh121666No ratings yet

- Study MaterialDocument187 pagesStudy MaterialTanisha Tibrewal100% (1)

- Amalgamation & AbsorptionDocument11 pagesAmalgamation & AbsorptionSubhra DasNo ratings yet

- 20 Admission of PartnerDocument12 pages20 Admission of PartnerNadeem Manzoor100% (1)

- Introduction To Partnership AccountsDocument88 pagesIntroduction To Partnership Accountssaheer100% (1)

- Admission of A PartnerDocument23 pagesAdmission of A PartnerMohd Arman50% (2)

- कार्य करेंDocument199 pagesकार्य करेंkushvverma2003No ratings yet

- Document (2) AccountsDocument6 pagesDocument (2) Accountsabhishekmu95No ratings yet

- HTFA Exam 1 (Spring 2023) 2Document12 pagesHTFA Exam 1 (Spring 2023) 2AruzhanNo ratings yet

- Mediocre Non-Profit OrganizationDocument12 pagesMediocre Non-Profit OrganizationveenaNo ratings yet

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573No ratings yet

- Admission of A PartnerDocument27 pagesAdmission of A PartnerKumarNo ratings yet

- ch2 Slides InstructorDocument52 pagesch2 Slides Instructorakshitnagpal9119No ratings yet

- Accounting For: Presentation OnDocument24 pagesAccounting For: Presentation OnMonir Ahmmed Ovi50% (2)

- 12 AccountancyDocument6 pages12 AccountancygattulokhandeNo ratings yet

- POA Section 8 PartnershipsDocument26 pagesPOA Section 8 Partnershipskxng ultimateNo ratings yet

- Session 2 - Income Statement and Transaction AnalysisDocument42 pagesSession 2 - Income Statement and Transaction Analysishieucaiminh155No ratings yet

- Post Test. A12Document5 pagesPost Test. A12GICHA FEARL GIPALANo ratings yet

- Admission of PartnersDocument11 pagesAdmission of Partnerssneha sasidharanNo ratings yet

- Accounting For: Presentation OnDocument24 pagesAccounting For: Presentation OnDas ApurboNo ratings yet

- Partnership AccountsDocument4 pagesPartnership AccountsManoj Kumar GeldaNo ratings yet

- 2022 9 27 Q Merged - PagenumberDocument11 pages2022 9 27 Q Merged - PagenumberMike HKNo ratings yet

- AFAR - Partnership DissolutionDocument36 pagesAFAR - Partnership DissolutionReginald ValenciaNo ratings yet

- M.No.9818168085 Reconstitution of Partnership:: Notes On Admission of Partner Prepared By: VINEET RAJANDocument5 pagesM.No.9818168085 Reconstitution of Partnership:: Notes On Admission of Partner Prepared By: VINEET RAJANvineet_rajan100% (2)

- Lect 5 ReceivablesDocument40 pagesLect 5 Receivablesjoeltan111No ratings yet

- The Accounting Treatment of DividendsDocument5 pagesThe Accounting Treatment of DividendsVictor SantiagoNo ratings yet

- Designed Partnership Deed PresentationDocument13 pagesDesigned Partnership Deed Presentationjindalmehul03No ratings yet

- GoodwillDocument14 pagesGoodwillsandeep44% (9)

- Admission of A Partner, Class 12, CbseDocument13 pagesAdmission of A Partner, Class 12, CbseTULIP DAHIYANo ratings yet

- Accounting Olevel Theory NotesDocument7 pagesAccounting Olevel Theory NotesMujahid AmanNo ratings yet

- Nandha AccountancyDocument7 pagesNandha Accountancyrangasamibanumathi1950No ratings yet

- Unit 4 Admission of New PartnerDocument5 pagesUnit 4 Admission of New PartnerNeelabh KumarNo ratings yet

