Professional Documents

Culture Documents

ACIGH - Money Markets Update - 06-05-2024 v2

ACIGH - Money Markets Update - 06-05-2024 v2

Uploaded by

KofikoduahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACIGH - Money Markets Update - 06-05-2024 v2

ACIGH - Money Markets Update - 06-05-2024 v2

Uploaded by

KofikoduahCopyright:

Available Formats

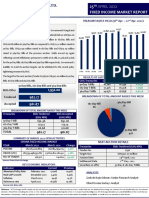

Money Market Update 6th May 2024

Rates

Primary Market: Treasury Bills & Bank of Ghana Bills

Commentary

Expected maturities for the week of May 6th 2024 include:

• GHS 2.73 billion in Treasury Bill maturities:

o GHS 1.91 billion in 91-day maturities due on May 6th

o GHS 439 million in 182-day maturities due on May 6th

o GHS 381 million in 364-day maturities due on May 6th

• GHS 7.09 billion in 56-day BOG Bill maturities:

o GHS 4.13 billion due on May 6th

Commentary o GHS 2.96 billion due on May 6th

Yields on the 91-Day, 182-Day and 1-Year T-Bill rates fell by 10bps, 25bps

and 25bps to close at 25.45%, 27.40%, and 28.00% respectively. BOG 56- Treasury Bills – Demand

day bill and interbank rate remained at 29.00% and 28.74% respectively.

Liquidity

The Treasury Bill auction demand on Friday was oversubscribed by

17.07%. The Government accepted all the GHS 3.465 billion bids tendered,

which was above the auction target of GHS 2.960 billion.

Auction Target GHS 2.96 billion

Total Bids GHS 3.465 billion

Total Accepted GHS 3.465 billion

Bid-to-Cover 1.0000x

Subscription Ratio 1.1707x

Money Market Term(s) of the Week

Cer4ficate of deposit: A cer'ficate of deposit (CD) refers to a product extended by

banks, credit unions, and other financial lenders to provide a specified interest rate

to investors who leave a lump-sum deposit that cannot be withdrawn for a certain

period of 'me.

ACI Ghana Money Market Committee Members:

Kofi Koduah-Sarpong | Ebenezer Allotey | Ronald Mensah | Kojo Bedu-Addo | Nicholas Tawiah Page 1

Money Market Update 6th May 2024

Repo Market Flows

ACI Ghana Money Market Committee Members:

Kofi Koduah-Sarpong | Ebenezer Allotey | Ronald Mensah | Kojo Bedu-Addo | Nicholas Tawiah Page 2

You might also like

- Asset Classes and Financial Instruments: Bodie, Kane, and Marcus Eleventh EditionDocument48 pagesAsset Classes and Financial Instruments: Bodie, Kane, and Marcus Eleventh EditionFederico PortaleNo ratings yet

- KKR Transaction PresentationDocument41 pagesKKR Transaction PresentationKofikoduah96% (23)

- Determinants of Land DemandDocument3 pagesDeterminants of Land Demandjoytoriolsantiago80% (5)

- On January 1 Pulse Recording Studio Prs Had The FollowingDocument1 pageOn January 1 Pulse Recording Studio Prs Had The FollowingLet's Talk With HassanNo ratings yet

- Partnership DeedDocument2 pagesPartnership DeedSafal Visa78% (9)

- Specialists How They Perform Their Magic by Richard NeyDocument6 pagesSpecialists How They Perform Their Magic by Richard Neyaddqdaddqd100% (1)

- ACIGH - Money Markets Update - 20-05-2024Document2 pagesACIGH - Money Markets Update - 20-05-2024KofikoduahNo ratings yet

- ACIGH - Money Markets Update - 03-06-2024Document2 pagesACIGH - Money Markets Update - 03-06-2024KofikoduahNo ratings yet

- ACIGH - Money Markets Update - 27-05-2024Document2 pagesACIGH - Money Markets Update - 27-05-2024KofikoduahNo ratings yet

- ACIGH - Money Markets Update - 10-06-2024Document2 pagesACIGH - Money Markets Update - 10-06-2024KofikoduahNo ratings yet

- ACIGH - Money Markets Update - 25092023Document1 pageACIGH - Money Markets Update - 25092023KofikoduahNo ratings yet

- ACIGH - Money Markets Update - 01102023Document1 pageACIGH - Money Markets Update - 01102023KofikoduahNo ratings yet

