Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsStatement of Management Responsibility

Statement of Management Responsibility

Uploaded by

FrancisqueteCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Statement of Management's Responsibility For Annual Income TaxDocument2 pagesStatement of Management's Responsibility For Annual Income TaxJohn Heil96% (25)

- SMR For BIR-uploadDocument1 pageSMR For BIR-uploadRich Gatdula100% (7)

- Statement of Management ResponsibilityDocument1 pageStatement of Management ResponsibilityKristel Dianne U. Soliven100% (2)

- Statement of Management Responsibility For BIRDocument1 pageStatement of Management Responsibility For BIRGia Paola CastilloNo ratings yet

- SMR For Sole ProprietorsDocument1 pageSMR For Sole Proprietorsflordelei hocate100% (4)

- Statement of Management Responsibility (Not Personally Owned)Document1 pageStatement of Management Responsibility (Not Personally Owned)Mabz Buan0% (2)

- BIR - Statement of Management Responsibility - 2010Document1 pageBIR - Statement of Management Responsibility - 2010aileenrconcepcionNo ratings yet

- SMR - BirDocument1 pageSMR - BirGideon HilardeNo ratings yet

- SMR FOR BIR SampleDocument1 pageSMR FOR BIR SampleAnn Cristine Cabebe100% (1)

- SMR For Sole PropDocument1 pageSMR For Sole PropMarijune LetargoNo ratings yet

- SMR For ITR 2022Document1 pageSMR For ITR 2022Micaela VillanuevaNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementHarrah Daine Lilis NatividadNo ratings yet

- xxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNDocument1 pagexxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNGlen JavellanaNo ratings yet

- For Signature DoneDocument3 pagesFor Signature DoneJayson LeybaNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementRunel BringasNo ratings yet

- WWCC 2022 SMR For BIRDocument1 pageWWCC 2022 SMR For BIRMisheru AlmarioNo ratings yet

- Noel B. Tutor (St. Anthonys Gas Station) SMR For ITR 2023Document1 pageNoel B. Tutor (St. Anthonys Gas Station) SMR For ITR 2023rodelryanyanaNo ratings yet

- Sample Statement of Management ResponsibilityDocument1 pageSample Statement of Management ResponsibilityLost StudentNo ratings yet

- Statement of Management'S ResponsibiilityDocument1 pageStatement of Management'S ResponsibiilityDianneNo ratings yet

- Statement of ManagementDocument31 pagesStatement of ManagementSharmz SalazarNo ratings yet

- Statement of Managements ResponsibilityDocument1 pageStatement of Managements ResponsibilityDonnie Ray DistajoNo ratings yet

- SMR SoleDocument1 pageSMR SoleJheza Mae PitogoNo ratings yet

- Statement of Management's ResponsibilityDocument1 pageStatement of Management's ResponsibilityMark LiganNo ratings yet

- SMR For ITRDocument1 pageSMR For ITRACYATAN & CO., CPAs 2020No ratings yet

- UntitledDocument3 pagesUntitledKim Patrice NavarraNo ratings yet

- SMR Atty Powell Del RosarioDocument1 pageSMR Atty Powell Del RosarioWORKAVENUE INC ACCTNGNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementIamayang JacaNo ratings yet

- Statement of Management'S Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Management'S Responsibility For Annual Income Tax Returnneo14No ratings yet

- TenorioDocument1 pageTenorioGaddiel NasolNo ratings yet

- Statement of Management ResponsibilityDocument1 pageStatement of Management Responsibilityariel jueves calditNo ratings yet

- RITCHARD A. ACAO, Complete and Correct in All Material RespectsDocument1 pageRITCHARD A. ACAO, Complete and Correct in All Material RespectsCrispaYojSalvaneraCabanasNo ratings yet

- Management ResponsibilityDocument1 pageManagement ResponsibilityShana Marie C. GañoNo ratings yet

- TaxesDocument1 pageTaxesJan Roger YunsalNo ratings yet

- Statement of Owner'S Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Owner'S Responsibility For Annual Income Tax ReturnMargie VenturaNo ratings yet