- Chapter 4 Chapter 4 Retirement or Death of A Partner 1599071952606Document10 pagesChapter 4 Chapter 4 Retirement or Death of A Partner 1599071952606gyannibaba2007No ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Liaison Officer Bookeeper Signature Over Printed Name/Date SignedDocument51 pagesLiaison Officer Bookeeper Signature Over Printed Name/Date SignedArmando LlidoNo ratings yet

- QHSE Audit Schedule: SL No Date Time Auditor Auditee DepartmentDocument2 pagesQHSE Audit Schedule: SL No Date Time Auditor Auditee DepartmentMuthusamy AyyanapillaiNo ratings yet

- Bfar Chapter 9 Answer KeyDocument2 pagesBfar Chapter 9 Answer KeyNow OnwooNo ratings yet

- Group4 PFRS15FocusnotesDocument10 pagesGroup4 PFRS15FocusnotesJohanna Nina UyNo ratings yet

- Chapter10 Solutions Hansen6eDocument17 pagesChapter10 Solutions Hansen6etccl polder39No ratings yet

- Subject Name: Business Strategy Topic Name(s) : Case Study Lecture No: 18Document11 pagesSubject Name: Business Strategy Topic Name(s) : Case Study Lecture No: 18SANKET GANDHINo ratings yet

- World Home Decor Market - Opportunities and Forecasts, 2014 - 2020Document5 pagesWorld Home Decor Market - Opportunities and Forecasts, 2014 - 2020api-311896562No ratings yet

- Module 5-Distribution MGTDocument21 pagesModule 5-Distribution MGTRevenlie GalapinNo ratings yet

- Tugas 12 - B.ING - B - WidyaNovitaDocument2 pagesTugas 12 - B.ING - B - WidyaNovitaWidya NovitaNo ratings yet

- (Ebook PDF) (Ebook PDF) Strategic Management and Competitive Advantage: Concepts and Cases Global Edition 6th Edition All ChapterDocument43 pages(Ebook PDF) (Ebook PDF) Strategic Management and Competitive Advantage: Concepts and Cases Global Edition 6th Edition All Chapterrokkiknaub100% (8)

- Pincon Spirit Limited: 37th Annual ReportDocument66 pagesPincon Spirit Limited: 37th Annual ReportSiddharth ShekharNo ratings yet

- Ifrs 15 QuestionsDocument2 pagesIfrs 15 QuestionsTata MgpNo ratings yet

- HCA PerformanceDocument9 pagesHCA PerformanceDead EyeNo ratings yet

- Asmamaw Module Edit 11 FontDocument155 pagesAsmamaw Module Edit 11 FontEdlamu AlemieNo ratings yet

- Admas University: Individual Assignment Prepare Financial ReportDocument7 pagesAdmas University: Individual Assignment Prepare Financial ReportephaNo ratings yet

- MKTG2 - Mod 1Document2 pagesMKTG2 - Mod 1ShanseaaNo ratings yet

- Accounting Applications - Part 4 - Lecture 2Document7 pagesAccounting Applications - Part 4 - Lecture 2Ahmed Mostafa ElmowafyNo ratings yet

- Porter Five (5) Forces Model: Home Writing ServicesDocument10 pagesPorter Five (5) Forces Model: Home Writing ServicesJaylen Del RosarioNo ratings yet

- Asm2 Slide BriefDocument26 pagesAsm2 Slide Briefhoattkbh01255No ratings yet

- Data Visualization Dashboard CreationDocument12 pagesData Visualization Dashboard CreationSamuel GitongaNo ratings yet

- Set B Instructions: Choose The BEST Answer For Each of The Following Items. Mark Only OneDocument15 pagesSet B Instructions: Choose The BEST Answer For Each of The Following Items. Mark Only OnePamela SantosNo ratings yet

- BPS - 5 Level of StrategiesDocument6 pagesBPS - 5 Level of StrategiesAniket YadavNo ratings yet