- 2019 October BREIT Securities UpdateDocument43 pages2019 October BREIT Securities UpdateMAYANK AGGARWALNo ratings yet

- IM Capital Morning Note 13 Oct 2023Document6 pagesIM Capital Morning Note 13 Oct 2023GabrielNo ratings yet

- H1 2023 Funding PDFDocument15 pagesH1 2023 Funding PDFVinay SudershanNo ratings yet

- Treasury ManagementDocument30 pagesTreasury ManagementAMAL CHRISTY GEORGENo ratings yet

- Whitecap Resources Inc.: Equity ResearchDocument7 pagesWhitecap Resources Inc.: Equity ResearchForexliveNo ratings yet

- Adobe Scan 20-Mar-2024Document3 pagesAdobe Scan 20-Mar-2024BhagyaNo ratings yet

- Investing in Oil, in A Crisis: Covid-19 - Impacts On Oil Futures and EtpsDocument8 pagesInvesting in Oil, in A Crisis: Covid-19 - Impacts On Oil Futures and EtpsSandesh Tukaram GhandatNo ratings yet

- How big is cash-futures basis trading in Canada’s government bond market_ - Bank of CanadaDocument15 pagesHow big is cash-futures basis trading in Canada’s government bond market_ - Bank of CanadafelixniefeiusNo ratings yet

- Frm2 Derivatives BasicsDocument34 pagesFrm2 Derivatives BasicsDîvýâñshü MâhâwârNo ratings yet

- (LS) Part I-Topic 1 - Futures Markets-20230921Document33 pages(LS) Part I-Topic 1 - Futures Markets-20230921hannahlin115No ratings yet

- Hedge FundsDocument48 pagesHedge FundsanshuNo ratings yet

- Pakistan Economy - IMF Loan Review Funding Requirement, Primary Deficit, Gas Pricing & Monetary PolicyDocument10 pagesPakistan Economy - IMF Loan Review Funding Requirement, Primary Deficit, Gas Pricing & Monetary PolicyMohammad RazaNo ratings yet

- Commodity Swaps ArticleDocument6 pagesCommodity Swaps ArticleVicho BNo ratings yet

- Important Characteristics of Buyer's IndustryDocument10 pagesImportant Characteristics of Buyer's IndustryizazNo ratings yet

- Genesis 23 Q2 Quarterly ReportDocument15 pagesGenesis 23 Q2 Quarterly ReportRubikkav InsiderNo ratings yet

- Money MarketDocument13 pagesMoney MarketDîvýâñshü MâhâwârNo ratings yet

- 26 02 21 213055 FertilizerDocument10 pages26 02 21 213055 FertilizerMuhammad IlyasNo ratings yet

- China A Inclusion Consultation - Thierry PollaDocument16 pagesChina A Inclusion Consultation - Thierry PollaThierry PollaNo ratings yet

- Kisan Credit Card Scheme: EpathshalaDocument4 pagesKisan Credit Card Scheme: EpathshalaAjay Singh PhogatNo ratings yet

- Prudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesDocument21 pagesPrudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesSubrahmanya ShastryNo ratings yet

- Z5 1 82Document82 pagesZ5 1 82DEVESH GUPTANo ratings yet

- Financial Markets - MAINAKDocument88 pagesFinancial Markets - MAINAKjayaNo ratings yet

- Nat Gas FuturesDocument35 pagesNat Gas FuturesDROMEASNo ratings yet

- Fixed Income Market Report - 04.05.2022Document1 pageFixed Income Market Report - 04.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Chinese Companies Told To Co-Operate On Bids - Upstream OnlineDocument1 pageChinese Companies Told To Co-Operate On Bids - Upstream OnlinebarbaraNo ratings yet

- HandbookDocument25 pagesHandbookmahendra pratapNo ratings yet

- Bodie Essentials of Investments 11e Chapter02 PPTDocument46 pagesBodie Essentials of Investments 11e Chapter02 PPTquyngo.dymunNo ratings yet

- Analysis of Financial DataDocument53 pagesAnalysis of Financial DataKiran HingeNo ratings yet

- Notes 1Document8 pagesNotes 1Praksh chandra Rajeek kumarNo ratings yet

- Article - Interest Rate FuturesDocument2 pagesArticle - Interest Rate FuturesSuresh SNo ratings yet