- Statement of Owner'S Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Owner'S Responsibility For Annual Income Tax ReturnMargie VenturaNo ratings yet

- Valdez StatementDocument1 pageValdez StatementMargie VenturaNo ratings yet

- 2022 Statement of Management's ResponsibilityDocument3 pages2022 Statement of Management's ResponsibilitymarabillonjanetNo ratings yet

- Balabat Statement of Management Responsibility-Income Tax No.4Document1 pageBalabat Statement of Management Responsibility-Income Tax No.4Ma. Consolacion TambaoanNo ratings yet

- Responsibility For ITR 2Document1 pageResponsibility For ITR 2edong the greatNo ratings yet

- SMR BIR Gap - GraphixDocument1 pageSMR BIR Gap - GraphixPaolo Martin Lagos AdrianoNo ratings yet

- Statement of Managements ResponsibilityDocument1 pageStatement of Managements ResponsibilityFevelyne NavaltaNo ratings yet

- SMR - ItrDocument1 pageSMR - ItrJasper Andrew AdjaraniNo ratings yet

- Statement of MNGT Responsibility For Annual Itr Sideco 2018Document1 pageStatement of MNGT Responsibility For Annual Itr Sideco 2018NERALENE DIAZ EBIONo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementDaisuke InoueNo ratings yet

- Paap Wellness Center: Sto - Cristo, Guagua, PampangaDocument1 pagePaap Wellness Center: Sto - Cristo, Guagua, PampangaAngeline Aquino LaroaNo ratings yet

- Statement of Management ResponsibilityDocument2 pagesStatement of Management ResponsibilityRENATO CAPUNONo ratings yet

- SMR Bir Gla Merch.2022Document1 pageSMR Bir Gla Merch.2022Paolo Martin Lagos AdrianoNo ratings yet

- SMR - ItrDocument1 pageSMR - ItrBaldovino VenturesNo ratings yet

- Madaum Resource Labor Service CooperativeDocument1 pageMadaum Resource Labor Service CooperativeProbinsyana KoNo ratings yet

- EAFS346104682OTHTY122023Document1 pageEAFS346104682OTHTY122023Paulo BelenNo ratings yet

- Statement of Management'S ResponsibilityDocument1 pageStatement of Management'S ResponsibilityLizanne Gaurana100% (1)

- Certification Statement of Management's Responsibility (Itr)Document1 pageCertification Statement of Management's Responsibility (Itr)Earl Jhune Amoranto100% (1)

- Statement of Management ResponsibilityDocument1 pageStatement of Management ResponsibilityLecel Llamedo100% (1)

- Statement of ManagementDocument4 pagesStatement of ManagementMaria Cristina VicenteNo ratings yet

- Statement of Management'S Responsibility For The Annual Income Tax ReturnDocument1 pageStatement of Management'S Responsibility For The Annual Income Tax ReturnSTYLEE CORPORATIONNo ratings yet

- Flamen, Inc.: Statement of Management Responsibility For Annual Income Tax ReturnDocument2 pagesFlamen, Inc.: Statement of Management Responsibility For Annual Income Tax Returndaryl canozaNo ratings yet

- Statement of MGT Responsibility ITRDocument1 pageStatement of MGT Responsibility ITRJasper Andrew AdjaraniNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Leasing Sec. CertificateDocument1 pageLeasing Sec. CertificateFrancisqueteNo ratings yet

- Draft - Website Development and Maintenance AgreementDocument3 pagesDraft - Website Development and Maintenance AgreementFrancisqueteNo ratings yet

- Sec Cert For LeaseDocument1 pageSec Cert For LeaseFrancisqueteNo ratings yet

- J & T Sec. CertificateDocument2 pagesJ & T Sec. CertificateFrancisqueteNo ratings yet

- Bank Account Opening - Sec. Certificate For ONE Authorized PersonDocument3 pagesBank Account Opening - Sec. Certificate For ONE Authorized PersonFrancisqueteNo ratings yet