- Research PaperDocument33 pagesResearch PaperEnock HangwemuNo ratings yet

- Business Plan 2Document4 pagesBusiness Plan 2Zainab AshrafNo ratings yet

- 07 Franchise AccountingDocument5 pages07 Franchise AccountingAllegria AlamoNo ratings yet

- Audit of EquityDocument1 pageAudit of EquityChristine Bandigan TaladuaNo ratings yet

- Caselet - Logistics PerformaceDocument6 pagesCaselet - Logistics PerformaceNitin ShankarNo ratings yet

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocument9 pagesTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNo ratings yet

Partnership Handout Week 3

Partnership Handout Week 3

Uploaded by

yuvita.prasadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Handout Week 3

Partnership Handout Week 3

Uploaded by

yuvita.prasadCopyright:

Available Formats

Ministry of Education

Cyril Potter College of Education

TVET Department

Business Studies Option

PBS 251: Advance Financial Accounting

Week Three (3)

Topic: Accounting for Partnership

Sub topic: Admission of a New Partner and Goodwill

Admission of a new Partner

Reasons for admission of a new partner

New partners may be admitted to a partnership, usually for one of three reasons:

1. As an additional partner, either because the business has grown or because someone is needed who has

different skills to those of the existing partners.

2. To replace a partner who ceases to be a member of the firm: this might be because of the retirement or

death of a partner.

3. To bring in additional capital.

When a new partner is admitted to an existing business, an important factor to be consider is goodwill.

Goodwill

Goodwill is an intangible asset that is associated with the purchase of one company by another.

Specifically, goodwill is the portion of the purchase price that is higher than the sum of the net fair value of

all of the assets purchased in the acquisition and the liabilities assumed in the process.

Reasons for payment of goodwill

In buying an existing business, which has been established for some time, there may be quite a few

possible advantages. Some of them are listed below.

There is a large number of regular customers who will continue to deal with the business under a

new owner.

• The business has a good reputation.

• It has experienced, efficient and reliable employees.

• The business is situated in a good location.

• It has good contacts with suppliers.

• It may have good brand names that are known and recognized within the industry.

Few of those advantages are available to a completely new business. For this reason, many people will

decide to buy an existing business and pay an extra amount for goodwill.

Methods of calculating goodwill

There is no single way of calculating goodwill on which everyone can agree. The seller will probably

want more for the goodwill than the buyer will want to pay. All that is certain is that, when an

agreement is reached between buyer and seller, the selling price includes the amount of goodwill.

Various methods are used to help buyer and seller come to an agreed figure. The calculations give

buyer and seller a figure with which to begin discussions of the value of the business. Very often, each

industry or occupation has its own customary way of calculating goodwill.

Method 1

Direct pay off of Goodwill without record (off the book)

When a new partner buys into the business, their capital is recorded into the books while their premium for

goodwill which is an additional amount. This amount is paid directly to the existing partners of the

business. No official record of this is made in the books.

Method 2

Premium paid is retained in the business BUT NO Goodwill account is opened

the extra premium for goodwill brought in by the new partner is debited to the Cash Book and Credited to

the Capital Account of the partner according to the original profit and loss sharing ratio. The Goodwill

Account the is not opened and the original partners’ Capital Accounts are increased.

Method 3

Opening a Goodwill Account

when the new partner has no extra cash to bring in for goodwill, a Goodwill Account is created. The double

entries are crediting the original partners’ Capital Account to the original profit and loss sharing ratio and

debiting the Goodwill Account.

Method 4

Goodwill with drawn by original partners

when the new partner has no extra cash to bring in as premium, a goodwill Account is created and the

original partners are entitled to withdraw this amount of goodwill.

Good will is placed on the Balance Sheet as Non-Current Account.