- Global Equity Strategy: Upgrade Mining, Benchmark OilDocument46 pagesGlobal Equity Strategy: Upgrade Mining, Benchmark OilSaad AliNo ratings yet

- Fixed Income Market Report - 25.04.2022Document1 pageFixed Income Market Report - 25.04.2022Fuaad DodooNo ratings yet

- BM & RM Presentation 20 May Bhalwal BranchDocument14 pagesBM & RM Presentation 20 May Bhalwal Branchmech_eng285No ratings yet

- Mumbai Educational Trust: Submitted ToDocument42 pagesMumbai Educational Trust: Submitted ToPRATIK SHETTYNo ratings yet

- II - Money MarketDocument16 pagesII - Money MarketPRATYUSH DASHNo ratings yet

- Chapter PDFDocument4 pagesChapter PDFVicky MajumdarNo ratings yet

- Fixed Income Market Report - 19.04.2022Document1 pageFixed Income Market Report - 19.04.2022Fuaad DodooNo ratings yet

- STOCKS TO WATCH 2023-10-19 v1Document10 pagesSTOCKS TO WATCH 2023-10-19 v1Solomon MainaNo ratings yet

- Demonetisation: Assessment of Macro & Sectoral ImpactDocument22 pagesDemonetisation: Assessment of Macro & Sectoral ImpactPritee RaneNo ratings yet

- Fdusd Attestation 2024 01 31 65d2b6173dfb9Document7 pagesFdusd Attestation 2024 01 31 65d2b6173dfb9bismantara56No ratings yet

- Treasury Bills & Commercial PaperDocument45 pagesTreasury Bills & Commercial Papertoufique007100% (1)

- Nelly TBDocument19 pagesNelly TBcheekygal_89No ratings yet

- Procurement Plan Indonesia - Health System Strengthening ProjectDocument29 pagesProcurement Plan Indonesia - Health System Strengthening ProjectFathurNo ratings yet

- Money Market in IndiaDocument51 pagesMoney Market in IndiaAlexandra RossNo ratings yet

- 2 Financial Markets and Interest RatesDocument21 pages2 Financial Markets and Interest Ratesadib nassarNo ratings yet

- Ecuador LATIN AMERICA AND CARIBBEAN P152096 Supporting Education Reform in Targeted Circuits Procurement PlanDocument16 pagesEcuador LATIN AMERICA AND CARIBBEAN P152096 Supporting Education Reform in Targeted Circuits Procurement PlanAndre SantosNo ratings yet

- ETW 5 Oct 11 Oct 2020Document3 pagesETW 5 Oct 11 Oct 2020Sai KushalNo ratings yet

- FRMUnit IDocument17 pagesFRMUnit IAnonNo ratings yet

- Resume Prospectus BCP EOS 2020 VAngDocument30 pagesResume Prospectus BCP EOS 2020 VAngIsmail bnjNo ratings yet

- Pre-Placement Talk HDFC AMC 2023-2024-1Document24 pagesPre-Placement Talk HDFC AMC 2023-2024-1omkaraurange228No ratings yet

- Economy & Debt Market Review: HighlightsDocument8 pagesEconomy & Debt Market Review: HighlightsssattirajuNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- ACIGH - Money Markets Update - 10-06-2024Document2 pagesACIGH - Money Markets Update - 10-06-2024KofikoduahNo ratings yet

- State-of-the-Art in Corporate TreasuryDocument2 pagesState-of-the-Art in Corporate TreasuryKofikoduahNo ratings yet

- 100 Per Cent Equity Allocation For TreasuryDocument2 pages100 Per Cent Equity Allocation For TreasuryKofikoduahNo ratings yet

- Wholesale Power Markets in The United StatesDocument60 pagesWholesale Power Markets in The United StatesKofikoduahNo ratings yet

- Cocktail Menus - GH NEWDocument5 pagesCocktail Menus - GH NEWKofikoduahNo ratings yet

- Hovik Tumasyan - Understanding and Applying Funds Transfer PricingDocument12 pagesHovik Tumasyan - Understanding and Applying Funds Transfer PricingKofikoduahNo ratings yet

- Constant Capital Ghana Inflation Index UpdateDocument2 pagesConstant Capital Ghana Inflation Index UpdateKofikoduahNo ratings yet

- The Rothschild FoundationDocument28 pagesThe Rothschild FoundationKofikoduah100% (1)