- SECRETARY CERT For Renewal of PermitDocument2 pagesSECRETARY CERT For Renewal of PermitFrancisqueteNo ratings yet

- Authorization - Sec. CertificateDocument2 pagesAuthorization - Sec. CertificateFrancisqueteNo ratings yet

- Engagement Letter For Accounting Services: TitleDocument1 pageEngagement Letter For Accounting Services: TitleFrancisqueteNo ratings yet

- Transmittal LetterDocument1 pageTransmittal LetterFrancisquete100% (1)

- 1.) Peppercorns (3 Tsps Black, Plus 2 Tsps White)Document2 pages1.) Peppercorns (3 Tsps Black, Plus 2 Tsps White)FrancisqueteNo ratings yet

- Suppliers For CoffeeDocument1 pageSuppliers For CoffeeFrancisqueteNo ratings yet

Statement of Management Responsibility

Statement of Management Responsibility

Uploaded by

Francisquete0 ratings0% found this document useful (0 votes)

1 views1 pageOriginal Title

STATEMENT OF MANAGEMENT RESPONSIBILITY

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views1 pageStatement of Management Responsibility

Statement of Management Responsibility

Uploaded by

FrancisqueteCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

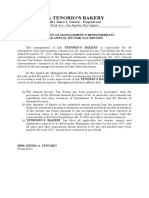

STATEMENT OF MANAGEMENT’S RESPONSIBILITY

FOR ANNUAL INCOME TAX RETURN

The Management of Golden Copra is responsible for all the information and

representations contained in the Annual Income Tax Return for the years ended December

31, 2020, December 31, 2021, and December 31, 2022. Management is likewise responsible

for all information and representations contained in the financial statements accompanying

the (Annual Income Tax Return or Annual Information Return) covering the same reporting

period.

Furthermore, the Management is responsible for all information and representations

contained in all the other tax returns filed for the reporting period, including, but not

limited, to the value added tax and/or percentage tax returns, withholding tax returns,

documentary stamp tax returns, and any and all other tax returns. In this regard, the

Management affirms that the attached audited financial statements for the years ended

December 31, 2020, December 31, 2021, and December 31, 2022 and the accompanying

Annual Income Tax Return are in accordance with the books and records of Golden Copra,

complete and correct in all material respects. Management likewise affirms that:

a) The Annual Income Tax Return has been prepared in accordance with the provisions

of the National Internal Revenue Code, as amended, and pertinent tax regulations

and other issuances of the Department of Finance and the Bureau of Internal

Revenue;

b) Any disparity of figures in the submitted reports arising from the preparation of

financial statements pursuant to financial accounting standards and the preparation

of the income tax return pursuant to tax accounting rules has been reported as

reconciling items and maintained in the company’s books and records in accordance

with the requirements of Revenue Regulations No. 8-2007 and other relevant

issuances;

c) Golden Copra / Wendy C. Tan has filed all applicable tax returns, reports and

statements required to be filed under Philippine tax laws for the reporting period,

and all taxes and other impositions shown thereon to be due and payable have been

paid for the reporting period, except those contested in good faith.

Signature: ____________________________________________________

Wendy C. Tan

Proprietor

You might also like

- Statement of Management's Responsibility For Annual Income TaxDocument2 pagesStatement of Management's Responsibility For Annual Income TaxJohn Heil96% (25)

- SMR For BIR-uploadDocument1 pageSMR For BIR-uploadRich Gatdula100% (7)

- Statement of Management ResponsibilityDocument1 pageStatement of Management ResponsibilityKristel Dianne U. Soliven100% (2)

- Statement of Management Responsibility For BIRDocument1 pageStatement of Management Responsibility For BIRGia Paola CastilloNo ratings yet

- SMR For Sole ProprietorsDocument1 pageSMR For Sole Proprietorsflordelei hocate100% (4)

- Statement of Management Responsibility (Not Personally Owned)Document1 pageStatement of Management Responsibility (Not Personally Owned)Mabz Buan0% (2)