Change in partnership

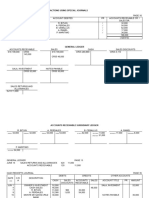

Andrew and Binta have been in partnership, sharing profits or losses in the ratio 4:3. They agreed

to admit Chen to the partnership, with profits or losses being shared between Andrew, Binta and

Chen in the ratio 3:2:1. On the date of the change in partnership, the partners’ capital and current

account balances were:

Partners Capital Current

Andrew $60,000 Cr $12,800 Cr

Binta $40,000 Cr $9,500 Cr

It was agreed that, at the date of Chen’s admission, the goodwill in the partnership was

valued at $42,000.

Step 1 – Recognise goodwill asset

The goodwill account is created by a debit entry of $42,000.

This value is credited to the old partners in the old profit or loss sharing ratio – ie 4/7 (or

$24,000) to Andrew and 3/7 (or $18,000) to Binta.

Thus, the new capital balances are:

Andrew $84,000 Cr ($60,000 Cr and $24,000 Cr)

Binta $58,000 Cr ($40,000 Cr and $18,000 Cr)

If goodwill is to continue being recognised in the partnership accounts, no further entries are

needed in relation to goodwill, as the only change is that a new asset of goodwill has been

created, and the capital balances of the old partners have increased by the same value.

Step 2 – Eliminate goodwill (if required by question)

If goodwill is not recognised going forward, it is eliminated by a credit entry in the goodwill

account, and debit entries in the partners’ capital accounts, based in the new profit or loss

sharing ratio:

Andrew $21,000 ($42,000 x 3/6)

Binta $14,000 ($42,000 x 2/6)

Chen $7,000 ($42,000 x 1/6)

As a result, the new capital balances are:

Andrew $63,000 Cr ($84,000 Cr and $21,000 Dr)

Binta $44,000 Cr ($58,000 Cr and 14,000 Dr)

Chen $7,000 Dr (share of goodwill eliminated)

Step 3 – Contribution of capital by new partner (if required by question)

If the question requires a contribution by any of the partners (or a repayment of capital) we

simply need to follow the normal principles of double-entry bookkeeping.

For example, the question may require the new partner to contribute cash so that the

opening capital balance is nil.

In this case, a credit of $7,000 would be needed in Chen’s capital account, so this is the

amount of cash that must be contributed.

The entries will therefore be:

Debit Bank $7,000

Credit Capital – Chen $7,000

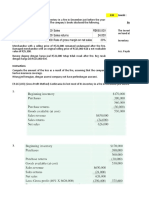

Summary of journal entries

Profit for the year Dr Statement of profit or loss

Cr Appropriation account

Partners’ salaries Dr Appropriation account

Cr Partners’ current accounts

Interest on capital Dr Appropriation account

Cr Partners’ current accounts

Interest on drawings Dr Partners’ current accounts

Cr Appropriation account

Residual profit if profit for the year is greater than total of

appropriations:

Dr Appropriation account

Cr Partners’ current accounts

if total of appropriations is greater than profit for

the year:

Dr Partners’ current accounts

Cr Appropriation account

Interest on loan from partner Dr Statement of profit or loss

Cr Bank account*/Accrued expenses**

Loan made by partner Dr Bank account /Capital account

† ‡

Cr Loan payable

You might also like

- Unit Test 4 Answer KeyDocument1 pageUnit Test 4 Answer Keyalesenan0% (1)

- Fedex AssignmentDocument20 pagesFedex AssignmentAibak Irshad100% (2)

- Chapter 8: Admission of Partner: Rohit AgarwalDocument3 pagesChapter 8: Admission of Partner: Rohit AgarwalbcomNo ratings yet

- Ncert Sol Class 12 Accountancy Chapter 3 PDFDocument66 pagesNcert Sol Class 12 Accountancy Chapter 3 PDFAnupam DasNo ratings yet

- Module 3 - Partnership DissolutionDocument54 pagesModule 3 - Partnership DissolutionMaluDyNo ratings yet

- NCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 2Document70 pagesNCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 2ROo SonNo ratings yet