- Business Rescue PlanDocument21 pagesBusiness Rescue PlanKofikoduahNo ratings yet

- Licensing of Credit Reference BureauDocument4 pagesLicensing of Credit Reference BureauKofikoduahNo ratings yet

- Triangular ArbitrageDocument5 pagesTriangular ArbitrageAnil BambuleNo ratings yet

- Wilmar International: Outperform Price Target: SGD 4.15Document4 pagesWilmar International: Outperform Price Target: SGD 4.15KofikoduahNo ratings yet

- Metro Concast v. Allied BankDocument3 pagesMetro Concast v. Allied BankDyrene Rosario Ungsod100% (1)

- Leich and TannerDocument12 pagesLeich and TannerThai Hoa NgoNo ratings yet

- Ag Gold Loan FormatDocument22 pagesAg Gold Loan Formatmevrick_guy100% (1)

- Solved SNAP 2015 PaperDocument44 pagesSolved SNAP 2015 PaperVishal RajNo ratings yet

- New Balance $9,940.40 Minimum Payment Due $99.00 Payment Due Date 08/23/22Document13 pagesNew Balance $9,940.40 Minimum Payment Due $99.00 Payment Due Date 08/23/22Rahul SharmaNo ratings yet

- Mrunal Explained - Monetary Policy, Rep, SLR, CRR, Qualitative ToolsDocument22 pagesMrunal Explained - Monetary Policy, Rep, SLR, CRR, Qualitative ToolsGSWALIANo ratings yet

- NiftDocument19 pagesNiftAstha MishraNo ratings yet

- Risk and Return: Investment and Portfolio ManagementDocument13 pagesRisk and Return: Investment and Portfolio ManagementBantamkak FikaduNo ratings yet

- Remedies For Breach of ContractDocument9 pagesRemedies For Breach of ContractBhaveshNo ratings yet

- Role Play MpuDocument2 pagesRole Play MpukebayanmenawanNo ratings yet

- Volume8-Bangladesh MFI ReportDocument213 pagesVolume8-Bangladesh MFI ReportSaurabh PratapNo ratings yet

- Investment Banking Prep Interview QuestionsDocument8 pagesInvestment Banking Prep Interview QuestionsNeil GriggNo ratings yet

- Credit Management Policy and Financial Performance in Financial Institutions in Uganda A Case of Selected Centenary Bank Branches in Rwenzori RegionDocument16 pagesCredit Management Policy and Financial Performance in Financial Institutions in Uganda A Case of Selected Centenary Bank Branches in Rwenzori RegionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Some Important Viva QusetionsDocument21 pagesSome Important Viva QusetionsLakshmi NairNo ratings yet

- Accounts of Banking CompaniesDocument20 pagesAccounts of Banking CompaniesBasappaSarkar100% (1)

- Fractional Bank FraudDocument13 pagesFractional Bank FraudStevee BatesNo ratings yet

- CP Chapter 2 - 201819 1Document8 pagesCP Chapter 2 - 201819 1Jerome JoseNo ratings yet

- Section 4: Government and The Macroeconomy: Part 1 DefinitionsDocument24 pagesSection 4: Government and The Macroeconomy: Part 1 DefinitionsDamion Brussel100% (1)

- ZB 5csDocument3 pagesZB 5csGamuchirai Michael DereraNo ratings yet

- Digitalization of Retail Financial ServicesDocument110 pagesDigitalization of Retail Financial ServicesAlaa' Deen ManasraNo ratings yet

- Account Statement 010721 210122Document30 pagesAccount Statement 010721 210122PhanindraNo ratings yet

- Agreement Personal LoanDocument8 pagesAgreement Personal LoanAnkush KotakNo ratings yet

- Live Leak - RPF SI CBT Model Question Paper (Predicted Pattern 2018)Document25 pagesLive Leak - RPF SI CBT Model Question Paper (Predicted Pattern 2018)Samiksha ShambharkarNo ratings yet

- Test: 1 Topic: Fundamental, Goodwill, Change in Profit Sharing RatioDocument4 pagesTest: 1 Topic: Fundamental, Goodwill, Change in Profit Sharing RatioHigreeve SrudhiNo ratings yet

- ABG Shipyard Fraud AnalysisDocument17 pagesABG Shipyard Fraud AnalysisMd Ahsan AliNo ratings yet

- Govt. Securities Market - 1Document46 pagesGovt. Securities Market - 1Bipul Mishra100% (1)