- BIR - Statement of Management Responsibility - 2010Document1 pageBIR - Statement of Management Responsibility - 2010aileenrconcepcionNo ratings yet

- SMR - BirDocument1 pageSMR - BirGideon HilardeNo ratings yet

- SMR FOR BIR SampleDocument1 pageSMR FOR BIR SampleAnn Cristine Cabebe100% (1)

- SMR For Sole PropDocument1 pageSMR For Sole PropMarijune LetargoNo ratings yet

- SMR For ITR 2022Document1 pageSMR For ITR 2022Micaela VillanuevaNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementHarrah Daine Lilis NatividadNo ratings yet

- xxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNDocument1 pagexxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNGlen JavellanaNo ratings yet

- For Signature DoneDocument3 pagesFor Signature DoneJayson LeybaNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementRunel BringasNo ratings yet

- WWCC 2022 SMR For BIRDocument1 pageWWCC 2022 SMR For BIRMisheru AlmarioNo ratings yet

- Noel B. Tutor (St. Anthonys Gas Station) SMR For ITR 2023Document1 pageNoel B. Tutor (St. Anthonys Gas Station) SMR For ITR 2023rodelryanyanaNo ratings yet

- Sample Statement of Management ResponsibilityDocument1 pageSample Statement of Management ResponsibilityLost StudentNo ratings yet

- Statement of Management'S ResponsibiilityDocument1 pageStatement of Management'S ResponsibiilityDianneNo ratings yet

- Statement of ManagementDocument31 pagesStatement of ManagementSharmz SalazarNo ratings yet

- Statement of Managements ResponsibilityDocument1 pageStatement of Managements ResponsibilityDonnie Ray DistajoNo ratings yet

- SMR SoleDocument1 pageSMR SoleJheza Mae PitogoNo ratings yet

- Statement of Management's ResponsibilityDocument1 pageStatement of Management's ResponsibilityMark LiganNo ratings yet

- SMR For ITRDocument1 pageSMR For ITRACYATAN & CO., CPAs 2020No ratings yet

- UntitledDocument3 pagesUntitledKim Patrice NavarraNo ratings yet

- SMR Atty Powell Del RosarioDocument1 pageSMR Atty Powell Del RosarioWORKAVENUE INC ACCTNGNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementIamayang JacaNo ratings yet

- Statement of Management'S Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Management'S Responsibility For Annual Income Tax Returnneo14No ratings yet

- TenorioDocument1 pageTenorioGaddiel NasolNo ratings yet

- Statement of Management ResponsibilityDocument1 pageStatement of Management Responsibilityariel jueves calditNo ratings yet

- RITCHARD A. ACAO, Complete and Correct in All Material RespectsDocument1 pageRITCHARD A. ACAO, Complete and Correct in All Material RespectsCrispaYojSalvaneraCabanasNo ratings yet

- Management ResponsibilityDocument1 pageManagement ResponsibilityShana Marie C. GañoNo ratings yet

- TaxesDocument1 pageTaxesJan Roger YunsalNo ratings yet

- Statement of Owner'S Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Owner'S Responsibility For Annual Income Tax ReturnMargie VenturaNo ratings yet

- Statement of Owner'S Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Owner'S Responsibility For Annual Income Tax ReturnMargie VenturaNo ratings yet

- Valdez StatementDocument1 pageValdez StatementMargie VenturaNo ratings yet

- 2022 Statement of Management's ResponsibilityDocument3 pages2022 Statement of Management's ResponsibilitymarabillonjanetNo ratings yet

- Balabat Statement of Management Responsibility-Income Tax No.4Document1 pageBalabat Statement of Management Responsibility-Income Tax No.4Ma. Consolacion TambaoanNo ratings yet

- Responsibility For ITR 2Document1 pageResponsibility For ITR 2edong the greatNo ratings yet

- SMR BIR Gap - GraphixDocument1 pageSMR BIR Gap - GraphixPaolo Martin Lagos AdrianoNo ratings yet