- Profit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership FirmDocument10 pagesProfit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership Firmd-fbuser-65596417No ratings yet

- 23 PartnershiptheoryDocument10 pages23 PartnershiptheorySanjeev MiglaniNo ratings yet

- NCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 2Document70 pagesNCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 2The stuff unlimitedNo ratings yet

- Unit V PartnershipDocument11 pagesUnit V PartnershipMUDITSAHANINo ratings yet

- Hsslive-CHAPTER 3.2 Admission of A Partner - NotesDocument8 pagesHsslive-CHAPTER 3.2 Admission of A Partner - NotesPES FOOTBALLNo ratings yet

- Accounting For Partnerships 2Document35 pagesAccounting For Partnerships 2Lazarus Henga100% (1)

- Ncert Solutions For Class 12 Accountancy 22 May Chapter 3 Reconstruction of A Partnership Firm Admission of A PartnerDocument86 pagesNcert Solutions For Class 12 Accountancy 22 May Chapter 3 Reconstruction of A Partnership Firm Admission of A PartnerHome Grown CreationNo ratings yet

- Partnership NotesDocument10 pagesPartnership NotesannabellNo ratings yet

- Accounting For Partnership - Basic ConceptsDocument19 pagesAccounting For Partnership - Basic ConceptsAashutosh PatodiaNo ratings yet

- Key Terms and Chapter Summary-3Document3 pagesKey Terms and Chapter Summary-3AbhiNo ratings yet

- Fundamantal of Partnership PPT As On 21 12 2020Document50 pagesFundamantal of Partnership PPT As On 21 12 2020jeevan varma100% (1)

- NCERT Solutions For Class 12 Accountancy Chapter 3 - Reconstitution of A Partnership Firm - Admission of A Partner - 69pDocument69 pagesNCERT Solutions For Class 12 Accountancy Chapter 3 - Reconstitution of A Partnership Firm - Admission of A Partner - 69pshanmugam PalaniappanNo ratings yet

- Detailed Handouts in Partnership DissolutionDocument14 pagesDetailed Handouts in Partnership DissolutionVinz Ray PitargueNo ratings yet

- Chapter 3 Chapter 3.admission of A Partner-1599071940612Document9 pagesChapter 3 Chapter 3.admission of A Partner-1599071940612gyannibaba2007No ratings yet

- Accountancy Chap 3 Theory NotesDocument17 pagesAccountancy Chap 3 Theory NotesRevati MenghaniNo ratings yet

- Admission of A Partner Assignment 3Document9 pagesAdmission of A Partner Assignment 3Arun KCNo ratings yet

- Accountancy Notes PDF Class 12 Chapter 3Document5 pagesAccountancy Notes PDF Class 12 Chapter 3Rishi ShibdatNo ratings yet

- 12 AccountancyDocument4 pages12 AccountancygattulokhandeNo ratings yet

- A. Retirement Notes 2023Document4 pagesA. Retirement Notes 2023Nishtha GargNo ratings yet

- Partnership Accounts PDFDocument12 pagesPartnership Accounts PDFDecereen Pineda RodriguezaNo ratings yet

- Chapterwise Theory Accounts by Sunil Panda - 240227 - 171656Document191 pagesChapterwise Theory Accounts by Sunil Panda - 240227 - 171656kawaljeetsingh121666No ratings yet

- Study MaterialDocument187 pagesStudy MaterialTanisha Tibrewal100% (1)

- Amalgamation & AbsorptionDocument11 pagesAmalgamation & AbsorptionSubhra DasNo ratings yet

- 20 Admission of PartnerDocument12 pages20 Admission of PartnerNadeem Manzoor100% (1)

- Introduction To Partnership AccountsDocument88 pagesIntroduction To Partnership Accountssaheer100% (1)

- Admission of A PartnerDocument23 pagesAdmission of A PartnerMohd Arman50% (2)

- कार्य करेंDocument199 pagesकार्य करेंkushvverma2003No ratings yet

- Document (2) AccountsDocument6 pagesDocument (2) Accountsabhishekmu95No ratings yet

- HTFA Exam 1 (Spring 2023) 2Document12 pagesHTFA Exam 1 (Spring 2023) 2AruzhanNo ratings yet

- Mediocre Non-Profit OrganizationDocument12 pagesMediocre Non-Profit OrganizationveenaNo ratings yet

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573No ratings yet

- Admission of A PartnerDocument27 pagesAdmission of A PartnerKumarNo ratings yet

- ch2 Slides InstructorDocument52 pagesch2 Slides Instructorakshitnagpal9119No ratings yet

- Accounting For: Presentation OnDocument24 pagesAccounting For: Presentation OnMonir Ahmmed Ovi50% (2)

- 12 AccountancyDocument6 pages12 AccountancygattulokhandeNo ratings yet

- POA Section 8 PartnershipsDocument26 pagesPOA Section 8 Partnershipskxng ultimateNo ratings yet

- Session 2 - Income Statement and Transaction AnalysisDocument42 pagesSession 2 - Income Statement and Transaction Analysishieucaiminh155No ratings yet

- Post Test. A12Document5 pagesPost Test. A12GICHA FEARL GIPALANo ratings yet

- Admission of PartnersDocument11 pagesAdmission of Partnerssneha sasidharanNo ratings yet

- Accounting For: Presentation OnDocument24 pagesAccounting For: Presentation OnDas ApurboNo ratings yet

- Partnership AccountsDocument4 pagesPartnership AccountsManoj Kumar GeldaNo ratings yet

- 2022 9 27 Q Merged - PagenumberDocument11 pages2022 9 27 Q Merged - PagenumberMike HKNo ratings yet

- AFAR - Partnership DissolutionDocument36 pagesAFAR - Partnership DissolutionReginald ValenciaNo ratings yet

- M.No.9818168085 Reconstitution of Partnership:: Notes On Admission of Partner Prepared By: VINEET RAJANDocument5 pagesM.No.9818168085 Reconstitution of Partnership:: Notes On Admission of Partner Prepared By: VINEET RAJANvineet_rajan100% (2)

- Lect 5 ReceivablesDocument40 pagesLect 5 Receivablesjoeltan111No ratings yet

- The Accounting Treatment of DividendsDocument5 pagesThe Accounting Treatment of DividendsVictor SantiagoNo ratings yet

- Designed Partnership Deed PresentationDocument13 pagesDesigned Partnership Deed Presentationjindalmehul03No ratings yet

- GoodwillDocument14 pagesGoodwillsandeep44% (9)

- Admission of A Partner, Class 12, CbseDocument13 pagesAdmission of A Partner, Class 12, CbseTULIP DAHIYANo ratings yet

- Accounting Olevel Theory NotesDocument7 pagesAccounting Olevel Theory NotesMujahid AmanNo ratings yet

- Nandha AccountancyDocument7 pagesNandha Accountancyrangasamibanumathi1950No ratings yet

- Unit 4 Admission of New PartnerDocument5 pagesUnit 4 Admission of New PartnerNeelabh KumarNo ratings yet

- Chapter 4 Chapter 4 Retirement or Death of A Partner 1599071952606Document10 pagesChapter 4 Chapter 4 Retirement or Death of A Partner 1599071952606gyannibaba2007No ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Liaison Officer Bookeeper Signature Over Printed Name/Date SignedDocument51 pagesLiaison Officer Bookeeper Signature Over Printed Name/Date SignedArmando LlidoNo ratings yet

- QHSE Audit Schedule: SL No Date Time Auditor Auditee DepartmentDocument2 pagesQHSE Audit Schedule: SL No Date Time Auditor Auditee DepartmentMuthusamy AyyanapillaiNo ratings yet