- Statement of Managements ResponsibilityDocument1 pageStatement of Managements ResponsibilityFevelyne NavaltaNo ratings yet

- SMR - ItrDocument1 pageSMR - ItrJasper Andrew AdjaraniNo ratings yet

- Statement of MNGT Responsibility For Annual Itr Sideco 2018Document1 pageStatement of MNGT Responsibility For Annual Itr Sideco 2018NERALENE DIAZ EBIONo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementDaisuke InoueNo ratings yet

- Paap Wellness Center: Sto - Cristo, Guagua, PampangaDocument1 pagePaap Wellness Center: Sto - Cristo, Guagua, PampangaAngeline Aquino LaroaNo ratings yet

- Statement of Management ResponsibilityDocument2 pagesStatement of Management ResponsibilityRENATO CAPUNONo ratings yet

- SMR Bir Gla Merch.2022Document1 pageSMR Bir Gla Merch.2022Paolo Martin Lagos AdrianoNo ratings yet

- SMR - ItrDocument1 pageSMR - ItrBaldovino VenturesNo ratings yet

- Madaum Resource Labor Service CooperativeDocument1 pageMadaum Resource Labor Service CooperativeProbinsyana KoNo ratings yet

- EAFS346104682OTHTY122023Document1 pageEAFS346104682OTHTY122023Paulo BelenNo ratings yet

- Statement of Management'S ResponsibilityDocument1 pageStatement of Management'S ResponsibilityLizanne Gaurana100% (1)

- Certification Statement of Management's Responsibility (Itr)Document1 pageCertification Statement of Management's Responsibility (Itr)Earl Jhune Amoranto100% (1)

- Statement of Management ResponsibilityDocument1 pageStatement of Management ResponsibilityLecel Llamedo100% (1)

- Statement of ManagementDocument4 pagesStatement of ManagementMaria Cristina VicenteNo ratings yet

- Statement of Management'S Responsibility For The Annual Income Tax ReturnDocument1 pageStatement of Management'S Responsibility For The Annual Income Tax ReturnSTYLEE CORPORATIONNo ratings yet

- Flamen, Inc.: Statement of Management Responsibility For Annual Income Tax ReturnDocument2 pagesFlamen, Inc.: Statement of Management Responsibility For Annual Income Tax Returndaryl canozaNo ratings yet

- Statement of MGT Responsibility ITRDocument1 pageStatement of MGT Responsibility ITRJasper Andrew AdjaraniNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Leasing Sec. CertificateDocument1 pageLeasing Sec. CertificateFrancisqueteNo ratings yet

- Draft - Website Development and Maintenance AgreementDocument3 pagesDraft - Website Development and Maintenance AgreementFrancisqueteNo ratings yet

- Sec Cert For LeaseDocument1 pageSec Cert For LeaseFrancisqueteNo ratings yet

- J & T Sec. CertificateDocument2 pagesJ & T Sec. CertificateFrancisqueteNo ratings yet

- Bank Account Opening - Sec. Certificate For ONE Authorized PersonDocument3 pagesBank Account Opening - Sec. Certificate For ONE Authorized PersonFrancisqueteNo ratings yet

- SECRETARY CERT For Renewal of PermitDocument2 pagesSECRETARY CERT For Renewal of PermitFrancisqueteNo ratings yet

- Authorization - Sec. CertificateDocument2 pagesAuthorization - Sec. CertificateFrancisqueteNo ratings yet

- Engagement Letter For Accounting Services: TitleDocument1 pageEngagement Letter For Accounting Services: TitleFrancisqueteNo ratings yet

- Transmittal LetterDocument1 pageTransmittal LetterFrancisquete100% (1)

- 1.) Peppercorns (3 Tsps Black, Plus 2 Tsps White)Document2 pages1.) Peppercorns (3 Tsps Black, Plus 2 Tsps White)FrancisqueteNo ratings yet

- Suppliers For CoffeeDocument1 pageSuppliers For CoffeeFrancisqueteNo ratings yet