- Bfar Chapter 9 Answer KeyDocument2 pagesBfar Chapter 9 Answer KeyNow OnwooNo ratings yet

- Group4 PFRS15FocusnotesDocument10 pagesGroup4 PFRS15FocusnotesJohanna Nina UyNo ratings yet

- Chapter10 Solutions Hansen6eDocument17 pagesChapter10 Solutions Hansen6etccl polder39No ratings yet

- Subject Name: Business Strategy Topic Name(s) : Case Study Lecture No: 18Document11 pagesSubject Name: Business Strategy Topic Name(s) : Case Study Lecture No: 18SANKET GANDHINo ratings yet

- World Home Decor Market - Opportunities and Forecasts, 2014 - 2020Document5 pagesWorld Home Decor Market - Opportunities and Forecasts, 2014 - 2020api-311896562No ratings yet

- Module 5-Distribution MGTDocument21 pagesModule 5-Distribution MGTRevenlie GalapinNo ratings yet

- Tugas 12 - B.ING - B - WidyaNovitaDocument2 pagesTugas 12 - B.ING - B - WidyaNovitaWidya NovitaNo ratings yet

- (Ebook PDF) (Ebook PDF) Strategic Management and Competitive Advantage: Concepts and Cases Global Edition 6th Edition All ChapterDocument43 pages(Ebook PDF) (Ebook PDF) Strategic Management and Competitive Advantage: Concepts and Cases Global Edition 6th Edition All Chapterrokkiknaub100% (8)

- Pincon Spirit Limited: 37th Annual ReportDocument66 pagesPincon Spirit Limited: 37th Annual ReportSiddharth ShekharNo ratings yet

- Ifrs 15 QuestionsDocument2 pagesIfrs 15 QuestionsTata MgpNo ratings yet

- HCA PerformanceDocument9 pagesHCA PerformanceDead EyeNo ratings yet

- Asmamaw Module Edit 11 FontDocument155 pagesAsmamaw Module Edit 11 FontEdlamu AlemieNo ratings yet

- Admas University: Individual Assignment Prepare Financial ReportDocument7 pagesAdmas University: Individual Assignment Prepare Financial ReportephaNo ratings yet

- MKTG2 - Mod 1Document2 pagesMKTG2 - Mod 1ShanseaaNo ratings yet

- Accounting Applications - Part 4 - Lecture 2Document7 pagesAccounting Applications - Part 4 - Lecture 2Ahmed Mostafa ElmowafyNo ratings yet

- Porter Five (5) Forces Model: Home Writing ServicesDocument10 pagesPorter Five (5) Forces Model: Home Writing ServicesJaylen Del RosarioNo ratings yet

- Asm2 Slide BriefDocument26 pagesAsm2 Slide Briefhoattkbh01255No ratings yet

- Data Visualization Dashboard CreationDocument12 pagesData Visualization Dashboard CreationSamuel GitongaNo ratings yet

- Set B Instructions: Choose The BEST Answer For Each of The Following Items. Mark Only OneDocument15 pagesSet B Instructions: Choose The BEST Answer For Each of The Following Items. Mark Only OnePamela SantosNo ratings yet

- BPS - 5 Level of StrategiesDocument6 pagesBPS - 5 Level of StrategiesAniket YadavNo ratings yet

- Research PaperDocument33 pagesResearch PaperEnock HangwemuNo ratings yet

- Business Plan 2Document4 pagesBusiness Plan 2Zainab AshrafNo ratings yet

- 07 Franchise AccountingDocument5 pages07 Franchise AccountingAllegria AlamoNo ratings yet

- Audit of EquityDocument1 pageAudit of EquityChristine Bandigan TaladuaNo ratings yet

- Caselet - Logistics PerformaceDocument6 pagesCaselet - Logistics PerformaceNitin ShankarNo ratings yet

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocument9 pagesTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNo ratings yet